Recensione di eToro: guida 2026 e opinioni sul broker online più famoso

eToro currently represents the leading international platform for investing, buying and selling stocks and commodities and for copy trading, a very popular option in the financial markets and which we will describe in detail moving forward in our eToro review.

The brand was born in 2007 from the investment company of the same name, eToro Europe Ltd, which is headquartered in Cyprus and operates through several branches in Australia and the United Kingdom with more than 700 employees. The company decided to go public in 2021, thanks to an agreement with the FinTech company Acquisition Corp.

Thanks to its global reach and an ever-increasing number of active users, eToro ranks as one of the most important online brokers. Let’s see in detail how eToro works; let’s find out what its main features are and the advantages of investing with this platform.

[stocks_table id=”20″]

Il {etoroCFDrisk} % dei conti degli investitori retail perde denaro negoziando CFD con questo fornitore. È necessario sapere come funzionano i CFD e se ci si può permettere di perdere i propri soldi.

-

-

What is eToro?

Before going into the details of our review, which analyses all the features and fundamental aspects of the eToro investment portal, we want to briefly and quickly summarise the basic features of this online trading platform .

Registered office Limassol, Cipro Supported assets Stocks, Forex, ETFs, Indices, Commodities and Cryptocurrencies Minimum deposit $ 50 Commissions 0% commission on ETFs App Mobile Yes Demo Account For 30 days and with $100,000 virtual Trustpilot Reviews 4.4/5 Regulations CySEC, FCA, ASIC in Italy CONSOB Authorization Il {etoroCFDrisk} % dei conti degli investitori retail perde denaro negoziando CFD con questo fornitore. È necessario sapere come funzionano i CFD e se ci si può permettere di perdere i propri soldi.

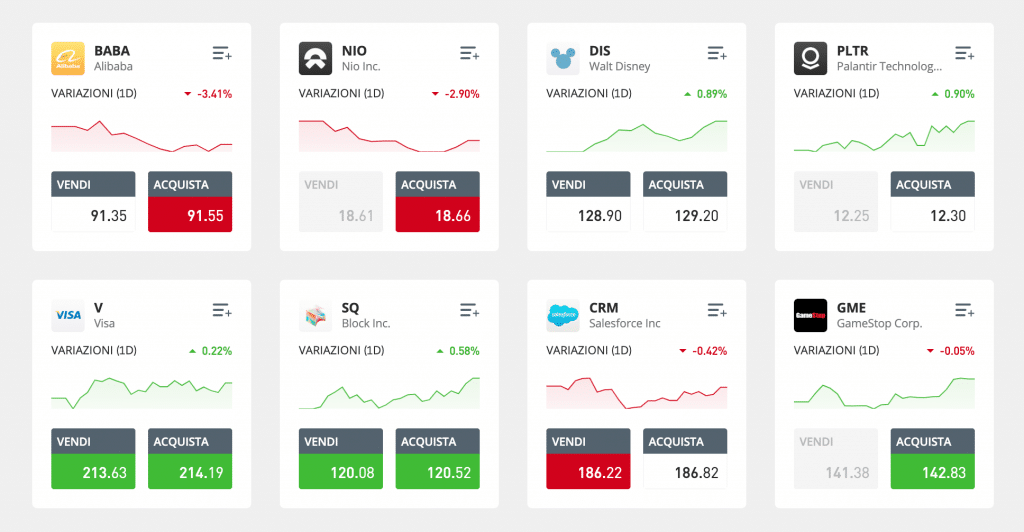

What to invest on eToro?

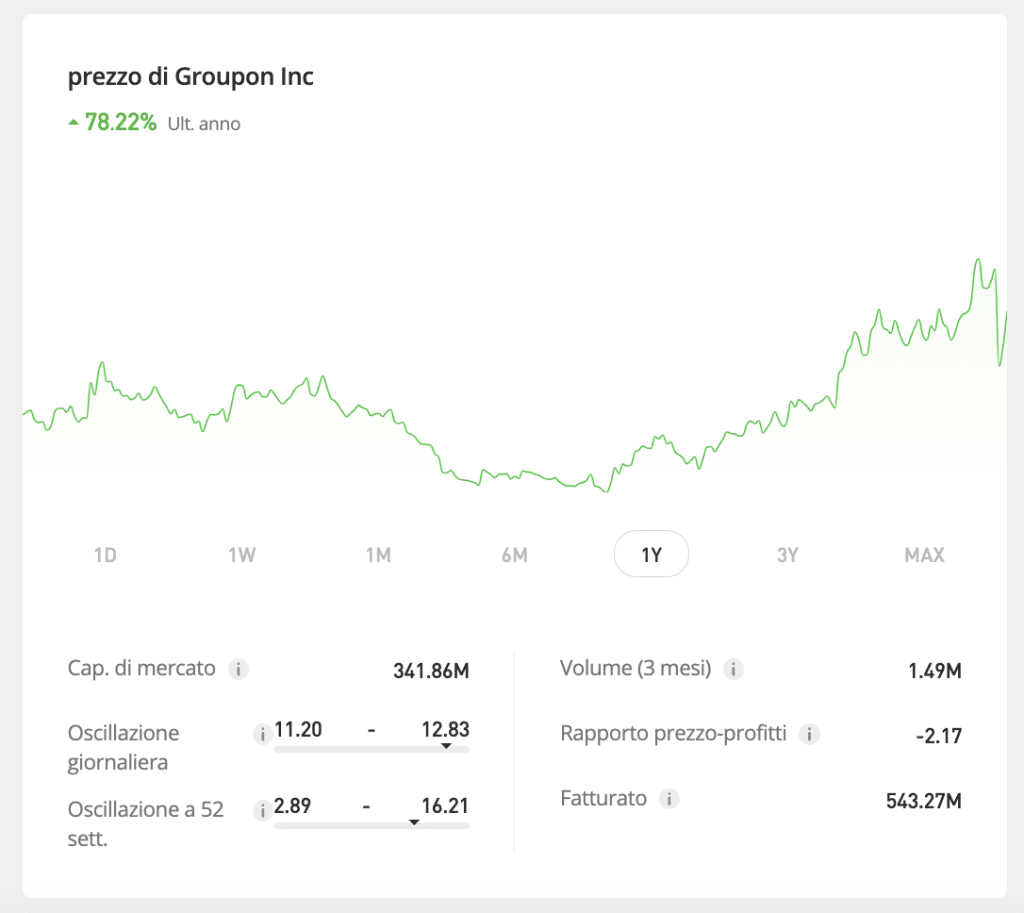

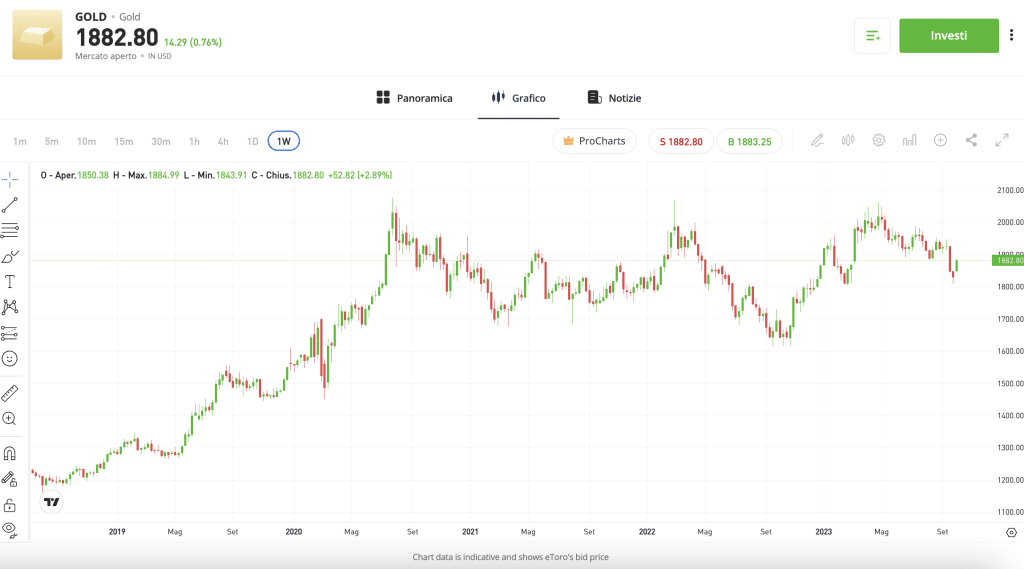

eToro represents one of the main trading platforms in the world precisely because it is possible to make trades of all types, from stocks to metal raw materials – such as gold – and not, passing through the best cryptocurrencies , which represent one of the most widespread types of online investment.

Once registered, from the “search” section of eToro, you will be able to view the trend of global markets and decide what to invest in, browsing through the various categories which are:

To go into more detail about the assets supported, eToro offers over 2,400 stocks from 17 different markets, allowing you to invest in stocks of companies from the USA, Canada, the UK, Hong Kong and several European exchanges.

With eToro, you can also invest in fractional stocks with much less upfront capital to commit than “real stocks” and without the risk associated with other complex investment vehicles.

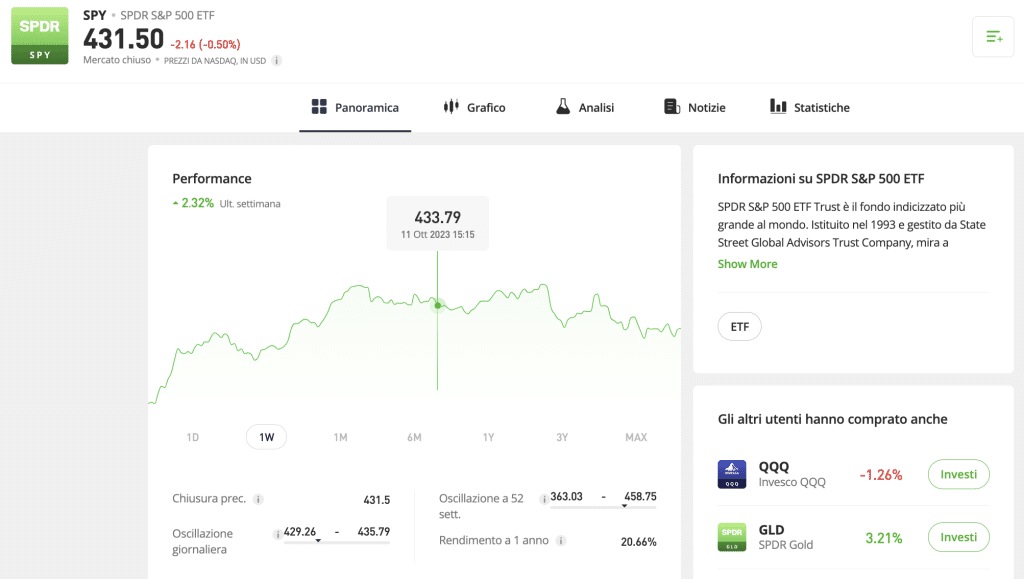

The platform also allows access to 250 types of ETFs, most of which are real (by purchasing them you effectively own them) and others offered in the form of CFDs.

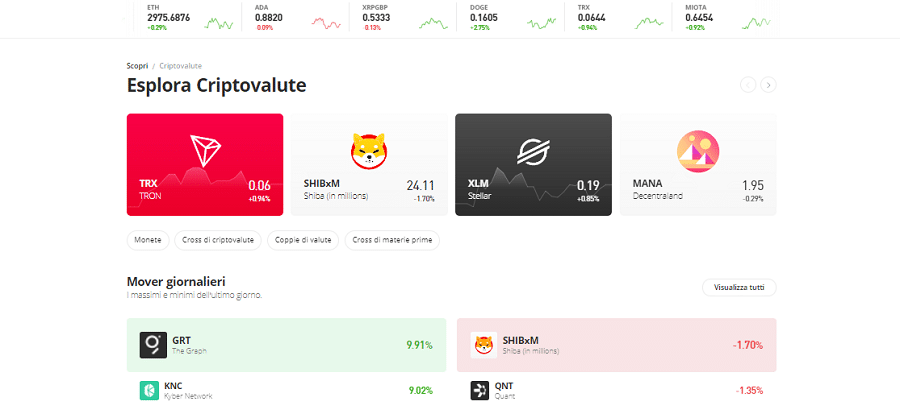

Cryptocurrency trading is among the largest in the industry and includes the exchange of more than 60 crypto assets including Bitcoin (BTC) , Ethereum (ETH) , Cardano (ADA), Ripple (XRP) , Stellar (XLM), Tron (TRX); even meme coins such as Dogecoin (DOGE) and emerging cryptocurrencies such as Solana (SOL) .

eToro’s offering is completed by trading in hard commodities such as gold, silver, crude oil and natural gas, and soft commodities such as coffee, rice or sugar. It also provides various tools for forex trading.

eToro Fees and Commissions

Opening an account is completely free, as is investing in ETFs: no commission is applied for these operations. Even on withdrawals there is no liquidation fee, but a standard cost of 5 dollars will be applied.

As for indirect trading costs, when you decide to invest you need to pay close attention to the spread, which represents the difference between the so-called “buy” price and the “sell” price and which depends on market conditions, therefore not directly attributable to direct costs of eToro. In any case, this type of cost will not even be noticed, precisely because it is already included in the two prices that you find explicitly stated every time you want to sell or buy.

Below we summarize in a table the different types of commissions of the platform. In any case, if you access eToro you can consult the commissions for each type of financial product.

Instruments Commissions Actions 1$ (real stocks) CFD 0.15% daily ETF No commissions Cryptocurrencies 1% on the transaction Indexes From 0.75 to 25 points (Nasdaq100 2.4 points) Raw materials From 2 to 20,000 pips (Or 45 pips) Currency Pairs Gives 1 to 1,000 pips (EUR/USD 1 pip) Let’s see in detail what the costs and commissions are for each financial operation carried out.

ETFsCriptovaluteCFDMoreETFs

When purchasing stocks, eToro does not charge any ticket, rollover or management fees.

Cryptocurrencies

For all cryptocurrency purchases and sales, the spread cost is 1% of the value, both for purchases and sales.

CFD

CFDs are complex and higher risk investment instruments because they benefit from leveraged trading or short selling. In this case, the commission is due to the fact that no real assets are sold and overnight fees apply.

Other

In addition to the withdrawal fee, eToro applies an inactivity fee, which is charged after 12 months of inactivity (i.e. without logging in) and corresponds to 10 dollars per month.

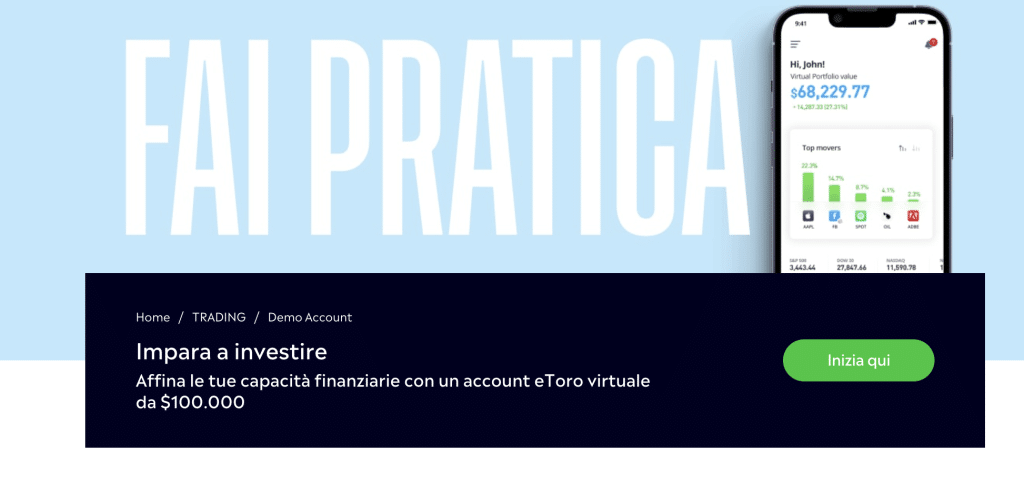

Demo account on eToro

One of the most relevant and interesting options of eToro, once you have registered and created your account, is the ability to use a virtual section of your account. How does this wallet work? eToro offers new users a budget of 100,000 dollars (note: please note that, even if you are on the Italian website of eToro, the currency will always be expressed in dollars, so when evaluating your gains or losses, calculate a small spread regarding the exchange rate from euro to dollar.

But let’s get back to our demo account. Once you have registered, which is always free on eToro, from the home page you can click on the “switch to virtual” button that will allow users to use the credit made available. In this way it will be possible to start browsing among the various investment options offered: on eToro, in fact, you can find the section dedicated to cryptocurrencies, investments in raw materials and their shares or an entire section dedicated to the best traders and copy trading, which we will talk about in more detail in the eToro review that follows.

With this possibility, all registered users will have the opportunity to try the varieties of investments and their daily performance without risking their capital.

Il {etoroCFDrisk} % dei conti degli investitori retail perde denaro negoziando CFD con questo fornitore. È necessario sapere come funzionano i CFD e se ci si può permettere di perdere i propri soldi.

App mobile

We have tested for you in detail the application that eToro has dedicated to all its most loyal users but also to those who have just signed up on the site.

Its mobile application, in fact, represents another very important feature that the online broker eToro makes available to its many users and which makes it one of the main trading sites, is the possibility of downloading a dedicated application, available for both Android and iOS systems.

Thanks to the mobile version of eToro, you can monitor the performance of the markets and your investments at any time and in any place, also with the help of various push notifications that will alert you of changes.

Additionally, thanks to two-factor authentication, users will be able to better protect their investment portfolio and wallet on the site.

Payments

Once you have done a test with the virtual account, or if you are sure to proceed with your own money that you have decided to invest, you need to make a deposit to your eToro account. But where can you transfer the necessary funds? Obviously the process is made very easy, and this represents an advantage both for users, who can choose between various options, and for the portal itself, which benefits from the immediacy of systems such as Paypal to gather the interest of users as soon as we decide to invest.

In addition to Paypal, you can use other virtual tools such as Skrill or Neteller, but only after making the first deposit. For those who do not have any of these tools, you can make a transfer through your current account with a bank transfer, or make a deposit from your credit card by entering the information requested on the site.

The bank transfer can take 4 to 7 business days to arrive on your eToro wallet.

Remember that the minimum amount to deposit is 50 dollars but, once the first deposit is made, the minimum amount required for each subsequent deposit drops to a minimum of 10 dollarseToro – Pros and Cons

After having examined some of the features of the cryptocurrency exchange and all the main trading products, we now want to briefly summarize the main positive and negative aspects of eToro.

Advantages:

- Easy to use even for beginners

- Free demo account for 30 days

- Copy Trading e Copy Portfolios

- Multiple payment methods: Debit/Credit Card, Paypal, Skrill

- Thousands of assets available with spreads from 0.22%

Disadvantages:

- $5 fee on withdrawals

- Currency Conversion Fee

eToro, how to get started

After having explained to you well how eToro works and what it represents for its users, let's see in detail all the steps to take to enter the world of investments and copy trading thanks to the eToro platform.

The first step to take, necessarily, is a simple review that requires name, surname, password and email address. The latter will need to be confirmed to verify that it is a real user.

Once you click on the link received in your email inbox, you will be able to access all the assets and investment choices on the site.Based on your preferences, you can search the homepage or choose from the various sections, which will guide you in choosing all the types of investments and sales you can make. The initial deposit can be made according to the methods we described in the previous paragraph or you can carry out tests through the virtual account.

In detail, to open an account on eToro and start trading you need:

Step 1 – Register on the eToro platform

You must provide your personal information such as name, email and a password to register.

Step 2 – Upload your ID

You will need to verify your account by submitting your personal information and attaching photos of your ID, driver’s license or passport. eToro may also ask for a copy of your bank statement to verify that the address on your application is the same as your bank statement. You will soon be able to invest in stocks.

Every platform that has a regulation requires customers to complete the KYC process or verify their identity. This will be the mandatory next step regardless of whether you created your account through Facebook, Gmail or from scratch.

Step 3 – Deposit your funds

Once your account is set up, before you can invest in stocks or other assets, eToro requires you to deposit funds. For this purpose, you can use credit cards, debit cards, bank transfers, PayPal, Neteller, Skrill to fund your trading account.

The minimum deposit required for the first payment is $50 if you decide to make the operation via credit or debit card, while if you want to proceed with a bank transfer, the amount required by the platform is much higher, $500.

Step 4: Start Trading Stocks

With eToro you can buy stocks directly from your computer after your account has been funded. Let’s take BP as an example. To open a new trade, we enter “BP” in the search box at the top of the page and click “TRADE”.

Il {etoroCFDrisk} % dei conti degli investitori retail perde denaro negoziando CFD con questo fornitore. È necessario sapere come funzionano i CFD e se ci si può permettere di perdere i propri soldi.

.eToro, investing in cryptocurrencies

One of the most sought-after investment methods, especially for beginners, is cryptocurrencies and, in particular, Bitcoin. The online broker eToro offers its users a wide range of cryptocurrencies in a dedicated section. Anyone who wants to invest (remember that the minimum amount is 50 dollars) can choose between the currencies available and indicate the amount for each.

It should be noted that, especially for those interested in investing in cryptocurrencies in the long term, eToro offers its users 19 digital currencies to choose from.

Among the most widespread we find:

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

- Ripple (XRP)

- Dash (DASH)

- Litecoin (LTC)

- Cardano (ADA)

- Stellar (XLM)

- Tron (TRX)

- Zcash (ZCASH)

- Tezos (XTZ)

- Chainlink (LINK)

- Dogecoin (DOGE)

- Shiba Inu (SHIBA)

Furthermore, eToro tries to always keep up with user demands, constantly adding new cryptocurrencies , in line with market demand.

In your purchases, which are definitive, therefore long-term, you will also have to take into account where you plan to store the digital coins you have just purchased. We will explain this to you in the next paragraph.

Il {etoroCFDrisk} % dei conti degli investitori retail perde denaro negoziando CFD con questo fornitore. È necessario sapere come funzionano i CFD e se ci si può permettere di perdere i propri soldi.

eToro Portfolio

There are two options for managing and storing cryptocurrencies purchased on eToro. The first, more immediate, is to leave them in the portal's digital wallet. This way, you can check their value at any time and you can also enjoy eToro's security systems.

You can also sell the digital currency on your wallet at any time right now and with a simple click.

With the second option, however, you will need to download the cryptocurrencies through a special application that supports the eToro wallet, thus making all the transfers you want.

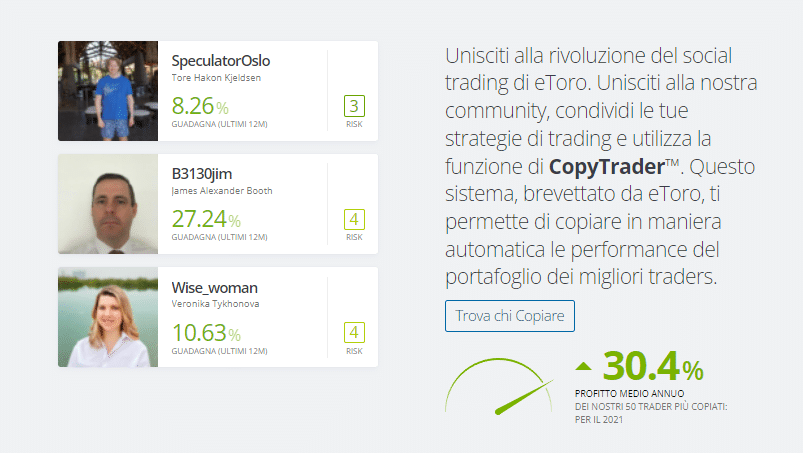

Copy Trading

As we mentioned at the beginning of our eToro review, the portal offers a really interesting option for beginners with little knowledge of finance and investments who want to try making their first investments.

Thanks to the Copy Trading option, you can navigate through a special section that collects the best international traders, accompanied by a whole series of indicators and statistics that will give you a first general overview of the investments and results of each one.

This way you can evaluate the level of risk and the types of financial operations of each "popular investor", before deciding which of them to entrust your invested capital to.

Of course, even in this case you will be able to decide the exact amount to allocate to your investment, choosing whether to use the capital for the entire investor's portfolio or whether to copy only the new positions that the broker will open.

In any case, you will be notified of each new open position and you can also decide to close it independently or remain automatically copying the trader's actions until the latter closes it.

Before you start investing in a specific trader, we recommend that you study their profile carefully, as on eToro everyone shares a profile with the information needed to help the traders they decide to copy understand the financial strategy they will implement.

Il {etoroCFDrisk} % dei conti degli investitori retail perde denaro negoziando CFD con questo fornitore. È necessario sapere come funzionano i CFD e se ci si può permettere di perdere i propri soldi.

Should I choose eToro or traditional banks?

You may be wondering whether it is better to invest in an online broker or in a traditional investment bank. What advantages could eToro bring you compared to, for example, Fineco, Intesa San Paolo or Unicredit?

First of all, the commission aspect, which so often makes us angry with our bank: in eToro they are significantly lower. Also the annual management costs, the opening and closing costs of accounts or stamp duties are absent in eToro.

eToro offers a much more competitive pricing plan than investment banks and other ECN brokers, and also offers free access to high-value added tools such as copy trading, a mobile app, a demo account and much more.

eToro, CySEC and Consob regulations

It is very important, if not essential, that a site like eToro, which operates internationally and deals with financial investments all over the world, is regulated and reliable. Let's start by saying that at a legislative level, eToro finds regulation in each of the countries in which it has its registered office (for Europe we find CySEC license no. 109/10).

But let's see specifically what interests our readers the most, that is Italy. All brokers operating in our country must be registered in a specific list of Consob (authorized investment firms without branches. We can find eToro within it at number 2830.

Obviously, the approvals by Italian and European control bodies support the reliability of the platform in the eyes of users and institutions.

eToro, the reviews of opinion leaders

In our eToro review we have decided to also include the opinions of leading newspapers and commentators in the sector, which will be able to give the user a more detailed and complete vision of how it is considered in 2026 in Italy one of the most famous online brokers.

eToro opinions: what Sole24Ore says

In the field of finance and investments, being able to benefit from an in-depth analysis on the pages of the historic magazine is priceless. In a well-researched piece, Il Sole 24 Ore analyzes in detail how the most famous investment platform in the world works, underlining the possibility of copy trading and comparing it to the Facebook model.

On eToro, in fact, it is possible to share your experiences or the latest financial news on the home page, just like a real social network. We also find a section called eToro club, with the possibility of sharing your nickname and inviting friends.

As for copy trading, the article reports the experience of Massimiliano De Falco, a broker who managed to earn 2 million dollars on eToro through copy trading strategies.

eToro, review on Altroconsumo

When it comes to consumer protection and you want to be well informed about possible scams already committed against users, Altroconsumo is the exceptional voice in this matter. And that is precisely why we want to bring you an article from the "Invest" section of the magazine's online portal.

Reading the article, one might tend towards a negative opinion of the portal, even if from a more careful and conscious analysis, one can find confirmation of what has already been said regarding the less positive aspects of eToro, such as the presence of some commissions that we have told you about or the fact that it has a headquarters abroad.

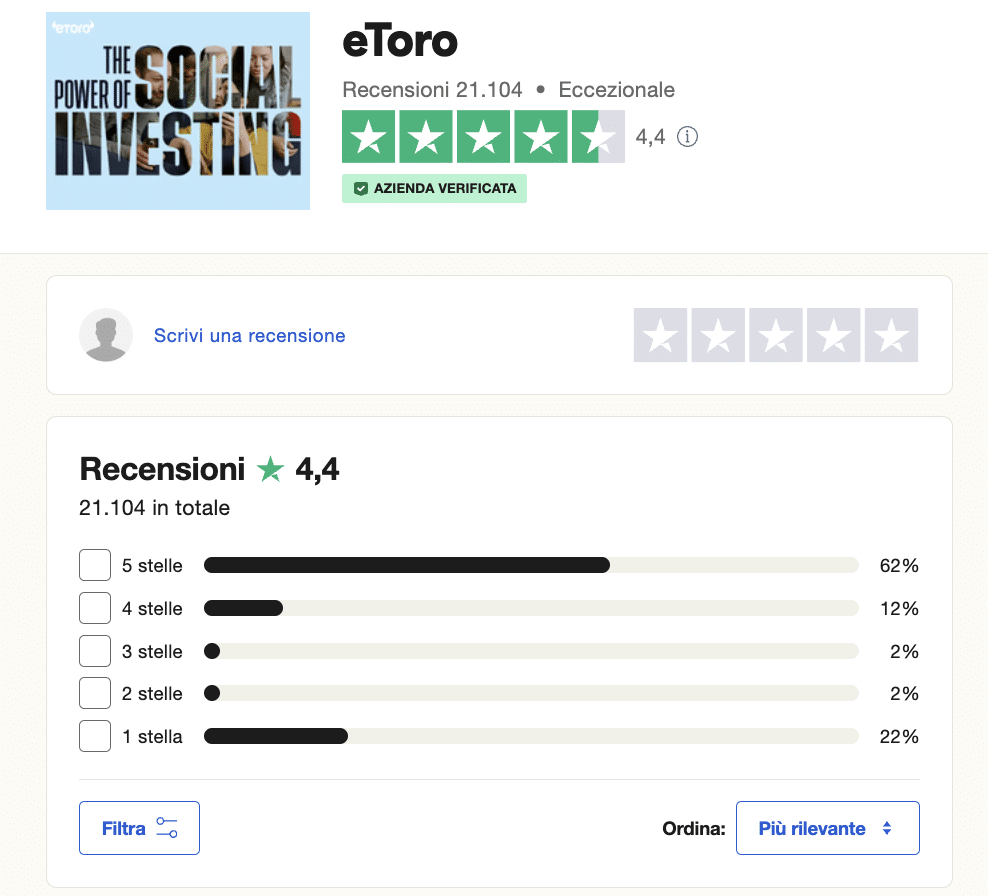

User reviews on Trustpilot

On Trustpilot, the eToro platform has a score of 4.4/5 out of more than 21 thousand reviews. The platform receives praise from users for various aspects, including the quality of customer service, the accessibility of services and features, the usability of the interface and the wide range of assets that meet the different needs of investors.

Conclusions

At the conclusion of this review, for all the aspects we have spoken to you about in depth, we have also formed an opinion about eToro and we believe that it is a reliable portal with a solid company behind it.

However, always keep in mind that trading generally involves high risks of losing your capital in the event of negative market fluctuations. Before investing in eToro or any other broker, we recommend that you do your own thorough research, exercise due caution, and always consider the possibility of losing your money.

Il {etoroCFDrisk} % dei conti degli investitori retail perde denaro negoziando CFD con questo fornitore. È necessario sapere come funzionano i CFD e se ci si può permettere di perdere i propri soldi.

Frequently Asked Questions

What is eToro?

eToro is the leading online broker for financial investments. Through its website and also thanks to the mobile application, you can create your own account through which you can manage your assets and carry out investment transactions, sales and purchases of thousands of raw materials and other assets.How does eToro work?

How do you make money with eToro?

With its thousands of assets, ETFs, stocks and cryptocurrencies, there are many earning opportunities, especially if you have a solid investment strategy and a minimum of knowledge and information on the financial markets. In the absence of all this and for all those who approach online trading, you can follow the operations of expert brokers using the so-called copy trading, a system that automatically performs the same activities as them, obviously using a maximum set budget.What is the risk level on eToro?

Obviously, like all financial investments, you have to take into account a percentage of risk. Precisely for this reason, the portal itself warns users to always use an amount of money that they are willing to lose. In any case, once you access the copy trading section, you can have in-depth information on the risk level of each trader, which goes from 1 (lowest risk) to 6 (highest risk).Is eToro good for a beginner?

We can absolutely confirm that eToro, compared to other investment sites, is undoubtedly the most suitable online broker to start on a path of this type. Obviously, the more you are informed and study the different markets and types of investments, you can become more expert. But the thing that undoubtedly distinguishes it from all the others is the possibility of trying, as we described in our eToro review, the demo account. In this way everyone will be able to evaluate the trends of their choices and the types of financial assets to choose from.All this before risking investing your own money.Is eToro really free?

As surprising as it may seem, eToro has no hidden costs. You can therefore purchase ETFs and Shares at no additional cost, and other assets that include small additional spreads. The costs for withdrawing from your wallet are also clearly indicated, and vary based on the payment method chosen. Other commissions may apply in certain cases, such as if the account remains inactive for more than 12 months. In any case, you can consult the fees and commissions of eToro in detail both in our review and in the information section of the website.eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZMario Leonardo

Mario Leonardo

Vedi tutti i post di Mario LeonardoMario Leonardo si è laureato in Economia Aziendale all’Università di Roma. Dopo una breve esperienza come private banker e gestore di fondi d’investimento, ha cominciato a lavorare come analista finanziario e financial controller, dapprima interno, quindi esterno alle imprese, con particolare riferimento alle Borse internazionali e alla gestione dei capitali delle aziende.

Fin dall’inizio Mario ha accompagnato quest’attività a una sua altra grande passione, la scrittura, collaborando con testate finanziare on e off line su temi quali i mercati internazionali ed emergenti, gli investimenti a lungo termine, il trading forex e finalmente il comparto degli asset digitali: le criptovalute.

Da sempre interessato alla tecnologia e affascinato dalla blockchain, circa 10 anni fa ha deciso di focalizzare i suoi interessi in questo nuovo settore, e oggi ha tutte le ragioni per ritenersi quasi un pioniere, peraltro estremamente soddisfatto della sua scelta. Per completare le sue competenze, Mario si è specializzato negli ultimi anni nelle strategie di trading a breve termine e che egli stesso definisce ad alto rischio: il day trading, lo scalping e il carry trade per il mercato forex.

ATTENZIONE: il contenuto di questo sito non deve essere considerato un consiglio di investimento e non siamo autorizzati a fornire consulenza di investimento. Niente in questo sito web costituisce un’approvazione o una raccomandazione di una particolare strategia di trading o decisione di investimento. Le informazioni presenti su questo sito web sono di natura generale, pertanto è necessario considerarle alla luce dei propri obiettivi, situazione finanziaria ed esigenze. Investire è speculativo. Quando investi il tuo capitale è a rischio. Questo sito non è destinato all’uso in giurisdizioni in cui il commercio o gli investimenti descritti sono vietati e deve essere utilizzato solo da tali persone e nei modi legalmente consentiti. Il vostro investimento potrebbe non essere idoneo alla protezione degli investitori nel tuo Paese o Stato di residenza, pertanto ti preghiamo di condurre la vostra due diligence o di ottenere consulenza ove necessario. L’utilizzo di questo sito Web è gratuito, ma potremmo ricevere una commissione dalle società che presentiamo su questo sito.

Il trading è rischioso e include il rischio di perdite. Le informazioni fornite sono solamente a scopo informativo ed educativo e non rappresentano alcun tipo di consulenza finanziaria e/o raccomandazione di investimento.

Continuando a utilizzare questo sito web accetti i nostri termini e condizioni e l’informativa sulla privacy. Numero di registrazione della società: 103525

© tradingplatforms.com Tutti i diritti riservati 2024

Utilizziamo i cookie per assicurarci di darti la migliore esperienza sul nostro sito web. Se continui ad utilizzare questo sito noi assumiamo che tu ne sia felice.Scroll Up