Migliori exchange di criptovalute italiani online nel 2026

What are the best crypto exchanges to operate in 2026 in Italy? It is now clear to everyone how the cryptocurrency market has undergone dizzying growth in recent years, acquiring an increasingly important role in the global market. Now, the panorama of crypto platforms and exchanges is truly vast and today’s question is: which are the best to rely on, safe from all points of view, regulated in Italy, rich in assets but intuitive and simple to use even for trading beginners?

In this guide we take an in-depth look at the best crypto exchanges in Italy, providing all the information and useful advice suitable for every type of trader: those who are beginners and want to start investing, or those who already know the world of trading and are looking for the best option to operate safely.

In any case, if you want to invest in cryptocurrencies for the first time, you should know the best crypto exchanges of 2026. By continuing reading, you will find a comparison between the different platforms and you will be able to know the costs, the features, the offer, and finally the strengths and weaknesses of each, to find the best investment solution.

[knock]

Top Cryptocurrency Platforms of 2026 – Updated List

To evaluate the best crypto exchanges in 2026 in Italy, you need to consider many factors. First of all, the reference application must be reliable and guarantee customer security. Then, it is important that there is good customer support, because most of the complaints made by customers depend precisely on this. But probably, the most important thing is that a user can always find at his disposal numerous support tools, such as graphs and indicators, which are essential for understanding the performance of the best cryptocurrencies in the market.

Let’s now see in detail which are the best online trading platforms for cryptocurrencies.

75% dei conti al dettaglio di CFD perdono denaro.Best Crypto Exchanges: Overview

The best crypto brokers in Italy 2026

All trading platforms differ mainly in terms of commissions, supported markets, ease of use and more. Below you will find a list of what our experts believe are the platforms richest in crypto assets, safe because they are regulated, intuitive and convenient in terms of management costs and commissions.

1. XTB – Trade CFDs on 50 Cryptocurrencies

The broker offers access to thousands of markets in a single platform, with trading solutions designed around the needs and ambitions of investors. It allows trading on over 5900 instruments from all over the world and is easy and intuitive to use, suitable for both novice and experienced traders.

It also includes a section with free training content for those who are new to the world of trading and cryptocurrencies.

The XTB app is the famous xStation 5, one of the most reliable and functional trading services on the market, with which each user can trade on over five thousand instruments including forex, real stocks and ETFs with 0% commissions, CFDs on indices, raw materials such as gold and cryptocurrencies.

In the table below, we summarize all the key points of XTB:

With an intuitive interface, a user-friendly design and created to make managing investments quick and easy, XTB has earned the trust of over 721,000 clients worldwide. All the functions needed for trading are also available on mobile, with the app available for both iOS and Android. To invest in new cryptocurrencies , or in more historicized assets, the platform offers more than 50 CFDs on assets including Bitcoin , Ethereum, Stellar, Dogecoin and other cryptocurrencies that will explode . The CFD, we recall (“Contract for Difference”) will allow you to speculate on both the rise and fall of prices. The trader will then have to decide when to close the operation, and any profits or losses will be calculated based on the difference in value compared to the opening. But be careful: operating with CFDs is really very risky, so maximum caution is required. XTB also provides users with advanced analysis tools (technical analysis, correlation analysis, a wide range of technical indicators), negative balance protection, leverage up to 1:2, low trading costs and spreads starting from 0.22%.

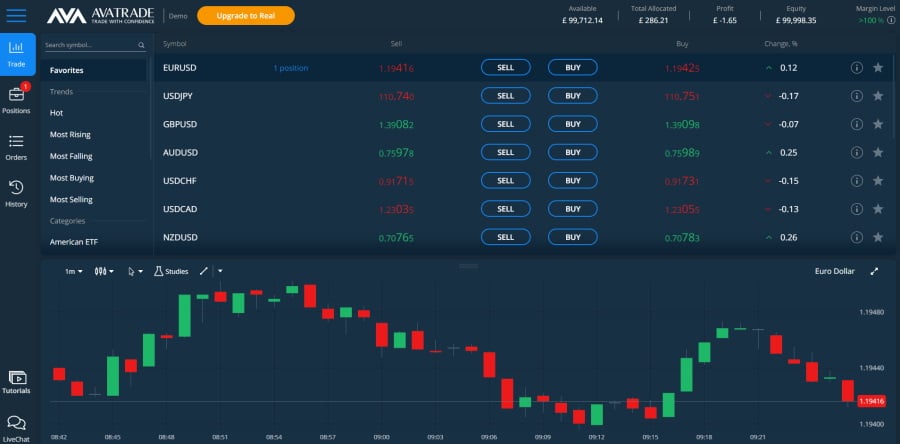

75% dei conti al dettaglio di CFD perdono denaro. Founded in 2006, AvaTrade is an international CFD and forex broker regulated by several top financial institutions. When it At AvaTrade you can then trade seven different cryptocurrencies directly in the AvaTrade platform with zero transaction fees. But let's take a closer look at all the key metrics of the exchange, from commissions to payment options, to mobile trading. In terms of trading minor, major and exotic currency pairs you can download the best MetaTrader 4 and MetaTrader 5 platforms on both Windows and iOS operating systems, as well as a web-based version and mobile trading app for Apple and Android devices. AvaTrade also has plenty of resources and tools that novice traders will appreciate, such as a free trading account with $100,000 in virtual funds to practice your trading strategy in a risk-free environment, as well as access to more than 250 financial instruments including 24/7 cryptocurrency trading.

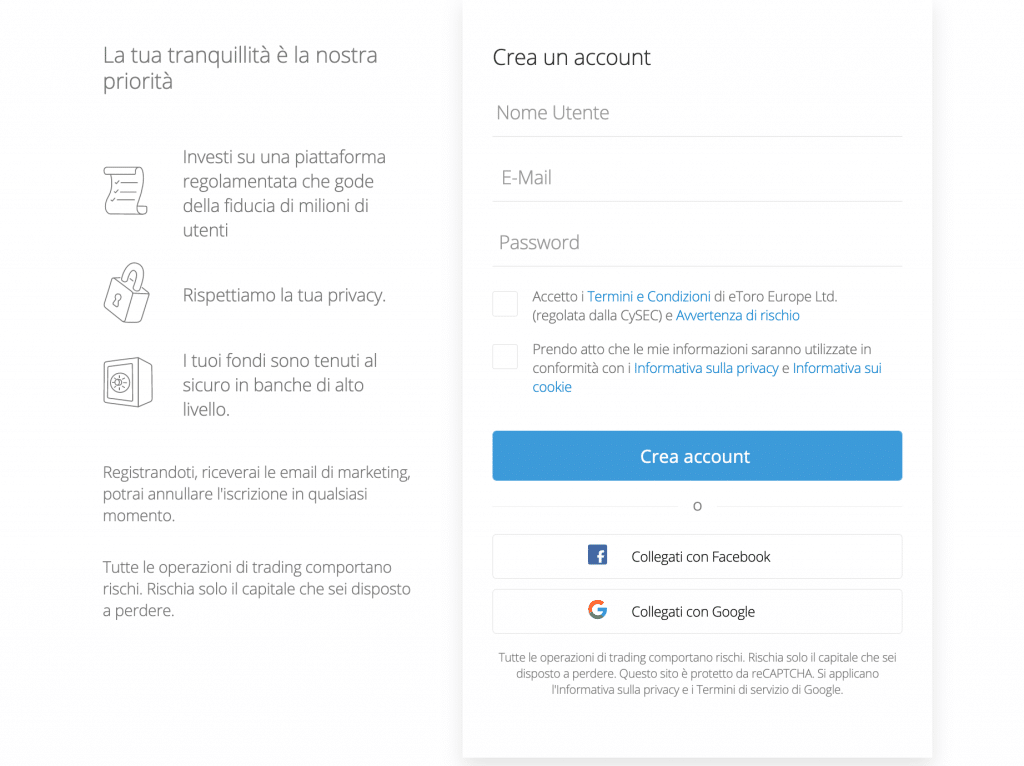

Your capital is at risk Among the best online crypto exchanges we point out eToro , perhaps the most famous and popular trading platform in the world, which covers a vast range of markets and investment activities, guaranteeing you access to thousands of stocks and ETFs from the United States, the United Kingdom, Hong Kong, Canada, Germany and beyond. In addition to CFDs, with eToro you can also invest directly. eToro is also at the top of its game when it comes to regulation, as it is approved in Europe by the regulatory body CySEC, and in Italy also by Consob, which increases security for Italian users and has one of the lowest percentages of losing accounts, significantly lower than the average among cryptocurrency trading platforms.

The user who wishes to register on the platform must enter a name, an email address, an alphanumeric password, accept the terms and conditions and the risk warnings. He/she must then confirm the registration via email. At this point, all you have to do is click on “Invest”, eToro will show you a new tab where you can set up all the details of the investment. The minimum trade on eToro is only $10.

Il {etoroCFDrisk} % dei conti degli investitori retail perde denaro negoziando CFD con questo fornitore. È necessario sapere come funzionano i CFD e se ci si può permettere di perdere i propri soldi. Skilling is one of the most reliable crypto exchanges specializing in CFDs. The company was founded in 2016 by a group of Swedish investors, who Skilling is suitable for both experienced traders – as it supports advanced tools such as MT4 and cTrader – and for those who are new to the world of cryptocurrencies – for whom it simplifies the search for assets, reviewing price charts and placing trading orders. Skilling also offers a Copy Trading tool that allows investors to replicate proven strategies in real time. This will appeal to those who want to actively trade CFDs but passively. Skilling offers a maximum leverage ratio of 1:30, but the limits will depend on the trader’s position.

[/su_list]

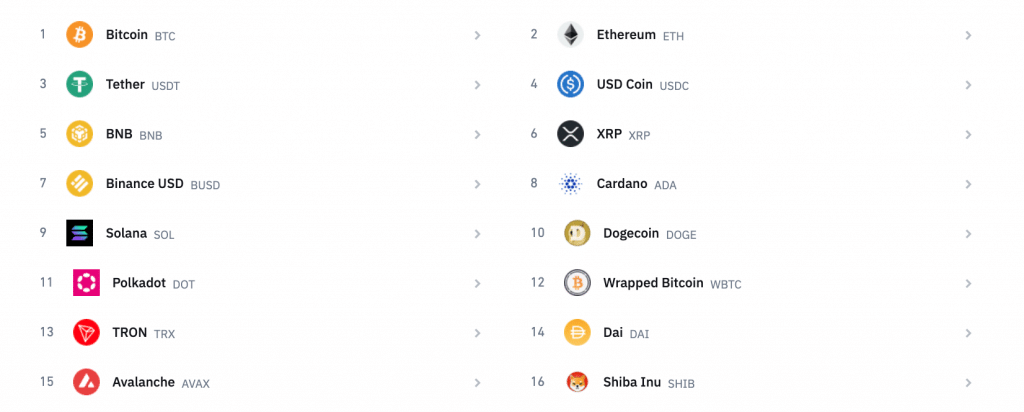

Il 56% dei conti degli investitori al dettaglio perde denaro quando fa trading di CFD con questo fornitore. As we have already had the opportunity to specify, trading platforms often do not allow the direct purchase of assets in the cryptocurrency market, but only through derivative instruments, the so-called CFDs. Exchanges, on the other hand, offer the user the possibility of being able to purchase the most promising cryptocurrencies directly. The differences between trading and exchange platforms are not only related to the possibility of direct purchase of assets, but also to other factors. First of all, exchange platforms do not have derivative instruments, but only allow the direct purchase of crypto-assets. For this reason, as a second difference, exchanges are less secure and are not authorized and regulated in the same way. In addition, these platforms for investing in cryptocurrencies that will explode have a series of alternative tools such as digital wallets, which can be customized according to the user's needs, and with which it is possible to earn simply by blocking the assets. The biggest problems that arise through exchange platforms are certainly on the security level. For this reason, in this guide we also try to explain how to avoid losing the fruits of your investment. But, first, let's see what the best crypto exchange platforms are. Before we start talking about the best trading platforms , let's specify what it is exactly. The so-called online trading brokers are essentially online platforms with which you can have access to a series of tools and ways to optimize your investment strategies. In the same way that you can start investing in classic markets, such as stocks and Forex, you can also start doing the same, in your own small way, in the cryptocurrency market through these platforms. In fact, one of the major advantages represented by cryptocurrency assets is the fact that the market is not regulated, which allows anyone to start investing, especially if you consider the high volatility that, on the one hand, can cause your investment to fail, but on the other could lead to success. This is one of the reasons why betting on the performance of a cryptocurrency has become very popular and accessible to everyone. In fact, such a market is also open to small investors, who try their luck without risking too much money. Furthermore, trading platforms operate thanks to Contracts for Difference (usually abbreviated to CFD), which are actually the engine of the cryptocurrency market, as they allow you to operate on an asset without actually owning the invested securities, but replicating exactly the trends of the latter. With CFDs you can have a series of advantages such as: But now, let's see together what are the best cryptocurrency investment platforms and discover together what are the advantages and disadvantages of each of them. Being an exchange platform, finding the cryptocurrency you are interested in will be very easy, since it will probably appear right on the main screen. If not, just write the asset you intend to buy in the appropriate search box. At this point, all that remains is to purchase the desired asset. The main payment methods are bank transfer or credit/debit card entered during registration and, after entering the amount you want to purchase, finally, just click on the yellow 'Buy' button. As for the bank transfer, however, the procedure is slightly slower, since the app will ask you to verify some additional information, such as your residential address and a bank statement. At the end of the procedure, you will find the amount of your deposit in the personal section of your account and you can immediately proceed with the conversion into the cryptocurrency of your choice. This review so far has covered the best cryptocurrency trading platforms and exchanges currently available, recommending the best ones and all the specific features of each. In general, however, we now try to provide the essential features that each cryptocurrency platform must offer in order to be considered good. All of the ones listed above have these conditions, but if you want to try others, make sure that these requirements are met. Brokers usually have a section dedicated specifically to charts and often offer users tools and settings to best adjust them, according to their own perspectives. For exchanges, however, usually, even if there are graphs, there are often not all the settings that can be found on a cryptocurrency trading platform. In general, however, each crypto exchange has a section dedicated to graphs in which it is possible to find the performance of an asset: Indicators are analytical tools consisting of algorithms and statistical equations that allow the trader to perform detailed analysis on the performance of a given cryptocurrency in the market. As for indicators, the difference between trading platforms and exchange platforms becomes clearer. Indicators, in fact, are a prerogative mainly of trading brokers rather than exchanges, which instead have few and are mostly default. For this reason, it is always recommended for less experienced traders to use cryptocurrency trading platforms, since indicators are really very important tools for understanding the performance of an asset, while with exchanges you could find yourself in serious difficulty and you could make reckless investments. What can be said about this is that exchange platforms usually charge higher commissions than brokers. This is because instruments such as CFDs tend to increase the number of trades compared to platforms that do not allow this. Another consideration to make is the minimum deposit to be made. Platforms like Libertex, which require a minimum deposit of €100, are certainly less convenient for those who do not intend to invest that amount in the cryptocurrency market, or at least, not immediately. For this reason, many investors prefer eToro. As for exchanges, minimum deposits are increasingly lower, as in the case of Crypto.com, with which you only need to invest 1 euro. This is because exchanges try to involve mostly novice investors, while more experienced ones rely on brokers who, consequently, seek larger investments. It is absolutely essential that a trading platform or exchange presents the best conditions to allow a user to open an account in complete safety. As we have already written, trading platforms are definitely safer and offer greater guarantees than exchange platforms. This is because brokers must comply with a whole series of regulations and specific authorizations prescribed by law. To find out all the information about it, just consult an organization called ESMA. While, as far as exchanges are concerned, only some of these rules must be respected, as prescribed by the MIFID II regulation. To best protect your data on exchange platforms, it is important that they always present two-factor authentication, even if this is not enough to guarantee the same security as a cryptocurrency trading platform. Again, brokers are better than exchanges, but in general, every cryptocurrency platform tends to offer the best possible service when it comes to customer support, such as a dedicated operator who can solve your problems. Customer support is also important in determining the success of a cryptocurrency platform, as negative user reviews often tend to highlight their experience with support. First of all, it is always possible that you may receive a cyber attack or that there may be malfunctions within the exchanges, which can practically destroy your assets contained in the wallet. Often, cryptocurrency exchange purchasing platforms believe that the user is making non-transparent operations with their assets and therefore freeze the account. Furthermore, statistics show that at least one account of every type of exchange in circulation has been hacked. This is because inexperienced users are fooled by promises of earnings offered by intermediaries who instead simply try to take advantage of your digital wallet. To prevent this from happening to you, one of the best tips we can offer you is to move your assets to an external wallet and simply leave what you want to invest in the wallet provided by the exchange. Opening an external wallet is not very complicated and there are two types: hot wallets and cold wallets. Hot wallets are digital wallets available online on some platforms such as Coinbase and MetaMask and are connected to the internet. But, if you are really paranoid, for example, you can even buy a physical wallet, a cold wallet, which has the same characteristics as a simple hard disk, on which you can physically deposit your crypto-assets and is not connected to the internet. We have finally reached the end of this guide, in which we have attempted to explain in detail many information regarding the cryptocurrency market. First we saw what a crypto exchange actually is and then we analyzed the best investment platforms out there to start investing in the cryptocurrency market. Finally we explained what the essential requirements of each platform are and what the associated advantages and risks are, and how to avoid them. Now, in conclusion, we can only hope that you have a clear and complete overall vision of the cryptocurrency phenomenon and that you can manage to move within it without too much difficulty.

75% dei conti al dettaglio di CFD perdono denaro.

Resources

Stocks, Forex, ETFs, Indices, Commodities and Cryptocurrencies

Commissions

Variable spreads starting from 1 pip

Minimum deposit

–

Minimum trade

0.01 lot

Advantages and disadvantages of XTB exchange

Advantages:

Disadvantages:

2. AvaTrade – Popular exchange for trading forex, CFDs and cryptocurrencies without commissions

comes to tradable assets, AvaTrade offers forex trading and a wide range of CFD derivatives including stocks, bonds, ETFs, commodities and indices.

Resources

Stocks, Forex, ETFs, Indices, Commodities and Cryptocurrencies

Commissions

Spreads as low as 0.9 pips

Minimum deposit

100 dollars

Minimum trade

0.01 lot

Advantages and disadvantages of AvaTrade exchange

Advantages:

Disadvantages:

3. eToro – Best Stock and Cryptocurrency Broker for 2026

Simple and intuitive, eToro is suitable for every trader profile, from beginners to expert investors, as demonstrated by 20 million users and an international community. The platform interface is very intuitive and user-friendly, capable of accompanying the user step by step in investments.

One of the best services of the exchange is Social trading, with which, through the so-called "copy trading" it is possible to emulate the investments of the most expert traders by selecting them based on your investor needs - returns, risk index, markets of interest. With the Social Trading feature it is then possible to share your experience and useful advice for other users on a social network-style bulletin board.

eToro also offers so-called Smart Portfolios, innovative and diversified investment portfolios for long-term accumulation or savings strategies, managed in real time by eToro's expert analysts.

Resources

Stocks, Cryptocurrencies, ETFs, Copy Trading, Smart Portfolios

Commissions

0% on ETFs, 1% on cryptocurrencies

Minimum deposit

10 dollars

Minimum trade

10 dollars

Advantages and Disadvantages of eToro

Advantages:

Disadvantages:

Open an account and start investing with eToro

Once the account is opened, it will be possible to access the platform tools without any deposit through a demo account, to test the app's features before starting to invest.

After making a minimum investment of 50 euros, you can search the crypto assets of your interest in the navigation bar and start investing. It may be useful to first have all the information on the coin of your interest such as its performance, history, price and capitalization.

The easiest way to deposit money into your account is with a credit card, debit card or from an e-wallet, as these payment methods can be processed instantly. Bank transfers are also supported, although these may involve fees based on the agreements with the banking institution.4. Skilling – Intuitive CFD trading platform with over 1,200 markets

now own a private company based in Nicosia, Cyprus.

On Skilling, traders have access to over 1,200 financial markets including forex, commodities, metals and gold, energies, indices, stocks and ETFs. Skilling also offers trading in over 50 cryptocurrency pairs.

The platform differs from its competitors in that it offers a wide variety of CFDs for both stock trading and forex trading, and through CFDs, the broker offers limited trading in commodities and cryptocurrencies, offering a good selection of financial instruments.

In this regard, the exchange offers two different versions of its trading platform: one for rapid trading and analysis and one for advanced analysis and algorithmic trading. To this should be added the MetaTrader4 platform for forex trading. There is also a trading app that you can use on the go with your mobile phone.

Resources

Stocks, Forex, ETFs, Indices, Commodities and Cryptocurrencies

Commissions

Spread only

Minimum deposit

100 euros

Minimum trading

No minimum required

Advantages and Disadvantages of Skilling

Advantages:

Disadvantages:

Best crypto exchanges to buy

What is a crypto exchange?

2. Find cryptocurrencies

3. Buy cryptocurrencies

Best Crypto Exchanges: Essential Features

1. Graphs

2. Indicators

3. Costs and commissions

4. Security

5. Customer Service

Best Crypto Exchanges - Main Risks

Best Crypto Exchanges - Conclusion

Frequently Asked Questions

What are the best crypto exchanges?

Are there any deposit fees?

Can I buy cryptocurrencies even if I have no experience?

How can I buy cryptocurrencies?

Is investing in the cryptocurrency market safe?