Come Comprare Solana (SOL) in Italia – Guida per principianti 2026

Solana is undoubtedly one of the emerging cryptocurrencies that has performed best in recent years and, for this reason, many agree that buying Solana is definitely a great investment to make in 2026.

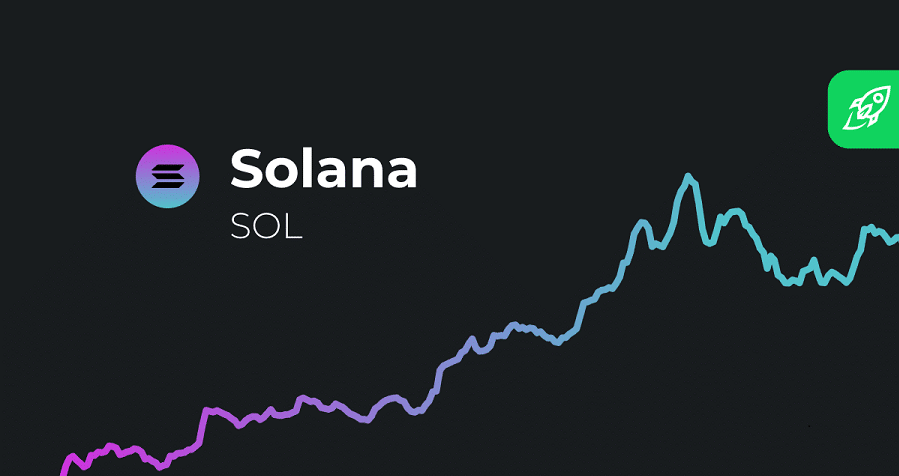

In July 2021, its value stood at around €30 and, in just 4 months, it reached a new high of €224. The current value is on the rise and this means that it is a great time to invest in this cryptocurrency.

Navigating the cryptoverse, however, may not be so easy for a beginner, so we have created a guide to help you take your first steps in this world and make your first investment in Solana.

Your capital is at risk.

[knock]

What is Solana (SOL)?

Solana is a governance cryptocurrency of the Solana ecosystem , founded in 2020 by CEO Anatoly Yakovenko. The Solana blockchain was one of the first to provide an alternative to the Ethereum ecosystem, enabling the creation of numerous new exchanges and decentralized apps that work thanks to smart contracts. For example, among the projects that have had significant growth on Solana, it is possible to find the Chainlink project and the NFT platform “Solanart”, as well as the Raydium token.

The Solana coin, therefore, is used on its own ecosystem for any kind of transaction and for the payment of fees on the various exchanges. This means that the more the ecosystem grows and reaches new peaks of popularity, the more SOL will increase its value exponentially. If we consider all these characteristics, it is possible to naturally compare Solana to Ethereum, with the difference that the former allows cheaper and faster transactions and, for this reason, represents a truly competitive alternative that is increasingly emerging on the crypto market.

Just think about the difference in transaction times: Solana allows 50,000 transactions per second, while Ethereum allows only 45 per second. This difference, in recent years, has led to the migration of thousands of projects from the Ethereum blockchain to Solana and, we are sure, that SOL will become an even more relevant reality in the coming years.

Why buy Solana (SOL)?

After a marginal decline in November 2021, Solana seems to have returned to growth in recent weeks, suggesting that a new bull run could be triggered in the short term that could bring the value of the coin back to €200.

It is quite understandable that you wonder whether it is seriously worth investing in Solana. From our point of view, it is one of the “must have” cryptocurrencies that you must necessarily include in your diversified portfolio. From the cryptocurrency chart, it is possible to deduce that the resistances are quite solid and the daily trading volumes are gradually increasing. Some people even venture that Solana could represent the next Bitcoin or Ethereum.

One aspect to consider is that, as already mentioned, Solana was born as an alternative to the Ethereum blockchain. In fact, the first smart contracts were developed on Ethereum and the first decentralized applications (or DApps) were born. Despite the revolution that smart contracts and DApps have generated, all users agree that Ethereum fees are excessively expensive, especially considering the slowness of transfers. Surely, with the next and imminent updates, Eth2 will lead to several changes in 2022 but it is not possible to predict what evolutions this transition will lead to.

For this reason, investors, waiting for more information on the matter, are investing in alternative blockchains, first and foremost Solana. Solana already allows for the versatility and cost-effectiveness that Ethereum is trying to achieve with the announced updates, which is why, paradoxically, at this moment Solana represents a more solid investment than its direct competitor.

The Solana blockchain is designed to be fast, intuitive and cheap, and for this reason, it is quite predictable that starting in 2022 we will see a significant increase in the price of SOL.

Buy Solana, how much is it worth?

As you can see on the best exchange sites, the price of Solana is currently around €89 per token. However, like all other cryptocurrencies, the price of SOL is subject to high price volatility. Between the months of August and November 2021, Solana saw an exceptional bull run that led to an increase in value from €30 to around €200 per token.

Compared to the value of €30 last August, in fact, the current value of the coin has more than tripled and, we are convinced, that this is the best time to invest in this coin since a new bull run is possible soon.

Solana currently has a market cap of $34.9 billion and an average daily trading volume of $3 billion.

Where to buy Solana safely

The best way to buy Solana is to use a regulated and reliable exchange. In recent years, in fact, there are many platforms specialized in trading and cryptocurrency exchange that have seen their expansion to Italy. It is possible, however, to run into fraudulent platforms that perpetrate scams and deceptions against less experienced users who are new to the world of cryptocurrencies. For this reason, we suggest always being cautious and always consulting the web to search for opinions and feedback before investing your money. We can undoubtedly suggest the eToro , Huobi , Libertex and Activtrades exchanges .

On eToro, for example, you can buy cryptocurrencies without paying commissions and it provides access to a lot of useful information for traders. Huobi offers newly registered users a rich welcome bonus. Libertex has a pleasant and secure interface, while Activtrades provides complex tools and charts to better plan your trading strategy. All the platforms mentioned, however, require you to register your own account before carrying out any type of operation. Registering your account, in fact, is equivalent to creating a wallet.

After creating an account and sending your identity document to the platform, you will be able to access your balance and start making your investment.

Are there any risks in buying Solana?

If we have talked about the great earning opportunity related to investing in Solana, we should also warn you about the related risks that, generally, you could encounter in the world of cryptocurrencies. As you well know, in fact, cryptocurrencies represent a category of assets whose price is very volatile and, for this reason, you could encounter unexpected fluctuations generated by the markets or by world news.

You can, however, minimize your risks by trading with leverage, which can be used on certain platforms and on particular assets such as CFDs. This will allow you to increase your earnings thanks to multipliers but, even in this case, it is possible to incur significant losses.

For this reason, we recommend that you always do thorough research before making your investments and never invest an amount that you are not willing to lose.

How to sell Solana

If you intend to trade your tokens, you will need to understand what the best time to sell them and make a profit is. The work of traders is essentially based on this: buy when the token is worth little and resell it when it is worth more. This formula can be repeated endlessly and the most experienced manage to earn exorbitant figures with this simple procedure.

Once you have purchased and understood the SOL cryptocurrency, with the help of the price predictions available online, you will be able to understand when the price is about to go up or down. Often, the best time to sell Solana is when you think the price has reached a new high and a correction is coming. Right then might be the wisest time to take profit and sell your tokens.

Solana Future Price Prediction

After the All time high (ATH) in November in which it reached a maximum value of over €200 per token, Solana made a very long correction until the following March. In recent weeks SOL seems to have regained ground, rising above €100 in value.

It is highly likely that Solana will experience a new bull run in the next quarter and it is foreseeable that by August 2022 it could, at least, reach the value of €200 again. By the end of the year it is plausible to expect a value of €350 per token. In short, if you decide to invest €1000 in Solana right now, at the end of the year you could find over €3000 in your wallet.

Our prediction, assuming a growing interest in the project and the birth of new dApps on the platform, is that Solana can reach the price of €1000 by 2030. The very low supply of circulating tokens, in fact, is just over 500 million. This will make Solana a rather rare coin, over time, which is why we are convinced that like Bitcoin or Ethereum it will tend to have a deflationary nature and reach new historical highs more and more frequently starting from 2022.

Where can I buy Solana?

As mentioned above, there are numerous platforms in Italy to buy Solana safely. Let’s see together which are the main exchanges and what are the respective peculiarities that characterize them.

The platforms we have selected are: eToro, Huobi, Libertex and ActivTrades.

The first of the alternatives that you can consider is, without a shadow of a doubt, eToro. eToro allows you to buy many cryptocurrencies and follow the value of the entire crypto sector in real time. The commission costs are very cheap and the platform is presented in an intuitive and attractive way, allowing its users to consult all the main news related to the world of cryptocurrencies. It is considered the number 1 platform in Italy in the exchange sector and, therefore, you can deposit your funds here in complete safety.

Your capital is at risk.1) eToro – By far the best platform to buy SOL

Pros:

Against:

Likewise, you can use the Huobi platform, which is full of features and very professional. Here you can register in just a few clicks and purchase your Solana tokens through a good number of payment systems. The platform also provides access to a variety of tools for trading cryptocurrencies, which will give you the opportunity to use part of your SOL funds to try to increase your income. The main feature of Huobi is that you can periodically take advantage of bonuses and promotions that can be redeemed through certain operations to be carried out on the platform. By registering on Huobi, in fact, you can redeem a welcome bonus that will allow you to earn up to 150 dollars.

Your capital is at risk.2) Huobi – The platform full of bonuses and promotions

Pros:

Against:

On Libertex you can buy Solana in complete safety and comfort, thanks to the applications made available for Android and iOS devices directly on the platform’s website. Even the desktop version of the website, however, is very intuitive and it will be very easy to orient yourself among all its various sections. Wherever you are and at any time of the day, you can add new funds to your balance and follow the progress of your investment in real time. Even in this case, to access the Solana wallet, it is necessary to complete the registration process, which, however, is simple and quick.

85% of retail investor accounts lose money when trading CFDs with this provider.3) Libertex – The best mobile application

Pros:

Against:

Activtrades is an emerging platform, probably unknown to most, which is making a lot of noise about itself within our country. On Activtrades you can buy cryptocurrencies such as Solana, stock indices or invest in ETFs using a large amount of specific calculation tools that allow users to organize investment strategies and plans efficiently. It is certainly a highly professional platform, which is why it is generally recommended for expert users who are already familiar with the world of digital investments in crypto assets. It must be said, however, that it takes little to understand all the mechanisms of Activtrades and, with a little ingenuity, it is possible to use all the tools made available without too much difficulty.

65% of retail investor accounts lose money when trading CFDs with this provider.4) Activtrades – The most professional platform

Pros:

Against:

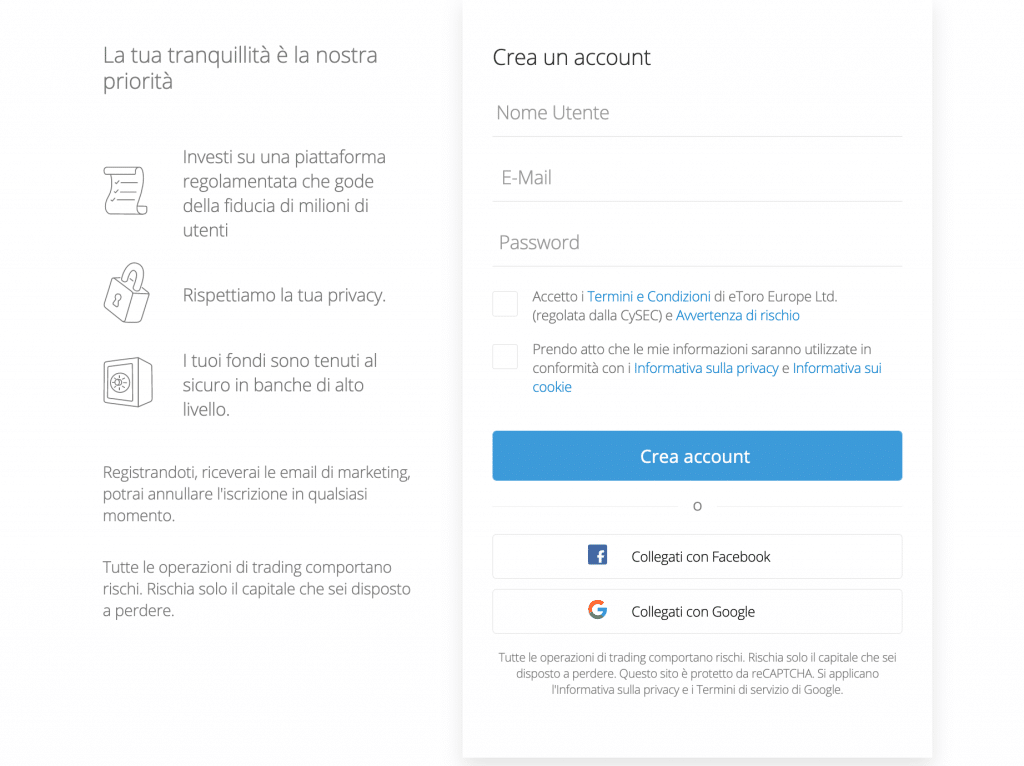

The Easiest Way to Buy Solana - Tutorial with eToro

In this section of our guide we would like to show you, step by step, how to buy your Solana on an exchange. The procedure is generally similar for all platforms. It will be up to you to choose the one that best meets your needs and tastes. Below we will report the steps necessary to buy Solana through eToro, one of the best exchanges in Italy.

Log in to the official eToro website and, on the main page, at the top right you should find a green button that says “Sign up now”. Clicking on it will open a form to fill out with your personal details, your email address and your mobile number. To confirm that the data entered is correct, a confirmation email will be sent to you. It will then be necessary to access your email inbox and click on the confirmation button on the email. If you do not find the eToro email, it may be possible to find it in the spam section. At this point you will be asked to send a copy of a valid identity document. You can choose between an identity card, driver’s license or passport. Alternatively, you can send a bank statement issued by your bank in which your name appears. Una volta che il processo di registrazione sarà giunto correttamente a termine, vi sarà possibile depositare i vostri fondi su eToro. La piattaforma accetta numerosi sistemi di pagamento tra cui carta di debito o credito dei circuiti Visa e Mastercard, Paypal e bonifici bancari; nonostante alcune piattaforme richiedano un deposito minimo di almeno 250€, su eToro è possibile ricaricare il proprio conto anche solo con 50€. I pagamenti vengono processati immediatamente anche se, nel caso dei bonifici bancari, la transazione potrebbe richiedere dai 3 ai 4 giorni per essere convalidata. Inoltre scegliendo l’opzione bonifico bancario è possibile che l’istituto bancario di riferimento possa richiedere il pagamento di una commissione per il trasferimento. Su eToro è possibile acquistare un vastissimo numero di criptovalute, e vi sarà possibile avere accesso istantaneo a tutte le informazioni relative a ciascun token; qualora siate interessati ad acquistare Solana, vi basterà cliccare sulla barra di ricerca di eToro e inserire la sigla “SOL”. Una volta aperta la scheda relativa a Solana, sarà necessario inserire l’importo che si desidera acquistare e confermare cliccando sul pulsante “Compra Solana”. Acquistare criptovalute su eToro non richiede il pagamento di commissioni aggiuntive. I token verranno, quindi, immediatamente convertiti sul vostro wallet e potrete subito utilizzarli per effettuare operazioni di trading o per trasferirli su altre piattaforme. Il tuo capitale è a rischio. Giunti alla conclusione della nostra guida per comprare Solana in Italia, ci auguriamo di aver sciolto ogni dubbio riguardo a questa particolare blockchain. Solana si presenta come un progetto solido, valido e affidabile. La piattaforma intuitiva e user-friendly, la scalabilità e la velocità delle transazioni ha rappresentato una vera e propria rivoluzione. Non a caso, solo pochi mesi fa ha cominciato la sua prima vera corsa nel crypto verso ma quello di cui siamo certi è che questa crescita rappresenta solo l’inizio. Siamo certi, infatti, che il progetto darà ottime soddisfazioni ai propri investitori e pensiamo che sia più che saggio approfittare del prezzo attuale. Nonostante il progetto sia relativamente giovane, sta compiendo progressi immensi mese dopo mese; questo permette agli sviluppatori di dApps e ai programmatori di avere ancora più confidenza e fiducia nell’ecosistema, garantendo ad esso una crescita sempre più rapida.

Your capital is at risk.1) Register your account on eToro

2) Verification via an identity document

Although this is often considered a tedious procedure, verifying your identity document is an additional guarantee of the security of the platform.3) Effettua un primo versamento su eToro

4) Compra Solana (SOL)

Conclusione

eToro, la migliore piattaforma per comprare Solana

Buy Solana - Frequently Asked Questions

What is Solana?

Who created Solana?

Do I need a crypto wallet to buy Solana?

Can I buy Solana in Italy?

How much money should I spend to buy Solana?