Le migliori piattaforme di trading online per principianti nel 2026

Le migliori piattaforme di trading in Italia, recensite per te dai nostri esperti. Trova i broker azionari, Forex, CFD, cripto, social o day trading a misura delle tue esigenze di investimento

- Solo piattaforme di trading regolamentate

- Scopriamo costi nascosti, commissioni e spread

- Le recensioni dei migliori broker in base alle tue esigenze

Del tutto regolamentato

Recensito da esperti

Sicuro e affidabile

Commissioni trasparenti

Versione mobile

What are the best online trading platforms? In this guide, useful for beginners but also for those who already move between financial markets on the web, we will offer an overview of the safest and most advantageous brokers for every portfolio need.

In fact, when you try your hand at trading, it is essential to have the most suitable and versatile free platform available based on the markets chosen for your financial operations: stocks, forex, raw materials or cryptocurrencies.

For this, you can count on the reviews of TradingPlatforms analysts, who can help you identify the best performing and most suitable trading sites for you in 2026 for Italy.

As you continue reading, you will find many indications on the best online brokers, which stand out in the sea magnum of different platforms. We will take care of updating the list in order to always offer you the best solutions for your trading needs.

Best Online Trading Platforms of 2026: Overview

Let’s start with a quick overview of the best online trading platforms to consider for this 2026, after which we will examine, one by one, those that in our opinion are the most interesting and reliable brokers.

Choosing the best trading platform is not easy, in a market where hundreds of online service providers operate and where the offer is really varied and competitive… and it’s clear why! In fact, it is not enough for a platform to have an excellent reputation and to be able to support the financial markets you are interested in. It must also offer competitive rates, first-rate customer service, and then of course advanced but easy-to-understand tools, an excellent user experience for trading functions, all the training resources and indicators for reading the charts.Best Trading Platforms in Italy – Reviews

Guide to the most interesting online platforms

Let’s now examine the best trading platforms: those that offer the most competitive rates and commissions, the widest range of assets and of course the greatest guarantees from a regulatory point of view.

For each platform we will see the main features and distinctive aspects, variety of assets, costs of use and commissions, then how to proceed with registration. We will review user opinions and finally outline the advantages and disadvantages in a quick list.

1 . XTB – The best trading platform for CFDs, forex and cryptocurrencies

XTB, ranked first in our ranking as the best trading platform, is a broker founded in Poland in 2002, later spread throughout Europe and present in Italy since 2010.

Currently, XTB has branches in more than 13 countries, including the UK, Germany, and is able to offer more than 700 thousand clients worldwide at least 5,600 investment instruments, including more than 50 CFDs on the best cryptocurrencies and stocks.

The company is listed on the Warsaw Stock Exchange under the symbol XTB, and for Europe it is regulated by the Cypriot supervisory body CySEC.

The broker offers access to thousands of markets in a single platform, with trading solutions designed according to the needs and greater or lesser risk appetite of investors.

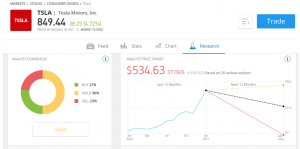

At XTB you can invest in a wide range of assets, including forex with 48 currency pairs, leverage up to 1:30 and EUR/USD spreads from 0.00003, more than 35 indices CFDs and over 3,000 shares from 16 major exchanges around the world including Tesla, Netflix, Amazon and Mediaset. The offer is completed by 21 commodities CFDs with 1:10 leverage and negative balance protection, around 300 instruments to invest in ETFs from all over the world, with a minimum transaction value of just 1 euro, and of course 50+ cryptocurrencies CFDs with advanced analysis tools, leverage up to 1:2 and spreads starting from 0.22%.

The offer, as we have seen, is very broad and tailored to every trading need and preference, but the most noteworthy feature of XTB is certainly the possibility offered to the user to operate directly or use CFDs.

Trading with CFDs (contracts for difference) gives you the opportunity to operate on the upward or downward movements of different assets – be they stocks, cryptocurrencies, indices, raw materials or forex or other – without actually owning them but only obtaining exposure to price trends. For example, if you think the price of an asset will rise, you will go “long”, while if in your prediction you think the price will fall, you will go short. You will have profits or losses based on the accuracy of your prediction. In any case, we point out that operating with CFDs is very risky, so we recommend you to be extremely cautious.

Easy and intuitive to use, TXB is suitable for both experienced traders and those new to the world of trading.

XTB’s attitude towards training is evident in the “training” area of the site, full of training and informative content, with webinars, guides, market analysis and free video courses and ebooks for those who are approaching the world of trading and cryptocurrencies for the first time.

XTB also offers more experienced investors advanced analysis tools – such as technical analysis and correlation analysis, with a wide range of technical indicators. All are provided with negative balance protection, leverage up to 1:2 for cryptocurrencies, low trading costs and spreads starting from 0.22%.

Stocks and ETFs with a monthly volume of up to 100,000 euros are also commission-free, while transactions above this limit will be subject to a 0.2% commission.

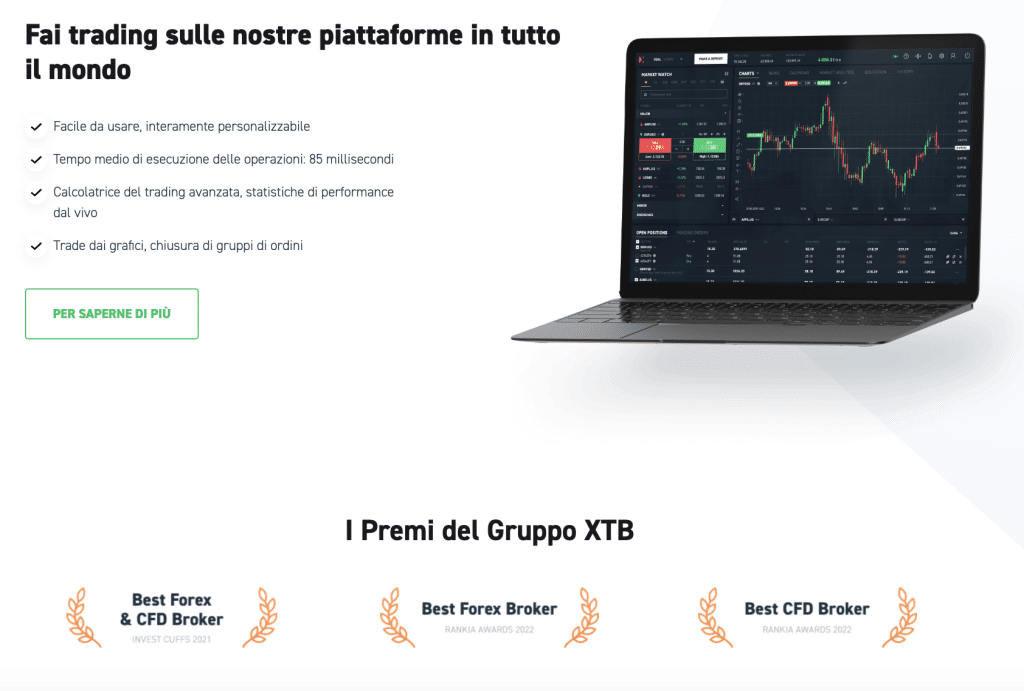

XTB offers users two trading platforms to operate from any device: XStation 5, the web-based and desktop version of the platform and the XStation app. The XTB app is the award-winning xStation 5, one of the most reliable and functional trading services on the market, with which every user can trade CFDs on indices, commodities such as gold and cryptocurrencies.

In the table below, we see all the key points of XTB:

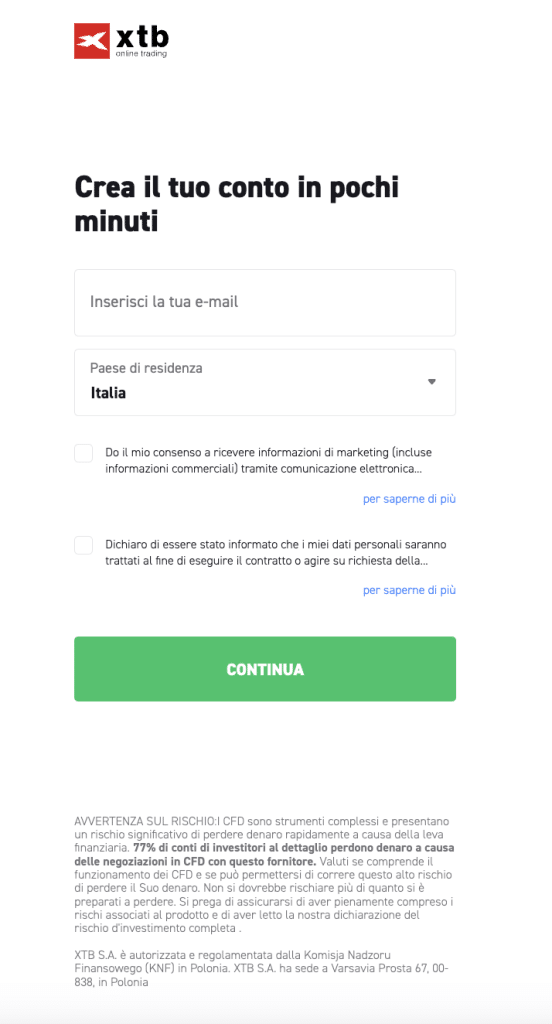

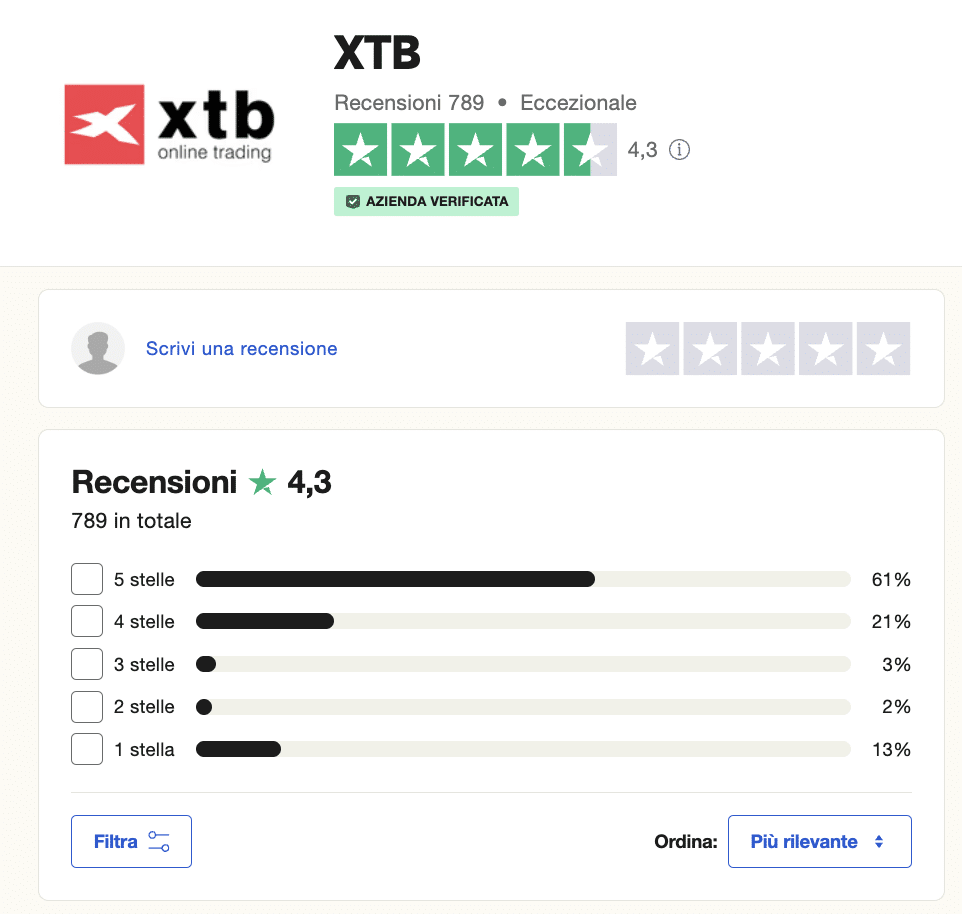

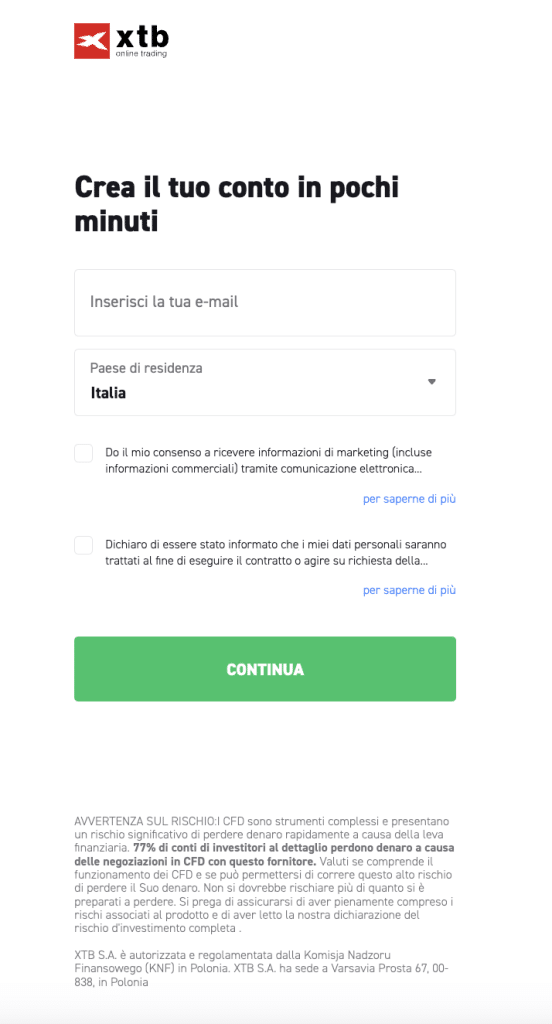

Signing up to the XTB platform is simple and free. Just go to the homepage of the official AvaTrade website and click on “Open an account”. You will have to fill out the form with your personal data, accept the terms and conditions of the site, then complete the steps required by EU regulations for the KYC (Know Your Customer) procedure. You will be asked to upload a valid ID and proof of address – for example, a household utility bill dated within 3 months of the current date. Once you have completed the registration, you will be able to access a free demo account for 30 days that offers you many CFD instruments with virtual funds of 100,000 euros, spreads starting from 0.2 pips. If something is not clear to you, you can ask customer support. Afterwards you can switch to the standard account without opening, closing and management costs. Let’s now see the costs, commissions and spreads provided by XTB. Registration for the service is free, while the cost of inactivity of the account is 10 euros per month and starts from the thirteenth month from the last operation of the user. XTB also does not charge commissions for deposits via card or bank transfer, and there are no fees with Paypal and Skrill. However, we remind you that deposits may be subject to possible charges by the bank or the issuing company. There are no commissions for transactions and the average spread ranges from 0.22 to 0.35% of the market price. Withdrawals are free for amounts over 100 euros, while below this amount there is a commission of 10 euros. On Trustpilot the XTB.it Trading platform has an excellent score of 4.5/5 out of almost 800 reviews. The XTB app also has the most positive reviews on the App Store and Google Play Store. The platform’s strengths are mainly the high quality of customer service, the ease of use of the platform and the training resources. Let’s now see what the strengths and weaknesses of the XTB trading platform are.

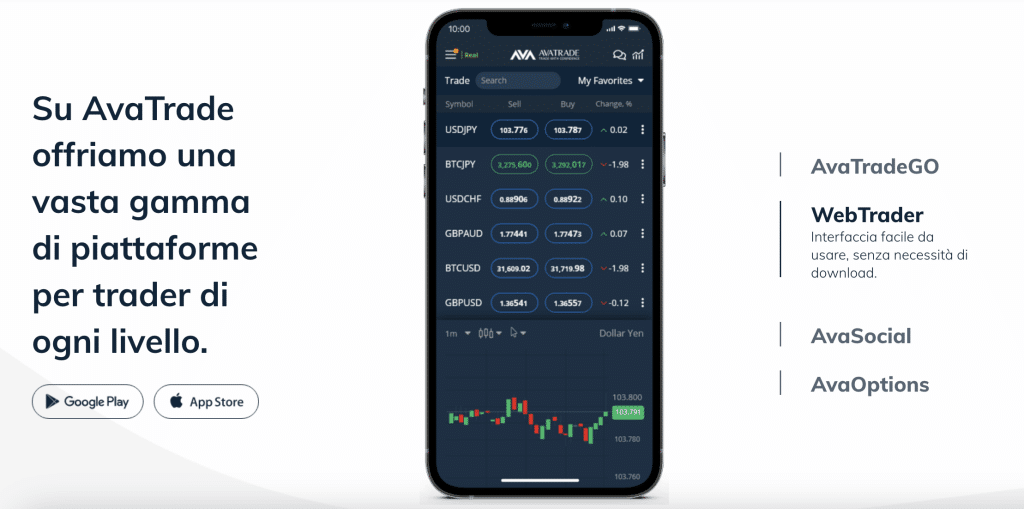

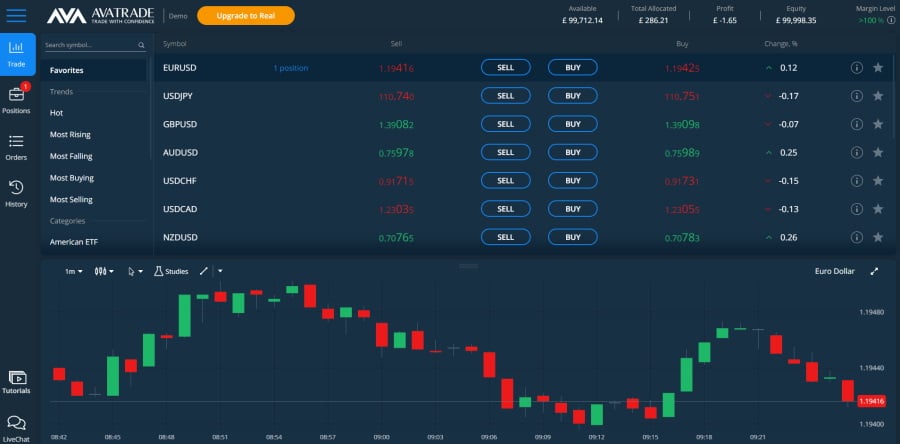

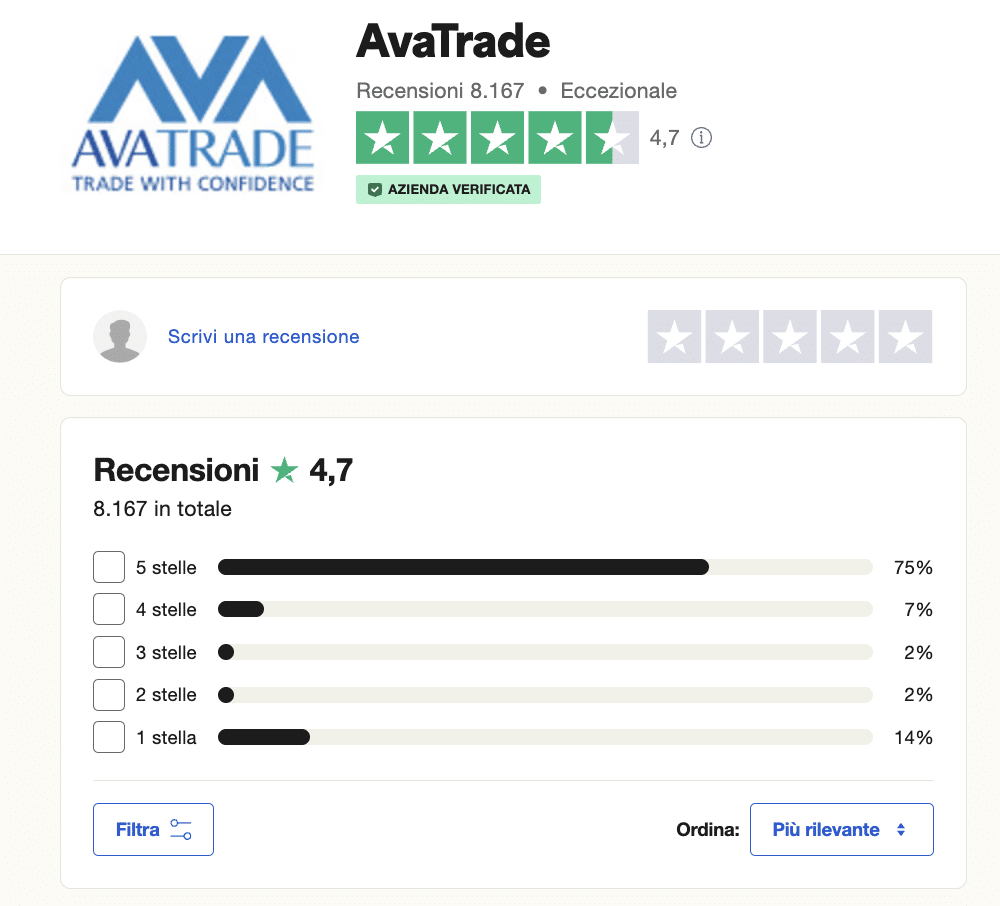

75% dei conti al dettaglio di CFD perdono denaro. AvaTrade offers global forex and CFD brokerage services. Founded in 2006, the service The company is headquartered in Dublin (Ireland) and is regulated by several financial authorities such as ASIC, FSCA, JFSA and the Central Bank of Ireland, CySEC for Europe and in Italy also Consob. Italian investors can therefore carry out their operations on this platform with complete safety. AvaTrade users can trade forex, CFDs and cryptocurrencies without commissions. Taking a closer look at AvaTrade's offerings, this trading platform allows users to trade on the forex markets, FX options and a wide range of CFD derivatives including stocks, bonds, ETFs, commodities and indices. Avatrade is also a cryptocurrency exchange : on the platform you can trade various assets available as trading pairs, including Bitcoin (BTC), Ethereum (ETH) , Litecoin (LTC), Ripple (XRP) and Dash (DASH). Cryptocurrency trading on AvaTrade can be done through CFDs. In this way, you can also operate with leverage, minimizing commissions. We remind you that CFD trading is a high-risk investment, and we always recommend maximum caution and attention. The AvaTrade platform you can trade from any device with the best MetaTrader 4 and MetaTrader 5 applications on Windows and iOS operating systems, as well as a desktop version and mobile trading app for Apple and Android devices. For those new to trading, or for those who want to delve deeper into certain aspects of the sector, AvaTrade offers a large section of educational resources with in-depth articles, tutorials, videos and webinars. Also designed for beginners, the platform offers the highly appreciated copy trading feature, thanks to which it is possible to emulate the operations of expert traders. AvaTrade customers can also count on a multilingual assistance and support service, also available in Italian, an aspect that is highly appreciated, as can be read in the numerous online reviews. Registering with AvaTrade is easy and free: simply fill out a registration form with the required data. You will then need to verify your account with proof of identity (passport or ID card) and proof of address, as required by standard KYC procedures. Once your account is verified, AvaTrade also provides you with a free demo trading account with $100,000 in virtual funds to practice your trading strategy in a risk-free environment, as well as access to more than 250 financial instruments. The minimum deposit required for the real account is 100 euros, which you will need to start trading with the assets you are interested in. AvaTrade offers affordable commissions, especially for those residing in Europe. The only commission on deposits and withdrawals is the currency conversion, in case you deposit a currency not supported by the platform, but this does not concern the Italian investor who uses Euro. As for spreads, commissions on major Forex pairs range from 1.8 if variable, to 8 if fixed. On Trustpilot AvaTrade.com has a high score, 4.7/5 out of more than 8,000 reviews. Users of the platform particularly praise the professional and helpful customer service, but also the clarity of the graphics and content of the site and the accessibility from different devices. Below you can see the major advantages and disadvantages of the AvaTrade trading platform outlined.

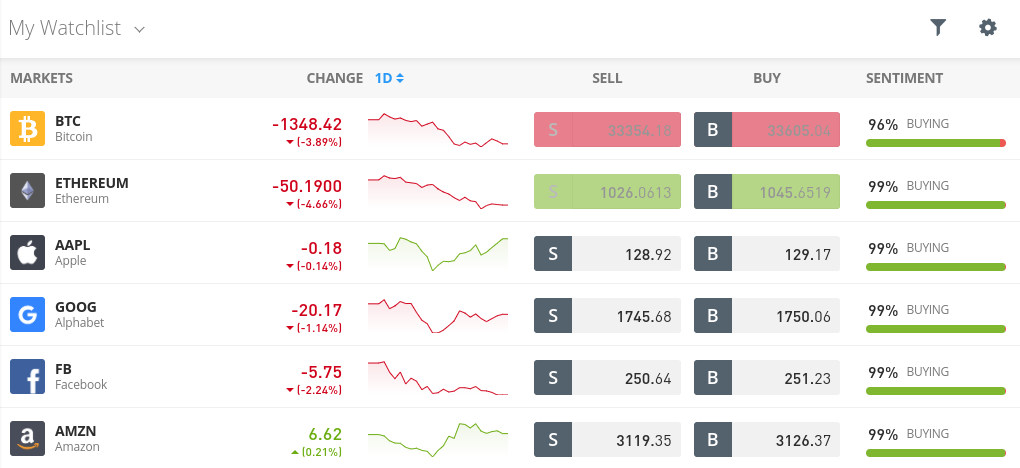

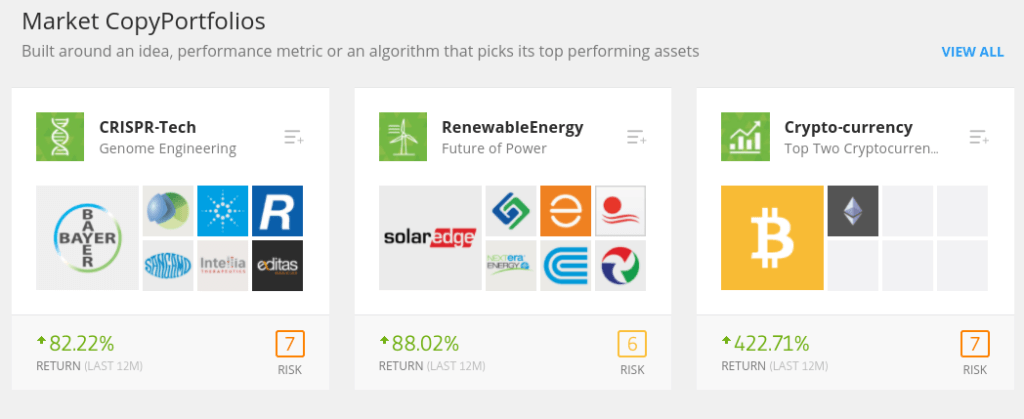

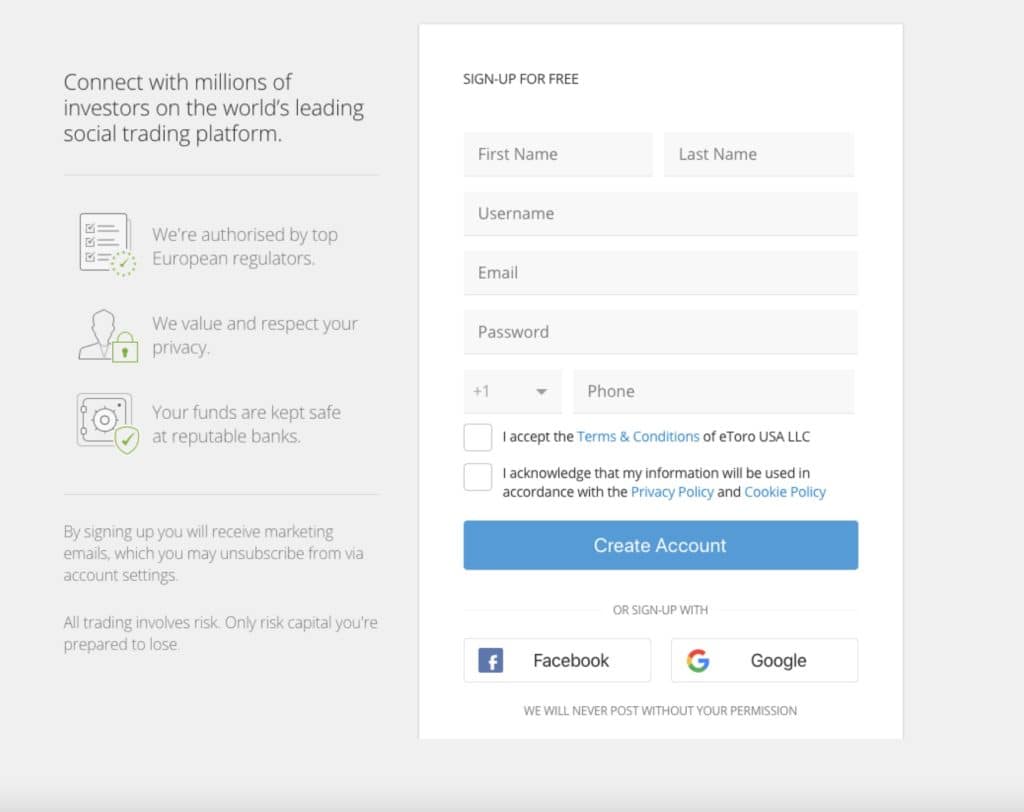

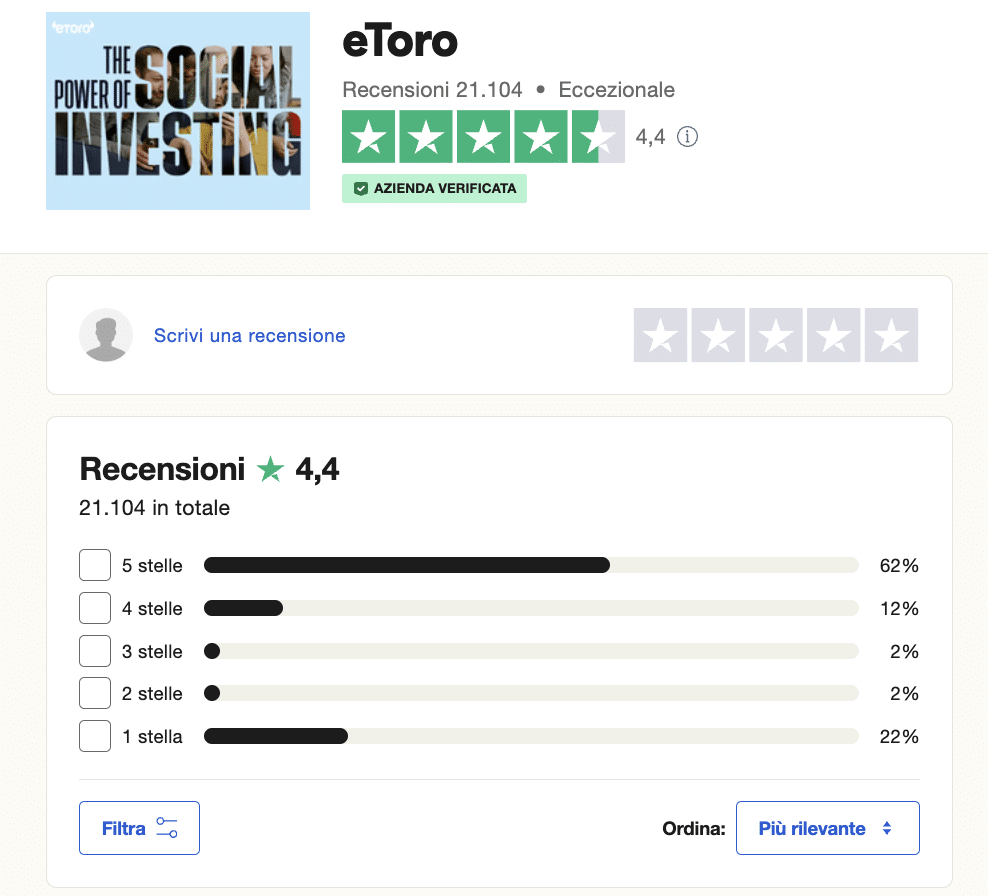

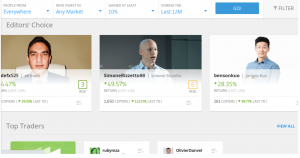

Your capital is at risk The platform is in fact really simple to use and allows investments of even moderate amounts. The minimum initial deposit in many countries including Italy is $50, and subsequently it will be possible to invest starting from $50. Deposits via bank transfer must be at least $500. eToro also offers a huge range of assets to trade, including over 2,400 stocks from 17 different markets, with the ability to buy shares of companies operating in the US, Canada, the UK, Hong Kong, as well as numerous stocks listed on European stock exchanges. eToro also offers access to 250 different types of ETFs and many of the major cryptocurrencies including Bitcoin (BTC) , Ethereum (ETH) and Cardano (ADA), as well as interesting growing cryptocurrencies including Ripple (XRP), Stellar (XLM) and Tron (TRX) and Solana (SOL) . For those looking to trade commodities, the platform supports trading in gold, silver, crude oil and natural gas. eToro also offers a wide range of instruments for trading forex. The most important aspect of the platform is that it allows you to operate on all types of financial markets. In short, we can say that eToro is the best trading platform for investors who prefer to make moderate investments. Not only that. What has definitely tipped the scales in favor of eToro as the best trading platform for beginners, are the passive investment tools. CopyPortfolios, a truly unique feature in eToro, are portfolios composed of financial assets that the trader chooses based on his interests and needs, with which the team of eToro experts will take care of managing the buying and selling of assets on behalf of the client. Clients on eToro can choose from many investment strategies: technology stocks, emerging and historic cryptocurrencies including meme coins like Shiba Inu (SHIB) or Dogecoin (DOGE), even renewable energy sources. The platform also features a Copy Trading feature, which allows you to identify an expert reference trader and copy all of his trading operations. An example: if the reference trader allocates 3% of his portfolio to Apple shares and 2% to IBM shares, the user can do the same on his portfolio. For basic functions, eToro allows you to deposit funds via credit/debit cards, bank transfers and e-wallets such as Paypal, Neteller and Skrill. User safety first: the eToro trading platform is regulated for Europe by the Cyprus Securities & Exchange Commission (CySEC) and for the United Kingdom by the FCA. Both eToro Europe and eToro UK operate under and in compliance with the Markets in Financial Instruments Directive (MiFID). Sign up for free on the platform: complete the registration form and submit, then wait for your account to be verified. As part of the KYC procedure, you will need to provide a confirmation of residence and proof of identity, such as a valid passport or ID card. Make a minimum deposit of 50 euros now using payment methods such as debit cards, credit cards or e-wallets. Then, navigate the platform and discover all the services, search and buy the assets you want. eToro does not charge any management fees, even when copying other traders' Portfolios. There is a $5 withdrawal fee when transferring money from eToro to your bank account or PayPal. When it comes to CFDs, there is sometimes a small overnight - or rollover - fee, usually a few dollars. On Trustpilot, the eToro platform has a score of 4.4/5 out of more than 21 thousand reviews. The most appreciated aspects of the platform concern various aspects, from the high quality of customer service to the usability of services and features, from the ease of use of the platform, to the wealth of assets based on the different needs of investors. Let us now examine the advantages and disadvantages of the eToro trading platform.

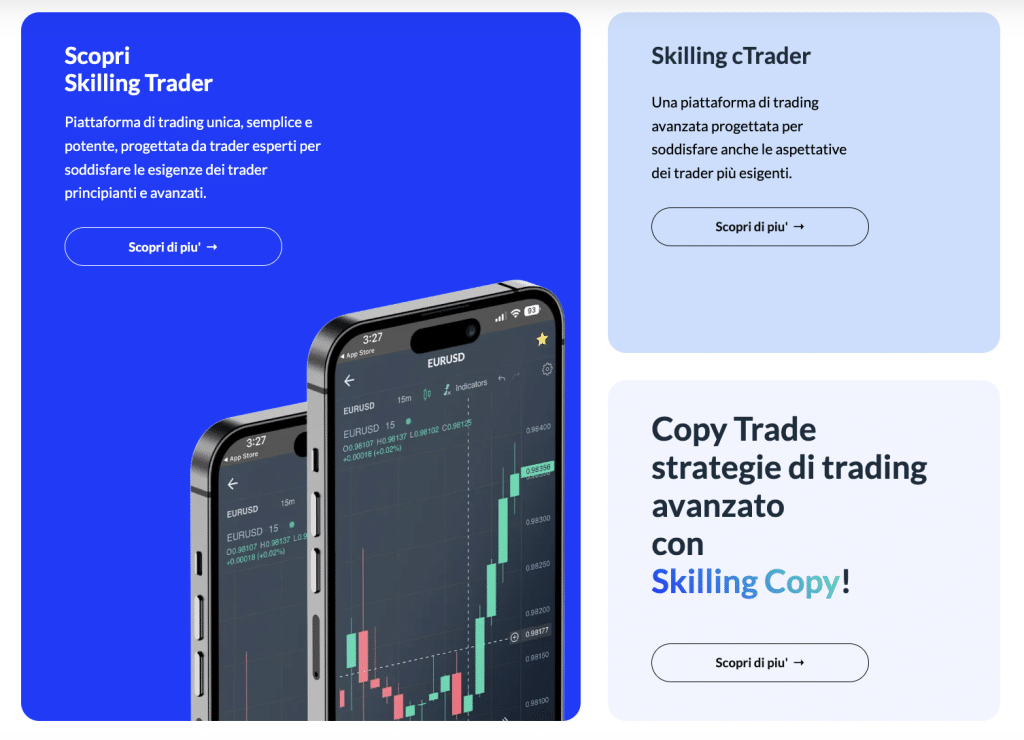

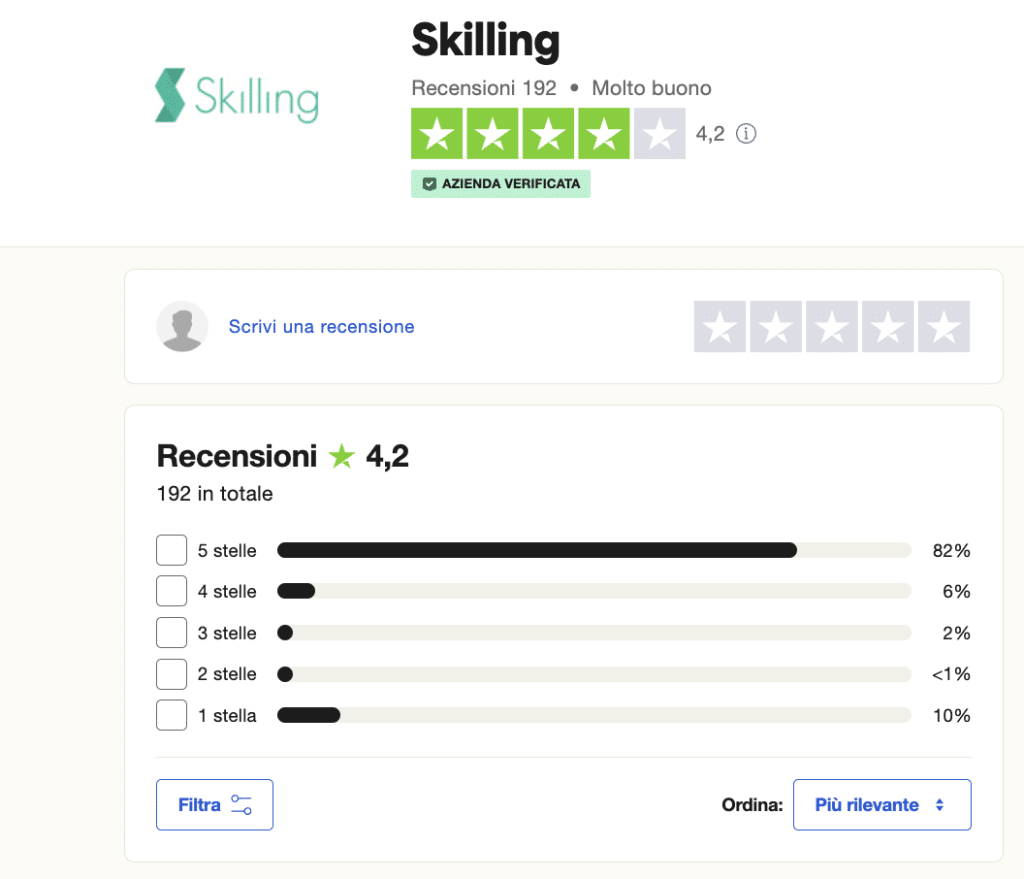

Il {etoroCFDrisk} % dei conti degli investitori retail perde denaro negoziando CFD con questo fornitore. È necessario sapere come funzionano i CFD e se ci si può permettere di perdere i propri soldi. Skilling is an international and globally recognized broker specializing in CFDs. The company was founded Skilling is a trading platform suitable for both expert traders, with support for advanced tools such as MT4 and cTrader, and for those who are approaching the world of trading for the first time. For the latter, the platform offers simplified tools for searching for assets of interest, for correctly reading graphs and for placing orders, as well as an interesting demo account, with 10,000 virtual dollars available, to simulate operations without spending a penny. Not only that, to facilitate investments and to further "democratize" the sector, the platform has introduced functions such as social trading with Trading View and, in particular, an aspect appreciated by many investors, Copy Trading. These are in fact functions through which it is possible to compare and even connect your portfolio to that of more expert traders. The broker also offers two different versions of the trading platform: one for fast trading and analysis and one for advanced analysis and algorithmic trading. In addition, there is the MetaTrader4 platform for forex trading. There is also a trading app that you can use anywhere with your smartphone. Individual users of the platform then have the opportunity to earn income by joining the interesting affiliate programs offered by the platform: on the one hand, a referral program for those who wish to invite friends to the platform; on the other, reserved for content creators, bloggers and influencers with expertise in finance, a monthly income based on the affiliates they bring to the platform via a tracked link. Similar to the trading platforms just reviewed, also on Skilling the registration is free. quite quick, even if, to operate with a real trading account, you will have to provide a confirmation of residence and proof of identity, uploading the requested documents, according to the KYC procedure required by law. Once your account is verified, you can learn all the features of the platform with your demo account, or you can start trading directly with your real account. We remind you that the minimum deposit required is 100 dollars. In terms of fees and commissions, the platform has a very competitive proposition. There are commissions only on FX pairs and spot metals on the Premium account type, with rates starting at $35 per million USD traded. Skilling will also charge a currency conversion fee for trades on instruments denominated in a currency other than your account currency. For the rest, especially for holders of a Standard account with low trading volume, Skilling has practically zero commissions and service charges on stocks and stock indices with spreads starting from 0.7 Pips on raw materials and forex. As for cryptocurrencies, given the market volatility, a fixed rate of 1% is applied to the total transaction. We have examined the platform's popularity on Trustpilot. Skillig.it has a score of 4.2/5 out of 192 reviews at the time of writing. The platform is appreciated for its prompt and prepared customer service, for the quality of its services and for its low commission and fee costs. Some criticize the platform for the difficulties encountered in uploading the documents required by the KYC process, or for other difficulties encountered in using the platform. In the columns below we have listed the strengths and weaknesses of the platform.

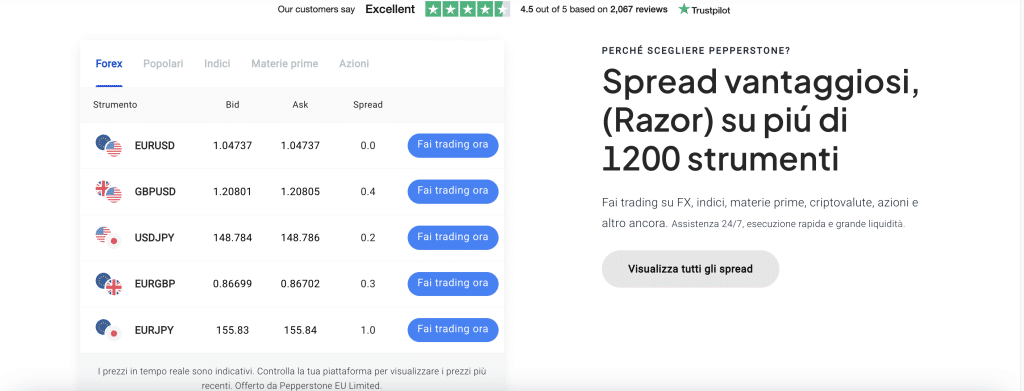

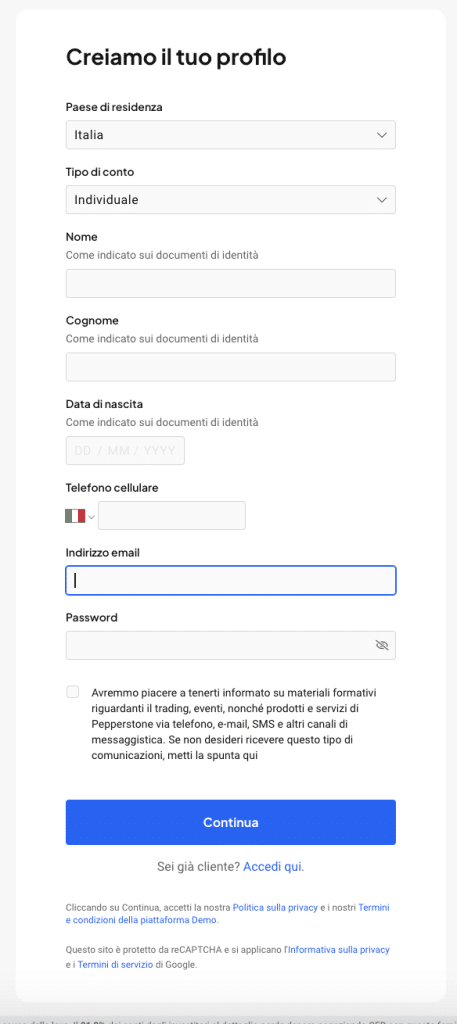

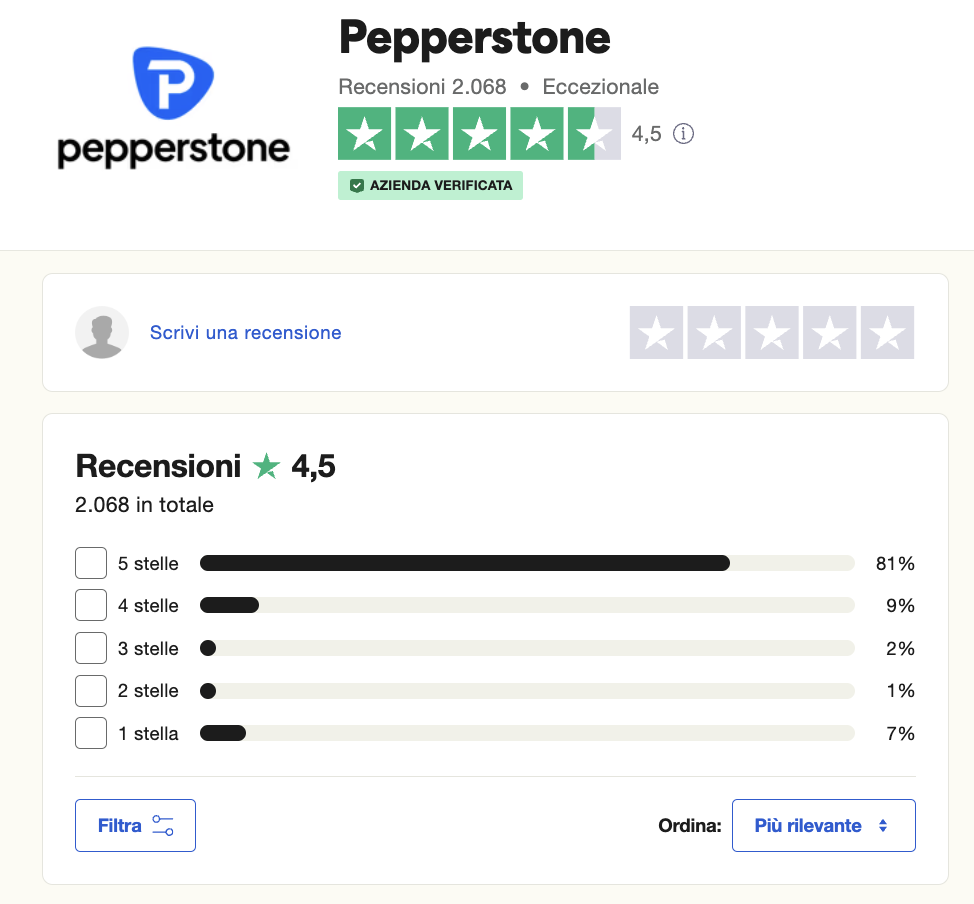

Il 56% dei conti degli investitori al dettaglio perde denaro quando fa trading di CFD con questo fornitore. Pepperstone is an international broker founded in 2010 in Australia. Now globally distributed with clients in over 150 countries, the company has offices in Melbourne, As for the regulation of the platform, Pepperstone is a broker regulated by numerous national and international bodies, including FCA, ASIC and CySEC, while in Italy Pepperstone operates with a regular CONSOB license. Pepperstone offers its users the ability to do copy trading and social trading. For more experienced traders, it also supports a wide range of trading techniques such as scalping and algorithmic trading. The broker operates on approximately 180 different trading instruments and it is immediately clear that the offer is not very broad for an international broker, especially when compared to the platforms seen above. For CFD and Forex trading Pepperstone offers around eighty instruments that include indices, stocks and currency pairs as CFDs. A particularly interesting aspect is Forex trading, with a wide range of currency pairs - more than 100, with spreads and trading costs that are really competitive when compared to other brokers. The truly distinctive aspect of Pepperstone compared to its competitors is the offer of multiple valid types of accounts, starting from the different needs and profiles of traders. In addition to an interesting and complete demo account, available for 30 days, but that you can request to extend based on your needs, dedicated to private traders, we mention here the Standard and Razor accounts. With a deposit of $200, the Standard profile allows you to trade with more than 100 CFDs and with all the most performing trading platforms such as MT4, MT5 and cTrader. The Razor account, on the other hand, appears more than attractive because it always offers the three platforms but with a truly reduced cost regarding spreads, which start from 0 pips. In terms of platform security, Pepperstone has several measures in place to protect users, such as negative balance protection, which prevents traders from spending more than they have in their account. The broker also keeps client funds in segregated trust accounts, ensuring that client money is protected in the event of financial difficulties or even bankruptcy of the broker. Registration on Pepperstone, in addition to your basic data, will require you to complete the KYC procedure, which requires you to upload your identity document and proof of residence. Once your account is verified, you can decide which account profile to open based on your needs. We remind you that the minimum deposit required is 200 dollars. Considering trading commissions, Pepperstone looks quite attractive, with a spread of 1 pip for the Standard account and 0 pips plus a commission of $7 per lot for the Razor account. Pepperstone does not charge any inactivity fees and currency conversion is also free, unlike almost all competitors. When it comes to international bank transfers, Pepperstone charges are quite high. As for customer appreciation, on Trustpilot. Pepperstone has a score of 4.5/5 out of 2,068 reviews at the time of writing this guide. Reading the reviews, the biggest strengths of the client-side platform are customer support, the overall excellent functioning of the platform and the absence of problems in withdrawing funds. We have identified some strengths and weaknesses of the platform. The main ones you can see below.

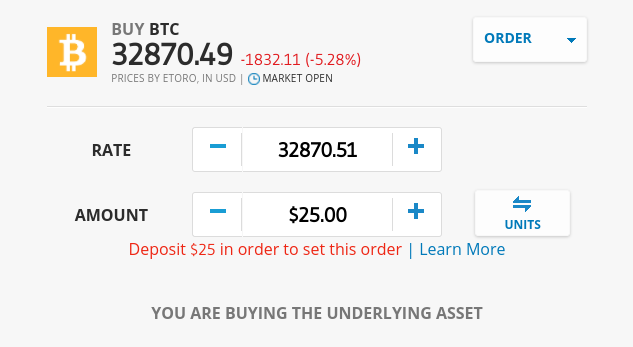

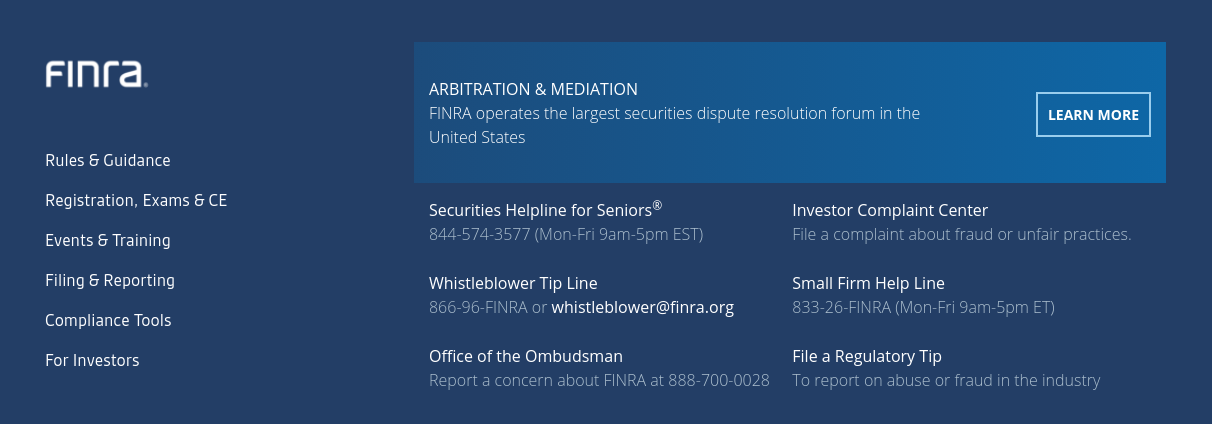

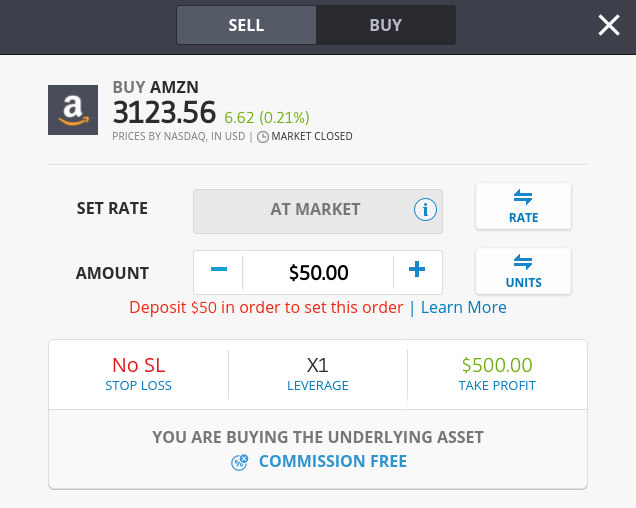

Your capital is at risk Faced with such a wide offer, finding the best online trading platforms based on individual needs can be a really difficult task! Since you are putting your money at risk, it is clear that choosing the best trading platforms for the 2026 will have to be careful and in line with your financial goals. But what are the main factors to consider when evaluating whether a platform is really right for you? Perhaps the convenience of the rates and the breadth of the offer may seem the most important criteria for choosing the best trading platform: be careful though, the aspect of security, guaranteed by regulation, is an essential element. The chosen platform must in fact guarantee maximum reliability, since the money put into play is the user's personal capital, and for this reason it is necessary to pay maximum attention to the regulatory bodies, European and Italian, that authorize the activity of the chosen provider. Ultimately, choosing a broker provider that is unregulated or only licensed in remote offshore locations puts your client’s funds at serious risk. There are many types of investors: from those who sell and buy shares, to those who want to operate on more sophisticated instruments, such as futures. For this reason, it is essential for a trader to check that financial service providers are able to offer operations on the markets of his interest. The best beginner platforms we have presented above offer market access to the following asset classes: The availability of the required financial markets can however be easily verified on the websites of the providers of the best trading platforms. It almost goes without saying that the best trading platforms are those that offer very competitive rates. There are platforms - for example those we reviewed above - that present very clear prices and no hidden costs. But be careful: there are operators that present a very complicated and not very transparent pricing system, which makes it very difficult for users to identify exactly how much they will actually spend. To help users navigate these situations, below we present the list and detailed description of the costs of a trading platform. The most important item to keep an eye on is the commissions applied on trading operations, which are usually presented in two possible forms. Some trading software apply fixed rates, that is, it is possible to always pay the same amount - for example €15 for the purchase of securities and another €15 for the sale - while in other cases variable rates are applied, commensurate with the volume of orders. In this second case, the trading platform, for example, can charge a commission of 1% on all buying and selling operations, so, buying securities for €500, you pay a commission of €5, while closing a position worth €600 you pay a fee of €6. If you carefully look at the list of the best online trading platforms for beginners, you will notice that the best providers we have listed do not charge any commissions, so that users can buy stocks, ETFs and other assets without having to worry about fees and commissions. Long-term investors who plan to hold stocks and funds for several years do not need to worry much about spreads, but for short-term traders, who repeatedly buy and sell forex, commodities or cryptocurrencies, the amount of spreads is a crucial factor to consider. But what are spreads? Spreads are simply the difference between the buy and sell prices of the assets being traded, which are sometimes calculated as a percentage, while in the case of forex trading they are expressed in pips. As mentioned above, traders like IG offer very competitive spreads, starting from just 0.8 pips on major currency pairs. Although it may seem strange, it is important to know that most brokers offering online trading services charge fees on deposit and withdrawal transactions. As always, any fees paid vary from operator to operator and can be fixed commissions or a percentage based on the amount of deposits. In addition to trading commissions, spreads and transaction fees, there are other charges to consider before choosing the best trading platform, including: Ultimately, the fees and costs applied on trading platforms are a very important factor to consider and not always easy to understand. Traders who are looking for a simple trading software that essentially allows them to buy and sell assets will probably not be very interested in the features available. However, this is an aspect that should not be underestimated, as there are many useful trading tools that users may need, among which we point out: The ability to buy fractional shares is very important for retail clients who have a limited budget and, for example, cannot afford to shell out $3,000 to buy a single Amazon share or $1,700 for a Google share. Brokers that offer the fractional share option allow their traders to buy only a "portion" of these very expensive shares. All online trading platforms that investors choose to use require the need to send "orders" to execute trades on a position. Brokers who offer this service must know what investors intend to do with their trading. The best trading platforms offer the possibility of basic orders such as "buy" and "sell", but there are other types of orders that will be appreciated by users. For example, the best online trading platforms also offer "stop loss" and "take profit" orders, which are essential for trading while protecting yourself from risks. In addition, it is also necessary to consider the availability of so-called "trailing stop loss" orders, offered by the best trading platforms, such as XTB, because they allow you to keep a profitable position open until the profit made falls below the preset percentage. Users who want to actively trade the financial markets, but do not have enough experience or time to constantly follow the markets, can consider platforms that offer the Copy Trading function. In its most basic form, this feature allows users to passively copy all the trades of their favorite expert traders. An example of this is eToro, which hosts thousands of verified professional investors who have signed up for the Copy Trading program. The system allows you to verify the results of each trader by consulting key indicators such as: Based on the evaluation of these parameters, users can choose their favorite trader to copy with a minimum investment requirement of €200. After confirming the choice, every position opened by the chosen trader will be reproduced in the user's trading account, with the possibility of stopping the copy at any time. Experienced traders know that the most popular platforms are those of the MetaTrader (MT) series. For those who are not familiar with them, remember that MT4 and MT5 are third-party online trading platforms placed in an intermediate position between the user and the chosen brokerage site. Their availability is often a determining factor in choosing the broker that offers access to these platforms, precisely because of the numerous advanced tools available. For example, both MT4 and MT5 offer: Not all trading platforms offer access to MT4 and MT5, so you should also check this factor when choosing a provider. Financial markets are almost always fast-moving, so all traders need to be informed promptly when important events occur. It can therefore be a good choice to rely on providers that offer the option of alerts. The best trading platforms allow users to define price alerts, which can be received via email or via an app. This gives traders the ability to be notified when an asset hits a certain target price. For example, an investor might decide to manually trade the GBP/USD pair when it hits 1.36. Additionally, the best trading platforms allow for volatility alerts, which notify users if one of their selected assets shows significant upward or downward volatility. Among our evaluation criteria for defining the best online trading platforms there is certainly the availability of a rich and comprehensive section of training materials, so that users can acquire the skills necessary to operate adequately on the financial markets without having to turn to external suppliers. The main educational resources offered by the best trading platform providers include: In addition to educational tools, another resource that we have often found among the best online trading platforms are numerous research and analysis tools. The former include real-time financial news, trading insights and updates on market trends. As for analysis, the best online trading platforms offer advanced chart reading tools and technical indicators. Traders who are new to online trading will want to choose a provider that offers the best possible user experience. With the best web-based trading platforms, this is usually not an issue, but it can be difficult with a trading app, especially since mobile trading requires placing buy and sell orders via your mobile phone, which has a very small screen. Ultimately, it is very important that the app is easy to use, not only for searching for assets, but also for opening and closing orders, checking your portfolio values, and withdrawing and depositing funds. The best trading platforms usually offer apps for all Android and iOS devices, so the apps offered by the various providers are developed specifically for the operating system of the user's device. Another important aspect of the best trading software is that they offer demo accounts that allow you to test all these aspects without risking the users' real capital. The first thing to do to start trading stocks in the comfort of your home is to make a deposit into your trading account. For this reason, it is very important to check the availability of payment methods offered by your provider. Most trading systems allow you to transfer funds from your bank account, but not always instantly, as most wire transfers require a couple of business days to process. This is why it is very important to go with platforms that also support debit/credit cards, as this method usually allows instant payments. For example, the best trading platform we reviewed, XTB, allows you to deposit funds with Visa and MasterCard, but also supports e-wallets such as Paypal, Neteller and Skrill. Another factor that makes a lot of difference in choosing the best trading platforms is the quality of customer support offered. Providers that only allow you to request support via email or by sending tickets to report problems should be avoided, as communication can take several days. Instead, the best trading platforms offer real-time customer support, and in this sense the best contact methods are live chat and telephone support. You should also carefully inquire about the days and hours of operation of the customer support team: most platforms do not offer support during the weekends since the markets are closed then, but the service is available 24/5. So far we have dealt with the best online trading platforms, also describing the main factors to consider in order to choose well, and with full knowledge of the facts. Let's now briefly see how to start operating at your best with the trading platform you have chosen. We have taken XTB as an example, which, in addition to offering an excellent user experience, gives you the possibility of trading without commissions on thousands of instruments on the most varied markets. For the example of opening a position we have instead taken eToro as an example, an equally valid platform. Regardless of the trading platform you choose, the process starts by opening a trading account, which at XTB happens in just a few minutes. XTB, like other trading platforms, has a legal obligation to verify the identity of its users before they are able to make a withdrawal, so the first thing you should do is to quickly go through the verification process. Simply upload a legible copy of the following documents: In most cases, XTB will be able to automatically validate the documents received, so that the account will be instantly verified. At this point to start trading the markets, you will need to deposit funds into your newly created XTB trading account. You can choose different payment methods: In any case, if you are not yet ready to deposit funds at this point, we remind you that XTB, unlike many other trading platforms, does not require a minimum deposit by default. The next step now is to search for the assets you want to trade and, if you already know the markets you are interested in, simply search for them in the navigation menu or by typing the name of the asset in the search bar. Once you have identified the assets you want to trade, you need to send an order. In the following example, we intend to trade on Bitcoin, taking another equally valid platform as an example, eToro. As you can see, we have entered the volume of our $25 trade in the "Amount" box. To set a stop loss and/or take profit order, you will simply enter the target prices of those orders. When you are ready to submit your commission-free order, simply click the "Open Trade" button. Today, there are hundreds of trading platforms to choose from, so you need to do some thorough research to find the providers that best suit your needs. Some traders may place greater importance on the cost-effectiveness of low commissions, others may be looking for platforms that offer specific asset classes and markets. Our research found that XTB ticks all the boxes that we expect to find in the best online trading platform: it is well regulated, offers access to a wide range of market instruments, and allows you to trade without paying commissions and periodic fees.

75% dei conti al dettaglio di CFD perdono denaro.

Resources

Stocks, Forex, ETFs, Indices, Commodities and Cryptocurrencies

Commissions

Variable spreads starting from 1 pip

Minimum deposit

–

Minimum trade

0.01 lot

How to register on XTB

Costs for using XTB

XTB, user opinions

XTB, pros and cons

Advantages:

Disadvantages:

2. AvaTrade – Best Forex Trading Platform with No Commissions

now boasts over 200,000 registered users and a total trading volume of around $60 billion per month.

Resources

Stocks, Forex, ETFs, Indices, Commodities and Cryptocurrencies

Commissions

Spreads as low as 0.9 pips

Minimum deposit

100 dollars

Minimum trade

0.01 lot

How to register on AvaTrade

AvaTrade Fees and Commissions

The platform does not provide commissions for deposits and withdrawals on the platform, while the bank commissions for transferring funds obviously do not depend on AvaTrade, but on the banking operator.AvaTrade, user reviews

AvaTrade Pros and Cons

Advantages:

Disadvantages:

3. eToro - In many ways the best trading platform, and certainly the most popular

Resources

Stocks, Forex, ETFs, Indices, Commodities and Cryptocurrencies

Commissions

0% commission onETFs

Minimum deposit

50$

Demo Account

Demo account with $100,000 virtual money available

How to register on eToro

Costs, charges and commissions

Resources

Stocks, Forex, ETFs, Indices, Commodities and Cryptocurrencies

Commissions

Spreads as low as 0.9 pips

Minimum deposit

100 dollars

Minimum trade

0.01 lot

eToro, user opinions

eToro, pros and cons

Advantages:

Disadvantages:

4. Skilling - One of the best CFD platforms with over 900 markets

in 2016 by a group of Swedish investors based in Nicosia, Cyprus. The broker operates on over 900 different trading instruments including stock CFDs, forex, stock indices and commodities. On Skilling it is also possible to trade soft raw materials such as wheat, cocoa, coffee and sugar.

As for cryptocurrencies, the platform offers around fifty of the most promising cryptocurrencies available in CFDs and pegged to the main world currencies: not bad for lovers of digital assets!

Resources

CFD Stocks, Forex, ETFs, Indices, Commodities and Cryptocurrencies

Commissions

Spread only

Minimum deposit

100 euros

Minimum trading

No minimum required

How to register on Skilling

Skilling Fees and Charges

Skilling, user reviews

Skilling, pros and cons

Advantages:

Disadvantages:

5. Pepperstone - Interesting platform with a wide choice of accounts based on trading needs

Resources

CFDs, FX, Indices, Commodities and Shares

Commissions

With Razor account, spreads start from 0 pips

Minimum deposit

200 euros

Demo Account

Extendable on request to more than 30 days

How to register on Pepperstone

Pepperstone Trading Commissions, Fees and Charges

Pepperstone, user reviews

Pepperstone, pros and cons

Advantages:

Disadvantages:

How to choose the best trading platforms

First factor: whether the platform is regulated

Second factor: the offer of assets compatible with your needs

Third factor: the rates proposed by the broker

A. Trading commissions

B. The spreads

C. Transaction fees

D. Other costs

Fourth factor: trading tools and features

A. Fractional shares

B. Types of orders

C. Copy Trading

D. The MT4/MT5

E. The notices

Fifth Factor: Research, Analysis and Training Material

Sixth factor: the user experience

Seventh factor: payment methods

Eighth factor: customer services

How to start trading on the best online trading platforms

Step 1: Open an account and upload an ID

Log in to the XTB website and click on the "Continue" button. The system will ask you to enter your personal information, such as your name, surname, nationality, residential address and date of birth.Step 2: The system requests and verifies your identity

Step 3: Deposit Funds

Step 4: Explore the available trading markets

To see the supported assets, click on the 'Trading Markets' button. This will allow you to view the tradable asset classes such as stocks, CFDs, ETFs, forex, commodities and cryptocurrencies.Step 5: Open a position

Find a broker based on your needs

Frequently Asked Questions

What is the best trading platform for beginners?

What is the best free trading platform?

How much does it cost to trade online?

How can I trade safely in Italy?

What is the best platform to buy cryptocurrencies in Italy?

Is buying cryptocurrencies legal in Italy?