Fidelity vs Robinhood – Cheapest Broker Revealed

With thousands of online trading platforms out there, making the right decision can be overwhelming. Nevertheless, in this Fidelity vs Robinhood review, we reveal the best broker in 2025 to help you hit your trading goals.

By the end of this comparison, we will have explored a range of key metrics, from fees and commissions to account types and regulations, to help you make the right choice today!

Fidelity vs Robinhood Comparison

What are Fidelity and Robinhood?

In layman’s terms, Fidelity and Robinhood are US-based online trading platforms that give you access to a range of tradable assets, including commission-free stock and ETF trading, from the comfort of your own home. The process of starting is simple; once you’ve opened and deposited funds into your brokerage account, you will have unrestricted access to a variety of financial instruments and trading markets.

For instance, both brokers offer stocks and ETFs, which can be traded on a commission-free basis, and options. However, Robinhood also gives you access to 7 different cryptocurrencies such as Bitcoin trading. On the other hand, Fidelity also offers mutual funds, government, and corporate bonds, and it also covers more than 22 US and international stock markets.

Let’s take a brief overview of each broker. Launched in 2013, Robinhood is a US-based discount brokerage firm that is tailored to new investors with little to no experience in online trading. Robinhood’s 13 million users have access to zero-commission stock and ETF trading, as well as options and cryptos. In terms of security, Robinhood is also regulated by the US Securities and Exchange Commission and the Financial Industry Regulatory Authority.

Fidelity, on the other hand, is also a US-based investment platform that was established in 1946 and since then has become home to more than 35 million traders. Fidelity also offers100% commission-free ETF and stock trades, as well as access to international stock markets. This is perfect for investors looking to diversify their portfolios by investing in shares of international stock. Fidelity offers top security and is a trusted broker because it is regulated by FINRA and the US SEC.

Fidelity vs Robinhood Tradable Assets

Now let’s take a look at the different assets you can trade and invest in on Fidelity and Robinhood.

Stocks, shares, and ETFs

As we have already mentioned, if you are looking to buy and sell US and international stocks then Fidelity is the way to go because it covers all the major US stock exchanges, but also heaps of international exchanges including Europe and Asia. For example, you could buy shares in companies that are listed on the New York Stock Exchange and the Hong Kong Stock Exchange. Fidelity also offers around 80 ETFs.

Turning our attention to Robinhood, you can also buy and sell shares but this is limited to US stocks. Having said this there are some non-US stocks available that are provided via American depositary receipts. ADRs give US traders a way of gaining exposure to international stocks without having to deal in foreign stock exchanges. Major companies such as Unilever list their shares on US stock exchanges via ADRs. ADRs are a type of equity security that were designed to make the process of investing in foreign stock easier and simpler for the investing community in the United States.

Thus, with Robinhood, you can access roughly 5,000 different exchange-traded funds and stocks. ETFs are an effective way to diversify your investment portfolios. For instance, the Vanguard FTSE 100 UCITS ETF is a popular fund which enables you to invest in the largest 100 UK-based constituents that make up the FTSE 100.

Cryptocurrencies

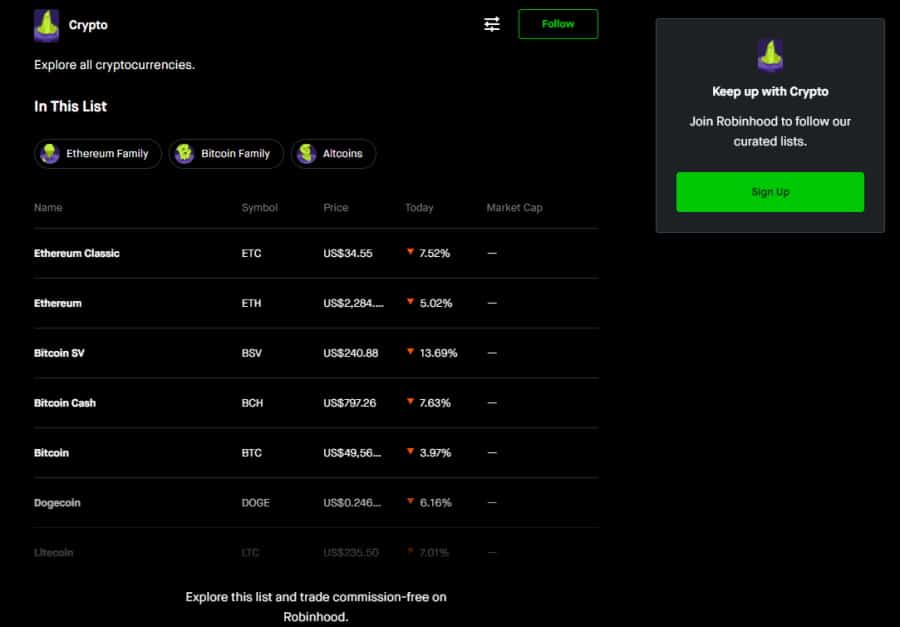

If you have a higher risk threshold then you may consider investing in digital currencies such as Bitcoin or Ethereum trading. If this is the case then Robinhood Crypto LLC is the broker we recommend simply because Fidelity does not support cryptocurrency trading.

Therefore, you will be pleased to know that Robinhood allows you to invest in 7 different cryptos on its web trading platform or fully-fledged mobile trading app. The list of commission-free cryptos available at Robinhood include:

- Ethereum

- Bitcoin

- Ethereum Classic

- Litecoin

- Bitcoin Cash

- Dogecoin

- Bitcoin SV

Options

Let’s start with the basics. Options, commonly referred to as equity or stock options are contracts between sellers and buyers covering a specific stock or asset. The option buyer has the right to make the seller do whatever is included in the contract within a set time frame. If the buyer exercises the option, the seller is contractually obligated to abide by the directions specified by the option.

For instance, a call option on a specific stock gives the buyer the option to purchase stock at a specified price before a predefined deadline. The seller of the option has to sell the stock to the buyer if the option is exercised.

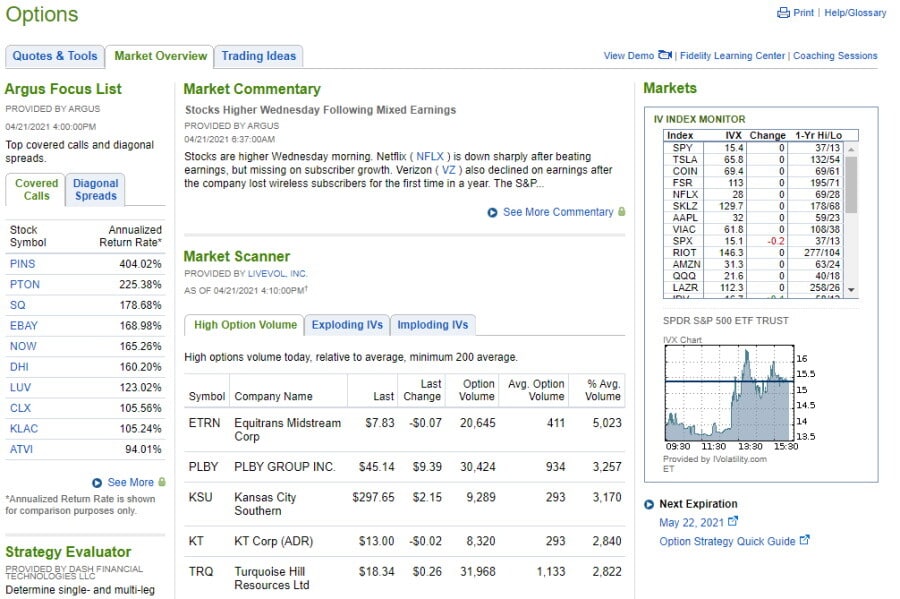

With Fidelity, you can access 9 different options markets on the web trading platform. By clicking on the options page you can access quotes and tools, market overviews with market commentary, scanners, and charts.

Options trading on Robinhood is commission-free but is limited to stock index and stock options. Once you’ve opened an account and deposited funds you can trade options on major US stocks such as Apple (APPL) with the click of a button.

Fidelity vs Robinhood Account Types

Our Robinhood vs Fidelity comparison found that the former is better suited to beginner traders and the latter is a great fit for new and advanced investors. When it comes to account types Robinhood keeps it simple and offers three different accounts with different perks and features. Fidelity, on the other hand, has a myriad of different account types for you to choose from.

The following 3 accounts are available with Robinhood, each created to meet your trading needs:

- Robinhood Instant: After signing up for a brokerage account you will automatically open an Instant account. Some of the perks include instant deposits with any sum up to $1,000 as well as extended-hours trading. You can also trade options with margin.

- Robinhood Gold: With a Gold account you have access to larger instant deposits and more purchasing power in terms of trading on margin. Other tools and features include level II market data and market research provided by third parties such as the financial services firm, Morningstar. In terms of costs, there is a $5 monthly membership fee.

- Robinhood Cash Account: With this type of account you can access Instant Deposits up to the initial $1,000. Also, day trading is not restricted by Pattern Day Trading standards. Cash account users cannot trade with unsettled funds from assets they have sold.

Fidelity has a wide range of account types, which include:

- Investing and trading accounts – standard brokerage accounts

- Retirement accounts – from Roth IRA accounts to SEP IRA accounts

- Managed accounts – such as Fidelity Go

- Saving for education – Custodial account & 529 account

- Saving for medical expenses – Health Savings Account

- Charitable accounts – Fidelity Charitable account

- Estate planning and trusts – trust account and estate account

- Annuities

- Life insurance accounts

All in all, Fidelity almost certainly has an investment account to suit whatever your trading goals and financial needs are.

Fidelity vs Robinhood Fees & Commissions

Nowadays, the majority of new and advanced investors look for a broker with low trading fees. Thousands of online trading platforms claim to have reduced trading costs to the bare minimum. This isn’t limited to commissions and dealing fees, but other non-trading fees such as withdrawal and deposit fees.

On that account, we will examine the trading and non-trading fees of both of these brokers.

Stock and ETF fees

Aside from commission-free US stock and ETF trading, Fidelity generally has low trading and non-trading fees. On the contrary, if you plan to invest in international stocks this will come with a cost. For example, let’s say the price of UK stock is $50 and you $2,000 worth, Fidelity will charge £9 per trade. Fidelity charges a fixed commission rate in most stock markets, such as 0% commission for US markets, €19 per trade for European markets, and HKD 250 per trade for the Hong Kong stock market.

Robinhood clients benefit from commission-free US stock and options, cryptocurrency, and ETF trading. This unquestionably will save you a ton on trading expenses. As well as US stocks and ETFs you can also access several international stocks via American Depositary Receipts. ADRs come with relatively small custody fees which are typically 1 to 3 cents for every share.

Margin trading

For those of you interested in margin trading then you will need to open a Robinhood Gold account. Margin trading comes with a 2.5% margin rate. Simply put, margin or buying power is the funds that you loan from your selected broker to trade financial instruments. As with any loan you will pay interest on this borrowed amount. Depending on your risk tolerance you will need to consider the odds when margin trading because it maximizes both potential profits and potential losses.

In comparison, Fidelity’s margin rate is significantly higher at 7.075%. The margin rate at Fidelity is volume-tiered which means the base rate (7.075%) is added to a premium which is based on the total amount borrowed.

Options fees

At just $0.65 per options contract, Fidelity’s fees for options trading are low. On the other hand, trading options contracts with Robinhood will cost you $0 in commission.

Non-trading fees

Both brokers have industry-leading non-trading fees which include things like no account fees or inactivity fees as well as free deposits and withdrawals.

Fidelity charges $0 for account transfers whereas Robinhood charges a $75 transfer fee.

| Inactivity fee | Deposit fee | Withdrawal fee | Account fee | US Stock fee | ETF fee | USD margin rate | Transfer fee | |

| Robinhood | No | $0 | $0 | $5 fee per month for Gold account | 0% | 0% | 2.5% | $75 |

| Fidelity | No | $0 | $0 | $0 | 0% | 0% | 7.075% | $0 |

Fidelity vs Robinhood User Experience

In the matter of user experience, our Robinhood vs Fidelity comparison found that the former is a better match for traders with limited investing experience. This is clear from the moment you visit the website as there is no complex terminology. Furthermore, when you cast your mind to the account types, Robinhood only offers 3 simple accounts which have everything a new investor would need to start trading right away.

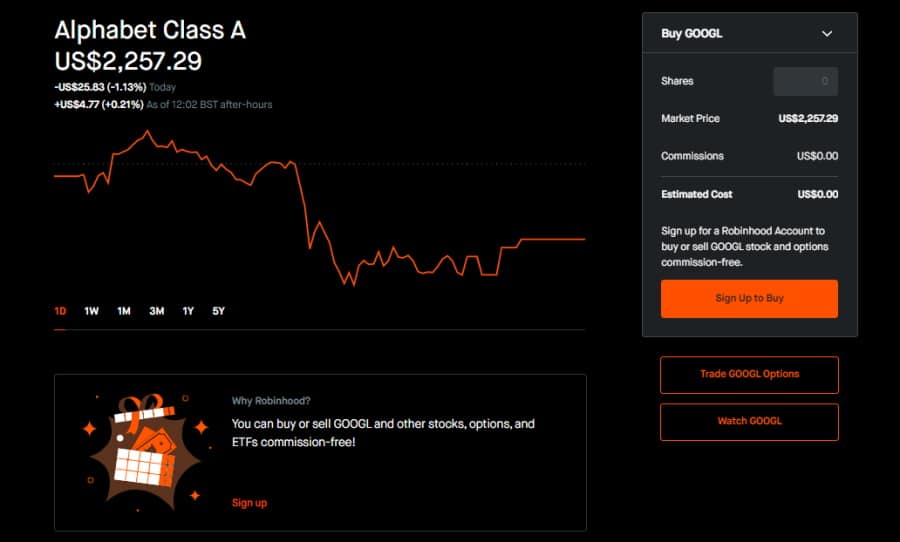

This same is true when trading assets; simply type the name of the company or ticker symbol into the search bar and Robinhood will bring up a range of relevant results. You cannot customize the trading platform which can be frustrating for users who like to tailor the platform to suit their preferences. Nevertheless, the workspace is clear and user-friendly.

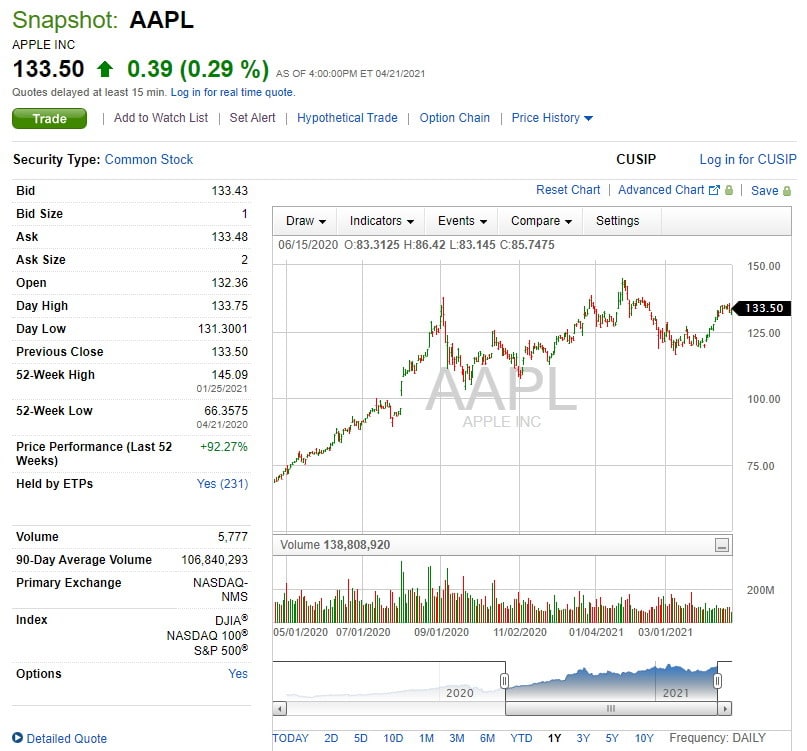

Fidelity’s web trading platform is also user-friendly and well designed but is suited for both new and advanced traders, simply because it has heaps of features and options on offer. Both brokers do not allow you to customize their platforms.

The search functionality on Fidelity’s investment platform is also quick and accurate. By typing the name of the company or the stock’s ticker symbol, the predictive search will display a list of relevant results based on the keywords that you enter.

Fidelity vs Robinhood Mobile App

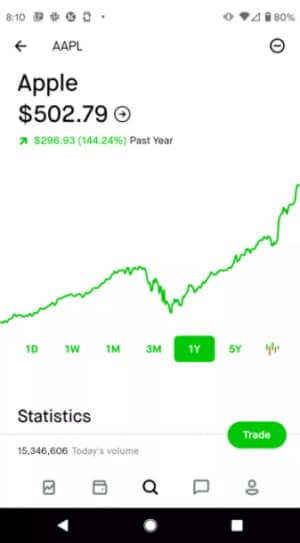

Both Fidelity and Robinhood give you access to their online trading services via a mobile trading app. Both are compatible with Apple and Android devices and are user-friendly. Navigating your way around the apps is simple and straightforward, with great search functionality allowing you to trade and invest in your favorite financial assets wherever you are from the handheld device.

Focusing on Robinhood, our research found that it is perfect for all types of investors. Beginner stock traders will find the Robinhood mobile app very useful because you can buy and sell stocks with the click of a button. For instance, to invest in shares of Amazon stock simply type ‘Amazon’ or ‘AMZN’.

After selecting the result you will land on the relevant page that gives you the option to buy Amazon stock. Then simply decide how much you want to invest and click trade. Moreover, this free trading platform also provides fractional shares which means you could buy stocks with an investment of just $1.

Placing order types, from market to stop-loss orders, on the mobile app is also an easy task. Similarly, depositing funds into your account is also very easy. Ultimately, with the Robinhood mobile app you have all the benefits of a trading platform packed onto your mobile screen, giving you the convenience and ability to trade wherever you are.

With the Fidelity mobile trading app you can buy and sell US and international stocks, ETFs, funds and options easily with the swipe of a finger. Many brokers are jumping on the bandwagon when it comes to the growing popularity and appeal of fractional share trading. Fidelity is no exception, giving its clients the ability to trade with as little as $1.

You can pick the login page and filter the buttons on the dashboard based on those you use the most, and you can specify how the financial news is displayed. Advanced traders will be pleased to know that fundamental and technical analysis, as well as charting, are also available on the investment app. Fidelity also allows you to seamlessly set up alerts and push notifications on the app, which gives you peace of mind knowing that you will be kept in the loop regarding your ongoing trades and investments.

Fidelity vs Robinhood Trading Tools, Education, Research & Analysis

Robinhood’s research tools include trading ideas, live market data and fundamental data which is great for beginners. For advanced traders, Fidelity has a wide range of research tools including trading ideas, advanced fundamental data and screeners.

Trading ideas

You can find trading ideas for ETFs, mutual funds and stocks on Fidelity. In particular, you can access a summary score for stocks which is compiled from multiple analysts and third-party providers such as Morningstar.

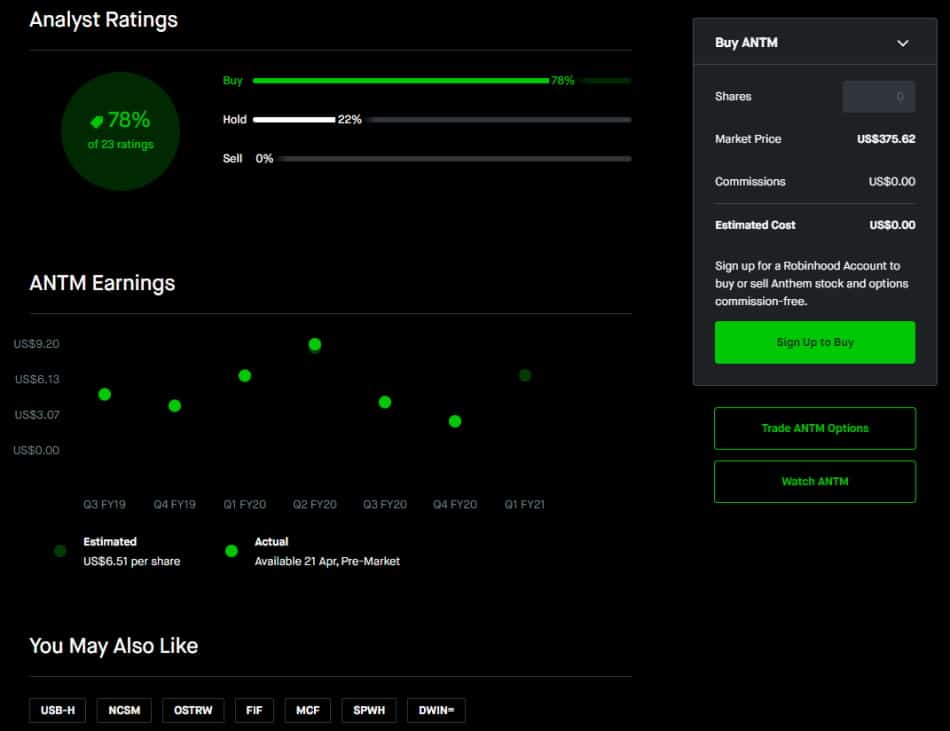

As for Robinhood, users have access to something called analyst ratings which are designed to help with the decision-making process in online trading. These ratings display the ratio of analysts who have rated each asset as either hold, buy, or sell.

If you’re looking for an online broker that provides an advanced charting experience then Fidelity has the best offering. Customizing the charts is easy and there are roughly 50 different technical indicators to choose from.

On the flip side, charting via the Robinhood platform is basic. You can access past price movements of the asset you are interested in buying or selling, and a couple of technical indicators are accessible when pressing on the ‘expand’ tab.

Fidelity vs Robinhood Demo Account

A demo account, otherwise referred to as paper trading, is a simulated investing environment that is designed to imitate the ‘reality’ of online trading with virtual funds.

Demo accounts are useful tools for both ends of the spectrum. Novice traders benefit from paper trading because they let you familiarize yourself with the way a platform operates, and allow you to develop your knowledge and confidence without having to worry about risk tolerance and market volatility.

Likewise, demo accounts are valuable for advanced traders who want to use trial and error to test a new investing strategy without any associated risks.

With this in mind, our broker comparison found that Fidelity is the only one out of the two that offers a demo account. You can access this via its in-house developed desktop trading platform known as Active Trader Pro.

Fidelity vs Robinhood Payments

After you have successfully opened an account with the broker of your choice you will need to deposit funds. Fidelity offers more payment options in comparison to Robinhood which only allows you to use bank transfers. Both charge no fees for deposits and have no account minimums for regular accounts, but, you cannot deposit funds with a credit or debit card.

While there are no deposit fees with either broker, Fidelity allows you to deposit funds via ACH bank transfers and e-wallets such as PayPal. The only option with Robinhood is via bank transfer. If you want your funds to appear immediately then you should use the instant deposit option, if not you will have to wait 4 to 5 business days. The amount of money you can instantly deposit varies depending on the account you have.

| Minimum Deposit | Deposit Fee | Processing Time | Withdrawal Fee | |

| Fidelity | $0 | FREE | 2 business days | FREE |

| Robinhood | $0 | FREE | Instant, depending on account type | FREE |

Fidelity vs Robinhood Customer Service

When it comes to customer support both brokers give relevant answers and have fast response times. However, Robinhood’s customer services can only be contacted via email, whereas you can contact Fidelity’s customer support via email, telephone and live chat.

Support is not available 24/7, instead live chat is available between the hours of 9 am and 10 pm on weekdays and 9 am to 4 pm on weekends.

To reach customer services at Robinhood you will need to fill out a request form, specifying the category and topic of your request. The support team will respond via email which typically takes one business day, depending on the number of requests they receive. Generally, the responses are useful and relevant. The only downside is that this service is not available 24 hours 7 days a week.

Also, if you’ve enjoyed this broker comparison so far, then you might want to read our Acorns vs Robinhood review.

Robinhood vs Other Brokers

Overall, Robinhood is better suited to beginners with little trading experience who want to trade US shares and ETFs on a zero-commission basis. If you’d like to see how Robinhood does when pinned against other top online brokers be sure to check out these comparison reviews as well:

- Stash vs Robinhood

- Coinbase vs Robinhood

- Acorns vs Robinhood

- Webull vs Robinhood

- Robinhood vs Charles Schwab

- Robinhood vs Ally Invest

- TD Ameritrade vs Robinhood

- M1 Finance vs Robinhood

Fidelity vs Robinhood Safety & Regulation

As with any investment, big or small, you need to know you can trust the broker of your choice with your deposits. Both Fidelity and Robinhood are regulated by established financial authorities including the US Securities and Exchange Commission and are members of the Financial Industry Regulatory Authority (FINRA).

When it comes to client fund protection, Fidelity is covered by the US investor protection scheme called the Securities Investor Protection Corporation or SIPC for short. This protects you against cash and security losses should the brokerage firm liquidate. The SIPC cover is capped at $500,000, and $250,000 for cash claims.

If you are planning to trade cryptos with Robinhood you should be aware that Robinhood Crypto LLC is not a member of FINRA which means that its clients are not covered by protection. On the other hand, Robinhood Financial LLC is covered by SIPC protection.

Fidelity vs Robinhood vs eToro

So far in this Fidelity vs Robinhood comparison we have examined all the key metrics including fees and commissions and safety and regulation. It’s safe to say that both brokers allow new and advanced investors to trade and sell their favorite assets from the comfort of their own homes. Both offer commission-free US stock and ETF trading, and fractional shares which is great if you’re looking for a low-cost investment platform.

Having weighed up the pros and cons of each broker we think there’s a better option for you. Home to over 20 million active traders, eToro gives its users access to 17 different stock markets and more than 140 ETFs. In terms of trading costs, this broker supports a 100% commission-free scheme for ETF and stock trading.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

If forex trading is more your style, then you’ll be happy to hear that eToro has some of the tightest spreads on the market. There are just under 50 different currency pairs to choose from including exotics, majors, and minors. eToro also gives you the option to use leverage, with the majority of traders having access to 1:20 on minors and 1:30 on majors.

Furthermore, eToro provides access to a demo account with $100,000 worth of virtual funds, as well as social trading features allowing you to interact with and share your trades with the rest of the investing community on the platform. All these qualities reinforce the fact that eToro was designed with new investors in mind.

Here’s a quick breakdown of eToro’s competitive trading and non-trading fees:

| Fee | Amount |

| Stock trading fee | Free |

| Forex trading fee | Spread, 2.1 pips for GBP/USD |

| Crypto trading fee | Spread, 0.75% for Bitcoin |

| Inactivity fee | $10 a month after one year |

| Withdrawal fee | $5 |

| ETF trading fee | Free |

| Account fee | No |

| Deposit fee | $0 |

Fidelity vs Robinhood – The Verdict

This Fidelity vs Robinhood review has assessed everything you need to know about both trading platforms. We’ve gone through everything from the fees you are likely to encounter to the user experience when operating the mobile trading apps. Therefore, you should be in a strong position to make an informed decision about which one best fits your needs.

But, if you’re looking for an overall great broker that is trusted by millions and delivers top-tier services then eToro secures the top position on our recommendation list.

eToro offers tons of different financial instruments with 0% commission investing. eToro’s CopyTrader and CopyPortfolio are perfect If you want a passive trading experience. Copy trading gives you the ability to copy the trades and strategies of other advanced investors, with a minimum investment of just $200.

So, if you want to start investing on eToro with 0% commission, simply click the link below!

eToro – Best Copy Trading Platform For Stocks

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.