TD Ameritrade vs Robinhood – Which Broker Is Best in 2025

For anyone interested in trading and investing in popular assets such as stocks and ETFs you have to start with an online trading platform that suits your needs. TD Ameritrade and Robinhood are two stockbrokers that come to mind.

Throughout this TD Ameritrade vs Robinhood comparison, we will examine the key metrics that make a great discount broker. These include fees, non-trading costs, markets and products, regulation, and user experience. So, read on to find out who we will crown the best overall broker in 2025.

TD Ameritrade vs Robinhood Comparison

What are TD Ameritrade and Robinhood?

In short, both Robinhood and TD Ameritrade are online trading platforms that allow you to trade financial instruments from the comfort of your own home. Once you’ve opened a brokerage account, and deposited funds you will have unfettered access to a range of markets and products.

Firstly, Robinhood is a US-based discount broker that was launched in 2013 and offers commission-free trading. This broker is regulated by leading financial authorities including the Securities and Exchange Commission and the Financial Industry Regulatory Authority.

Robinhood also offers Cash Management which enables its users to earn interest on uninvested capital.

On the other hand, TD Ameritrade, one of the most widely recognised online trading platforms in the US, was established in 1975. This broker is regulated by the US SEC, FINRA, and CFTC. It is also listed on the NASDAQ stock exchange under the ticker symbol AMTD.

TD Ameritrade is a trusted broker because it has a lengthy history, publishes its financials, is listed on one of the largest stock exchanges in the world, and is supervised by top financial authorities.

TD Ameritrade vs Robinhood Tradable Assets

In this section of our review, we will examine the types of financial instruments that are on offer and just how you can go about trading and investing in them.

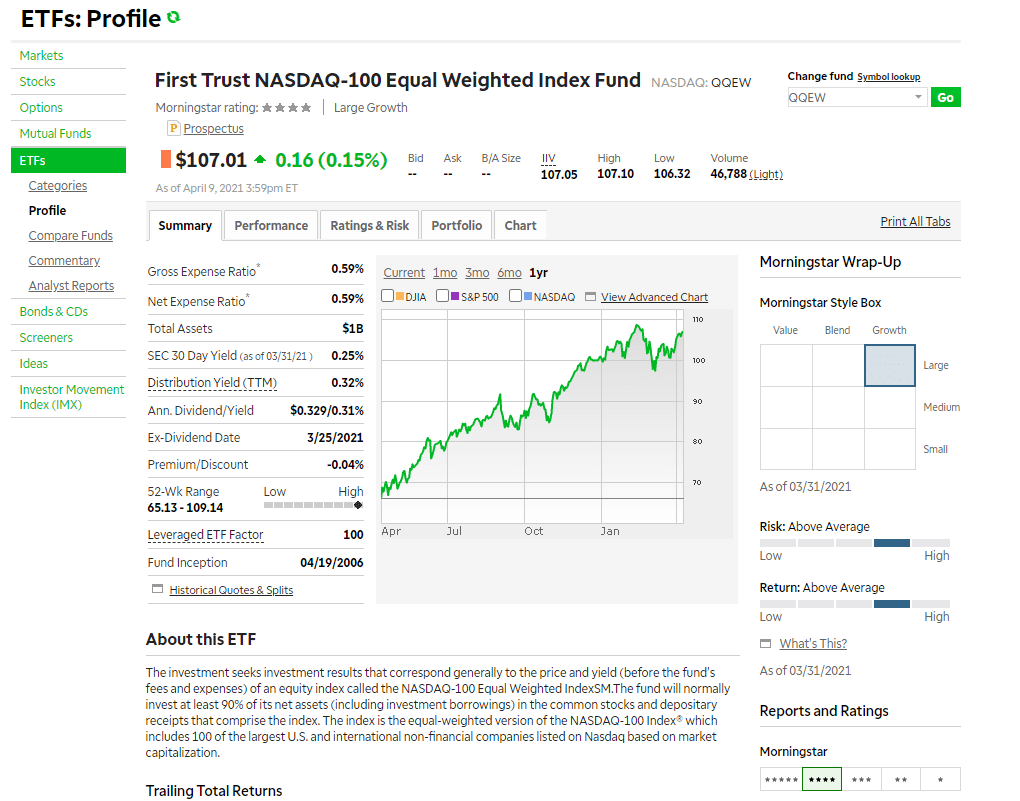

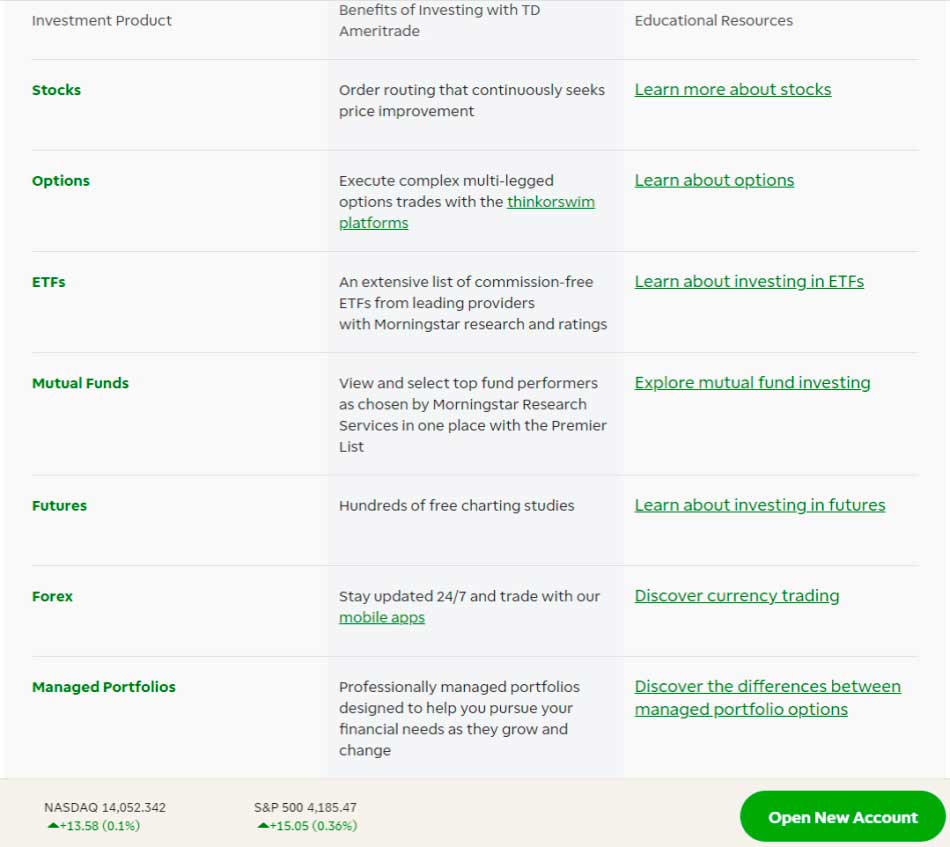

When it comes to markets and products at TD Ameritrade you can choose from a variety of popular asset classes from stocks, ETFs, and forex to options and futures. Other unique and useful features include robo-advisory services and social trading via its desktop trading platform Thinkorswim. Our extensive review found that TD Ameritrade offers financial products from the US market. These include 4 stock markets, more than 2,000 ETFs, and 40,000 bonds.

TD Ameritrade also offers social trading through its Thinkorswim trading platform. By navigating to the tools menu you can create a public trading profile and track other investors, interact with them via chatrooms and even share the outcomes of your trades.

This is a great feature for beginners who want to sample different trading ideas and would like to copy the trading strategies of other more advanced traders. Copying trades can be made with a couple of clicks. Additionally, you can find research and charts created by the TD Ameritrade community.

In comparison, Robinhood’s asset portfolio is smaller as it only supports stock, cryptocurrency, options trading, and ETF trades. Moreover, these assets are mostly limited to US markets. Robinhood offers roughly 5,000 stocks and ETFs which are traded on a zero-commission basis. For those of you who want access to international stocks, you can find some non-US stocks which are provided through American depositary receipts. Simply put, ADRs are stocks that can be traded on US exchanges but represent shares in non-US companies.

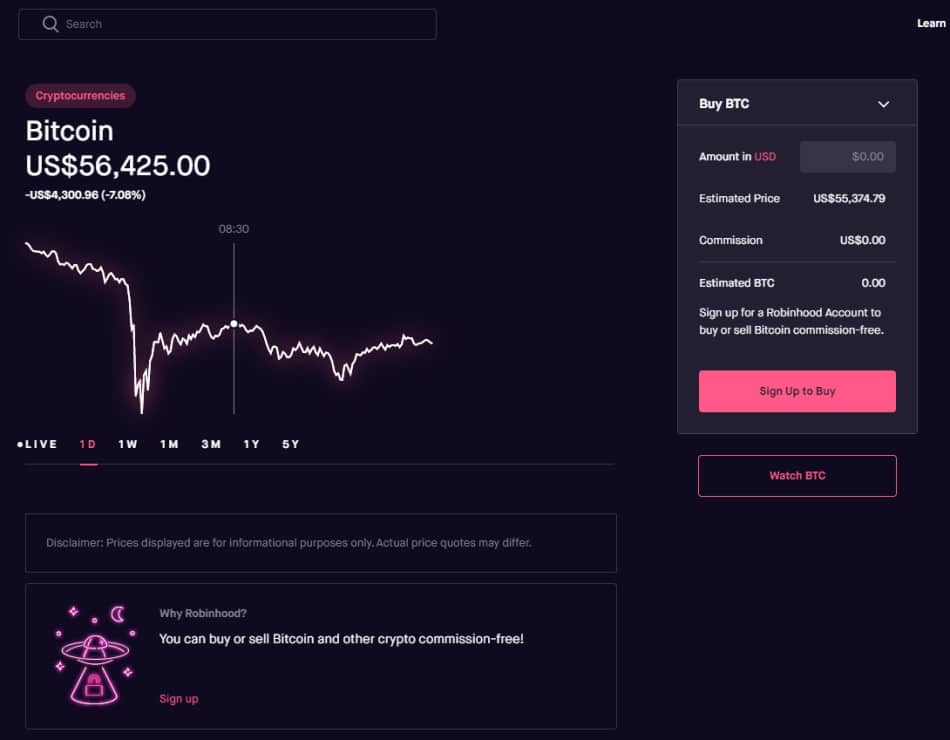

If you are a trader with a preference for digital currencies then Robinhood is definitely going to impress. This discount broker offers 100% commission-free crypto investing. From Bitcoin to Ethereum trading, there are 7 cryptos in total that you can access. Furthermore, Robinhood Crypto also provides live market data for a range of digital currencies such as Bitcoin Gold, Monero, NEO, Stellar, and Qtum. Currently, this broker does not offer Initial Coin Offerings.

If you’re interested in forex trading, our TD Ameritrade vs Robinhood review found that the former offers more than 70 currency pairs covering all forex categories – minors, majors, and exotics. TD Ameritrade offers transparent pricing without hidden costs. You can trade forex currency pairs in increments of 10,000 units with 0% commission. The fees are included in the spread. The spread is the gap between the bid and ask price of the currency pair.

TD Ameritrade vs Robinhood Account Types

When it comes to account types our comparison found that TD Ameritrade has a wider range of accounts to suit almost any situation. Whether you’re looking for a standard, retirement accounts (Roth IRA accounts), education, specialty, managed portfolio, or margin trading account, TD Ameritrade has you covered.

For US-based traders, there are no account minimums when you choose the standard account. However, the minimum deposit varies depending on the type of account you open and your trading preferences. For example, if you open a margin account with this brokerage firm there is a $2,000 minimum deposit.

Alternatively, Robinhood keeps it simple when it comes to account types. You can choose from 3 main accounts: Cash Account, Robinhood Instant, or Robinhood Gold. With a Robinhood Gold account, the minimum deposit is $2,000.

By default when you sign up to the Robinhood trading platform you open a Robinhood Instant account. You can then downgrade to a Cash Account or upgrade to a Gold account whenever you wish. It’s worth noting here that for the latter there is a $5 monthly fee and comes with extra features that are not available with the other accounts.

For example, Robinhood Gold account holders have access to analyst research from third-party providers including Morningstar, and can deposit any amount up to $50,000 instantly. This type of account also gives you the ability to trade with leverage of 2:1.

TD Ameritrade vs Robinhood Fees & Commissions

Most traders and investors around the world will look to pick a trading platform based on their fees and commissions. In other words, you will benefit the most from keeping your trading fees as low as possible. As well as commissions and dealing costs, you will need to consider other non-trading fees such as withdrawal and overnight fees.

Having said this, we compare the trading and non-trading fees of both online brokers below.

Stocks and ETFs

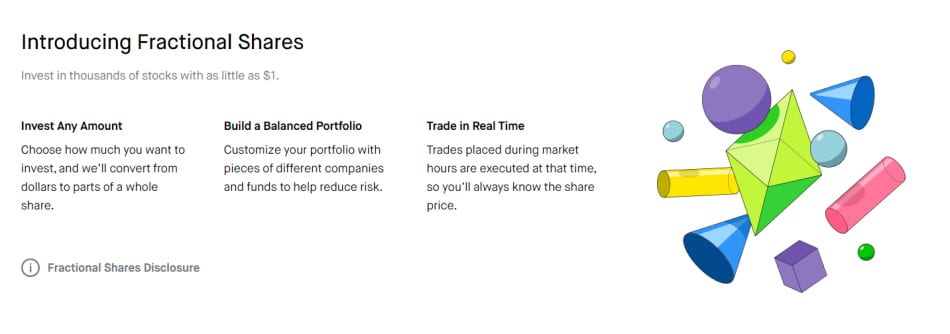

Both brokers offer ETF and stock trading with zero commission. This means that you can trade and invest in stocks and ETFs without having to pay a penny in dealing commissions. Additionally, Robinhood also gives you access to fractional shares which allow you to invest in a wide range of stocks with as little as $1. This is perfect for diversifying your investment portfolio and those of you who have a tight investment budget.

It is perhaps worth noting that for online OTC stock trading TD Ameritrade charges a commission of $6.95.

Forex

Robinhood doesn’t provide forex trading, so this section is devoted to TD Ameritrade. In short, TD Ameritrade offers forex trading from 6 pm – 5 pm ET every day of the week and all on a commission-free basis. As we have already mentioned there are over 70 forex currency pairs to pick from and are traded in 10,000 unit increments. The trade fees are included in the spread, with 1.2 pips being the average spread fee throughout peak trading hours.

Crypto

TD Ameritrade does not offer cryptocurrency trading therefore our focus will be entirely on Robinhood in this section. When trading Bitcoin or Ethereum on Robinhood there are no added commissions however you will incur an order flow fee that changes depending on the trade. Robinhood offers 7 different cryptos which are as follows:

- Ethereum Classic

- Ethereum

- Bitcoin SV

- Bitcoin Cash

- Bitcoin

- Dogecoin

- Litecoin

Mutual Funds

TD Ameritrade charges $49.99 per trade for mutual funds with a zero commission No-transaction-Fee. Simply put, NTF mutual funds are no-load funds that this US-based broker does not charge a transaction fee for. Additionally, this broker has a wide offering of more than 13,000 mutual funds a quarter of which are free to trade.

Here’s a rundown of the key trading and non-trading fees charged by both TD Ameritrade and Robinhood.

| Inactivity fee | Deposit fee | Withdrawal fee | Account fee | Stock fee | ETF fee | Crypto fee | Options fee | |

| Robinhood | No | $0 | $0 | No | 0% | 0% | 0% | $0 |

| TD Ameritrade | No | $0 | $0 | No | 0% | 0% | n/a | $0.65 per contract |

All in all, both free trading platforms give you access to low-cost trading from the comfort of your own home. But, Robinhood is more cost-effective when it comes to option trading. Furthermore for those of you with a preference for Bitcoin trading then Robinhood is the go-to broker for 0% commission on crypto trading.

TD Ameritrade vs Robinhood User Experience

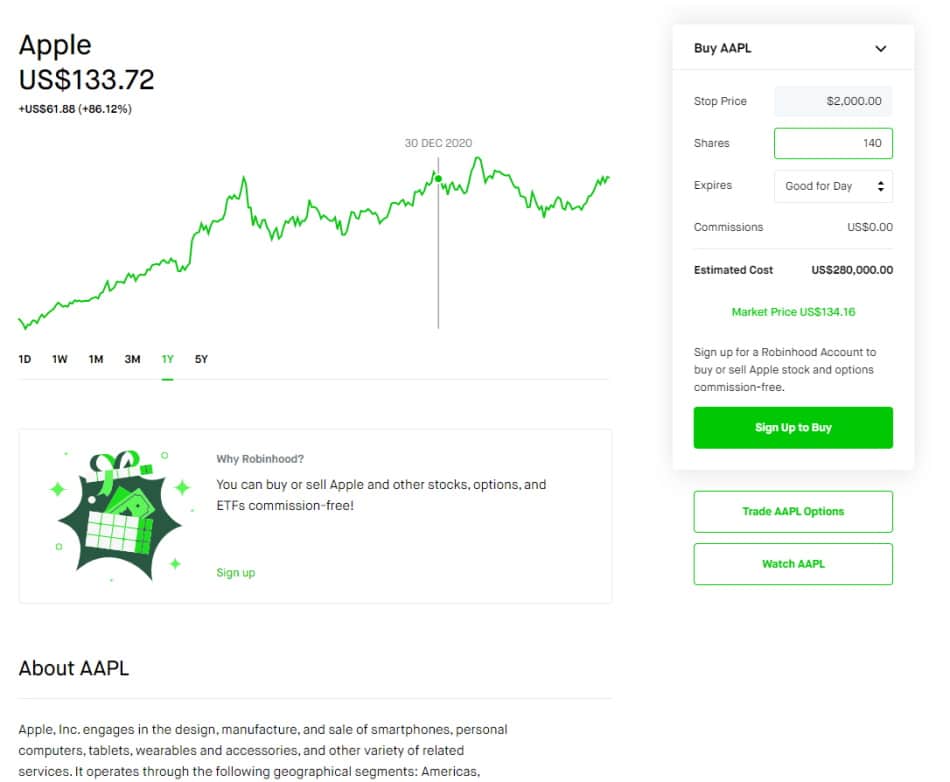

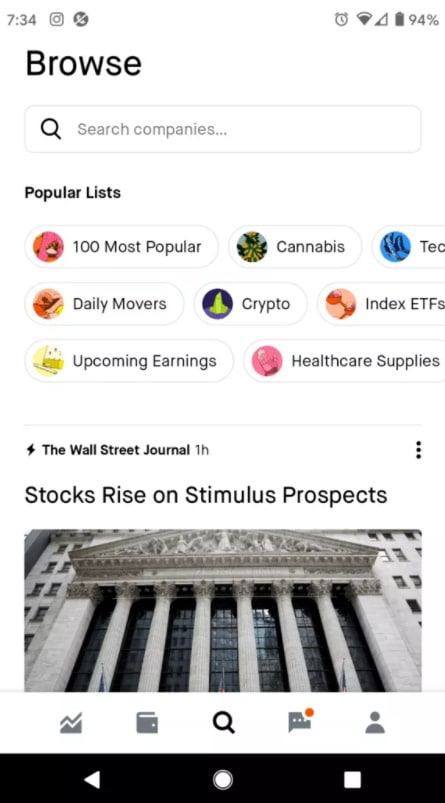

With regards to user experience, our comparison guide found that Robinhood is much better suited to new traders with little experience of online investing. This is apparent once you land on the website for the first time. For instance, there is no complex trading terminology and the layout is very simple and user-friendly.

Despite being unable to customize the Robinhood trading platform it is easy to navigate your way around and is very well designed. When it comes to finding an asset all you have to do is enter the name of the stock or cryptocurrency into the search bar and you will be presented with a relevant selection of results.

Furthermore, the user experience on Robinhood is particularly good when opening a position. For instance, let’s say you wanted to buy stocks, all you would need to do is enter your stake. This means that you wouldn’t need to calculate how many shares you could afford because Robinhood offers fractional shares. This means that if you wanted to buy $25 worth of stock you can.

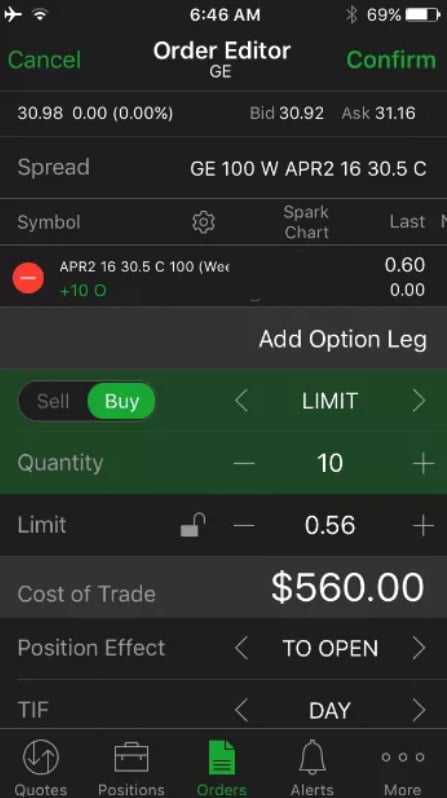

On the other hand, the user experience at TD Ameritrade is tailored for all types of investors from the experienced to the beginner. Firstly, this US-based broker provides web, desktop, and mobile trading platforms. The web and mobile trading apps are great for placing trades, fundamental data, and researching certain financial instruments. Whereas if you are looking to trade more complex assets TD Ameritrade’s desktop trading platform called Thinkorswim might be the perfect fit for your trading objectives. The Thinkorswim platform supports a wider range of assets including forex trading and futures trading, as well as offering advanced technical research tools.

The web trading platform is well designed and very user-friendly but does not offer customizability which can be a hindrance if you are the type of trader who prefers to set things up as you see fit. Along with relevant search functionality, the trading platform allows you to place different order types and you can set a variety of price alerts and push notifications to help you stay updated with the latest developments and market movements in the financial sphere.

TD Ameritrade vs Robinhood Mobile App

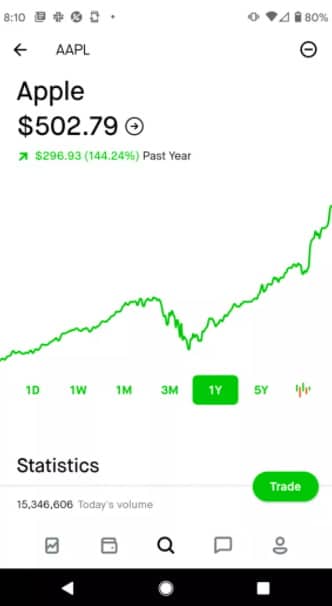

Both TD Ameritrade and Robinhood have native mobile trading apps that allow you to invest in financial instruments wherever you are on your mobile device. Both apps are compatible with Android and Apple devices. When it comes to user experience, both offer more or less the same functions and design as the web trading platforms.

Turning our attention to the Robinhood mobile app, the only thing that differentiates the mobile app from the web platform is the fact that stock screeners are not supported on mobile. In terms of safety, the Robinhood app uses a two-step authentication, as well as the option to use biometric authentication, which is very convenient.

TD Ameritrade, on the other hand, offers two mobile trading platforms: TD Ameritrade Mobile and its in-house developed Thinkorswim Mobile Trader. Both are available on Apple and Android devices but there are a few elements that separate the two apps.

Firstly, you can only access futures and forex trading via the Thinkorswim mobile app, and secondly, the Thinkorswim Mobile Trader provides paper trading, charting tools, and conditional trading. During our review, we found that the Thinkorswim Mobile Trader is targeted towards advanced traders who have experience trading complex assets like futures. Secondly, if you are looking for a demo account then your only option is the Thinkorswim app.

TD Ameritrade vs Robinhood Trading Tools, Education, Research & Analysis

Thus far we have explored key metrics including tradable assets, fees, and the general user experience. Now, let’s take a look at what educational resources and tools that both brokers have to offer.

Trading ideas

Are you just stepping into the world of online trading? Or do you want to test out your investment strategies? Starting with TD Ameritrade, you can access investment and trading ideas from third-party providers such as Reuters, Morningstar, and TD Group for popular asset groups including ETFs, stocks, and mutual funds.

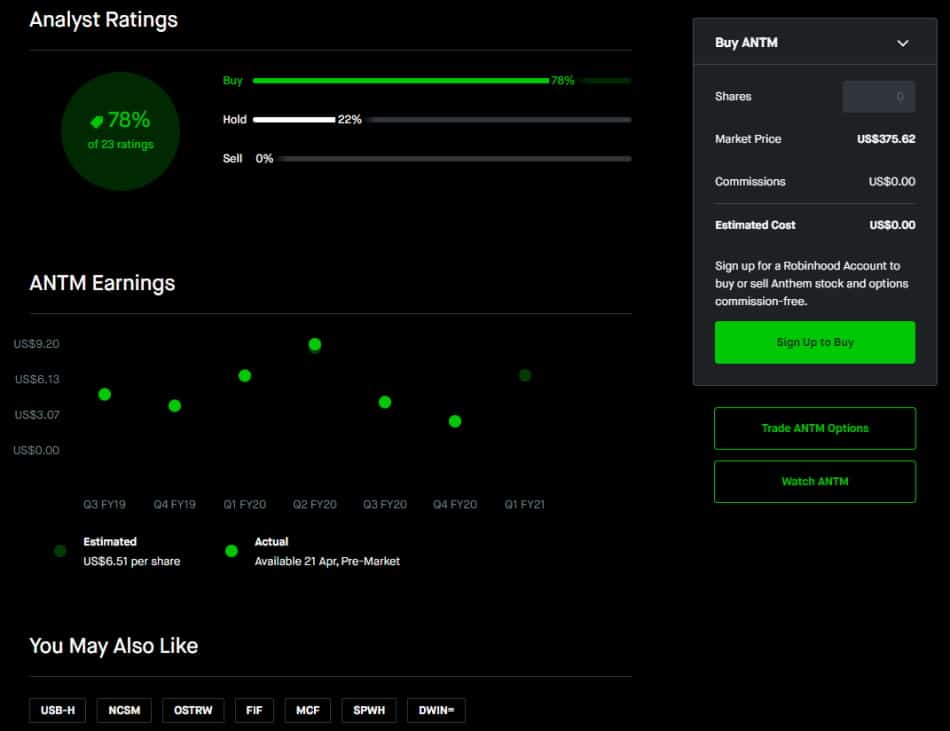

On the other hand, Robinhood users have access to analyst ratings of financial instruments by experienced investors helping them to make more informed decisions. These analyst ratings present assets that have been rated by experts as either buy, sell or hold. There is also a section entitled ‘people also bought’ which displays alternative and relevant products that are related to the one you have searched for.

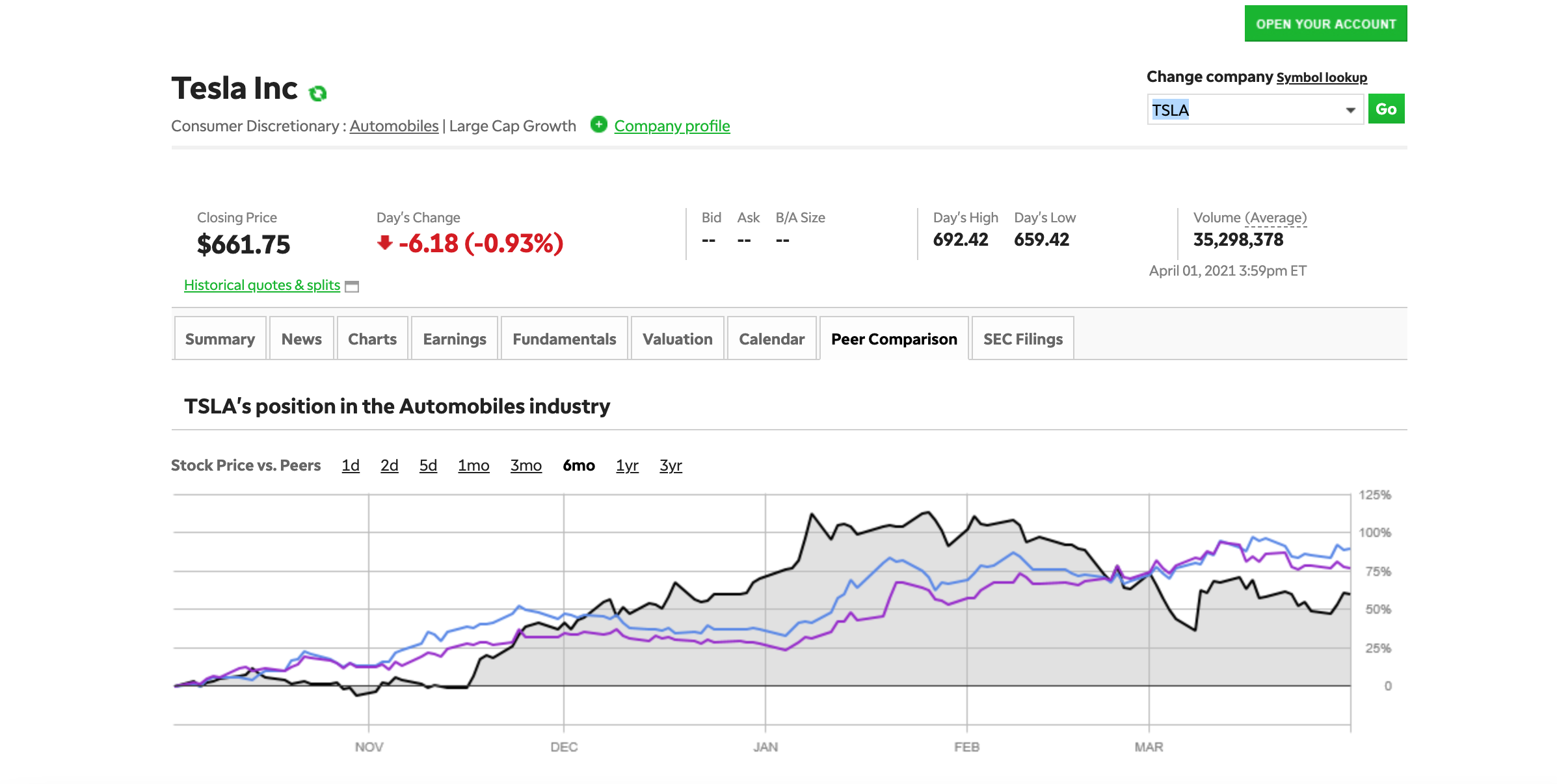

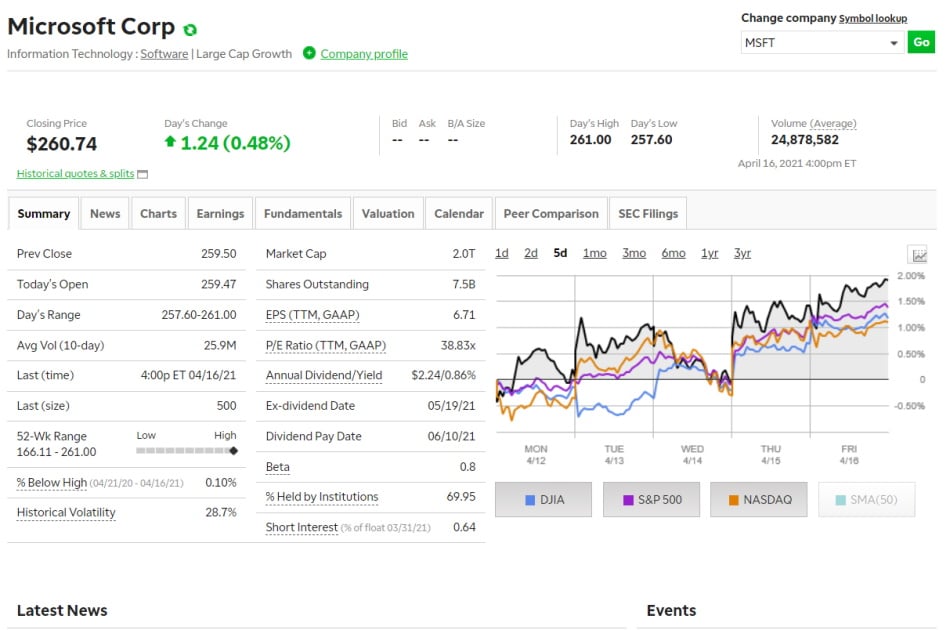

Fundamental data & Charting

TD Ameritrade provides fundamental data predominantly on stocks. After choosing the stock of your choice, simply navigate to the tab that says fundamentals and explore the financials for the past 5 years as well as other rating metrics. Active traders also have access to 400 technical indicators when it comes to TD Ameritrade’s charting tools.

In comparison, Robinhood offers a handful of fundamental data including the number of employees, market capitalization, and Price-Earnings ratios. Furthermore, in keeping with the notion that Robinhood is designed for beginner traders, it is perhaps no surprise that its charting features are simple and straightforward. You can explore past price movements of your chosen stock and have access to a couple of technical indicators when pressing the expand button. But, if you favor a more advanced and in-depth chart analysis then your safest bet will be with TD Ameritrade.

Educational resources

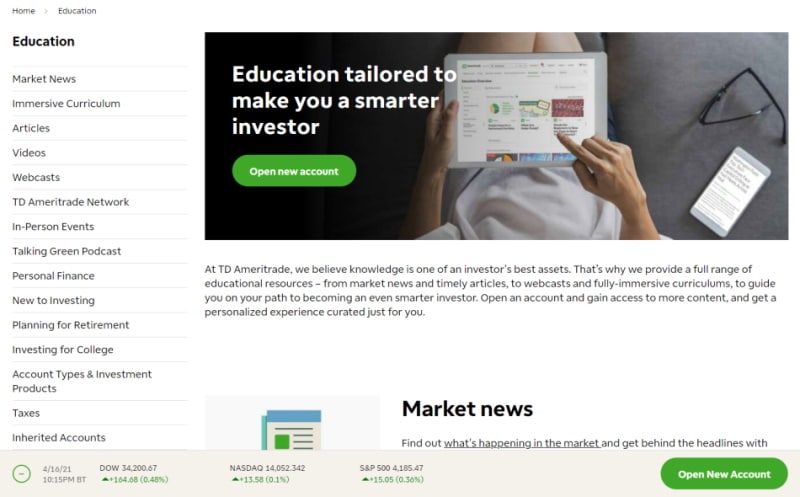

When it comes to education, our comparison review found that TD Ameritrade simply has tons more to offer when compared to Robinhood.

With TD Ameritrade there are many ways you can develop your investing experience and knowledge:

- Thinkorswim paperMoney demo account

- Educational tutorial video content

- Webinars

- Informative articles

If you use the Thinkorswim desktop platform you also have access to a dedicated learning section that provides other educational materials and FAQs.

Having said this, the articles are easy to comprehend, relevant, and perfectly suited to people just entering the world of online trading.

TD Ameritrade vs Robinhood Demo Account

Our extensive research found that Robinhood does not offer a demo account which therefore puts TD Ameritrade ahead when it comes to educational resources.

For those of you who are new to this, a demo account is simply a paper trading account that allows you to test and strengthen your trading strategies without the added risk of losing your capital. TD Ameritrade offers a demo account called ‘paperMoney’ via the Thinkorswim desktop trading platform. As well as $100,000 worth of virtual funds you also have access to a wide variety of advanced trading and charting features giving you the chance to test your trades without the threat of suffering financial losses.

TD Ameritrade vs Robinhood Payments

There are no deposit or withdrawal fees with both brokers and the only available deposit option is via bank transfer as credit/debit cards, and e-wallets are not supported. It typically takes 1 business day with an ACH transfer on TD Ameritrade with a $50 minimum transfer.

With Robinhood, your funds arrive straight away when using the instant deposit option. Alternatively, this can take between 4 to 5 working days to process. The instant deposit option has some restrictions: for example, if you are using an Instant account you are allowed to deposit any sum up to $1,000 without delay, whereas Gold account holders are limited to $50,000.

| Minimum Deposit | Deposit Fee | Processing Time | Withdrawal Fee | |

| TD Ameritrade | $0 | FREE | 1 day with ACH transfer | FREE |

| Robinhood | £100 | FREE | Instant, depending on account type | FREE |

TD Ameritrade vs Robinhood Customer Service

When it comes to customer support TD Ameritrade takes the number one spot because Robinhood’s customer services can only be contacted via email and are not available 24/7. Having said this there is an entire Robinhood support page dedicated to FAQs and other helpful content that can sometimes offer the answers to your questions.

But, in terms of accessibility TD Ameritrade’s customer support can be reached via telephone, email, and live chat 24 hours 7 days a week. The live chat function offers relevant and fast answers. In addition, there is a virtual assistant that can guide you to relevant pages.

Robinhood vs Other Brokers

Overall, Robinhood is perfectly suited to new investors with little trading experience who want to buy and sell US shares and ETFs on a commission-free basis. However, these aren’t just empty words, as we have pinned Robinhood against other widely popular online brokers in the following comparison reviews:

- Stash vs Robinhood

- Coinbase vs Robinhood

- Acorns vs Robinhood

- Webull vs Robinhood

- M1 Finance vs Robinhood

- Fidelity vs Robinhood

- Robinhood vs Charles Schwab

- Robinhood vs Ally Invest

TD Ameritrade vs Robinhood Safety & Regulation

When selecting an online trading platform, evaluating safety and regulation should be your number one priority. As we already mentioned at the beginning both brokers in question are regulated by widely recognized financial authorities including the SEC and FINRA. It is worth noting here that TD Ameritrade is also regulated by the Commodity Futures Trading Commission, the Monetary Authority of Singapore, and the Hong Kong Securities and Futures Commission.

Client Protection

TD Ameritrade clients are covered by the Securities Investor Protection Corporation. In short, this protection scheme protects up to $500,000 of investor funds as well as $250,000 for cash claims.

Robinhood Crypto LLC is not covered by the SIPC protection and therefore should the company go bust your funds will not be covered. On the other hand, Robinhood Financial LLP is covered by the SIPC client fund protection.

Moreover, both brokers do not offer negative balance protection, which means that you can lose more capital than you have invested.

TD Ameritrade vs Robinhood – The Verdict

This TD Ameritrade vs Robinhood review has examined all the key metrics that need to be considered before choosing a broker. We have focused on tradable assets, available payment options, customer services, user experience, mobile trading, fees, and more. Therefore, you should be in a position to decide which broker can help you achieve your trading goals.

Additionally, if you want to find out how Robinhood does when compared to another online trading platform then you might just want to read our Robinhood vs eTrade review.

Your capital is at risk.