Robinhood vs eTrade – Which Broker Is Best in 2025

If you’re looking to buy and sell stocks with the click of a button you’re going to need a top-rated broker. But with so many options to choose from, how do you make the right choice? Read our full Robinhood vs eTrade comparison to find out.

This review covers important metrics such as tradable assets, non-trading fees, demo accounts, and more. What are the qualities that make a great low-cost broker?

Robinhood vs ETrade Comparison

What are Robinhood and ETrade?

In a nutshell, both Robinhood and eTrade are online trading platforms that give traders of all experience levels the ability to buy and sell tradable assets easily and with low costs. To begin, create and open an account with your desired brokerage firm, deposit funds, and then you can start ETF trading, crypto trading, and more.

With top-level regulators including the FINRA (Financial Industry Regulatory Authority) and the SEC (Securities and Exchange Commission) under its wing, eTrade is a US-based investment platform. Its roots can be traced back to 1982 when it was launched.

eTrade is regarded as a safe broker because of its history, as well as being listed on the NASDAQ stock exchange under the ticker symbol ETFC.

On October 2nd, 2020 the US investment banking company Morgan Stanley announced its all-stock acquisition of eTrade in a move to increase its target demographic and improve its presence in the online investment world.

On the other side of the equation, Robinhood is a US-based SEC and FINRA regulated online trading platform which was launched more recently in 2013. This low-cost broker offers stock trading, ETF trading, and cryptocurrency trading on a commission-free basis.

Aside from being a commission-free online trading platform, Robinhood also offers a Cash Management service that allows its users to collect interest on uninvested funds. With Robinhood’s Cash Management service clients can use any of the staggering 75,000 ATMs in its network while paying zero fees. Not to mention that this also covers around 15,000 international ATMs, through Robinhood’s collaboration with interbank networks MoneyPass and Allpoint.

Robinhood also prides itself on the fact that through its Cash Management service, clients can earn an APY (annual percentage yield) of 0.30% on uninvested funds. But, an important point as stated by Robinhood itself is that the 0.30% annual percentage yield is not a fixed APY because the program banks can fluctuate the percentage whenever they want.

Robinhood users who choose to use the Cash Management service agree to take part in the IND sweep service, meaning that their uninvested funds will be automatically swept, or transferred, into deposits at a group of program banks.

Robinhood’s Cash Management service is covered by the Federal Deposit Insurance Corporation up to a limit of $1.25 million.

Robinhood vs eTrade Tradable Assets

In this segment of our Robinhood vs e*Trade review, we will uncover the types of tradable assets available at the two free trading platforms.

Starting with eTrade, you can invest in a vast range of US assets including ETFs, stocks, Futures, Options, Mutual Funds, Bonds and CDs, and Prebuilt Portfolios. On the flip side, eTrade does not support forex or CFD trading.

Cryptocurrency direct trading is not available with eTrade, however, the broker does support futures trading with access to CME (Chicago Mercantile Exchange) Bitcoin Futures and Ether Futures.

eTrade clients have access to zero-commission on US market listed stock, ETFs, and options trades with the added benefit of no account minimums.

In terms of mutual funds, eTrade has more than 500 funds on offer from top-tier US investment management companies BlackRock and Vanguard.

eTrade provides multiple kinds of Prebuilt Portfolios, including Prebuilt ETF portfolios and Prebuilt Mutual Fund portfolios. This is perfect if you want help to manage your investments. With a Prebuilt Portfolio, you get access to advice and ideas from a professional or eTrade’s robo-advisor service. The portfolios can be customized and easily tweaked to suit your needs and trading style.

But, be aware that there are minimum deposit requirements and annual advisory fees allocated to each type of portfolio. For example, with the mutual fund portfolio, the minimum deposit is $500 while the minimum deposit for the ETF portfolio is $2,500.

Robinhood’s selection of tradable assets is rather limited. With that said the online trading platform offers stocks and funds, options, and cryptocurrency trading with zero commission.

Cryptocurrency trading

Robinhood clients have access to a wide range of crypto commission-free trades such as:

- Ethereum Classic (ETC)

- Litecoin (LTC)

- Bitcoin Cash (BCH)

- Dogecoin (DOGE)

- Bitcoin (BTC)

- Ethereum (ETH)

- Bitcoin SV (BSV)

This online discount broker also offers live market data for other tradable cryptocurrencies including OmiseGO (OMG), Qtum (QTUM), Ripple (XRP), Stellar (XLM), Bitcoin Gold (BTG), Dash (DASH), Lisk (LSK), Monero (XMR), NEO (NEO), and Zcash (ZEC).

Currently, Robinhood offers cryptocurrency trading to 47 US states. It has announced plans to expand its services to more states across the US.

Robinhood stocks and funds

Robinhood provides approximately 5,000 different exchange-traded funds and stocks that are listed on the top US stock exchanges. Traders can also access certain stocks outside of US markets via American depositary receipts.

Robinhood vs eTrade Account Types

Opening a brokerage account with either trading platform is user-friendly, simple, and is completely digital. Perhaps a hindrance for some, Robinhood and eTrade only accept US-based users.

Having said this, Robinhood has intentions to expand its services to Europe and other countries, which is why in August 2019 the broker gained the UK’s Financial Conduct Authority’s approval to launch its trading services in Britain. But, these efforts have been put on the back burner because of Covid-19 lockdown restrictions.

There are no account minimums for either online broker but this does vary depending on the type of trading account you opt for. For example, with a Robinhood Instant account, the minimum deposit is zero. However, if you upgrade to a Robinhood Gold account you will be required to deposit a minimum amount of $2,000.

The same is true for eTrade users; basic eTrade accounts have a minimum deposit of $0 whereas its margin trading accounts have a $2,000 minimum deposit requirement.

Robinhood vs eTrade: What account types are available?

There are three types of accounts available at Robinhood:

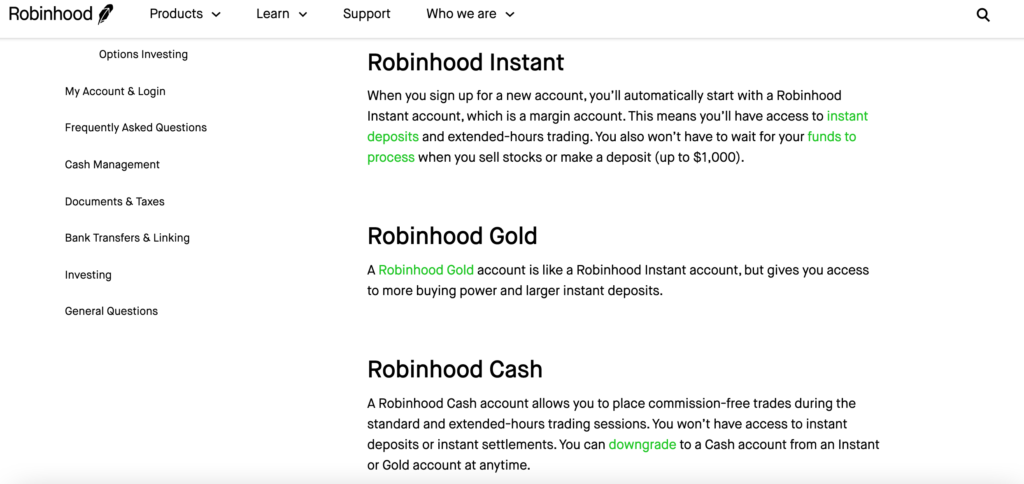

- Robinhood Instant – By default, when you sign up with Robinhood, you begin with a Robinhood Instant trading account. Simply put, this is a margin trading account. With this type of account, active traders can deposit funds instantly and have access to extended-hours trading. In addition, when Instant account holders fund their accounts with any sum up to $1,000 the processing time is instant.

- Robinhood Gold – is similar in many ways to a Robinhood Instant account, the difference being that it offers greater margin and instant deposits greater than $1,000.

- Robinhood Cash – Robinhood Cash accounts offer 0% commission trades during both standards and extended trading hours. Instant deposits and settlements are not available. If you are an Instant or Gold account owner then you can downgrade to a Cash account whenever you choose.

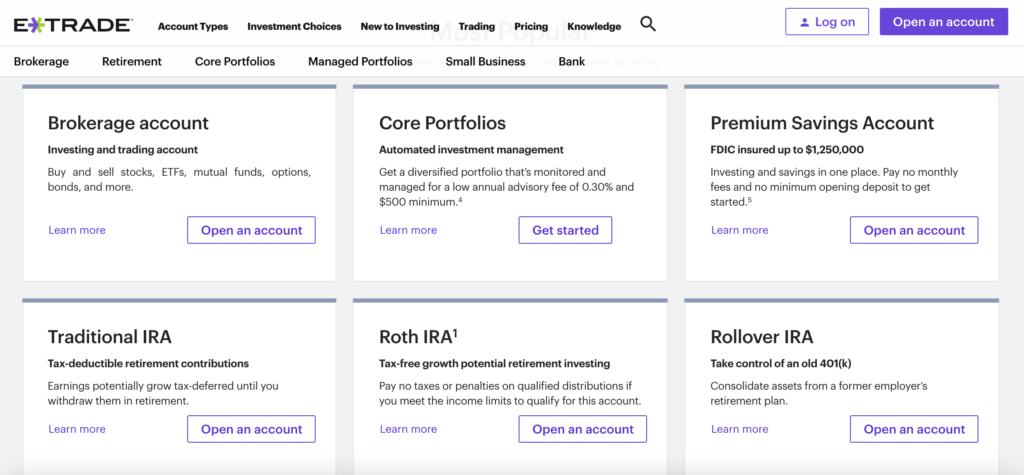

There are heaps of account types available at eTrade from basic brokerage accounts to retirement accounts (for example ROTH IRA accounts). In comparison, eTrade appeals to a wider audience depending on what they need. All in all, there are five different categories of eTrade account types that users can choose from. All accounts are explained in full on the website to ensure that you are getting exactly what you are looking for.

As we have already mentioned there are no minimum deposits for eTrade’s basic trading accounts. For other more complex accounts, such as margin accounts there is a $2,000 minimum deposit. Clients who open an eTrade account, gain access to its low-fee premium Savings Bank account.

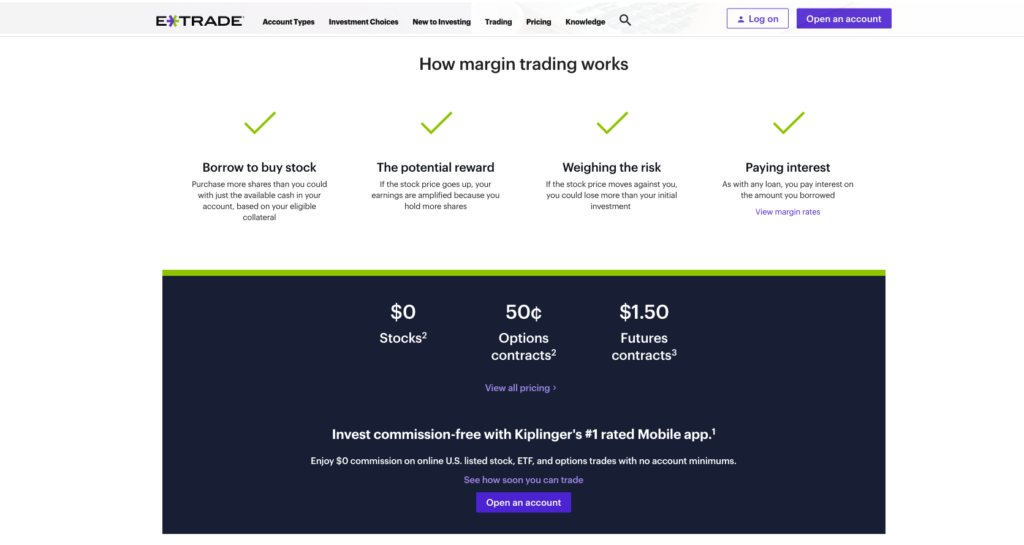

eTrade vs Robinhood Fees & Commissions

This section will cover all things trade and non-trade fee-related. Robinhood and eTrade offer commission-free trading of US stock and ETFs. In eTrade’s case, some mutual funds and bonds are also free to trade. For more information on which trades

Most US investors will try and pick a broker based on fees. After all, you’ll want to keep your trading costs as low as possible. This includes commissions and dealing fees, and other potential costs such as withdrawal and annual fees.

If you prefer margin trading then Robinhood is the cheaper option as it charges an annual margin rate of 2.5% whereas e*Trade charges 6.45%. Trading on margin simply means that you borrow funds from your investment broker to execute trades. The annual margin rate is basically the interest that is charged on the borrowed amount.

As we have already mentioned Robinhood provides zero-commission cryptocurrency trading. All in all, eTrade has a wider variety of tradable assets which means that it has a wider list of fees, but for what they both offer Robinhood seems to be the cheaper option.

To better understand this Robinhood vs eTrade comparison here’s a breakdown of the trading and non-trading fees.

| Commission (US stocks) | Mutual fund (per purchase) | Inactivity fee | USD margin rate | Deposit fee | Withdrawal fee | Account fee | |

| Robinhood | $0 | n/a | No | 2.5% | $0 | $0 | No |

| e*Trade | $0 | $19.99 | No | 6.45% | $0 | $0 | No |

In conclusion, both brokers offer a low-cost way to buy and sell tradable assets like stocks and ETFs from the comfort of your own home.

eTrade vs Robinhood User Experience

As for user experience, this broker comparison found that Robinhood is the better match for those just starting out in the world of online trading and investing. This is very clear from the moment you enter the Robinhood website for the first time. For instance, the layout is very simplistic and gives the feeling of a very modern trading experience without complicated investment jargon.

Everything is designed clearly and efficiently – making it perfect for beginner traders. The same applies when you search for a particular asset. The first phrase that you encounter when jumping on the Robinhood platform is ‘Investing for everyone’. This is exactly what Robinhood is trying to achieve with its easy-to-use interface and educational-style, back-to-basics tone of voice.

When it comes to buying stock on the Robinhood web and mobile trading platforms the process couldn’t be much easier. All you need to do is go to the stock detail page. Once there you have access to the stock’s track record, analyst ratings, and other useful data you will need to study to trade stocks. Then you specify the amount you would want to buy. Press the Review button to confirm your choices. The trading platform even allows you to modify your stock order if you made a mistake or changed your mind. Once you’re happy with your choices simply click buy. And that’s it, a seamless and very user-friendly experience as far as Robinhood traders are concerned.

As for eTrade, the website is also user-friendly and easy to use and navigate around. However, when compared to Robinhood you cannot help but feel slightly lost in the abundance of options that are available.

Both platforms provide two-step authentication to log in for added security. As for being able to customize the platform both providers offer limited charting and dashboard customization which can be a turn-off for those of you who want to be able to fully customize your trading experience.

Setting order types like market and stop-loss orders is also easily performed on both platforms. You can also set alerts and push notifications for a range of different events including dividend payments, price movements, and more.

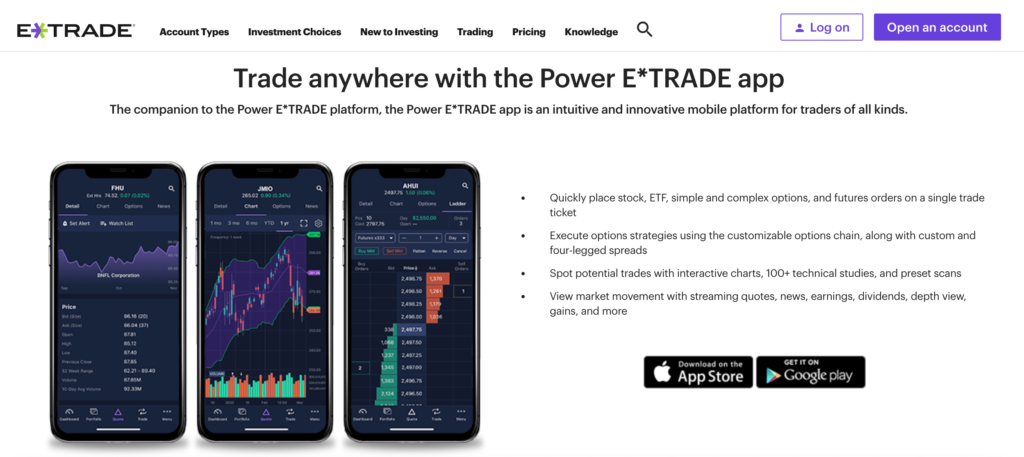

eTrade vs Robinhood Mobile App

Both eTrade and Robinhood provide mobile trading apps to buy and sell your favourite stocks, ETFs, and more. They are both compatible with iOS and Android mobile devices. When it comes to the user experience, this mirrors the user-friendly sentiment that we mentioned in the previous segment.

The Robinhood mobile trading app provides the same layout, user experience, and functionality as its web trading counterpart. The only noticeable difference being that the stock screener is not offered on the Robinhood mobile app.

Robinhood’s mobile trading app supports a two-step authentication login. This is an important feature nowadays as scams and hackers continue to pose a real threat to peoples’ personal finances.

As for the eTrade mobile app, its functionality is practically identical to the web trading platform. The eTrade mobile app is very easy to use and has a useful search tool. You can place a variety of order types, and set alerts quickly and easily. On the flip side, two-step authentication logins are not supported. However, TouchID is available which is a cool security feature.

During this comparison and review, we found that the eTrade mobile trading app is easier to use than its web trading platform.

Robinhood vs eTrade Trading Tools, Education, Research & Analysis

So far in our Robinhood vs eTrade review – we have compared key metrics including tradable assets, fees, and more. In this section, we will explore what financial tools and features both platforms have available.

Both brokers offer user-friendly research tools like trading ideas and fundamental analysis.

For Robinhood Gold account clients other research tools are available including real-time market data (level II) and research reports which are sourced from reputable third-party providers such as the US financial services company Morningstar.

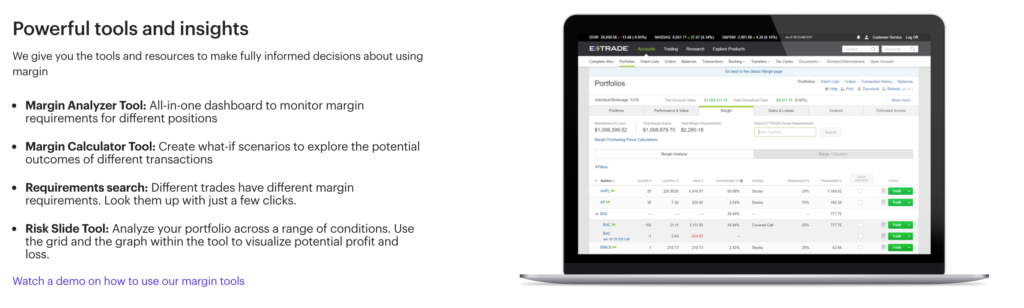

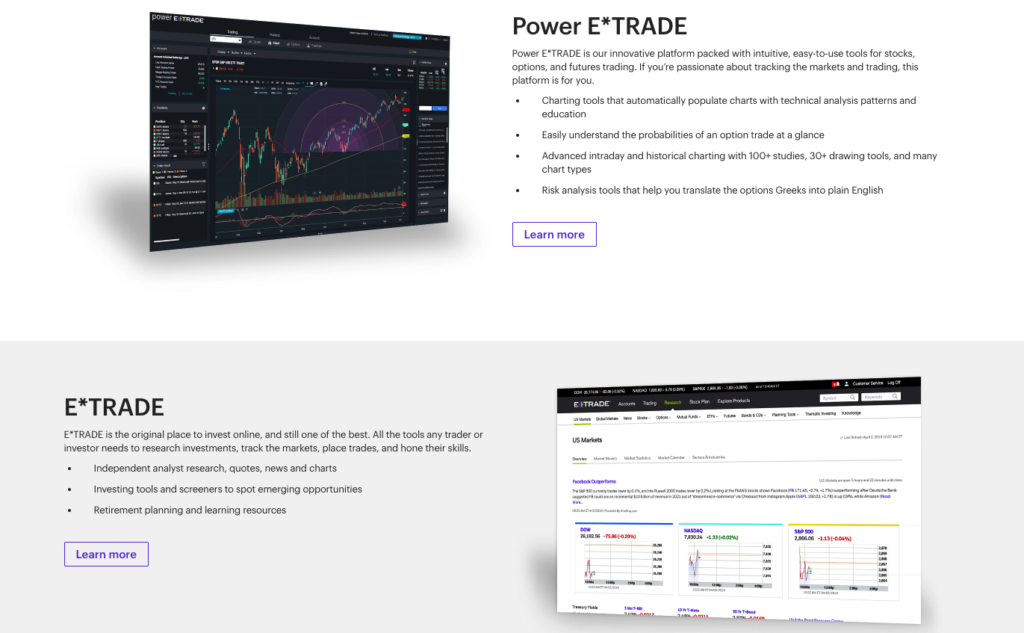

The range of research tools varies depending on the type of platform you use: the eTrade and the Power eTrade web-based platforms.

The eTrade web trading platform is perfect for basic investment research on assets like ETFs and stocks. On the other hand, the Power eTrade platform is the better option for researching more advanced financial products such as futures.

Robinhood gives you access to expert analyst ratings of different assets, which are designed to give you insights to help make better trading choices. These analyst ratings tell you which stocks have been rated as either buy, sell, or hold by experts. There is also a tool that shows other popular assets that other traders are showing an interest in.

eTrade also offers trading ideas and insights for tradable assets including ETFs, stocks, and mutual funds. Certain stock trading ideas are sourced from third-party companies such as TipRanks, Reuters, MorningStar just to name a few.

Robinhood and eTrade both provide some basic fundamental data on stocks like Price-Earnings ratios, dividend yield, average volume, and market cap.

Robinhood’s charts are simple and user-friendly. Traders have access to historic price fluctuations of the stock they are interested in buying, selling, shorting, or holding. There are a limited amount of technical indicators by pressing on the expand tab. All in all, if you require a more in-depth chart analysis experience, eTrade’s charting tools may be a better match for you because it offers around 30 technical indicators.

Robinhood vs eTrade Demo Account

At this point in our Robinhood vs eTrade comparison, we have found that the former broker appears to be better suited to beginners. Having said this it does not offer a demo account or paper trading platform.

eTrade does offer a demo account called the Power E*TRADE demo account. This is a paper trading account that allows users to gain a hands-on experience of what online trading entails. Albeit that the funds are virtual this appeals to new traders who want to try online trading without the added risks of losing money.

Paper trading on the eTrade Power app allows you to explore and trial trading strategies such as equities and options chains without ever investing real funds.

Robinhood vs eTrade Payments

Once you have opened an account with Robinhood or eTrade, you can make a deposit straight away. eTrade and Robinhood have no fees when it comes to deposits however the only option is through bank transfers. Electronic wallets such as Paypal or Skrill, as well as debit cards and credit cards are not offered as acceptable deposit methods with either platform.

Robinhood’s instant deposit option allows clients to deposit funds immediately. Robinhood Instant account users can deposit anything up to $1,000 instantly while anything above this amount can take between 4 and 5 business days to process.

Both brokers do not charge a withdrawal fee if it is made via ACH withdrawals, wire transfers come with a $25 withdrawal fee.

There is no minimum deposit for the Robinhood Instant account which is the same for eTrade basic brokerage accounts.

If you use the Robinhood Gold account, or if you use an eTrade margin account you have to deposit a minimum of $2,000.

| Minimum Deposit | Deposit Fee | Processing Time | Withdrawal Fee | |

| Robinhood | $0 for Robinhood Instant – $2,000 for Robinhood Gold | $0 | Instant up to $1,000 otherwise 4-5 days | $0 |

| eTrade | $0 for Basic accounts – $2,000 for margin accounts | $0 | 1-2 days | $0 |

eTrade vs Robinhood Customer Service

Our Robinhood vs eTrade review found that eTrade offers relevant and effective 24/7 customer support via phone, live chat, and email. Robinhood’s customer service is only available through email and cannot be contacted 24/7.

In terms of Robinhood, after placing a request with the broker’s customer support, you can pick from a range of topics like opening an account and funding; and a customer service representative will respond with an email. After you have selected a certain topic, you can elaborate further on your issue or request.

Robinhood vs eTrade Safety & Regulation

Finding the right trading platform for you involves weighing up all key metrics. Perhaps one of the most important metrics is that of security and regulation. Needless to say, both Robinhood and eTrade are regulated by major financial organizations including the US SEC, FINRA, and in Robinhood’s case the UK’s FCA.

Both brokers are members of FINRA and therefore its clients are covered by the US investor protection scheme, otherwise known as the SIPC. The SIPC protection is limited to $500,000, as well as a $250,000 limit for cash.

Robinhood Crypto is not covered by the SIPC protection scheme.

Both brokers do not offer negative balance protection, so if you are interested in margin trading then you should consider this carefully alongside your risk tolerance.

Robinhood vs eTrade

Our eTrade vs Robinhood guide found that both trading platforms are similar in the sense that both offer zero-commission stock and ETF trading, have a user-friendly design and layout, offer no fees for deposits and withdrawals, and are regulated by the SEC and FINRA.

On the other hand, Robinhood does not offer a demo account, and its customer services are limited to just emails. So, eTrade is better than Robinhood in those respects. But, then again if you are interested in 0% commission cryptocurrency trading then Robinhood Crypto is your only option unless you want to trade crypto futures.

Robinhood vs eTrade – The Verdict

To summarize, our Robinhood vs eTrade comparison studied every crucial metric that active traders need to look at when picking a broker. This covers everything from tradable assets, fees, and commissions, customer services, and regulation.

We found that both brokers offer a user-friendly and cost-effective way of accessing certain assets such as cryptos and stocks – directly from the comfort of your own home.

Robinhood – Overall Best Stock Trading Platform

Your capital is at risk. Other fees apply.