Coinbase vs Robinhood – Cheapest Broker Revealed

If you’re based in the US and are searching for a low-cost broker to trade cryptocurrencies then Coinbase and Robinhood are two names you may have already come across. But, to buy and sell assets you only need one brokerage account – so which one should you pick?

This is precisely what we will be focusing on in this Coinbase vs Robinhood comparison. We examine all the key metrics, from fees and commissions to payments and user experience.

Coinbase vs Robinhood Comparison

Coinbase – crypto

Visit SiteYour money is at risk. The exchange holds an e-money license from the FCA....

Robinhood

Visit SiteSecurities trading offered through Robinhood Financial LLC, a registered broker-dealer and Member SIPC, and a subsidiary of Robinhood Markets, Inc....

What are Coinbase and Robinhood?

Coinbase and Robinhood Crypto LLC are both cryptocurrency exchanges that allow new and advanced traders to purchase, store and sell digital assets such as Bitcoin on their mobile devices or desktops. While both platforms open a gateway to the cryptocurrency markets, each trading platform has its unique benefits and separate features.

For example, Robinhood is made up of Robinhood Financial LLC, which provides stock, options, and ETF trading services, and Robinhood Crypto LLC which gives its users access to the cryptocurrency marketplace.

Launched in 2013, Robinhood provides a user-friendly and easy-to-use platform that is perfectly suited to new investors who have little to no experience in online trading. Trading is made as simple as possible with the click of a button. Furthermore, as most brokers nowadays are finding new ways to bring trading costs down, Robinhood offers US stocks, ETFs, options, and crypto trading on a 100% zero-commission basis.

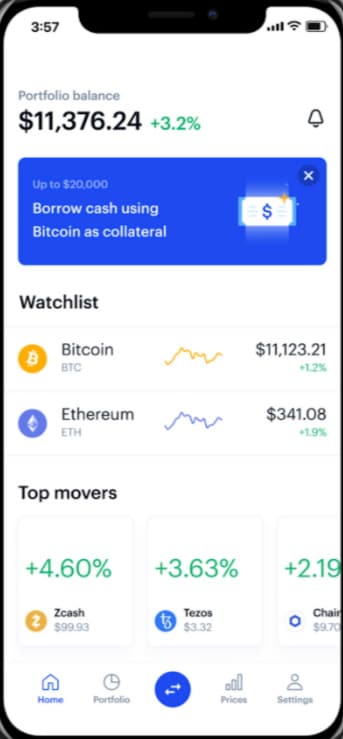

On the other hand, as one of the industry-leading names in the US cryptocurrency exchange, Coinbase’s popularity has grown making it one of the go-to platforms for new crypto traders. Coinbase provides a huge range of cryptocurrencies, an online and mobile trading app, Coinbase Custody for institutions, Coinbase Pro for seasoned investors, and its own USD coin otherwise known as a stablecoin.

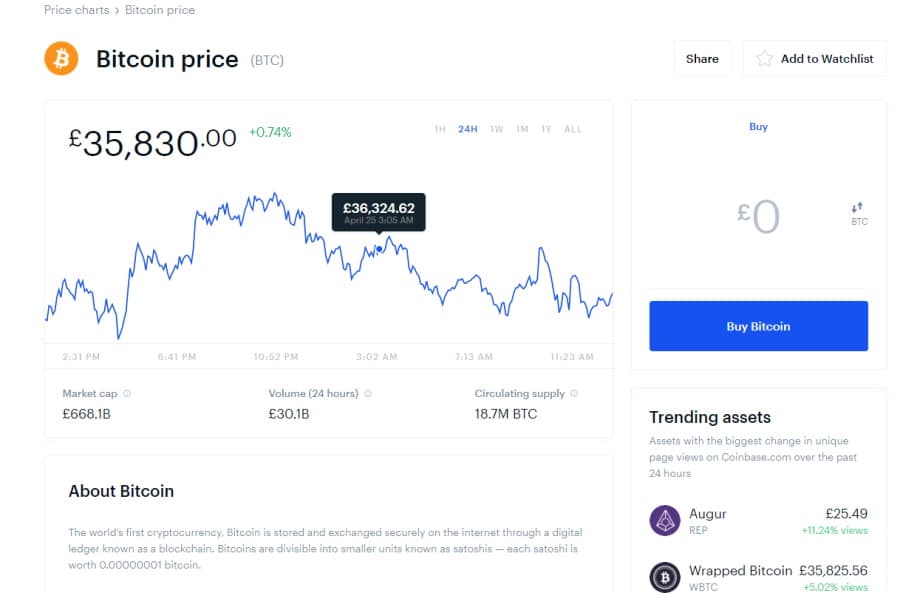

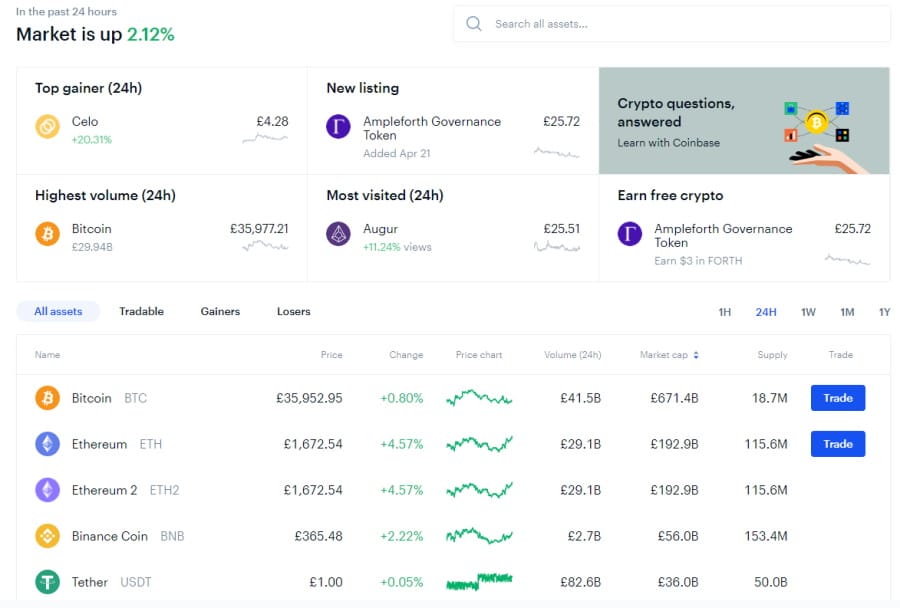

Established in 2012, Coinbase now supports 57 different cryptocurrencies from Bitcoin and Ethereum trading to Litecoin and Tether.

Coinbase vs Robinhood Tradable Assets

With Robinhood, you can buy and sell shares of US stocks. Nevertheless, there are a number of non-US stocks available through American depositary receipts. Simply put, ADRs give US investors exposure to foreign stocks without having to deal in international exchanges. Major companies including Adidas and Tencent list their shares on US stock exchanges via ADRs. With ADRs, US-based investors can access hundreds of foreign stocks of globally recognized companies.

As a result, Robinhood users can access around 5,000 exchange-traded funds and stocks. Diversifying your investment portfolio can be done effectively and efficiently by using ETFs. For example, the SPDR S&P 500 ETF is a popular exchange-traded fund that tracks the performance of the S&P 500 stock market index.

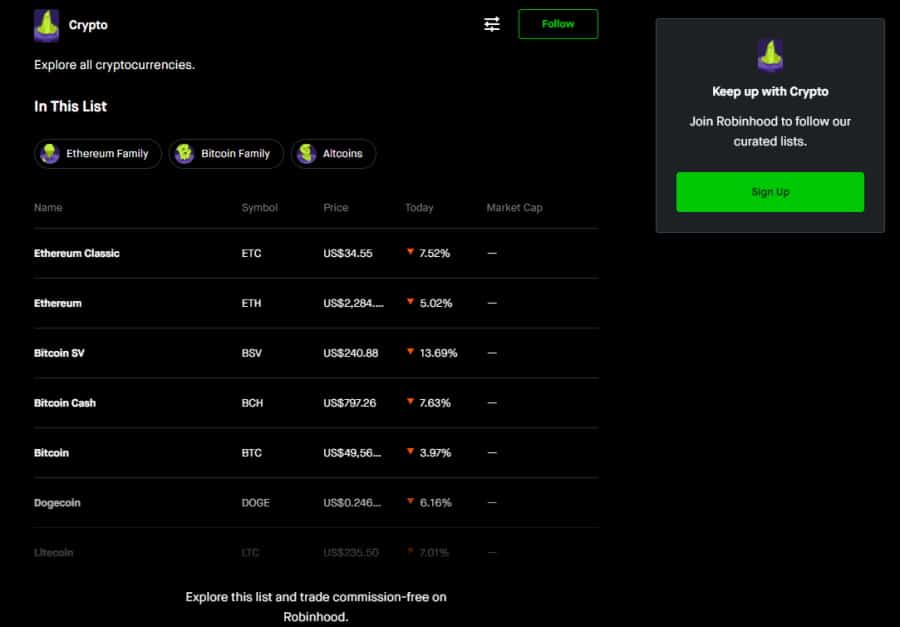

Cryptocurrencies

For those looking to buy and sell popular cryptocurrencies, Robinhood offers 7 different digital currencies that can be traded without commission. You can trade them on the Robinhood web trading platform or its fully-fledged mobile app. The list of commission-free cryptos are as follows:

- Bitcoin Cash

- Dogecoin

- Bitcoin SV

- Ethereum

- Bitcoin

- Ethereum Classic

- Litecoin

Options

Going back to basics, an option, or equity or stock option, is a contract between a buyer and a seller covering a particular stock or financial instrument. The buyer of the options contract has the right to make the seller do whatever is specified within the contract at any time before a predetermined expiry date. Should the buyer exercise the option before the deadline then the seller is contractually obliged to follow rules outlined by the options contract.

Robinhood clients benefit from 0% commission options trading, but this is restricted to stock and stock index options. By opening an account and depositing funds you can trade options on major US stocks such as Amazon (AMZN) wherever you are with the Robinhood mobile trading app.

Coinbase crypto trading

Coinbase is one of the most popular crypto exchanges in the US and is designed to help beginner traders to access cryptocurrency trading with ease. As such, it shouldn’t be a surprise that Coinbase has over 50 different cryptos on offer, from Bitcoin and Ethereum to Dash and Ripples. So, if your main trading objectives centre on digital currencies then Coinbase is likely to have exactly what you are looking for.

Coinbase vs Robinhood Account Types

Both Robinhood and Coinbase have tailored their services, content, and platforms to meet the needs and demands of beginner traders who are just stepping into the world of online investing.

With Robinhood, you can pick between three different account types – Cash, Instant, and Gold.

Let’s have a quick look at the features of each account:

Robinhood Cash Account

Cash Account users do not have access to leverage, which for new traders is not a big deal because while trading with leverage can maximize potential returns it also works in the opposite direction and can maximize potential losses. Robinhood Cash offers access to Instant Deposits for the first $1,000, which means that anything above that figure will take between 4 and 5 business days. Also, you don’t have access to trading with unsettled funds from sold assets. In terms of day trading, Cash accounts are not restricted by Pattern Day Trading regulations.

Robinhood Instant

All users who open a new Robinhood account begin with an Instant account. With this type of Robinhood account, you can deposit funds up to $1,000 instantly, and you can access extended-hours trading. When you sell securities you will be able to trade on those unsettled funds. If you are eligible for options trading, you will have the ability to enter options trades that would otherwise require a margin account.

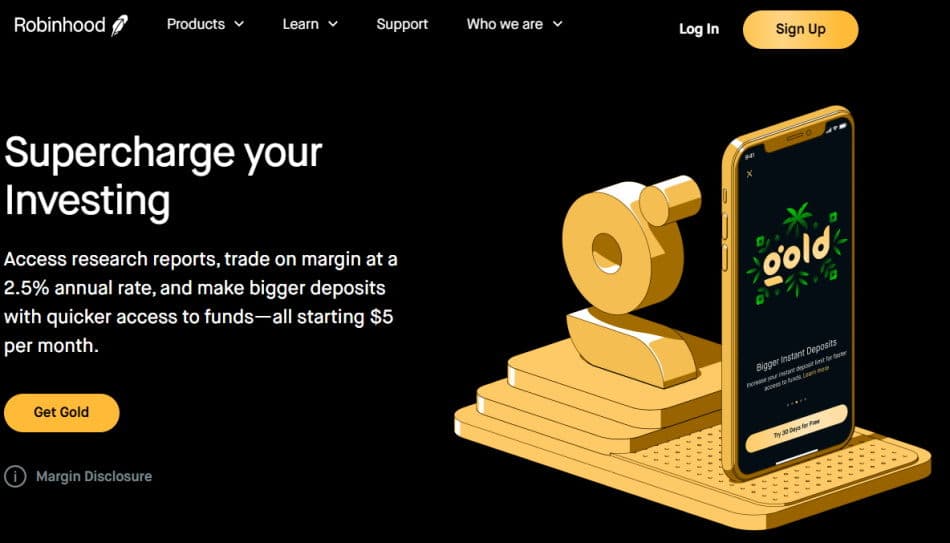

Robinhood Gold

A Gold account bears similarities with an Instant account but there are some key differences. For example, with Robinhood Gold, you have greater buying power through margin investing and can deposit funds up to $50,000 instantly. You can also trade with unsettled funds after selling securities, enter options trades, and access margin trading. Additional perks include level II market data and advanced research from third-party providers. However, there is a $5 per month membership fee.

Coinbase’s account types

Coinbase keeps things very simple when it comes to account types. The entire process of opening an account, adding a payment method, and then trading cryptocurrencies is fully digital, streamlined, and user-friendly.

In short, Coinbase offers a single account that offers the same fees and trading conditions for all types of traders. Having said this, it also offers Coinbase Pro which is designed for more advanced and active crypto investors. This is a more complex online trading platform that features real-time market quotes, charting tools and technical indicators, and a simple order form that makes placing buy orders simple and easy.

With Coinbase Pro you can place a variety of order types such as market, stop, and limit orders with lower commission rates. You can also access margin trading and complex charting tools.

Coinbase vs Robinhood Fees & Commissions

As we have already mentioned, Robinhood and Coinbase provide different trading services and therefore the pricing structures are not the same. In this section of our broker comparison, we will take a look at the fees and commissions charged by both trading platforms.

Here’s a quick breakdown of some of the trading and non-trading fees:

| Crypto Dealing Fee | Deposit and Withdrawal fees | Inactivity Fee | Margin Fee | Account fee | US Stock fee | ETF fee | Options fee | |

| Robinhood | 0% Commission | 0% | No | 2.5% Margin rate | $5 monthly for Gold account | 0% | 0% | 0% |

| Coinbase | Approx. Spread: 0.5% | Between 1.49% – 3.99% | No | A flat fee of 2% of the total transaction | N/A | N/A | N/A | N/A |

All in all, if you plan to invest in cryptocurrencies you are likely to find the Robinhood platform simpler and easier to comprehend when it comes to fees and commissions. This is because Robinhood operates on a zero-commission structure without fixed rates. There are only 7 different digital currencies to choose from and trading them can be done with the click of a button.

Coinbase, on the other hand, has a different fee structure. You can purchase cryptos straight from the exchange itself, or you can choose to convert them into other digital currencies. Whatever you choose to do, Coinbase charges a fee for it. Our research found that the fee structure is rather intricate and can be hard to understand, especially if you are new to the crypto trading scene.

Coinbase’s fee model varies depending on the location and the payment methods used.

When it comes to buy and sell transactions, Coinbase charges a spread of 0.50%. Nonetheless, the actual spread can fluctuate depending on crypto price movements between the time Coinbase quotes a price and the time when the order is executed.

Coinbase also charges a flat fee depending on the transaction amount and the payment method.

| Transaction amount | Flat fee |

| Less than or equal to $10 | $0.99 |

| $10 – $25 | $1.49 |

| $25 – $50 | $1.99 |

| $50 – $200 | $2.99 |

Let’s use an example to better understand the fee structure. If you are a US-based investor and want to buy $150 of Ethereum using a Coinbase USD Wallet, you would be charged a $2.99 flat fee. Then when it comes to the variable fees based on location and payment methods, you would incur a 1.49% fee of the total transaction. With the flat fee being greater than 1.49% of the entire transaction, the fee would be $2.99. However, if you wanted to buy Ethereum with PayPal, the fee would be $3.99 because the variable fee is greater than the flat fee.

Here’s a quick breakdown of Coinbase’s variable fees for the US:

| Payment Method | Variable fee |

| US Bank Account | 1.49% |

| Coinbase USD Wallet | 1.49% |

| E-wallet (PayPal) / Debit Card | 3.99% |

| Instant Card Withdrawal | Up to 1.5% |

| USD Deposit Method | Fee |

| Wire Transfer | $10 and $25 for outgoing |

| PayPal | 2.5% |

| ACH transfer | $0 |

Coinbase vs Robinhood User Experience

Turning our attention to the topic of user experience and the design of the interface, our Coinbase vs Robinhood comparison concluded that both crypto exchanges are perfect matches for new traders.

However, if you want to trade more than just cryptos then Robinhood is a better choice for you because it offers US stocks, ETFs, and options trading with 0% commission, as well as access to some international stocks via ADRs. Yet again, if you are mainly focused on digital currencies then Coinbase has an abundance of cryptos, as well as a more sophisticated platform for advanced investors.

With Coinbase there are just five tabs on the dashboard including prices, portfolio, home, market news and guides, and price alerts. If you wanted to tweak the account settings all you have to do is click the profile symbol at the top of the screen. More importantly, Coinbase makes trading cryptos on its platform a simple and user-friendly process.

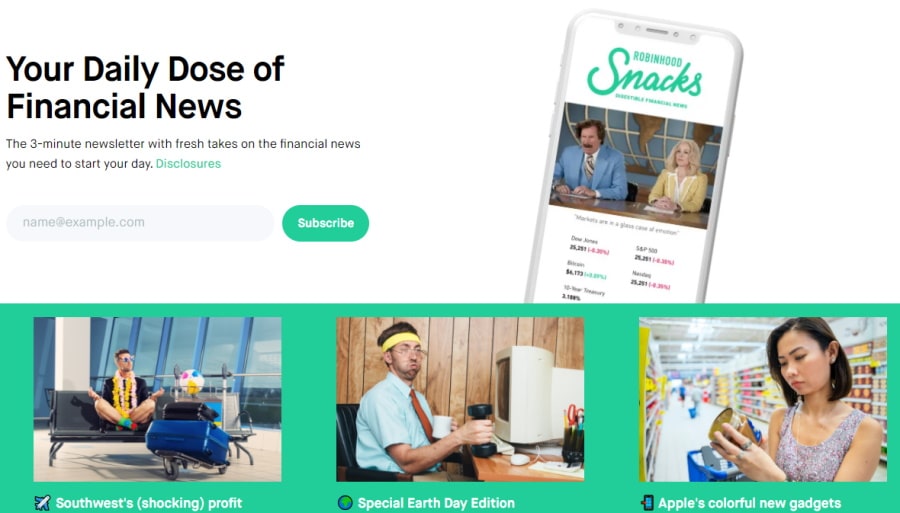

As for Robinhood, this online free trading broker has created a platform with newcomers in mind. Furthermore, when comparing the two platforms, you get a sense of the general financial markets and their movements which Coinbase lacks somewhat.

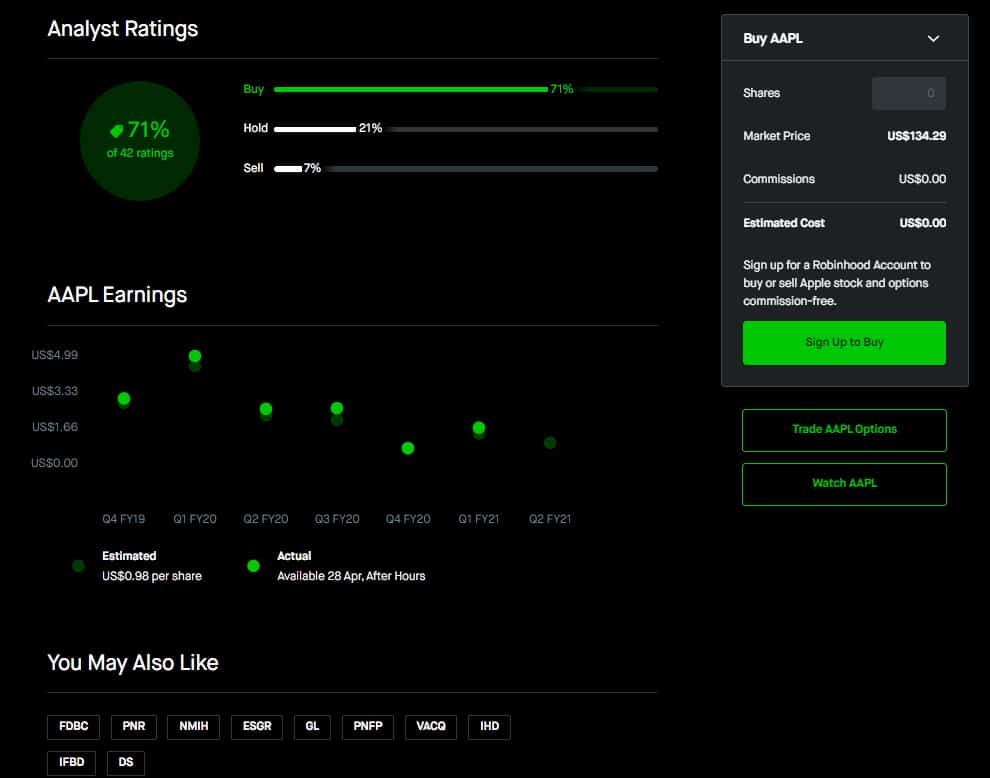

After all, Coinbase is a crypto exchange platform that was designed and developed to give its traders access to crypto trading. For example, Robinhood provides analyst ratings which show the percentage of experts that rate assets as either buy, sell, or hold. In other words, you get an insight into the market sentiment with Robinhood that you don’t with Coinbase.

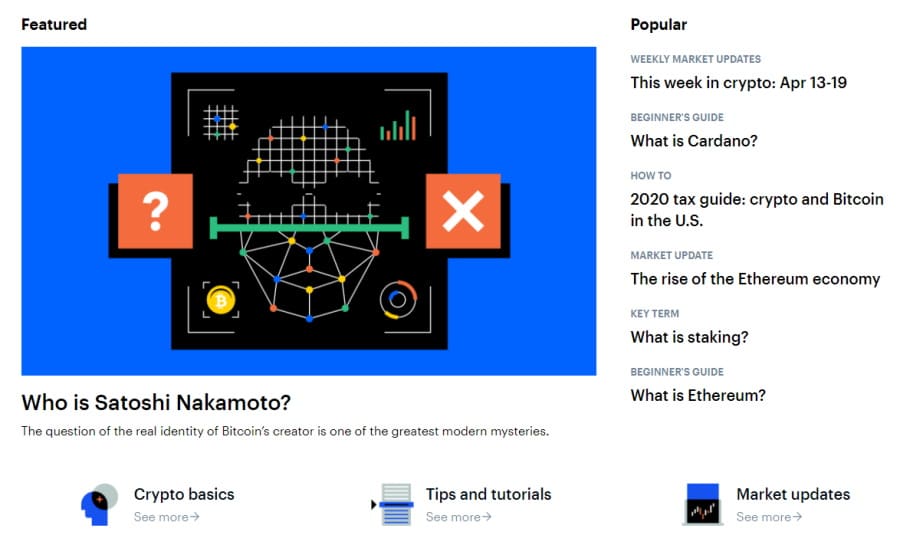

Having said this, if you navigate to the ‘Learn’ tab at the top of the Coinbase site, you can access market updates which are summaries and analyses of the latest market movements in the cryptocurrency sector.

Coinbase vs Robinhood Mobile App

The popularity of mobile trading apps is constantly rising, with new and advanced investors actively trading the markets wherever they happen to be; whether on their commute to work, or just out and about. Having the ability to trade with the click of a button from your mobile device is essential nowadays. With that said, both platforms offer well-designed trading apps that are perfect for beginner investors and are compatible with both Apple and Android devices.

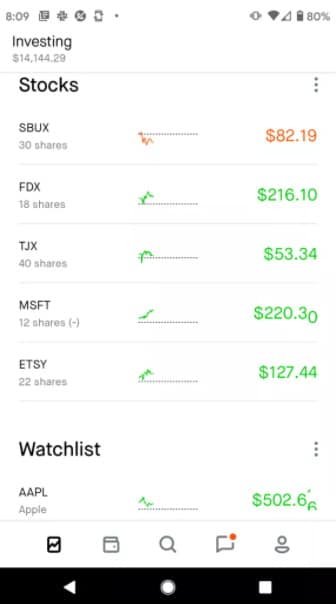

When it comes to Robinhood, our review found that you can find more than 5,000 US stocks including over 250 foreign stocks. If you’re interested in diversifying into international stock markets then Robinhood gives you the chance to do so.

Additionally, Robinhood’s trading app supports Bitcoin trading, as well as 6 other cryptos, options, and ETF trading with 0% commission. You can deposit funds into your account and search for your favourite assets from your iOS or Android device. There are no account minimums unless you open a Gold account, and the trading interface is very user-friendly and easy to use.

As far as Coinbase’s trading app is concerned, it is well designed and very easy to use. You have access to market quotes of all cryptos in real-time, the latest news from the markets, and can set price alerts and push notifications to keep you informed at all times.

Coinbase vs Robinhood Trading Tools, Education, Research & Analysis

When the spotlight falls on the topics of research and educational materials, Robinhood takes the upper hand over Coinbase. For example, Gold account holders have access to market data and research reports from third-party providers like Morningstar.

As aforementioned, you also have access to trading ideas in the form of ‘analyst ratings’. This is designed to help you make more informed investment choices. When you pick a financial instrument you can view the analyst ratings to see the percentage of experts who rate the particular asset as either buy, sell, or hold. This is very similar to social trading, where the trading community can interact with one another on the platform.

As we already know, Robinhood is designed primarily for beginners and so In terms of fundamental data, despite being quite basic it does provide everything a newcomer would need to trade comfortably. These include metrics such as the price-earnings ratio, the number of employees, the market capitalization, and the dividend yield.

In keeping with the simplistic design and features, you can access charting tools with Robinhood with a limited number of technical indicators.

As for Coinbase’s research tools and educational materials, these can be found under the ‘Learn’ tab at the top of the website. When you hover over the tab you will have the option to pick between ‘Tips and Tutorials’, ‘crypto basics’, and ‘market updates’. This is purely aimed at beginner traders with little to no experience whatsoever in the cryptocurrency sector. The resources range from basic tutorial articles to rundowns on all the latest digital currency market news.

Coinbase vs Robinhood Demo Account

A demo account, commonly referred to by the investing community as a paper trading account, is a simulated trading platform in which users can test their trading strategies and invest in assets without the risk of losing capital. This is a very effective and useful tool, especially if you are just starting out because it allows you to familiarize yourself with the platform and online trading without having to worry about risk and potential losses. It is common practice for advanced investors to use demo accounts to trial their trading strategies and automated trading modes.

During our research of Coinbase and Robinhood, we found that neither platform offers a paper trading account. This means that the only way you can gain full access to the platforms is by opening a live account and depositing funds.

Coinbase vs Robinhood Payments

Firstly, withdrawing and depositing funds with Robinhood is free of charge and streamlined. Nevertheless, the only available option is to use bank transfers, and depending on the type of account you have access to instant deposits above $1,000 can take around 4-5 days to process.

For example, with an Instant account, you can deposit any amount up to $1,000 instantly, whereas with a Gold account you can deposit any amount up to $50,000 straightaway. There is no charge for ACH withdrawals, but there is a $25 fee for domestic wire transfers and a $50 fee for international wire withdrawals. Additionally, if you wanted to transfer assets out of your Robinhood account you will have to pay $75 per transaction.

According to Coinbase, it tries to make depositing funds available as soon as payments clear. Nevertheless, because Coinbase collaborates with international payment service providers, the processing times will vary depending on where you are based and the type of payment method you use.

When using the USD Coinbase wallet or a debit card the funds are made available immediately. ACH bank transfers usually take 3 to 5 business days.

| Minimum Deposit | Deposit Fee | Processing Time | Withdrawal Fee | |

| Coinbase | $50 | Free | 3-5 business days | Free |

| Robinhood | $0 | FREE | Instant, depending on account type | FREE |

Coinbase vs Robinhood Customer Service

There are a number of ways to contact Coinbase support; either via email by selecting the most relevant category and subcategory and then describing your issue. Secondly, you can also use an automated phone number to disable your crypto account if you suspect the security of your account has been compromised. Lastly, Coinbase uses Twitter to post any product updates. With this in mind, response times are fairly fast depending on the number of requests they have.

It’s the same story with Robinhood, you can only contact customer services through email as phone or live chat services are not available. When opening a ticket you will be prompted to specify the category and topic of your issue. The customer support team usually responds within one working day.

Robinhood vs Other Brokers

Overall Robinhood is perfectly suited to beginners with little trading experience who want to trade US shares and ETFs without paying a penny in commission. If you’d like to see how Robinhood does when pinned against other top brokers be sure to check out these comparison reviews as well!

- Robinhood Review

- Stash vs Robinhood

- Acorns vs Robinhood

- Webull vs Robinhood

- M1 Finance vs Robinhood

- Fidelity vs Robinhood

- Robinhood vs Charles Schwab

- Robinhood vs Ally Invest

- TD Ameritrade vs Robinhood

Coinbase vs Robinhood Safety & Regulation

Safety is perhaps one of, if not, the most important metric you need to consider when choosing a platform that suits your needs.

Coinbase is not licensed with or regulated by the US SEC (Securities and Exchange Commission) or the CFTC (Commodity Futures Trading Commission).

Nevertheless, Coinbase abides by the laws and standards set by all the jurisdictions it operates in. Coinbase is licensed to conduct money transmissions in most US states, and these licenses cover USD wallets and transfers.

Additionally, Coinbase is registered with the US Financial Crimes Enforcement Network as a Money Services Business.

On the other hand, Robinhood is regulated by the US Securities and Exchange Commission and the Financial Industry Regulation Authority. Robinhood Financial LLC is a member of FINRA and consequently falls under the SIPC protection scheme which covers clients up to $500,000 including $250,000 for cash claims.

If you are interested in buying and selling cryptocurrencies on Robinhood Crypto LLC then you should be aware that it is not a member of FINRA and as a result does not offer cover for potential losses.

Coinbase vs Robinhood – The Verdict

In a nutshell, Coinbase and Robinhood are perfectly suited for new investors but they offer different types of services. Coinbase has over 50 cryptos for you to buy and sell, but Robinhood provides a simpler pricing model and offers commission-free ETF, options, crypto, and stock trading.

Coinbase is the better option for those who are looking to trade in the decentralized finance markets whereas Robinhood is a good option for traditional investing and trading.

Both platforms are available to use on mobile and desktop and offer a range of resources for education and analysis.

Your capital is at risk.