Stash vs Robinhood – Which Broker Is Best in 2025

If you’re just stepping out into the online trading scene then things can seem somewhat overwhelming. With a simple Google search, you will have access to thousands of online brokers, but which one is the right choice for your trading needs?

In this comparison, we examine the most important metrics between Stash vs Robinhood from tradable assets to regulation and protection. By the end of this guide, we will reveal the best online trading platform in 2025.

Stash vs Robinhood Comparison

What are Stash and Robinhood?

Before we get to the nitty-gritty details of fees and deposit options, let’s start with the basics. Both Robinhood and Stash are built with beginner traders in mind.

Launched in 2015, Stash is a US-based stock and ETF broker that is now home to more than 5 million traders and investors. According to Stash sources, in 2019 it raised just under $200 million in venture capital funds. In terms of fundamentals, Stash is regulated by the US Securities and Exchange Commission which is a top-tier financial authority. This is important because it means that Stash complies with US federal standards and regulations that are designed to protect you, the trader, and the investor.

Your investments are protected with Stash because they are held by a third-party broker Apex Clearing Corporation. ACC is regulated by the SEC, Financial Industry Regulatory Authority and the Securities Investor Protection Corporation. As a member of the SIPC, your account funds are covered up to $500,000 which includes $250,000 for cash.

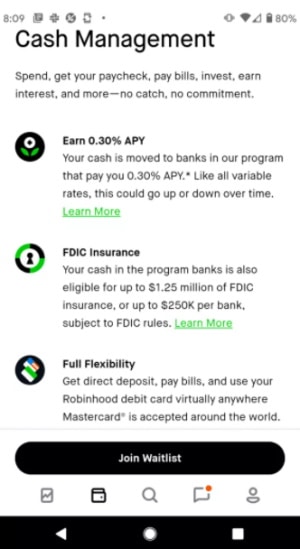

On the other hand, Robinhood is also a US-based discount broker which was launched in 2013. As with most online brokers, Robinhood is regulated by top financial authorities including the US SEC and FINRA. Aside from its trading services, Robinhood also piloted a Cash Management service that helps its users earn interest on uninvested funds.

Both brokers also offer mobile trading apps, compatible with Android and Apple devices, which are great for keeping track of your open positions while out and about.

Stash vs Robinhood Tradable Assets

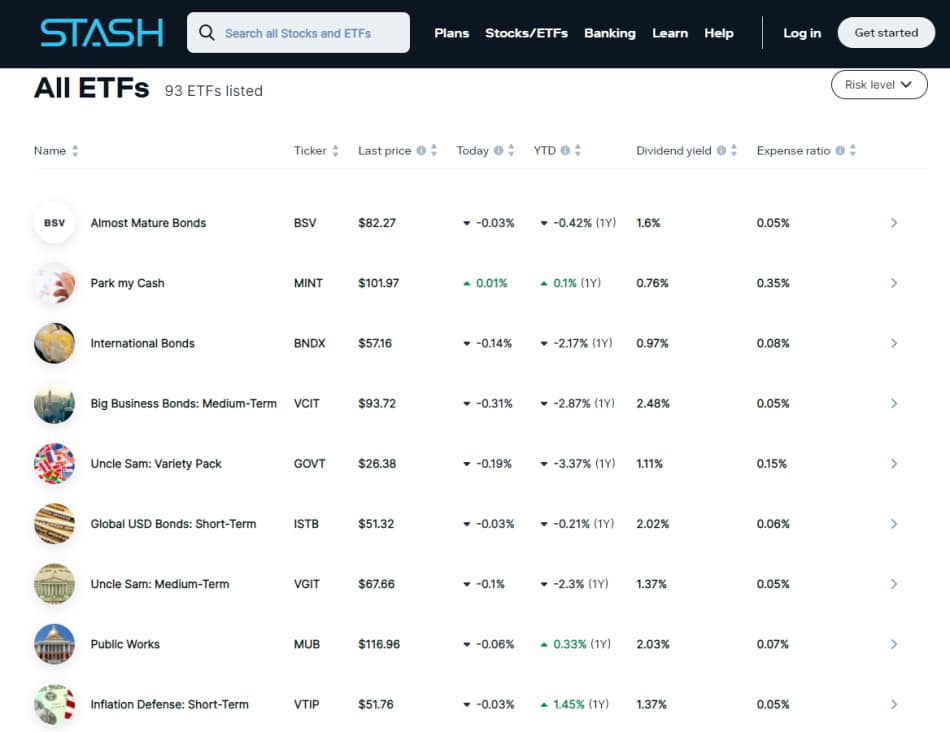

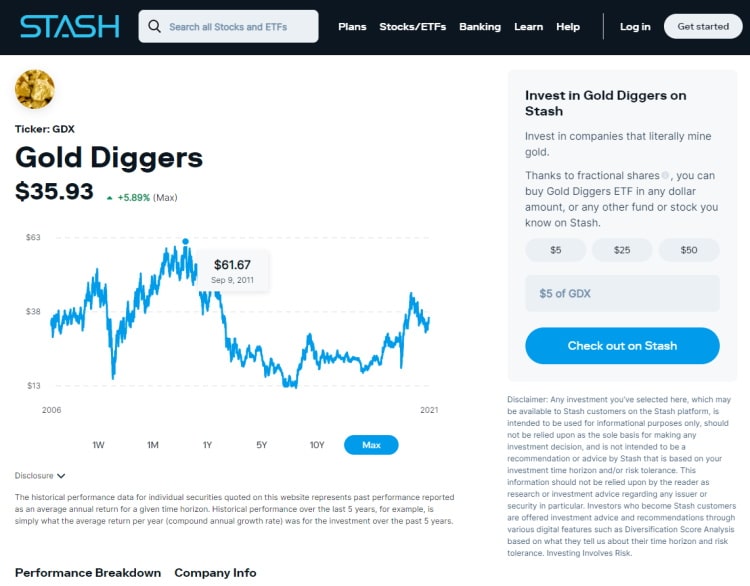

Firstly, Stash is a stock and ETF trading platform which means that other financial instruments such as cryptocurrencies and futures are simply not offered by this broker. With that said there are over 3,000 ETFs and individual stocks to choose from. Stash traders have access to a range of stocks and exchange-traded funds which are neatly categorized by industry and category which makes the process of deciding which assets are best suited to your trading objectives much simpler and easier than other brokers on the market.

Stocks are broken down by industry allowing you to browse through and choose your favourite stocks from the energy and finance sector to the health care and real estate industries. ETFs are also grouped by categories including bonds, commodities, diversified mixes, thematic, and goods and services.

For example, there are a bunch of bond ETFs to choose from, which are baskets of investments made up of loans to governments and businesses which are combined into individual exchange-traded funds. If you click on US Incorporated bond ETF, you will be greeted with a user-friendly and easy-to-understand page that gives you the ability to invest with a minimum of $5.

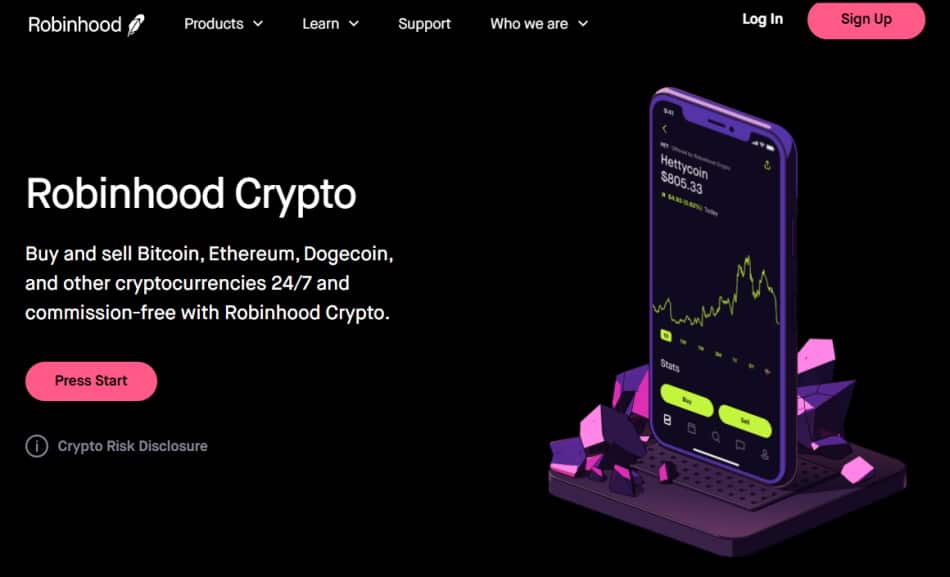

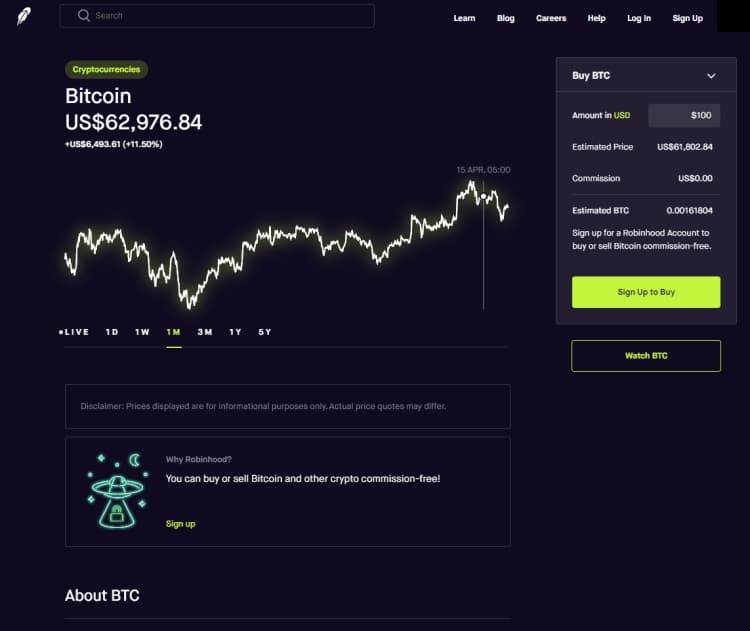

Now, let’s look at the tradable assets that Robinhood has to offer. When compared to Stash Robinhood has a more diversified offering of financial instruments. These include roughly 5,000 stocks and ETFs, options. Also for those who prefer Bitcoin trading or Ethereum trading there are 7 different cryptocurrencies to pick from and trade 100% commission-free 24/7.

Robinhood offers crypto trading in 47 US states with plans to include more in the future. Robinhood offers commission-free trading on stocks, ETFs, cryptos, and options.

As we have already mentioned, with Robinhood you can choose from 5,000 ETFs and stocks. Most of these are listed on US stock exchanges, while 250+ international stocks are provided via American Depositary Receipts. This gives you access to companies from all over the world such as China and the UK.

Both Robinhood and Stash offer fractional shares which are great options if you cannot afford to buy a share of an expensive stock. Fractional shares offer low-cost investment opportunities to help diversify your investment portfolio without spending great amounts of money or using margin or leverage which maximises risk, losses, and profits.

Stash vs Robinhood Account Types

Stash provides the most common account types from debit and taxable accounts to traditional IRA accounts, UTMA (Uniform to Minors Act) accounts, and basic accounts. There are three Stash plans to choose from,

- Stash Beginner – an individual brokerage account – which has a monthly subscription fee of $1, allows you to invest in stocks and ETFs, and offers Stock-Back Cards. To be eligible for a Stash banking account you need to be verified by Green Dot Bank and have successfully opened a taxable brokerage account with Stash.

- Stash Growth – a retirement account – which has a monthly subscription fee of $3 per month offers a Smart Portfolio, options include Roth IRA and Traditional IRA accounts.

- Stash+ – a custodial account – has a $9 per month fee that offers a Smart Portfolio and UGMA and UTMA accounts for children.

Turning our attention to Robinhood, there are three account types to choose from including a Cash Account, Robinhood Instant, and Robinhood Gold. Robinhood does not offer retirement accounts. When you sign up, by default you open a Robinhood Instant brokerage account. Nevertheless, you can downgrade to a Cash Account or upgrade to a Robinhood Gold account whenever you see fit. There is also a $5 monthly fee when you open a Robinhood Gold account.

Something that separates the various accounts is the cap on day trading by Pattern Day Trading rules. This is important for day traders who buy and sell stocks on the same trading day and have less than $25,000 in their accounts.

On the other hand, with the Instant and Gold accounts, you are limited to a maximum of 3-day trades each week. Opening an account with Robinhood is simple, easy, and fully digital. Applying takes a matter of minutes and account verification takes around one working day. As with all SEC-regulated brokers, you will need proof of ID and address.

Stash vs Robinhood Fees & Commissions

| Inactivity fee | Deposit fee | Withdrawal fee | Account fee | Stock fee | ETF fee | Crypto fee | Options fee | |

| Robinhood | No | $0 | $0 | No | 0% | 0% | 0% | 0% |

| Stash | No | $0 | ACH $0 | $1, $3, $9 depending on the plan | 0% | 0% | n/a | n/a |

As we have already seen throughout this comparison, Stash provides ETF and stock trading without any commission or fees. But, you will need to consider the monthly fees for each plan. For instance, let’s say you chose to invest in Microsoft stocks with just $10. You could do this on the web trading platform or on its mobile trading app because the broker offers fractional shares. Nevertheless, if you did not invest any more for the following 10 months, the chances are you would lose money. In short, after a ten-month period, you would have paid $10 in subscription fees which would effectively negate the initial $10 investment.

Robinhood is home to more than 13 million traders and this can be partly attributed to its 100% zero commission offering. This is true across all the tradable assets that it offers – which means that you can trade and invest in ETFs, stocks, cryptos, and options without paying a penny in commission or fees. For this reason, Robinhood is one of the most cost-effective brokers in the online trading market.

However, this does raise quite an interesting question; if Robinhood does not charge commission for its trades, how does it make money? In short, this free trading platform makes money when its clients use margin and leverage to trade. The only non-trading fees that we could find are a $75 ACH withdrawal fee, and a $5 a month membership fee when using the Robinhood Gold account.

Stash vs Robinhood User Experience

Perhaps the most attractive feature that Stash has to offer is how it gives you the chance to invest with very minimal costs. It is therefore clear why it appeals to new traders who are just starting out in the online trading scene. At the end of the day, advanced traders are typically on the hunt for a trading platform that can offer them extensive charting tools and a wide variety of complex trading instruments like futures and CFDs. Having said this, Stash is perfectly suited to beginners who have little to no experience in trading or investing.

For example, the interface is very user-friendly and simple. It seems to have been developed with the notion of less is more. There isn’t any financial jargon and navigating your way around is easy.

In terms of placing a trade or opening a position, Stash provides a great predictive search function that helps you find and browse through thousands of stocks and ETFs.

One of the recurring motifs that you will notice throughout this comparison is that both brokers are tailored for beginner traders who are just getting started. With this in mind, Robinhood also offers a web and mobile trading platform that are very easy to use. The Robinhood web trading platform and mobile trading app offer trading at the click of a button. For instance, if you wanted to purchase stocks in Apple, all that is required is to type the name of the stock in the search bar, then specify the amount you want to invest and click trade. Furthermore, as Robinhood also supports fractional shares you could even buy stocks with just a few dollars. The same applies to its offering of other tradable assets.

Overall the whole process is seamless and user-friendly. From opening an account to searching for and investing in financial instruments, the entire platform is a pleasure to use.

Stash vs Robinhood Mobile App

As innovative technology continues to develop and evolve, brokers are looking for better ways to boost the convenience of their services. To this end, mobile investing apps are more popular than ever amongst the investing community.

To demonstrate this, Robinhood first launched its mobile trading app before it released its web trading platform. Aside from being user-friendly and well-rounded, the Robinhood mobile trading app is compatible with Apple and Android devices. In terms of security, the app supports two-step authentication for logging in as well as the ability to use biometric authentication.

The Robinhood app offers great functionality similar to that of its web platform counterpart and allows you to easily place trades at the click of a button. Moreover, when you open an account for the first time and connect it to your bank account, Robinhood gives one share of free stock which you can hold and sell after 2 trading days. According to Robinhood the value of the shares of free stock are picked at random and the value of which can be anything between $3 and $225 depending on market movements and volatility. Furthermore, the probability of getting a free share of stock worth between $2.50 and $10.00 is 98%.

When it comes to adding funds to your Robinhood mobile trading account, popular and convenient payment options such as e-wallets, Apple or Google Pay, and credit and debit cards are not supported by the application. As a result, the only available option is via a bank transfer. While there are no deposit fees there is a $75 ACH withdrawal fee. Buying and selling stocks on the mobile app can be done in just a few clicks and the funds are added to your cash account balance instantly.

On the other hand, the Stash mobile trading app is also user-friendly and well designed with just under 2,000 stocks and ETFs on offer. Having said this, traders only have access to stocks listed on the New York Stock Exchange and the NASDAQ. If you are the type of investor who has an eye for international shares then you may be interested to find out that you can gain exposure to international stock markets by investing in ETFs. In keeping with the very straightforward nature of the broker, the only available asset classes are stocks and ETFs.

As we have already discussed, the Stash mobile app has been designed with beginner-level traders in mind, so it’s no surprise that there is a lack of advanced features and tools. Users also have the ability to purchase fractional shares of stocks. This is a low-cost way of investing as you don’t have to invest in full stocks. Thus, you can invest as much as you want as a way of testing your trading strategies without the risk of losing large amounts of capital.

As well as making the investing more inexpensive, fractional shares are great for portfolio diversification. Let’s say that you have a budget of $200 set aside for investing. Theoretically, you could invest in 200 individual stocks at $1 per share. You could do this easily on the Stash mobile trading app as all investments come with 100% zero commission.

Navigating your way around the Stash app is easy and user-friendly, and the process of trading stocks and ETFs can be made with the click of a button. Furthermore, the app is great for new traders who want to start at the shallow end with fractional shares and commission-free trading.

Stash vs Robinhood Trading Tools, Education, Research & Analysis

When it comes to research tools, Robinhood offers trading ideas, financial news, and fundamental data. On the flip side, its charting tools only offer a small variety of technical indicators. Robinhood Gold account users have access to a wider range of research tools including live market data and research reports from the third-party provider Morningstar.

As for educational resources, Robinhood offers educational articles which are posted under the learn tab. As we know, Robinhood is specifically tailored to new traders as the content is simple and easy to understand. However, this free broker does not offer a demo account. Demo investment accounts are great trading vehicles for learning without the added risk of losing real money. With a demo account, you can use paper funds or virtual currency to experiment with new trading strategies, giving you an accurate representation of what online trading is all about.

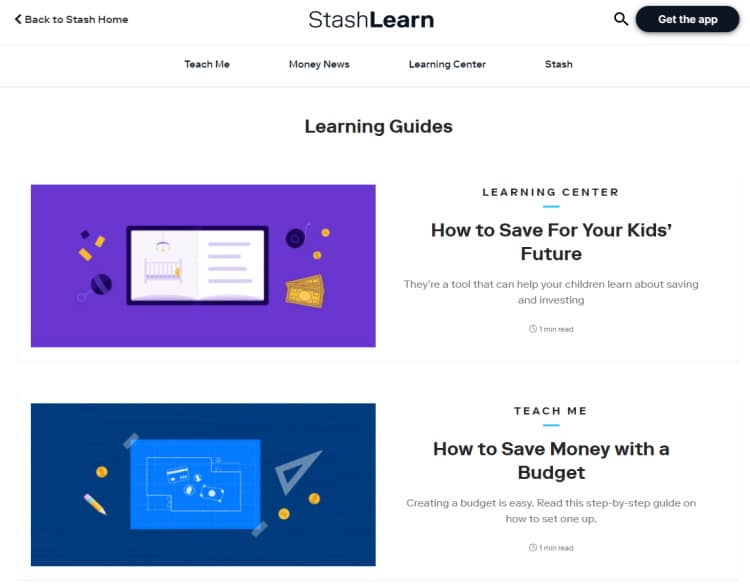

Stash provides educational resources and content free of charge, via its Stash Learn section. Stash Learn offers users plenty of educational articles and blog posts that are conveniently grouped into topics ranging from credit and debt management to retirement and financial news. There is also a Stash Academy For Kids with educational articles to help teach children about finance and money-related topics. There are also a variety of how-to posts which can be found via the FAQ section. All the content is simple making it perfect for its target audience of new investors.

Stash vs Robinhood Demo Account

As we have already mentioned in this broker comparison, both Robinhood and Stash do not offer demo trading accounts.

Stash vs Robinhood Payments

Depositing funds to your Robinhood account is free of charge, but the only available option is via bank transfer as credit/debit cards and e-wallets are not supported. By using the instant deposit option, your funds are processed instantly. Alternatively, processing times can take between four and five working days. The instant deposit option has some restrictions depending on the type of account you have. For example, you can deposit anything up to $1,000 immediately with an Instant account, whereas with a Gold account you can deposit up to $50,000.

ACH withdrawals are free of charge at Robinhood but wire transfers come with a $25 fee. In terms of processing times, withdrawals typically take 3 business days. The limit for withdrawals is $50,000 a day and should you deposit uninvested funds you will only be allowed to withdraw them after 5 working days.

On the other hand, Stash accepts debit and credit cards, bank transfers, and e-wallets including PayPal. The processing time for ACH transfers is 4 business days.

Given that both brokers have low trading and non-trading fees, it is no surprise that they do not have account minimums which means that traders can get started immediately. There are, however, exceptions to this rule. For example, there is a minimum account deposit requirement of $2,000 to open a margin trading account with Robinhood.

| Minimum Deposit | Deposit Fee | Processing Time | Withdrawal Fee | |

| Robinhood | $0 | $0 | Instant, apart from bank transfers | $0 |

| Stash | $0 | $0 | Instant, apart from bank transfers | $0 |

Stash vs Robinhood Customer Service

The customer support at Robinhood can only be contacted through emails as there is no phone or live chat support. Furthermore, it is not available 24/7. When you want to submit a request, there are a range of topics to pick from including account opening or deposits. Robinhood’s customer services will then respond via email. Response times are fairly fast and the answers to questions and solutions to issues are usually relevant and helpful.

Alternatively, the customer support at Stash takes the upper hand over its rival. If you have any issues related to phishing attempts or other general questions regarding your trading account and experience then the Stash support staff can be contacted via email 24/7 or via telephone between the hours of 8:30 AM – 6:30 PM ET Monday – Friday and 1:00 AM – 5:00 PM ET Saturday – Sunday.

Stash also offers a convenient FAQ interactive feature that allows you to type your question and it will present related information with relevant answers.

Robinhood vs Other Brokers

Overall Robinhood is perfectly suited to beginners with little trading experience who want to trade US shares and ETFs without paying a penny in commission. If you’d like to see how Robinhood does when pinned against other top brokers be sure to check out these comparison reviews as well!

- Robinhood Review

- Coinbase vs Robinhood

- Acorns vs Robinhood

- Webull vs Robinhood

- M1 Finance vs Robinhood

- Fidelity vs Robinhood

- Robinhood vs Charles Schwab

- Robinhood vs Ally Invest

- TD Ameritrade vs Robinhood

Stash vs Robinhood Safety & Regulation

We have already touched on this topic, but in terms of the fundamentals both Stash and Robinhood are regulated by top-tier financial authorities including the US SEC and FINRA.

There are several entities within Robinhood: Robinhood Crypto LLC which offers cryptocurrency trading and Robinhood Financial LLC which offers stock, ETF, and other assets. The latter is regulated by FINRA and therefore is covered by the US investor protection scheme. SIPC protection covers up to $500,000 including $250,000 for cash claims.

On the other hand, Robinhood Crypto is not regulated by FINRA and therefore does not offer the same investor protection scheme. Another point to keep in mind is that this free broker does not offer negative balance protection.

Stash also offers the same investor protection because it is a registered member of FINRA. Thus, investments at Stash are protected through the SIPC up to a limit of $500,000 which includes $250,000 for cash.

Stash vs Robinhood

Throughout this guide, we have found that both Robinhood and Stash are similar in that they are both designed for beginner traders who want to be able to buy and sell stocks, ETFs, and other assets easily with the click of a button while being in the comfort of their own home.

For example, both provide:

- 100% zero-commission trading

- Fractional shares

- User-friendly interface

- Regulated by the US SEC and FINRA and offer SIPC protection

- Mobile trading apps compatible with Apple and Android devices

Some areas which separate the two online trading platforms are:

- Both support ETF and stock trading, however, Robinhood also offers options and cryptocurrency trading

- There are no retirement accounts available with Robinhood.

- Stash requires monthly subscription fees which vary depending on the type of account you choose

- Stash has more payment options compared to Robinhood

All in all, Robinhood does seem to make it out on top because it offers more tradable assets and fewer monthly subscriptions and is a great online trading platform for beginner traders with little to no experience in the financial world. To see how Robinhood compares to another popular broker read our Robinhood vs eTrade review.

Stash vs Robinhood – The Verdict

This broker comparison has examined all key metrics you should take into consideration when choosing an online trading platform. If you are a beginner trader and are looking for a free trading platform to trade stocks, ETFs then both Robinhood and Stash are great options.

If you want to start investing but aren’t sure where to begin, Robinhood has all the tools and content you need to choose the right assets and manage your portfolio either actively or passively.

Robinhood – Best Free Trading Platform with No Fees to Trade Stocks

Your capital is at risk. Other fees apply.