Robinhood vs Ally Invest – Which Broker Is Best in 2025

If you want to start buying and selling tradable assets online you will need to choose a top-rated broker. But with so many options available, how do you decide which trading platform is right for you?

In this Robinhood vs Ally Invest review, we will cover all the key metrics, such as trading fees and mobile trading, to help you pick the right broker for your trading needs. So, to find out which broker suits your trading needs, keep reading!

Robinhood vs Ally Invest Comparison

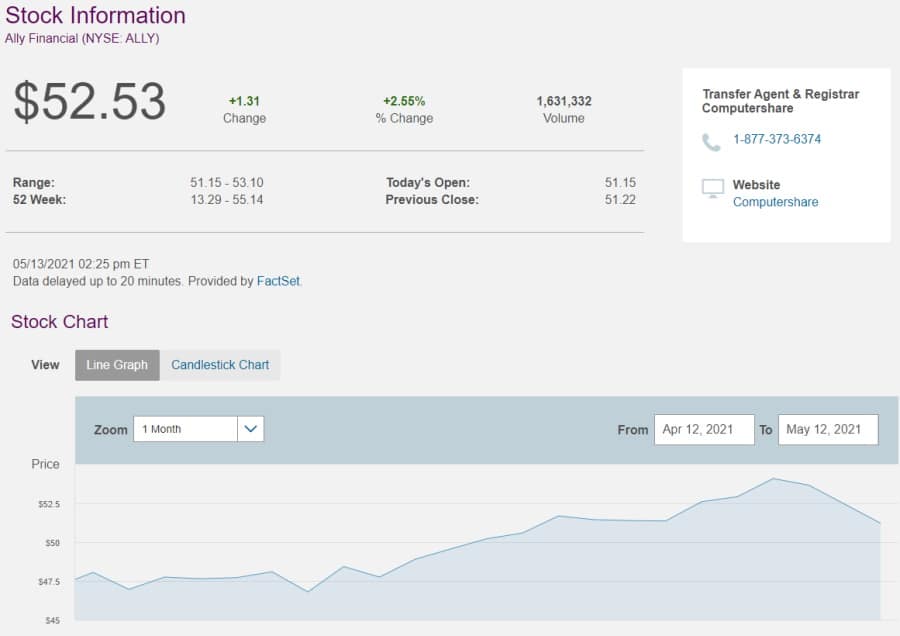

Ally Invest

Visit SiteForex, options, and other leveraged products involve a significant risk of loss and may not be suitable for all investors. Products that are traded on margin carry a risk that you may lose more than your initial deposit.......

What are Robinhood and Ally Invest?

Simply put, both Robinhood and Ally Invest are online trading platforms that allow you to trade and invest in tradable assets with the click of a button. To get started simply create and open an account with an online broker of your choice, deposit funds, and you will have access to various financial products and markets.

For example, both Ally Invest and Robinhood offer US ETF, options, and stock trading on a commission-free basis. This means that you will not have to pay a penny in commissions, which allows you to keep expenses as low as possible.

But, it must be noted that there are some key differences between these two free trading platforms. While Ally Invest also gives you access to mutual funds and bonds, Robinhood supports crypto trading with a selection of 7 different digital currencies.

Launched in 2013, Robinhood is a US-based free trading platform that is regulated by the US Securities and Exchange Commission and is a member of the Financial Industry Regulatory Authority. In addition to the brokerage services, Robinhood also pioneered its Cash Management service which allows you to gain interest on uninvested capital.

Ally Invest, on the other hand, was founded in December 2005 and is a US-based broker that complies with regulations set by the US Securities and Exchange Commission and is a member of FINRA. Ally Invest provides commission-free US stock and ETF trading and has no account minimums.

Robinhood vs Ally Invest Tradable Assets

In this section of our Robinhood vs Ally Invest comparison, we will cover the different financial instruments that are on offer and how you can go about trading them.

Stocks and ETFs

Both brokers offer commission-free US stock and ETF trading. As we have already mentioned both trading platforms only cover US exchanges, which means that you cannot invest in international stocks.

Having said this, Robinhood does offer several stocks listed on foreign exchanges, which are offered through American Depositary Receipts. In addition to this, Robinhood also allows you to access fractional share trading.

What are fractional shares?

Fractional shares are fragments or portions of whole shares of stocks or ETFs. seeing as Robinhood Financial supports fractional share investing, you can buy and sell fractional shares and exchange-traded funds in percentages of shares, as well as having the option to trade and invest in whole shares of stock listed on US stock exchanges.

Fractional shares on Robinhood can be as little as 1/1000000 of a whole share, and perhaps the best advantage of buying and selling fractional shares on Robinhood is that it happens in real-time and is 100% commission-free.

Simply put, trading in real-time means that fractional share trades placed during market hours are executed instantly.

Fractional shares offer unique investment opportunities to traders who might not have the means and funds to invest in the US stock markets. Fractional shares allow you to trade and invest in some stocks and ETFs that would otherwise cost hundreds or thousands of dollars for an individual share with just $1. Fractional share trading gives you the flexibility to choose the investment amount while diversifying your portfolio without investing in an entire share.

Therefore, you can invest in multiple fractional shares of US stock, rather than spending huge amounts of capital on single shares of expensive stock.

Penny stocks

While Ally Invest does not offer fractional shares, it does provide access to penny stock trading. Penny stocks are typically valued under $5, are not traded on national stock exchanges, and can be listed in pink sheets or on the OTCBB (Over the Counter Bulletin Board).

Ally Invest requires a minimum opening purchase of $100 for every order in OTCBB stocks and does not accept opening trades for penny stocks valued under 1 cent per share. Ally Invest recommends that before you trade penny stocks you should contact their customer services for further information.

Both Robinhood and Ally Invest offer options trading with 0% commission. However, Ally Invest also provides access to mutual funds from third-party providers including BlackRock and Vanguard, government and corporate bonds, and a robo-advisory service known as Managed Portfolios which is perfect if you need extra investment management support.

Robinhood Crypto

If you are interested in Bitcoin or Ethereum trading then you’ll be pleased to know that Robinhood Crypto LLC supports crypto trading.

With Robinhood, you can access 7 different cryptos on its web trading platform or fully-fledged mobile trading app. The following commission-free cryptos are available at Robinhood 24/7:

- Ethereum

- Bitcoin

- Ethereum Classic

- Litecoin

- Bitcoin Cash

- Dogecoin

- Bitcoin SV

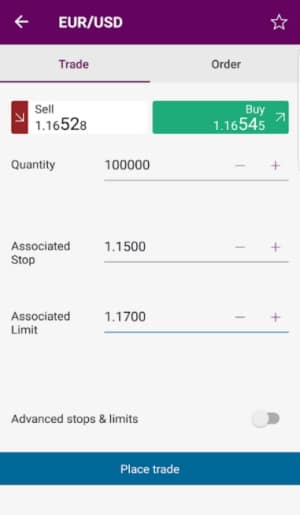

Ally Invest Forex Trading

Ally Invest also provides forex trading, as well as a practice account with Ally Invest Forex trading platform or MetaTrader 4. Forex is the most traded market with average daily trade volumes surpassing the $3 trillion mark. When you trade forex via Ally Invest you can access more than 50 different currency pairs in real-time.

The minimum investment to start trading forex at Ally Invest is $250, but the broker itself recommends you deposit a minimum of $2,500 to take advantage of margin trading and to give you move investing flexibility.

Ally Invest does not charge a commission on forex trades, but it does make money from the gap between the bid and ask price, otherwise referred to as the spread. Ally Invest has some of the lowest forex spreads on the market with the average being between 1 and 2 pips.

Robinhood vs Ally Invest Account Types

Our Robinhood vs Ally Invest review found that the former is better suited to new investors and the latter is a great fit for new and advanced traders. When it comes to account types Robinhood keeps things as simple by offering 3 trading accounts with varying perks and features. On the other hand, Ally Invest has a wider account type variety which includes retirement accounts and custodial accounts.

Ally Invest offers individual brokerage accounts, joint accounts, retirement accounts such as Traditional IRA, Roth IRA, custodial accounts, educational savings accounts, and managed portfolios.

Robinhood provides the following 3 accounts, each designed to meet your financial and trading goals:

- Robinhood Instant: After successfully signing up you will automatically open a Robinhood Instant account. Several features include instant deposits with any sum up to $1,000 as well as extended-hours trading. You can also trade options with margin.

- Robinhood Gold: Gold account holders have access to larger instant deposits and more purchasing power when it comes to margin trading. Other tools and features include Nasdaq Level 2 market data and Morningstar Research Reports. In terms of account fees, there is a $5 monthly fee.

- Robinhood Cash Account: With this type of account you can access Instant Deposits up to the initial $1,000. Also, day trading is not restricted by Pattern Day Trading standards. Cash account users cannot trade with unsettled funds from assets they have already sold.

Robinhood vs Ally Invest Fees & Commissions

Nowadays, most beginner traders are searching for a trading platform with low trading fees. Hundreds of online brokers claim to have cut trading costs to the bare minimum. This isn’t limited to commissions and dealing charges, but other non-trading fees such as inactivity and account fees.

That being the case, in this section we cover the trading and non-trading fees of both of these free trading platforms.

Stock and ETF fees

Robinhood clients have access to commission-free US stock and options, cryptocurrency, and ETF trading. This undoubtedly helps to reduce your overall trading expenses. In addition to US stocks and ETFs, you can also trade several non-US stocks via American Depositary Receipts. When you trade stocks through ADRs you usually pay a custody charge of 1 – 3 cents per share.

On the other hand, Ally Invest does not charge commission for stocks and ETFs with a value greater than $2. If you buy or sell ETFs or stocks priced under $2, there is a fixed rate of $4.95 as well as a $0.1 for every stock. There are no commissions on options trades and low contract fees of just $0.50 for every options contract.

Margin rates

Ally Invest’s margin account rates are volume-tiered which means that the larger the margin loan the lower the margin rate. As such, let’s have a quick look at how Ally Invest and Robinhood compare when it comes to margin trading.

| Margin Balance | Ally Invest Margin rate | Robinhood Margin rate |

| $1,000,000+ | 3.25% | 2.5% |

| $500,000 – $999,999 | 4.00% | 2.5% |

| $250,000 – $499,999 | 4.50% | 2.5% |

| $100,000 – $249,999 | 5.50% | 2.5% |

| $50,000 – $99,999 | 6.75% | 2.5% |

| $25,000 – $49,999 | 7.50% | 2.5% |

| $10,000 – $24,999 | 7.75% | 2.5% |

| $.01 – $9,999 | 7.75% | $1,000 – $9,999 = 2.5% |

As of December 21st, 2020, Robinhood announced a reduction of its margin interest rate from 5% to 2.5% making it one of the most competitive margin rates in the trading sector.

Margin trading is available to eligible traders using a Robinhood Gold account. The initial $1,000 margin is included in the monthly fee, thereafter clients pay a fixed 2.5% margin rate on any amount above the $1,000 benchmark. Robinhood’s pricing model is simple and the same for all eligible margin traders regardless of the margin amount.

When it comes to non-trading fees both brokers do not charge account, deposit, inactivity, or withdrawal fees with ACH transfers.

| Inactivity fee | Deposit fee | Withdrawal fee | Account fee | US Stock fee | ETF fee | USD margin rate | ACATS Transfer fee | |

| Robinhood | No | $0 | $0 | $5 fee per month for Gold account | 0% | 0% | 2.5% | $75 |

| Ally Invest | No | $0 | $0 | $0 | 0% | 0% | Between 3.25% – 7.75% | $50 |

Robinhood vs Ally Invest User Experience

When it comes to user experience, our Ally Invest vs Robinhood review found that the former is a better match for beginner trades with little to no experience in online trading. Everything from the layout to the user interface is straightforward and user-friendly.

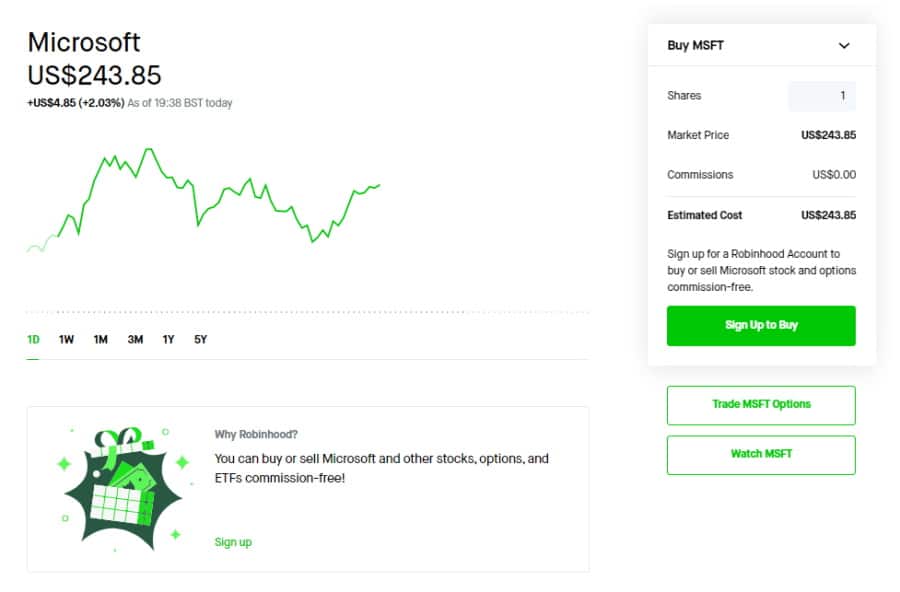

Similarly, when it comes to searching for an asset and placing a trade all you have to do is type the name of the financial instrument into the search bar and Robinhood will bring up a range of relevant search results.

More importantly, the user experience on Robinhood is particularly great in terms of placing an order. For instance, if you wanted to invest in shares, all you would need to do is find your chosen stock and specify the investment amount. Simply put, you don’t have to worry about calculating how many whole shares you can afford to invest in, because Robinhood supports fractional share trading. This means that you could purchase fractional shares of stocks listed on US exchanges for as little as $1.

Over at Ally Invest, our judgment is that the platform is a better match for all types of investors, from beginners to experienced pros. Ally Invest offers a wider range of account types as well as forex trading which broadens its appeal to a wider demographic. However, Robinhood is designed to make online trading accessible for most new traders which means that if you are new to the investment scene and want a gentle introduction to learn how to buy and sell assets then both trading platforms provide adequate services and a great user experience to satisfy your trading needs and expectations.

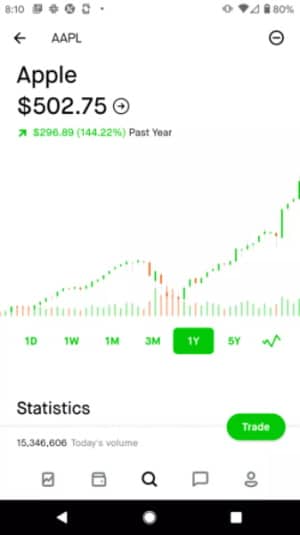

Robinhood vs Ally Invest Mobile App

Both Ally Invest and Robinhood give you the ability to buy and sell assets on fully-fledged mobile trading apps that are compatible with Android and Apple devices. Both the interface and design are user-friendly and you can trade assets with the click of a button.

The Robinhood mobile trading platform mirrors the design, layout, and functionality of its web platform counterpart. You cannot access the stock screener on the mobile trading app. When it comes to placing orders there are a bunch to choose from including market, limit, stop-loss, stop limit, trailing stop, as well as several time limits you can implement into your trading strategies.

When it comes to security you can use two-step authentication or biometric logins for added convenience and protection. Furthermore, you can also set up price alerts and push notifications to stay updated in real-time when your orders have been met.

Overall, if you are looking for a mobile trading app that is both secure and allows you to trade financial instruments without any effort then both discount brokers provide top-rated trading apps.

Robinhood vs Ally Invest Trading Tools, Education, Research & Analysis

What is Automated Trading with Ally Invest?

Experienced investors commonly take a more direct approach to investing, and therefore automated trading is not something that they are likely to adopt. However, for beginner traders looking for supplementary investment management services, robo-advisory services are a great low-cost option. With automated trading, algorithms will recommend prebuilt portfolios based on criteria that you specify when applying for managed portfolios with Ally Invest.

The minimum deposit is just $100 to get started and there are no advisory fees, annual fees, or rebalancing charges. Additionally, 30% of the investment portfolio is frozen and you earn interest on the uninvested funds. As aforementioned, a prebuilt portfolio is recommended based on your unique trading objectives, time horizon, and risk tolerance.

The term automated trading does exactly what it says on the tin; algorithms and sophisticated trading software place trades on your behalf so that you don’t have to lift a finger. Your portfolio is rebalanced automatically to make sure you meet your trading goals. The investment portfolio itself consists of diversified US ETFs.

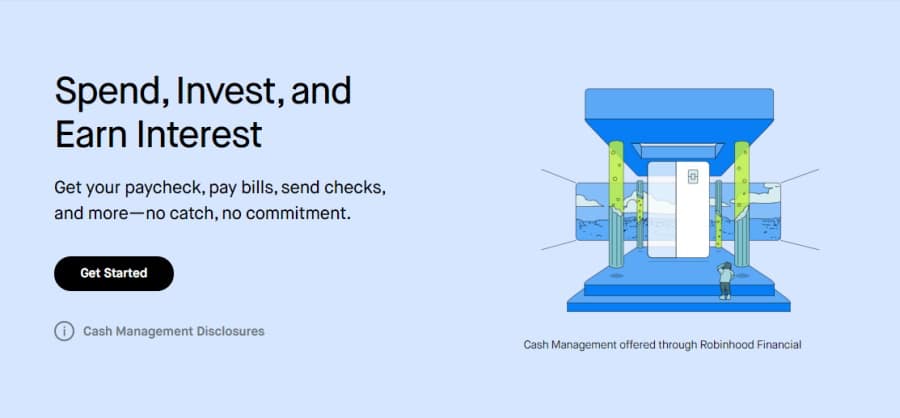

What is Cash Management?

Cash management is a feature offered to Robinhood clients that allows you to spend and earn interest on uninvested cash. If you use the cash management feature you will receive a debit card provided by Sutton Bank. with this debit card, you can execute everyday transactions such as buying groceries, paying utility bills, and sending checks. Your cash is pooled into Robinhood’s network of program banks where it earns 0.30% APY.

What Research tools can you use with Robinhood and Ally Invest?

Our review of Ally Invest and Robinhood found that both online trading platforms offer trading ideas. Firstly, Ally Invest provides stock trading ideas from third-party providers including Morningstar and CFRA. Options trading is also backed by a strategy evaluation tool that allows you to test your strategy against varying volatility settings.

This is reminiscent of social trading features, however, there is another broker that offers much more when it comes to social trading. But more on this later on.

When it comes to fundamental data both brokers provide basic key statistics such as the price-earnings ratio, dividend yield, market capitalization, and more.

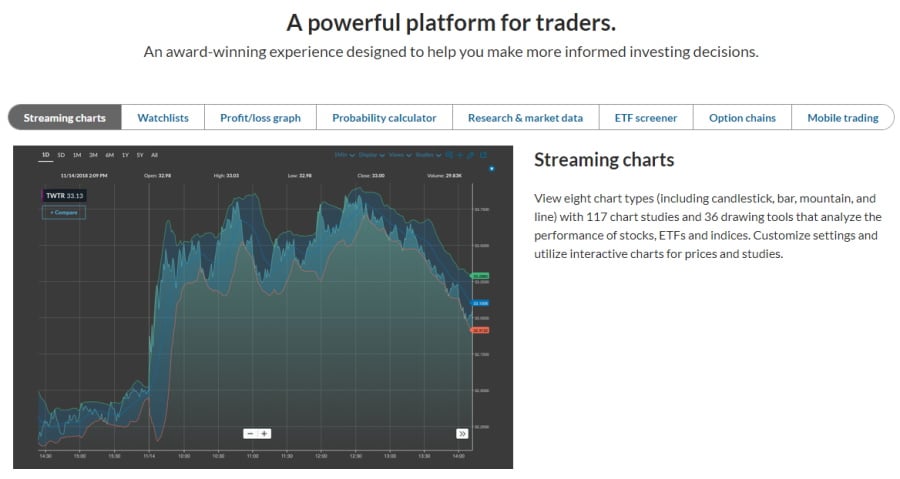

In terms of charting tools, Robinhood’s offering is very basic in keeping with its user-friendly design and approach to online trading. However, if you are looking for a more in-depth chart analysis you may want to use Ally Invest as its charts are easily customizable, can be saved and downloaded, and gives you access to more than 120 technical indicators such as Bollinger Bands, Stochastics, and Money Flow Index.

You can access educational materials and resources by navigating to the Learn tab at the top of the Robinhood website. The options available include investing basics, a library of useful educational articles, and snacks which is a daily newsletter that summarizes the day’s top-trending financial news.

Ally Invest also features an entire page dedicated to financial news, trends, technology, and more called Ally do it right. From here you can access the latest financial news, video market analysis by chief investment strategists, and much more.

Robinhood vs Ally Invest Demo Account

A trading demo account is a perfect vehicle to perfect your trading strategies and familiarize yourself with the trading platform. But, this begs the question: what exactly is a demo account? A demo account otherwise referred to as a paper trading account, is a simulated trading account that mimics the real trading environment of live markets without the associated risks of capital loss. With a paper trading account, you can make practice trades with paper funds, or virtual money.

Both beginner traders and experienced investors use demo accounts to learn via simple trial and error and to practice online trading in a risk-free setting.

During our extensive research, we found that Robinhood does not offer a paper trading account, but this is more than made up for by its fractional shares offering that allows you to invest in shares of US stocks for as little as $1.

Ally Invest, on the other hand, does provide two demo accounts with $50,000 in paper funds. Ally Invest allows you to access all forex platforms with a practice account including the web and desktop investment platforms, as well as the mobile trading apps. In addition, you can even sign up for an Ally Invest Forex MetaTrader 4 demo account to trial the optimized version of the top-rated MT4 platform, with special features including order management, real-time streaming news, and functional trading ideas, all from the comfort of one’s home.

Robinhood vs Ally Invest Payments

While there are no associated ACH deposit or withdrawal fees when transferring funds to and from either a Robinhood or Ally Invest account, the only available payment method you can use is via bank transfer, as credit cards, debit cards, and e-wallets such as PayPal are not supported.

When it comes to processing times, deposits can take as long as 5 business days to finalize, but this can be faster depending on your transfer track history with Robinhood. However, if you use the Instant Deposit feature your funds arrive straight away. Nevertheless, the Instant Deposit feature does have some restrictions. With a Robinhood Instant account, you are allowed to deposit any amount up to $1,000 immediately, whereas if you have a Robinhood Gold account the instant deposit limit is $50,000. Any amount that surpasses the fixed instant deposit threshold will be credited to your account after 5 business days.

For instance, let’s say you have a Robinhood Instant account and you use the instant deposit option to transfer $2,000 into your brokerage account. The initial $1,000 will be credited to your account straight away, whereas the remaining $1,000 will be credited after 5 working days.

As for Ally Invest, transfers between Ally Invest and Ally Bank accounts are processed Monday to Friday from 8 am and 3:55 pm ET. Transfers to and from Ally Invest and Ally Bank accounts are usually processed within 1 or 2 minutes, whereas the processing time for transfers from an Ally Invest Managed Portfolio to an Ally Invest bank account can be as long as 5 business days as the portfolio has to be rebalanced.

| Minimum Deposit | Deposit Fee | Processing Time | Withdrawal Fee | |

| Ally Invest | $0 | FREE | 2 business days for non-Ally Invest accounts | FREE |

| Robinhood | $0 | FREE | Instant, depending on account type | FREE |

Robinhood vs Ally Invest Customer Service

Ally Invest takes the upper hand when it comes to customer services because you can contact support via email, live chat, or telephone 24 hours a day 7 days a week. The responses are fairly quick and relevant.

On the flip side, you can only contact Robinhood’s customer support via email. To do this you need to submit a request stating the category and topic of your question or issue, to which a Robinhood customer service representative will respond usually within one business day.

Robinhood vs Other Brokers

Overall Robinhood is an ideal free trading platform for beginners with little trading experience who want to trade commission-free US shares and ETFs. Furthermore, we have pinned Robinhood against other widely popular online brokers in the following comparison reviews:

- Stash vs Robinhood

- Coinbase vs Robinhood

- Acorns vs Robinhood

- Webull vs Robinhood

- M1 Finance vs Robinhood

- Fidelity vs Robinhood

- Robinhood vs Charles Schwab

- TD Ameritrade vs Robinhood

Robinhood vs Ally Invest Safety & Regulation

Arguably one of the most important key metrics you need to consider when selecting an online trading platform is that of security and regulation. Robinhood Financial LLC and Ally Invest are regulated by the US Securities and Exchange Commission and are members of the Financial Industry Regulatory Authority (FINRA).

It’s important to bear in mind that Robinhood Crypto LLC, which is a separate entity to Robinhood Financial, is not a member of the FINRA which means that crypto trading on Robinhood is not covered by any investor protection scheme.

If you are interested in forex trading with Ally Forex, then you will also be pleased to know that it is regulated by the Commodity Futures Trading Commission.

Robinhood Financial LLC and Ally Invest clients are covered by the US Securities Investor Protection Corporation’s investor protection scheme. The SIPC protection covers against the loss of capital and securities should the broker go bankrupt. This client fund protection is limited to $500,000 including a $250,000 cap for cash claims.

Robinhood vs Ally Invest vs eToro

For beginner traders, Robinhood has everything you need to start online trading with the click of a button. Not only can you buy and sell a range of financial instruments without paying commissions, but you can also earn interest on uninvested funds via Cash Management and easily diversify your investment portfolio by investing in fractional shares of stock listed on US exchanges.

Alternatively, there is a third broker that takes the number one spot on our top recommended brokers for 2025. Launched in 2007, and regulated by top financial authorities including the UK’s Financial Conduct Authority, the CySEC, ASIC, eToro has become the go-to broker of 2025 for the majority of new traders and investors.

eToro is home to more than 20 million active traders and it isn’t hard to understand why so many investors are turning to this social trading platform. In addition to stocks and ETF trades, you can also access crypto trading, forex trading, and CFD trading all on one platform and with a single live brokerage account.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Bitcoin trading and Ethereum trading can be accessed on a commission-free basis with no overnight fees. Furthermore, when it comes to forex trading eToro offers more than 50 different currency pairs with tight spreads as low as 1 pip.

When you trade cryptos on eToro you gain ownership of the underlying assets and the only fees that you incur are the low spreads. For example, if you wanted to buy Ethereum you would be charged 1.90% which is the difference between the buy and sell prices of the altcoin.

If you are looking for a more hands-off approach to investing then eToro has you covered with its copy trading tools including CopyTrader and CopyPortfolios. These features allow you to copy the trades of experienced traders like for like.

CopyPortfolios are also investment vehicles that are made up of a basket of assets. CopyPortfolios operate like several investors, all working for you simultaneously. Therefore, multiple underlying positions are opened for you based on your trading goals, risk tolerance, and time horizon. The minimum investment for CopyPortfolios is just $5,000.

eToro also provides a demo account with access to $100,000 worth of paper funds for you to practice your trading strategies and familiarize yourself with the trading platform before trading for real.

Let’s take a quick look at the eToro’s key trading and non-trading fees:

| Asset type / non-trading fee | Commission fee / Charge |

| Stock trading | 0% |

| ETF trading | 0% |

| Crypto trading | 0% |

| Forex trading | 0% |

| Account opening fee | $0 |

| Inactivity fee | $10 per month after 1 year |

| Deposit fee | 0.5% conversion fee for non-USD deposits |

| Withdrawal fee | $5 |

Robinhood vs Ally Invest – The Verdict

After careful consideration and research, we recommend eToro as the number one free trading platform in 2021. If you want to buy and sell stocks, ETFs, cryptos, CFDs, forex on a 100% commission-free basis with a minimum deposit of just $200 then eToro has it all.

eToro also supports fractional share trading which means that you can invest as little as $50 to buy portions of a share whose price per unit is greater than your investment.

Furthermore, there are no commissions, markup, management, or ticket fees when you open a non-leveraged buy position on a given stock.

With that said, if you want access to commission-free trades, simply follow the link below to open an eToro account today and take advantage of the unique trading opportunities facilitated by this leading platform.

eToro – Best Trading Platform with 0% Commission to Trade Stocks and ETFs

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.