Charles Schwab vs Fidelity – Which Broker Is Best in 2025

Are you on the hunt for a great all-round investment broker to trade stocks, ETFs, and futures with zero commission? Two US-based discount trading platforms caught our eye. Both are popular amongst investors, partly due to their low trading fees. Keep reading for our complete Charles Schwab vs Fidelity comparison.

We will cover everything from non-trading fees to account types. With so many available options out there find out which discount broker we recommend for 2025.

What are Charles Schwab and Fidelity?

Fidelity is a US-based trading platform that was launched in 1946. It is regulated by top-tier financial supervisory regulators including the FINRA (Financial Industry Regulatory Authority) and the SEC (Securities and Exchange Commission).

Fidelity offers zero commissions on stock trading, ETF, and options trading. Zero cost ratio index mutual funds as well as fixed income solutions that could save each trader $15 for every bond.

Fidelity is regarded as a safe broker by many traders since it has a strong reputation in the financial sphere and falls under strict regulation by mainstream financial authorities, as we have already mentioned.

Charles Schwab is also a US-based broker that was established in 1971 and is listed on the New York Stock Exchange. Charles Schwab offers its shares to trade under the ticker symbol SCHW on the NYSE.

In terms of fundamentals, it is regulated by multiple top-ranking financial bodies, which include the SEC (US Securities and Exchange Commission), FINRA (the Financial Industry Regulatory Authority), and the United Kingdom’s FCA (Financial Conduct Authority).

Charles Schwab vs Fidelity Tradable Assets

When it comes down to what you can trade, both Charles Schwab and Fidelity cover a lot of ground. Charles Schwab has to offer many tradable assets from mutual funds, ETFs, Index Funds to ETF stocks. Fidelity similarly has a lot to offer; from commission-free trading on all U.S. stocks, ETFs, and indices, and charges $0.65 for each options contract.

Stocks and ETFs

When it comes to global stock market offerings Fidelity stands out, as the majority of US-based stockbrokers do not offer access to global stock exchanges. Fidelity excels with its mutual fund and bond offerings but blends in with the crowd in terms of its tradable options and ETFs.

Charles Schwab offers a range of different tradable asset classes, such as stocks, bonds, options, futures, and even cryptocurrencies. Having said this, the product portfolio only supports financial markets in Canada and the United States. For long-term investors with a preference for, low-cost mutual funds and ETFs, this broker is a good choice.

In terms of funds and bonds, Charles Schwab offers a broad variety. The offered products often vary depending on the country. This means that investors in the United Kingdom, for instance, have the ability to trade bonds, ETFs, stocks, and options. However, products such as mutual funds are not offered.

Traders who choose Charles Schwab can only trade with stocks on the NASDAQ, OTC, New York Stock Exchange, and NYSE MKT. Fidelity traders can also trade with stocks on the same stock exchanges but the difference is that it also offers stock trading on international stock markets which include Europe, Hong Kong, South Africa, New Zealand, and many more.

Fidelity offers more than 2,000 different ETFs and ETPs for its traders to select which include inverse and leveraged ETFs.

Similarly, Charles Schwab gives its traders exposure to over 2,000 ETFs across different asset classes. Furthermore, when you trade ETFs on a U.S. exchange there is a $0 fee per online trade.

Crypto

If you are the type of trader who has their eyes set on cryptocurrency trading then both Charles Schwab and Fidelity are not for you as they do not offer it.

Mutual funds

Fidelity’s FundsNetwork and Charles Schwab give traders and investors the option to invest in mutual funds from a wide range of top-tier fund providers including BlackRock and Vanguard, as well as some being available with zero transaction fees.

Charles Schwab vs Fidelity Account Types

When it comes to account types both Charles Schwab and Fidelity have an abundance of available options to choose from depending on your individual needs. With Fidelity, there are all sorts of trading account types from standard investing and trading accounts such as a Cash Management Account and a Fidelity Account for Businesses. Others include traditional Individual Retirement Accounts and Roth IRA accounts, Self-Employed IRA, Self-Employed 401(k) accounts, Robo-advisor accounts managed by Fidelity itself, annuities, charitable accounts, and more.

Similarly, Charles Schwab also offers a broad range of account types from brokerage individual accounts, robo-advisor accounts, to rollover IRA accounts, with the list going on.

When it comes to opening an account with either trading platform both are very user-friendly and easy. The only difference is that when you open an account with Fidelity you have to print and send your application either by mail or fax for it to be reviewed and approved, which during busy periods can take days.

Charles Schwab vs Fidelity Fees & Commissions

| Commission (US stocks) | Mutual fund | Inactivity fee | USD margin rate | Options fee | Deposit fee | Withdrawal fee | Account fee | |

| Charles Schwab | $0 | $49.95 | $0 | 8.3% | $0.65 | $0 | $0 | No |

| Fidelity | $0 | $49.95 or $75 | $0 | 7.075% | $0.65 | $0 | $0 | No |

Both brokers Charles Schwab and Fidelity charge zero commission for stock and ETF trading, which is great for beginner traders looking to make the most out of their investments and trades.

If you’re the type of trader who prefers to trade on margin, which basically means that you trade with money borrowed from the broker itself, then Charles Schwab charges an 8.3% interest rate and Fidelity charges 7.075%, more commonly known as the margin rate in financial trading terms.

Mutual funds fees are considerably high for transaction-fee and funds outside Fidelity’s offerings. Fidelity has more than 3,000 free mutual funds. But a $49.95 fee is charged when traders sell these funds within the 60-day threshold of having bought the fund. The buying costs, usually either $49.95 and $75, depending on the type of fund.

There are approximately 4,000 mutual funds on offer by Charles Schwab that aren’t covered by trade costs. The standard fee is $49.95 for every fund that is purchased.

Overall, we think both brokers are very similar when it comes to fees and commissions. Both offer commission-free stock and ETF trading, accompanied by low non-trading fees.

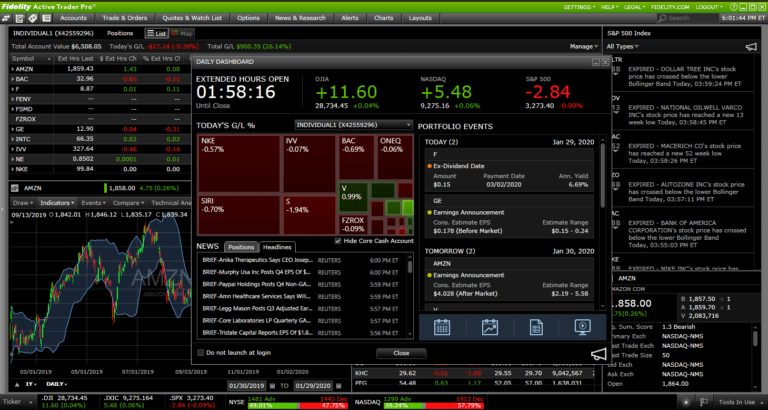

Charles Schwab vs Fidelity User Experience

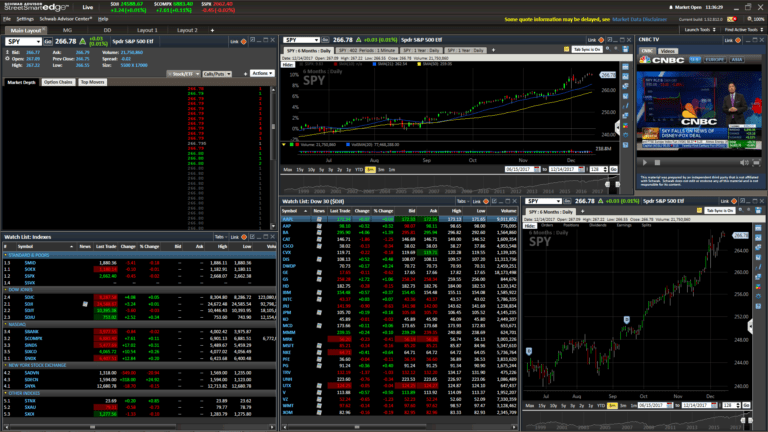

In terms of user experience, both brokers offer a web trading platform that is user-friendly and easy to use. However, if you are a trader who likes to create a tailored dashboard you may be unhappy to find out that both web trading platforms do not support customization. So, what you see is what you get.

When it comes to logging in and overall user security both do well. Both brokers, Charles Schwab and Fidelity offer a two-step authentication process for logging in, as well as a default one-step authentication step.

When logging in for the first time, you will need to register a new device, for example, a tablet or smartphone. Once registration is completed successfully you can gain access to your account by using your ID and password credentials.

Both Fidelity and Charles Schwab give their users the ability to set different notifications and alerts. From costs to research, traders can toggle alerts for account services, market analysis, and research and you can even set push notifications so you can stay updated about all your trading activities on the go. Portfolio and fee reports can also be downloaded in CSV (comma-separated values) format.

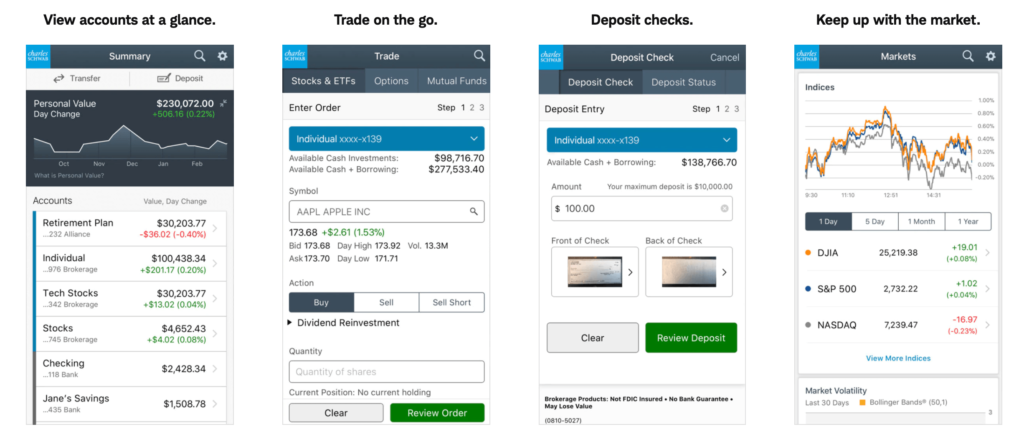

Charles Schwab vs Fidelity Mobile App

Charles Schwab and Fidelity each offer mobile trading apps for iOS and Android. Both are user-friendly and it is easy to navigate your way around.

In terms of functionality, Charles Schwab’s mobile trading app is very much like the web trading platform in that it provides the same order types, search options and offers secure logins via a default one-step login process or a more secure two-step login.

The most striking contrast between the web trading platform and the mobile trading platform is the inability to set alerts on the mobile app. For those of you who spend most hours of the day out and about not being able to set push notifications on the Charles Schwab, the mobile trading app can be a cause for concern.

On the other hand, Fidelity’s mobile trading platform application is simple and easy to use. Unlike the Charles Schwab mobile app, it is more streamlined than the web trading platform. Setting alerts and push notifications on the Fidelity mobile trading platform app is very simple and easy. Placing stop orders, stop-limit orders, market orders and more is also a simple process. Perhaps the only downside is that you cannot enable a two-step authentication login process. But for most users, the default one-step authentication step should be enough to make them feel secure.

Charles Schwab vs Fidelity Trading Tools, Education, Research & Analysis

Charles Schwab and Fidelity provide trading ideas for stocks and ETFs, but Fidelity also offers trading ideas for mutual funds as well.

The stock rating sections give ideas on whether to purchase, hold, or sell the specific stock. Charles Schwab offers a rating for all US-traded equities based on its quantitative rating system. Credible sources are also featured on certain stock reports.

Charles Schwab provides a large variety of fundamental data. Traders can search vast data for different assets, such as funds and stocks. For instance, you can find financial statements for anything between one and six years.

When it comes to charting tools, Charles Schwab beats Fidelity by offering 56 technical indicators as opposed to just 50. Fidelity also gives you the option to download the charts. Both brokers offer screeners for ETFs, stocks, and mutual funds, and their news feeds are populated by renowned and credible sources such as Morningstar, Bloomberg, and Thomson Reuters.

| Technical charting | Analysis Tools | Order types | |

| Charles Schwab | 56 indicators | Economic calendar, news feed, price alerts | Trailing stop limit, market, stop limit, and more. |

| Fidelity | 50 indicators | Economic calendar, news feed, price alerts | Trailing stop limit, market, stop limit. |

Charles Schwab vs Fidelity Demo Account

Especially for beginner traders, a demo account is an invaluable tool. It helps gain experience of online trading without the volatility or risks associated with real investments or trading such as bitcoin trading.

In this case, your choice would have to go with Fidelity because Charles Schwab does not offer a demo account or paper trading. An important note is that Fidelity only offers its demo account, otherwise known as Active Trader Pro demo, on its desktop trading platform. It features a fully customizable dashboard and data display, gives traders the ability to speculate trades and create trade ideas with options analytics.

Charles Schwab vs Fidelity Payments

Firstly, the most noteworthy thing to mention about Fidelity is that it offers 16 base currencies from USD, EUR, to JPY and GBP. But why is this important? There are a couple of reasons. By funding your trading account with the same currency as your bank account you can avoid conversion fees.

With this in mind Charles Schwab only has USD as its base currency, which means that if you trade assets or fund your trading account with any other currency you will incur a conversion fee.

In terms of deposit fees and minimum deposits, both Charles Schwab and Fidelity do not have any, which is a definite plus. As you can gather from the comparison table below Charles Schwab allows its US-based traders to deposit funds via check, ACH, and wire transfers. It does not accept credit cards, debit cards, or e-wallets for deposits. The processing time is usually 1 – 2 business days.

On the other hand, Fidelity users can make deposits via checks, ACH, wire transfers, and electronic wallets like Paypal. But, like Charles Schwab, does not accept credit or debit cards.

| Minimum Deposit | E-Wallets | Deposit Fees | Base Currencies | |

| Charles Schwab | $0 | No | No | 1 |

| Fidelity | $0 | Paypal | No | 16 |

Charles Schwab vs Fidelity Customer Service

Traders can contact both Charles Schwab and Fidelity via phone or live chat. Fidelity also offers its users the ability to contact their customer service via email. Customer support is also available 24/7 to answer questions or find solutions to any issues that you may have.

Fidelity’s virtual assistant chatbot is very helpful and easy to use. This offers traders the ability to find answers to simple questions, or while they wait to be consulted by a customer service agent.

Charles Schwab vs Fidelity Safety & Regulation

Safety and regulation should be a number one priority when it comes to choosing an online trading platform. Fidelity is regulated by top-tier US financial bodies such as the Financial Industry Regulatory Authority and the Securities and Exchange Commission or SEC and FINRA.

How do Fidelity and Charles Schwab protect their users’ funds? Fidelity and Charles Schwab protect their traders because they are covered by the Securities Investor Protection Corporation (SIPC). This safeguards against cash and security losses in the event that the company liquidates. SIPC protection is limited to $500,000, and $250,000 for cash.

Charles Schwab is also heavily regulated by a range of international financial authorities which include the Commodity Futures Trading Commission, the Financial Industry Regulatory Authority, the Securities and Exchange Commission, the Monetary Authority of Singapore, the Financial Conduct Authority, the Hong Kong Securities and Futures Commission.

Charles Schwab vs Fidelity – The Verdict

Charles Schwab and Fidelity are two of the largest US brokers. They fall under the regulations and standards of major financial authorities including the SEC and FINRA. Both online trading platforms offer commission-free stock and ETF trades with no minimum deposits or deposit fees, or account minimums.

Both brokers offer a range of tradable assets from stocks and ETFs to mutual funds and an extensive variety of bonds. Charles Schwab and Fidelity offer robust research tools, no transaction fees, and are user-friendly and easy to use, as well as a range of technical tools and options.

Your capital is at risk.