Webull vs Robinhood – Which Broker Is Best in 2026

When it comes to low-cost trading from the comfort of your own home – chances are you’re going to need a top-rated broker. From the thousands of options to choose from two brokers stand out from the rest. This is our full Webull vs Robinhood comparison.

In this guide we compare everything from non-trading fees to mobile trading apps. By the end we reveal the cheapest broker in 2026.

Webull vs Robinhood Comparison

Webull

Visit SiteAll investments involve risk, and not all risks are suitable for every investor. The value of securities may fluctuate and as a result, clients may lose more than their original investment.......

What are Webull & Robinhood?

Webull and Robinhood are online brokerage companies that give active traders access to the stock markets and the opportunity to invest and trade at the click of a button. Both platforms are targeted towards both the new and experienced trader – making them perfect for newcomers to the investing scene.

Webull is a fintech startup based in the United States which offers both no-fee and discount brokerage services. Founded in 2017, Webull is regulated by SEC (the US Securities and Exchange Commission), and is a member of the Financial Industry Regulatory Authority (FINRA), Securities Investor Protection Corporation (SIPC), The New York Stock Exchange (NYSE), NASDAQ and Cboe EDGX Exchange, Inc (CBOE EDGX).

Webull is committed to maintaining a safe trading environment as it is regulated by mainstream financial bodies and offers a $500,000 maximum protection for its investors, as well as a SIPC protection scheme.

Much like Webull, Robinhood is a US-based broker which was founded in 2013. Robinhood is also regulated by the main financial authorities, including the US Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).

In addition to the expected brokerage service, Robinhood also piloted the Cash Management to help its users make interest through uninvested funds.

When it comes to Webull vs Robinhood, both brokers offer zero percent commission on US stock trading, ETFs and options with no inactivity costs. Robinhood does not come with withdrawal fees unlike Webull. Opening a trading account with either brokerage is easy, simple and fully digital. Both brokers offer mobile and web trading platforms that are very user friendly and easy to use, making them the perfect choice for new traders.

Webull vs Robinhood Tradable Assets

In this section of our Webull vs Robinhood review and comparison, we are going to take a detailed look at the types of assets you can trade and invest in.

Let’s begin with stocks and shares.

Stocks and shares

Most new traders will opt for more well known and traditional shares and stocks when it comes to first time trading and investing. If this sounds like you, you’ll be pleased to know that both Webull and Robinhood offer a great selection of companies.

It is worth mentioning that both Webull and Robinhood brokers only allow traders and investors who are based in the United States. Due to the impact of the pandemic global expansions projects have been put on hold for the time being.

Robinhood enables its traders and investors to tailor their strategies to work for them. Robinhood offers a range of assets that can be invested in with the click of a button, varying from options to stocks.

You can invest in more than 5,000 stocks with Robinhood, covering the majority of U.S. equities and ETFs (exchange-traded funds) which are listed on U.S. exchanges. Robinhood also offers access to in excess of 650 global stocks via ADRs (American Depositary Receipts), and options trading. Robinhood provides traders with access to options and stock trading, as well as fractional shares.

At present Robinhood offers the following assets:

- U.S. ETFs and U.S. Exchange-Listed Stocks

- Options contracts for U.S. Exchange-Listed Stocks and ETFs

- American Depositary Receipts for more than 650 Globally-Listed firms

Webull has a variety on offer, from ETFs, stocks, options, crypto trading, and the ability to short sell shares. Thingssuch as mutual funds, bonds and futures are not offered. Webull also gives traders access to Initial Public Offerings (IPOs) without making minimum account requirements compulsory. Robo-Advisors or robo-portfolios, banking services, and advisory services are not available with Webull.

ETFs

Once again, both Webull and Robinhood give you access to a wide range of ETFs. This is effective if you plan on investing in a basket of assets through an individual trade. We found that both brokers offer ETFs that are backed by top-ranking providers. By investing in an ETF at both Webull and Robinhood, you may be eligible for dividends after a distribution has been made by the provider. As a result of it’s user friendly layout Robinhood is also a good option if you are considering investing in ETFs or cryptocurrencies or even searching for a penny stock trading platform.

Cryptocurrencies

Robinhood gives its traders access to a wide variety of cryptocurrencies. You have the ability to trade major cryptos including Bitcoin and Ethereum. For traders who want to trade minor cryptocurrencies such as Stellar and Monero there are real-time data features.

When it comes to Webull, you can apply for crypto trading via the broker’s mobile app by navigating to the Crypto Trading tab.

Webull offers crypto trading of Ethereum, Bitcoin, Bitcoin Cash, and Litecoin via Apex Crypto. If you find you are having trouble with trading cryptos Webull recommend that you check for any updates and download the latest version of the mobile app.

In terms of costs, Robinhood and Webull do not charge for cryptocurrency trading. Buying and selling Bitcoin, Ethereum, Dogecoin, and other cryptocurrencies 24/7 is completely commission-free with Robinhood Crypto.

Webull vs Robinhood Account Types

Next up in our Webull vs Robinhood review is that of account types.

To start off with, Webull offers two account types that are suitable for both the advanced traders and the new to the scene investors.

So, to break it down, Webull recommends that its traders create and open an individual account. Webull’s individual account can be broken down into two categories: margin accounts and cash accounts. Every Webull trader is allowed one of each type of account. For example, if a Webull user already owns a cash account, they will need to create new login credentials in order to apply for a margin account.

Secondly, Webull supports individual retirement accounts (IRAs), Roth, Traditional, and Rollover IRAs. Each individual Webull user can create and open a single IRA account. Webull traders need to have an individual account in order to create an individual retirement account.

When it comes to Robinhood, this brokerage offers three types of accounts, each tailored to fit your trading needs.

Firstly, when users sign up for a new Robinhood account, by default, they start with something called a Robinhood Instant account, otherwise known as a margin account. A Robinhood Instant margin account gives its traders and investors exposure to extended-hours trading and instant deposits. In addition, when selling stocks or making a deposit of up to $1,000, users do not have to wait for their pending funds to process.

Secondly, Robinhood offers what it calls a Robinhood Gold account, which in many ways is very similar to a Robinhood Instant account, with the difference being that it gives its users access to greater buying power and more instant deposits.

The final account type that Robinhood offers is the Robinhood Cash account which allows its traders to invest and trade without commission fees during both extended and standard-hours trading sessions. With a Robinhood Cash account users do not have access to instant settlements or instant deposits. If you have a Robinhood Gold or Instant account, you can switch to a Robinhood Cash account whenever you want.

Currently, Robinhood does not offer trusts, joint accounts, IRA, or custodial accounts.

Webull vs Robinhood Fees & Commissions

As we already mentioned earlier, both Webull and Robinhood are low-cost US-based brokers. Having said that, there are a range of different fee types that you should take into consideration prior to opening an account with any broker and trading platform.

| Trading Platform | Cost per trade | Annual fee | USD margin rates | ETFs fee | Options fee | Inactivity fee |

| Webull | $0 | $0 | 7.0% | $0 | $0 | No |

| Robinhood | $0 | $0 | 2.5% | $0 | $0 | No |

In light of this, we have deconstructed the main fees that traders are most likely to come across when using either Webull or Robinhood. Both Robinhood and Webull do not have an account minimum, so both beginner investors and advanced traders can start trading immediately.

When trading and investing with Robinhood, its traders enjoy zero percent commission. There are no fees involved when opening an account, maintaining an account, or transferring money to your account.

But, self-regulatory organizations (SROs) including the Financial Industry Regulatory Authority (FINRA) charge Robinhood a relative fee for sell orders. These fees are charged by FINRA for every sell order, which applies to all brokers. Robinhood gives these fees to its traders and forwards them to the appropriate and relative self-regulatory organization.

In terms of Webull, this broker also offers commission free trading. However, the appropriate fees charged by SEC and FINRA also apply. In addition, Webull investors who make margin trades and hold the position beyond the day’s trading hours, are charged interest on that margin.

In terms of the bottom line, our Webull fees vs Robinhood fees review found that both brokers offer very low investing and trading services.

Webull vs Robinhood User Experience

With regards to the end-to-end user experience, it is worth noting that both Webull and Robinhood are perfectly matched and tailored for new traders making their way to the investing scene. In fact, we would go one step further and suggest that both Webull and Robinhood are designed with those who have basic to no investment experience in mind.

Opening an account with Webull and Robinhood is fully digital, simple and quick. Typically accounts are verified within one business day. You can open a Webull or Robinhood trading account on most web, desktop and mobile platforms. The user interfaces for both Robinhood and Webull are very easy to navigate and they pride themselves on their simplicity and efficiency.

In terms of the actual investment process, both Webull and Robinhood offer easy and practical order forms. In fact, if you want to keep things as simple as possible, all you need to do is enter your stake and click confirm.

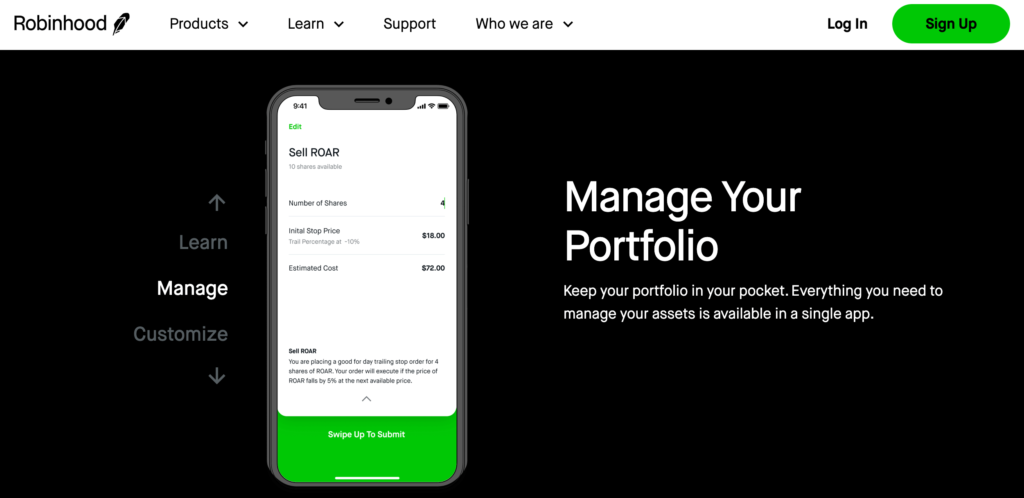

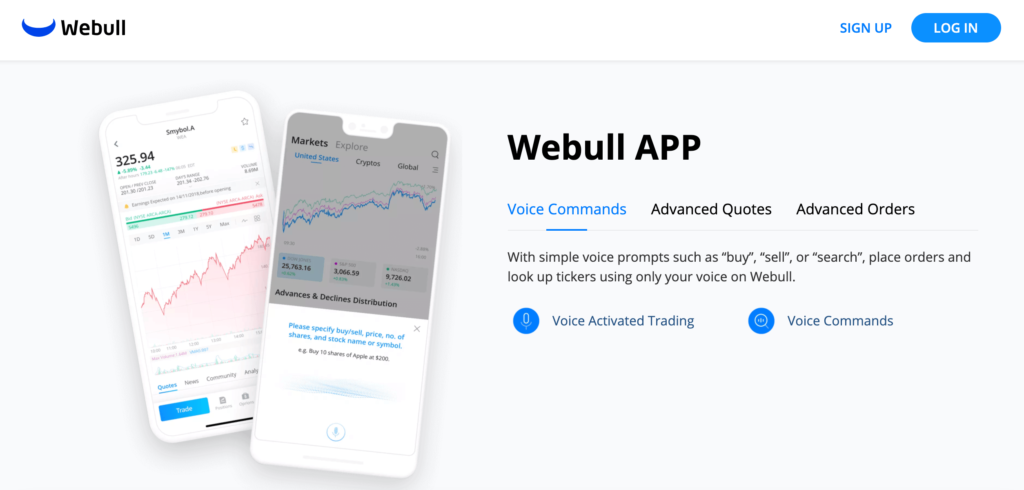

Webull vs Robinhood Mobile App

When it comes to Robinhood vs Webull mobile trading it’s a well known fact that trading apps and investing apps are fast becoming one of the largest sectors in the investment scene and is gaining more user engagement every day. At the end of the day, having the ability to trade assets wherever you are, is an important and necessary feature that both new and experienced traders need. For instance, you may decide to cash out a stock investment straight away, as opposed to waiting to reach your home.

Having said this, it makes sense to us that both Webull and Robinhood offer fully developed and well integrated investment apps. Both brokers offer a mobile app that is compatible with both Apple and Android devices.

Webull’s mobile app is streamlined for a user-friendly experience, displaying data and graphs and charting options in an easy to understand manner. Navigating your way around the Webull mobile app is also very simple, which means the app is perfect for the less experienced trader. Adding to this, Webull ensures that the user experience is stable and reliable across multiple mobile devices, especially as the mobile app is essentially a desktop and web version of the Webull platform, just in the convenience of your smartphone or tablet device.

This wouldn’t be a Webull vs Robinhood review without also looking at the Robinhood mobile app. So here goes, Robinhood’s mobile application is quick, simple, and very user friendly. In terms of trading stocks and shares, the Robinhood mobile app has all the necessary features to meet the needs and demands of its traders. Those features include basic watch lists, basic stock quotations accompanied by charts, data and ratings from financial analysts, current news, streaming Bloomberg TV, and more. Another important point to mention is that Robinhood makes day trading a simple process. There is a zero account minimum required to begin trading ETFs, stocks and much more.

Webull vs Robinhood Trading Tools, Education, Research & Analysis

Both Webull and Robinhood have a wide range of trading tools and investment options for its users. Once you have successfully downloaded and opened the app you can trade stocks with the click of a button. In terms of investing and trading both Webull and Robinhood are rather similar.

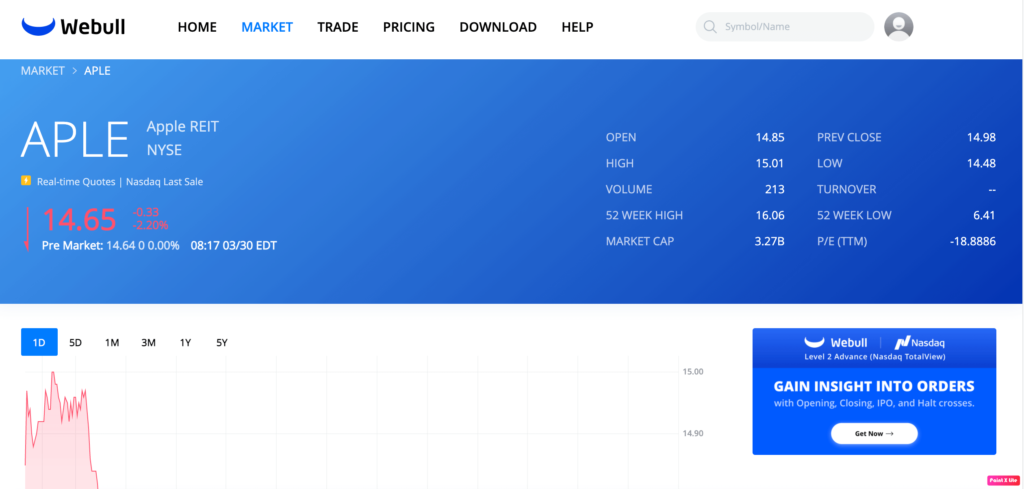

With Webull, data charts can be expanded to cover more than 20 different technical indicators. You have the option to set candles from anything between one minute to an hour and the chart can present years of history with moving averages.

With this in mind, Webull offers valuable information on sales, revenue statistics, earnings-per-share data and the list goes on. Screeners can also be managed to find stocks with any sort of volume or the most recent gains. Webull also offers margin trading, economic calendars and short selling.

On the other hand, Robinhood’s mobile app is simple and easy but does fall short in certain areas when compared to Webull’s mobile app. Trading stocks and options can be conducted with a few clicks on your mobile device, but when it comes to the tools on offer the list is rather limited.

When it comes to stock charts you can choose to display up to five years of historical data through a line or candlestick format. However, the Robinhood app does not give you the option to overlay technical indicators or implement moving averages.

The statistics available on the Robinhood app include the 52-week low and high dividend yield P/E ratio, market cap, average daily volume.

Research

Webull traders have access to real-time market data in the United States for free. This includes live price quotes, cash flow reports, balance sheets, technical analysis, and income statements.

Adding to this, Webull users have access to current streaming news reports from reputable and mainstream sources such as CNBC and Bloomberg.

Despite Webull users only being able to trade US ETFs and stocks, they can still gain access to global market research tools which include financial markets such as foreign exchange and cryptocurrencies.

When it comes to Robinhood, it offers breaking news stories and updates from popular and mainstream sources including Bloomberg, CNBC, and Yahoo Finance. The Robinhood mobile app displays the preceding earnings reports underneath every stock chart as well as live conference calls.

With this in mind, the Robinhood Gold account type, which comes with a monthly cost, does offer stock research from sources such as Morningstar.

Webull vs Robinhood Demo Account

Demo accounts are very important, especially if you are just venturing into the online investing scene. The bottom line is that they enable you to invest with practice funds – meaning that you can still practice trading and investing in the financial world without the risk of losing your hard earned money. Our Webull vs Robinhood review found that both platforms offer a demo trading feature.

With that said, the Webull mobile app and its desktop platform offer a demo account, whereas Robinhood does not offer a demo account.

Webull offers a demo account, or as the broker calls it the Webull Paper Trading on both its mobile application and the desktop trading platform. To find the Webull demo trading account on the mobile app, click on the ‘Menu’ tab in the bottom right hand corner. Then, click on the ‘Paper Trading’ button in the center of the screen.

Webull demo account traders have a default $1,000,000 in online Webull paper trading currency. This offers everything new investors and traders need to get started and learn the ins and outs of online investing; and the option to reset the demo account can be taken at your own convenience. The reset link can be located at the top right-hand corner of the screen.

Webull vs Robinhood Payments

Webull does not charge commission for trading stocks, ETFs, and options. Whereas the majority of trading platforms charge $0.65 – $0.75 for option contracts, Webull charges nothing.

In terms of a minimum deposit Webull does not impose a minimum account balance; with that said, traders who would like short selling stocks are required to create and open a margin account, which has a minimum deposit of $2,000.

| Minimum Deposit | Deposit Fee | Processing Time | Withdrawal Fee | |

| Robinhood | $0 | $0 | 1-2 days | $0 |

| Webull | $0 | $0 | 1-5 days | $0 |

In terms of the Robinhood Instant account there is no minimum deposit, unless you switch to the Robinhood Gold account, where there is a minimum deposit of $2,000.

For Webull traders If you deposit funds by ACH transfers, deposits are required to stay in the trading account for a minimum of 7 trading days. If funds are deposited by wire transfers, the withdrawal holding period is one trading day.

Meanwhile for Robinhood traders when opening and funding a trading account, Robinhood is unlike Webull because it offers its users access to funds up to the sum of $1,000, which are available straight away for trading purposes while your ACH transfer deposit processes. Under normal ACH transfers, the normal processing period is between two and three trading days.

Webull vs Robinhood Customer Service

You can contact Webull via its message centre through the trading platforms, email and via telephone.

There is also a ‘Feedback’ section on the Webull trading platform for user reviews and experiences. Something worth mentioning is that this customer support channel is available even on the weekends.

The Webull customer service reps are available 24/7 to assist its users through using its multiple trading platforms and to answer any queries and questions they may have.

In terms of this Webull vs Robinhood review, the Robinhood customer service seems to fall short in comparison to because its users are only able to contact the customer support department via e-mail as telephone and live chat options are simply not offered.

Robinhood vs Other Brokers

Overall, Robinhood is better suited to beginners with little trading experience who want to trade US shares and ETFs on a zero-commission basis. If you’d like to see how Robinhood performs when pinned against other top online brokers be sure to also read these comparison reviews!

- Robinhood Review

- Stash vs Robinhood

- Coinbase vs Robinhood

- Acorns vs Robinhood

- M1 Finance vs Robinhood

- Fidelity vs Robinhood

- Robinhood vs Charles Schwab

- Robinhood vs Ally Invest

- TD Ameritrade vs Robinhood

Webull vs Robinhood Safety & Regulation

When it comes to safety and regulation, our Webull vs Robinhood review and comparison for 2026 found that both brokers are regulated by the US Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).

Both Webull and Robinhood are members of FINRA and fall under the US investor protection scheme, the SIPC. The limit of SIPC protection is $500,000, which also includes a $250,000 limit for cash.

Webull vs Robinhood vs eToro

When it comes to safety, our eToro review found that this broker is regulated by the FCA. eToro is also covered by the FSCS. This means that in the unlikely event that the trading platform were to liquidate, your funds would be covered up to the first £85,000 (applicable within the UK only).

Having said this, eToro has also gone the extra step in getting licenses from regulatory authorities such as ASIC and CySEC. In addition to this, eToro is also registered with FINRA in the US which just reinforces that the eToro broker takes regulation and trader safety very seriously. If you’re searching for a commodity trading platform, eToro supports a wide variety from silver and gold to oil and natural gas.

Furthermore, in terms of its KYC process this can be completed in minutes. This is due to the fact that the trading platform uses automated ID software – which means that it does not need to manually review the documents one by one which can be a time consuming process.

Perhaps the most prominent feature at eToro is the fact that it also offers passive investing services. At the centre of this is its Copy Trading feature. Basically, this feature enables its users to search through a wide variety of experienced eToro traders. eToro traders can look at key data points including the trader’s investing preferences, in terms of asset classes, their average monthly profits, and more.

Once you have picked a eToro trader, you can copy their trades. Simply put, if your chosen trader purchases shares in Amazon and Shell, your trading portfolio will copy it.

| Fee | eToro |

| Stock trading fee | Free |

| Forex trading fee | Spread, 2.1 pips for GBP/USD |

| Crypto trading fee | Spread, 0.75% for Bitcoin |

| Inactivity fee | $10 a month after one year |

| Withdrawal fee | $5 |

Webull vs Robinhood Review – The Verdict

In summary, both Webull and Robinhood are hugely popular brokerage firms that offer a simple and easy user experience tailored for new traders. For example, both platforms allow you to buy shares and ETFs commission-free, both are simple and easy to use, and both offer their services on a mobile app so you can trade on the go.

However, our comprehensive Robinhood vs Webull review did find that the former does stand out in several areas.

Commission-free trading is a part of both Webull and Robinhood which is gaining more and more market share from the biggest brokers in the game. If you’re new to the trading world and want a simple yet effective experience, Webull and Robinhood are great choices.

However our analysis found that Webull provides much more. Technical tools and market research are key resources and Webull offers both completely free of charge. Furthermore, the demo account allows traders to practice new trading strategies and understand their way around the trading world. Despite being unable to trade and invest in cryptocurrencies and options, our Webull vs Robinhood review found Webull to be the better option for the new trader.

Having said this If you want a further look into eToro, as an all round top-rated broker and trading platform then check out eToro here. eToro is the world’s number one social trading platform that offers its unique Copy Trading feature. This is perfect for new traders who want to learn from the more experienced investor. Copy Trading gives you the ability to copy the trades of any eToro investor at the click of a button. If you want to get started with zero-commission trades right away, simply click the link below to sign up today!

eToro – Overall Best Trading Platform with 0% Commission

67% of retail investor accounts lose money when trading CFDs with this provider.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.