M1 Finance Review 2025 – Platform, Fees & Features Revealed

M1 Finance is a fast-growing digital personal finance and wealth management robo-advisor that gives investors the power to model their own portfolios. With assets under management soaring over the past couple of years, M1 Finance should be considered alongside some of the industry’s bigger hitters as a serious option for portfolio investors.

In this M1 Finance review, we look into everything you need to know about an app that is fast becoming a key player in the world of digital finance.

M1 Finance History & Background

M1 Finance was launched in 2015 as a trading application for investors in the US. According to founder and CEO, Brian Barnes, the app was created out of “frustration with the status quo”. He wanted to create a finance company that took a different approach. He wanted to create a different way of managing portfolio investments.

Barnes wanted to create a digital solution that allowed investors to:

- be able to pick their own investments

- have recurring deposits automatically added to portfolio allocations – in order to prevent “idle cash”

- make an app that enabled investing to become an automated process

The solution that Brian Barnes came up with was an automated investing platform that would be low-cost and scalable as investments grow. M1 Finance was created.

The growth in popularity of M1 Finance is huge. In 2020, the number of users of the app tripled to now have over 500,000 investors. Assets under management are also growing at an incredible rate. From $1 billion of assets around the turn of 2020, at the beginning of 2021 M1 Finance announced that they had $3 billion in client assets on the platform. These certainly are impressive numbers.

M1 Finance Pros & Cons

Before we get into the finer detail of this M1 Finance review, here are a few pros and cons that we think you need to be aware of before investing.

Pros

- Automated portfolio rebalancing means no manual calculation of position sizing

- Choose your own investments or build a portfolio of “expert” portfolios

- No management fees or commissions

- Low non-trading fees

Cons

- M1 Finance is not available to investors outside the USA

- Instruments limited to stocks & ETFs. No forex, commodities or crypto available.

- No margin trading

- Limited analysis tools for intermediate and sophisticated investors

What Can You Trade and Invest in on M1 Finance?

M1 Finance is an app for longer-term investors rather than shorter-term day traders. This is reflected in the traded instruments that the app offers. With M1 you can only trade stocks and ETFs (Exchange Traded Funds). Despite this, there is still a large number of investments to choose from:

- Over 6200 stocks (from US equity markets) and ETFs.

- This includes ADRs (American Depository Receipts) on foreign shares, allowing investors to gain exposure to foreign companies.

- Also over 80 “Expert Pies” (pre-selected portfolios made up of investments chosen by the team at M1 Finance).

Trade Fractional shares

The ability to invest in fractional shares is a crucial aspect of what M1 Invest offers traders. This enables the whole system of “Dynamic Rebalancing” to work and also is what sets them apart from competitors. US shares are often worth hundreds of dollars, so buying 1 share can use up a large portion of a trading account. This is especially a problem for investors at the lower end of the scale. The ability to buy fractional shares allows the automation of investing and rebalancing in positions across the account to run smoothly.

Fractional shares are available on M1 for all stocks and ETFs. Of its competitors, only Robinhood can match this:

- Vanguard – no fractional shares

- Schwab – fractional shares only on S&P 500 stocks

- Fidelity – fractional shares only available on the mobile app

Limited instruments for shorter-term traders

One of the main downsides of M1 Finance is that you are rather limited when it comes to the various asset classes you can trade. If you are looking to trade forex, commodities, futures, and options, or cryptocurrency then M1 Finance is not the broker for you. The only way to gain exposure to indices or commodities is through trading the ETFs that are available. You are also able to gain exposure to bond funds via the pre-built expert pies.

A further negative aspect for shorter-term traders is that trading on margin is not available through M1 Invest. There are no CFDs available on the M1 app.

Assets available

- Stocks

- ETFs

Investments you cannot trade

- Forex (spot or CFDs)

- Commodities (including metals, energy and softs)

- Indices

- Futures and Options

- Cryptocurrency

M1 Finance Fees & Commissions

Looking into M1 Finance fees we find one of the great positives of using the M1 app. There are zero trading fees and the non-trading fees were also low.

Zero Trading Fees with M1 Finance

- No mark-ups on trading. No artificial spreads used and that investors get the real market price.

- No trading commissions to be paid either.

- No platform costs. The M1 account has no platform usage fees

The only trading fees that are applicable are regulatory fees. However, this would be the same as with any account. The SEC and FINRA both add tiny regulatory fees to any security transaction. For the SEC, this is approximately $0.02 for a $1000 transaction. Additionally, FINRA’s Trading Activity Fee is $0.00019 per share.

Comparing Trading Fees

As part of our M1 Finance trading review, we looked into the fees that can be incurred with other robo-advisor accounts. Unlike M1 Finance, many other accounts will have fees, although these are mostly annual fees.

Here is a table comparing various robo-advisor accounts on trading fees and annual fees. We believe that on trading fees, M1 Finance comes out on top.

| Broker | M1 Finance | Charles Schwab | Fidelity | Vanguard |

| Robo-Advisor Account | M1 Invest | Intelligent Portfolios | Fidelity Go | Digital Advisor |

| Trading fees | FREE | FREE | FREE | FREE |

| Annual fees | FREE | FREE | $0 up to $10k 3/mo to $50k 0.35% over $50k | 0.15% net |

| Minimum account size | No minimum | $5000 | $10 (to trade) | $3000 |

With M1 Finance, there are no annual fees to pay and there are no fees or commissions to trade. Having zero fees means that with M1 Finance, you keep more of your money to build on your portfolio.

Zero fees on trading will often be a feature of other robo-advisor accounts, however, these will often come with annual fees. With robo-advisor accounts through Fidelity and Vanguard, annual fees tend to be paid for the administration of the account. Furthermore, we found that there are often minimum investment levels to have the account open and trading.

Non-trading Fees

One of the important features of M1 is that there are also no fees charged on deposits and withdrawals (when paid to and from your connected bank account). At M1, as long as you are moving funds between your connecting bank, there are no charges.

However, we did notice that there were a few non-trading fees that M1 does charge. Although this may not be part of the day-to-day running of the account, investors should still be aware of them. Using other payment methods into or out of the account will incur fees:

- Wire Transfer $25

- Check request $25

There are also a few other (very rare) non-trading fees that investors should be aware of:

- Inactivity fees of $20 with no activity of over 90 days. Charging an inactivity fee after just three months is rather soon though, especially for a longer-term form of wealth building.

- Escheatment Processing of $75 – for an account closure needing to be legally administered after a multi-year dormancy.

- TOD (Transfer on Death) fee of $200

Comparing these non-trading fees with other robo-advisor accounts, M1 is higher than the others, with Fidelity and Vanguard coming out on top.

| Non-trading Fees | M1 Finance | Charles Schwab | Fidelity | Vanguard |

| Robo-Advisor Account | M1 Invest | Intelligent Portfolios | Fidelity Go | Digital Advisor |

| Direct account transfer | $0 (in), $100 (out) | $0 | $0 | $0 |

| Wire transfer | $25 (both in and out) | $25 (out) | $0 | $0 |

| Check transfer | $25 (both in and out) | $0 | $0 | $0 |

| Inactivity fee | $20 | $0 | $0 | $0 |

M1 Finance User Experience

From this M1 Finance review, we believe that M1 is a very simple process of investing and easy to navigate for the user. The functionality is also strong.

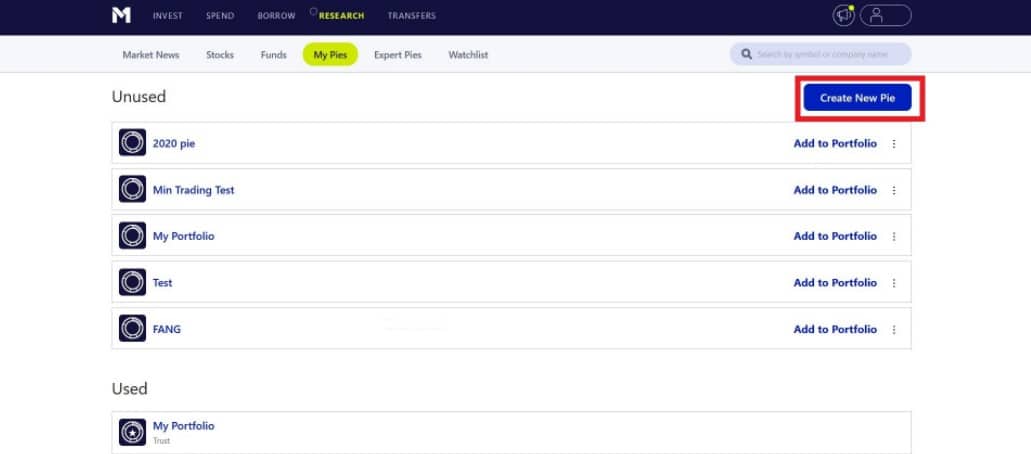

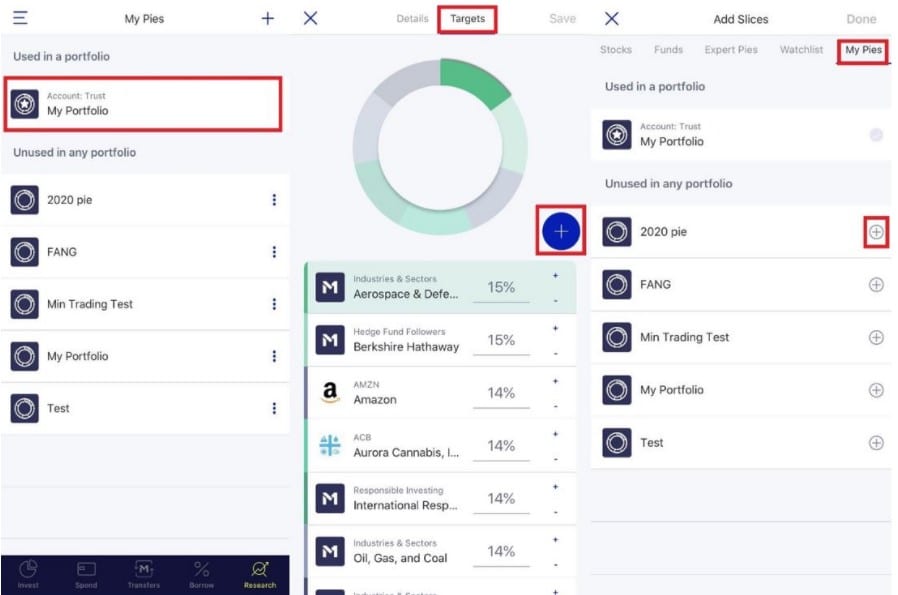

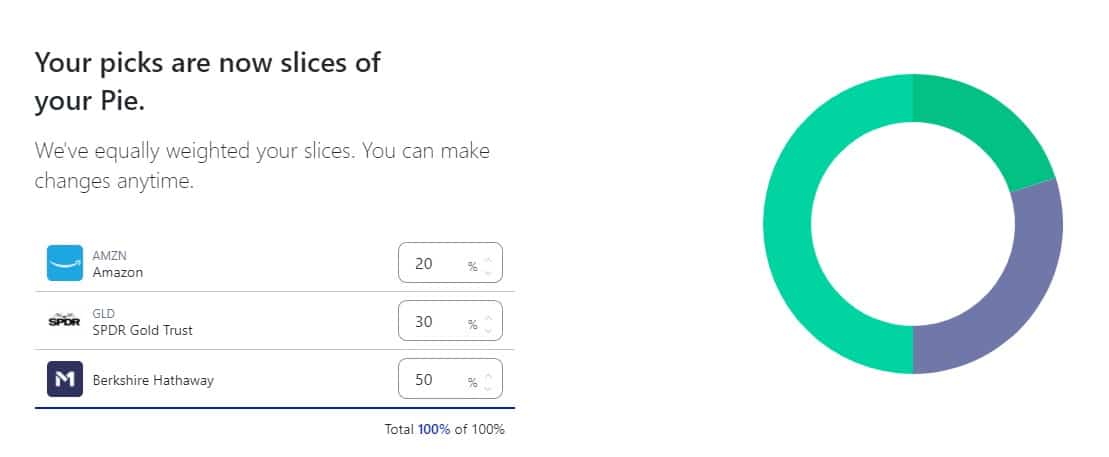

M1 is based on the concept of building a portfolio “pie”. Each pie can consist of up to 100 “slices” which can be individual stocks, ETFs, or other “pies”. So you can build up your portfolio in two ways:

- You can choose your own investments when building a “Custom Pie“.

- You can also choose from over 80 expert portfolios called “Expert Pies“.

You then decide on the percentage allocation that you would like each slice to have within your pie. These are the parameters that the app’s algorithm tries to keep to with the dynamic rebalancing when you deposit more funds into the account.

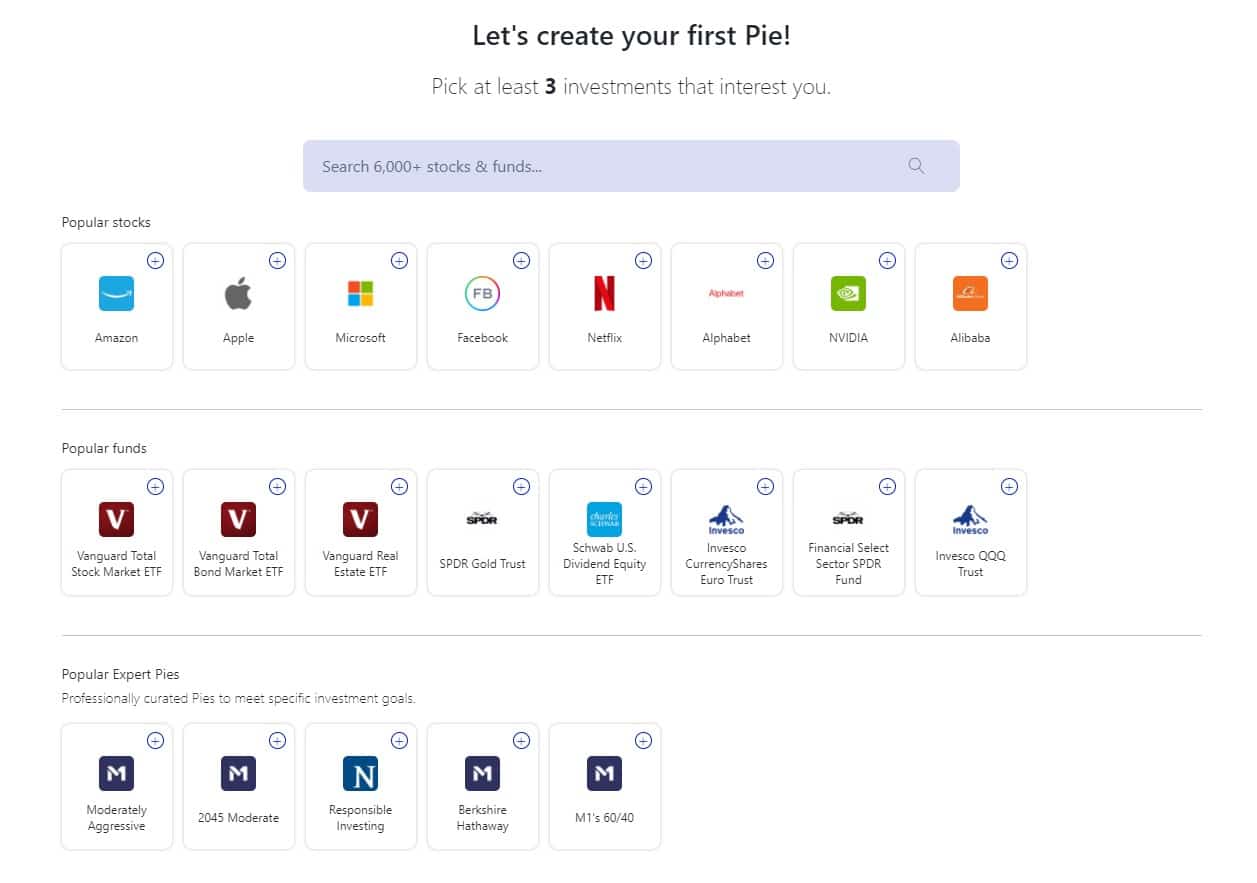

Custom Pie

The customisation of M1 Invest is something we really like. You can build your own pie by selecting from over 6000 stocks and ETFs. If you wish, you can also use “Expert Pies” which can help to add diversification to your portfolio.

You can build a number of different pies and save them before choosing whether to add them to your portfolio or not. Furthermore, you can also create more than one portfolio and manage payments into the account separately from your other portfolios.

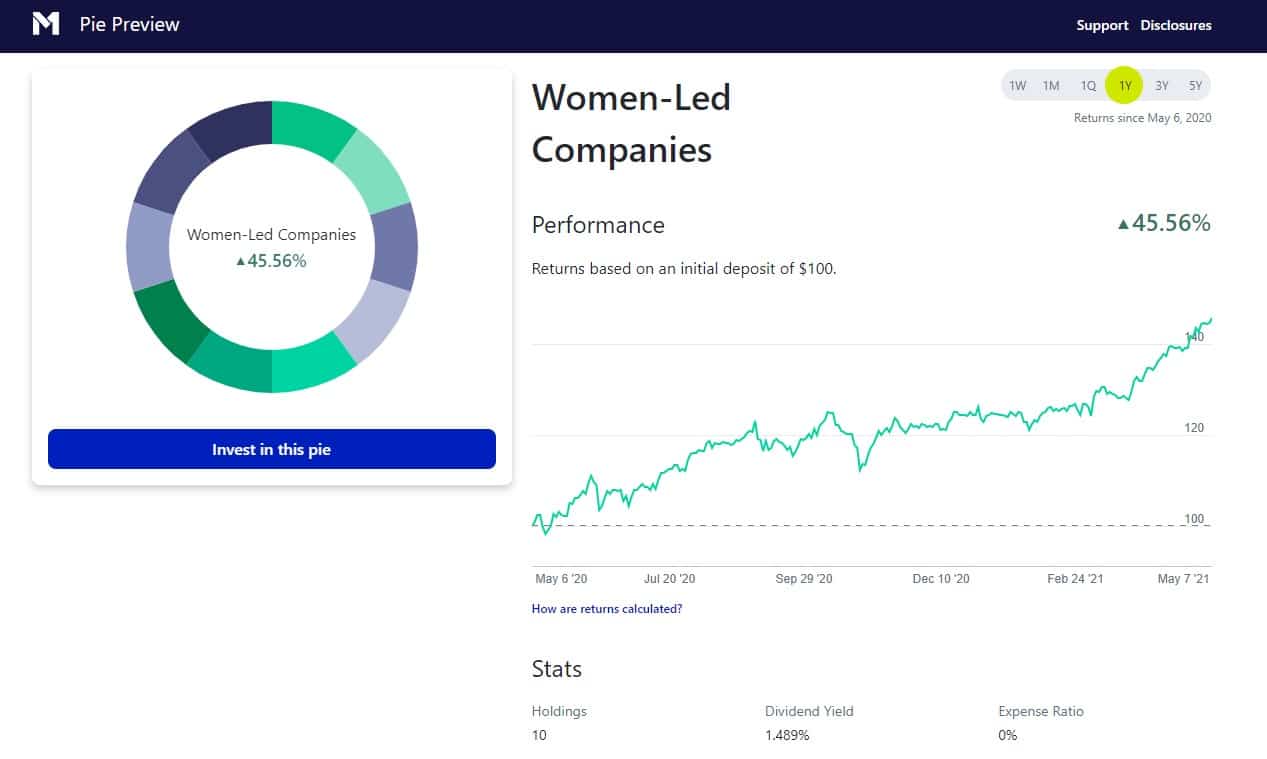

Expert Pies

The availability of Expert Pies is another of the key features we like about the M1 app. This is a tool that would be extremely useful for beginners and make the whole process of investing much easier.

Expert Pies are allocations of securities that been compiled by the M1 Finance team of experts. The companies chosen to become slices in these Expert Pies have to fit specific investing criteria. This is a similar concept to the components of investing in ETFs. However, the crucial difference is that whilst investing in ETF will incur an expense ratio (effectively an annual performance fee charged by the provider), the Expert Pies with M1 have an expense ratio of zero (as long as they are not invested in ETFs).

As part of the Expert Pies, there are also “Community Pies”. Investors can gain exposure to portfolios of publically traded companies that are led by minority groups such as black, female, and LGBTQ+ executives. Others Community Pies include a pie full of Companies Committed to Sustainability.

M1 Finance Features, Charting, and Analysis

During this M1 Finance trading review, we looked at the features and analytics of M1 Invest and it is clear that it is strongly geared towards beginner level investors.

Analysis & Charting

There are no specific reports on which companies to buy and sell on the M1 app. However, there are plenty of articles to read on the concept of investing and “systems thinking”. M1 Investor account holders can also sign up to receive “The Investor’s Mindset” (a monthly investing strategy newsletter) and “Mini Mindset” (a weekly publication). These are guides and helpful education tools for beginner investors.

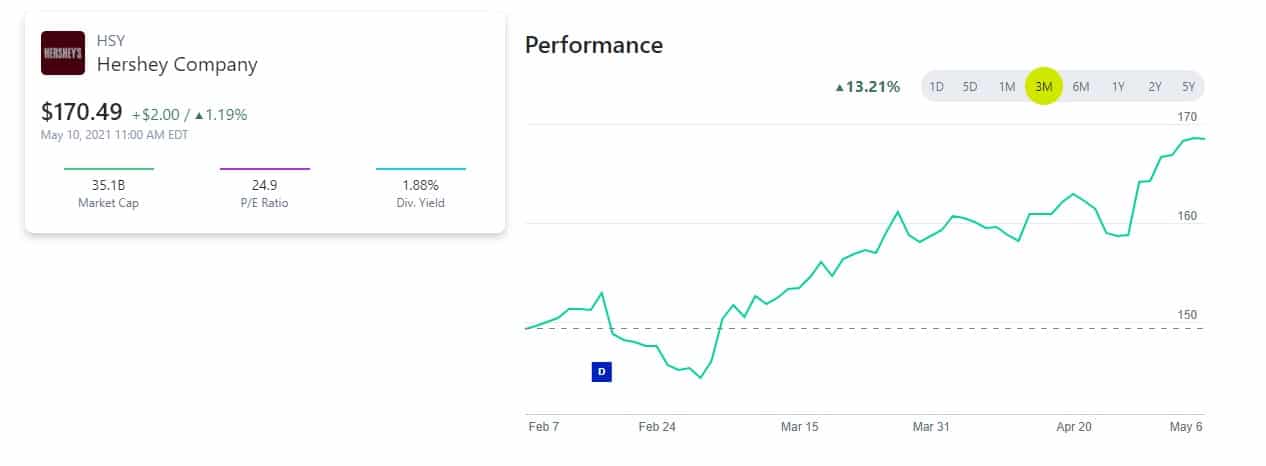

The analysis of investments available through the M1 app is very basic. For beginners, this would help to make the app less daunting. However, if you are an intermediate or more sophisticated investor, looking for a more in-depth analysis of your investment decisions, then you may need to look elsewhere before choosing the investments to make up the slices in your pie.

There are also basic charting tools for technical analysis. The analysis is limited to price history.

M1 Finance App Account Types

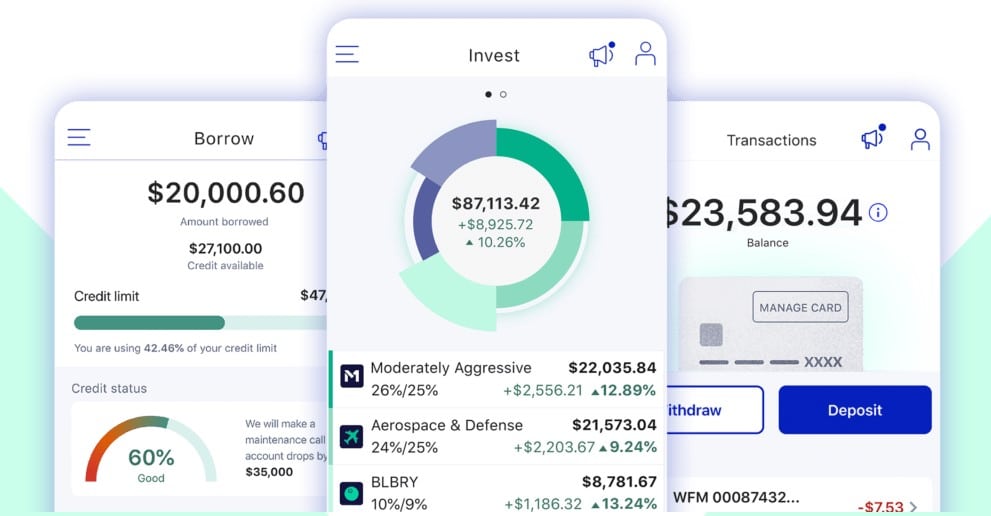

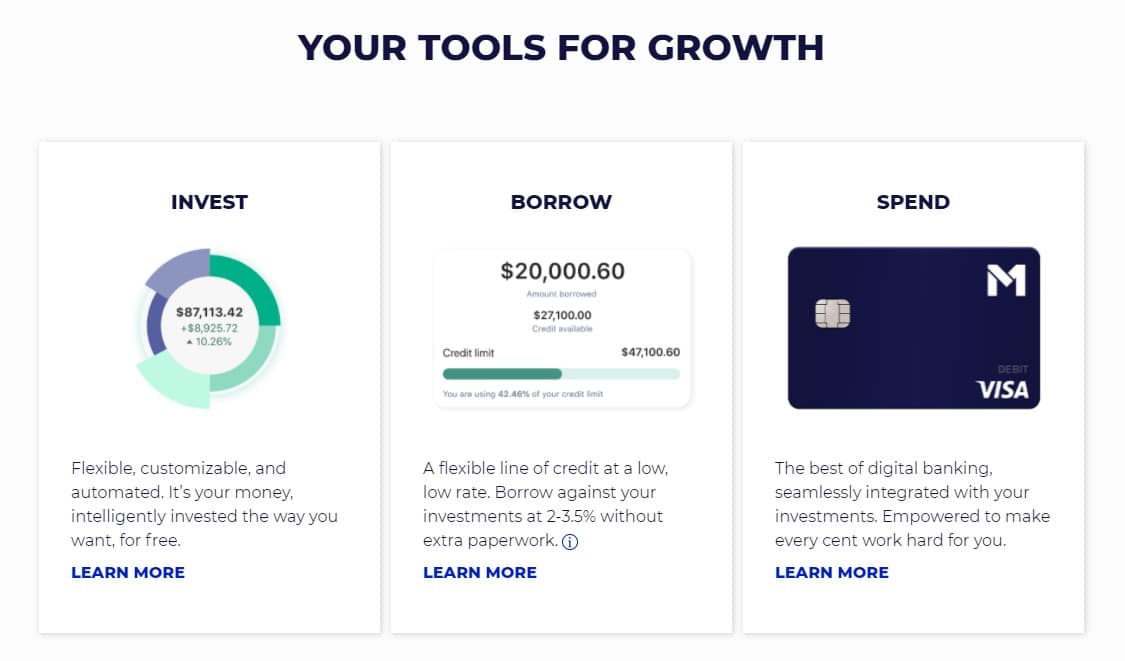

Our M1 Finance review of the account types showed there are three elements to the app:

- M1 Invest – investing in stocks and ETFs

- M1 Spend – a depository account

- M1 Borrow – investors can borrow up to 35% of their investment account

In addition to these three elements, there is also a premium service called M1 Plus.

Let’s take a look at these in more detail.

M1 Invest

Investment in stocks and ETFs is the primary function of the M1 app. However, there are several ways that accounts can be set up. You can have traditional brokerage accounts, accounts for retirement, in addition to accounts as a custodian and a trust.

- Brokerage Account – Accounts used to buy and sell stocks and ETFs. These can be both individual and on a joint basis.

- Retirement Account – Individual Retirement Accounts (IRAs) can generate tax benefits in saving for retirement. These include Traditional IRA, Roth IRA, and Simplifies Employee Pension IRA.

- Custodian Account – an account set up to benefit a minor. Notably, the funds are an irrevocable gift until the minor reaches maturity.

- Trust Account – setting up a trust account requires additional paperwork and a minimum account value of $5000.

M1 Spend

The digital banking side of the app allows you to use the M1 app as a traditional banking app. There is also a debit card that can be used for purchases.

M1 Borrow

One of the impressive features of the M1 Finance app is the function to borrow money against your investments. The rates are incredibly low and you can borrow up to 35% of the value of your portfolio (as long as you have at least $5000 invested). The borrowing rate of the M1 Basic account is 3.5% but is even lower at just 2% on M1 Plus. Here the website shows how these rates compare to its competitors.

M1 Plus

This is the premium service of the M1 app. For a fee of $125 per year, M1 Plus gives perks on the various account features across the Invest, Spend and Borrow services. Some of the benefits include:

- Lower borrowing rates on M1 Borrow

- Cash Back on qualifying debit card purchases on M1 Spend

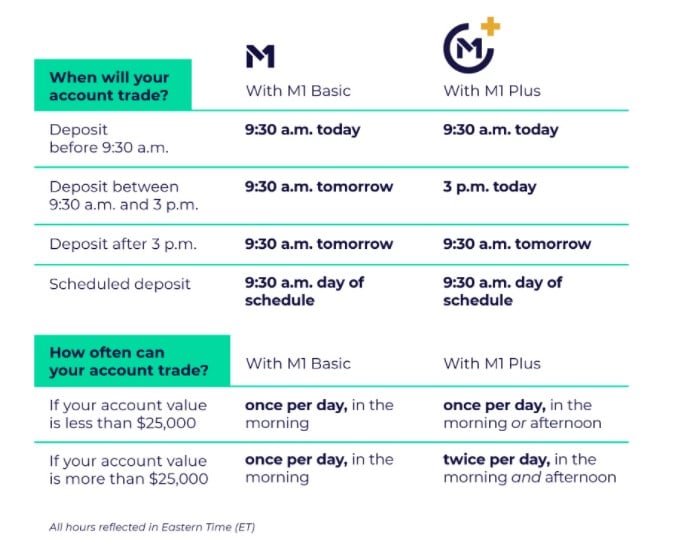

- Two Trade Windows for account holders with more than $25,000 equity in their M1 Invest portfolio. Account-holders on the basic account get just one “Trade Window” in the morning starting at 9:30 am. Plus account holders have an additional window in the afternoon, starting at 3 pm. Here is how investment deposits are treated on the Plus account.

M1 Finance App Review

The M1 Finance app is excellent and is great for beginners. The design is very simple to navigate and has strong usability.

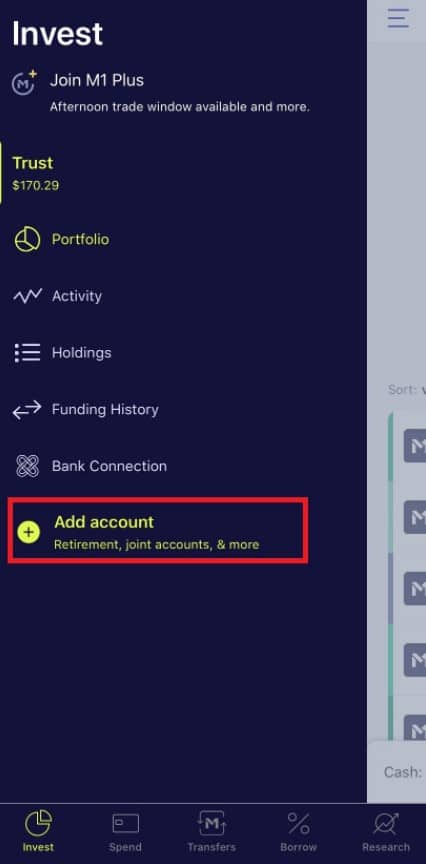

By clicking into the Invest homepage you can quickly move to view your portfolio, account activity and analyse your holdings.

If you want to make changes to the pie, you can move into the Research tab you can change or add new slices to your portfolio. You can edit pies that you have not added and easily change the proportions of each holding.

Via the app you can also very easily:

- View stocks and ETFs analysis under the Research tab

- View newsflow from media outlets

- Access M1 Borrow and M1 Spend functions

M1 Finance Payments

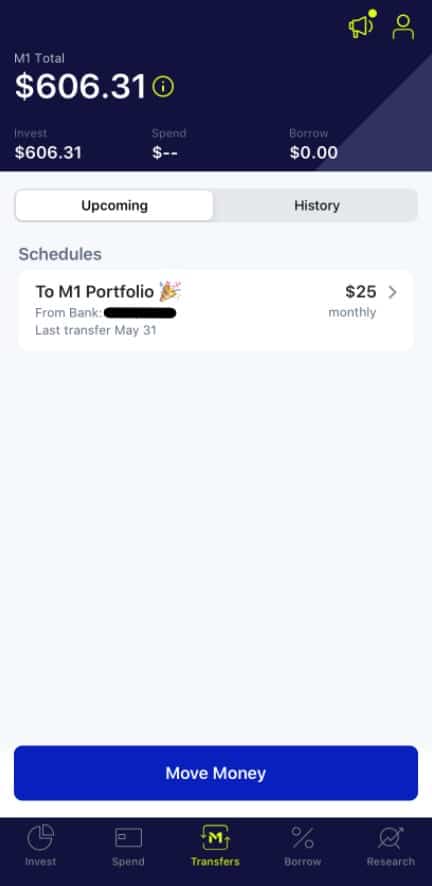

With the fully automated system of M1, you can set up direct debit payments into the account. You can do this via the “Transfers” tab on the app. Set up a connecting bank to either schedule money transfers, or do one-off payments.

Once the money is cleared into the account, then the portfolio automatically invests the money via the “Dynamic Rebalancing” to spread your payments across your portfolio.

You can also wire money into M1 Invest for free. However, to wire money out of M1 Invest will cost you a charge of $25. There are no other payment options.

M1 Finance Minimum Deposit

There is no minimum deposit for a basic account with M1 Invest. There is also and no minimum account size to open or run the account. This is unlike other robo-advisor accounts. There are minimum account sizes for accounts with Charles Schwab ($5000) and Vanguard ($3000). There is a nominal $10 account minimum for Fidelity.

| Broker | M1 Finance | Charles Schwab | Fidelity | Vanguard |

| Robo-Advisor Account | M1 Invest | Intelligent Portfolios | Fidelity Go | Digital Advisor |

| Minimum account size | No minimum | $5000 | $10 (to trade) | $3000 |

However, we should note that this no minimum account size condition for M1 is not the case for every account. Investors who are looking to set up some special accounts will find a minimum account limit. There are minimum account sizes on certain accounts:

- Taxable account – $100 minimum

- IRA account and Roth IRA account – both $500 minimum

However, even these limits are much smaller than those of Charles Schwab and Vanguard.

M1 Finance Bonus

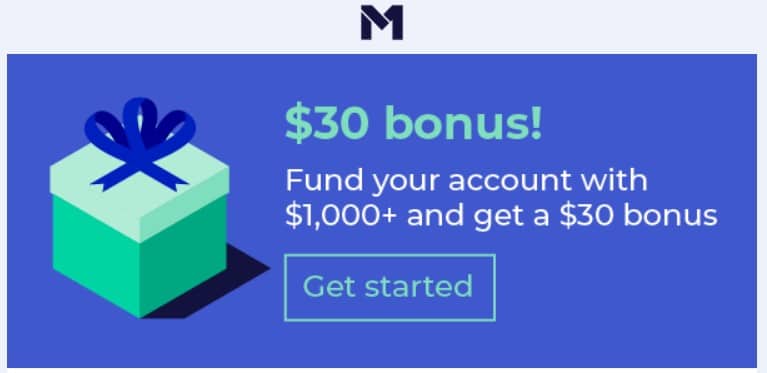

As part of this M1 Finance review, we found that there were bonus payments are available during the client onboarding process. There are bonuses for funding the account, as well as transferring in investments from another broker.

Sign-up Bonus

When we signed up for M1 Finance, we were offered a bonus payment. If we funded the account with $1000 or more, then we would receive a $30 bonus.

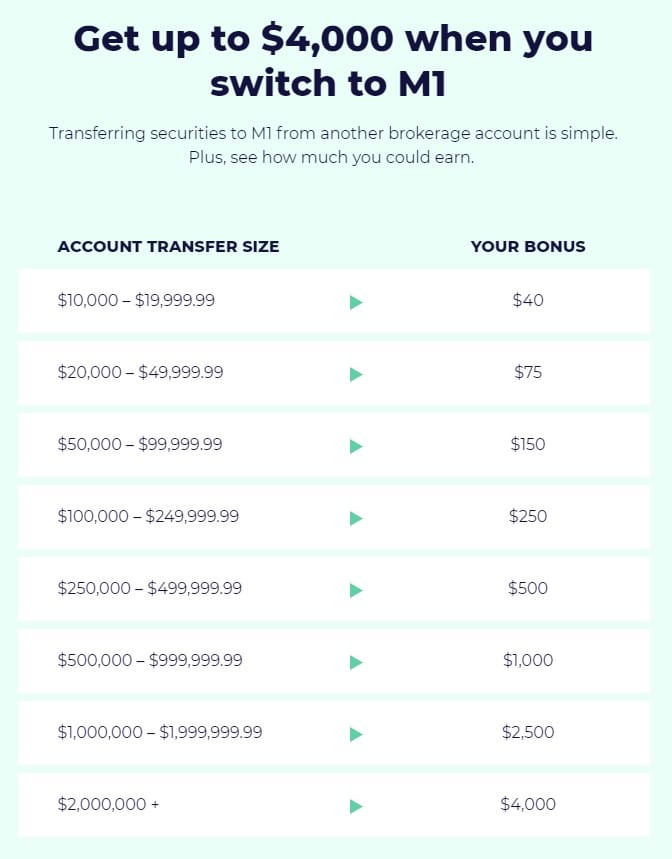

Transfer Bonus

There are also more considerable bonuses on offer for traders who transfer securities into the M1 account from another brokerage. The amount that you can be paid depends upon the size of the investments that you are transferring in.

Bonuses start from $40 (for transferring in over $10,000) and increase on a sliding scale up to $4,000 (for transferring in $2,000,000 and above). Here are the various bonus payments that you can earn.

Share Pie Bonus

You can also get a bonus when you refer a friend to open an account with M1. When you send someone your link, who then creates and funds a new M1 account, you will be paid a $30 bonus.

M1 Finance Demo Account

Our M1 Finance review showed that there is no specific demo account available for the M1 app. This means that there is no paper trading. With M1 you dive straight into live trading. This may sound a little daunting to newbie investors and we believe that for a technology that is a new way of trading, this is not ideal.

Despite this though, there are plenty of useful guides on the website explaining how to invest via M1. We also believe that the app is fairly straightforward, so hopefully, the lack of a demo account should not put off would-be investors.

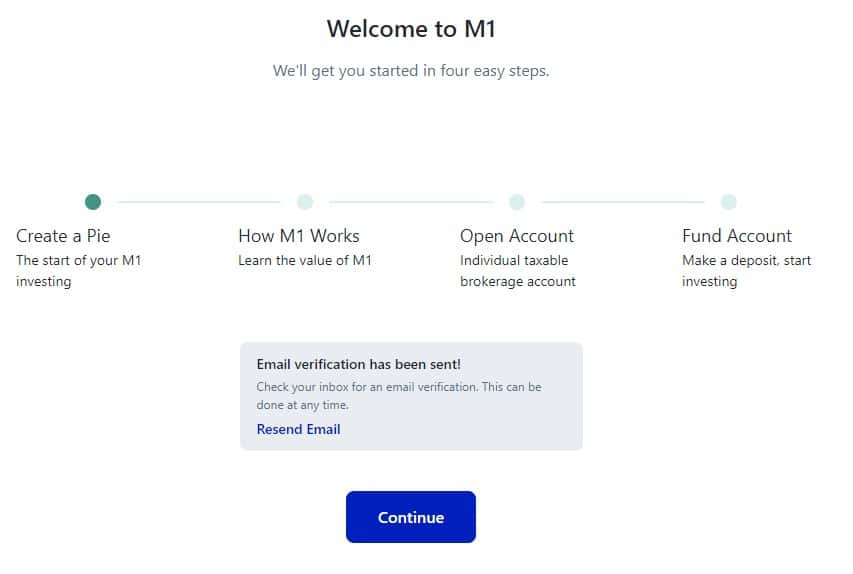

The closest thing to a demo account comes during the sign-up process where there is a quick how-to guide that doubles up as creating your first pie:

Step 1: Select your investments – use the search bar to choose from the 6,000 instruments available, or click on the example stocks, ETFs, and expert pies available.

Step 2: Choose your allocation – now choose how much of your portfolio you would like to be allocated in each specific investment.

That’s pretty much it on the demo side of things. This would be used by investors as a start-up tutorial and also this first pie is saved for you to use if you wish.

M1 Finance Contact and Customer Service

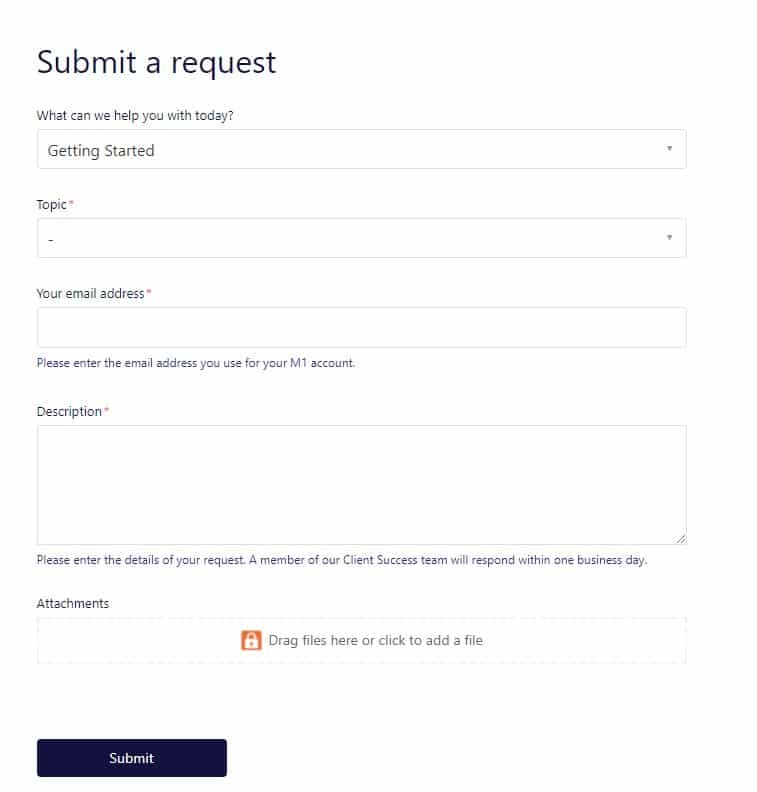

Once we located the contact us section on the website (it did take some digging) it became clear that if you need information from customer service there are a number of ways to contact them:

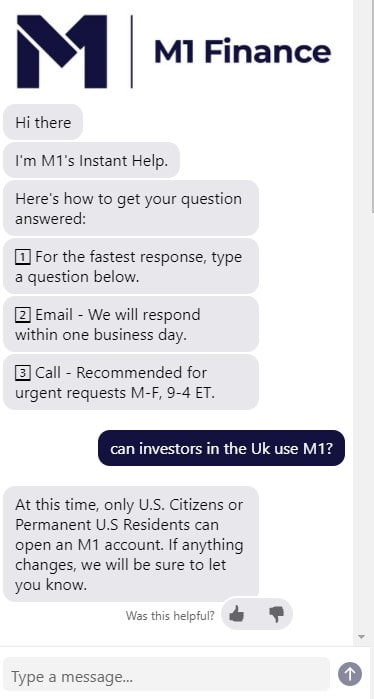

1. On-line chatbot – known as Instant Help. This is the usual chatbot technology that most brokers will provide as a service. The technology provides pre-determined answers to various topics. The response time was instant.

3. Telephone contact – The US contact number (312-600-2883) is available to callers on Monday to Friday from 9 am to 4 pm Eastern time. This means that investors are allowed to speak to someone only during stock market opening hours. According to the website, there is only around 20 staff in the office (it is a fairly new tech company after all). Despite this low number, ideally, the contact hours would be longer.

Overall, we believe that the contact and customer service for M1 Finance is fairly reasonable. We would also note that contacting a traditional stockbroker out of market hours can often be sporadic too.

Is the M1 Finance App Safe?

Is M1 Finance safe? M1 Finance is not a scam. The company has stringent regulation which helps to ensure that investor funds are fully protected on the app.

SEC-regulated with SIPC and FDIC protection

M1 Finance is a fully regulated broker-dealer registered by the SEC (Securities and Exchange Commission). The SEC is the US Government agency in charge of the protection of investors. This means that the M1 Finance app is a safe place for your money. As part of this, M1 Finance is a member of the SIPC (Securities Investor Protection Corporation). The SPIC is a non-profit corporation that covers the client funds of member firms if the broker goes into liquidation. For users of the M1 Invest account, client investments are covered up to $500,000 by the SIPC. This SIPC protection also covers investors on up to $250,000 of money sitting in their investment account.

M1 Finance is a member of FINRA (Financial Industry Regulatory Authority) which oversees broker-dealers. This means that investors are afforded regulatory protection, with M1 Finance needing to uphold certain values of being truthful, integrity, and not misleading to retain their license. Uses of the M1 Spend account also have cash sums of up to $250,000 covered by the FDIC (Federal Deposit Insurance Corporation).

Furthermore, as a technology company, M1 Finance keeps on top of cyber-security to give its investors added peace of mind.

How to Start Trading with M1 Finance

Signing up for the M1 app is an easy process. However, there are a few conditions that have to be met in order for you to trade. You need to:

- Be at least 18 years old

- Be a US citizen or permanent resident (with a Green Card)

- Have a current US mailing address and telephone number

If you don’t meet these criteria, you will need to look elsewhere to do your investing. However, for people who are able to set up an account, the sign-up is very simple.

Here’s how to sign-up:

Step 1: Create a login – select an email address for contact and choose a password. You will then simply need to confirm your email address to progress.

Step 2: Create your first pie – this step is just to take you through the process of choosing investments. It is effectively just a practice session, however, you can use it as a model for your live investing later on.

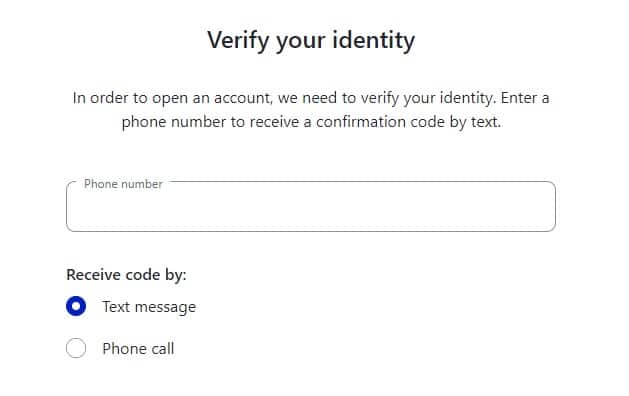

Step 3: Verify your identity – you will then be asked to add a telephone number.

Step 4: Add a bank account – now you will be asked to link a bank account in order to fund your trading account.

Step 5: Choose account type – You will also need to choose from the various account types:

- Individual or joint accounts

- Retirement accounts – IRA, Roth IRA, or SEP IRA

- Custodian account

- Trust account

Once you have chosen the account type and funded your account you can start investing.

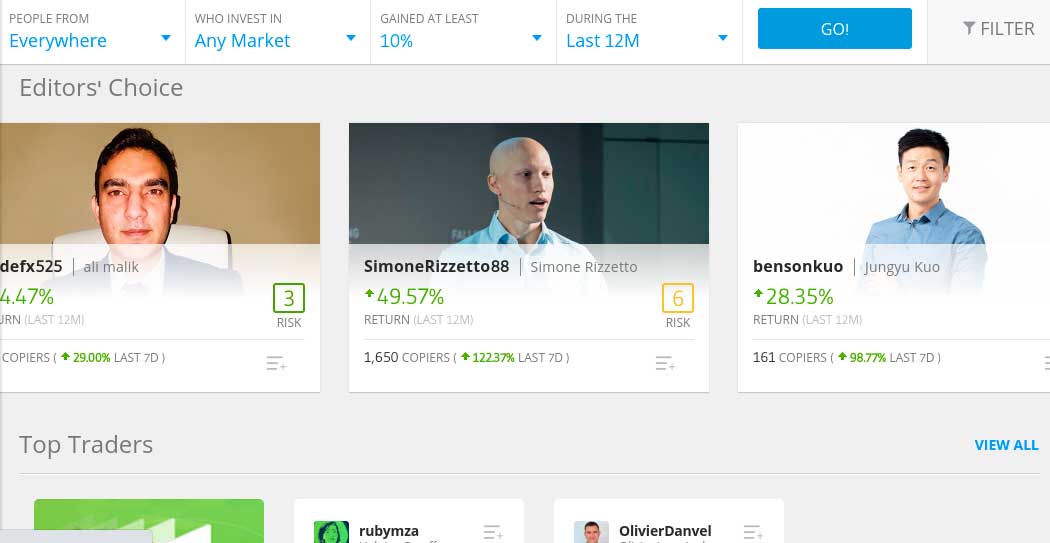

M1 Finance vs eToro

In our M1 Finance trading review, we found that the robo-advisor scores well in many departments. It is good for beginners, with low costs and the app has strong functionality. However, you need to consider whether the lack of variety in traded instruments is restrictive for you. So before signing up to M1 Finance, at tradingplatforms we would consider looking at eToro. Our M1 Finance review found that eToro is a much better option.

Past performance is not an indication of future results

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

In our M1 Finance vs eToro comparison here’s what we found:

- International traders: Only traders from the USA can use M1 Finance to invest. If you live anywhere else in the world then M1 Finance is not an option. Traders all over the world can use eToro.

- Traded instruments: With M1 Finance you are limited to trading just US stocks and ETFs. With eToro you can trade thousands of instruments across several asset classes including stocks, indices, ETFs, forex, commodities, and cryptocurrencies.

- Payments: There are limited payment options for M1, with only card payments and connected bank accounts free. With eToro, there are multiple payment options available including debit/credit card, e-wallet, and PayPal.

- Social Trading: There is no specific social trading aspect to M1 (although you can gain bonuses by referring a friend). However, eToro are pioneers in Social Trading and Copy Trading. This is a massive benefit of using the eToro platform.

M1 Finance Review: The Verdict

Looking at everything we have found during the M1 Finance review, we believe that the M1 app is a good robo-advisor account for investors to use. The functionality of the app is strong whilst building a portfolio is simple with both customisable and expert pies.

We like that there are zero M1 Finance fees for trading and zero account fees. We also think that the bonuses available for transferring funds into the account are very enticing. Being able to borrow up to 35% of your investment account at incredibly low rates of interest is another good feature of the account. Finally, if you are asking yourself the question, “Is M1 Finance safe for my money?” we believe that in reading this M1 Finance trading review, you can safely say, “Yes!”

Despite this, we believe that eToro offers investors a much better service. eToro has low costs with commission-free trading across many asset classes and tight spreads. The platform is simple to use and eToro is great for beginners. We also love the Social and Copy Trading features that eToro offers.

You can sign up to eToro in about 10 minutes by opening an account and depositing funds.

eToro – Best Trading Platform with Zero Commission to Trade ETFs

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.