Acorns vs Robinhood – Which Broker Is Best in 2026

If you’re new to the online trading scene you will undoubtedly have come across thousands of brokers, all offering different features and products. Choosing the right trading platform is crucial.

In this Acorns vs Robinhood comparison, we examine everything from fees and commissions to mobile apps and safety. Read on to find out which online broker is right for you!

Acorns vs Robinhood Comparison

Acorns

Visit SiteInvesting involves risk, including loss of principal. Past performance does not guarantee or indicate future results. Please consider, among other important factors, your investment objectives, risk tolerance and Acorns pricing before investing.......

What are Acorns and Robinhood?

Acorns is not a traditional brokerage firm, instead, it specializes in automated trading and micro-investments. Acorns offer five different investment portfolios which are designed to maximize returns depending on your risk tolerance and your trading goals.

In addition to no account minimums, Acorns does not charge commission. Instead, this online broker offers a trading experience and service that is completely automated and driven by algorithms.

And is Robinhood legit? Robinhood is also a US-based broker that was founded in 2013 and offers a bunch of investment options. In terms of the fundamentals, this online investment platform is regulated by the US Securities and Exchange Commission and is a member of the Financial Industry Regulatory Authority.

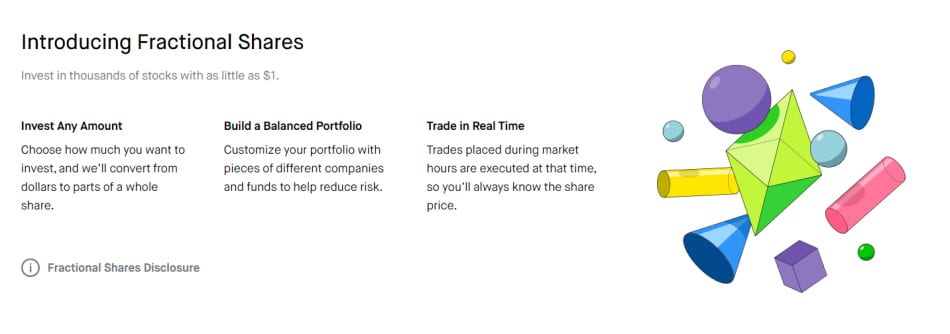

Robinhood provides access to stock, ETF, options, and crypto trading. As well as commission-free ETF and US stock trading, this broker has low non-trading fees and even offers an automated trading service called ‘Recurring Investments’. The popularity of low-cost trading is growing as more new investors enter the trading scene. As such, Robinhood offers fractional shares which means you can buy individual stocks with as little as $1.

Acorns vs Robinhood Tradable Assets

When you set up a profile with Acorns app, its algorithm will recommend an investment portfolio based on the goals and information you enter. An Acorns portfolio is made to maximize any potential returns depending on your level of risk tolerance.

Your funds are then invested automatically into twelve separate ETFs. These exchange-traded funds cover bonds, stocks, and other assets.

With Acorns there are two ways to invest your money:

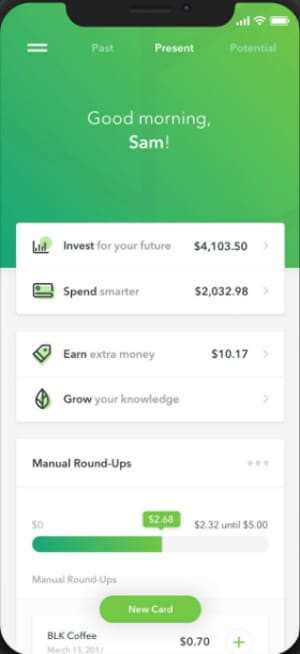

- Acorns Invest – is a micro-investing account that trades using spare change from your linked bank account. Every time you spend money, Acorns rounds it up to the nearest dollar and invests that amount into your trading account. For instance, if you spend $10.50 at a coffee shop, the Acorns Round-up feature would round it up to $11 and the extra 50 cents would be added to your trading balance.

- Acorns Later – offers automated services to save for retirement.

The ETFs that Acorns offers are as follows:

- iShares Core S&P Mid-Cap ETF | IJH

- iShares Core S&P Small-Cap ETF | IJR

- Shares Core MSCI Total International Stock | IXUS

- Vanguard 500 Index Fund ETF Shares | VOO

- iShares Core U.S. Aggregate Bond | AGG

- iShares Core 1-5 Year USD Bond | ISTB

- SPDR® Bloomberg Barclays 1-3 Month T-Bill ETF | BIL

- Goldman Sachs Access Treasury 0-1 Year ETF | GBIL

- iShares Ultra Short-Term Bond ETF | ICSH

- JPMorgan Ultra-Short Income ETF | JPST

- iShares Short Treasury Bond ETF | SHV

- iShares ESG Aware MSCI USA ETF | ESGU

- iShares ESG Aware U.S. Aggregate Bond ETF | EAGG

- iShares ESG Aware MSCI EM ETF | ESGE

- iShares ESG Aware MSCI USA Small-Cap ETF | ESML

- iShares ESG Aware 1-5 Year USD Corporate Bond ETF | SUSB

- iShares ESG Aware MSCI EAFE ETF | ESGD

- iShares 1-3 Year Treasury Bond ETF | SHY

- iShares MSCI USA ESG Select ETF | SUSA

- iShares U.S. Treasury Bond ETF | GOVT

- iShares MBS ETF | MBB

- iShares ESG Aware USD Corporate Bond ETF | SUSC

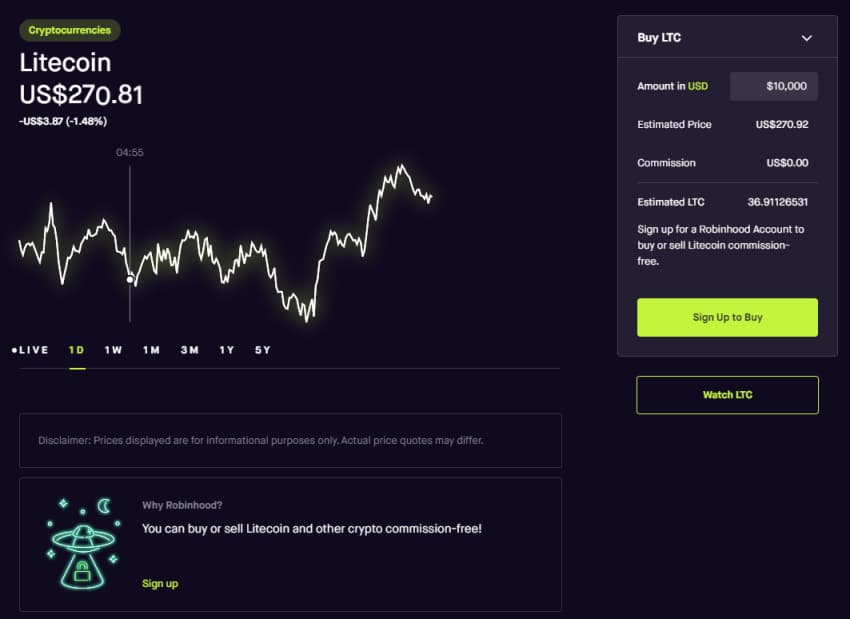

Robinhood allows you to buy and sell financial instruments including stocks, options, ETFs, and cryptocurrencies. For traders with a preference in digital currency trading, you will be pleased to find out that Robinhood offers 7 different cryptos thus giving you access to the likes of commission-free Ethereum trading. Other cryptos include:

- Ethereum Classic

- Bitcoin SV

- Bitcoin Cash

- Bitcoin

- Dogecoin

- Litecoin

Robinhood provides roughly 5,000 ETFs and stocks which are mostly listed on the top stock exchanges in the United States. You can also gain access to some international stock markets which are provided via American Depositary Receipts.

When it comes to options trading, you are limited to just stock and stock index options which are only available for major stocks.

Acorns vs Robinhood Account Types

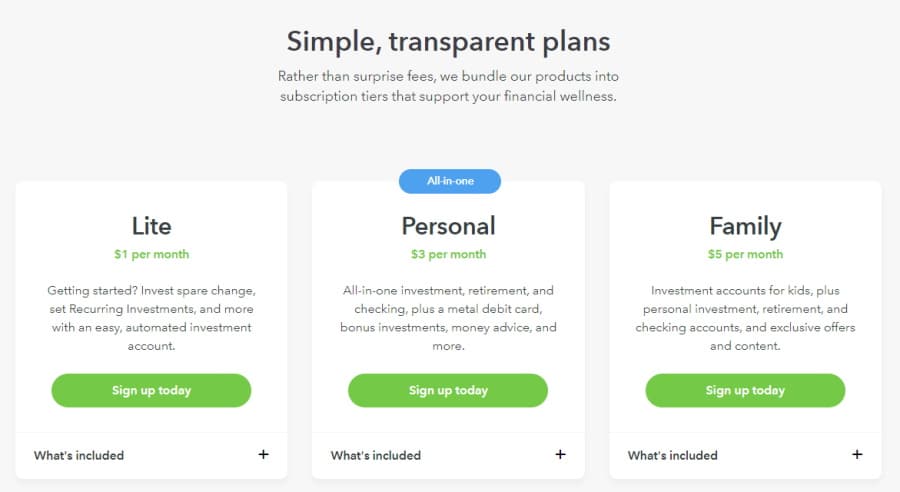

With Acorns, you can choose between 3 different subscription options depending on your trading objectives and financial needs.

- Acorns Lite is an automated trading account and comes with a $1 per month subscription fee. As we have already mentioned you can use your spare change to fund your account with the Acorns Round-ups feature.

- Acorns Personal comes with a $3 per month fee and is an investment, retirement (IRA account), and checking account all rolled up into one.

- Acorns Family provides a custodial account (UTMA/UGMA) and costs $5 each month.

To summarize, Acorns offers standard investment accounts, retirement accounts, checking accounts, and investment accounts for kids.

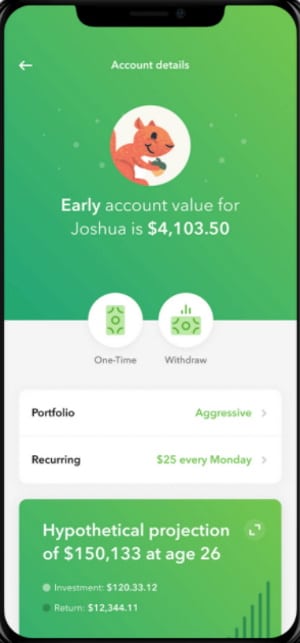

Opening an Acorns account is fully digital and simple. There are no minimum deposits required to open an account with Acorns, however, to start investing you need to fund your brokerage account with the Round-ups feature or with a one-time investment of $5. Acorns also gives you the option to use Recurring Investments which start at $5 and you can set the frequency to daily, weekly or monthly.

Let’s turn our focus to Robinhood now. When you sign up with Robinhood by default you open a Robinhood Instant account. There is no minimum deposit required to open an Instant account but you can upgrade to a Robinhood Gold account at any time with a $2,000 minimum deposit and a $5 monthly fee. It’s worth noting here that retirement (IRA) accounts are not provided with this broker.

- A Robinhood Cash account gives you access to Instant Deposits up to the initial $1,000. Nevertheless, any amount above that $1,000 limit will take longer to process and you also do not have access to trading with unsettled funds. Downgrading to a Cash account from an Instant or Gold account can be executed at any time.

- A Robinhood Instant account is a margin account that gives you access to instant deposits of any amount up to $1,000 as well as extended-hours trading. You’ll be able to trade on unsettled funds from securities that you sell.

- A Robinhood Gold account offers larger instant deposits and greater buying power through margin trading. Robinhood Gold provides level II Data and market data and research, with a $5 monthly subscription fee.

When it comes to day trading, you are restricted to three-day trades per week, by Pattern Day Trading regulations, with instant and gold accounts. If you have an account balance lower than $25,000 and execute more than 3 day trades your account will be barred for 90 days. Despite there being no such limits when using a Cash Account, day trading is practically redundant as you will have to wait at least 3 days for settlement after you have sold securities to use any profits.

Acorns vs Robinhood Fees & Commissions

As we have already mentioned, Acorns provides three separate subscription tiers to suit your trading and financial goals. Acorns Lite has a $1 monthly subscription fee, Acorns Personal has a $3 per month fee and Acorns Family has a $5 per month subscription fee.

Acorns Invest offers an automated trading service that invests your spare change allowing you to invest in 5 different ETF portfolios for as little as $5. Your investments are diversified across thousands of ETF stocks and bonds, and in terms of rebalancing, this is also automated depending on your trading goals and risk threshold.

If you use an Acorns Spend account, which is a checking account, you have the ability to save, invest and make returns while spending money. There is no overdraft limit or minimum balance fees, and you also get access to Allpoint ATMs.

Account management fees are fees that an advisor or robo-advisory service charges to manage your investment account. Acorns charges a linear rate as opposed to a percentage of the assets. Fixed rates are typically beneficial for traders with large account balances.

For example, let’s say that you open an Acorns Lite account with a $1 per month account management fee. If you have an account balance of $100 this management fee becomes 12% of your annual management fees. On the flip side, if you have an account balance of $10,000 this $1 per month subscription fee becomes 0.12% of your annual management fees.

There is no minimum deposit to open an Acorns account, but you need at least $5 to start investing in one of the five pre-built ETF investment portfolios. If you want to transfer your investments to another brokerage firm, there is a $50 per exchange-traded fund charge. This is something you need to keep in mind because if you have ten ETFs and you want to transfer them to another broker you will incur a hefty $500 transfer fee.

Robinhood offers commission-free stock, ETF, options, and crypto trading. In terms of non-trading fees, these are also very low. For instance, there are no inactivity, deposit, or withdrawal fees.

Transferring securities from your Robinhood Financial account to alternative brokers can be done through the Automated Customer Account Transfers Service otherwise known as ACATS. You have the option to transfer all or a portion of your securities in either a full or partial ACAT transfer. There is a $75 fee when using ACATS to transfer securities.

When it comes to margin trading with Robinhood you will need a minimum deposit of $2,000 and there is a 2.5% APY charge.

| Inactivity fee | Deposit fee | Withdrawal fee | Account fee | Stock fee | ETF fee | USD margin rate | Transfer fee | |

| Robinhood | No | $0 | $0 | $5 fee per month for Gold account | 0% | 0% | 2.5% | $75 |

| Acorns | No | $0 | $0 | Lite – $1 per month

Personal – $3 per month Family – $5 per month |

n/a | 0% | n/a | $50 per ETF |

Acorns vs Robinhood User Experience

In terms of user experience, both brokers are designed for new investors. This is evident in the user-friendly interface and the lack of complex jargon and financial terminology.

Opening an account is simple, fully digital, and can be completed in a matter of minutes. Navigating your way around both trading platforms is simple and easy as well.

As with most robo-advisory services, Acorns makes the whole trading process automatic, giving the user access to a passive and hands-off way of investing. When you sign up with Acorns you will be asked to provide your age, financial and trading objectives, risk tolerance, total earnings, and time horizon.

Based on that data Acorns then recommends one of five investment portfolios ranging from aggressive, which is made up of 55% large company stocks, to conservative which is made up of 80% short-term government bonds and ultra-short-term corporate bonds.

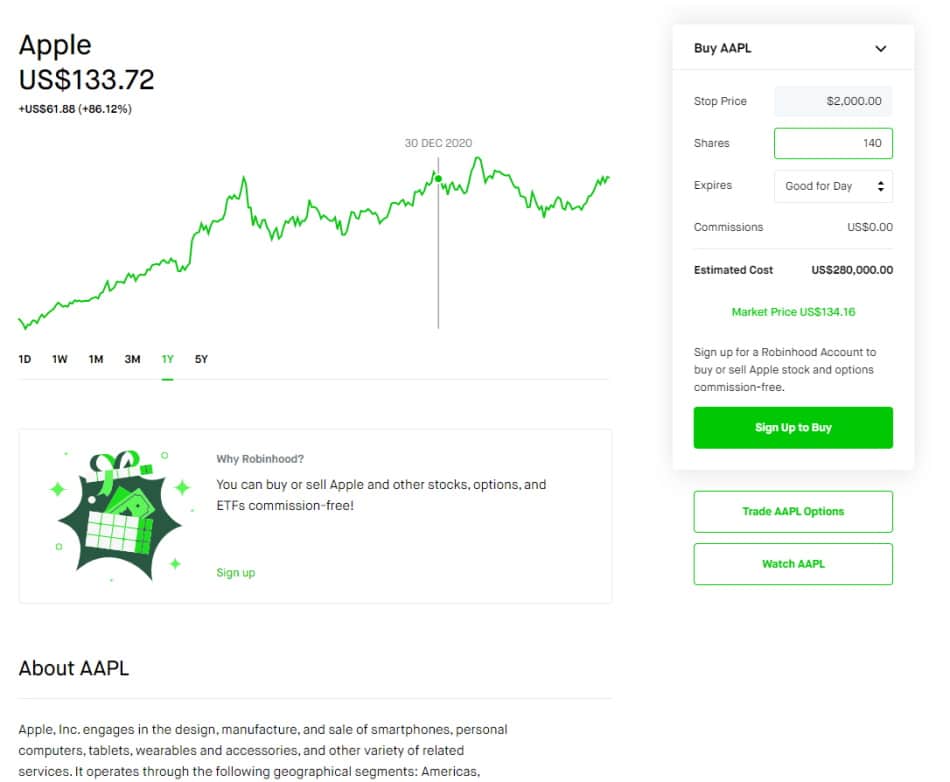

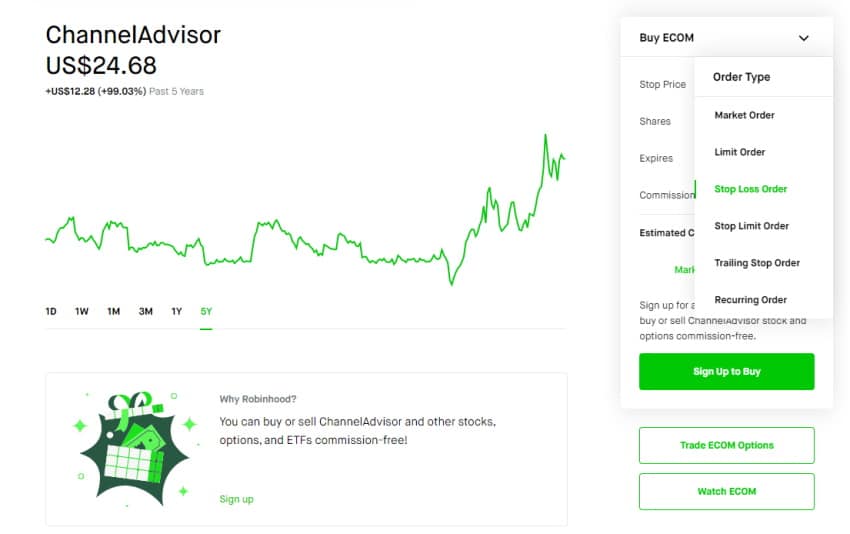

Robinhood offers a fully-fledged web trading platform that is very user-friendly and simple. This is evident from the very first moment you land on the page with a well-designed layout and good search functionality. On the downside, you cannot customize charts and the trading dashboard which some advanced traders may find annoying.

The search functions provide relevant results allowing you to find exactly what you are looking for 100% of the time. Furthermore, if you click on a stock you can gain access to related tags by clicking on the collections button. By tapping on a tag, Robinhood will present stocks with the same tag which is a useful feature if you wanted to compare similar stocks.

Robinhood also makes placing an order type, such as market orders and stop-loss orders, very easy. You can also set a range of price alerts and push notifications for different events from earnings announcements to price movements.

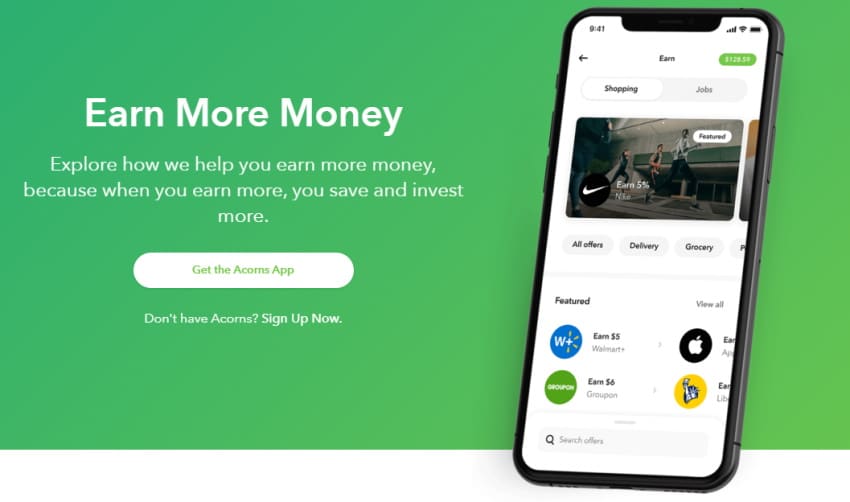

Acorns vs Robinhood Mobile App

Both Acorns and Robinhood allow you to invest via a mobile investment app. These are compatible with both Apple and Android devices, allowing you to stay in the loop regardless of where you may be.

Acorns, which is now home to more than 8 million users, offers a mobile trading app that is very similar to the web platform. You can invest your spare change with the Round-ups feature, invest for your children using Acorns Early (a UTMA/UGMA investment account), and widen your trading knowledge with custom financial content provided by CNBC and the broker itself, all from the comfort of your own mobile device.

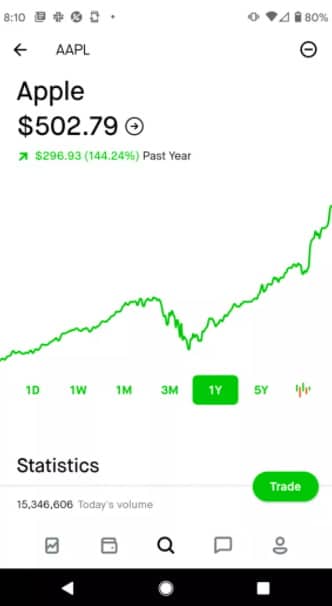

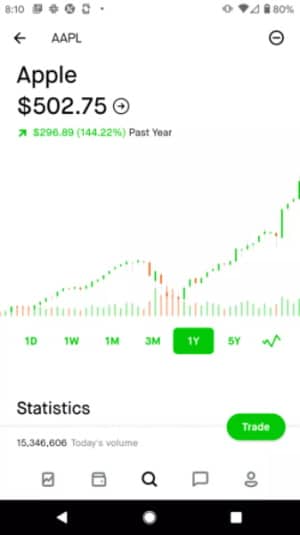

Robinhood provides a mobile trading app that closely reflects the functionality and user experience of the web trading platform. It uses a two-step authentication login process which is great for logging in and out securely.

In terms of functionality, when using the Robinhood app you can search for your favourite stocks, cryptos, and other assets using the search bar, and, if you have a Gold account you can access Nasdaq level II market data in real-time, and other research tools such as trading ideas from Morningstar, all from your mobile device.

Acorns vs Robinhood Trading Tools, Education, Research & Analysis

Acorns vs Robinhood Trading Tools, Education, Research & Analysis

As both brokers are targeted towards beginner traders they both provide a range of educational materials.

Acorns provides content that it creates in-house as well as from third-party providers including CNBC. Simply, click on the ‘Education’ tab at the top of the screen and choose between ‘Money Basics’ and ‘Grow Magazine’. Both these educational resources offer relevant information to help you build your understanding of investing and online trading.

The same can be said for Robinhood. To access the educational materials, simply click on the Learn tab at the top of the page and choose between investing basics, a library of content, and ‘Snacks’. With ‘investing basics’ and ‘library’ you can access everything you need to build your online trading knowledge. The ‘Snacks’ feature is a daily newsletter covering all the key financial news for the day. All you need to do is enter your email and click subscribe.

When it comes to trading ideas, Robinhood offers analyst ratings of various securities to help you make informed trading decisions. These analyst ratings reveal how many experts rate the assets as hold, sell or buy.

If you are interested in fundamental analysis and data then you can access some basic metrics including price-earnings ratios, market cap, and dividend yield. Robinhood also offers fractional shares which means that you can invest in some ETFs and stocks that are valued at thousands of dollars per share with just $1.

Investing in fractional shares is a great way to maximize your portfolio diversification without spending large amounts of money on expensive shares.

Acorns vs Robinhood Demo Account

A demo account, otherwise referred to as a paper trading account, gives you the ability to trade with virtual funds. Therefore, demo accounts give you a realistic online trading experience without the added risk of losing your money.

During our research, we found that both brokers do not offer demo accounts.

Acorns vs Robinhood Payments

Acorns Spend is a checking account that was developed with Lincoln Savings Bank. After opening an Acorns Spend account your account is linked to an Invest or Later account with the broker.

When it comes to depositing cash you can do so by depositing funds into your connected primary checking account and then you can transfer the funds directly to your Acorns Spend account.

With an Acorns Spend checking account there are no account fees and you have access to tens of thousands of fee-free ATMs. You can also transfer funds to your Spend checking account from a PayPal e-wallet.

Withdrawing money from your Acorns checking account can take between 3 and 5 working days due to the settlement period of 2 days.

In terms of Robinhood’s payment options, your funds arrive instantly when using the instant deposit feature. Alternatively, you can expect funds to arrive in your account after 4 to 5 business days. However, there are some limitations: if you are using an Instant account you are allowed to deposit any sum up to $1,000 straightaway, whereas Gold account holders are limited to a $50,000 instant deposit. You can only deposit funds via bank transfers as credit cards, debit cards, and e-wallets are not supported payment methods. If you want to withdraw funds from your account, you will be happy to hear that there are no fees for ACH withdrawals, but it can take 3 business days to process.

| Minimum Deposit | Deposit Fee | Processing Time | Withdrawal Fee | |

| Acorns | $0 | FREE | 2-3 business days | FREE |

| Robinhood | $0 | FREE | Instant, depending on account type | FREE |

Acorns vs Robinhood Customer Service

Acorns customer support can be reached by submitting a request or accessing the Acorns Support virtual assistant.

When it comes to submitting a request, you have to choose from a list of potential issues and then fill in your contact details such as email address and phone number. It usually takes 1 business day to receive a response and the answers are relevant and straight to the point.

It’s the same story when you go to Robinhood as well. Customer services can only be reached via email by submitting a request. After you have chosen a topic and given a brief description of your query you can expect an answer within one business day.

Robinhood vs Other Brokers

Overall, Robinhood is better suited to beginners with little trading experience who want to trade US shares and ETFs without paying a penny in commission. If you’d like to see how Robinhood does when pinned against other top brokers be sure to check out these comparison reviews as well!

- Robinhood Review

- Stash vs Robinhood

- Coinbase vs Robinhood

- Webull vs Robinhood

- M1 Finance vs Robinhood

- Fidelity vs Robinhood

- Robinhood vs Charles Schwab

- Robinhood vs Ally Invest

- TD Ameritrade vs Robinhood

Acorns vs Robinhood Safety & Regulation

With regards to safety and regulation, both brokers are regulated by top financial authorities including the US SEC and FINRA.

Robinhood and Acorns are members of the Securities Investor Protection Corporation which protects client funds up to $500,000 including $250,000 for cash claims.

In terms of protection, it’s important to note here that Robinhood Crypto LLC is not a member of the Financial Industry Regulation Authority and therefore its clients are not covered by the US investor protection scheme.

Acorns vs Robinhood – The Verdict

All in all, if you are looking for an investment app for [cur_year, both Acorns and Robinhood are good options to consider. However, Robinhood is better suited to experienced investors who may want to conduct their own research and analysis. Meanwhile, Acorns is suitable for less-experienced investors who can invest in ready-made accounts and portfolios instead of conducting research into individual stocks.

Before choosing an investing app, we recommend conducting your own research into both options.

Your capital is at risk.

Acorns vs Robinhood Trading Tools, Education, Research & Analysis

Acorns vs Robinhood Trading Tools, Education, Research & Analysis