6 Best Commodity Brokers of July 2025

If you’re looking to trade the likes of crude oil, gold, silver, natural gas, and wheat, you will need to find a top commodity trading platform. On top of supporting the commodities that you wish to access, the platform must also offer competitive fees and commissions, as well as a sufficient number of trading tools and indicators.

To help clear the mist, this guide reviews the best commodity brokers to consider in 2025.

-

-

Top Commodity Trading Platforms in 2025

- Plus500: Plus500 is a popular CFD brokerage platform that offers CFD commodities. You can trade with leverage of up to 1:30 and deposit funds with bank transfers or debit/credit cards. Plus500 is a popular choice because it is regulated in several jurisdictions.

- eToro: eToro is one of the best commodity trading platforms that supports more than 40 commodity markets. Amongst the commodities available include gold, silver, wheat, oil, cotton, and cocoa. As well as supporting commodities, eToro can be used to trade stocks, cryptos, forex, and indices. It is a popular platform amongst beginners as it offers social trading and copy trading features.

- Libertex: While it doesn’t cover agricultural products, Libertex provides access to numerous hard metals and energy products. The main reason that Libertex stands out from other options is that it offers low fees and tight spreads on all assets. The platform is also compatible with third-party charting tools for more advanced traders.

- TD Ameritrade: TD Ameritrade is a widely used stock app that also offers commodity derivatives. including gold, silver, and oil. Traders can also use the platform to trade futures and CFDs.

- Interactive Brokers: Interactive Brokers offer commodity derivatives including futures and options. The platform covers commodity markets in Asia, Canada, the US, and Europe as well as several other prominent countries around the globe. Users can access technical analysis tools and trade with no minimum deposit.

- Trading 212: Trading 212 is a well-known stock trading platform that also provides access to over 100 commodity CFDs. The broker is user-friendly and offers a demo account that can be used to test different strategies before putting real money at risk.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

What is Commodity Trading?

Commodity trading involves buying and selling financial instruments that represent physical assets such as metals, oil and wheat. The instruments that are traded reflect the underlying assets and fluctuate depending on supply and demand.

Similarly to traditional stock trading, commodity traders profit when the value of long term investments go up or when they correctly predict price movement and place trades accordingly.

Online commodity trading typically involves buying an instrument that represents the asset, rather than buying the asset itself. This is because commodities can be difficult to store and sell in their physical form.

The most popular instruments to trade commodities are futures, ETFs and CFDs. Futures allow traders to speculate on the future price of commodities through pre-determined contracts. ETFs are funds that track the value of a basket of assets. Meanwhile, CFDs are another type of contract that enable traders to speculate the price movement of an asset without owning the underlying asset.

Commodity trading platforms often cater to different types of trading however, some will specialize in just one type of commodity trading.

A Closer Look at The Best Commodities Brokers

There are many trading platforms that allow you for commodity trading online from the comfort of your home.

Whether you’re interested in hard metals trading, such as gold trading and silver trading, energy trading on oil stocks, or agricultural products like coffee commodities, wheat stocks, corn stocks or sugar stocks – there are many metrics that you need to explore before choosing a provider.

On top of fees, regulation, supported markets, payments, and customer support – you also need to consider the specific financial instrument that you will be trading – such as CFDs, futures, or options.

To save you countless hours of research, below we review the very best commodity trading platforms of 2025.

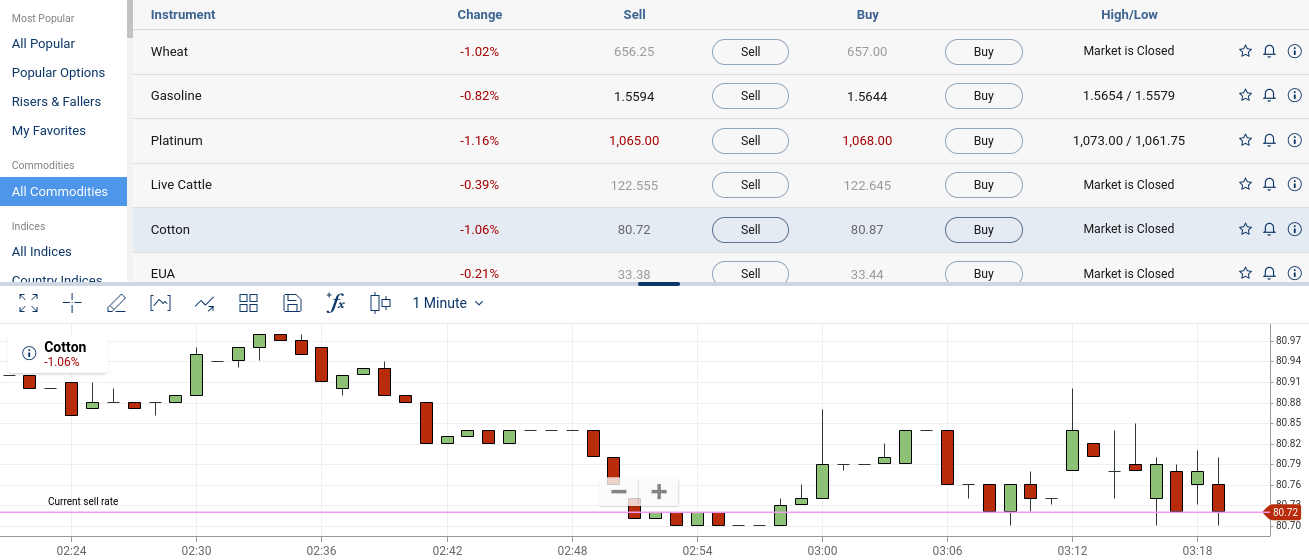

5. Plus500 – One of the Biggest CFD Commodity Trading Platforms for Beginners in the UK

Plus500 is a popular online trading platform that provides access to commodity futures and options in the US on the Plus500Futures platform. For traders outside of the US, the brokerage can also be used for CFD trading.

This provider offers an abundance of commodity CFDs from a variety of sectors. In the case of energies, you can trade everything from heating oil, Brent oil, gasoline and natural gas.

You can also trade agricultural markets like live cattle, cotton, soybeans, and cocoa. If hard metals are what you are after, Plus500 supports gold, silver, palladium, copper, and more. Plus500 even offers CFD markets on commodity options. This covers oil, gold, and natural gas – all of which come with various strike prices and expiry dates.

These financial derivative products allow you to trade your chosen commodity market in a much more flexible and sophisticated manner. And of course, as a top-rated CFD provider, you can also trade with leverage. In accordance with the ESMA regulations, the maximum leverage that Plus500 offers is 1:30.

The platform supports debit/credit cards, Paypal, and bank transfers with a minimum of $100.

Once you are set up, you trade commodities on the Plus500 or via the provider’s mobile app. This is available on both iOS and Android and is fully optimized for your respective device. Finally, Plus500 has a great reputation in the CFD trading scene, with several regulatory licenses under its belt.

Plus500 fees

Fee Amount Commodities trading fee Variable spread Forex trading fee Spread. 1.3 pips for GBP/USD Crypto trading fee Spread. 4.11% for Bitcoin Inactivity fee £10 per month after three months Withdrawal fee Free Pros:

- A commission-free trading policy

- Over 2800 CFD trading markets available to non-US citizens

- Tight spreads

- In-house trading platform, available on web browsers and mobile phones

- Leverage trading is available to non-US clients

Cons:

- No social trading tools

- US traders can only access futures and options

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

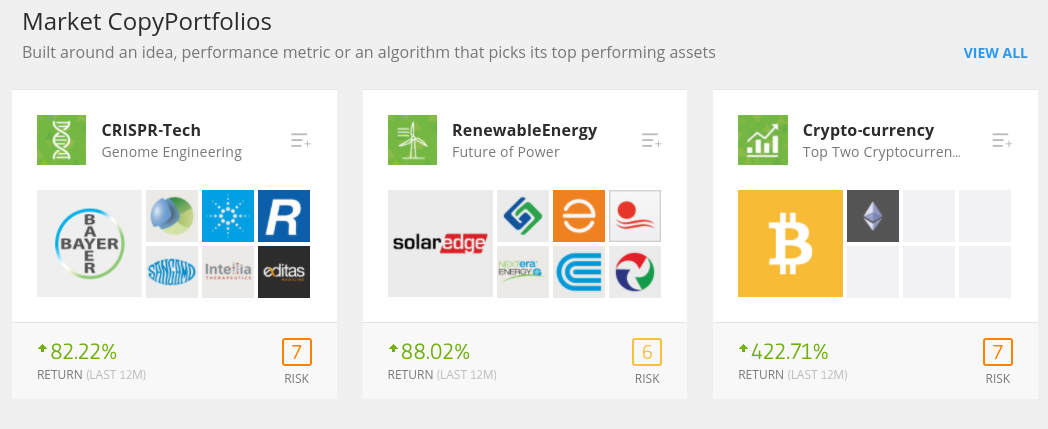

2. eToro – Overall Commodity Trading Platform 2025

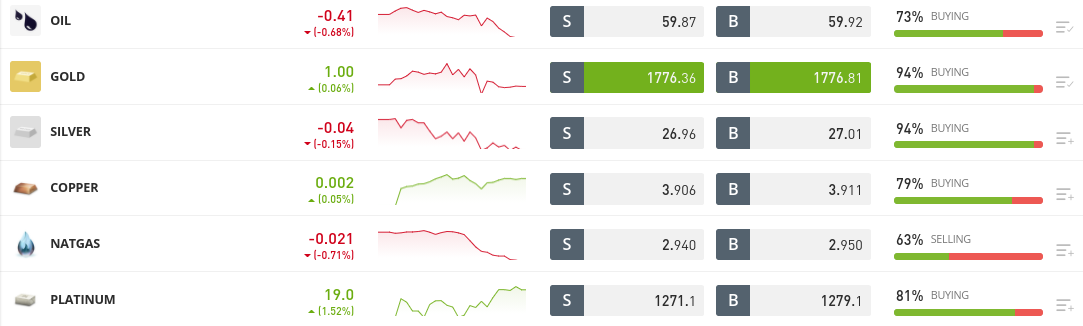

We found that the best online commodity trading platform for 2025 is eToro. With more than 45 commodity markets supported, you won't be spoilt for choice. In the case of hard metals, you'll be able to trade everything from gold and silver to copper and platinum.

In the energies department, there are heaps of crude oil markets as well as natural gas. eToro is also great when it comes to agricultural products. Here, you can trade the likes of cotton, wheat, sugar, cocoa, and more.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

You can also trade several commodity futures in the form of CFDs. Irrespective of which commodity market takes your interest. eToro offers zero commissions when trading US stocks, commodities and ETFs. You will also find that spreads are very tight on major commodity markets like gold stocks and oil. There are no ongoing platform fees to consider and deposits cost just 0.5%.

eToro is famous for its social trading platform. This allows you to trade commodities in a completely passive nature. All you need to do is select a seasoned commodity trader that is using the eToro website, and elect to mirror their trades like-for-like. Additionally, we should also mention that eToro offers commodity ETFs. All the social and copy trading platform features are available both on the eToro web platform and the mobile trading app.

This allows you to invest in gold and other major commodities rather than trade short-term price movements. When it comes to payments, eToro supports debit cards and bank transfers. The minimum deposit is just $20, which is great for first-timers.

It holds licenses with ASIC, and CySEC - and is now home to over 20 million traders. Finally, we should also note that eToro offers leverage on all of its commodity trading markets. Your limits will depend on your location, but in most cases - you'll get up to 1:20 on gold and 1:10 on other commodities.

eToro fees

Fee Amount Commodities trading fee Spread, starting from 2 pips Forex trading fee Spread, 2.1 pips for GBP/USD Crypto trading fee Spread, 0.75% for Bitcoin Inactivity fee $10 a month after one year Withdrawal fee $5 Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

3. Libertex – Best Online Commodity Trading Platform with Tight Spreads

Libertex is a great commodity trading platform for both amateurs and seasoned pros alike. There are several reasons why you might choose this top-rated provider as your go-to commodities broker. It is a CFD trading platform with super-low fees in the form of tight spreads.

This is even the case of less liquid commodities like palladium. Although you need to pay a commission on some assets at Libertex, this isn't the case with major commodity markets.

In terms of supported commodity instruments, Libertex as a metals trading platform covers numerous hard metals and energies. You won't, however, have access to agricultural products. Nevertheless, as a CFD broker, you will be able to go long and short on your chosen market with ease.

This is reserved for professional clients though so expect lower limits if you are a retail trader. Libertex is also worth considering if you are looking to trade other asset classes. For example, this top-rated platform also supports stock CFDs, forex, cryptocurrencies, and ETFs.

Once you open an account with Libertex - which requires a minimum deposit of $100, you will be able to choose from two different platforms. For new traders, the Libertex web-trader is simple to use and allows you to trade commodities in a burden-free manner. But, if you're a seasoned pro or wish to try a more sophisticated platform, you can trade via MT4.

Libertex also enables mobile trading, which allows you to trade commodities on the move. In terms of reputation and trust, Libertex has been active for over 23 years. It now boasts a client base of almost 3 million traders and is regulated by CySEC. As such, you can rest assured that Libertex is a secure commodity trading platform to meet your investment needs.

Libertex fees

Fee Amount Commodities trading fee Variable commission Forex trading fee Commission. 0.008% for GBP/USD Crypto trading fee Commission. 1.23% for Bitcoin Inactivity fee $5 a month after 180 days Withdrawal fee Free Pros:

- Tight spread CFD trading

- Very competitive commissions

- Good educational resources

- Long established broker

- Trade stocks and indices like the Dow Jones

- Compatible with MT4

- Great choice of markets

Cons:

- Only offers CFDs

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

4. TD Ameritrade – Best Platform for Commodity Trading for Advanced Futures Traders

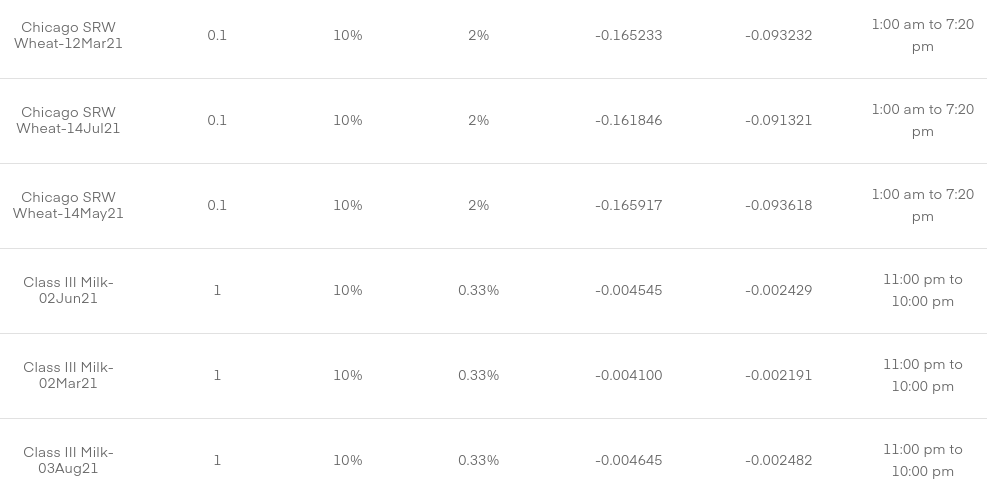

You might wondering what is the best futures trading platform for commodities. Well, this highly established broker gives you access to commodity derivatives in the shape of futures contracts.

As you likely know, this is a more sophisticated way of trading commodities, as you'll have access to long/short positions, leverage, and super-high liquidity levels. In terms of tradeable markets, TD Ameritrade covers dozens of commodities.

In the case of hard metals, this includes gold, silver, copper, platinum, palladium, and several mini-futures contracts. TD Armetirade really stands out when it comes to energy, as you'll have access to benchmarks like Brent Crude oil, Light Sweet Crude Oil, and RBOB Gasoline.

You can also trade futures on natural gas and heating oil. There are plenty of agricultural commodity markets at this broker too. For example, soft commodities include cocoa, coffee, cotton, orange juice, and sugar. You even have livestock marketplaces like cattle, hogs, and feeder cattle.

If grains are more your thing, TD Ameritrade supports oats, soybeans, corn, and wheat stocks, among others. All in all, if you're a seasoned futures trader that seeks access to a specific commodity market, you are all-but-certain to find it at TD Ameritrade. When it comes to fees, TD Ameritrade charges $2.25 per contract when trading futures - plus exchange and regulatory fees.

In terms of the trading arena itself, Thinkorswim is the proprietary platform offered by TD Ameritrade. This is suitable for experienced traders that seek access to advanced pricing charts, technical indicators, and real-time data feeds. Thinkorswim is also available via an Android and iOS mobile app.

TD Ameritrade fees

Fee Amount Commodities trading fee $2.25 per futures contract Forex trading fee Spread. 1.2 pips average during peak hours Crypto trading fee N/A Inactivity fee Free Withdrawal fee Free for ACH, $25 for wire transfer Pros:

- Trusted US brokerage firm

- App is available on iOS and Android devices

- Buy stocks and ETFs commission-free

- Options can be traded at just $0.65 per contract

- Fully-fledged paper trading account

- More than 11,000 mutuals to choose from

- No account minimums

Cons:

- Not as user-friendly as other investing apps in the market

- The sheer size of tradable markets on offer can appear overwhelming

There is no guarantee that you will make money with this provider. Proceed at your own risk..

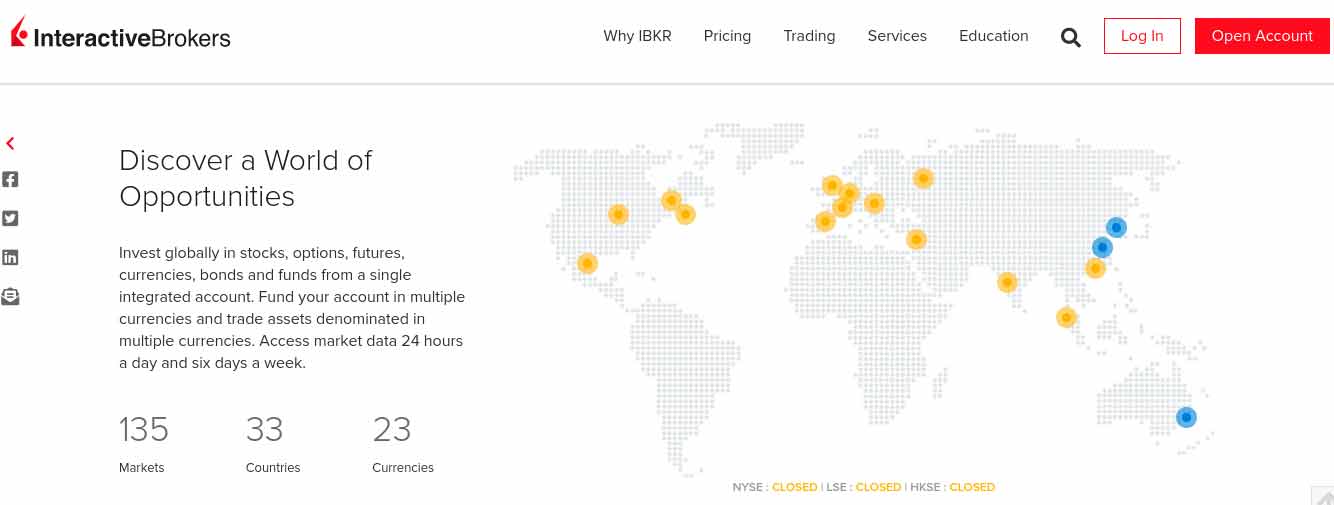

5. Interactive Brokers - Best Commodities Broker for Low-Cost Futures

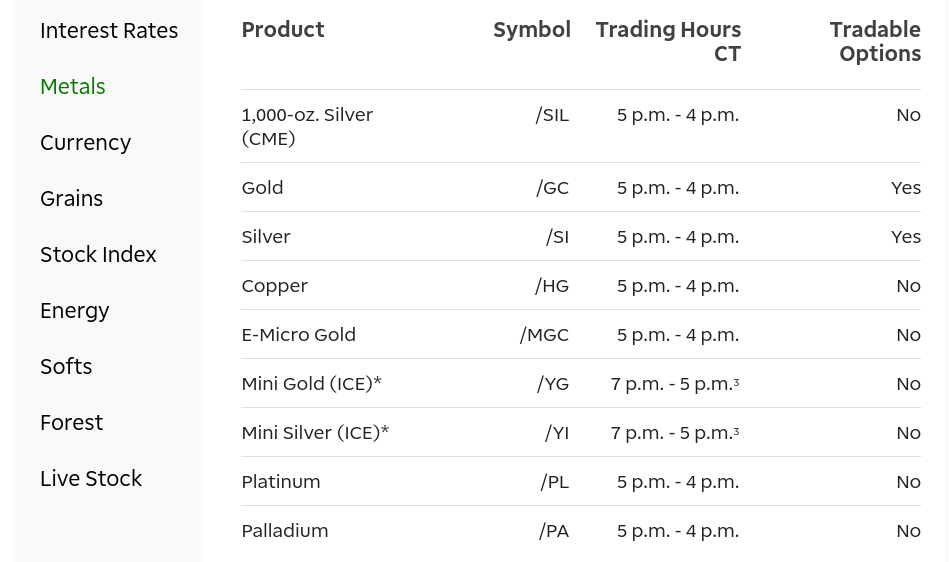

In a similar nature to TD Ameritrade, Interactive Brokers is a popular brokerage firm that supports commodities. This includes both futures and options on a wide variety of commodity markets.

Not only does this include US commodity markets, but heaps of other regions. This includes exchanges in Canada, Europe, Mexico, Australia, and several Asian countries.

As such, whether you're keen on hard metals, energies, or agricultural products - Interactive Brokers has you covered. Perhaps one of the biggest advantages of choosing this top-rated commodity trading platform is that it offers attractive fees. For example, while TD Ameritrade charges a fee of $2.25 per contract, Interactive Brokers allows you to trade from just $0.85 per contract.

This low fee is, however, reserved for major commodity futures listed in the US. If you're looking to trade further afield - expect to pay a higher commission. In terms of who Interactive Brokers is suitable for, we would suggest that this platform is ideal for experienced traders.

This is because the trading platform itself is highly advanced, with a full suite of technical indicators, algorithms and charting tools. With that said, Interactive Brokers does not have a minimum deposit policy in place - so you can start trading commodity futures without needing to have a huge cash balance. This is especially the case if you decide to trade with margin at the broker.

Interactive Brokers fees

Fee Amount Commodities trading fee $0.85 per futures contract Forex trading fee Commission + spread. Commission is 0.08 to 0.20 basis points. 0.1 pip GBP/USD Crypto trading fee Commission. $15.01 per Bitcoin futures contract Inactivity fee $20 per month Withdrawal fee Free Pros:

- Huge library of traditional stocks, index funds, and ETFs

- Really advanced trading features and chart analysis tools

- More than 135 markets across 33 countries

- Trade CFDs, futures, options, forex, and more

- No minimum deposit

- Buy US-listed stocks and ETFs commission-free

Cons:

- Not suitable for new investors

- Fee structure is a bit confusing

There is no guarantee that you will make money with this provider. Proceed at your own risk..

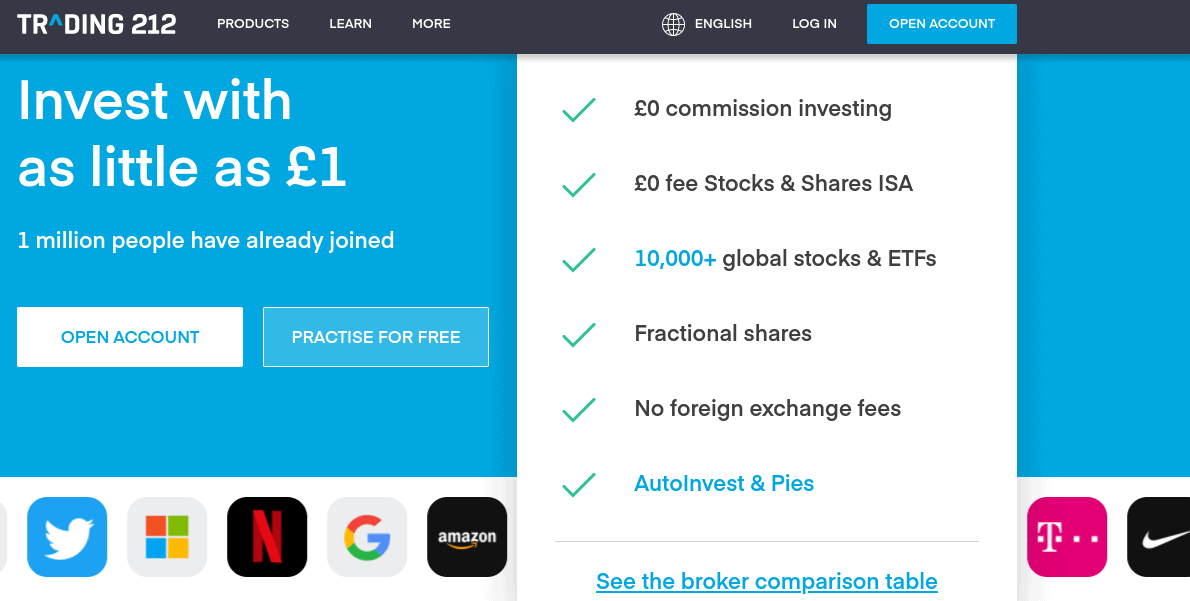

6. Trading 212 – Best Commodity Futures Trading Platform

Trading 212 is a hugely popular stock trading platform that is primarily aimed towards new traders. Put simply, the provider is known for the ease with which you can buy stocks - all of which are commission-free, including the best inflation stocks. With that said, Trading 212 also offers a fully-fledged CFD trading facility.

Although this has a strong focus on stocks and forex - the platform also supports various commodity markets. More specifically, you will be trading CFDs futures. This is particularly beneficial if you want to try your hand at commodity futures but you have little to no experience.

After all, as you are trading CFDs, it means that you do not own the underlying asset and thus - you won't be liable for settling the contract upon expiry. Instead, you are speculating on whether their futures contract will increase or decrease. At Trading 212, the price of the commodity CFD contract will move on a second-by-second basis until the expiry date.

In terms of what commodity futures you can trade, this covers well over 100+ individual markets. For example, you can trade coffee, copper, gold, silver, gasoline, crude oil, feeder, cattle, lumber, soybeans, and even cheese! All of these CFD futures markets come with various expiry dates.

Trading 212 also allows you to trade commodities with margin. If you are a retail investor, then you can trade gold with a margin of just 5%, and 10% on all other commodities. This means that a £10,000 gold position would require a deposit of just £500. If, however, you are classed as a professional client, the margin requirement starts at just 0.2%.

In terms of the specifics, getting started at Trading 212 is simple, albeit, you'll need to have your ID verified before you can trade with real money. This usually takes up to 1-2 working days. Until then, you can use the Trading 212 demo account facility. Not only does this mirror live market conditions, but you don't need to open an account to gain access.

We also like the fact that the minimum deposit at Trading 212 is just £1. As the platform supports fractional ownership/trading, you don't need to risk large amounts. Instead, you can trade commodity CFD futures with just a few pounds. Finally, this FCA-regulated broker allows you to deposit funds with a debit/credit card, e-wallet, or bank wire.

Trading 212 fees

Fee Amount Commodities trading fee Variable spread Forex trading fee Spread, 1.4 pips for EUR/USD in average Crypto trading fee Spread, 40 pips for Bitcoin Inactivity fee Free Withdrawal fee Free Pros:

- Buy more than 10,000 shares and ETFs commission-free

- No deposit or withdrawal fees

- Very user-friendly

- Regulated by the FCA

- Trade CFDs with leverage

- Mobile app supported on iOS and Android devices

- Minimum investment just £1

Cons:

- 0.5% FX fee on CFD instruments not priced in your primary currency

- Too basic for experienced trading pros

There is no guarantee that you will make money with this provider. Proceed at your own risk..

How Do Online Commodity Trading Platforms Work?

In some ways, commodity trading platforms function in the same way as other investment providers - such as those centered on stocks or forex. That is to say, the commodity trading platform sits between you and your desired marketplace.

You will be required to open an account and deposit funds, and then set up a series of orders on each trading position. Then, if you speculate on the future direction of your chosen commodity instrument correctly, you will make a profit.

However, there are many different types of commodity trading platforms in the market, so you need to be aware of what options best suit your requirements.

This includes the following:

Commodity CFDs

Make no mistake about it - the easiest, safest, and most cost-effective way of trading commodities online is via a CFD broker. For those new to CFDs (contracts-for-differences), these are financial instruments created and offered by regulated trading platforms.

The CFD instrument will simply track the underlying asset in real-time, meaning that you do not own the respective commodity. Instead, your task is to predict whether the commodity will rise or fall in value.

Opting to trade CFDs come with various benefits, such as:

- You do not need to worry about storing or transporting hard assets like gold, oil, or natural gas. Instead, you can trade them from the comfort of your home without needing to take ownership.

- CFDs allow you to trade with leverage. The best commodity trading platforms typically offer leverage of at least 1:20 on gold and 1:10 on other markets. This means a $100 balance would allow you to trade with up to $2,000.

- By trading commodity CFDs, you will always have the option of going long or short. This allows you to profit from both rising and falling markets.

- The best commodity trading firms offering CFDs allow you to trade commission-free and with tight spreads. After all, the underlying asset doesn't exist, so this allows platforms to offer really competitive trading fees.

Don't forget, if you are based in the US then you will not be able to trade commodities in the form of CFDs. This is because US Citizens are prohibited from accessing leveraged CFD products. As such, you will need to consider futures, options or ETFs.

Commodity Futures

The likes of TD Ameritrade and Interactive Brokers allow you to trade commodities via futures contracts. These are a lot more sophisticated than CFDs, so they are much more suitable for experienced investors and traders.

For example, not only do you need to consider strike prices, contract durations, and expiry dates - but even more importantly - what happens when the futures settle. This is because most futures are settled in the underlying asset.

To put it simply, if you trade oil futures and are still in possession of the contracts when they expire, there is every chance that you will be liable to take delivery of the asset.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

This is what forced oil futures to go into negative territory in the midst of the coronavirus pandemic last year. In other words, as demand for oil was so weak, storage facilities were at breaking point - meaning that traders were prepared to pay buyers to take ownership of the futures!

Nevertheless, much like CFDs, the best commodity trading platforms offering futures will allow you to trade with leverage. You also choose from a long or short position on all futures markets.

Commodity Options

Similar to futures, options contracts allow you to speculate on the future value of a commodity in a complex manner.

- The main premise here is that you will need to pay a small premium to access your chosen options market. This might be, say, 5% of the total contract amount.

- Once the commodity options expire, you are not under any obligation to purchase the respective asset. Instead, the contract gives you the option to proceed.

- This is good as if you speculated on the commodity incorrectly, the most you can lose is the options premium.

- But, if you speculated correctly, you then proceed to purchase the asset at the predefined strike price.

Take note, if you're a newbie trader, it's best to stay away from options as they are better suited for experienced investors.

Commodity ETFs

US traders cannot trade CFDs. In order to gain exposure to commodities, ETFs are the best choice. US investors can choose SPDR Gold Shares ETF that tracks the price of gold bullion in OTC markets. For crude oil and natural gas, Energy ETFs can be used instead.

Traders outside the United States may also trade leveraged ETFs CFDS in many sectors. Leveraged financial products come with a high risk, experience and risk management is often a must.

What Are The Advantages and Disadvantages of Trading Commodities in 2025?

Pros:

- Commodities can be used to hedge against inflation. This is due to the fact that commodity prices often rise alongside rates of inflation.

- Investing in commodities is a good way to diversify. Commodity ETFs can be particularly beneficial for this because they track a basket of different commodity assets.

- Trading commodities can generate short term profits. However, returns are not guaranteed.

- Commodities are available on regulated exchanges in the US.

Cons:

- US traders are prohibited from trading commodity CFDs.

- Commodities can be extremely volatile assets due to the fact that supply and demand can change quickly.

- Commodities do not attract dividends.

- It is difficult to invest in commodities directly due to storage issues.

How To Trade Commodities in the US 2025

Looking to start buying and selling commodities from the comfort of your home right now? If so, follow the step-by-step walkthrough to start trading commodities with eToro in less than 10 minutes!

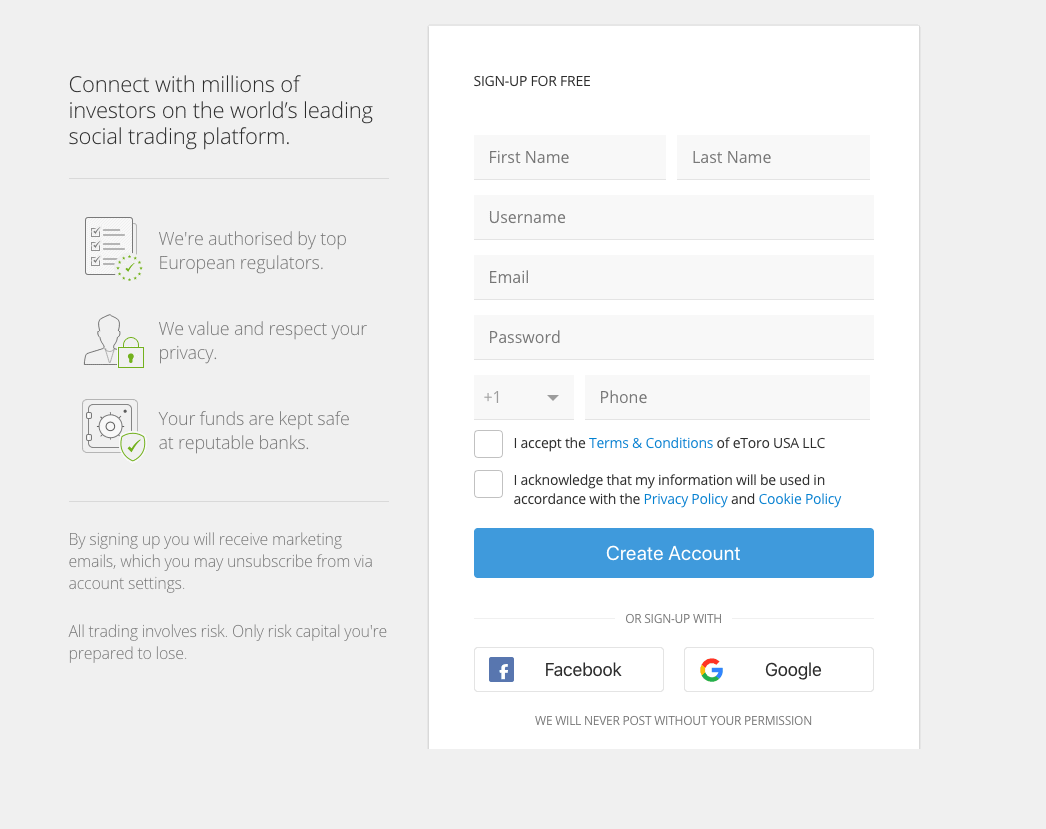

Step 1: Open an Account and Upload ID

Visit the eToro website and open an account. You will need to provide your personal information, contact details, and national tax number.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

You will also need to choose a username and password, and verify your mobile number.

Step 2: Confirm Identity

You will now be asked to confirm your identity. All you need to do is upload the following to documents.

- Valid passport or driver's license

- Utility bill or bank account statement (issued within the last 3 months)

Step 3: Deposit Funds

It's now time to make a deposit - with the minimum at eToro standing at just $200. You can choose from a debit card, credit card, e-wallet, or bank wire.

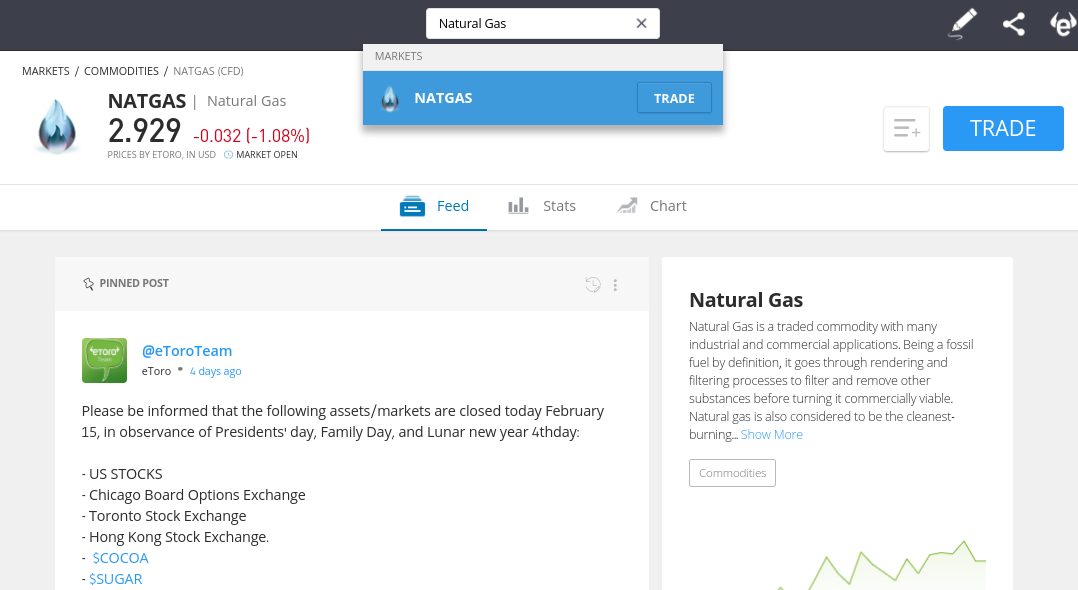

Step 4: Search for a Commodity Trading Market

With over 45 commodity markets at eToro, you can trade everything from hard metals, energies, and agricultural products.

If you already know which commodity you want to trade, search for it. In our example, we are looking to trade natural gas.

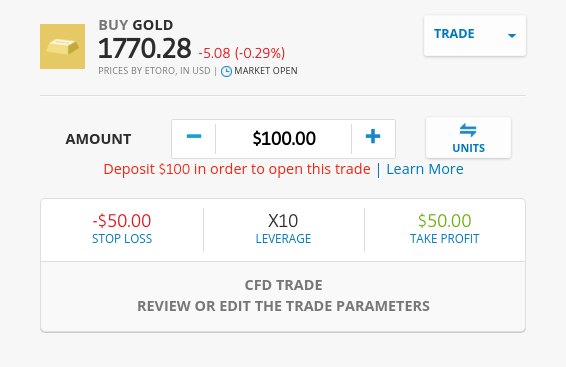

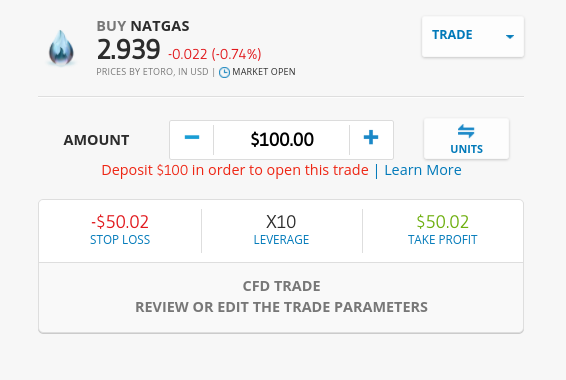

Step 5: Place a Commodity Trade

Finally, to complete your commission-free commodity trade, you need to set up an order.

- Choose a buy order if you think the price of the commodity will rise, and a sell order if you think the opposite.

- You can choose the price that your trade is executed at by setting up a limit order.

- Choose your required leverage level.

- You can also set up a stop-loss and take-profit order.

To place your position, click on the 'Open Trade' button.

Conclusion

In summary, choosing the right commodity trading platforms for your needs is crucial. Not only does the provider need to support your preferred instrument - such as CFDs or futures, but also the specific market, like gold, silver, or natural gas.

And of course, the commodity broker needs to be regulated by the appropriate bodies and offer low fees and commissions.

In our view, eToro is the best commodity trading platform to consider in 2025. You will have access to over 45 commodity markets on a commission-free basis. The regulated broker also offers a Copy Trading feature, leverage, and heaps of payment methods.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

FAQs

What is the best online commodity trading platform?

We think that eToro is the best commodities trading platform, as the broker offers heaps of hard metals, energies, and agricultural markets on a commission-free basis. It is also heavily regulated, so you will be trading on a safe and secure platform.What is the commodities trading platform for beginners?

Once again, we also think that eToro is the best trading platform for commodities if you are a newbie. The platform is super easy to use, minimum stakes are low, and you will have access to an abundance of educational tools.How much leverage do the best trading platform for commodities offer?

Leverage limits available at the best commodities trading platforms will depend on your country of residence and whether you are a retail or professional trade. For example, retail clients in most regions are capped to 1:20 on gold and 1:10 on other commodities. However, if you are a professional client, the best commodities trading platforms often offer leverage in excess of 1:500.What is the best online commodity broker for options?

If you are looking to trade options, the best online commodity broker is likely to be TD Ameritrade.What commodities can you trade online?

The best commodity trading platforms give you access to dozens of markets. This might include gold, silver, copper, oil, natural gas, wheat, corn, soybeans, and even cheese!Which commodity trading platforms accept Paypal?

Several of the best commodity trading platforms that we came across support Paypal deposits. This includes eToro, Trading 212.How do you short commodities online?

It's very easy to short commodities online if you think the value of the asset will decline. You can opt for a broker that supports CFDs and place a sell order. Or, if you want to go with options, you'll need to purchase puts.References:

Kane Pepi Finance Writer

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, InsideBitcoins, Blockonomi, Learnbonds, Buyshares n and the Malta Association of Compliance Officers.

Before starting his career as a writer, Kane studied at the University of Central Lancashire where he received a Masters Degree in Financial Investigation and then a Research Doctorate in Criminal Justice. Pepi is passionate about helping people to make informed decisions through high-quality, educational content.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

Libertex also enables mobile trading, which allows you to trade commodities on the move. In terms of reputation and trust, Libertex has been active for over 23 years. It now boasts a client base of almost 3 million traders and is regulated by CySEC. As such, you can rest assured that Libertex is a secure commodity trading platform to meet your investment needs.

Libertex also enables mobile trading, which allows you to trade commodities on the move. In terms of reputation and trust, Libertex has been active for over 23 years. It now boasts a client base of almost 3 million traders and is regulated by CySEC. As such, you can rest assured that Libertex is a secure commodity trading platform to meet your investment needs.