Best Silver Trading Brokers in July 2025

If you’re looking to trade silver online, you’ll need a reputable silver trading platform. You can easily find thousands of potential exchanges by performing a simple Google search. Unfortunately, finding the best silver trading platform for you is time-consuming. In addition, you need to consider things like commissions, minimum account balances, and regulations.

This guide reviews the best silver trading platforms for 2025. We will also show you how to get started with a top-rated silver trading platform today!

Best Silver Trading Platforms in July 2025

- eToro – Overall Best Silver Trading Platform

- TD Ameritrade – Highly-Reputed Platform for Online Silver Trading

- Interactive Brokers – Excellent Broker for Silver Trading

Best Online Silver Trading Platforms Reviewed

Silver is the second most invested precious metal after gold, and it has been used for centuries for currency, jewelry, and as a long-term investment. So here we have listed the best silver platforms to start trading now.

1. eToro – Overall Best Silver Trading Platform

eToro has more than 13 million clients and allows you to invest in silver through ETFs. This platform has the best SPDR ETFs, but the SPDR silver shares market is the most popular

On eToro, purchases and sales of shares and ETFs are not subject to commissions. In addition, there are no monthly fees to keep your silver investment forever. Additionally, you may also trade silver on other markets at eToro, such as trading silver CFDs – which means you can use a leverage of up to 1:20. Finally, if you think silver is overpriced, you can sell it instead of shorting it. eToro offers commission-free silver CFDs as well.

Feel safe investing in eToro, which is regulated by the FCA and offers an excellent mobile investment app that allows you to invest in silver on your mobile device.

eToro fees

| Fee | Amount |

| Stock trading fee | Free |

| Forex trading fee | Spread, 2.1 pips for GBP/USD |

| Crypto trading fee | Spread, 0.75% for Bitcoin |

| Inactivity fee | $10 a month after one year |

| Withdrawal fee | $5 |

Pros:

Pros:

- The interface is simple to use

- Intensively regulating

- Copy-trading is available

- Low spread basis

- with 0 % commission

- Diversified assets

- Easy to deposit funds

Cons:

Cons:

- Unsuitable for advanced traders

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

2. TD Ameritrade – Highly-Reputed Platform For Online Silver Trading

The brokerage firm TD Ameritrade is arguably one of the most reputable. Since its founding more than 40 years ago, it has been known for providing an extensive collection of stocks, ETFs, and investment funds.

TD Ameritrade also offers a fully-fledged Silver trading platform supporting gold trading.

Silver can be traded 23 hours a day, ensuring that the platform serves its global customer base. It should be noted that the TD Ameritrade 'Thinkorswim' platform is best suited for experienced traders.

As a result, it comes with professional-level tools and features that might seem intimidating to the untrained eye.

TD Ameritrade fees:

| Fee | Amount |

| Stock trading fee | 0% |

| Forex trading fee | Not Supported |

| Crypto trading fee | Not Supported |

| Inactivity fee | No |

| Withdrawal fee | Free |

Pros:

Pros:

- A US-based brokerage firm

- Offering thousands of stocks and funds

- Include forex, futures, and cryptocurrencies

- Trade US stocks and ETFs without commission

- Fast bank transfers

- Excellent regulatory standing

- Research materials of high quality

Cons:

Cons:

- No debit/credit card or e-wallet deposits

Your Money Is At Risk.

3. Interactive Brokers – Excellent Broker For Silver Trading

Interactive Brokers was founded in 1978 and is a free trading platform regulated by several financial authorities, including the UK's Financial Conduct Authority, the US Securities and Exchange Commission, the Commodity Futures Trading Commission, and Hong Kong's Securities and Futures Commission.

In addition to the fact that Interactive Brokers is listed on NASDAQ and regulated by multiple global authorities, Interactive Brokers also has a market capitalization of $28.08 billion. Moreover, as a public company and a publisher of financial statements, Interactive Brokers is viewed as a safe trading platform by millions of traders.

Trade commission-free with Interactive Brokers and open an account with no minimum deposit, two of the most appealing features for new and experienced traders alike. The platform also offers one of the most extensive product and market offerings. This discount broker provides traditional stocks and ETFs, futures, CFDs, and forex trading on a low-cost, commission-free basis, allowing you to diversify your portfolio.

With Interactive Brokers, you can invest in metals such as silver or gold, stocks listed on international markets, and fractional shares of stocks. As a result, beginners and experienced investors can invest as much money as they wish to meet their trading objectives and time horizons and diversify their portfolios without calculating how many whole shares they can afford.

Interactive Brokers fees:

| Fee | Amount |

| Stock trading fee | 0% |

| Forex trading fee | Not Supported |

| Crypto trading fee | $5.00 per contract |

| Inactivity fee | No |

| Withdrawal fee | One free withdrawal request per month. |

Pros:

Pros:

- ETFs and stocks can be traded commission-free for US clients

- Low margins and low-interest rates

- Fractional shares can be bought and sold.

- Shares of stocks listed on international exchanges are available to purchase.

- Social trading services and robo-advisory services are available

Cons:

Cons:

- A $20 monthly inactivity fee is charged to accounts with less than $2,000 in balance.

- Traders who are new or inexperienced may find the interface confusing.

Your Money Is At Risk.

How to Choose the Best Silver Trading Platform for You

In order to meet your silver trading needs, there are some factors to consider ahead. Here we have identified the most important factors that every silver trader must analyze before investing in this metal.

Regulation

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

According to a recently published study, new trading platforms and more subtle forms of manipulation make it harder to regulate the global silver markets.

According to a report scheduled for release next month, Singapore, Dubai, and China have become hubs for commodities trading, adding additional complexities for national regulators.

The report warns that opaque pricing mechanisms and poorly governed market platforms are vulnerable to manipulation by powerful market participants, including traders, producers, and financial institutions.

Also, it points out that combatting such practices is an urgent task for policymakers to avoid the substantial negative economic impacts and prevent the international tensions they can cause.

A US Senate investigation released last week raised allegations that Wall Street banks manipulated aluminum, oil, and coal markets. Due to regulatory burdens and listless markets, many banks have given up physical trading and owning commodities.

Risks will then be transferred to companies with fewer regulations, which has raised concerns.

The report notes that national authorities regulate commodity markets, but unclear and overlapping jurisdictions often hamper these efforts. For example, the Financial Conduct Authority regulates the London Metals Exchange in London but does not consider itself responsible for the exchange's warehouse network.

Commodities

Silver trading usually involves Gold and Silver, and sometimes platinum as well. Trading silver is closely related to the outlook for the global economy and major currencies.

Fees

Every Silver trading platform is in the business of making money. How they do this varies from platform to platform. Therefore, you must check what fees will be applied when you trade silver at your chosen site.

Here are the main fees charged by the best silver trading platforms:

Silver Trading Commission

Some Silver trading platforms charge a commission on every buy and sell order that you place. That will come in a variable percentage in all cases except a few rare instances. For example, let's say you are trading silver and your broker charges a commission of 0.1. You place a $500 buy order. You will only have to pay $0.50 as a commission (0.1% of $500). When you close your trade, it is worth $600.

Lastly, the trade will attract a 0.1% commission, so that's $0.60 (0.1% of $600).

Furthermore, you can place buy and sell positions commission-free with the best Silver trading platforms in 2025. These include sites like eToro. In this scenario, you only pay a spread.

Commodity Trading Spreads

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

There is a commodity-product spread when the price of a raw material commodity differs from the price of the finished product that is created from that raw material. In the futures market, commodity-product spreads are the basis for some popular trades.

Investors who trade on the spread typically take long positions in raw materials and short positions in finished products related to them.

Leverage Fees

Silver trading platform accounts usually must be leveraged unless you have substantial capital. Trading leveraged products will incur overnight financing fees. A position being open overnight requires you to pay a fee to the platform you select. Daily charges will be applied to your account balance and deducted from it.

Considering this, you should figure out how much your chosen platform will charge. Usually, this is expressed as a percentage multiplied by the stake. Your payout will also increase as your stake and your leverage does it too.

Other Fees

Moreover, the best Silver trading platforms charge fees in other areas, including:

- Inactivity fee: Even the best Silver investment platforms charge a fee after your account has been inactive for a given amount of time. In many cases, this fee occurs much sooner than 12 months.

- Fees for transactions: The depositing and/or withdrawing of funds may require that you pay a fee.

- Fees associated with currency conversion: Silver trading platforms may charge you a fee if you trade silver priced in another currency than your base currency.

Trading Tools and Features

Traders who make consistent profits from Silver online have difficulty doing so. That is particularly true for complete beginners. However, you should consider if your platform allows you to choose from various tools and features that can help take your currency trading efforts to the next level.

Leverage

Since it is still not easy to make a living trading Silver without having a large amount of capital to work with, this area may provide a specific challenge. As a result, the profit margins you will target will be very small, especially if you're looking to day trade.

If this is something you are looking for, you should check if your chosen Silver trading platform offers leverage to you. It is important to note that your country of residence will determine your limits, with the United Kingdom, Europe, and several other regions being limited to 1:30.

Order Types

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

You can choose from many different order types on the best Silver trading platforms. These should also include stop-loss and take-profit orders and buy/sell and market/limit orders. In this way, you can trade Silver online in a risk-averse manner.

A good Silver trading platform will offer the following order types:

- Trailing Stop-Loss

- Guaranteed Stop-Loss

- Good for the Day (GFD)

- Good 'Till Cancelled (GTC)

- One-Cancels-the-Other (OCO)

Alerts

Choose a Silver trading platform that provides alerts so you can stay on top of things at all times. In addition, these notifications should be delivered in real-time to your mobile phone. An example of this might be receiving an alert if a silver pair breaches a key residence line. You might also be notified when a news story breaks that might influence the price of a currency pair.

You must not miss any important technical and fundamental events when trading on the best Silver trading platforms.

Education, Research, and Analysis

You will benefit most from choosing a platform that helps you improve your knowledge of the Silver industry if you are just getting started as an online Silver trader. For example, eToro offers everything from Silver trading guides and videos to weekly webinars.

In the case of research, the best Silver trading platforms offer financial news and market insights. That is great for keeping abreast of key market developments and can help with your trading decision-making process.

Silver trading platforms with advanced chart reading tools offer advanced technical data. That should include customized screens, indicators, and the ability to draw charts.

User Experience

There is an alarming amount of movement in the silver trade industry - where exchange rates change by the second. For this reason, you should make sure that the platform you choose offers an excellent end-to-end user experience. For example, can you easily locate your chosen Silver market on the Internet, and if so, does placing orders present any problems?

Our research found huge differences in how user-friendly Silver trading platforms are.

Many platforms, such as TD Ameritrade - are geared more towards Silver pros. However, TD Ameritrade Silver's advanced functionality tools and features make it a powerful trading platform. Beginners may find this overwhelming, but experienced traders might find it useful.

Demo Account

We mentioned Silver demo accounts earlier on this page because they are an excellent way to try the Silver product. The demo account, stated, permits you to practice the art of trading with silver in a secure, risk-free environment. Some of the top platforms for trading silver offer demo accounts that are exact replicas of actual trading conditions.

In the sense that you can keep practicing until you are ready to invest your own money, this is a great way to learn the ropes of a complicated Silver trading scene. However, be aware that some silver trading platforms have a time limit on how long you can use the demo account facility - for example, 30 days.

Payment Methods

All the top Silver trading platforms we came across offer a very wide choice of payment methods readily available to most of the public. That makes it very easy for you to make deposits and withdrawals. In addition to instant deposits in debit or credit cards, eToro also supports direct transfers into the account through an e-wallet.

The only problem with some of the platforms we reviewed for trading silver is that some only accept bank transfers. However, there is a possibility that an instant deposit will be available to you if you are using a platform based in your country of residence. Although, in the majority of cases, it can take several days for bank transfers to reach their destinations.

Customer Service

Silver trading platforms with a high level of customer service offer a live chat function that operates at least 24 hours a day. The advantage of this is that you can speak with a support agent in real-time without picking up the phone.

Alternatively, we also found that some of the Silver trading platforms we came across offer only email support as a mode of communication. In this case, you might have to wait for several hours before you get an answer.

How to Start Silver Trading in the US - eToro

You should now understand what it takes to find a Silver trading platform suitable for your needs if you have done all your reading up to this point. The only thing left to do now is place your first order for silver.

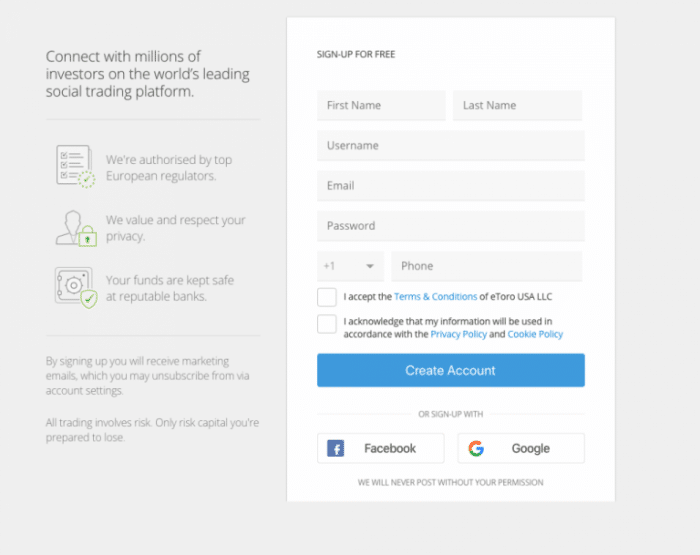

To ensure that you know exactly what this entails, let us walk you through the setup process of its commission-free platform, eToro.

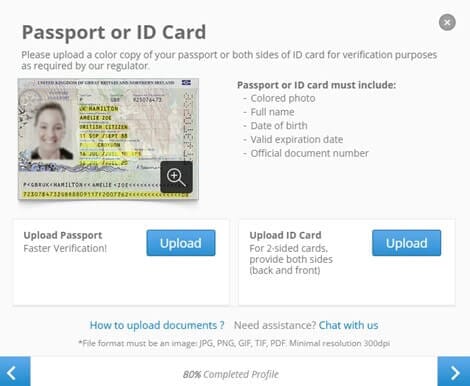

Step 1: Open an Account and Upload ID

In order to trade on eToro using the demo account, you must open a real account first. However, the process is quick and easy.

Click on 'Join Now' on the eToro website and follow the on-screen instructions. Providing your contact information, national tax number, and personal information is needed.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

eToro is a regulated silver trading platform that requires all new account holders to be verified. At eToro, this process takes just a few minutes and requires the following two documents:

- Passport or driver's license valid

- Bills for utilities or bank account statements within the last three months

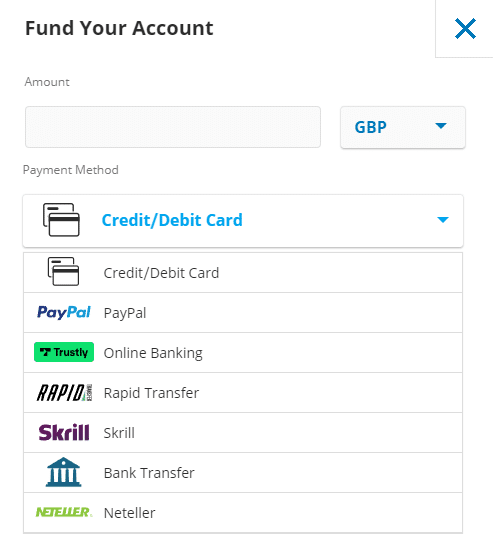

Step 3: Deposit Funds

eToro will now ask you to deposit your newly created silver trading account.

You can choose from the following deposit options:

- Debit cards

- Credit cards

- E-wallets (Paypal, Skrill, or Neteller)

- Bank transfer

Unless you opt for a bank transfer, all deposits on eToro are processed instantly.

Step 4: Search for Silver

As soon as your deposit has been processed, you will be able to look for the Silver pairs that you desire to trade.

In order to begin trading, you need to click the 'Trade' button.

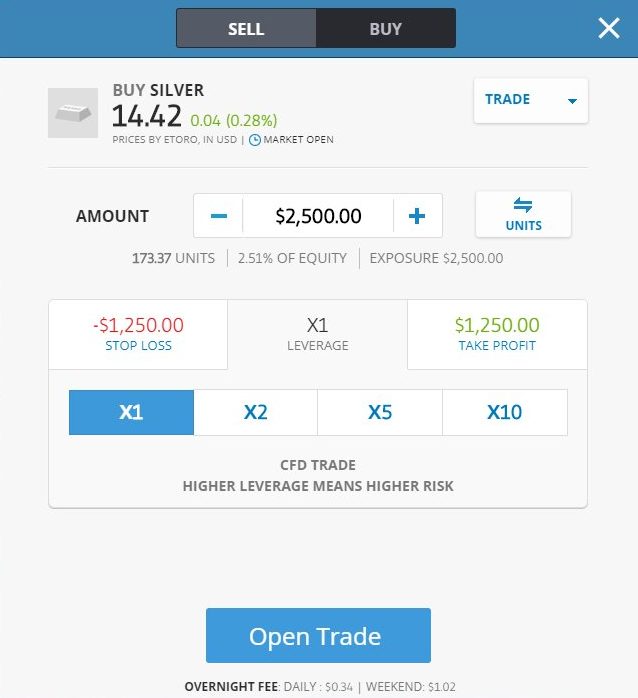

Step 5: Place a Trade

It is now time for you to place a Silver trading order.

You need to fill out the following fields:

- Orders to buy or sell: A buy should be made if you believe the pair will increase in value in the future. Conversely, if you think the pair's value will decrease, you should place a sell order.

- Amount: This is the amount you wish to stake in this Silver trade. eToro always requires US dollars for this input.

- Leverage: You can choose your preferred multiple if you wish to trade with leverage.

- Furthermore, you can choose the specific price you want to execute your Silver trade. You can do this by clicking on the 'Trade' button at the top right-hand side of the box and selecting 'Order.' Type in the price you wish to trade.

- Also, by clicking on the relevant button and entering your desired exit price, you can set a stop-loss or take-profit order.

- Lastly, click 'Open Trade' to place a commission-free Silver order on eToro!

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Conclusion

The platform you choose to sign up with is one of the most important decisions you need to make when trading Silver online.

You will risk your hard-earned money, so ensure the provider is properly regulated. A platform should also offer your chosen silver and let you enter positions at an affordable price.

According to our review of dozens of platforms, eToro is currently the best Silver trading platform. Traders can trade silver on this heavily regulated platform commission-free and low spreads.

With eToro, you can make an instant deposit with a debit/credit card or e-wallet, and you can get started in minutes!

eToro - Overall Best Silver Trading Platform

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.