Best Gold Stocks to Buy in June 2025

Wall Street professionals recommend keeping a small portion of your portfolio invested in gold. Gold also makes a great hedge against inflation, as it helps offset the loss of purchasing power during inflationary times.

With this guide, you will learn the 10 best gold stocks to add to your portfolio right now. You will also discover how to complete your investment at a commission-free broker.

The 10 Best Gold Stocks to Buy in 2025

According to our analysis, these 10 gold stocks represent the overall best gold stocks to invest in right now.

- Barrick Gold Corp – The Most Popular Mining Gold Stocks Company

- Newmont – One of the Tier One Gold Assets Company To Buy Stocks From

- Franco-Nevada Gold – The Best Gold Mining Solutions Provider

- Agnico Eagle Mines – Gold Stock Company to Watch

- Kinross Gold – A Well-Positioned Gold Stocks Company

- Sibanye-Stillwater – Mining Company With Gold Operations

- Wheaton Precious Metals – Precious Metal Company With Important Gold Operations

- Eldorado Gold – A Gold Stock Company With An Excellent Growing Projection

- B2Gold – Gold Stock with Strong 2020-24

- Centamin PLC – Multinational Mineral Exploration Company to Watch

Are Gold Stocks a Good Investment?

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

In a balanced portfolio, gold can be an excellent investment asset. In addition, gold is among the most liquid commodities in the commodity markets and has increased in value over time.

If you invested £1000 in gold 30 years ago, it has increased by over 500%. In other words, you may have made more than $5,000 out of your original investment. Nevertheless, suppose we know anything about financial markets. In that case, past performance isn’t indicative of future performance – although an asset that has performed well over time is preferable to one that hasn’t.

- Gold prices often rise in conjunction with rising inflation rates and a weakening dollar. Investors may therefore consider gold as a hedging asset when they lose money. According to this logic, gold often maintains its value or even appreciates when the dollar’s value decreases.

- In contrast to currencies, gold is not directly affected by interest rate decisions, and its supply and demand cannot be manipulated. Moreover, due to its scarcity, gold has maintained its value over time and has proven its worth as an insurance policy during adverse economic conditions. This is why many investors in stocks view gold as a haven.

- Portfolio diversification. Diversification assets like gold will often be included in a balanced portfolio since they negatively correlate with the stock market. As a result, investors can reduce risk and volatility by diversifying their investment portfolios.

- Gold stock opportunities. Gold stock values are sometimes affected by the price changes of the precious metal. However, gold stocks can still be profitable even when gold’s price is low. Many gold mining companies also offer strong dividends, which may also be why investors choose gold stocks over gold.

A Closer Look At The Best Gold Stocks To Invest In 2025

In 2020, gold stocks captured attention after the price of gold soared to record highs on pandemic-related fears that caused stock prices to plummet. As a result, gold prices have dipped slightly, leading many to believe that precious metal is undervalued.

The following are some of the best gold stocks on the market today:

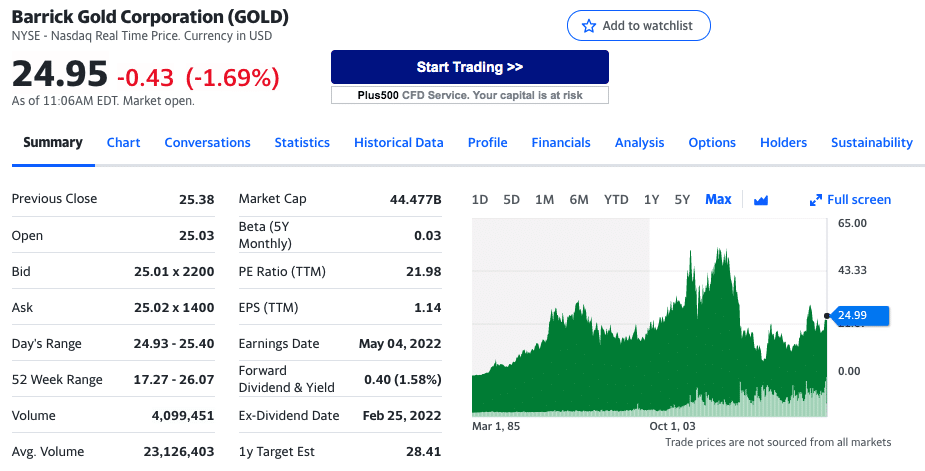

1. Barrick Gold Corp – The Most Popular Mining Gold Stocks Company

The company owns 14 gold mines, six of which are Tier One Gold Assets, which means they have a life expectancy of more than 10 years and produce at least 500,000 ounces of gold annually.

Essentially, the company owns six gold assets of the highest quality and highest expected return in the industry.

Eventually, gold deposits are depleted as mines extract them from the earth. Therefore, as part of its continued exploration and acquisition of mines, Barrick is working on developing new mines. The company looks for and develops new assets based on its ability to have a long life cycle and the best-operating margins.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

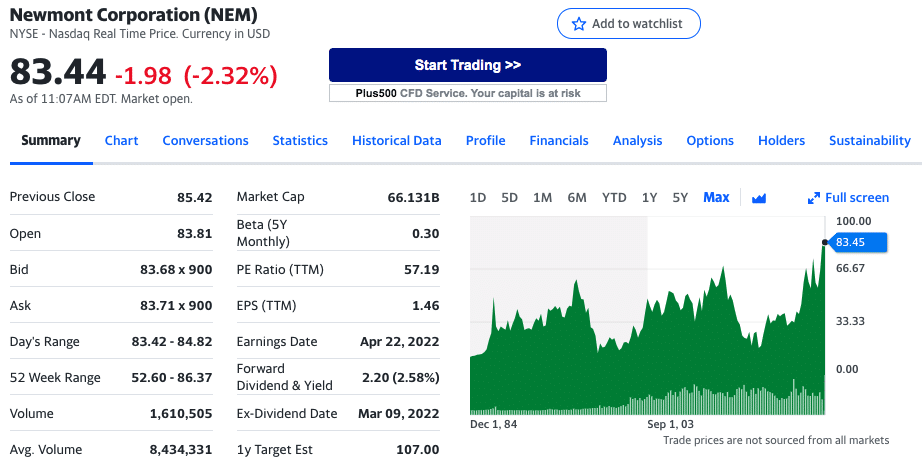

2. Newmont – One Of The Tier One Gold Assets Company To Buy Stocks From

Currently, the company owns 22 mines, with 10 being owned in underground mining and 12 in surface mining.

Newmont continuously expands its reach by developing new mines before its currently operating mines reach depletion. For example, a co-development agreement between the two companies was signed in 2019 for the Nevada Gold Complex. There are three of the world’s top 10 Tier One Gold Assets in the complex, which is estimated to be the largest gold production project in the world.

Newmont’s gold reserve base – a lineup of unmined gold resources – is one of the company’s key differentiators. More than 90% of this reserve base is located in top-tier jurisdictions. Considering that the company is building out its mining capacity and is the industry leader, it makes sense to expect continued growth in value.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

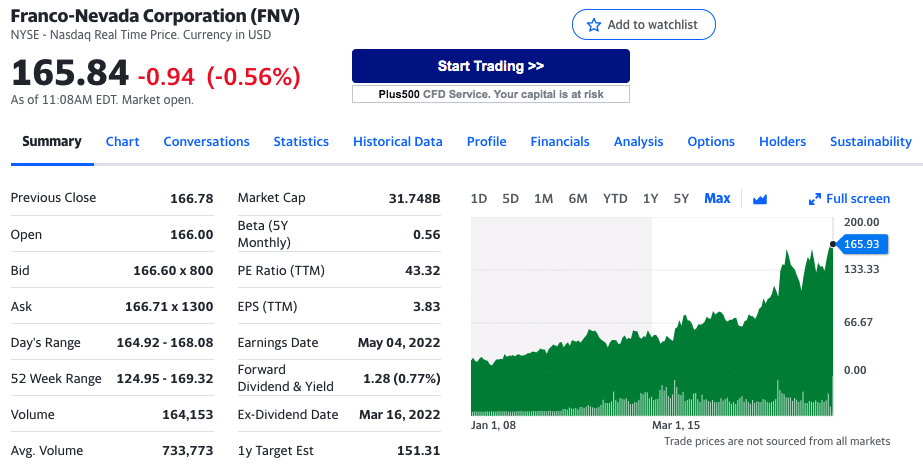

3. Franco-Nevada Gold – The Best Gold Mining Solutions Provider

Initially, the company provides the upfront funding necessary to develop and operate mines in exchange for a contractual right to purchase some or all of the gold produced at a highly discounted price.

Franco-Nevada Gold provides miners with the upfront capital they need to operate their mines, which is an expensive business. To be able to operate a mine, the companies must spend huge sums on equipment, fuel, and land.

Franco-Nevada Gold obtains the right to purchase gold at a contractually reduced rate for upfront funding. Consequently, Franco-Nevada Gold stands to benefit regardless of gold’s price. Whenever gold prices rise, it has the right to purchase the commodity at highly reduced rates. Conversely, gold prices decline when miners need cash, and the company makes the biggest deals.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

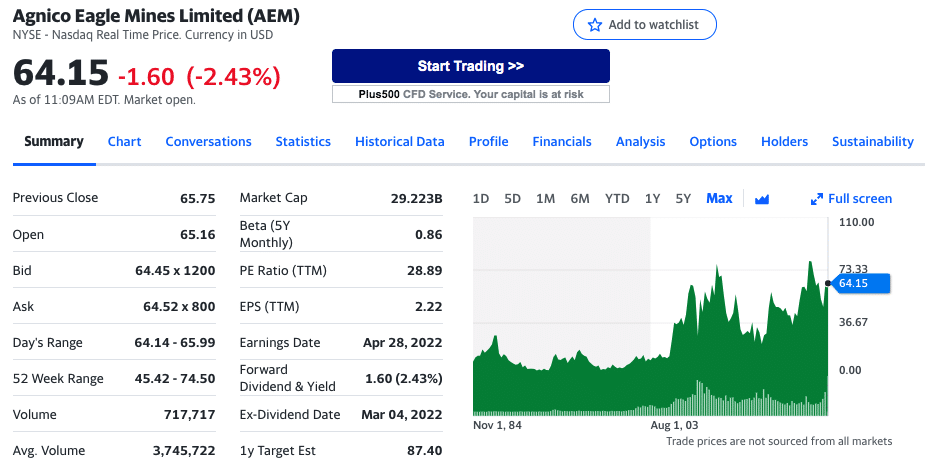

4. Agnico Eagle Mines – Gold Stock Company To Watch

Agnico Eagle Mines has a unique policy regarding gold sales, which tells you how confident the company is in its product. Agnico Eagle does not participate in forwarding gold sales like many other mining companies. It does not want to accept upfront cash in exchange for a discount on future gold production. Instead, it only sells its products after they have already been produced.

The company’s business model has proven to be both strong and stable, even when gold spot prices are low. Despite the current price tag on gold, the company has been paying dividends to investors since 1983, regardless of how strong the economy is.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

5. Kinross Gold – A Well-Positioned Gold Stocks Company

Despite having mines spread throughout the world, the company’s vast majority of production comes from its US operations. This is significant because it provides geopolitical insulation.

Kinross, for example, would only lose a small percentage of its production if tensions between the US and Russia deteriorated and sanctions were imposed against commodities, limiting trade between the two countries. However, other companies that operate primarily overseas would likely suffer significantly more losses.

Kinross’s strategy of maintaining most of its operations in North America is a major advantage in the current geopolitical environment.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

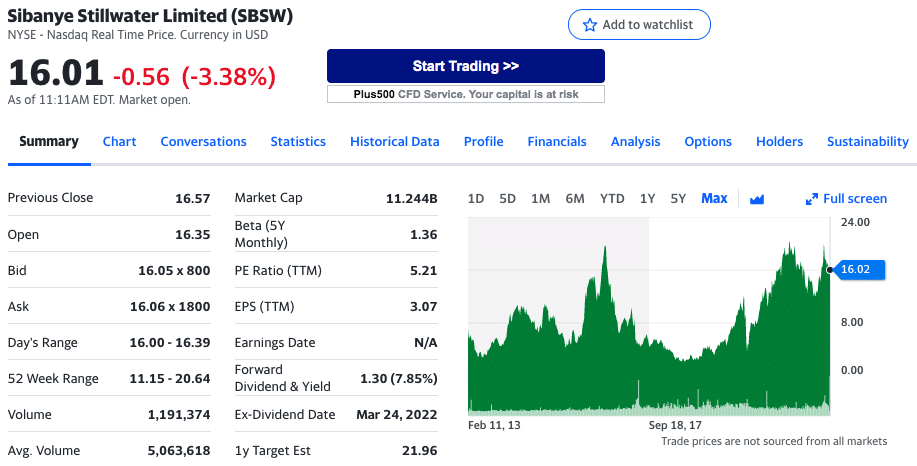

6. Sibanye-Stillwater – Mining Company With Gold Operations

Sibanye-Stillwater also produces lithium, whose value has skyrocketed as electric vehicles have become more common. However, the batteries in these vehicles run on lithium, a key component that’s hard to come by.

It is one of the newest companies on this list but has already grown, worth $10 billion. However, history indicates that its growth is far from over. This stock is one to watch very closely, given the leadership position the company has built over such a short period and its focus on rare precious metals in high demand.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

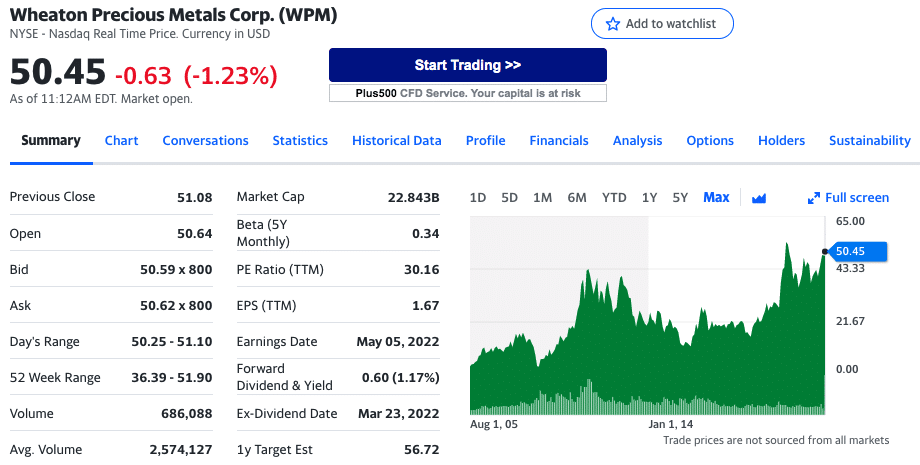

7. Wheaton Precious Metals – Precious Metal Company With Important Gold Operations

The company is one of the largest metals streaming companies globally, with a market capitalization of more than $20 billion. Currently, the company has a financial interest in 23 operating mines and eight mines in the development stage.

Streaming agreements are generally short-term, but Wheaton does things differently from most. The company is also one of the very few with contracts that span the life of the mines it invests in, even though some of its streaming deals are short-term.

The company stands out from other metal streaming companies with this competitive advantage.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

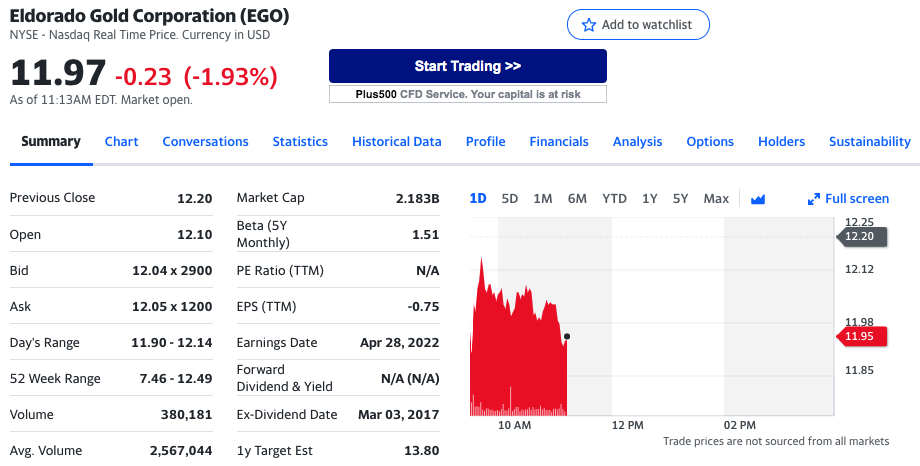

8. Eldorado Gold – A Gold Stock Company With An Excellent Growing Projection

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

9. B2Gold – Gold Stock with Strong 2020-22

B2Gold Corporation is a Canadian gold mining company with facilities in Mali, Namibia, and the Philippines. Founded in 2007, the company was listed on the Toronto Stock Exchange in 2007, then on the New York Stock Exchange and the Namibian Stock Exchange. Following Bema Gold’s acquisition by Kinross Gold, several Bema Gold executives formed the company. As a result of mergers with other mining companies, including Central Sun Mining, CGA Mining, Auryx Gold, and Papillon Resources, the company now operates five mines, two of which have been sold, and has a number of exploration properties.

The Covid-19 pandemic did hurt B2Gold’s share price. In January 2020, the share price decreased to $2.70. It then rose to $7.20 in August 2020, then declined to about $4.30. 2021 was a year of improvement for the company. The price has improved since then, and the stock is currently trading at $4.82.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

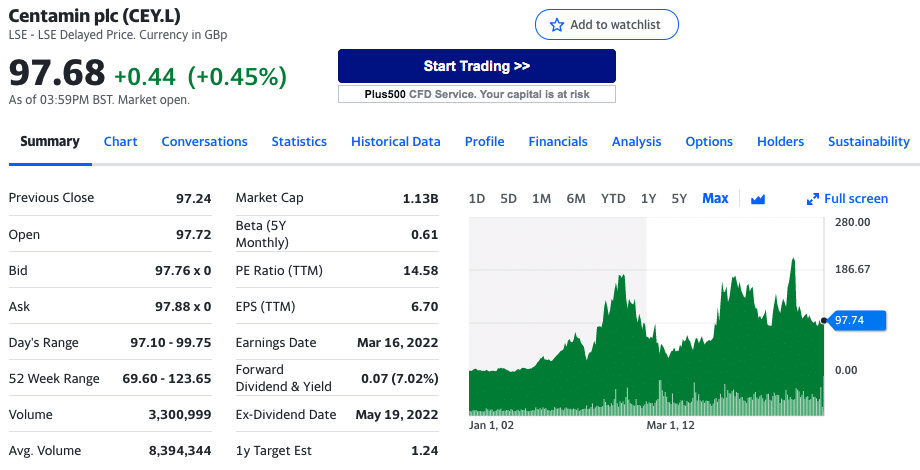

10. Centamin PLC – Multinational Mineral Exploration Company To Watch

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

How to Judge the Best Gold Stocks to Buy

As we have examined the top gold stocks to buy right now, we can evaluate how long it takes to find the right investment for your portfolio.

Performance Vs. Broader Markets

According to Sherman, the answer is rooted in economic policy: The monetary expansion and stimulus have pumped the markets with trillions of dollars, squashing fear and creating a surge in risk assets, such as cryptos, stocks, junk bonds, and real estate.

Due to this, investors are willing to take on more risks to cover inflation. In addition, investors have turned to other assets, such as equities, in response to gold’s decline for greater returns.

Another factor influencing gold prices is the rise of cryptocurrencies, which eat into gold’s market share. This weakening demand is reflected in the continued outflows from gold exchange-traded funds.

The investor community is debating whether cryptocurrency could play the same role as gold. Although Bitcoin’s value is far from stable, some see it as akin to gold because of its fixed supply and performance potential. But gold is a tested asset, whereas Bitcoin is an emerging asset, which increases investor risk.

Operating Costs and Break-Even Price

Understanding these metrics and their implications for better investment evaluation is crucial. They are:

Gold Production

In general, gold production means more gold for the company to sell and generate revenue from. In other words, we can think of this metric as having the potential of generating revenue for gold mining companies. Considering the importance of this metric, companies in the trade report gold production both quarterly and annually. Therefore, investors should seek out companies increasing their gold production. That indicates a growing future revenue potential, demonstrates the smart capital allocation strategy employed by the management, and opens the door to increased stock prices in the coming quarters. Alternatively, companies reporting shrinking gold production are at risk of financial decline, might have mining issues, and should generally be avoided.

Gold Recovery Rate

Once dirt and ores have been extracted from the mines, they must be processed and refined to yield usable physical gold. The recovery rate refers to how much gold is extracted from these ores. A company that produces 1kg of gold from 1000kg of ore is better off than a company that produces 1kg from 1 million kg of ore. A higher gold recovery rate would mean more ounces of gold being processed from the same amount of ore, making it a more profitable endeavor. Look for companies that have a high gold recovery rate.

Operational/Production Costs

Gold companies typically classify their operating costs according to the following criteria:

- Mining Cost: This refers to all the costs associated with excavating the ore, such as fuel, mine equipment, explosives, and fuel,

- Processing Cost: Includes costs associated with the plant where the ore is processed into gold, such as power and utilities, plant engineers, lease, water treatment, etc.

- General and Administrative Expenses: These expenses include salaries, environmental costs, taxes, etc. Costs are generally expressed in USD per ounce.

- Resources and Reserves: More gold reserves generally mean that a company will be able to produce gold consistently and steadily for the foreseeable future. The risk of gold mines running out, or even shrinking recovery rates, is reduced by doing so. In other words, gold reserves indicate untapped resources that can secure and stabilize the company’s future revenues. In contrast, companies with small or shrinking gold reserves may have to invest in more gold mines to maintain their sales or face financial decline. Our database at Business Quant shows that the top 10 gold mining companies by proven & probable reserves are as follows:

Dividend Program

Growth investors are typically more attracted to gold stocks than income investors. Some gold mining companies are profitable even when gold prices are low, but most rise and fall with gold prices. A rise in gold-stock prices is often reflected in increases in the price of gold. Even a relatively small increase in the price of gold can result in substantial gains in gold stocks, and investors typically achieve higher returns than those who own physical gold.

Gold stocks with historically strong dividend performance can benefit even investors focused primarily on growth rather than steady income. In a rising sector, dividend-paying stocks tend to show higher gains, and in a downturn, they do better – on average, nearly twice as well – than non-dividend-paying stocks.

Gold Penny Stocks

Although the 10 gold stocks that we discussed earlier are also classified as large-cap companies, there is also an abundance of penny stocks with a low share price and market capitalization.

A penny stock is a publicly-traded company whose share price is less than $5, according to the SEC. While gold penny stocks can offer great upside potential, they also carry many risks.

Even so, if you’re looking for the top gold penny stocks to buy right now, take a look at these companies:

Platinum Group Metals (AMEX: PLG)

Platinum Group Metals (AMEX: PLG)

Platinum Group Metals Ltd operates the Waterberg Project, a bulk underground PGM deposit in South Africa. Platinum Group discovered Waterberg, and it is currently being developed jointly with Implants, the Japan Oil, Gas and Metals National Corporation (JOGMEC), and Hanwa Co. Ltd. Waterberg can become a large-scale, low-cost producer of palladium, platinum, rhodium, and gold. Geographically, it operates in South Africa and Canada.

Avino Silver & Gold Mines (AMEX: ASM)

Avino Silver & Gold Mines (AMEX: ASM)

As a mineral resource company, Avino Silver & Gold Mines Ltd is involved in exploring, extracting, and processing silver, gold, and copper. Most of the company’s revenues come from selling silver produced by its mines. Avino, San Gonzalo, Oxide Tailings, Bralorne Gold, and others are among its projects.

Harmony Gold Mining Co (NYSE: HMY)

The market capitalization of a gold stock is $2.66 billion. Its 52-week low is $1.76, and its 52-week high is $7.61. There is high liquidity at Harmony Gold Mining Company, and it trades more than 4.1 million shares a day. This company had revenues of $26 billion in 2019.

Equinox Gold (AMEX: EQX)

Equinox Gold (AMEX: EQX)

Equinox Gold Corp has a product portfolio, near-production, and exploration-stage projects as a Canadian mining company. Aurizona gold project in Brazil and Castle Mountain are the company’s principal assets. It also owns the Koricancha gold milling operation in Peru, Warintza copper-molybdenum exploration property in Ecuador, Ricardo copper-molybdenum exploration property in Chile, and the resource-bearing Elk Gold project Canada.

Where to Buy Gold Stocks

Having completed this guide, you should now understand which gold stocks best suit your investment portfolio and long-term goals. Next, you might be interested in where to purchase gold stocks.

The trading platform you choose should provide competitive rates on gold stocks you wish to add to your portfolio. In addition, the platform should offer fractional shares if it does so that you can buy the hottest gold stocks and the best dividend stocks with a minimum investment of only $10.

The reason we found eToro to be the best overall place to buy gold stocks is:

eToro – The Best Place to Buy Gold Stocks

eToro is our top pick for the best online stock broker for retail investors. More than 3,000 stocks are available across 12 markets and exchanges on the platform. eToro offers stocks for as little as $10, which is the best. In addition, through fractional share trading, you can get exposure to the most expensive stocks.

eToro supports markets such as the US, UK, Hong Kong, Germany, etc. Whether you are buying the US or foreign companies, you can buy and sell gold stocks at 0% commission on eToro.

On top of that, on eToro, every gold stock is available for as little as $10. The reason for this is that eToro promotes fractional shares. Therefore, the minimum deposit required to find gold stock investments is $10. Moreover, you can deposit funds for free if you’re based in the US. The payment can be made via a debit or credit card, PayPal, Neteller, ACH, online banking, and other convenient methods.

It is also worth noting that gold stocks that pay dividends – most of which do – will deposit your share directly into your eToro account. Dividends generated from this investment can then be reinvested in the gold industry or requested to be withdrawn. Additionally, eToro offers hundreds of commission-free ETFs to diversify your portfolio.

The company also offers a professionally managed portfolio service called smart portfolios, which gives you passive exposure to various industries, including gold.

Pros:

- 0% commission on gold stocks

- The minimum deposit is only $10

- Provides a great stock app on the market

- Numerous top-tier entities regulate it

- Accepts credit/debit cards and PayPal payments

- Easy-to-use trading app

- Tools for copy trading

Conclusion

After gold prices cooled off after a run triggered by the COVID, it only makes sense that more and more investors are now diving into the market while prices are still reasonable. There is no doubt that investing in gold and the companies that mine and sell it can be a profitable endeavor. Nevertheless, plenty of investors has leveraged gold on their way to wealth by leveraging the precious metal.

Despite this, you should remember that not all gold stocks are created equal, as is true of any industry or sector. Therefore, research is vital before investing.

eToro – Overall Best Place to Buy Gold Stocks

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Platinum Group Metals (AMEX: PLG)

Platinum Group Metals (AMEX: PLG) Avino Silver & Gold Mines (AMEX: ASM)

Avino Silver & Gold Mines (AMEX: ASM) Equinox Gold (AMEX: EQX)

Equinox Gold (AMEX: EQX)