Best Brokers for NYSE Composite – Cheapest Brokers Revealed

Gaining exposure to the NYSE Composite index is a great way to diversify your portfolio. But, with so many trading platforms out there, picking the right broker can be overwhelming. In this guide, we review the best online brokers for the NYSE Composite in 2025 and beyond.

By the end, we show you how to take advantage of this unique trading opportunity and walk you through how to start your online trading journey with a trusted broker today!

Best Brokers for NYSE in 2025

Below you will find which top brokers made our top ten list. By scrolling down you can find an in-depth review of each trading platform to see which one is a perfect match for your trading objectives and personal finance.

- eToro – Overall Best Stock Trading Platform with 0% Commission

- Libertex – Best CFD Provider With Tight Spreads

- AvaTrade – Best CFD Broker with Top-rated Research Tools

- IG – Best Stock Trading Platform for MetaTrader 4

- Robinhood – Best Discount Broker for US Stocks

- Fidelity – Best US-based Broker for Commission-Free Stocks

- TD Ameritrade – Best Trading Platform with Low Non-Trading Fees

- XM – Best Broker for Low Stock CFD Fees

4

Payment methods

Features

Customer service

Classification

Mobile App

Fixed commissions per operation

Account Fee

- Buy shares and ETFs with 0% commission

- Social and copy trading network

- Invest and trade crypto with low fees

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Account Info

Fees per operation

- Amazing research tools

- Almost no fees

- User-friendly platform

Schwab Stock Slices is not intended to be investment advice or a recommendation of any stock. Investing in stocks can be volatile and involves risk, including loss of principal. Consider your individual circumstances prior to investing.

Account Info

Fees per operation

- Great selection of long-term investment products

- Access US-listed stocks

- ETFs

Investing involves risk, including risk of loss.

Account Info

Fees per operation

- Offers low-commission CFD and Forex trading

- Exposure to 78 different stock markets

- No minimum deposit required

The risk of loss in online trading of stocks, options, futures, currencies, foreign equities, and fixed income can be substantial.

Account Info

Fees per operation

What is the NYSE Composite?

The New York Stock Exchange Composite Index (NYSE) tracks the performance of all New York Stock Exchange-listed stocks, as well as ADRs (American Depositary Receipts) given by companies outside the US, tracking stocks, and REITs (Real Estate Investment Trusts). The NYSE Composite Index is market-weighted which means that the companies that make up the index are included based on their market capitalization. The New York Stock Exchange lists over 2,000 companies, and a large proportion of that figure is made up of international companies.

Ways to Trade and Invest in NYSE

The NYSE Composite Index is one of the most popular indexes in the US as it offers heaps of opportunities for both beginner and advanced traders and investors alike. In this section, you’ll learn how to gain exposure to the NYSE price movements through ETFs, individual stocks, cash indices, index futures.

If you are interested in opening a position on the NYSE Composite, here are a few simple steps you should follow.

- Firstly, you will need to pick between trading or investing. Gaining exposure to the NYSE Composite can be achieved in two ways. You could trade on the index’s value or you could invest in ETFs and shares.

- Before taking a position on the NYSE Composite you need to determine if you prefer short or long-term investments.

With this said you can trade or invest in the NYSE Composite Index by trading spread bets and CFDs or purchasing exchange-traded funds and individual shares of stock that make up the underlying index.

Trade the NYSE Composite with Cash Indices

Trading cash indices involves dealing at the current price of the market. Cash indices are typically sought-after by those who prefer short-term trades since they provide the lowest spreads. Nevertheless, by keeping your cash index positions open overnight, you will incur a funding fee.

Trade the NYSE Composite with Index Futures

Trading index futures involves agreeing to trade the chosen index at a specified price on a specified date. Index futures are favored amongst long-term traders as overnight fees are built into the spread which means you can hold positions for long periods without being charged overnight fees. Index futures give you access to a wide range of markets, indices, shares and currency pairs.

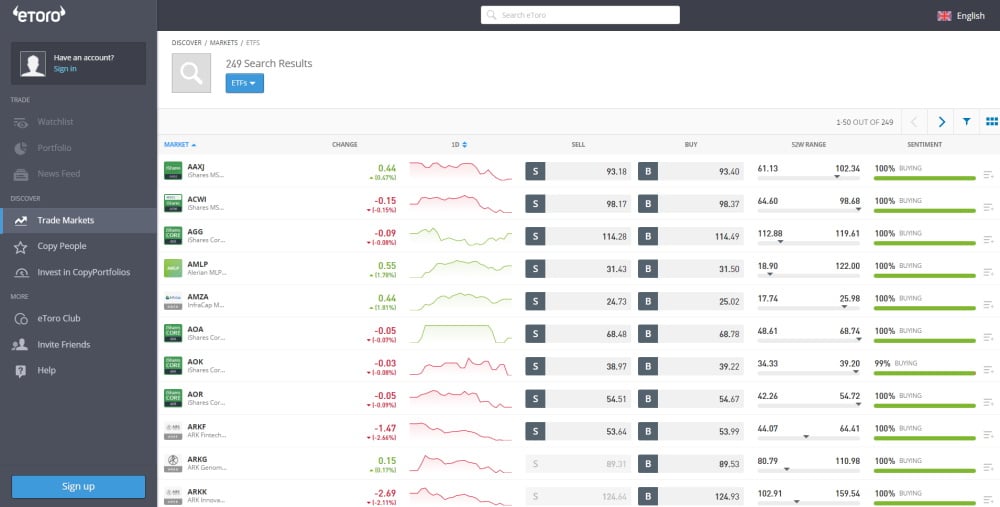

Invest in the NYSE Composite with ETFs

In short, by investing in a NYSE Composite Index ETF, you spread your investment across all companies that make up the index itself. The most popular form is a weighted tracker which replicates the performance of the underlying index. An example of a popular NYSE Composite ETF is the iShares NYSE Composite Index Fund ETF.

Invest in the NYSE Composite with Stocks

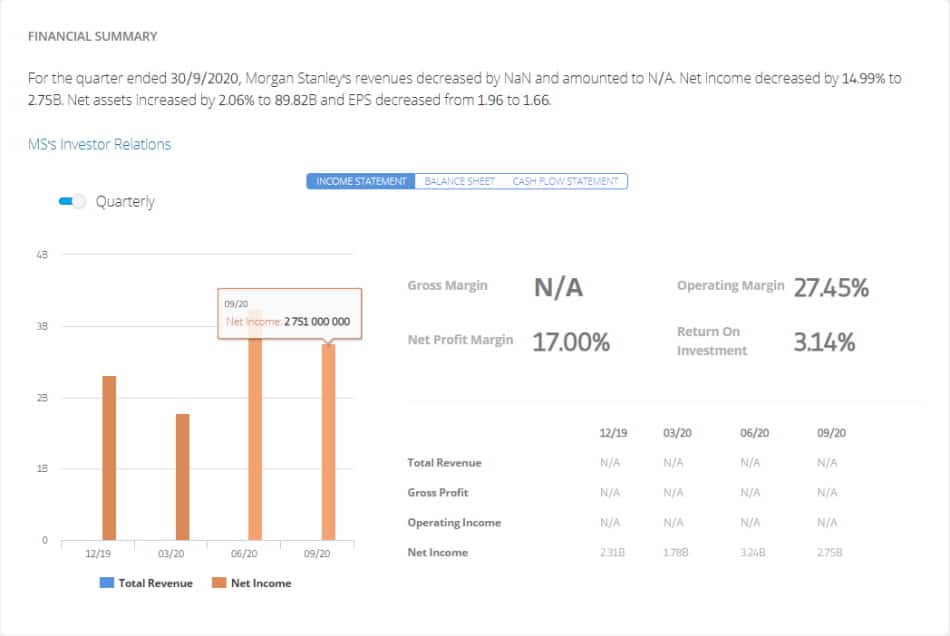

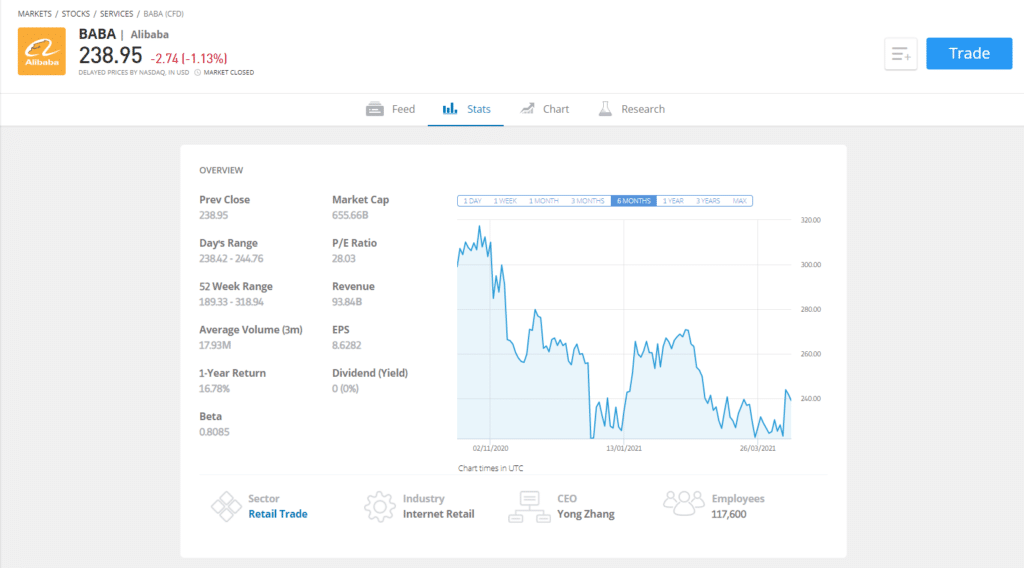

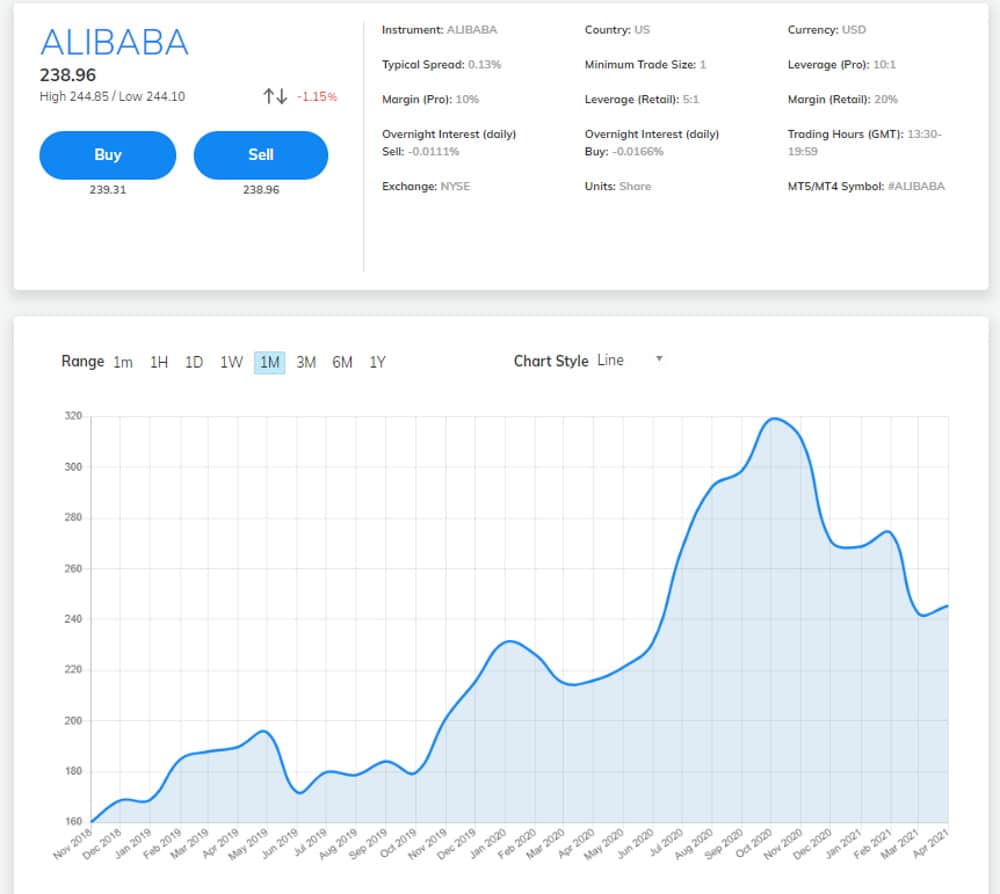

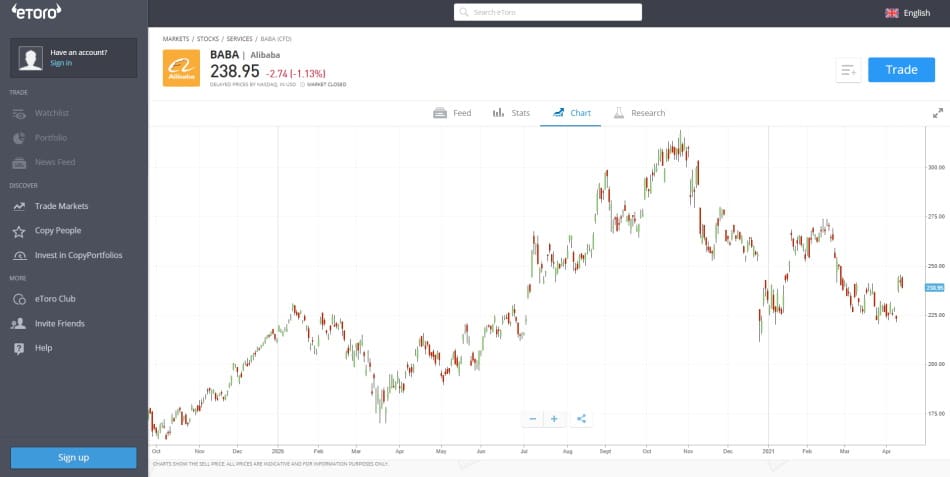

Alternatively, you can invest directly in the companies that make up the NYSE Composite, with the intention of selling them for a profit later on. NYSE Composite stocks are popular within the investing community due to their high returns. Examples of NYSE Composite stocks include Alibaba Group Holding Ltd under the ticker symbol BABA, American Express (AXP), Herbalife Nutrition Ltd (HLF), Morgan Stanley (MS).

NYSE Composite tracker funds

There is also the option of investing in NYSE Composite tracker funds to gain exposure to the index. Much like index funds, tracker funds monitor the performance and price movements of the underlying index. In simple terms, when you invest in NYSE Composite tracker funds, the value will rest heavily upon the price movements of the actual NYSE index. Basically, when the price of the NYSE Composite index rises so will the value of the tracker fund.

Why Trade or Invest in the NYSE Composite?

Bearing in mind that the combined market cap for the top four NYSE Composite stocks alone is estimated to be around the sum of $2 trillion, the NYSE Composite index can be a great investment. However, this depends on a range of factors from the health and performance of the global and US economies, to recent developments with the coronavirus pandemic and how the rollout of an effective vaccine could bring back some sense of normal to business and consumer sentiment. The NYSE Composite is made up of the largest companies in the world which means they are most likely to be unmoved in the midst of market volatility. But, if bearish sentiments overwhelm the markets then all indices including the NYSE Composite will feel the effects.

The NYSE Composite lists over 2,400 companies, including international ones which make up approximately 33% of the total market cap. This means that if you choose to invest in individual shares of companies that constitute the NYSE Composite then you can easily diversify your investment portfolio with shares of NYSE listed companies that meet stringent listing regulations and criteria.

In summary, the two most prominent reasons why investors and traders choose the NYSE Composite Index is because:

- It has a high-quality reputation as all the companies that make up the index need to meet the strict listing criteria as set out by the New York Stock Exchange itself.

- The diversification that it offers is highly desirable for investment portfolios especially as one-third of the index’s constituents are based outside the United States.

Best Brokers for NYSE Composite Reviewed

We spent the time and effort to review and compare the best low-cost trading platforms to trade and invest in the NYSE Composite index so that you can choose the best one that suits your needs as a trader.

With this in mind, let’s kick start this guide with our top ten selection of the best brokers for the NYSE composite ETF and trading stocks in 2025 and beyond.

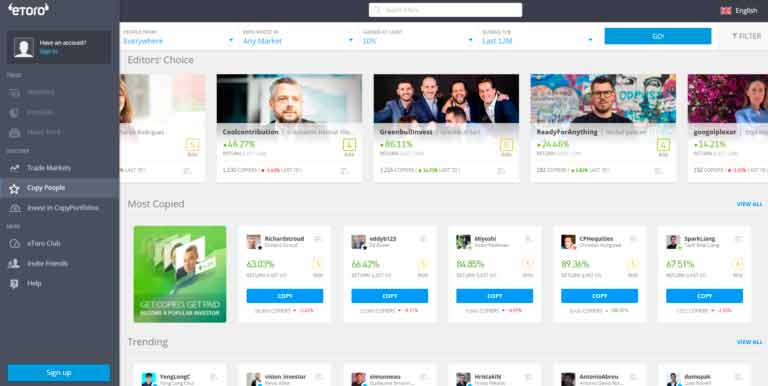

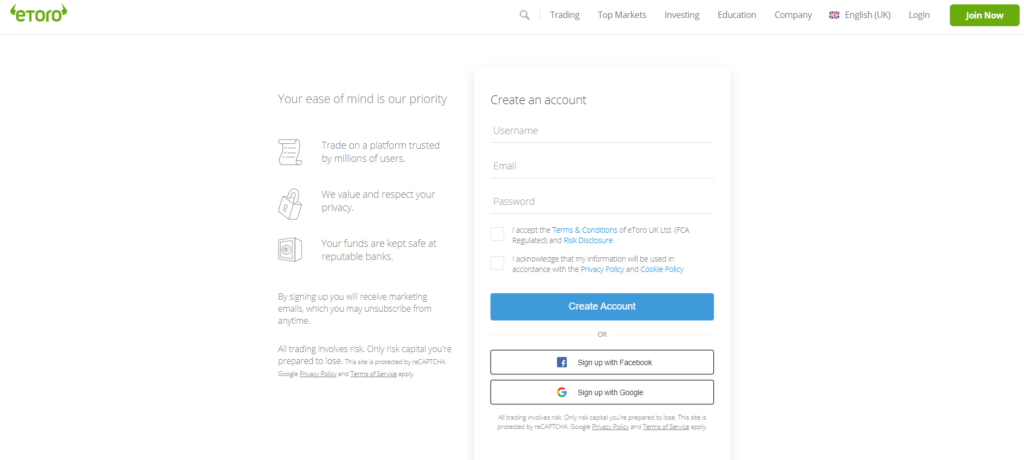

1. eToro – Overall Best Stock Trading Platform with 0% Commission

With such diversity nowadays, the online trading scene has become saturated with all kinds of brokers. Be that as it may, we had no second thoughts when picking eToro as our top-rated NYSE broker in 2025.

The social trading platform offers tons of tradable assets, a well-designed and easy-to-use platform, and is regulated by top-tier financial authorities including the UK’s Financial Conduct Authority. For these reasons and many more, eToro has become home to more than 20 million active traders.

With eToro you have access to more than 2,000 stocks from a range of different markets. Aside from the blue-chip stocks listed on the top stock exchanges including the NASDAQ, NYSE and LSE, you can also buy and sell stocks listed on other international exchanges. Furthermore, this popular copy trading platform allows you to trade financial instruments without paying a penny in commission.

Simply put, eToro offers 100% commission-free stock and ETF trading, and for an added bonus there aren’t any annual maintenance fees. When it comes to low trading fees, the minimum stock trade is only $50, which means that you can create a diversified portfolio that replicates the performance of the NYSE Composite index with a $50 minimum per trade.

eToro secures the number one position in our review because it is designed with beginner traders in mind. The web trading platform and the mobile app are well-designed and user-friendly. This means that you can trade wherever you are with the click of a button. The search functionality is great, with relevant predictive suggestions and its ease of use, navigating your way around the platform is simple and easy.

Pros:

- Designed with beginner traders in mind

- Trade stocks, ETFs, forex and other tradable assets with 0% commission

- In terms of cryptocurrencies, eToro offers Bitcoin trading and Ethereum trading

- Wide selection of stocks and ETFs on multiple markets

- Account opening process is fully digital and seamless

- Deposit funds instantly with e-wallet or credit/debit cards

- Innovative Copy Trading feature

- ASIC, CySEC, and FCA-regulated

- User-friendly mobile trading app for trading on the go

Cons:

- Not a great match for advanced traders looking to conduct technical analysis

- USD is the only account base currency available

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

2. Libertex – Best CFD Provider With Zero Spreads

Established in 1997, Libertex is a CFD broker with a global reputation for offering trades with zero spreads. Trading platforms across the industry charge spreads as a way of making money for providing their services. Simply put, the spread is the gap between the bid and ask price.

To further this idea, let’s say that the spread equals 0.5%. This would mean that you would need to make a minimum of 0.5% in returns just to break even. Having said this, the spread of the trade makes you open a position at a partial loss. Therefore, by offering trades on a tight spread basis, Libertex has changed the way we trade online.

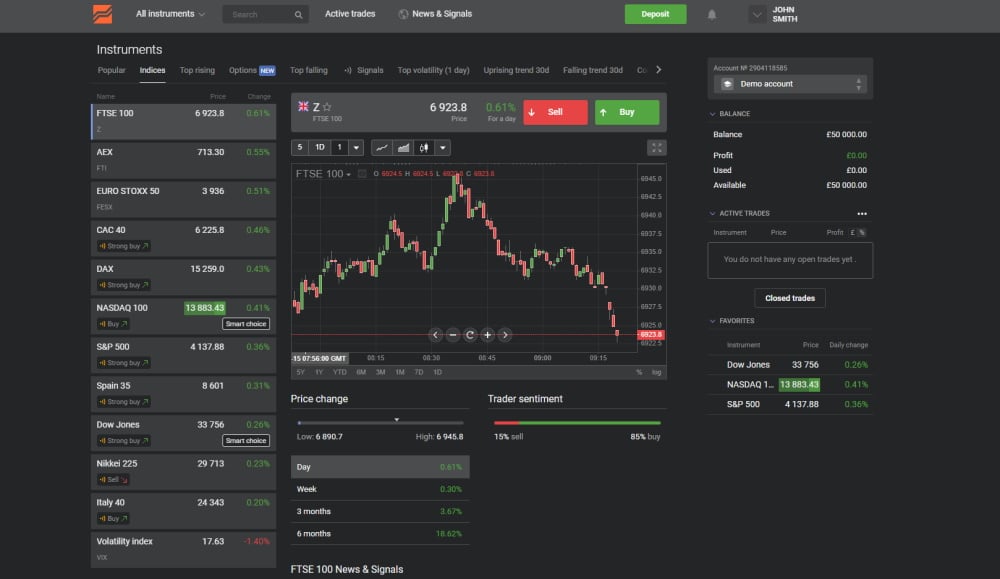

On the flip side, there are commissions for trading with Libertex. The actual amount of commission depends on the tradable asset and market that you pick. For example, if you want to trade stock CFDs you will typically pay 0.1% commission. When it comes to trading platforms Libertex offers a mobile trading app, a web trading platform and the third-party platform MetaTrader 4 which is best suited for advanced traders who want to make use of the diverse charting tools and fundamental data features it offers.

For those of you who are just starting in the world of online trading, you can use the Libertex demo account. A demo account allows you to test and trial your investment strategy without the risk of losing your capital. Moreover, the Libertex demo account gives you $50,000 worth of paper funds to use at your discretion.

Pros:

- Trade CFDs and pay tight spreads

- Competitive commissions for forex and stock trades

- Provides MetaTrader 4 trading platform

- Regulated by the financial authority CySEC

- No deposit fees

Cons:

- Limited markets available

- Lack of research and financial analysis

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

3. AvaTrade – Best CFD Broker with Top-rated Research Tools

Regulated by a range of financial authorities including ASIC, the Central Bank of Ireland, and the Financial Futures Association of Japan, AvaTrade is a global CFD and forex broker.

AvaTrade is a great option for day traders looking to trade CFD assets as it provides market-leading tight spreads. For example, the majority of forex pairs can be traded with a spread of less than 1 pip.

AvaProtect is an innovative feature that AvaTrade offers. Simply put, AvaProtect is a hedge that you can purchase for a fixed price depending on the length of time you want your trade to be covered for. In the event that you suffer losses on the trade, AvaTrade will compensate you. Something worth mentioning is that this industry-leading and unique feature can only be used on market orders.

Currently, most brokers do not charge any commission for trading or investing. AvaTrade is no exception to this trend. Zero commission means that the trading platform of your choice will not charge a fee for executing buy and sell orders. As a result, the broker is compensated via the market bid and ask spread, which is the gap between the bid and ask price.

AvaTrade supports five base currencies. Hence, your options for obtaining other trading accounts in various currencies are rather limited. This means that you will face a conversion fee when making a deposit that is in a different currency than the one already in your trading account.

Pros:

- The account opening process is simple and easy

- Low trading and non-trading fees

- Plenty of research and charting tools available for advanced traders

- No withdrawal fees

Cons:

- You cannot set price alerts or push notifications on the web trading platform

- Only basic order types can be placed

There is no guarantee that you will make money with this provider. Proceed at your own risk..

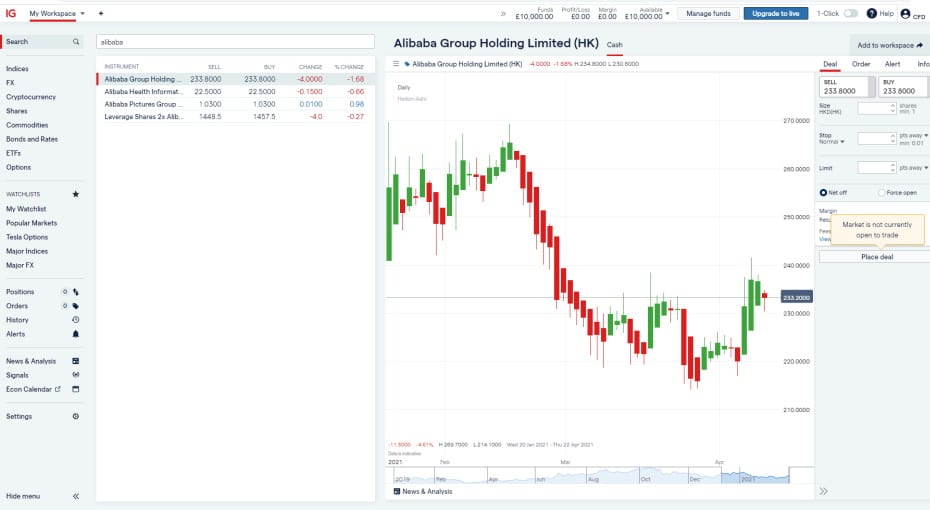

4. IG – Best Stock Trading Platform for MetaTrader 4

Established in 1974, IG has a reputation as one of the largest CFD brokers in the financial sector. This UK-based trading platform is regulated by top-tier financial bodies including the FCA and BaFin. In addition to this, IG is listed on the LSE under the ticker symbol IGG and has a market cap of 3.50 billion pounds.

IG clients can access heaps of CFDs, forex and options. For example, there are more than 10,000 stock CFDs to choose from. However, UK-based traders also have access to real stocks. If you are a trader with an eye for other popular financial instruments then you will be disappointed to find out that IG only offers CFDs, forex, options and stocks.

Another feature that only UK-based clients have access to is IG Smart Portfolio which offers iShares ETF portfolios which are actively managed by the investment management company BlackRock. Simply put, this is a robo-advisor service that offers automatically managed discount portfolios.

When it comes to trading fees this varies depending on the country. For instance, certain countries have access to 0% commission on stock CFD trades, whereas other countries incur low commission charges. IG traders can choose between its proprietary trading platform and MetaTrader 4.

MetaTrader 4 is a perfect match for more experienced investors who want to take advantage of a variety of technical indicators, screeners, and charting tools, in addition to using an automated trading robot.

Pros:

- FCA-regulated CFD and forex platform home to more than 200,000 traders

- Offers MetaTrader 4 trading platform

- Tight spreads averaged at 0.8 pips with 100% zero-commission

- Web trading platform and mobile trading app available

- No withdrawal fees

Cons:

- $250 minimum deposit

- As a disclaimer, please take into consider the lack of fundamental data

There is no guarantee that you will make money with this provider. Proceed at your own risk..

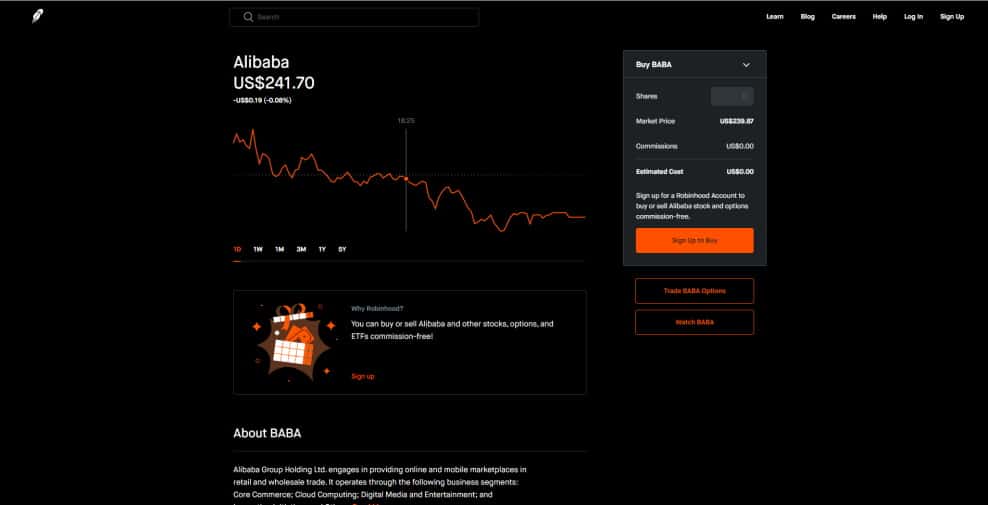

5. Robinhood – Best Discount Broker for US Shares

Launched in 2013, Robinhood is a US-based discount broker that is now home to more than 10 million traders. Regulated by top-level financial bodies including the US SEC and FINRA. Aside from the trading platform services, Robinhood also piloted the Cash Management system to allow its users to earn interest on dormant or uninvested funds. The uninvested funds are deposited with banks that are covered by the Federal Deposit Insurance Corporation.

For active traders with an eye for US stock and ETF trading Robinhood is the perfect broker as it offers commission-free trades of these popular financial instruments. In addition, options and cryptocurrencies including Bitcoin trading are free from commission charges. So, Robinhood offers a cost-effective way to trade your favourite assets without paying a dime in commission.

Robinhood’s 100% zero-commission trading foundation is also reflected in its low non-trading fees with no account or inactivity fees. You can choose between three account types: Robinhood Instant, Robinhood Gold and a Cash Account. There is no minimum deposit for the Instant account, but there is a $2,000 minimum deposit for the Gold account.

Pros:

- Earn 0.30% APY on your uninvested funds with Robinhood’s Cash Management

- Regulated by the US SEC and FINRA

- Mobile trading platform compatible with iOS and Android devices

- US Stock and ETF trading is free

- Low non-trading fees

- No minimum deposits for Robinhood Instant accounts

- No account minimum

Cons:

- Accounts only accessible to US-based traders

- Lack of IRA accounts

- Cannot deposit funds with debit or credit cards

There is no guarantee that you will make money with this provider. Proceed at your own risk..

6. Fidelity – Best US-based Broker for Commission-Free Stocks

Fidelity is a US-based broker that was founded in 1946. It is regulated by top financial bodies including the US SEC and the FINRA. Fidelity offers zero commission US stock and ETF trading. As well as its low trading costs, Fidelity provides heaps of research tools such as trading ideas for exchange-traded funds, stocks and mutual funds. On the topic of research tools, with Fidelity you can set 50 different technical indicators with the option to save and download the charts.

Fidelity also tailors its experience for beginner traders. There is a paper trading demo account available on the desktop platform. Demo accounts offer a great way to experience online trading without having to worry about your volatility threshold. There are around 16 base currencies to choose from with Firdleity which means that you can avoid conversion fees. In terms of your deposit fees and payment options, Fidelity does not charge for deposits. On the other hand, you cannot deposit funds with a credit or debit card. Needless to say you can use e-wallets like PayPal and bank transfers. Also, you might like to check out our Fidelity vs TD Ameritrade review for more details about these US-based brokers.

Pros:

- No deposit or withdrawal fees

- Offers web and desktop platforms and mobile trading app

- User-friendly and well-designed interface

- Heaps of order types to choose from

- Wide range of price alerts and push notifications to stay in the loop about potential trading opportunities

- Offers tons of tradable assets from stocks, ETFs, and bonds, to options and funds.

- SEC and FINRA-regulated

- Good selection of charting tools including 50 technical indicators

Cons:

- Customer support is not available 24/7

- Paper trading account is only available on the desktop trading platform

There is no guarantee that you will make money with this provider. Proceed at your own risk..

7. TD Ameritrade – Best Trading Platform with Low Non-Trading Fees

TD Ameritrade is a US-based broker that was established in 1975. Since then it has become one of the largest industry-leading brokers out there. In terms of the fundamentals, it is regulated by top-level financial bodies including FINRA, the CFTC and the SEC.

TD Ameritrade clients have access to free ETF and stock trading, with low trading fees for other popular products such as forex, bonds and options. If you have a preference for trading stocks on margin then you should consider TD Ameritrade’s annual margin rates. So what is a margin rate? In short, when you trade on margin, you are essentially trading with money that you have loaned from the broker to make a trade. With these borrowed funds you will be charged interest, or in financial trading terms a margin rate. As such, TD Ameritrade charges a 9.5% annual margin rate.

In regards to the types of tradable assets on offer at TD Ameritrade you can take your pick from stocks and ETFs to cryptocurrencies and futures. Additionally, you can access social trading through its desktop trading platform called Thinkorswim. Social trading gives users the ability to interact and communicate with other traders on the platform. Also, if you are looking for a more passive approach to trading TD Ameritrade offers a managed portfolio called Essential Portfolios which is a robo-advisory service. But, there is a $500 minimum deposit to start an Essential Portfolio.

The paperMoney demo account, or paper trading account is designed with new traders in mind. This is accessible via the Thinkorswim desktop trading platform and gives users access to a wide variety of advanced trading and charting tools allowing you to test your trades free from the risk of losing real funds. When you open a paperMoney account you start with a $100,000 default amount of paper funds.

Pros:

- paperMoney demo account available on the Thinkorswim desktop trading platform

- Paper trading starts with $100,000 worth of virtual funds

- Free stock and ETF trading

- Low non-trading fees

- Wide variety of account types to choose from

- Account opening is user-friendly and fully digital

- No minimum deposit required

- Web and desktop trading platforms offer loads of assets and tons of research tools and fundamental data

- Two mobile trading apps are available, both compatible with Apple and Android devices.

- TD Ameritrade mobile is better suited for beginner traders and Thinkorswim Mobile Trader is a better match for more advanced investors and traders

- Clients have access to social trading through the Thinkorswim platform.

- Regulated by the SEC, FINRA, MAS, and the CFTC

- Clients are covered by the SIPC

- TD Ameritrade is listed on the NASDAQ stock exchange

Cons:

- Negative balance protection is not provided

- E-wallets and credit/debit cards are not available deposit options

There is no guarantee that you will make money with this provider. Proceed at your own risk..

8. XM – Best Broker for Low Stock CFD Fees

XM is an online broker which is owned by the CFD and forex broker Trading Point Holding. XM falls under the regulation of CySEC, the IFSC, and the Australian Securities and Investments Commission or ASIC for short.

This trading platform provides around 60 forex pairs and over 1,000 CFDs, in addition to zero-commission account options. One of XM’s most attractive features is that it allows its clients to use the full MetaTrader trading suite, which gives you access to automated trading, advanced charting tools and technical indicators, and much more.

Although XM is primarily a forex broker, it has also gained a strong reputation as a stock broker. You can pick and choose from more than 1,200 stock contracts for difference (CFDs) with a leverage up to 20:1. There are heaps of stocks as XM covers markets from the US, UK, Europe and others. On the flip side, this broker does not offer popular trading instruments such as ETFs, options and bonds.

Pros:

- Huge offering of currency pairs and stock CFDs

- Provides MetaTrader 4 and MetaTrader 5 trading platforms

- Competitive, tight spreads particularly for CFD trading

- No withdrawal or deposit fees

- Variety of deposit options including bank transfers, debit/credit cards, and e-wallets

- Open an account quickly and easily and start using your brokerage account the same day

- An array of account types to choose from such as Micro, Standard, and XM Zero.

- Offers MT4 and MT5 mobile trading apps

Cons:

- Lack of fundamental data on assets

- Price alerts and notifications cannot be set on the web trading platform

There is no guarantee that you will make money with this provider. Proceed at your own risk..

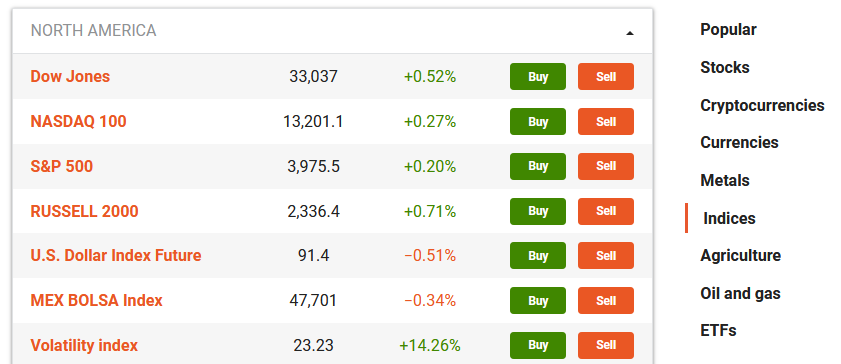

NYSE Brokers Fees Comparison

| Deposit fee | Withdrawal fee | Account fee | Inactivity fee | ETF fee | Stock fee | CFD Min Spread | |

| eToro | $0 | $5 | No | $10 per month after 1 year | 0% | 0% | 2.4 pips |

| IG | $0 | $0 | No | $12 per month after 2 years | 0.10% | 0% for US shares. Trading spread bets and CFDs 0.10% min commission | 1 |

| AvaTrade | $0 | $0 | No | $50 per 3 months after 3 months | 0.13%- 0.15% average | 0.13% for NYSE stock | 1 |

| Robinhood | $0 | $0 | No | No | 0% | 0% | n/a |

| Libertex | $0 | $0 | No | $12 per month after 180 days (if funds are less than $10,000 | Commission varies depending on the market’s current spread level | 0.1% – 0.2% | 0.0251 % for Nasdaq 100 index CFD |

| Fidelity | $0 | $0 | No | No | 0% | 0% | $49.95 transaction fee |

| TD Ameritrade | $0 | $0 | No | No | 0% | 0% | n/a |

| XM | $0 | $0 | No | $15 one-off fee after 1 year then $5 per month | n/a | Cash CFDs stocks – spread as low as 0.49 | Spreads as low as 2 |

How to Get Started with a NYSE Composite Broker

In this part of our guide we will walk you through the process of how to start investing in or trading the NYSE Composite with eToro, our top-recommended broker for 2025. The social trading platform is regulated by top-tier financial authorities and provides trading on a zero-commission basis.

Step 1: Open an Account with eToro

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Opening an eToro account is fully digital, easy, and very fast. Simply provide your personal details, accept the terms and conditions and acknowledge the privacy policy and click the create account button at the bottom of the screen.

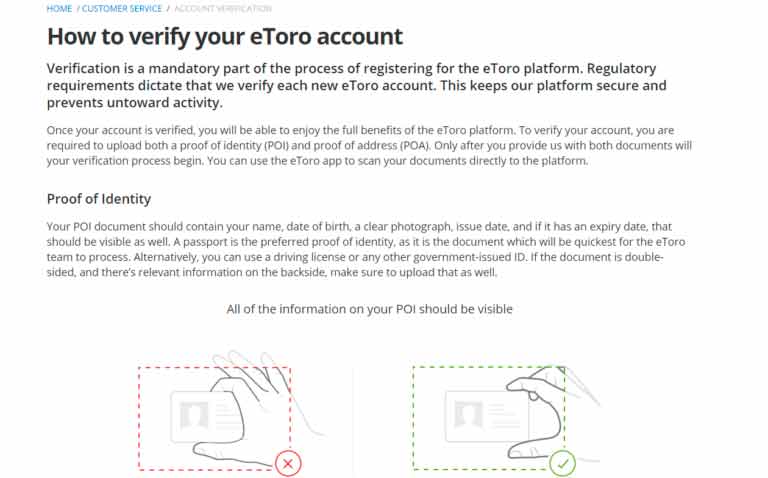

Step 2: Upload Your ID and Proof of Address

As eToro is regulated by top-level financial authorities including the UK’s Financial Conduct Authority you will be required to verify both your address and identity to withhold high levels of compliance and standards. You can upload a copy of your passport or ID card and a utility bill dated within the last six months.

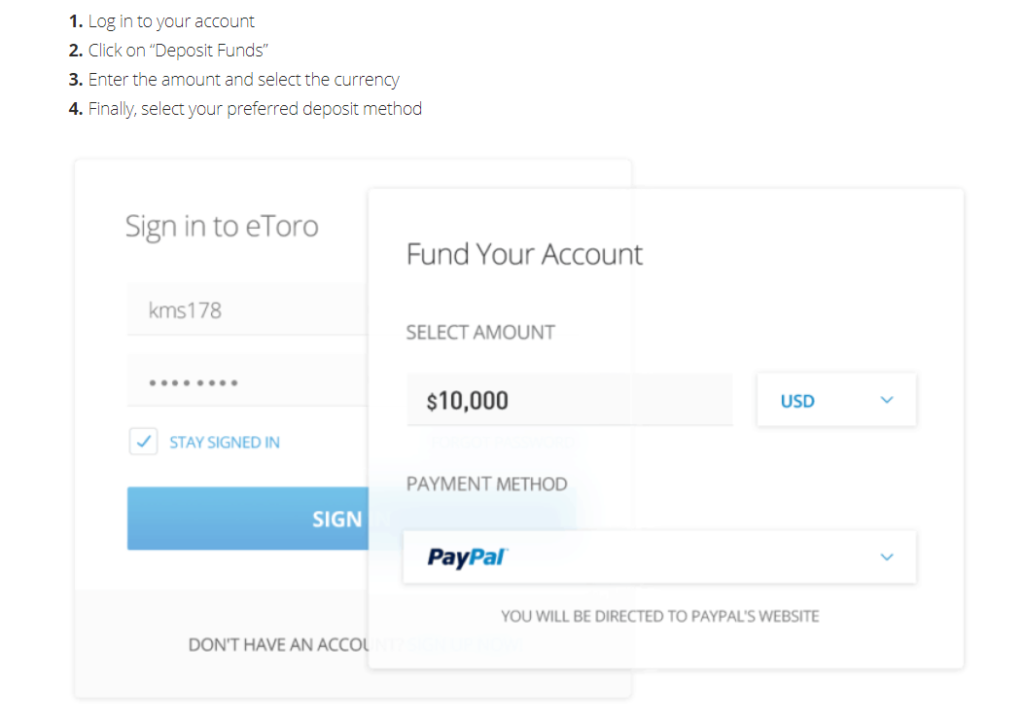

Step 3: Deposit Funds into Your eToro Account

Depositing money into your eToro account is free, easy, and available with a wide range of options. These include via bank transfer, credit or debit cards, e-wallets including PayPal, Neteller, China UnionPay, Skrill, and more. A bank transfer typically takes around 4-7 working days, on the other hand, credit/debit card and e-wallet deposits are processed immediately.

Step 4: Search for NYSE Composite Stocks to Invest in

eToro has a wide variety of tradable assets on offer with 100% zero-commission trading. Simply click on the search bar and type in the name or ticker symbol of the stock you wish to invest in. For this tutorial, we have chosen Alibaba.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Step 5: Place Your Trade

After you have picked your NYSE Composite stocks click on the trade button. Then the trading ticket will give you the ability to specify the exact amount you wish to invest, the leverage amount, and place order types such as stop loss. If there are any overnight fees to hold the position open after the end of the trading day then they will be displayed on the ticket itself.

All that’s left is to click on Open Trade and you will have invested in your chosen asset.

Conclusion

Throughout this guide, we have reviewed and examined 10 of the best brokers for trading and investing in the NYSE Composite Index, and we have gone through how you can either trade or invest in the index. As the coronavirus pandemic loosens its grip over the global economy and business sentiment, companies are beginning to plan for the long-term.

The NYSE Composite Index is home to a wide variety of companies some of which are based outside the US. Whether you decide to trade or invest in the NYSE Composite you will find it is a hugely diversified index with plenty of potentials to yield profits.

What’s more, to do all of this you will need to choose a top-rated, trusted, and competent broker. We recommend eToro for this as it is not only designed with beginner traders at the forefront of its services but it also provides great Copy Trading tools to help you learn from advanced traders before you step into the world of online trading alone.

Opening an account is quick and easy, and the best part is you won’t pay a penny in commission!

eToro – Invest in NYSE Stocks – 100% Commission-Free

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.