TradeStation vs Interactive Brokers – Cheapest Broker Revealed

Online trading is one of the fastest-growing sectors in the investment space. With millions of online active traders trying to capitalise on potential returns, choosing the right broker for your needs is crucial.

In this TradeStation vs Interactive Brokers review, we will be covering all the key metrics, from fees and commissions to mobile trading and payments, to help you start your online trading journey with a top-rated trading platform in 2025.

What are TradeStation and Interactive Brokers?

In short, with Interactive Brokers and TradeStation you can buy and sell tradable assets from the comfort of your own home. Once you have opened a brokerage account and deposited funds you can access thousands of financial instruments with the click of a button.

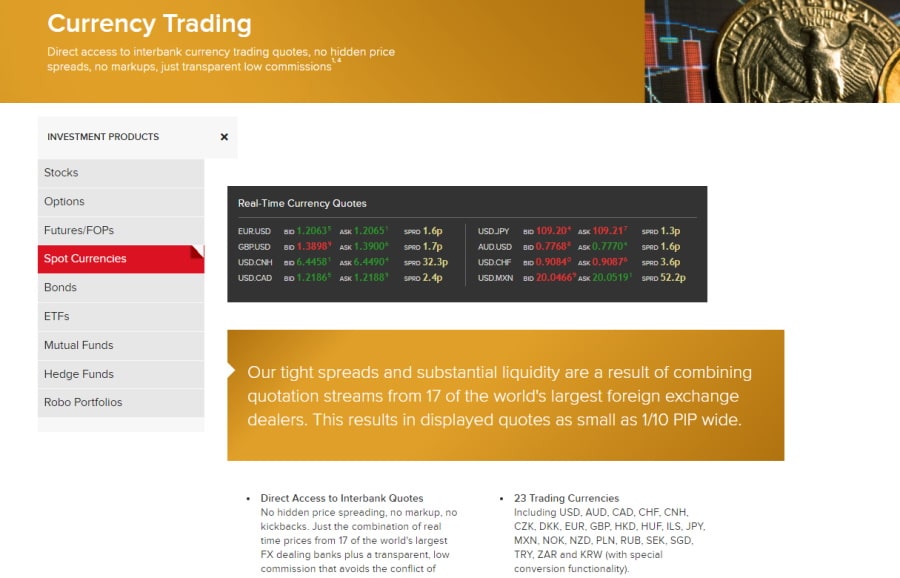

For example, both TradeStation and Interactive Brokers offer stock trading, ETFs, futures, and mutual funds, and more. However, Interactive Brokers also supports CFD and forex trading, including 23 trading currencies and real-time currency quotes.

While TradeStation facilitates traditional investments, Interactive Brokers also offers CFD trading which allows you to speculate on the future price movements of the underlying assets without taking ownership. Therefore, if you are interested in CFD and forex trading then Interactive Brokers is the way to go.

All in all, both online brokers have user-friendly and well-designed platforms that allow you to trade assets easily and deposit funds into your account for free via ACH transfer.

Additionally, both trading platforms allow you to buy and sell financial instruments via their web platforms, desktop, and mobile platforms. When it comes to safety and regulations, Interactive Brokers is regulated by the UK’s Financial Conduct Authority, the US Securities and Exchange Commission, and the Financial Industry Regulatory Authority (FINRA). TradeStation is also regulated by top financial authorities including the US SEC and FINRA.

TradeStation vs Interactive Brokers Tradable Assets

As we have already seen there is little to separate both brokers other than the fact that Interactive Brokers also offers CFD and forex trades. So, in this section, we will discuss the different asset classes and markets that each platform covers.

Stocks and ETFs

Firstly, at TradeStation you can trade on the major US stock exchanges such as the New York Stock Exchange and the Nasdaq. In terms of diversification, you are limited to just US stock markets.

Stock trading is popular amongst beginner traders because of the liquidity and diversity that comes with it. Buying and selling shares of stock can be used by both short-term and long-term investors looking to diversify their investment portfolios.

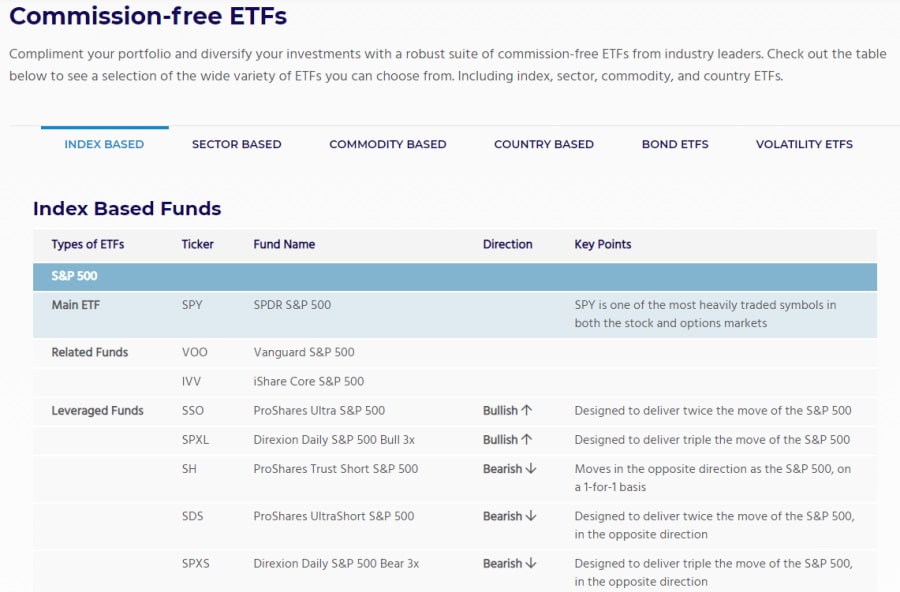

TradeStation also offers over 2,000 exchange-traded funds, or ETFs, which make up a large portion of the stock market. You can build your portfolio and diversify your investments with a wide range of commission-free ETFs at TradeStation, which are conveniently broken down into relevant categories including:

- Index-based ETFs

- Sector-based ETFs

- Commodity-based ETFs

- Country-based ETFs

- Bond ETFs

- Volatility ETFs

Importantly, TradeStation allows you to invest in all supported stocks in a traditional manner, which means that you gain ownership of the underlying asset and by default are entitled to potential dividends that could arise.

In the case of Interactive Brokers, this online trading platform offers heaps of financial instruments including traditional investments and CFD derivatives. This broker has a huge selection of markets and products, with over 13,000 ETFs.

With Interactive Brokers you can gain exposure to 78 different stock markets such as the Nasdaq exchange, the NYSE, the London Stock Exchange, and many other international exchanges. As well as the traditional stocks, you can access penny stocks and fractional shares.

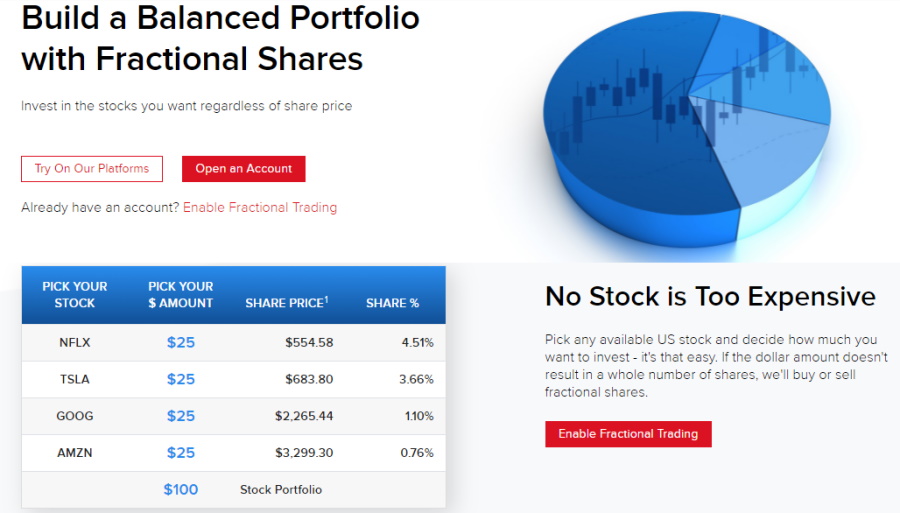

The main benefit of fractional shares is that you can buy a portion of a stock that would otherwise be too expensive for you to buy outright. All you have to do is select any available US stock and specify the amount you wish to invest. For example, if you wanted to buy shares of Tesla (TSLA) stock, rather than paying $683.80 for a single share, you could invest with $25 and own 3.66% of Tesla stock. It is worth mentioning that the share price of Tesla stock represents that of April 2021 and due to market volatility and price movements, this price is subject to change.

Forex trading

If you are interested in forex trading, our TradeStation vs Interactive Brokers comparison found that the latter provides access to 23 different trading currencies with low commissions and tight spreads including basis points of 0.08 to 0.20. For example, the currency quote for the popular EUR/USD pair has a spread of 0.1 pip. Interactive Brokers offers an FXTrader platform that gives you access to streaming quotes in real-time, technical indicators, trading volumes, average price plus P&L, and much more. All in all, if you want access to more than 100 different currency pairs covering all majors, minors, and exotics, with low spreads and commissions then Interactive Brokers will most likely meet your trading needs.

Cryptocurrency trading

When it comes to Ethereum or Bitcoin trading you may be looking for a broker that supports digital currencies or crypto derivatives. If this is the case, you will be happy to hear that both brokers offer crypto trading.

At TradeStation you can buy, sell, and trade cryptocurrencies such as Bitcoin, Ethererum, USDC, and Litecoin. Furthermore, regardless of your experience level, you can also earn up to 6% interest on certain crypto assets. This broker also allows you to withdraw and deposit in any supported crypto, which is a unique and innovative feature for online trading platforms nowadays.

On the other hand, Interactive Brokers offers crypto derivatives which means you can trade Bitcoin futures and Ether futures, as well as several ETFs and stocks associated with digital currencies, but these derivatives are denominated and settle in fiat currencies such as EUR and USD.

Interactive Brokers does not offer trading of any physical crypto, and similarly, does not accept cryptocurrencies as a payment method. It is also worth mentioning that Interactive Brokers complies with regulations and standards set by the Financial Conduct Authority. As a result MiFID (Markets in Financial Instruments Directive) non-professional traders are not allowed to trade crypto assets on the trading platform.

CFD Trading

If you want to actively trade stocks with tight spreads, low commissions, leverage, and other short-selling options, CFD trading could suit your trading objectives. But, before we progress, it is crucial to understand what CFD trading is and how you can benefit from it.

CFDs are designed to track the real-time price movements of underlying stocks, cryptos, commodities, or any other security. So, from gold and oil to indices and altcoins, CFDs cover virtually all investment classes.

With this in mind, you can buy stock CFDs with leverage, and you also short-sell the underlying company. In short, this allows you to speculate on the price of the shares falling, which is something you cannot do with traditional investments.

With Interactive Brokers you can access 13 different stock index CFDs, more than 7,000 share CFDs, index and metals CFDs, and forex CFDs. In terms of the financing rates and commissions associated with Interactive Brokers’ share CFDs, the commission rate starts as low as 0.05%, with active traders benefiting from even lower rates. As for overnight financing fees, these start at just 1.5%.

TradeStation vs Interactive Brokers Account Types

TradeStation offers a wide range of account types, these include:

- Individual brokerage account

- Joint with right of survivorship account

- Joint tenants in common account – this has up to three account holders where each participant owns a percentage of the account

- Custodial accounts – are accounts created by a parent or friend on behalf of a minor

- Retirement accounts: Traditional IRA, Roth IRA, SEP-IRA, SIMPLE IRA (Savings Incentive Match Plan for Employees).

- Entity accounts: Trust accounts, corporate account, General Partnership account, limited partnership account, Limited liability company account, sole proprietorship account.

Interactive Brokers also offers different account types, such as:

- Individual brokerage account which is used by individual investors

- Joint accounts which are owned and managed by two individuals

- Individual Retirement Account (IRA)

- Accounts for institutions

The process of opening an account is simple and takes a matter of minutes to complete online.

There is no minimum deposit required to open an account with Interactive Brokers, however, if you are interested in margin trading then there is a $2,000 minimum deposit. As for TradeStation the minimum deposit varies depending on the type of account you use. For example, the minimum deposit for a cash account is $1, whereas the minimum deposit for a day trading account is $25,000.

TradeStation vs Interactive Brokers Fees & Commissions

Most new traders will use trading fees as a deciding factor when picking a trading platform. In other words, you will want to keep your non-trading and trading costs as low as possible. This covers potential charges such as withdrawal and deposit fees, and trading commissions, and overnight fees.

TradeStation offers two commission-free pricing plans called TS Select and TS Go which provide a tailored trading experience, access to the web trading platform and mobile trading app, and real-time market data. With a TS GO pricing plan there are 0% commissions for stocks, ETFs, stock options, futures, futures micro e-mini, and futures options, but there are low per contract fees that start at $0.50.

TradeStation Crypto provides a competitive pricing structure that is not volume-tiered. Consequently, the fees vary depending on your account balance. For instance, when your crypto trade orders are instantly marketable, you incur Taker fees which are as follows:

- For account balances up to $100,000 the fee is 0.60%

- For account balances over $100,000 the fee is 0.30%

- For account balances over $100,000,000 the fee is 0.15%

As for Interactive Brokers, US-based clients with Joint, IRA, Individual, or trust accounts, can access commission-free US stock and ETF trading. There are also no activity fees or account minimums.

Margin trading

When you borrow money from a broker to fund your trades this is known as margin trading. The margin amount is charged with a margin rate, or interest rate, depending on the margin amount.

TradeStation’s margin interest rates are as follows:

| Margin Balance | Margin rate (%) |

| Less than $50,000 | 9.50% |

| $50,000 – $499,999 | 8.75% |

| $500,000 – $1,999,999 | 5.50% |

| $2,000,000 and above | 3.50% |

The margin rates at Interactive Brokers vary depending on whether you are using a IBKR Lite pricing plan or a IBKR Pro pricing plan, and the base currency. For this section, we will focus on the margin rates charged for the IBKR Lite pricing plan with USD as the base currency.

| Margin Balance | Margin rate (%) |

| 0 ≤ 100,000 | 2.56% |

| 100,000 ≤ 1,000,000 | 2.56% |

| 1,000,000 ≤ 3,000,000 | 2.56% |

| 3,000,000 ≤ 200,000,000 | 2.56% |

Here’s a comprehensive breakdown of the main trading and non-trading fees you are likely to encounter with TradeStation and Interactive Brokers:

| Inactivity fee | Deposit fee | Withdrawal fee | Account fee | US Stock fee | ETF fee | USD margin rate | ACATS Transfer | |

| TradeStation | $50 per year | $0 | $0 | $0 | 0% | 0% | As low as 3.5% | $125 |

| Interactive Brokers | No inactivity fee for US traders using IBKR Lite plan | $0 | $0 | No | 0% | 0% | 2.5% | $0 |

TradeStation vs Interactive Brokers User Experience

In terms of the user experience, our TradeStation vs Interactive Brokers review found that both platforms are perfectly suited to new and experienced investors. This is clear from the very moment that you land on the websites. For instance, there are no complex terms and the interface is very user-friendly.

Searching for and trading your chosen financial instruments is also a straightforward affair with both the Interactive Brokers platform and TradeStation platform. Simply type the name of the asset in the search bar and you will be presented with a list of relevant results.

Furthermore, the user experience on Interactive Brokers is especially good with regards to placing an order. For instance, let’s suppose you wanted to trade stocks, all you would need to do is enter the investment amount. Simply put, you don’t have to worry about your trading budget or how many shares you can afford to purchase because with Interactive Brokers you can invest in fractional shares. This means that if you could buy $25 worth of Amazon stocks and take ownership of a portion of a whole share, without having to pay the entire stock price.

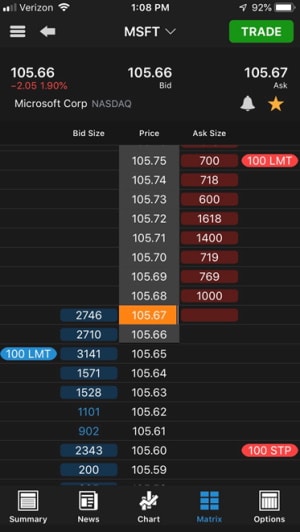

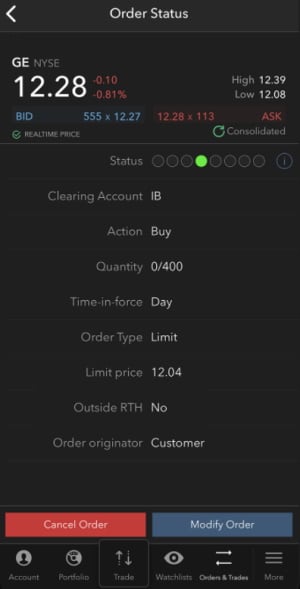

TradeStation vs Interactive Brokers Mobile App

During our Interactive Brokers vs TradeStation review, we found that both brokers allow you to buy and sell assets via a fully-fledged mobile trading app. These are compatible with most Android and iOS Apple devices and are user-friendly and well designed.

When it comes to security you can use two-step authentications on both apps as well as biometric authentication which is very convenient. Both the TradeStation and the Interactive Brokers trading apps offer the same functions as the main desktop platforms.

For example, you can deposit funds into your account with ACH transfers with the click of a button, browse through thousands of tradable assets, and even check the value of your investment portfolio when you’re on the go. Furthermore, you can even set alerts and push notifications so you can stay in the loop with all the latest market and price movements.

For instance, you could have a position open on EUR/USD and you place stop-loss and market orders. This means that when any of your orders are matched the mobile trading app will send an alert or push notification to your mobile device in real-time.

TradeStation vs Interactive Brokers Trading Tools, Education, Research & Analysis

Thus far we have covered several key metrics including fees and commissions and tradable assets. In this section, we will explore the different advanced trading tools, educational materials, research tools, and analysis features that the brokers in question provide.

Interactive Brokers and TradeStation provide trading ideas from third-party providers including Yahoo, Morningstar, the Motley Fool, and more. In terms of charting tools, both investment platforms offer more than 100 different technical indicators.

The main benefit of using technical analysis for online trading and investing is that it can provide useful insights to help forecast future market trends and movements. The downtrend, uptrend, and other movements of the financial markets can be more accurately mapped when using charting analysis tools.

Educational materials and resources

If you’re a beginner or an experienced investor you can access tons of educational resources by clicking on the ‘Education’ tab at the top of the Interactive Brokers website, which brings up a drop-down menu. You can access everything from webinars and short educational videos to the Traders’ academy and student trading lab.

Similarly, TradeStation also offers heaps of educational resources under the ‘Learn’ tab at the top of the website. We found the section called ‘New to Trading’ very informative and useful as it covers all the basics from financial instruments to trading terminology. This is perfect for new traders who are trying online trading for the first time.

TradeStation vs Interactive Brokers Demo Account

What is a demo account? A demo account, or paper trading account, is a simulated trading environment that allows you to practice online trading with virtual funds. This means that you can experiment with different trading strategies, while also familiarizing yourself with the platform itself, without the risk of losing your money.

Both TradeStation and Interactive Brokers offer a demo trading account. We were particularly impressed with the fact that all paper trading accounts at Interactive Brokers start with $1 million of virtual funds, which allows both new and experienced investors to practice in a risk-free trading environment.

To apply for an Interactive Brokers demo account, simply follow these steps:

- Sign in to your Account Management page.

- Tap the manage account button, then click on settings and select Paper Trading.

- You will then be asked to enter a paper trading account username and password.

- Then just confirm your request and you will have access to $1 million worth of paper trading funds to buy and sell assets without the risk of losing real capital.

TradeStation vs Interactive Brokers Payments

While there are no deposit fees with either broker, the only available payment method is via bank transfer. When you deposit funds via ACH transfer with TradeStation this is usually processed in one business day, however, for users outside the US, this can take up to 15 days.

As for Interactive Brokers, the deposit options are rather limited because credit cards, debit cards, and e-wallets are not supported payment methods. But, there are a few exceptions, for example, US-based traders who hold an Integrated Investment Management account can use direct debit deposits, and Australian-based clients have BPAY as a payment option. Bank transfers usually take 2 to 3 business days.

Both brokers do not charge a fee for ACH withdrawals.

| Minimum Deposit | Deposit Fee | Deposit Processing Time | ACH Withdrawal Fee | |

| TradeStation | $0 for standard brokerage accounts | $0 | 1 day | $0 |

| Interactive Brokers | $0 for standard brokerage accounts | $0 | 2-3 business days | $0 |

TradeStation vs Interactive Brokers Customer Service

Our TradeStation vs Interactive Brokers review found that both trading platforms offer great customer services. Perhaps the most convenient feature is that of the live chat function that allows you to contact customer support without having to speak to anyone directly. As well as live chat, you can use a dedicated phone number, and email to receive answers to your questions or resolve any issues you may have regarding your trading account.

The response times are fairly fast, with the average reply taking one business day, but needless to say, this can vary during busy periods.

TradeStation vs Interactive Brokers Safety & Regulation

In terms of the fundamentals, both brokers are heavily regulated by top financial authorities and provide client fund protection.

Interactive Brokers is regulated by the UK’s Financial Conduct Authority, the US SEC, and CFTC, and is a member of the SIPC protection scheme, and the UK FSCS. It is also regulated by the SFC in Hong Kong, and ASIC, as well as being a member of the NYSE FINRA SIPC.

TradeStation is regulated by the US SEC and is a member of the Financial Industry Regulatory Authority.

When it comes to client fund protection, US clients are protected by the US investor protection scheme called the SIPC (Securities Investor Protection Corporation). Nevertheless, the protection only covers equities accounts, which means that if you have a futures account, your assets on that account will not be covered by the scheme.

SPIC investor protection covers you against the loss of securities and cash should the broker liquidate. As a result, you are covered up to the first $500,000, including $250,000 for cash claims.

TradeStation vs Interactive Brokers vs eToro

In summary, both brokers have a lot to offer for both new and experienced traders, however, Interactive Brokers stands out for us simply because it offers CFD and forex trading which are highly popular asset classes that help with portfolio diversification.

Furthermore, with Interactive Brokers, you can also invest in fractional shares which are perfect for beginner traders who do not have the time or budget to buy whole shares of expensive stock. This means that with just $25 you could invest in and own portions of stock.

However, we would also recommend considering a third option – eToro. This social trading platform was launched in 2007 and has since become home to 20 million traders and counting. Regulated by the likes of the FCA, ASIC, and CySEC, this top-rated broker offers heaps of tradable assets on a 100% commission-free basis.

Designed with beginners in mind, eToro has an abundance of resources and automated trading tools to help manage your investments. In keeping with this, the eToro platform is user-friendly and easy to use. Opening an account is streamlined and fully digital and takes a matter of minutes.

67% of retail investor accounts lose money when trading CFDs with this provider.

As with the majority of online brokers, eToro also provides a mobile trading app, which is compatible with iOS Apple, and Android devices. Buying and selling assets is very easy, all you have to do is search for your chosen asset, specify the amount you wish to invest, place the order types you want to apply to the trade, and click confirm.

If Bitcoin trading or Ethereum trading is what you are looking for then eToro has you covered as it provides crypto trading. You can also invest in fractional shares, which means that with as little as $50 you could buy a percentage of a share that has a price per unit of $2,000.

Let’s take look at a breakdown of eToro’s trading and non-trading fees:

| Fee | Amount |

| Stock trading fee | Free |

| Forex trading fee | Typical spread for EUR/USD: 1 |

| Crypto trading fee | 1.90% spread for Ethereum |

| Inactivity fee | $10 a month after 12 months |

| Withdrawal fee | $5 |

| ETF trading fee | Free |

| Account fee | No |

| Deposit fee | $0 |

TradeStation vs Interactive Brokers – The Verdict

So, we have covered all the major key metrics that you need to consider when choosing an online trading platform in 2025. We have explored everything from fees and commissions to safety and regulation.

We found that if you want an overall trading platform that offers 100% commission-free trading with access to 17 international markets and heaps of tradable assets then eToro secures the number one spot on our list.

Furthermore, eToro allows you to copy the trades of other experienced traders, and invest in a theme such as cryptocurrencies or a portfolio of top-rated eToro investors.

If you want to start trading with 0% commission or practice with $100,000 worth of paper funds, simply follow the link below and open an eToro account today!

eToro – Overall Best Trading Platform in 2025

67% of retail investor accounts lose money when trading CFDs with this provider.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.