Best Wheat Stocks to Buy in 2025

While wheat is commonly associated with human food consumption, it constitutes only 58% of its global demand. The remaining portion is utilized in the production of biofuels and various derivatives for diverse industries, leading to an elevation in its significance and contributing to enhanced profitability for companies in this sector.

This guide will analyze the top 10 best wheat stocks to buy and valuable information about this asset to consider when investing through our recommended broker.

-

-

The 10 Best Wheat Stocks to Buy in 2025

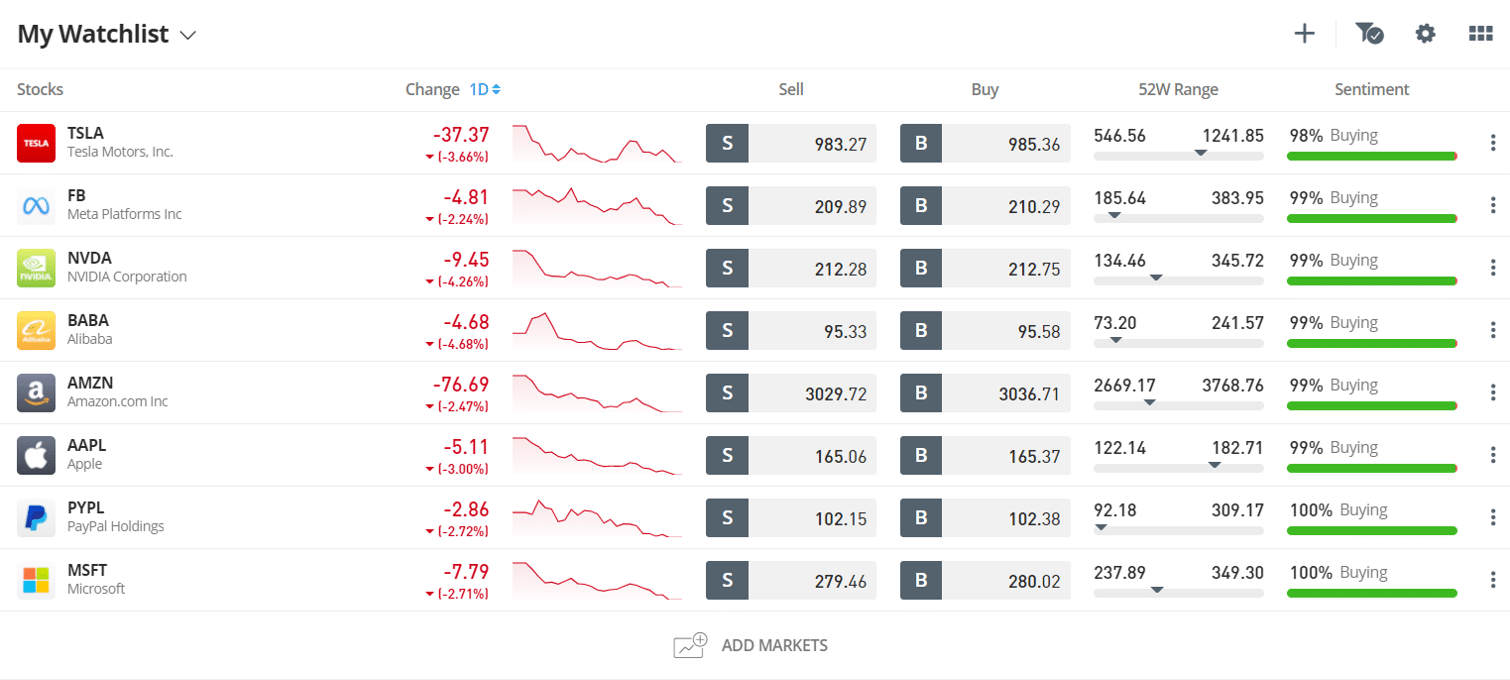

The following is a list of the 10 best wheat stocks related to this industry available on our recommended eToro platform that can be invested in to generate profits today.

- Archer Daniels Midland Company: Archer Daniels has a history that dates back to 1902, making it one of the most established wheat stocks to consider. The company recently announced a sustainable bond that will support ESG initiatives. The stock is listed as ADM on the NYSE and has seen significant growth over the last few years.

- Bunge Ltd: Bunge Ltd was founded in 1818 and is involved with various industries around the globe. As such, this stock is heavily influenced by global economic events. The stock trades as BG on the NYSE.

- The Andersons: Andersons is a fast-growing agricultural company that operates in North America. The company has been building a strong reputation for over 70 years and has experienced evidential growth in return. This stock trades as ANDE on the NYSE.

- CME Group: CME Group operates derivatives markets that effect the value of wheat stocks. Although this is not a wheat stock directly, it is a good way to diversify your portfolio with an asset that is influenced by the wheat industry. It trades as CME on the NYSE.

- Corteva Inc: Corteva is a agricultural products company that develops solutions to protect seeds and crops. Since 2020, the stock has almost doubled in value. It trades on the NYSE under the ticker CTVA.

- Mosaic Company: Mosaic Company specializes in phosphate and potash production for agriculture. Traded as “MOS” on the NYSE, its stock has seen a decent one-year return with key indicators including a 2.47% net profit margin.

- Deere & Company: Deere and Co is a leading provider of farming equipment that is used to grow and harvest wheat crop. The company is one of the most reputable agricultural equipment providers in the world and has seen generous returns. The stock is traded as DE on the NYSE.

- Adecoagro S.A: A South American wheat stock that trades as AGRO on the NYSE. The company is involved in a variety of farming activities and owns a substantial amount of land in South America.

- CF Industries: CF Industries is a clean energy stock that supports the development of sustainable farming practices. Traded as CF, the company is likely to see growth as the need for sustainable farming continues to grow.

- AGCO Corporation: AGCO is a leader in agricultural equipment that is headquartered in Georgia. The company distribute machinery on a global scale and has a commitment to delivering innovative solutions.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Are Wheat Stocks A Good Investment?

Throughout this article, we have seen how this commodity is impactful and has a great potential for generating profits due to its strong historical background and great global demand for its nutritional value and as a derivative in other industries.

We will examine some variables that will determine the rationale behind whether it would be wise to invest in wheat in large companies through our recommended broker, eToro, to ensure we are on the same page.

Speculating On The Growth Of Demand

The properties of wheat could support continued global demand growth due to crops of this variety being hardy and easy to grow. Unlike rice or other food commodities, it does not require much water or labor. In this manner, wheat could become the grain of choice in developing economies worldwide. Wheat also competes with corn for acreage.

The trend in biofuel production could result in a shortfall in wheat supply and higher prices. Additionally, due to the current state of conflict, where Russia and Ukraine are the largest exporters of wheat, its price will rise, and more companies will emerge to service this market.

Attractive Investment Choice

Here are a few reasons why agricultural commodities remain an attractive investment: Over the past several years, agricultural commodities have performed better than the broader market; in terms of one-year trailing total yield, the best-performing ETFs were corn, wheat, and RJA, and among the top holdings of these ETFs are futures contracts for wheat, soybeans, and corn.

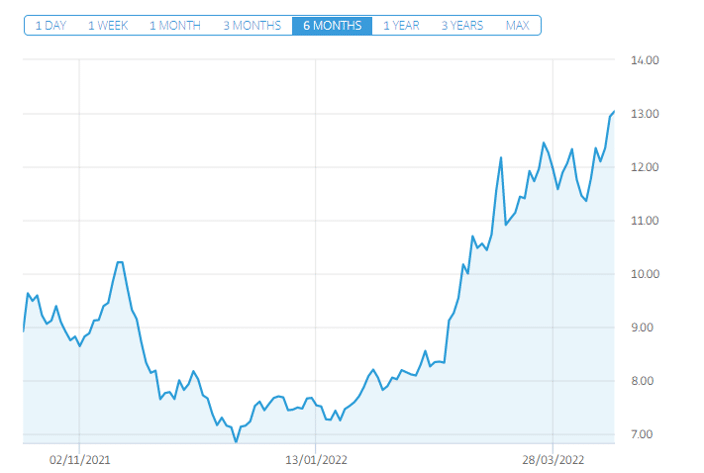

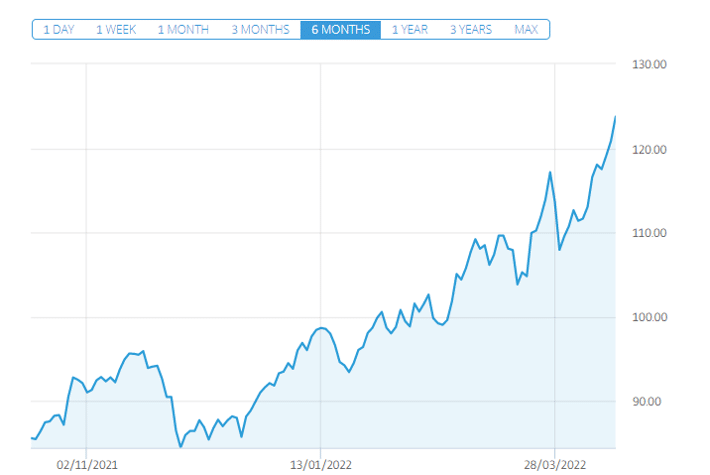

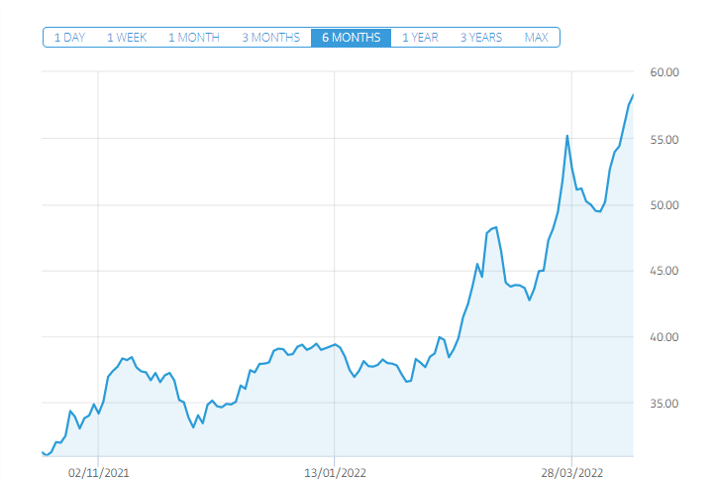

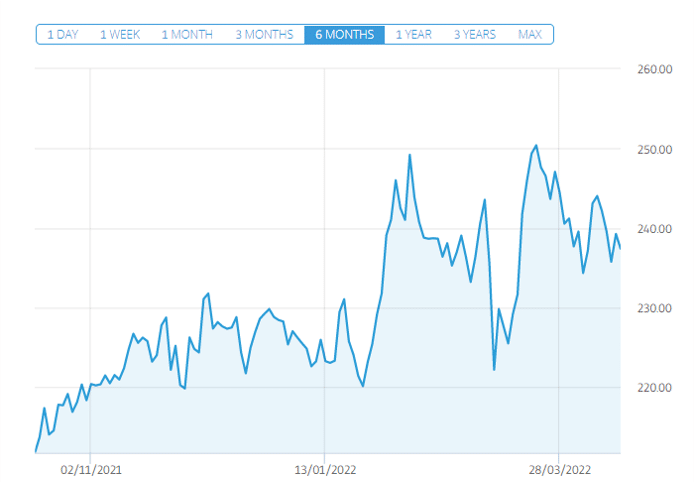

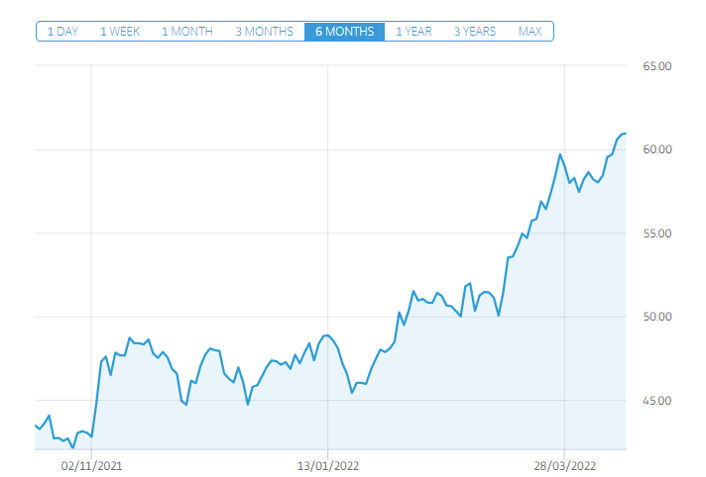

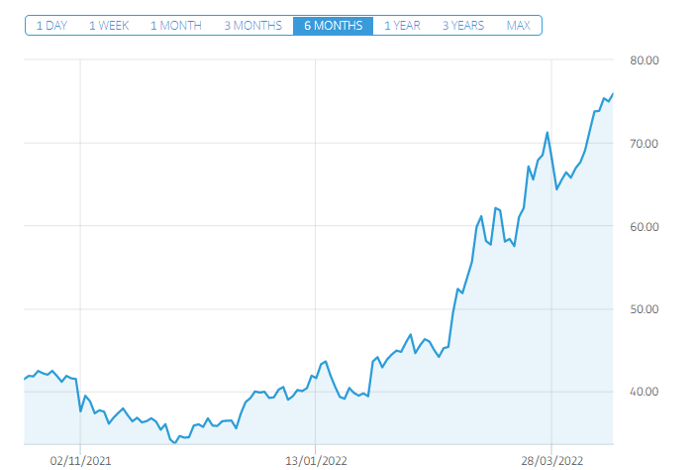

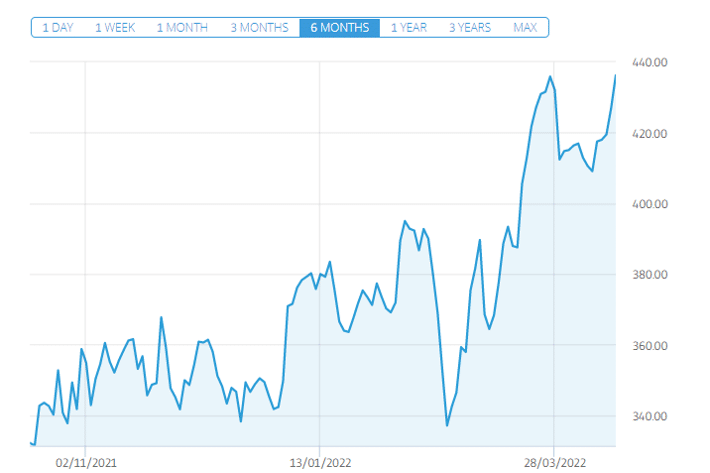

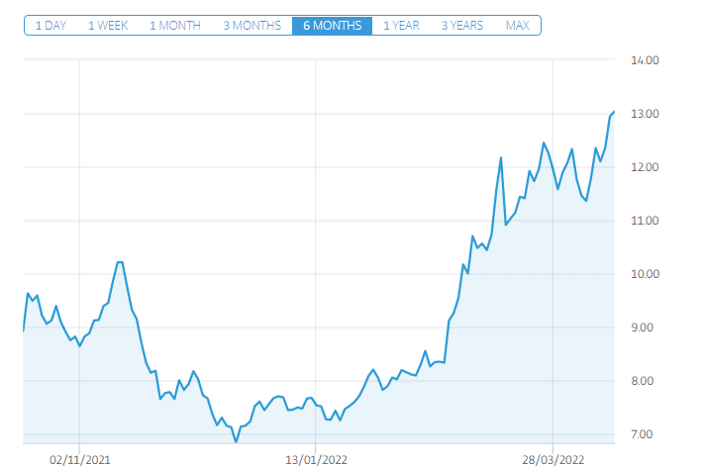

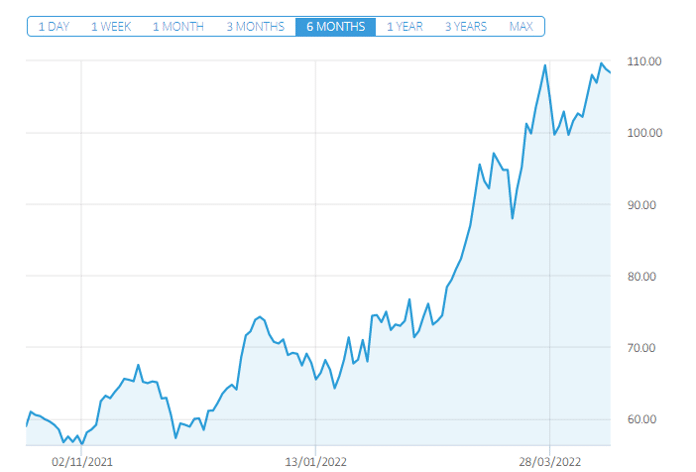

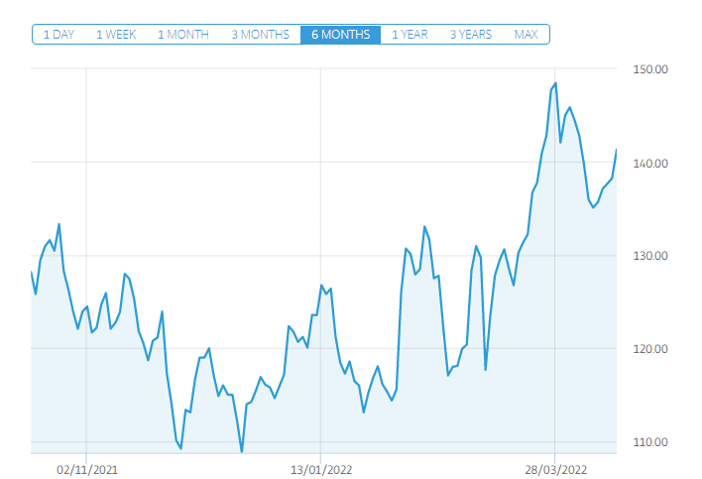

The chart above shows that the companies we are analyzing their wheat stocks for are generating profits and have a high market cap, indicating that prices continue to rise. To illustrate this further, if we examine the commodity for the last 3 years, wheat in 2019 had a value of $423 and to date in 2022 has a price of $1,093, which achieved double its value, and the maximum peak was reached on February 22nd, 2022 with a value of $1,208.06.

Hedging Against Inflation

Many soft commodities, such as wheat tend to rise in price when inflation increases. For your information, inflation occurs when money loses its value over time, increasing the cost of living. Therefore, investing in wheat when inflation rates are increasing is a good way to protect or ‘hedge’ against it.

Wheat usually benefits from rising inflation, especially unexpected inflation, because within the increase in demand for goods and services, the prices of goods and services also rise, as do the prices of the commodities used in their production.

Diversification Of Portfolios

While many investors tend to stick to stocks, bonds, and shares, adding wheat is an excellent way to diversify a portfolio and include a commodity that is used all around the globe. By including wheat stocks in your portfolio, you can diversify your investments and strengthen your portfolio during difficult market conditions.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

A Closer Look at the Best Wheat Stocks to Invest in

Based on the importance of wheat in the global economy, we will examine those ten stocks belonging to companies involved in wheat production and distribution and those directly or indirectly related to this commodity.

We will analyze key company information, indicators of importance, and how to locate each stock on our recommended broker, eToro. We have excluded other good wheat stocks such as MGP Ingredients Inc., Farmland Partners, Seaboard Corporation, and Arcadia Biosciences, among others, from consideration because they are not available on eToro. However, you may search for them in other brokers of your choice.

1. Archer Daniels Midland Company – Overall Best Wheat Stock to Buy Now

A global leader in food processing, Archer Daniels Midland Company, is one of the largest companies in the US. The company has operated a food processing plant, a grain elevator, and a transportation network for raw foods such as oats, milo, wheat, and barley since its foundation in 1902 in Minneapolis, Minnesota. Along with procuring raw materials, the transportation system also cleans, stores, and dispenses them to major consumers.

There are three segments within the company’s operations: Ag Services & Oilseeds, Carbohydrate Solutions, and Nutrition. By February 2022, the firm announced the pricing of its first sustainable bond, which will support initiatives relating to the company’s goals across the spectrum of environmental, social, and governance (ESG). The company will use the net proceeds from the offering to finance and refinance projects that meet certain criteria outlined in its Sustainable Financing Framework.

Archer Daniels Midland Company is listed on the NYSE under the ticker ADM. The company went public with a value of $72.16 and is currently trading at $95.71, resulting in a market capitalization of $53.19 39.8B. According to the main indicators of Archer Daniels Midland Company over the last 4 years, as of September 30, 2023 we have a gross margin of 8.34%, a net profit margin of 3.78%, an operating margin of 4.25%, and a return on investment 11.91%.

Despite facing substantial disruptions in the global food supply caused by low crop yields in 2021 and 2022, exacerbated by the war in Ukraine impacting supply chains, the company has sustained profitability. ADM perseveres, achieving consistent growth through its food and ingredients operation, making it a reliable dividend stock for investors seeking investment income.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

2. Bunge Ltd. – The Most Diversified Commodity Company in Wheat Stocks

Bunge Limited was founded in 1818 and has its headquarters in St. Louis, Missouri; it is an agricultural business and food company that operates worldwide. It sources, processes, and supplies oilseed, grain products, and ingredients.

The company operates in several segments, including agribusiness, edible oil products, milling products, sugar and bioenergy, and fertilizer. Bunge’s products and services are used by customers in the food, feed, and biofuel industries worldwide.

The company’s stock is publicly traded on the New York Stock Exchange under the ticker symbol “BG”. Bunge’s stock performance can be influenced by various factors, including global commodity prices, weather patterns affecting crop yields, and government policies affecting the agricultural industry. As with any investment, it’s important to conduct thorough research and consider your financial goals and risk tolerance before investing in Bunge’s stock or any other security.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

3. The Andersons – Fastest Growing Company by Value per Wheat Stock

The Andersons, Inc. was founded in 1947 as an agriculture company. The company operates grain elevators, trades grains, corn oil, ethanol, rents, repairs, and sells railway equipment. It is also based in Maumee, Ohio, and operates in North America.

The Andersons cultivate lasting relationships through extraordinary service, a deep understanding of the market, and a flair for adding value, as they have done for more than 70 years; they have 2,371 employees.

It trades on the NASDAQ under the ticker ANDE. It was trading for $44.98 and now has a value of $56.87, reaching a market capitalization of $1.85 billion. According to the main indicators considered over the past 4 years, it has a gross margin of 3.64%, a net profit margin of 0.72%, an operating margin of 0.24%, and a return on investment of 2.71%.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

4. CME Group – World’s Leading Derivatives Marketplaces Related to Wheat Stocks

The CME Group is one of the world’s leading derivatives marketplaces. Its exchanges assist in risk management. This is certainly true for commodity markets, including wheat. Although technically, CME Group is not a “wheat stock” per se, given its role in the wheat market, it makes sense to at least consider it.

The CME Group Inc. offers trading on a broad range of markets, with the ability to trade in a wide range of asset classes, including agricultural products, currencies, energy, interest rates, metals, stock indices, and cryptocurrencies. The firm also provides traders with tools and resources, such as a market news feed and a trading education website.

CME Group Inc. is listed on the NASDAQ, where it trades under the ticker symbol CME. The company has launched with a per-share value of $216.38. Since then, it has nearly tripled in value and is now valued at $242.14 and has a market capitalization of $77.89 billion. Considering the last four years quarter, we can see that the company has a gross margin of 84.64%, a net profit margin of 56.18%, an operating margin of 60.29%, and a return on investment of 19.75%.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

5. Corteva Inc. – Stocks With High Dividend Yields In The Wheat Sector

As a provider of agricultural products, Corteva, Inc. has its headquarters in Wilmington, Delaware, USA, and serves clients worldwide, including the United States, Canada, Latin America, Asia Pacific, Europe, the Middle East, and Africa. It was founded in 1897, although the brand Corteva AgriscienceTM was not created until 2018. Also, it was originally part of DowDuPont but became a separate company in June 2019.

Technology solutions that focus on seed and crop protection enhance resistance against weather, diseases, insects, and weeds and improve food and nutritional characteristics. Corteva also works with producers worldwide to create an agricultural ecosystem that supports people, progress, and the environment.

CTVA is the ticker symbol for Corteva on the NYSE. Since it was launched in 2020 with a share value of $37.08, it has nearly doubled and now stands at $44.51 with a market cap of $34,51 billion.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

6. Mosaic Company – Company with the Highest One-year Return on Wheat Stocks

The company was founded in 2004 and had its headquarters in Tampa, Florida. It operates internationally and, along with its subsidiaries, specializes in the production of phosphates and potash used in agriculture. Moreover, it collects urea for use in fertilizers through various international distribution networks, making this company the largest US producer of potash and phosphate fertilizers.

Mosaic is engaged in every phase of crop nutrition, from the mining of resources to the production of crop nutrients, feeds, and industrial products for clients around the globe, and today has more than 12,525 employees in chemical agriculture.

Mosaic’s stock trades on the NYSE under the ticker symbol MOS. Launched with a per-share value of $66.70, it is now trading at $75.37 and has a market cap of $27.22 billion. According to the main indicators of the last four years, we can find that the company has a gross margin of 26.04%, a net profit margin of 2.47%, an operating margin of 22.56%, and a return on investment of 2.23%.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

7. Deere & Company – Company with Largest Market Capitalization Related to Wheat Stocks

Deere & Company is an international American company with operations in three segments: agriculture and turf, construction and forestry, and financial services. They are among the world’s leading providers of advanced products, technology, and services for customers who cultivate, harvest, transform, enrich, and build on the land to meet the growing needs for food, fuel, shelter, and infrastructure.

In its production and precision agriculture segment, the company develops and delivers global equipment and technology solutions to enhance the production and productivity of growers of large grains, small grains, cotton, and sugarcane. Similarly, the small agriculture and turf segment provides unique equipment and technology solutions to unlock value for dairy and livestock producers, crop growers, and turf and utility companies.

On the NYSE, Deer & Co. trades under the ticker DE, Originally, the price per share was $14.63, and it has now reached a value of $369.62, which is reflected in the company’s market capitalization of $106.45B.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

8. Adecoagro S.A. – A Major Supplier of Wheat Industry to South America

Adecoagro was established in 2002 and is headquartered in Luxembourg. The company holds a variety of agriculture businesses in several South American countries, including Brazil, Argentina, and Uruguay. Its activities include farming crops, dairy operations, sugar production, land transformation, ethanol production, and energy production.

At the end of 2020, the company owned 220,186 hectares, including farms in Argentina, Brazil, and Uruguay, along with 241 megawatts of installed cogeneration capacity. It currently has 8,716 employees and is engaged in the agricultural commodities or milling industry.

It began with a value of $7.87 per share and is currently trading at $10.37, resulting in a slight increase in value per share, and its market capitalization is $1.11 billion.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

9. CF Industries – Company with Great Dividends in Wheat Stocks Today

CF Industries Holdings, Inc. produces hydrogen and nitrogen products used in clean energy, fertilizers, emissions reduction, and other industrial applications. Based in Deerfield, Illinois, the company was founded in 1946 and operated worldwide.

The company’s segments include ammonia, granular urea, UAN, AN, and others and the company’s main product is anhydrous ammonia (ammonia), which contains 82 % nitrogen and 18 % hydrogen. With 3,000 employees, it belongs to the agricultural chemicals industry.

CF Industries is listed on the NYSE under the symbol CF. A share of this company in 2015 had a value of $59.33 and now stands at $80.28, so it currently has a market capitalization of $15.34 billion.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

10. AGCO Corporation – Leading Company in Agricultural Solutions.

AGCO Corporation is an American company that manufactures and distributes agricultural equipment, such as grain storage bins, high horsepower tractors, seed processing systems, ventilation, and water systems, among others. With headquarters in Duluth, Georgia, the company operated internationally and was founded in 1990.

GCO is a world leader in designing, manufacturing, and distributing smart agricultural solutions. In over 35 countries, they have more than 20,000 colleagues involved in delivering industry-leading technologies that solve real-world problems in the industry of trucks or construction (or farm machinery)

The AGCO stock is listed on the NYSE under the ticker AGCO. Its value per share was $51.33 in 2011, and it has achieved a value of $114.08 to date, accumulating a market capitalization of $8.54 billion.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

How To Judge The Best Wheat Stocks To Buy

Let’s take a closer look at some of the features to consider or values to ensure profitability when choosing wheat stocks now that we have reviewed in detail the top 10 wheat stocks available on eToro.

Performance Vs. Broader Markets

By analyzing the data on the eToro platform, we can see that at the beginning of the year, the price of the commodity was at $792.40, reaching its maximum value on February 14th at $792.40, stabilizing at the date of writing this guide (November 10, 2023) at $576.60.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

$WHEAT, a notably volatile commodity, presents ample profit opportunities, especially considering its current distance from this year’s peak of nearly $580. Confidence in substantial growth for this commodity stems from its promising long-term outlook, influenced by key fundamentals and factors impacting its price.

- The global population’s rapid growth drives increasing demand for wheat, a vital grain alongside rice. The recent forecast by the FAO anticipates a record-high global cereal production for 2021, reflecting the continuous rise in the world’s population, which grows by 83 million annually or 1.1% per year. This surge in demand exerts significant pressure on wheat prices.

- China, Russia, and India, the world’s major wheat producers (BRIC countries), significantly affect the wheat market. Although the traded contract on eToro is likely the Chicago SRW Wheat Futures on the Chicago Mercantile Exchange, political issues in these countries impact wheat flow, compounded by currency instability. This political influence, coupled with USD inflation, contributes to the commodity’s volatility.

- The rising cost of oil, surging from $13.45 in April to the current $40 (a 300% increase), is another catalyst for increasing wheat prices. Given that oil heavily influences transport and production costs, the ongoing market revival suggests a likelihood of sustained pressure on wheat prices.

- Global warming, disrupting not only agriculture but the entire economy, adversely affects crop production with unpredictable weather patterns leading to droughts and floods. This directly influences the long-term prices of $WHEAT, along with other affected food commodities.

- Acknowledging the substantial volatility, prudent trading involves low leverage. While trading at x2 is common, opting for x5 for potentially higher gains requires careful consideration due to the daily swings of up to 3%. A cautious and steady trading approach remains advisable for long-term investment success on eToro.

Operating Costs And Break-Even Price

U.S. all-wheat exports experience a significant reduction by 25 million bushels, reaching 700 million bushels, marking the lowest point since 1971/72 (figure 1). Despite an uptick in Hard Red Winter (HRW) production, HRW exports see a 25 million bushel decrease to 165 million, the lowest recorded since the inception of by-class supply and utilization records in 1973/74.

Notably, U.S. HRW exports face challenges on the global market, evident in both shipment and sales data. June 2023 HRW exports stand at 10 million bushels, a notable decline from the 19.2 million bushels recorded in June 2022.

Utilizing data from the USDA, Foreign Agricultural Service’s Export Sales Reporting, total commitments for all-wheat U.S. exports, calculated as the sum of accumulated exports and outstanding sales, stand at approximately 6.4 million metric tons as of August 3.

This reflects a 26 percent decrease from the corresponding point last year and a 37 percent dip below the recent 10-year average (2013/14–2022/23). HRW total commitments exhibit a substantial 53 percent decline compared to the previous year, influenced by competitive shipments from Russia and the European Union on the international stage.

Dividend Program

In the wheat industry, wheat dividend stocks are equity securities of companies engaged in some aspect of agribusiness and which pay a regular dividend. Including farmers, manufacturers of farm equipment, processing plants for cleaning and packaging livestock, and chemical manufacturers responsible for developing crop fertilizers.

Companies with a track record of paying dividends at regular intervals are more likely to be established and at a more mature stage of their growth cycle, enabling them to return more earnings to their shareholders. In this regard, they can serve as a stable source of dividend income even if their stock prices decline sharply along with the overall market.

For example, Bunge Ltd has a dividend yield of 0.66% quarterly, which is within the list of companies we mention here. Other dividend yields include CF Industries’ 1.99% and Archer Daniels Midland Co.’s 2.49%.

Wheat Penny Stocks

To begin with, you should note that the list of top 10 wheat stocks we reviewed above through our recommended broker, eToro, refers to very large companies. These companies have a long history in the market and substantial capital backing all of their operations.

Wheat penny stocks were created due to small and new companies wanting to finance their operations by issuing shares below $5 (US) or £1 (UK). In addition to its high volatility, this product is greatly influenced by market speculation, which is frequently manipulated, so you must be very well informed.

Here are the 2 best-known wheat penny stocks in this sector, all of which have experienced great market growth since their launch. Unfortunately, they are not part of eToro at the moment. Therefore, you should go to another broker to purchase them if you are interested.

S&W Seed Company

S&W Seed Company (S&W) is an agricultural company that specializes in multi-crops and middle-market crops. This company specializes in breeding, producing, and selling agricultural seeds. In addition, the company is using its R&D to breed a wide range of products, ranging from pasture seeds to hybrid sunflower & wheat.

At present, this company has a value per share of $0.67, a market capitalization of $28.68M with a gross margin of 30.5%, and a revenue of $23.06M, and it is listed on NASDAQ.

Arcadia Biosciences

Arcadia Biosciences, Inc. produces and markets plant-based health and wellness products. Among the company’s objectives is to develop crop improvements, particularly wheat, to enhance farm economics by improving crops’ performance in the field and their value as food ingredients, health and wellness products, and their viability for industrial applications.

At present, this company has a value per share of $3.3, a market capitalization of $3.6M with a gross margin of 29.37%, and a revenue of $1.6M, and it is listed on NASDAQ.

Where to Buy Wheat Stocks

In this section of the guide, we have already covered all the relevant information about what stocks, the outlook for this commodity, and the companies that offer such a service.

So perhaps you are now wondering how you can invest in wheat stocks. So, let us examine in detail how you can get wheat stocks through the recommended broker, eToro; overall, the best place to buy wheat stocks.

eToro – Overall Best Place to Buy Wheat Stocks

eToro is considered the world’s leading social trading platform, offering thousands of short- and long-term investment options. It specializes in social trading with stocks, currencies, futures, options, and cryptocurrencies. In addition, eToro offers over 2,000 different financial assets that you can trade with or without leverage, and it is regulated by the FCA, ASIC, and CySEC.

In order to invest in wheat stocks in eToro, you must first open an account and provide all of the required information. Next, you must upload a copy of your ID which the platform will verify before you can deposit funds. Remember that the minimum deposit to begin trading is $10 in eToro, and you can do it from several sources.

As soon as you have the required funds, you may decide which of the 10 wheat stocks is right for you. All are available; also, eToro provides 24/7 customer service and a wealth of market information and research to assist you in making an informed decision. You also have the option to copy the trades of more experienced traders in the market if you wish to

As a part of this process, you must find the wheat stock of your choice in the eToro search engine and specify the operation you desire in the “Trade” button. You must also specify whether you wish to buy the underlying asset like a stock or a contract for difference (CFD) and a stop-loss if desired. Furthermore, you will be able to see the profits generated from your investments in wheat stocks over time.

In addition, any dividends paid by wheat stocks – most of which do – will be deposited directly into your eToro account when you invest in them; If you wish, you may reinvest your dividends back into the wheat industry or request a withdrawal. In addition, eToro supports hundreds of commission-free ETFs with wheat options for diversifying your portfolio.

A positive aspect of eToro is that there are no limits on commission-free trades, and you can purchase fractional shares. Consequently, as an eToro user, you will not pay any markups on the shares you buy, so the commissions will stay in your pocket and not go to your broker.

You can access thousands of stocks on this brokerage site. It includes not only the two leading US exchanges – the NYSE and NASDAQ but also 15 other international markets. We will mention a series of positive aspects of this platform regarding the options it offers to invest in wheat stocks.

Pros:

- You can buy wheat stocks on 17 international markets

- Wheat stocks are available for purchase at a 0% commission

- Social trading is a community of over 20 million users

- Demo Account of $100,000 for free

- Ready-Made Investment Portfolios of expert traders

- User-friendly platform for beginners

- Regulated by the FCA, ASIC, and CySEC

- It offers one of the best stock apps on the market

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

Conclusion

As the global economy is currently in a state of expansion, the price of wheat, as well as the companies related to it, are cashing in on great profits, making it an excellent time to invest in stocks of this sector since wheat is a commodity that is growing and pays good dividends to its owners.

We recommend that if you are convinced that you wish to invest in wheat stocks, you do so through our partner eToro, where you can find the best wheat stocks and purchase them for 0% commission and a minimum deposit of $10, in addition to the use of the tools of copy trading, education, customer service and demo-account provided by the platform.

eToro – Overall Best Platform to Buy Wheat Stocks

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

FAQs

Should I buy wheat stocks now?

Russia accounts for 19% of global wheat exports, and Ukraine accounts for 9%, and the price of wheat is rising rapidly in response to the current situation, making it an excellent time to invest in wheat stocks.What are the best wheat stocks to buy now?

eToro's best wheat stocks are Archer-Daniels-Midland Co with a market cap of $53.47B and dividends of 1.51, and Bunge Ltd with a market cap of $17.03B and dividends of 2.1. There are others with higher market caps but indirectly related to wheat, like Deere Co & CME Group.Can you invest in wheat stocks?

Of course, all you must do is locate a broker who offers this service, and your choice of wheat stocks is available. eToro offers wheat stocks on 17 exchanges, including the NASDAQ and NYSE.Are wheat stocks a good investment now?

Certainly, it would be a good investment considering the current situation we are in, which increases demand for wheat and the fact that wheat is the second most-consumed food worldwide and has a stable market.Where is the best place to buy wheat stocks?

At eToro, you can buy and sell any of the 10 companies on our list of the 10 best wheat stocks for as little as $10 and with 0% commission.How do I buy wheat stocks in eToro?

You only need to create your account, verify it, deposit the required funds, search for the wheat stock option you want the most on the platform, and you can start trading then.Sam Alberti

View all posts by Sam AlbertiSam Alberti has recently joined Trading Platforms as a content editor, having spent the past four years working as a journalist across various financial and business niches. He graduated from the University of Kingston in 2019 with a Master’s Degree in Journalism and an NCTJ Diploma, and has since developed a passion for both consumer and corporate finance. He now specializes in producing engaging and thoroughly-researched web content on all things finance.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up

A global leader in food processing, Archer Daniels Midland Company, is one of the largest companies in the US. The company has operated a food processing plant, a grain elevator, and a transportation network for raw foods such as oats, milo, wheat, and barley since its foundation in 1902 in Minneapolis, Minnesota. Along with procuring raw materials, the transportation system also cleans, stores, and dispenses them to major consumers.

A global leader in food processing, Archer Daniels Midland Company, is one of the largest companies in the US. The company has operated a food processing plant, a grain elevator, and a transportation network for raw foods such as oats, milo, wheat, and barley since its foundation in 1902 in Minneapolis, Minnesota. Along with procuring raw materials, the transportation system also cleans, stores, and dispenses them to major consumers.

Bunge Limited was founded in 1818 and has its headquarters in St. Louis, Missouri; it is an agricultural business and food company that operates worldwide. It sources, processes, and supplies oilseed, grain products, and ingredients.

Bunge Limited was founded in 1818 and has its headquarters in St. Louis, Missouri; it is an agricultural business and food company that operates worldwide. It sources, processes, and supplies oilseed, grain products, and ingredients.

The Andersons, Inc. was founded in 1947 as an agriculture company. The company operates grain elevators, trades grains, corn oil, ethanol, rents, repairs, and sells railway equipment. It is also based in Maumee, Ohio, and operates in North America.

The Andersons, Inc. was founded in 1947 as an agriculture company. The company operates grain elevators, trades grains, corn oil, ethanol, rents, repairs, and sells railway equipment. It is also based in Maumee, Ohio, and operates in North America.

The CME Group is one of the world’s leading derivatives marketplaces. Its exchanges assist in risk management. This is certainly true for commodity markets, including wheat. Although technically, CME Group is not a “wheat stock” per se, given its role in the wheat market, it makes sense to at least consider it.

The CME Group is one of the world’s leading derivatives marketplaces. Its exchanges assist in risk management. This is certainly true for commodity markets, including wheat. Although technically, CME Group is not a “wheat stock” per se, given its role in the wheat market, it makes sense to at least consider it.

As a provider of agricultural products, Corteva, Inc. has its headquarters in Wilmington, Delaware, USA, and serves clients worldwide, including the United States, Canada, Latin America, Asia Pacific, Europe, the Middle East, and Africa. It was founded in 1897, although the brand Corteva AgriscienceTM was not created until 2018. Also, it was originally part of DowDuPont but became a separate company in June 2019.

As a provider of agricultural products, Corteva, Inc. has its headquarters in Wilmington, Delaware, USA, and serves clients worldwide, including the United States, Canada, Latin America, Asia Pacific, Europe, the Middle East, and Africa. It was founded in 1897, although the brand Corteva AgriscienceTM was not created until 2018. Also, it was originally part of DowDuPont but became a separate company in June 2019.

The company was founded in 2004 and had its headquarters in Tampa, Florida. It operates internationally and, along with its subsidiaries, specializes in the production of phosphates and potash used in agriculture. Moreover, it collects urea for use in fertilizers through various international distribution networks, making this company the largest US producer of potash and phosphate fertilizers.

The company was founded in 2004 and had its headquarters in Tampa, Florida. It operates internationally and, along with its subsidiaries, specializes in the production of phosphates and potash used in agriculture. Moreover, it collects urea for use in fertilizers through various international distribution networks, making this company the largest US producer of potash and phosphate fertilizers.

Deere & Company is an international American company with operations in three segments: agriculture and turf, construction and forestry, and financial services. They are among the world’s leading providers of advanced products, technology, and services for customers who cultivate, harvest, transform, enrich, and build on the land to meet the growing needs for food, fuel, shelter, and infrastructure.

Deere & Company is an international American company with operations in three segments: agriculture and turf, construction and forestry, and financial services. They are among the world’s leading providers of advanced products, technology, and services for customers who cultivate, harvest, transform, enrich, and build on the land to meet the growing needs for food, fuel, shelter, and infrastructure.

Adecoagro was established in 2002 and is headquartered in Luxembourg. The company holds a variety of agriculture businesses in several South American countries, including Brazil, Argentina, and Uruguay. Its activities include farming crops, dairy operations, sugar production, land transformation, ethanol production, and energy production.

Adecoagro was established in 2002 and is headquartered in Luxembourg. The company holds a variety of agriculture businesses in several South American countries, including Brazil, Argentina, and Uruguay. Its activities include farming crops, dairy operations, sugar production, land transformation, ethanol production, and energy production.

CF Industries Holdings, Inc. produces hydrogen and nitrogen products used in clean energy, fertilizers, emissions reduction, and other industrial applications. Based in Deerfield, Illinois, the company was founded in 1946 and operated worldwide.

CF Industries Holdings, Inc. produces hydrogen and nitrogen products used in clean energy, fertilizers, emissions reduction, and other industrial applications. Based in Deerfield, Illinois, the company was founded in 1946 and operated worldwide.

AGCO Corporation is an American company that manufactures and distributes agricultural equipment, such as grain storage bins, high horsepower tractors, seed processing systems, ventilation, and water systems, among others. With headquarters in Duluth, Georgia, the company operated internationally and was founded in 1990.

AGCO Corporation is an American company that manufactures and distributes agricultural equipment, such as grain storage bins, high horsepower tractors, seed processing systems, ventilation, and water systems, among others. With headquarters in Duluth, Georgia, the company operated internationally and was founded in 1990.

By analyzing the data on the eToro platform, we can see that at the beginning of the year, the price of the commodity was at $792.40, reaching its maximum value on February 14th at $792.40, stabilizing at the date of writing this guide (November 10, 2023) at $576.60.

By analyzing the data on the eToro platform, we can see that at the beginning of the year, the price of the commodity was at $792.40, reaching its maximum value on February 14th at $792.40, stabilizing at the date of writing this guide (November 10, 2023) at $576.60. S&W Seed Company (S&W) is an agricultural company that specializes in multi-crops and middle-market crops. This company specializes in breeding, producing, and selling agricultural seeds. In addition, the company is using its R&D to breed a wide range of products, ranging from pasture seeds to hybrid sunflower & wheat.

S&W Seed Company (S&W) is an agricultural company that specializes in multi-crops and middle-market crops. This company specializes in breeding, producing, and selling agricultural seeds. In addition, the company is using its R&D to breed a wide range of products, ranging from pasture seeds to hybrid sunflower & wheat. Arcadia Biosciences, Inc. produces and markets plant-based health and wellness products. Among the company’s objectives is to develop crop improvements, particularly wheat, to enhance farm economics by improving crops’ performance in the field and their value as food ingredients, health and wellness products, and their viability for industrial applications.

Arcadia Biosciences, Inc. produces and markets plant-based health and wellness products. Among the company’s objectives is to develop crop improvements, particularly wheat, to enhance farm economics by improving crops’ performance in the field and their value as food ingredients, health and wellness products, and their viability for industrial applications.