5 Best Gold Trading Brokers & Platforms for July 2025

Investing in Gold is a popular way to hedge against inflation and protect your portfolio with a stable asset. To buy Gold in 2025, you will need to find a reputable broker that offers reasonable gold trading fees, features for research and analysis, and trading tools to facilitate your preferred gold trading strategy. There are a number of options to choose from and the best one will depend on your individual experience, goals and strategy.

Our team spent time reviewing the best gold trading brokers for 2025. In this article, we will present our findings to help you decide which platform is the most suitable for you.

-

-

Our List of the Best Gold Trading Platforms in July

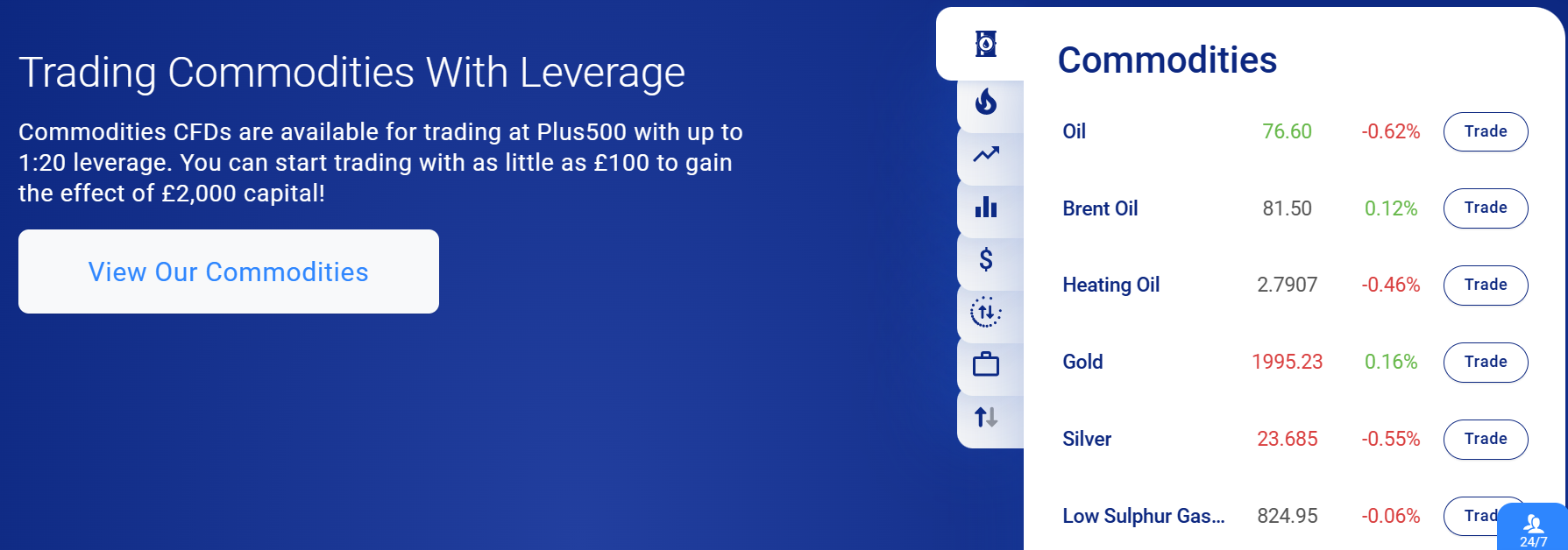

- Plus500: Popular CFD trading platform that offers 0% commissions on gold trading. Users can trade on desktop or mobile apps and access a range of charting tools to conduct technical analysis. Plus500 also offers leverage of up to 1:20 for gold trading.

- eToro: eToro is a regulated broker that supports metals, stocks, forex, cryptos, and ETFs. The platform offers a user-friendly interface that makes it easy to buy Gold from just $10. If you’re looking to build a diverse commodities portfolio, eToro also provides Smart portfolios which are created by experts who conduct market research on your behalf. The platform caters to both beginner and advanced traders making it an excellent option for Gold trading in 2025.

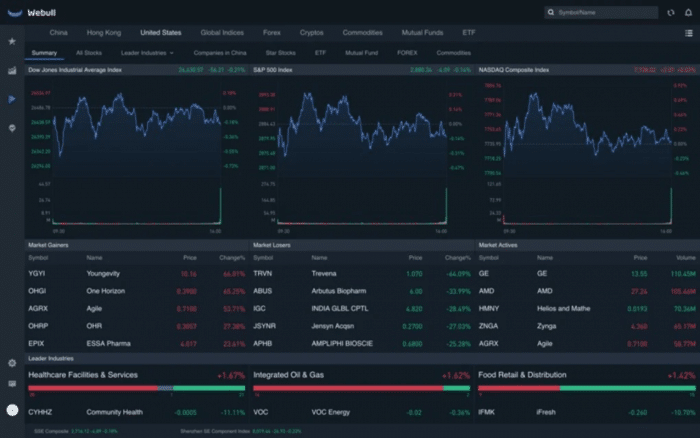

- Webull: Webull is a well-known trading app that offers a range of financial instruments, including Gold. The app is easy to use and provides a good variety of features to facilitate analysis. Webull also offers low fees and tight spreads, making it an affordable option to consider. You can start trading on the platform from just $1 and users must pay a monthly account fee of $1.99.

- Admiral Markets: Trade gold CFDs on MetaTrader 5. The best gold trading broker for short-term strategies. Traders can access a range of technical indicators for analysis as well as APIs, real-time data and market insights. Admiral Markets charges low spreads from 0.25 on gold trading as well as 0% commissions, making it one of the more affordable options.

- Revolut: The best gold trading app for investors. Buy gold on your mobile phone and build up a portfolio of assets. Revolut is user-friendly and designed for beginners. The app has a minimum deposit of $10 and charges an annual fee of just 0.12% for trading.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

What is Gold?

Gold is considered one of the world’s most precious metals that is used to make jewelry, art and technology. The metal is also used as a monetary system in some countries and can be traded for goods because it has objective value. Gold holds it’s value around the world, unlike fiat currency which is worth more in some countries than it is in others.

The main reason that gold is so valuable is that it is very rare. Gold is the outcome of star collisions that occurred before the solar system was formed. The metal sank to the core of the earth when the planet was formed and is extracted through a process known as mining. New gold is very hard to come by which means that the metal is not affected by inflation.

Gold is in the same column as silver and copper as a transition metal in the periodic table. As a result, Gold is often referred to as a ‘coinage metal’ since its members are frequently used to produce money. According to the Egyptians, Gold was one of the first metals known to man, dating to 2450 BCE. Wealth and beauty have always been associated with Gold. The Egyptians often acquired enormous amounts of Gold to cover the coffins of deceased pharaohs during the reign of Pharaohs.

Due to the nature of the metal, Gold is often used as a hedge against inflation. For this reason, it is a popular instrument amongst long term investors.

When you invest in gold, you invest in the stock of a Gold company which means that you do not actually own any of the metal. To invest in physical gold, you would need to buy bullion bars.

How to Make Money from a Gold Investment

The main reason that people invest in gold is to protect their wealth from inflation. However, it is also possible to invest for profit. Here are 5 ways that you could make money from a gold investment in 2025.

1. Gold bullions

Invest in Gold in bars or coins is one of the most emotionally satisfying ways to own it. However, it’s satisfying to see and touch; owning more than a little bit has serious drawbacks, too. Physical Gold must be insured and safeguarded, one of the biggest drawbacks.

A physical gold owner is entirely dependent on Gold’s price rising to make a profit, as opposed to owners of a business (such as a gold mining company), which can produce more gold and make more profit, driving the investment in the company higher.

In addition to online dealers such as APMEX or JM Bullion, you can invest in gold bullion from a local dealer or collector. You can also invest in Gold from a pawnshop. Make sure you know Gold’s spot price – the price per ounce right now in the market – as you buy so that you can make a fair deal. If you transact in bars rather than coins, you will likely pay more for the collector value of the coin than for its gold content.

Risks: If you don’t protect your gold holdings, someone can physically take it from you. Having to sell your Gold is the second-biggest risk. Your holdings may not receive the full market value, especially if they are coins and you need the money quickly. Thus, you may end up selling your holdings for much less than they would otherwise fetch on a national level.

2. Gold futures

You can speculate on gold futures to either rise or fall in value. Gold futures are contracts traded on exchanges that follow standard specifications. In these agreements, the buyer commits to receiving a predetermined quantity of gold from the seller at an agreed-upon price, with the actual delivery scheduled for a future date.

The biggest advantage traders have to invest in Gold using futures is the amount of leverage you can use. A relatively small amount of money can be used to buy a lot of gold futures. You can make profits if gold futures move in the direction you think they will.

Leverage is a risk for investors in futures contracts, however. When Gold goes against you, you will have to put up substantial amounts of money to maintain the contract (called margin), or your broker will close the position, and you will lose money. You can make a lot of money on the futures market, but you can also lose it just as quickly.

As a general rule, futures trading is reserved for sophisticated investors, and not all major brokers offer futures trading.

3. ETFs that own Gold

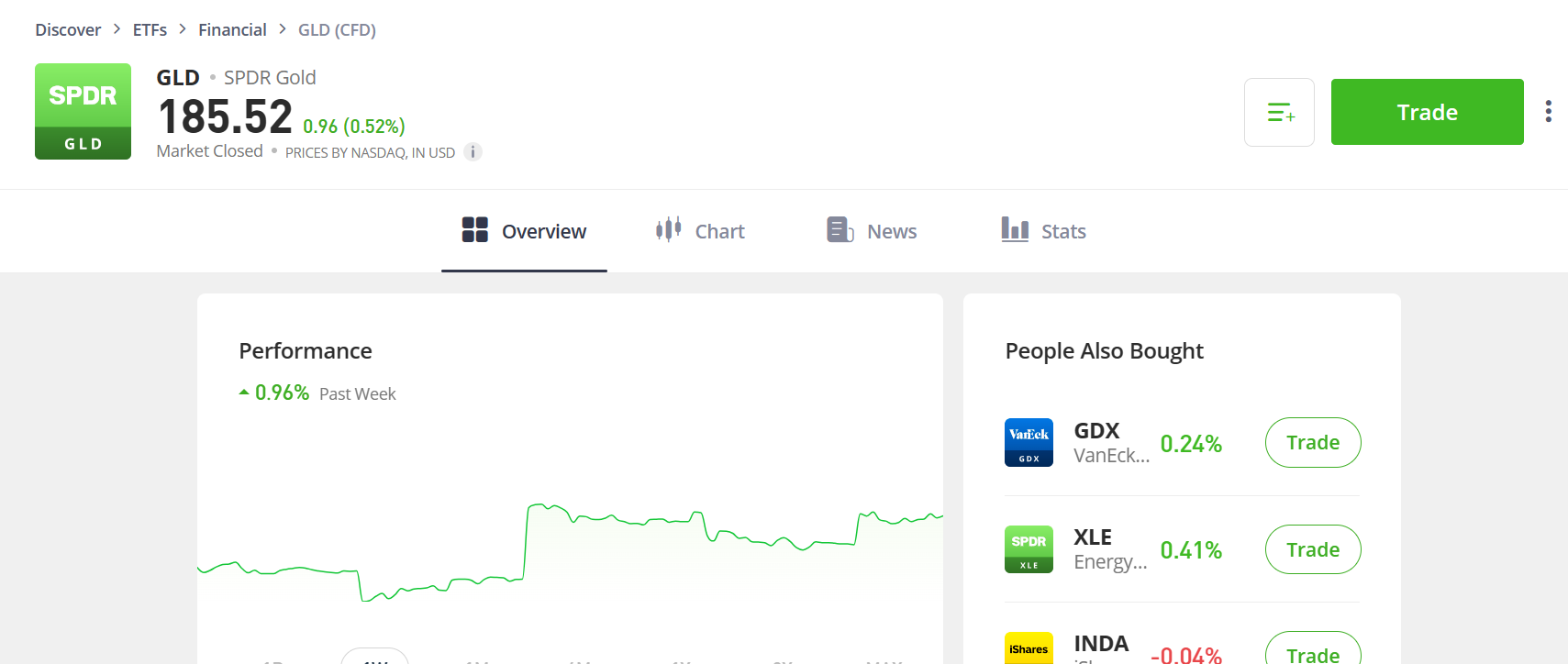

An exchange-traded fund (ETF) that tracks Gold is a great alternative to owning physical Gold or dealing with the fast pace of the futures market. SPDR Gold Shares (GLD), iShares Gold Trust (IAU), and Aberdeen Standard Physical Gold Shares ETF (SGOL) are three of the largest gold ETFs. These ETFs are designed to match the price performance of Gold minus the ETF’s annual expense ratio. As of September 2021, the expense ratios for the funds above were 0.4 percent, 0.25 percent, and 0.17 percent, respectively.

Besides being more readily exchangeable for cash at market prices, an ETF has another big advantage over bullion. The fund can be traded every day the market is open for the prevailing price, just like stocks. In addition, you can invest in gold ETFs from the comfort of your home, as they are more liquid than physical Gold.

Risk: The ETF gives you exposure to Gold’s price, so if it rises or falls, the ETF should perform similarly, again minus the cost of the fund. Sometimes Gold fluctuates like stocks. You can, however, avoid the biggest risks of owning Gold with these ETFs: protecting your Gold and obtaining the full value of your holdings.

4. Mining stocks

Owning mining companies that produce Gold is another way to take advantage of rising gold prices.

Investors may find this the best alternative because they can profit in two ways from Gold. First, a miner’s profits increase when Gold’s price rises. In addition, the miner can increase production over time, giving the miner a double whammy.

Risk: When investing in individual stocks, you must thoroughly understand the business. You will want to be cautious when selecting a proven player in the industry since some extremely risky miners are out there. You should probably avoid small miners and those without a producing mine. Mining stocks can also be volatile.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Our In-Depth Reviews of the Best Gold Trading Brokers

In the following section, we will take a closer look at each of the brokers that we reviewed. Here, we reveal why we have featured them on our list of the best gold trading platforms to use in 2025.

1. Plus500 – Best broker for trading gold CFDs with leverage

Plus500 is an established online broker that supports CFD trading in forex, commodities, shares, indices, ETFs and options. Users can access gold CFDs through the platform, which are suitable for short-term traders.

The platform offers 0% commissions on gold CFDs and tight spreads. It is also possible to trade with leverage up to 1:30 which is appealing to experienced traders who want to increase the size of their position.

The Plus500 platform offers a user-friendly mobile app that is suitable for trading on the go. It is one of the more easy-to-use apps that we found during our research and provides users with a range of helpful resources to facilitate informed trading.

The platform also offers a good selection of analysis tools and features. This includes advanced charting tools, a range of indicators, real-time data, alerts and professional trading account options. These features are available on both mobile and desktop.

Plus500 fees:

Fee Amount Stock trading fee 0% Forex trading fee Spreads from 0.8 Crypto trading fee N/A Inactivity fee $10 per month after 3 months of inactivity Withdrawal fee $0 Pros:

- There are no fees for deposits or withdrawals

- Plus500 offers a user-friendly mobile app which can be used for trading on the go

- Trade over 2800 financial instruments including gold CFDs

- 0% commissions

- Traders can access advanced charting tools

Cons:

- The inactivity fee kicks in after 3 months

- The minimum deposit is $100 which is fairly high

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

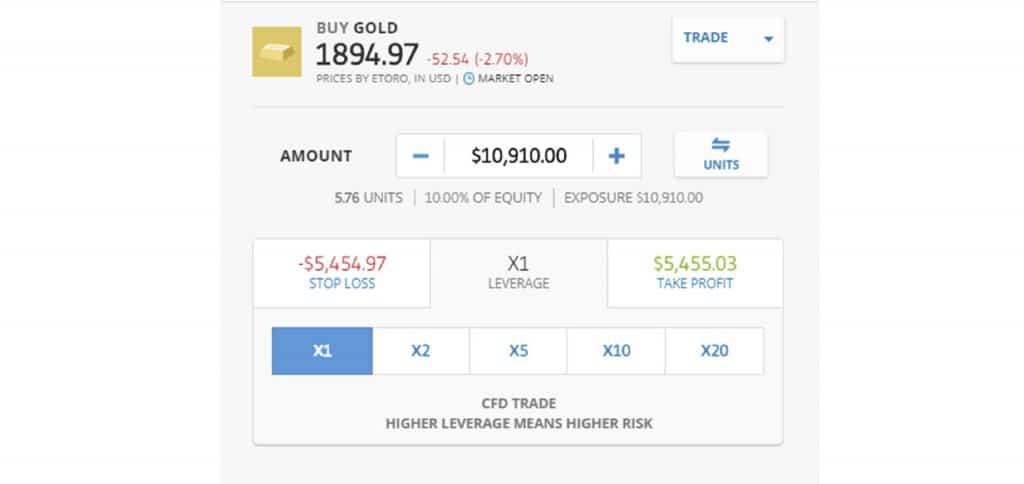

2. eToro – Our overall best gold trading broker with 0% commissions

With eToro, you can trade gold online via gold stocks or gold CFDs. In addition, the broker – which has over 20 million clients – lets you invest in gold via an ETF. This platform offers the best SPDR ETFs, although the SPDR Gold Shares market is by far the most popular. Newmont Corporation is another gold mining company on the platform.

Commissions do not apply to the purchase or sale of shares and ETFs on eToro. Additionally, there are no monthly fees, so you can keep your gold investment for as long as you like. It is also possible to use leverage of up to 1:10 and to place sell orders if you believe that the value of gold will go down.

eToro accounts require a minimum deposit for US users – $100 USD, for EU and UK – $50 USD. The cost of shares and gold ETFs on the UK stock market starts at $10. Investments in non-UK ETFs start at $500. On the other hand, CFDs can be accessed with even less capital – especially if leverage is used. eToro accepts debit cards and bank transfers for depositing funds. eToro’s excellent mobile investment app also allows you to invest in Gold on your mobile device.

eToro fees

Fee Amount Stock trading fee Free Forex trading fee Spread, 2.1 pips for GBP/USD Crypto trading fee Spread, 0.75% for Bitcoin Inactivity fee $10 a month after one year Withdrawal fee $5 Pros:

- Suitable for both long-term investing and trading

- Buy gold from just $10

- eToro is available on mobile and desktop

- eToro is a licensed broker in several jurisdictions

- The platform provides social trading and copy trading features as well as Smart Portfolios

- 0% commissions on US stocks and commodities

Cons:

- The platform is not suitable for advanced traders

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

3. Webull – Excellent broker for advanced gold trading strategies

Webull is an online brokerage that offers commission-free stock trading and interest on uninvested cash. As a gold broker, Webull stands out for offering a selection of Gold stocks that can be traded as options. Options are a type of derivative that give buyers the right to buy or sell a security at a chosen price.

Through Webull, it is possible to invest in Gold stocks from just £1 which makes it a suitable option for traders who have a low budget or want to practice strategies by using small amounts of capital.

During our review, we were impressed by the advanced trading tools that are offered by Webull. Through the platform, users can access charting tools for both desktop and mobile as well as educational guides, market news and a social hub through which users can communicate with each other.

Webull fees:

Fee Amount Stock trading fee 0% Forex trading fee Not Supported Crypto trading fee 0% Inactivity fee No Withdrawal fee $25 Pros:

- Trading thousands of stocks and ETFs

- ADR support for foreign companies

- Investing in cryptocurrencies and stock options

- 0% commission trading

- User-friendly interface

- There are iOS/Android apps available

Cons:

- The platform fee for Level II pricing data is $1.99 per month

- PayPal and debit/credit cards are not supported

There is no guarantee that you will make money with this provider. Proceed at your own risk..

4. Admiral Markets – The best gold trading broker for short-term traders

Admiral Markets is a CFD trading platform that is most suitable for short term strategies. This is because trading CFDs means that you do not own the underlying instrument. It is possible to trade Gold via the GOLD/USD pair.

Admirals is an appealing option due to the fact that is charges low spreads of 0f 0.25 pips per trade as well as low commissions start from 0%. The platform also offers micro lots, making it possible to trade Gold on a budget.

Another appealing aspect of this provider is that it is compatible with both MT4 and MT5 charting tools. These are considered to be the industry standard and provide traders with a range of indicators and tools that can be used for analysis.

As well as good charting tools, Admiral Markets offers educational resources, expert analysis and a weekly podcast that provides helpful market insight.

Admiral Markets fees:

Fee Amount Stock trading fee 0% Forex trading fee Spreads from 0.00008 Crypto trading fee N/A Inactivity fee $10 per month after 2 years of inactivity Withdrawal fee $1 Pros:

- Trade GOLD/USD with low spreads from 0.25 pips

- Free deposits and withdrawals

- Admiral Markets offers a user-friendly interface with access to advanced charting tools

- The company offers a range of market insight and educational resources

Cons:

- Limited to CFD trading

- The minimum deposit is $100 which is fairly high

5. Revolut – The best gold trading app for long-term investors

Many of the platforms covered in our article so far are most suitable for short-term traders. Revolut is an mobile investment app that stands out as being suitable for long-term investors who want to build a strong portfolio.

Through Revolut, you can invest in gold, silver, cryptocurrencies and stocks. The app can also be used as a mobile banking app, with high interest savings accounts and debit cards for convenient spending.

Although the minimum deposit is $10, it is possible to invest in gold with just $1. This is ideal for beginner’s who may want to test the water with small investment before putting a larger amount of capital at risk.

In terms of research and analysis tools, Revolut is limited. The app is catered towards less-experienced investors who want to make investments and hold them long-term. Therefore, the app doesn’t offer any advanced charting tools, indicators or APIs. If you’re looking to use advanced trading strategies or explore day trading, this might not be the best platform for you.

Revolut fees:

Fee Amount Stock trading fee 0.12% per year Forex trading fee N/A Crypto trading fee From 0.49% Inactivity fee $0 Withdrawal fee $0 Pros:

- Access your investing and banking in one place.

- Revolut has a user-friendly interface and is available on mobile.

- Invest in gold from $1.

- It is possible to diversify with commodities, cryptocurrencies and stocks.

Cons:

- No advanced research and analysis tools.

- Day trading features are not available.

- Limited number of instruments available to trade.

How To Use a Gold Broker in 2025

Online trading platforms make it possible to invest in gold in minutes. In the following section, we will take a look at how to invest in gold using our recommended broker, eToro.

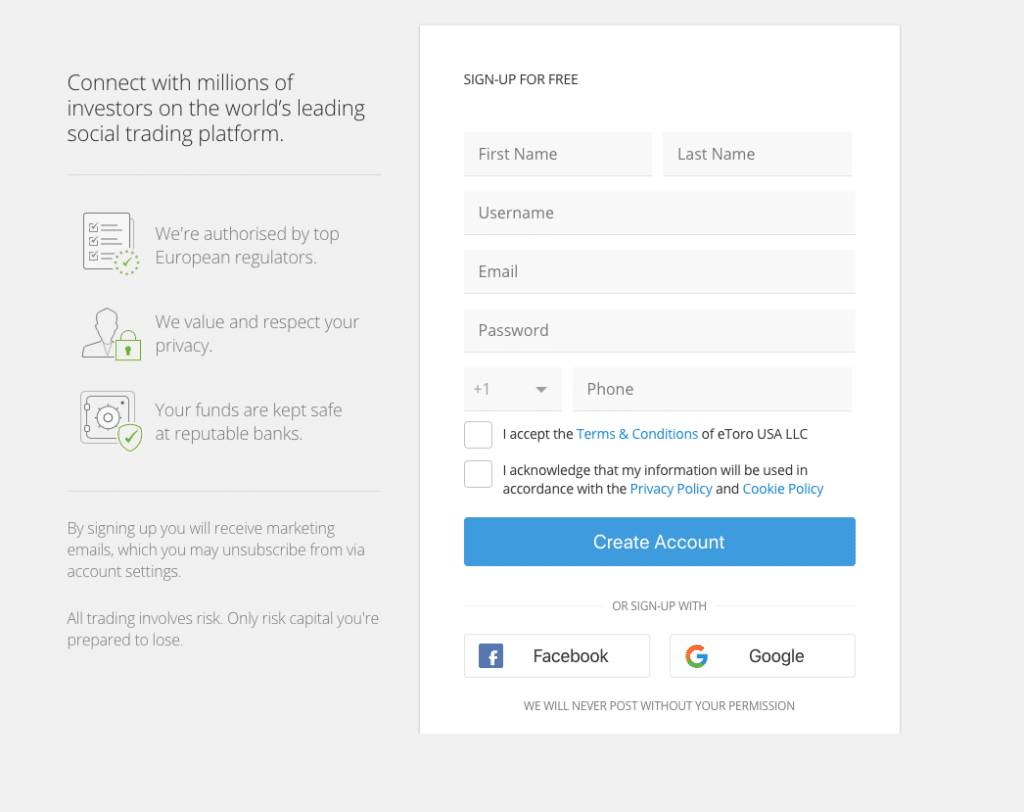

Step 1: Open an Account with eToro

Open an account by visiting the eToro website and clicking ‘create account’.

You will be asked for some personal details including your name, email address and mobile number. You can make this process simpler by signing up with your Facebook or Google accounts.

Step 2: Upload ID

Whether you created your account through Facebook, Gmail, or scratch, the next step is mandatory. KYC is a requirement for all regulated platforms.

Verifying your account will require you to upload photos of your ID, driver’s license, or passport. In addition, a copy of your bank statement may also be requested by eToro to verify that the address on your application matches the address on your bank statement. Once this is verified, you will be able to access the broker.

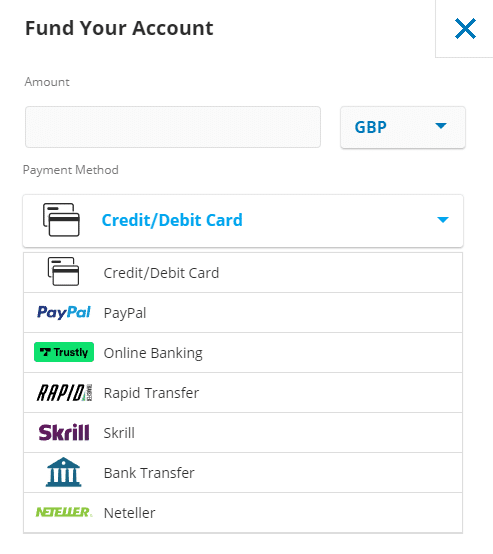

Step 3: Deposit Funds

In order to invest in Gold on eToro, you must first deposit funds into your account. Payments methods accepted by eToro include debit cards and bank transfer.

Step 4: Buy Gold

When your account is funded, you can then invest in Gold on eToro. BP is a good example. First, we will open a new order by typing ‘BP’ into the search box and clicking ‘TRADE.’ Next, we will enter an amount for our first gold trade and click ‘OPEN POSITION.’

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

What to Consider Before You Trade Gold

Despite its reputation as a hedge against inflation, investing in gold comes with financial risk. Although Gold itself can be used to protect wealth during periods of heightened inflation, investing in Gold stocks, ETFs or CFDs is much different. Before investing in these assets, it is a good idea to be aware of the risks involved with investing as well as what to look out for before making an investment.

Risks of Gold Investing

Investing in Gold has its limitations. Some of them are as follows:

1. Security Concerns

Physical gold assets like jewelry are always prone to theft because of their high price and value. However, digital Gold could be an option for investors who want to get the same benefits as Gold without security concerns.

2. Storage Concerns

Keeping physical Gold in the form of jewelry or coins can be difficult since:

- Robbery and theft are always a possibility

- A dedicated safe may be needed

- A paper gold investment, such as digital Gold, gold ETFs, etc., poses no storage concerns.

3. Making Charges

The price of Gold may be low, but commissions are high. Therefore, buying gold stocks may cost you more if you pay commissions. In addition, selling Gold may also require fees.

In this regard, gold ETFs perform better. An ETF that invests in gold bullion can be bought and sold like a share. Generally, ETFs are lower-cost.

If you wish to invest in Gold without making any charges, you can choose from options such as Gold ETFs, sovereign gold bonds, and digital Gold, among others.

4. Purity Concerns

Gold’s real value lies in its purity, measured using the karat (K) unit. The purest form of Gold is 24K. If you invest in Gold from a reputable and trustworthy seller, you won’t have to worry about purity concerns.

Additionally, investing in Gold stocks, ETFs or in digital Gold is one way of avoiding purity concerns. This is because these instruments track the value of Gold on the market so aren’t affected by the purity of individual bullions.

5. No Passive Income

In contrast to stocks, mutual funds, and peer-to-peer lending, gold investments do not generate passive income. If you’re considering retiring early or hoping to supplement your income with investments, this could be a concern.

Selling your physical gold investments is the only way to earn a profit.

Taxes and Regulations Regarding Gold Investments in the US

The Internal Revenue Service (IRS) considers physical holdings of precious metals such as Gold, silver, platinum, palladium, and titanium capital assets specifically classified as collectibles. Therefore, Gold and silver coins, gold bars, rare coins, and ingots are all subject to capital gains tax, regardless of their form. In addition, if such holdings are sold after more than a year of holding, capital gains tax must be paid.

The sale of precious metals is taxed differently from many other tradable financial securities, such as stocks, mutual funds, and ETFs. The capital gains tax rate on physical Gold and silver equals your marginal tax rate, up to a maximum of 28%. Accordingly, individuals in the 33%, 35%, and 39.6% tax brackets only have to pay 28% on their physical precious metals sales. In addition, precious metals are subject to ordinary income tax rates for short-term gains.

Gold as a Long Term Investment

We tend to focus on debt and equity when discussing asset classes in investment. However, these days, your financial plan may also include a portion of hybrid products, which combine the benefits of debt and equity in a more tailored way. But should Gold be included in your financial plan? When we talk about Gold, we’re not talking about the Gold in your jewelry, but Gold as an investment. Gold can be in gold bars, gold e-gold, or even gold bonds. As a result, any product that allows you to mimic the price of Gold can be considered a gold investment.

But isn’t gold a languid product?

It’s a standard refrain. What role does gold play in wealth creation? After all, Gold rarely changes over long periods. Historically, Gold has only provided attractive returns during limited periods, such as 1971 to 1979 and 2006 to 2011. If Gold has outperformed only twice in 50 years, is it worth considering Gold as an asset class?

What’s more, should you include Gold in your financial plan? Yes, you should. It is not the intention to outperform the market by including Gold in long-term portfolios. Diversity is more important than enhancing returns or creating wealth. Gold does not earn any income or generate any returns, so it has no intrinsic value. Price movements are normally influenced by demand and supply.

In turbulent times, gold is your best bet

Gold has typically outperformed during turbulent and uncertain times based on historical data. For example, between 1971 and 1979, there was tremendous economic and geopolitical turmoil. There were wars in the Middle East. Israel had collapsed the Gold Standard, Saudi Arabia had placed an oil embargo on the US, Iran was fighting Iraq, and Russia had invaded Afghanistan. Nevertheless, the gold price rose from $35/oz to $800/oz during this period. A subsequent period of gold appreciation occurred between 2006 and 2011, when the Lehman crisis, the sub-prime crisis, and the European debt crisis made Gold extremely valuable. Even if we ignore these periods of outperformance, Gold holds its value best during times of political and economic uncertainty.

Gold protects you from the risk of fiat currencies

There are a few more details to this argument. A fiat currency is issued by a central bank, such as a dollar, euro, rupee, or yen. It is almost impossible for these central banks to print a finite amount of currency. In the last 9 years, major central banks have printed these currencies left, right, and center. The result has been a significant devaluation of these currencies. Although the impact of this debasement may not be immediately apparent, it will show up in the value of your currency as well as your portfolio at some point. Gold, however, is a non-fiat currency with a limited supply. As a result, its value does not depreciate much. Therefore, having Gold as part of your portfolio makes sense again.

You can hedge your portfolio with gold

Gold has an important role in the economy because of its low correlation to debt and equity movements. The relationship between equity and debt is unusually complex. When the economy is healthy, equity and bond prices tend to diverge, while when the economy is distressed, both equity and debt prices crash. Gold has a low correlation to equity and bond prices, making it a natural hedge for your portfolio. In addition, due to Gold’s low correlation with other asset classes will provide a natural hedge, even a 10% exposure to Gold.

Gold has the longest surviving secondary market

Gold has an interesting aspect. Since the secondary market for Gold has existed the longest, it has managed to survive. Gold is a global product that never goes out of demand in the true sense of the term. Over the last 70 years, the Dow Jones index and the Sensex have had vastly different components. Along the way, new stars have emerged, and old stars have fallen. As a result, any equity or mutual fund investment is subject to market churn. Probably the only asset without churn risk is Gold. Gold will continue to have a strong secondary market even after 30 years.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Gold As a Short Term Investment

Fed interest rates are expected to increase in 2025, making Gold less attractive. In addition, since Gold does not pay dividends or interest when interest rates increase, the relative cost of investing in gold increases. As a result, the rising interest rate environment may make gold unattractive for investors to hold in their portfolios, affecting future investor holdings of Gold putting downward pressure on its price.

Wade Guenther, a partner at New York’s Wilshire Phoenix investment firm, says inflation and inflationary expectations can support gold prices despite rising 10-year Treasury yields. Inflation has proven to be less ‘ transient ‘ than expected with ongoing problems such as supply chain issues, rising energy prices, etc. Further, potential volatility in the equity markets might shift the spotlight back to Gold, proving a portfolio diversifier and a hedger.

Indian gold demand is rising, and China is the world’s fastest-growing gold market. In addition, the World Gold Council reports gold buyers in China to see drops in Gold’s price as opportunities to buy, another factor that could support gold prices.

Popular Gold Companies to Invest In 2025

1. Best Overall: Money Metals Exchange

MMX offers new buyers direct storage and premade portfolios alongside various precious metals. Unfortunately, payment method restrictions and transaction fees may impact the checkout process, and customer support is unavailable on weekends.

2. Best Comprehensive Offering: APMEX (American Precious Metals Exchange)

Gold and Silver investors can turn to APMEX, the leading Precious Metals dealer in the United States. With over 20 years of experience, APMEX distinguishes itself through exceptional customer service, unmatched product quality and options, and a wealth of resources to help investors develop their ideal investment portfolio.

3. Best Customer Experience: JM Bullion

Established in 2011, JM Bullion is an online retailer of precious metals products. Gold and silver are delivered directly to your door, as we deal exclusively in physical bullion.

Providing quality products is one of the top priorities. Using direct contacts with mints and distributors, JM Bullion inspects all new inventory carefully, ensuring that their customers receive only the best products.

4. Best Low-Price Option: SD Bullion

Gold & Silver News is a highly popular website started in 2011 by two doctors with one dream: Educate the masses on the value of hard assets and prepare for them. In March 2012, SDBullion.com was launched following the rapid success of that website. “Nothing Fancy” was the motto of all telephone sales. Just a Telephone and Low Prices.”

SD Bullion has since transacted more than $1 billion in sales and has been named to Inc. Magazine’s list of the 500 Fastest Growing Companies in the United States twice. Yet, at the same time, they remained true to our original mission of offering the absolute lowest Gold and silver bullion prices in the industry, guaranteed.

5. Best Reputation: Golden Eagle Coins

Golden Eagle Coins offers a wide range of gold bullion products. Both bullion investors and collectors can choose from the large inventory. As well as American Gold Eagles, it carries Canadian Gold Maple Leafs, Gold Krugerrands, and Gold Bars in large quantities. Please visit its website to get updates on the spot gold price. The quotes are derived directly from the commodities exchange and are updated in real-time.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

What Is The Best Broker to Trade Gold?

In conclusion, eToro is the best broker to trade gold in 2025 because it offers a variety of Gold ETFs, as well as CFD products. It is also possible to diversify with other commodities, stocks, indices, and cryptos. Furthermore, eToro charges 0% commission of Gold trading which makes it one of the more affordable options that we reviewed.

Compared with traditional assets like stocks and bonds, Gold offers many benefits. The primary advantage is its ability to store value. In addition, Gold’s price has held steady for thousands of years. Therefore, it does not depreciate and is finite. Investing in Gold can also protect you from falling stock markets or rising inflation rates.

Gold can be invested in various ways, as discussed throughout this guide. You can invest in Gold ETFs, buy shares in gold mining companies, and even trade gold CFDs. Plus500 allows you to access these gold markets from $100.

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

FAQs

Which exchange is best for gold?

There are a number of exchanges that can be used to buy gold. The best one stands to be eToro because it provides various Gold investment opportunities and it is possible to invest from $10.

What is the best gold trading strategy?

The most popular way to trade Gold is to hold it as a long-term investment. Gold is a fairly stable asset class that will not provide huge returns during short-term periods. Instead, investors typically rely on gold to provide appreciation overtime and to hedge against inflation.

How to learn to invest in Gold?

The best way to learn how to invest in Gold is to use educational resources that are provided by Gold brokers. It is also wise to stay up to date with market news and to use social trading to learn from experienced traders.

How many people are investing with Gold Trading Platforms?

Gold has also become more popular with investors. Commodities, particularly Gold, are increasingly viewed as an investment class for which funds should be allocated. SPDR Gold Trust became the world’s largest holder of gold bullion as of 2019, making it one of the largest ETFs in the US.

Jhonattan Jimenez Finance and Crypto Writer

View all posts by Jhonattan JimenezBefore starting his career as a freelance writer, Jhonattan studied at the Universidad La Gran Columbia from which he graduated in 2019. Jhonattan describes himself as a crypto enthusiast and regularly writes price prediction articles for new projects. During his time as a writer, Jhonattan has gained great knowledge about the crypto space and has mastered technical analysis skills that he uses when writing token price predictions. As well as writing for Trading Platforms, Jhonattan has written for Stocksapps.com and Buyshares.co.uk.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up