Best BSC Staking Platform for 2024 – How to Stake on BSC

Among the most popular blockchains in the cryptocurrency world is the Binance Smart Chain (BSC). Binance runs it, one of the world’s leading crypto exchanges. Due to its lower fees than the Ethereum (ETH) Network, it has successfully created an ecosystem of some of the biggest cryptocurrencies. For example, Dogecoin (DOGE) was responsible for making early investors millionaires and introducing millions to cryptocurrencies.

As part of this guide, you will find the best BSC staking platforms for 2024 and learn how this segment of the blockchain industry works.

Best BSC Staking Platforms in 2024

Check out the top BSC staking platforms on the market before getting into our reviews. Each of the BSC staking crypto sites has something to offer for everyone.

- DeFi Swap – Best DeFi Staking Platform for 2022

- AQRU – Overall Best Crypto Staking Platform

- Crypto.com – The Best BSC Staking Platform That Offers Flexible Withdrawals

- BlockFi – The Best Platform For New Crypto Investors

- eToro – A Popular Platform That Charges Low Fees For Crypto Staking

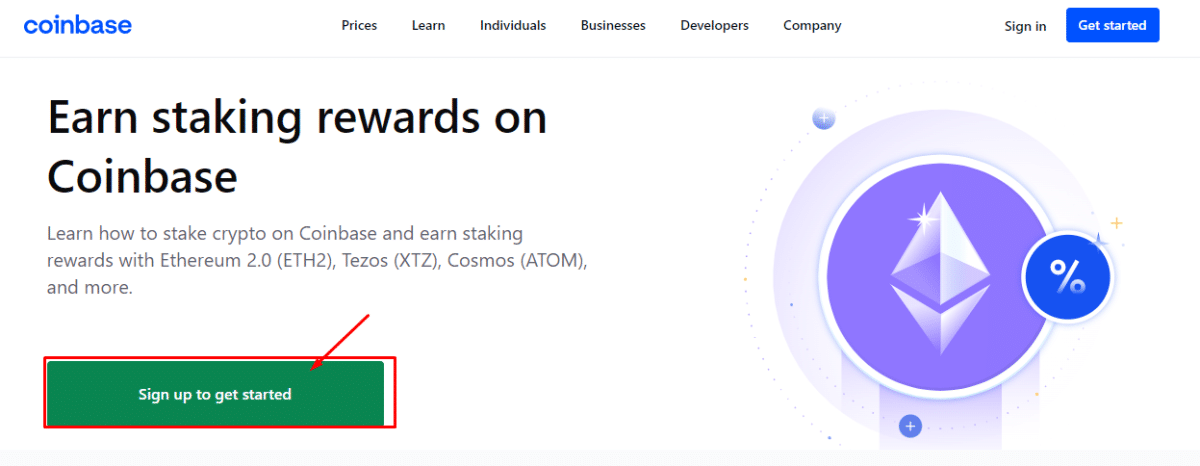

- Coinbase – Popular Exchange That Offers BSC Staking Services

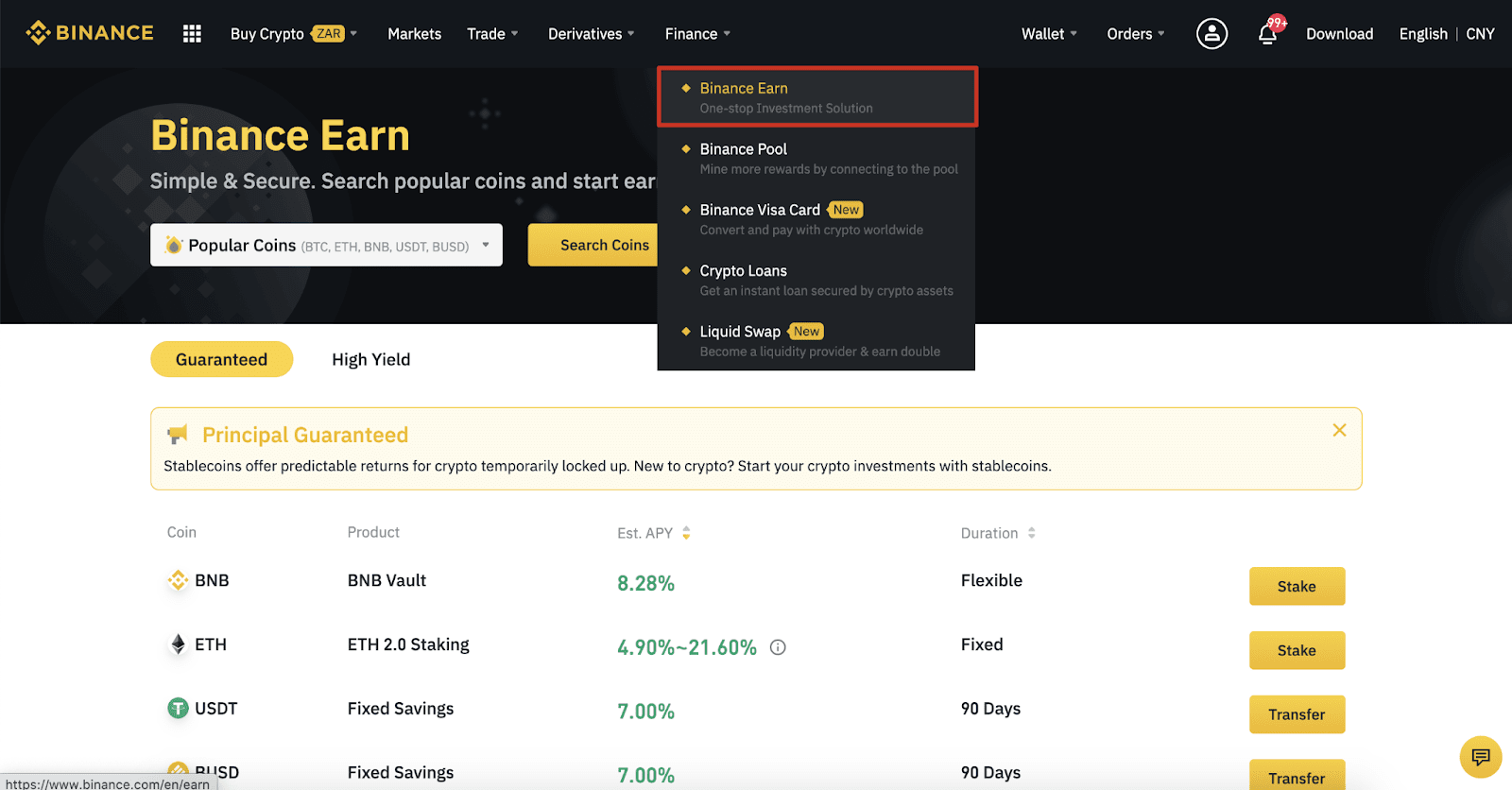

- Binance – Best Platform For High BSC Stake Rewards

- Kraken – Most Secure A Trusted Stake Platform

- Nexo – Best Staking Platform With Flexible Lock-Up Periods

Best BSC Staking Platforms Reviewed

Here you will find a review about each BSC staking platform and what you can expect from them.

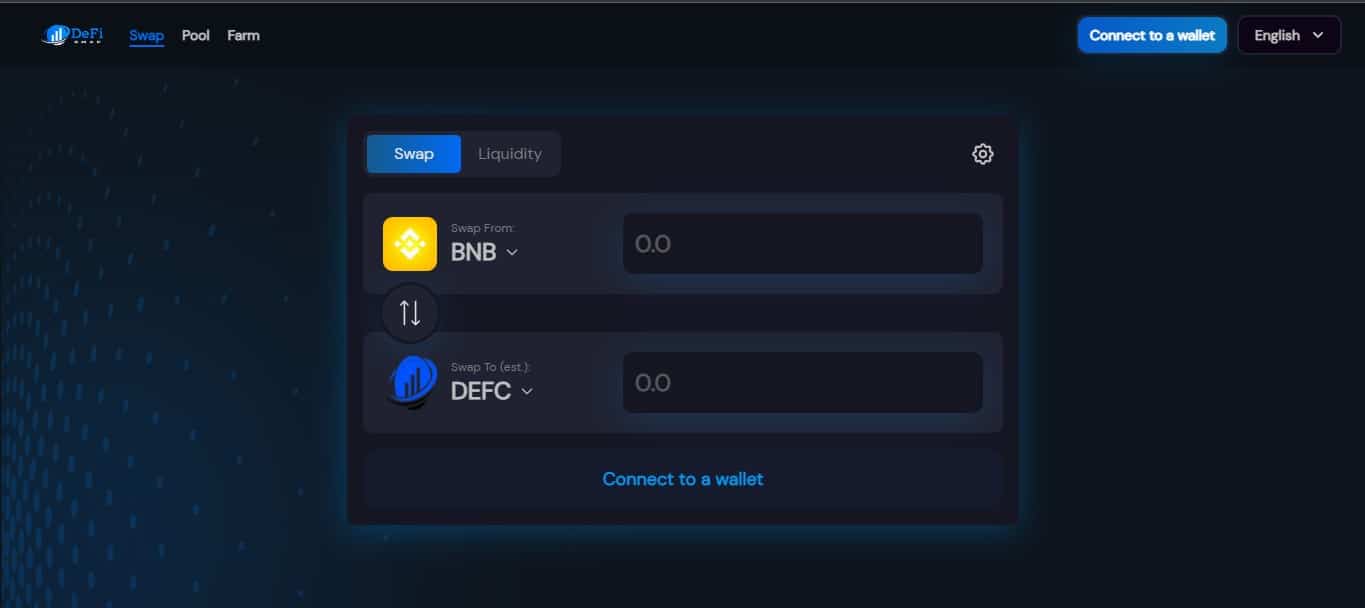

1. DeFi Swap – Best DeFi Staking Platform for 2022

In addition to providing access to some of the best DEX coins available, DeFi Swap came out on top of the best DeFi apps in 2022. As an exchange that offers a broad range of services, DeFi Swap is a recently launched decentralized exchange. Additionally, it supports a wide range of BSc tokens via a fully-fledged DEX.

DeFi Swap can therefore be used for buying and selling digital currencies without the need to utilize a centralized platform. As a result, you can trade anonymously, and there is no registration required. Instead, DeFi Swap works by simply connecting your crypto wallet to the platform.

In addition, DeFi Swap also offers several tools that allow you to earn interest on your idle tokens, making it one of the most effective staking platforms in 2022. Its liquidity provision tool is one of the key features. Using a secure and transparent smart contract, you can lend your crypto assets to the DeFi Swap exchange. As a result of providing liquidity, you’ll earn a share of the trading fees collected.

When the DeFi Swap exchange begins to attract more volume, it can add up to a nice passive income source. The more volume that people trade, the more fees you will earn, and therefore you will earn more. The DeFi Swap platform does not require lock-ups when providing liquidity.

In addition to crypto yield farming, this top-rated platform offers passive investment tools. APY will be generated by staking your chosen digital token, and in turn, you will earn a healthy amount of money. In the DeFi Swap ecosystem, you can earn interest up to 75% if you stake DeFi Coin – which is their native token.

You will, however, have to choose how long you want to lock away your DeFi tokens. If you choose the 30-day option, the APY is reduced to 30%, though it is still competitive. In addition, the DeFi Swap service will be extended to NFTs in the coming months. That will allow you to trade NFTs decentralized – with no third parties involved.

In addition, DeFi coin can be purchased for just one dollar, and the official group on Telegram has over 6000 members, meaning it’s a safe and famous coin.

| Staking Rewards on Cryptocurrencies | Rates of 75% APY |

| Min & Max Staking Amounts | N/A |

| Lock-In Period | 4 Lock-In periods from 30 to 360 days |

| Payout Frequency | Anytime |

Pros:

- Best DeFi app on the market

- High yields on offer

- Provides liquidity and yield farming support for crypto

- Powered by smart contracts, 100% decentralized

- Coming soon: NFT marketplace and mobile app

Cons:

- Other DeFi lending platforms are more established

Cryptoassets are a highly volatile unregulated investment product.

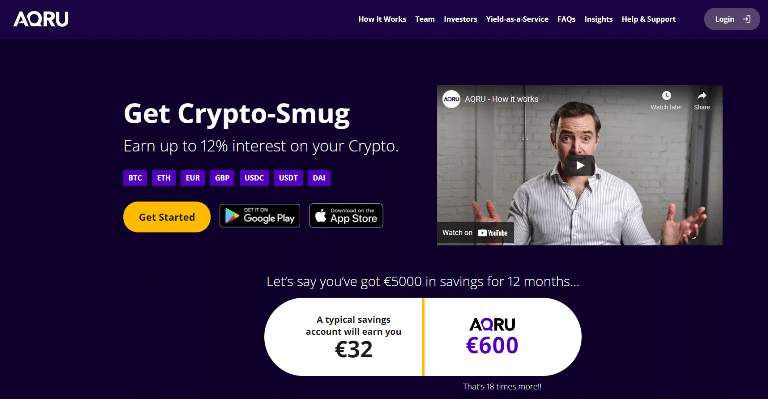

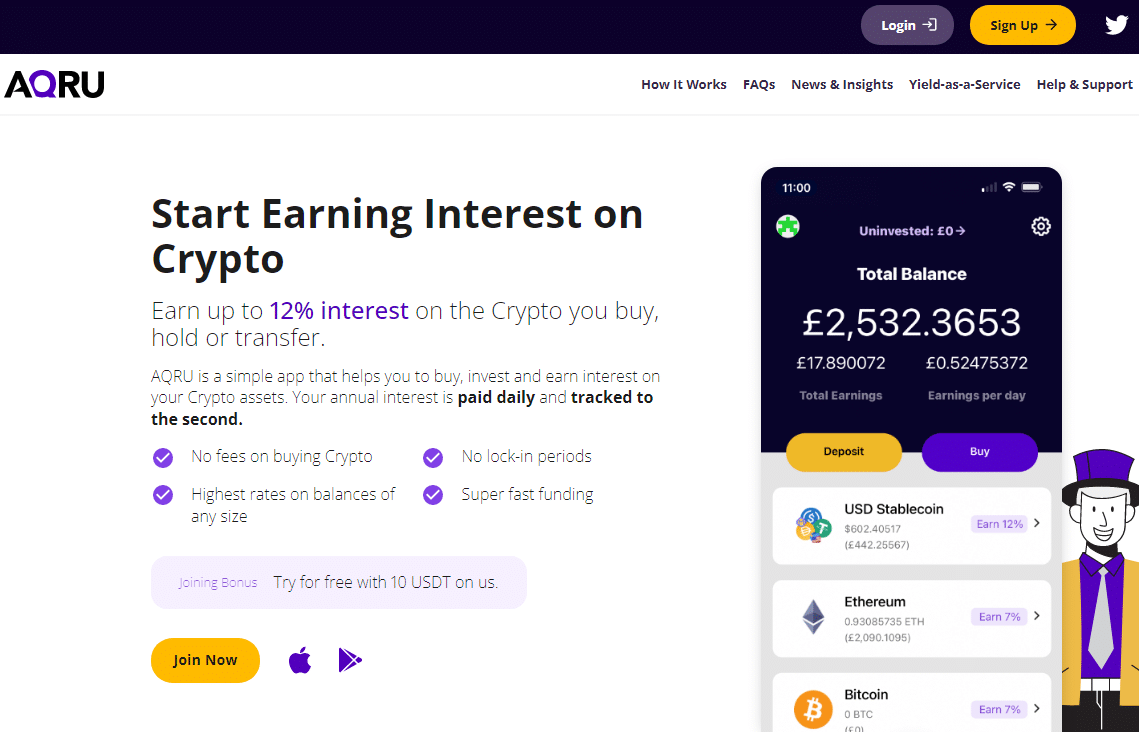

2. AQRU – Overall Best Crypto Staking Platform

The first BSC stake platform to consider is AQRU. The website is user-friendly and has minimal jargon, so this provider offers a staking platform well suited to newbies. In addition, it is easy to access your crypto staking account via the AQRU app.

AQRU supports both fiat currency and digital tokens. For example, the former supports EUR and GBP, large-cap tokens such as Bitcoin and Ethereum, and BSC stablecoins such as Tether and USDC.

BSC stablecoins such as USDC, Tether, and DAI generate an annual return of 12%. By comparison, Bitcoin and Ethereum generate 7% returns, respectively. Therefore, AQRU is our top pick for the best crypto interest accounts and staking platforms.

You can benefit from these APY rates by lending your capital to retail investors and institutions looking to borrow crypto. Take this into consideration.

There is no fee when withdrawing funds from the AQRU platform in fiat currency. Still, it charges a flat withdrawal fee of $20 for crypto withdrawals, making it unsuitable for small investments.

| Staking Rewards on BSC Cryptocurrencies | · Stablecoins (USDT, USDC, DAI) –12% |

| Min & Max Staking Amounts | €100 (£110.80) minimum; no maximum stated. |

| Lock-In Period | No lock-in period; flexible withdrawals offered |

| Payout Frequency | Daily |

Pros:

Pros:

- High-interest rates on GBP, ETH, USD, BTC, EUR, and USDT

- With BSC tokens, you can earn up to 12% daily interest

- Withdrawals can be made quickly

- Minimum deposit of $100.

- Several payment options are available

Cons:

Cons:

- Withdrawals of cryptocurrency cost $20.

Cryptoassets are a highly volatile unregulated investment product.

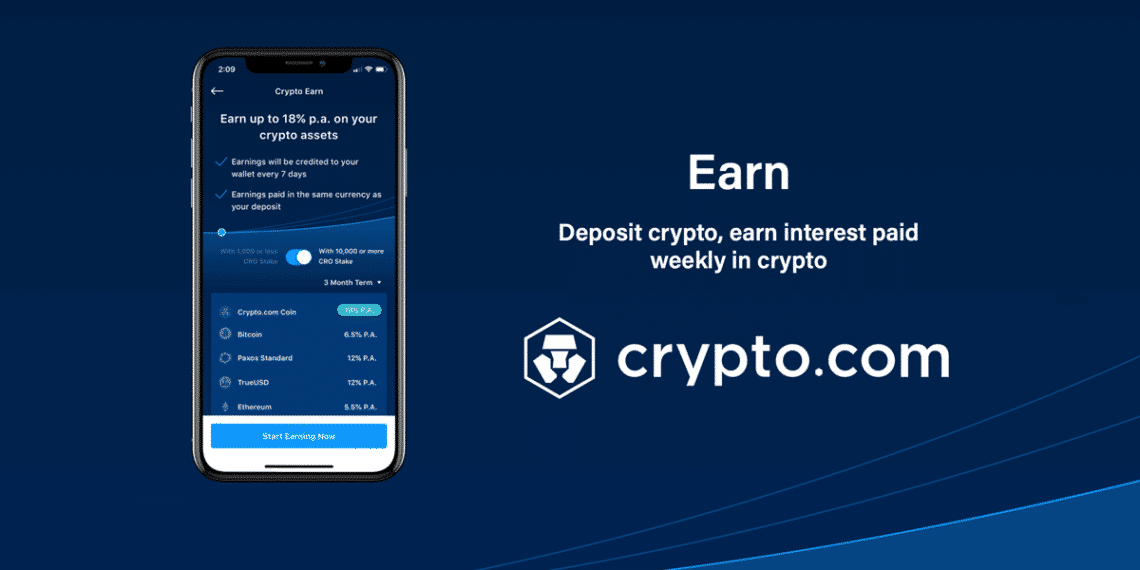

3. Crypto.com – The Best BSC Staking Platform That Offers Flexible Withdrawals

In 2016, Crypto.com was launched and is now one of the world’s largest cryptocurrency exchanges with millions of users. Crypto.com is not only a low-cost exchange for over 250 tokens, including many BSC tokens but also a provider of a variety of other crypto-focused products.

The platform offers digital asset loans, crypto credit and debit cards, and NFT markets via Crypto Earn. After you deposit your digital tokens, Crypto.com will use the funds to lend capital to your account. In addition, you will receive interest payments daily following the end borrowers’ repayment of funds.

In terms of payment, APY rates will, first and foremost, depend on the token. A typical APY for BSC stablecoins like USDC, TrueGBP is 12%, while non-stablecoins like BNB, DOGE, and SHIBA is 3%. Second, if you lock up your tokens for one or three months, you will receive a different rate.

| Staking Rewards on BSC Cryptocurrencies | · Stablecoins (USDC, DAI, USDT, etc.) – Up to 14%

· Non-Stablecoins (BNB, SHIBA, DOGE, etc.) – Up to 5% |

| Min & Max Staking Amounts | · Minimum – varies by currency (e.g., 0.015 ETH, 0.005 BTC)

· Maximum – $500,000 (USD equivalent) |

| Lock-In Period | Customizable – one month, three months, or flexible |

| Payout Frequency | Each week |

Pros:

- Easy cryptocurrency payments

- Money conversion is easy

- com Visa cards offer cashback rewards

- Gain interest in cryptocurrencies

- Low fees

- Variety in cryptocurrency selection

- A strong security system

Cons:

- Navigating the platform is difficult

- There is no universal supply of coins

- A poor customer service experience

Cryptoassets are a highly volatile unregulated investment product.

4. BlockFi – The Best Platform For New Crypto Investors

BlockFi was founded by Zac Prince in 2017 and has earned over $700 million in crypto interest and rewards to date for clients worldwide. Unfortunately, the service is currently unavailable in the United States, but it is legal and operates normally in the United Kingdom.

The BlockFi platform lets you stake on-chain and off-chain. It offers more than ten products. Also, a calculator on the platform can calculate the amount of money you will earn based on the amount you put into the account, the currency involved, and the length of time.

With a BIA (BlockFi Interest Account), you can earn an APR of 11% when choosing one of the currencies available. In addition, you will also receive an interest payment every month without having to pay fees or meet minimum requirements. As for BSC, BlockFi supports staking on stable and non-stable coins, such as BUSD, USDC, USDT, MATIC, UNI, and LINK.

| Staking Rewards on BSC Cryptocurrencies | An interest rate of up to 11% with a BlockFi Interest Account (BIA) |

| Min & Max Staking Amounts | No minimum or maximum balances |

| Lock-In Period | Flexible |

| Payout Frequency | Monthly |

Pros:

- It provides top-notch protection while ensuring transparency and trust

- Leaders in the industry support BlockFi

- Earn competitive interest rates while staking cryptocurrency

- There are no minimum balance requirements or balance caps

- For beginners in crypto staking, this is an excellent platform

Cons:

- Each month, withdrawals from interest accounts are restricted based on the type of cryptocurrency

- Not available in the US

Cryptoassets are a highly volatile unregulated investment product.

5. eToro – A Popular Platform That Charges Low Fees For Crypto Staking

eToro is a cryptocurrency broker that offers low account minimums and competitive fees. Through its portal, you can stake your cryptocurrency investments.

eToro offers staking rewards for three crypto-assets ( Ethereum, Cardano, and Tron) as of this writing. Additionally, eToro plans to support BSC tokens soon.

eToro is one of the best options for crypto staking for 2022 if you prefer a flexible arrangement. In other words, your crypto tokens don’t have to be locked up. Rather, the tokens you own in your eToro wallet will keep earning staking rewards until they are cashed out. That eliminates the need to move stake coins between platforms.

Additionally, eToro offers additional benefits as a staking provider. Your crypto assets will be staked with a highly regulated ecosystem through the SEC, FCA, ASIC license EToro, and CySEC. As an additional option, if you wish to invest in cryptocurrencies on eToro, you can deposit US dollars using a debit/credit card, bank wire, or e-wallet. Instead of expensive commissions, you only need to pay a 0.75 % spread.

| Staking Rewards on BSC Cryptocurrencies | Coming soon. |

| Min & Max Staking Amounts | Rewards of at least $1 per month in USD. |

| Lock-In Period | Flexible access; no lock-in period |

| Payout Frequency | Monthly |

Pros:

Pros:

- Trading forex, stocks, and cryptocurrencies

- Hold crypto allows you to earn money

- Stakes are automatically made every month.

- A variety of membership levels are available.

Cons:

Cons:

- A small fee is charged for the staking service.

- At the time of writing, there are no BSC tokens available.

Cryptoassets are a highly volatile unregulated investment product.

6. Coinbase – Popular Exchange That Offers BSC Staking Services

Coinbase is perhaps the best BSC staking platform for cryptocurrency enthusiasts who want to buy and sell digital assets safely. This is because Coinbase has a regulated and user-friendly exchange platform in addition to staking.

Coinbase supports six digital currencies, including Ethereum, Algorand, and the BSC tokens Cosmos, Tezos, Dai, and USDC. APY rates range from 0.15% with USDC to 5% with Cosmos. There are plans to add more staking coins soon. The important thing to remember is that you are not required to purchase cryptocurrency on Coinbase to receive staking rewards. An external wallet can be used to stake tokens as well.

With Coinbase, you can create a verified account in less than 5 minutes by providing personal information and a copy of your identification. After that, you can use your debit card or credit card to buy stake coins instantly if you do not currently own any. However, it should be noted that this payment method is associated with a nearly 4% fee.

| Staking Rewards on BSC Cryptocurrencies | 5% for non-stablecoins; 2% for stablecoins |

| Min & Max Staking Amounts | It varies depending on the asset (no minimum for ETH) |

| Lock-In Period | Depending on the asset, it varies |

| Payout Frequency | It varies from daily to weekly based on the assets |

Pros:

Pros:

- The largest cryptocurrency exchange in the world.

- Earn 5% APR by staking your coins.

- Documents related to taxation are available for users.

- User-friendly platform.

Cons:

Cons:

- There is a wide variation in token returns.

Cryptoassets are a highly volatile unregulated investment product.

7. Binance – Best Platform For High BSC Stake Rewards

Binance is an excellent crypto staking platform for those who want to earn high rewards. This popular exchange platform supports more than 100 different staking coins, covering a wide range of projects and APYs. Generally, Binance offers a period of 10, 30, 60, or 90 days to store tokens.

Using Binance’s website as an example, Moonbeam (GLMR) has a yield of 239% and a lock-up period of 10 days. Shiba Inu and Solana are also options, offering APYs of 8.78% (30 days) and 10.12% (10 days), respectively. Binance tends to pay higher rates for shorter lock-up periods.

There is little chance of locking in promotional APYs for longer than one month since rates change daily. You may also find that the best deals sell out quickly because each staking pool has a set allocation. If you have met your staking requirements, you may also want to consider digital currency trading with Binance.

For trading, Binance charges a maximum of 0.10% per slide. Therefore, each $1,000 you trade will incur a fee of $1. Binance also offers crypto savings account with interest paid on idle crypto assets. Additionally, you will be able to access a specific APY rate based on the cryptocurrency and lock-up period. Generally, flexible savings accounts offer the lowest APY rates.

| Staking Rewards on Cryptocurrencies | Gain up to 3.78% on stablecoins and 150% on non-stablecoins. |

| Min & Max Staking Amounts | It varies depending on the coin |

| Lock-In Period | Choose from flexible, 10 days, 30 days, 60 days, or 90 days |

| Payout Frequency | Daily |

Pros:

- A secure trading platform that allows risk-free token staking.

- The platform offers high returns

- DeFi and locked stakes are available

- For ETH 2.0, stakes are also available.

Cons:

- Customer support is lacking, and users are often left with no answers for days

- The stake assets are limited, and most of them are sold out.

Cryptoassets are a highly volatile unregulated investment product.

8. Kraken – Most Secure And Trusted Stake Platform

Kraken was founded in 2011 in San Francisco. It is one of the oldest and most reputable cryptocurrency exchanges in the US. Kraken is a great option for those looking to stake cryptos, regardless of their experience level.

It is very simple to use Kraken since it only requires a few steps. To begin with, you need to fund your Kraken account with one or more currencies or fiat that you are willing to stake. Then, you can select assets from your spot wallet, and twice per week, your staked assets will generate rewards.

Unlike many other crypto exchanges, Kraken customers can withdraw their funds right away without incurring fees, and there is no on-period and off-period for participating on the chain. Kraken also offers a table with the value of each cryptocurrency or fiat, upon which you can find the minimum or maximum stake amounts.

According to Kraken, various stake options and varying APRs depend on the option chosen. Cosmos (ATOM) is the only BSC token with a 12% APR on the platform.

Additionally, Kraken is regulated by FinCen in the United States, FINTRAC in Canada, and the FCA in the United Kingdom.

| Staking Rewards on Cryptocurrencies | On-chain staking up to 23%

Off-chain Staking up to 2% |

| Min & Max Staking Amounts | It varies depending on the coin |

| Lock-In Period | Flexible |

| Payout Frequency | Twice a week |

Pros:

- 15 options are available for staking cryptocurrencies on-chain

- Bitcoin, EUR, and USD can be staked off-chain

- Currency-based reward options

- Depending on your staked assets, you will receive rewards every two weeks.

- Staking is easy and fast

Cons:

- The mobile app does not support stakes

Cryptoassets are a highly volatile unregulated investment product.

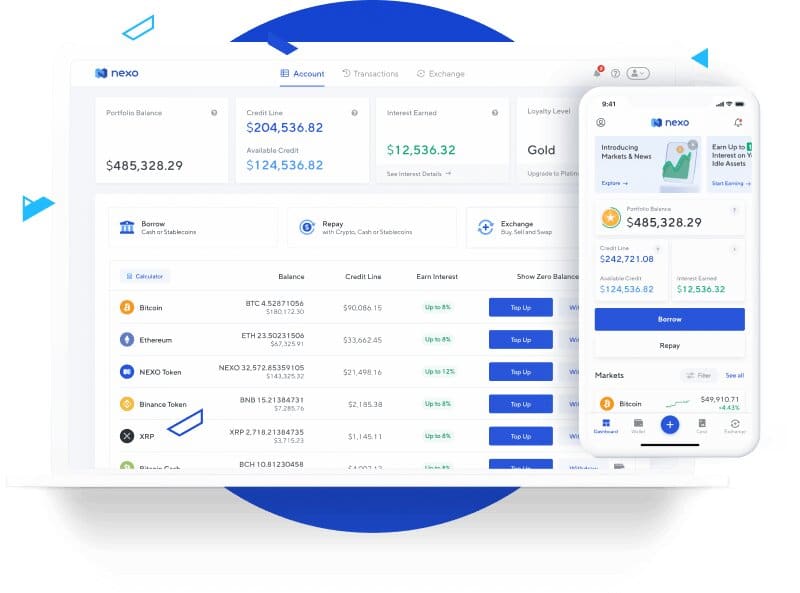

9. Nexo – Best Staking Platform With Flexible Lock-Up Periods

Since its launch in 2018, Nexo has gained a lot of popularity. The company plans to replace traditional banking by using cryptocurrency. its slogan is “Banking on Crypto.” Over 3.5 million users currently use the platform. With this Nexo, you can earn up to 17% interest and stake 37 BSC tokens, including AXS, MATIC, ATOM, FTM, BNB, LINK, etc. Adding or withdrawing funds is also possible at any time.

Nexo customers can become Platinum-level loyalty members by holding NEXO Tokens in their portfolio accounts. In addition, you can earn an additional 2% interest on NEXO Tokens as an added benefit.

With Nexo, you’re always protected, thanks to its high-quality security infrastructure. In addition to the ISO 27001:2013 certification, the system ensures precise risk assessment, effective data security, and enhanced privacy.

| Staking Rewards on Cryptocurrencies | Up to 17% in 37 options |

| Min & Max Staking Amounts | It varies depending on the coin |

| Lock-In Period | Flexible, 1 month or 3 months |

| Payout Frequency | Daily |

Pros:

- High insurance coverage ($100 million)

- Management is simplified with mobile apps

- Security features that have been enhanced

- Customer service is available 24/7

Cons:

- Education materials are lacking

- Low interest compared to competitors

Cryptoassets are a highly volatile unregulated investment product.

Best BSC Staking Platforms – Rates Comparison

| AQRU | DeFi Swap | Crypto.com | BlockFi | eToro | Coinbase | Binance | Kraken | Nexo | |

| Staking Rewards on Cryptocurrencies | Stablecoins (USDT, USDC, DAI) –12%

Non-Stablecoins (BTC, ETH) – 7% |

Rates of 75% APY | Stablecoins up to 14%

Non-Stablecoins up to 14.5% |

Up to 11% | For ADA, TRX, and ETH2.0, APR varies monthly, based on total staked volume for the entire eToro community. | 5% for non-stablecoins; 2% for stablecoins | Stablecoins: up to 3.78%; non-stablecoins: up to 100%. | On-chain staking up to 23%

Off-chain Staking up to 2% |

Up to 17% in 37 options |

| Min & Max Staking Amounts | €100 (£110.80) minimum; no maximum stated. | N/A | Minimum – Dependent on the coin

Maximum – $500k (USD equivalent) |

No minimum or maximum balances | Staking rewards of at least $1 per month in USD equivalent | Staking can be performed from $1; the maximum amount is not specified. | It varies depending on the coin | It varies depending on the coin | It varies depending on the coin |

| Lock-In Period | No lock-in period; flexible withdrawals offered | 4 Lock-In periods from 30 to 360 days | Three months, one month, or flexible | Flexible | No lock-in period; flexible access | It varies depending on the asset | You can choose between flexible, 7 to 120 days | Flexible | Flexible, 1 month or 3 months |

| Payout Frequency | Daily | Anytime | Weekly | Monthly | Monthly | Weekly | Daily | Twice a week | Daily |

What is Crypto Staking?

Staking may seem like a resource-saving alternative to mining. However, the funds are held in cryptocurrency wallets to support the operation and security of a blockchain network. To put it simply, staking is locking cryptocurrencies to receive rewards.

Generally, you can stake your coins directly from your crypto wallet, like Trust Wallet. Alternatively, many exchanges offer staking services to their users. For example, Binance Staking allows you to earn rewards by holding your coins on their exchange.

If you want to understand better what staking is, you first need to understand how Proof of Stake (PoS) works. Known as Proof of Stake (PoS), this consensus mechanism makes blockchains more energy-efficient while maintaining their degree of decentralization.

How Does BSC Staking Work?

BSC has seen a surge in activity; DApps such as PancakeSwap, Venus, and others thrive. Creating a community and ecosystem of projects, infrastructure, developers, tools, and users is not easy. This is what makes crypto so robust, and it is also what makes open-source software so appealing.

Many community validators and delegators in BNB Smart Chain can stake BNB to earn rewards. The goal of community validators is to make BSC a bigger and more accessible ecosystem.

BNB Smart Chain (BSC) validator

BNB Smart Chain relies on a consensus mechanism called Proof of Staked Authority (PoSA). It’s a hybrid of Delegated Proof of Stake (DPoS) and Proof of Authority (PoA). The consensus model can support a short block time and low fees, and it requires only 21 validators to run.

The validators produce blocks in turn. The BSC network is powered by transactions and signed blocks produced by the validators. As a reward for their service, they receive BNB tokens. In addition, they require daily re-election by stake governance to continue to be part of the validator set.

A validator must spin up a hardware node with the required specs, run a full BSC node, and stake at least 10,000 BNB. However, the requirements are not all required to become a candidate.

A validator candidate needs to become an elected one before they can begin producing blocks. Therefore, the elected validators are the top 21 validator candidates with the most votes.

BNB Smart Chain (BSC) Delegator

With one of the supported wallets, you can become a delegator and stake your BNB to validator candidates. With the help of staking, you can pick your preferred validator and help them achieve the minimum stake required for the protocol.

Essentially, you are pooling your BNB with your preferred validator. As a result, validators receive their rewards in BNB. We also know that cryptocurrency networks can be extremely effective at creating economic incentives. For example, the validator shares a portion of its earnings with its delegators in return for staking.

Delegators can also do Redelegation. That means they can transfer part of their stake from one validator to another. Using Redelegation is a great way to support multiple validators simultaneously.

Delegators are also able to undo the delegation of their stake. This means they stop delegating to the validator they were previously delegating to. It is important to note that undelegation has a 7-day unbinding period, after which the delegator receives their staked BNB. During the unbonding period, the delegater does not receive BNB rewards.

Benefits of Staking on BSC

Staking cryptocurrency has the following benefits:

- It is a simple way to earn interest in your cryptocurrency holdings.

- Crypto staking does not require any equipment, unlike crypto mining.

- You’re maintaining the efficiency and security of the blockchain.

- It’s greener than crypto mining.

- The majority of stablecoins that you can stake are part of BSC

Staking can be a great way to earn more crypto, and interest rates can be quite generous. For example, you may earn upwards of 10% or 20% per year. So there is a potential to make a great deal of money with this type of investment. But you require crypto that’s proof-of-stake based.

Staking is another way to support a cryptocurrency’s blockchain. Those holding these cryptocurrencies stake their coins to verify transactions and keep everything running smoothly.

The 5 Best BSC Staking Coins

There are many BSC coins in the market, but there are 5 tokens you can consider for staking now.

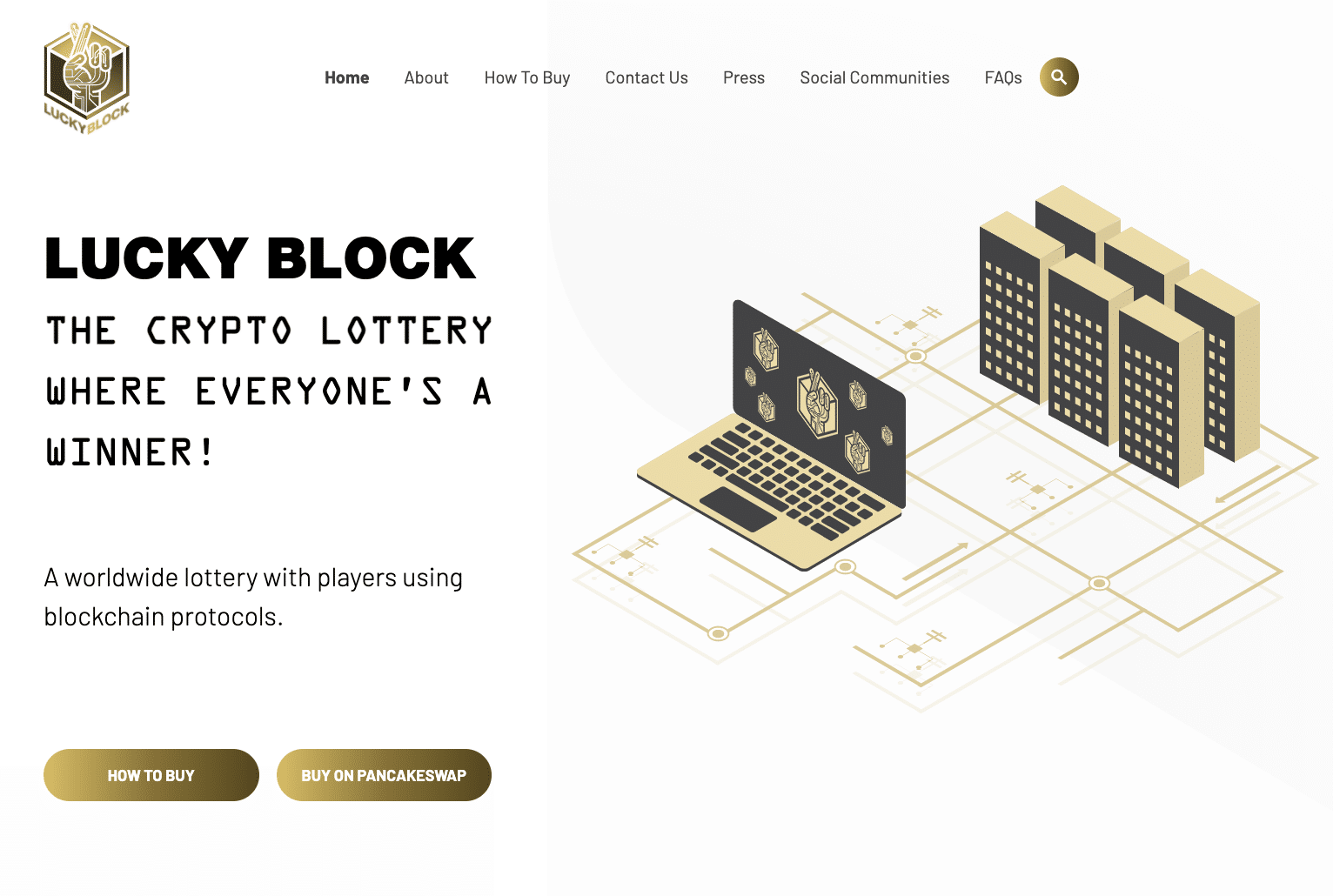

Lucky Block – LBLOCK

Smart contracts enable Lucky Block to operate its lottery games randomly, credible, and transparently. Furthermore, to ensure no errors, payouts are also processed this way. Given the scope of its online gaming business, Lucky Block should perform exceptionally well in the lottery sector.

Since its launch in early 2022, the price of Lucky Block has increased by over 6,000%. LBLOCK/WBNB is traded on the Pancakeswap DEX and runs on the Binance Smart Chain. With LBLOCK/WBNB, you can earn 19% APR by providing liquidity.

The platform also includes a token distribution feature in which token holders are given a 10% share of a daily lottery. Holders of LBLOCKs must access the app each day to receive the reward.

Tickets selling for raffles and LBLOCK are taxed at 12% on DEXs. LBLOCK says its yield is as high as 19.2% annually for holders of $1,000 worth of LBLOCK tokens, making it one of the most attractive interest-bearing coins out there, even though it isn’t strictly a staking coin.

BNB – BNB

Buying BNB and then staking it might be a good option if you’re put off by the fees that crypto staking platforms charge. If you stake BNB via Trust Wallet, you will not be charged any fees. As such, you will receive 100% of the stake rewards generated.

Additionally, staking your BNB tokens with the Trust Wallet app will earn you an attractive APY of 11%. Compound interest is earned daily, which is great for earning rewards. Furthermore, Trust Wallet does not impose any lock-up period, so you have full access to your BNB tokens at any time.

USD Coin – USDC

A stablecoin like USDC is likely your best bet if you want to earn a passive income when staking crypto.

The USDC stablecoin is backed by Coinbase, so you can be sure you are investing in a trusted digital asset. Furthermore, USDC’s reserves have been audited, unlike Tether’s. In other words, every USDC token in circulation is backed 1:1 by a US dollar.

USDC is a digital token that allows you to earn interest without worrying about volatility and offers some of the best rewards for staking on the market. For example, by Staking USDC at Aqru, you can earn 12% a year.

The Graph – GRT

The Graph is a cryptocurrency that offers great upside potential if you’re looking to invest. Ethereum Network supports this cryptocurrency, and The Graph’s technology allows blockchains to index data thanks to its underlying technology.

This allows blockchain networks to automatically move data off-chain, freeing space to continue running at high-efficiency levels. In addition, you can stake The Graph easily on several leading platforms, with some providers offering double-digit APYs.

Cosmos – ATOM

Cosmos – ATOM

Cosmos (ATOM) is a decentralized ecosystem designed to enable the seamless integration of other platforms on a decentralized network. Cosmos has been an excellent coin for staking with its proof-of-stake protocol due to its reliable and consistent rewards for delegators and running a node. In addition, cosmos tokens are supported on several exchanges, making them highly accessible, available, and easy for users to earn rewards. For example, Coinbase, Kraken, and Binance are some of the best exchanges that support ATOM staking.

Furthermore, several software and hardware wallets allow users to stake Cosmos tokens without transferring them to a crypto exchange. For example, with the Ledger Live software, users can easily stake ATOM using a trusted and secure wallet such as the Ledger.

Investing in Cosmos in a staking pool results in an average return of 15.4% APY. With inflation factored in, the annualized return at writing is about 5.06% APY. It is slightly more profitable to run a validator node than an exchange node, with an APY of 16.73%.

Is BSC Staking Taxed?

The tax implications of the cryptocurrency sector are extremely complicated. The specifics will depend not only on your residency status but also on your profile, so you should seek tax advice from a professional.

As a result, some countries will look to tax staking earnings – although the rules will vary based on the jurisdiction. Nonetheless, Coinbase points out that: Staking rewards are taxed the same way as mining proceeds: the tax amount is based on the fair market value of the reward on the day it was received.

Potential Risks of Staking on BSC

There are a few risks of staking crypto that you should be aware of:

- The price of cryptocurrencies is volatile and can fall rapidly. If the value of your staked assets falls drastically, that could outweigh the interest you earn.

- Your coins can be locked up for a minimal period when you stake. For that period, you cannot do anything with your staked assets, such as sell them.

- If you want to unstake your crypto, you may have to wait seven days or more.

The biggest risk of crypto staking is the possibility of its price falling. Remember this if you find cryptocurrencies that offer extremely high rewards for staking. For example, higher rates entice investors in many smaller crypto projects, but the prices crash. So to diversify your portfolio while reducing risk, you may prefer cryptocurrency stocks instead of crypto assets.

The crypto you stake is still yours, but before you can trade it again, you need to unstake it. Ensure you know the lock-up period and how long the unstacking process takes so you don’t get any unpleasant surprises.

Conclusion

In this comprehensive guide, we’ve covered everything you need to know about BSC staking. This list includes the best BSC staking crypto platforms for 2022 and the coins to consider.

We also discussed both the benefits and risks of BSC staking and whether to choose an on-chain or off-chain agreement.

AQRU is our choice for those new to BSC staking and who want to start earning rewards immediately.

AQRU – Best Platform to Stake Cryptocurrencies

Cryptoassets are highly volatile unregulated investment products.

Cosmos – ATOM

Cosmos – ATOM