Robinhood vs Charles Schwab – Cheapest Broker Revealed

Are you looking to buy and sell stocks, ETFs, and funds from your mobile device or at home on your desktop? Then your first step is to pick a top-rated online broker. Nowadays the number of providers on the market is constantly growing. But, there are two online trading platforms that stand out from the crowd. Keep scrolling for our full Robinhood vs Charles Schwab analysis.

Throughout this comparison, we will explore the ins and outs of all key metrics. Investing platforms provide heaps of stocks, allowing you to trade on a zero-commission basis. Read on and discover the cheapest broker that we recommend for 2026.

What are Robinhood and Charles Schwab?

Both Robinhood and Charles Schwab are US-based trading platforms that give you the chance to invest in ETFs, stocks, and other popular financial instruments for free or at low costs. The two stock brokers carry some similarities in terms of non-trading fees and regulation but there are also some key differences such as the types of tradable assets on offer. But more of this later on. Now for the fundamentals of each broker.

Launched in 2013 Robinhood is a US-based trading platform that offers commission-free US stock and ETF trading. Robinhood is regulated by top-level financial authorities which include the Financial Industry Regulatory Authority (FINRA), and the Securities and Exchange Commission (SEC). This discount broker also offers low non-trading fees making it cost-efficient for its users. Robinhood also offers a web trading platform and mobile trading app that are user-friendly, simple, and easy to use.

On the other hand, Charles Schwab is another US-based discount stockbroker which started in 1971. This broker is listed on the New York Stock Exchange (NYSE) under the ticker symbol SCHW. As is common with most popular trading platforms Charles Schwab falls under the standards and regulations of major financial regulators such as the UK’s Financial Conduct Authority (FCA), the Financial Industry Regulatory Authority (FINRA), and US Securities and Exchange Commission (SEC).

Charles Schwab provides free Exchange-traded funds (ETF) and stock trading. In terms of trading ideas and fundamental analysis, it has plenty on offer. The customer services are efficient and helpful.

On the flip side, Charles Schwab’s fees for certain mutual funds are rather expensive and you are limited to tradable assets that are accessible on the Canadian and United States exchanges.

Robinhood vs Charles Schwab Tradable Assets

In this segment of our Robinhood vs Charles Schwab review, we will be delving into what tradable assets are on offer.

Let’s begin with stocks and ETFs.

When compared to other trading platforms in its class, Robinhood is rather limited in its range of tradable assets. The broker offers stock, ETF, option, and cryptocurrency trading (including Ethereum trading), and the majority are restricted to US stock markets.

Robinhood Crypto provides Bitcoin trading, Ethereum trading, Dogecoin, and additional cryptocurrencies 24/7 on a zero-commission basis. It is worth mentioning here that Charles Schwab does not offer cryptocurrency trading. Instead, traders who own a futures account can currently buy and sell some Bitcoin futures. So, if you’re a trader with an eye for cryptocurrency trading Robinhood would be your go-to trading platform.

There are roughly 5,000 available stocks and ETFs on offer at Robinhood, most of which are listed on top stock exchanges in the US. Additionally, traders and investors can gain access to certain stocks outside of US exchanges, which are offered via ADRs (American depositary receipt).

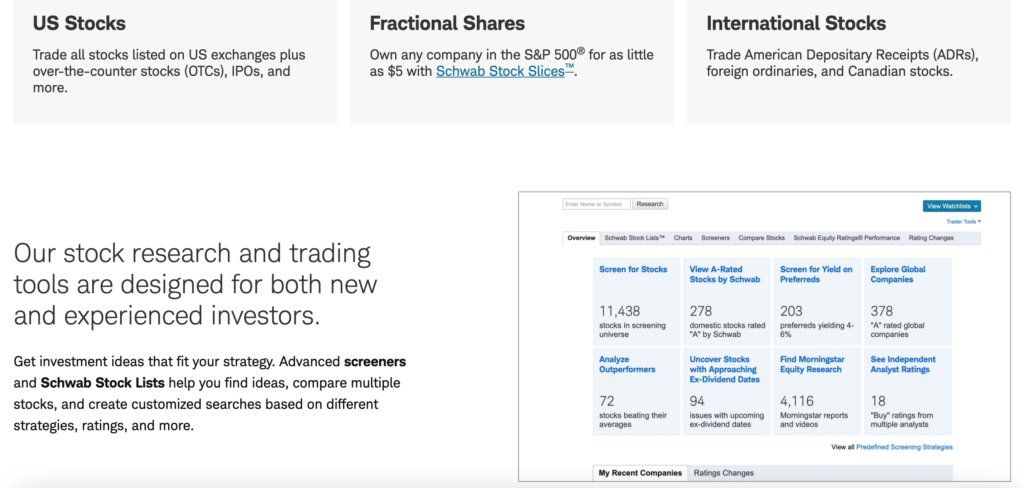

Charles Schwab offers free ETF and stock trades, as well as other tradable assets including mutual funds, bonds, options, and futures. Only North American markets are covered with this broker. Its clients can buy and sell stocks on stock exchanges such as the New York Stock Exchange (NYSE), the NYSE MKT, OTC, and NASDAQ.

Charles Schwab investors can trade S&P 500 stock fractional shares as opposed to purchasing a whole share of a particular stock. This means you can purchase a portion of stock that stands for fractional share. For instance, Let’s say Microsoft stock is going for $1000 per share, and an investor purchases a fractional share worth $400 of it. This would mean the investor owns 0.4 shares of the stock.

Mutual funds and bonds

In terms of mutual funds, Charles Schwab has around 600 funds available from top-level providers such as Vanguard and BlackRock. Traders have access to a vast range of both government and corporate bonds with Charles Schwab.

Cryptos

Robinhood offers a good number of cryptocurrencies which include:

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Bitcoin SV (BSV)

- Dogecoin (DOGE)

- Ethereum (ETH)

- Ethereum Classic (ETC)

- Litecoin (LTC)

This cryptocurrency trading platform also supports real-time market data for other tradable cryptos such as Bitcoin Gold (BTG), Dash (DASH), Lisk (LSK), Monero (XMR), NEO (NEO), OmiseGO (OMG), Qtum (QTUM), Ripple (XRP), Stellar (XLM), and Zcash (ZEC).

Robinhood plans to eventually increase its selection of tradable cryptos via the Robinhood Crypto platform. However, the broker does stress that just because it offers real-time market data for specific cryptos this does not imply that they will at some point add the option to buy or sell them.

In addition, Robinhood Crypto does not currently support Initial Coin Offerings (ICOs). What are ICOs? Think of initial coin offerings as the cryptocurrency counterpart to initial public offerings or IPOs. Businesses trying to raise funds to develop and launch a new cryptocurrency, mobile application, or digital service can use initial coin offerings as a method of crowdfunding or raising money for the project.

The Robinhood Crypto trading platform is available to US traders in 47 States. The broker has plans to increase the number of states that it offers its services to.

Robo-advisory service with Charles Schwab

Charles Schwab offers a robo-advisory service which it calls Schwab Intelligent Portfolios. This is a good option for traders and investors who require an automated investment management service.

To start you will be required to fill out questions regarding your trading objectives, risk tolerance, and a few other key metrics. Depending on the criteria you specify a portfolio is set up and the robo-advisor service rebalances the investment portfolio whenever it deems it necessary. In terms of account minimums, you will need a minimum deposit of $5,000 dollars. As for fees, Charles Schwab’s robo-advisory portfolio service runs on a commission-free basis.

There is also a premium robo-advisory service available which comes with an account minimum of $25,000 and a monthly subscription fee of $30 as well as a one-off planning fee of $300. According to Charles Schwab, cash is a crucial element of any investment portfolio. Depending on your investment goals and risk tolerance, a percentage of the robo-advisor intelligent portfolio is deposited into a Charles Schwab bank account which is covered by the FDIC.

Robinhood vs Charles Schwab Account Types

Next up in this Charles Schwab vs Robinhood review is that of account types.

Opening an account with either trading platform is streamlined, easy, and fully digital. Having said this Robinhood only offers trading accounts to US-based traders and Charles Schwab charges a $25,000 minimum deposit for users outside the US.

Robinhood has announced that it has plans to broaden its services to European traders and investors. In a move to make this a viable, the crypto trading platform has obtained a brokerage license from the UK’s Financial Conduct Authority.

There are no minimum deposits for US traders opening accounts with either broker. However, to open a Robinhood Gold brokerage account you will need to deposit a minimum amount of $2,000. Likewise, as we have already mentioned if you use the robo-advisory portfolio service that Charles Schwab offers you will need to deposit a minimum amount of $5,000.

There are three account types available with Robinhood, and each account is tailored to meet your trading and investing requirements. These include:

- Robinhood Instant – is basically a margin trading account. With a Robinhood Instant account, users have access to extended-hours trading and instant deposits. Additionally, fund processing times are instant when trading stocks or making a deposit.

- Robinhood Gold – is very similar to a Robinhood Instant account, however, it gives traders greater margin and the ability to deposit larger funds instantly.

- Robinhood Cash – gives you access to zero-commission trading during standard and extended-hours trading. But, you don’t have access to instant deposits. Downgrading from either Instant or Gold accounts can be done quickly and easily.

Something worth mentioning is that of margin or buying power. Margin trading enables trades made with funds borrowed from the broker which in this case is Robinhood. Consequently, margin account holders have to pay interest on the margin total. Robinhood Gold provides 2:1 leverage.

Charles Schwab accounts

Charles Schwab offers the following accounts:

- Brokerage Accounts

- Retirement accounts (Roth IRA, Traditional IRA, and Rollover IRA)

- Automated & Managed Portfolios (Schwab Intelligent Portfolios®, Schwab Intelligent Portfolios Premium™)

- Estate & Charitable Planning (Trust Account, Schwab Charitable)

- Banking (Schwab Bank High Yield Investor Checking® Account linked to Brokerage Account)

The main benefits of a Charles Schwab brokerage account include free digital equity trading. Once you’ve opened a brokerage account you have access to a range of financial instruments from stock and bonds, to ETF and options trading. Also, there are no account minimums and zero non-trading fees.

So, it is clear that Charles Schwab has a wider range of trading account types for all levels of experience. As Robinhood is a fairly new broker when compared to Charles Schwab, it has plans to increase its account type selection.

Opening an account with either trading platform is user-friendly, fully digital, simple, and fast.

Robinhood vs Charles Schwab Fees & Commissions

As we already know, Robinhood and Charles Schwab are both low-cost trading platforms but something that separates them is their product offerings. With that said, there are a number of trading and non-trading fee types that you need to examine before opening an account with a broker.

Therefore, we’ve broken down the most important fees that you will come across when using either Robinhood or Charles Schwab.

Fees for Stocks and ETFs

Both brokers offer stock and ETF trading on a zero-commission basis.

Margin

If you want to use margin to trade stocks then you will need to consider margin rates. To trade stocks on margin traders will need a Robinhood Gold account. Margin rates are applied when investors use margin or money borrowed from a broker to buy and sell stocks or other financial assets.

With this said, Charles Schwab charges an 8.3% margin rate and Robinhood charges 2.5%.

Cryptocurrency fees

Robinhood offers free cryptocurrency trading for traders in 47 states.

Mutual funds

Charles Schwab fund fees are rather expensive apart from 4,000 free to trade mutual funds. This is nearly 50% of its 10,000 mutual fund selection. $49.95 is the standard transaction fee as well as a zero-redemption fee.

| Commission (US stocks) | Mutual fund (per purchase) | Inactivity fee | USD margin rate | Deposit fee | Withdrawal fee | Account fee | |

| Robinhood | $0 | n/a | No | 2.5% | $0 | $0 | No |

| Charles Schwab | $0 | Up to $49.95 | No | 8.3% | $0 | $0 | No |

Both trading platforms have low non-trading fees such as zero inactivity, account, and deposit fees. Moreover, Robinhood and Charles Schwab offer ETF and stock trading without any added commission costs, while Robinhood also offers free crypto trading which sets it apart from Charles Schwab in that respect.

In conclusion, Robinhood is better suited to beginner traders who are looking for a low-cost cryptocurrency trading platform. On the other hand, Charles Schwab offers much more in terms of account types and tradable assets which makes it better suited to more advanced traders and investors who want to diversify their portfolios with more complex financial instruments.

Robinhood vs Charles Schwab User Experience

Based on our Robinhood vs Charles Schwab comparison we can conclude that both trading platforms offer a user-friendly experience with well-developed designs. On the flip side, both platforms are rather limited in terms of being able to customize the dashboard.

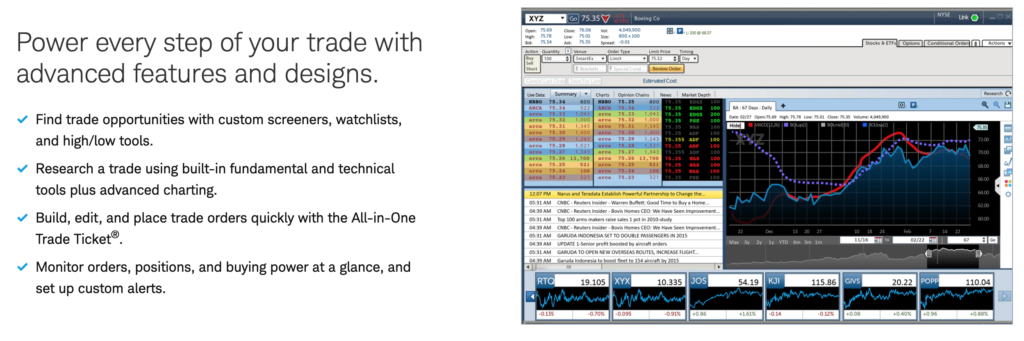

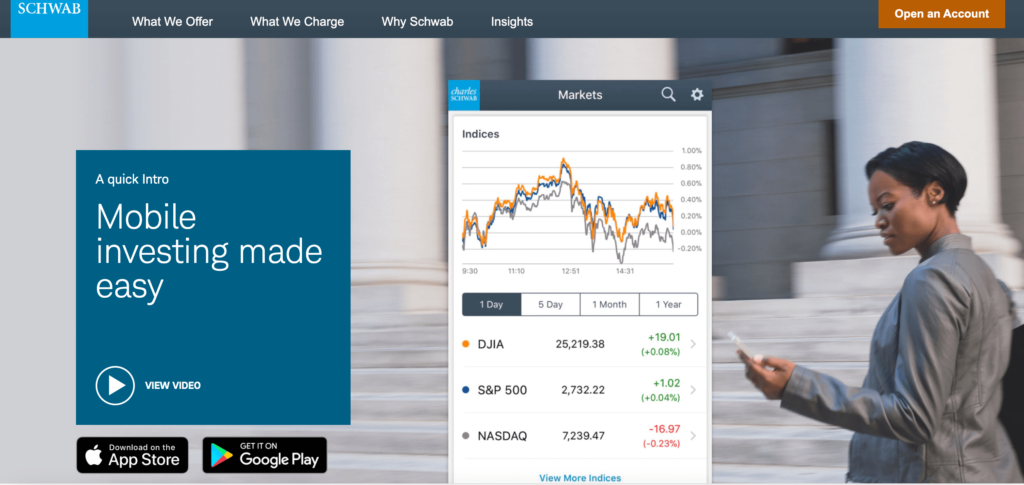

Before we move on, it’s important to note that Robinhood offers a web trading platform and a mobile trading application. Charles Schwab, on the other hand, provides web, desktop, and mobile trading platforms for its users.

Both web trading platforms are easy and simple to operate but do not allow for complete customization which can be an issue if you are the type of trader who likes to customize your trading experience.

When it comes to search functionality, Robinhood takes advantage as it is easy to find the tradable assets you are searching for. You can search for assets easily and quickly in the search box, or you can even search for assets based on tags. By clicking on the collections tab it will reveal other assets that have the same tag. This is the perfect tool if you need to compare different assets. Let’s say you want to compare energy firms, all you need to do is tap on the collections tab and you will get an exhaustive list of assets that share that tag.

The search functions on the Charles Schwab web trading platform are rather basic when compared to Robinhood. The platform gives traders the ability to search by either the asset’s ticker symbol or the name of the company.

Placing orders

Placing orders such as Market, Limit, and Stop-Loss can be done simply with the click of a button.

But, what are the most common order types, and what are their functions?

- An order to either purchase or sell a security straight away is known as a market order. A market order ensures that the order will be carried out, however, it does not ensure the price at which the security will be sold or bought.

- An order to purchase or sell securities at a specified price is known as a limit order. A buy limit order is only carried when the asset reaches either the specified price or a lower price. A sell limit order on the other hand is only carried out when the asset reaches either the limit price or more. So, let’s say that an investor decides to sell shares of Microsoft stock for no less than $20. The investor has the option to place a sell limit order for the amount of $20 which means that it will execute if the price of Microsoft stock is $20 or more.

- A stop-loss order is a type of order that purchases or sells an asset once the price of the asset matches the specified amount, otherwise called the stop price. Once the stop price is matched to the investor’s specified amount, the stop-loss order turns into a market order.

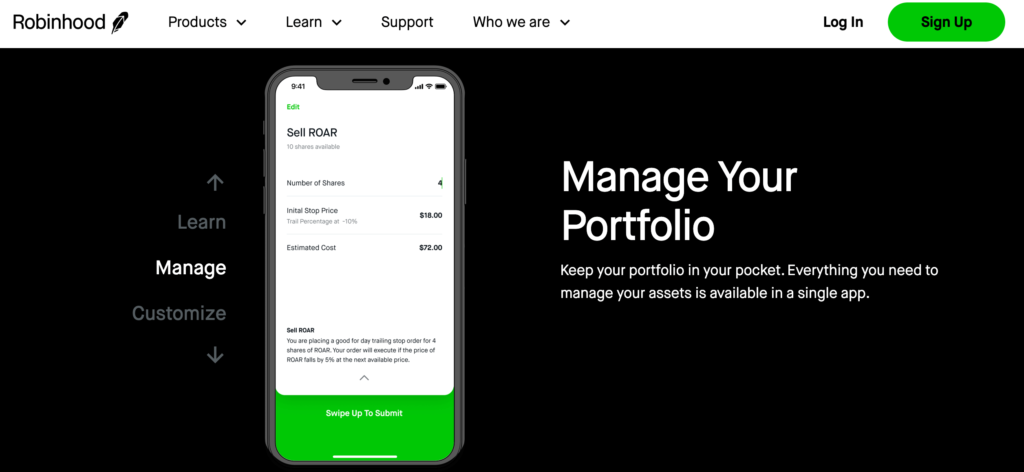

Robinhood vs Charles Schwab Mobile App

One of the most popular sectors for new and advanced investors in the online trading scene is Mobile trading. With all things considered, having the option to trade financial instruments wherever you happen to be is quickly becoming a necessity, and most traders expect brokers to provide this service. For example, you may decide to buy shares in Apple stock while on your commute to work. With a mobile trading app you can do this with the click of a button.

After all, we live in a society that expects convenience at every corner. Online trading is no exception and brokers around the world are coming up with new innovative ways to make digital trading an ever easier and user-friendly experience.

With this said, both Robinhood and Charles Schwab offer mobile trading apps that are compatible with Apple and Android mobile devices. Both mobile trading platforms offer the same functionalities and user experience as their web trading platform counterparts. In terms of the Robinhood mobile trading platform’s research tools, it differs from the web platform version in that the stock screener is unavailable on mobile.

Other than that, both mobile trading platforms are simple and easy to use and offer the latest security measures such as two-step authentication processes.

Alerts and Notifications

During our Robinhood vs Charles Schwab comparison, we found that with the Charles Schwab mobile trading app you cannot set notifications or alerts. This is something to consider if you prefer mobile trading and the real-time alerts that come with it.

On the contrary, the Robinhood mobile trading app does support alerts and notification functionalities. To set up push notifications on the Robinhood mobile app simply:

- Click on the Account button

- Press the menu bar at the top of the screen

- Select settings

- Then click on the Notification and Messages tab

You can set up your alerts and push notifications for orders, dividends, price and market movements, and more.

If this wasn’t enough you can also add the Robinhood trading platform to mobile widgets as well as Apple Watch.

Robinhood vs Charles Schwab Trading Tools, Education, Research & Analysis

Both Robinhood and Charles Schwab can be portrayed as DIY trading platforms. Simply put, after opening a brokerage account, you can access different financial instruments that you want to buy, sell or hold. While this may be better suited to more advanced traders, new investors may need trading tools and other research and education to help manage their investments.

Robinhood provides numerous research tools that incorporate trading ideas, reputable news, and fundamental data.

The research tools available on Robinhood are easy to use and have a user-friendly design. On the flip side, the stock screener which is featured on the web trading platform is not available on the mobile app. Robinhood Gold account traders have access to real-time market data and research analysis from credible third-party providers such as the US financial services company Morningstar.

In terms of Charles Schwab, the research tools it offers are good, however, because there are so many research tools at your disposal you can get overwhelmed by the sheer volume. This isn’t necessarily a bad thing, especially for advanced traders and investors who want to use fundamental analysis and complex research tools. But for the average beginner trader, there is more than enough when it comes to research tools and education.

Now let’s take a brief look at trading ideas.

ETF and stock trading ideas are available with Charles Schwab.

Trading ideas for stocks and ETFs can be accessed by clicking on the reports and rating tabs. The trading ideas give tips and insights with regards to buying, selling, or holding assets.

On the topic of charting tools, Charles Schwab simply has more to offer when compared to Robinhood. With Charles Schwab, there are more than 50 technical indicators on offer, which is great for advanced investors who want a more in-depth charting experience.

In comparison, Robinhood’s charting tools are simple and designed with beginner traders in mind. Once you pick the asset you want to trade you have access to price movements and a number of technical indicators. So, Charles Schwab’s charting tools are better suited to the more experienced investor, while Robinhood is designed for the beginner trader.

Robinhood vs Charles Schwab Demo Account

A demo trading account plays an important role especially if you are new to digital trading. After all, paper trading accounts give you the opportunity to trade with virtual money. This means that you can trade risk-free with paper funds. Our Robinhood vs Charles Schwab analysis found that both brokers offer a demo trading feature.

Robinhood does not offer a demo account. However, beginners can understand more about the online trading world via the educational materials it offers. These can be found in the learn tab on the top of the platform. Robinhood’s investing basics page is perfect for those of you who are just testing the waters of the investing and trading scene. Its user-friendly layout and easy-to-grasp content give beginner traders everything they need to start building a strong trading foundation.

The story is the same with Charles Schwab as it does not provide a paper trading account. Having said this there are plenty of educational tools and resources available from webinars to video tutorials.

Robinhood vs Charles Schwab Payments

Charles Schwab and Robinhood have no fees for deposits but the only deposit option is via bank transfer. Debit cards and credit cards, as well as e-wallets like Paypal and Skrill, are simply not available deposit options with either US-based broker.

For Robinhood clients who use the instant deposit option, the processing time is immediate; alternatively, it can take a whole working week for the deposited funds to process.

When it comes to the Robinhood instant deposit function there are some crucial things to be aware of. Firstly, for Robinhood Instant account holders depositing any amount is instantaneous. But, there’s a catch. The limit is $1,000. So, let’s say that you deposit $2,000 to your Robinhood Instant account. $1,000 will be deposited straight away whereas the remaining $1,000 will be processed after four to five working days.

Both brokers do not charge a withdrawal fee for ACH withdrawals but wire transfers come with a $25 fee.

| Minimum Deposit | Deposit Fee | Processing Time | Withdrawal Fee | |

| Robinhood | $0 for Robinhood Instant

$2,000 for Robinhood Gold |

$0 | Instant up to $1,000 otherwise 4-5 days | $0 |

| Charles Schwab | $0 for US Clients

$25,000 for clients outside the US |

$0 | 1-2 days | $0 |

Robinhood vs Charles Schwab Customer Service

In terms of customer support, Charles Schwab surpasses Robinhood.

Firstly, Charles Schwab’s customer services are available 24/7 and can be reached via email, live chat, and telephone. The customer service is efficient and offers relevant answers to questions.

Robinhood’s customer services, on the other hand, can only be contacted via email. When contacting customer support you need to specify the category and topic of your request so that it can be matched to the appropriate representative. Both brokers have fast response times but this can vary depending on the volume of requests and traffic.

Robinhood vs Other Brokers

Robinhood is quickly becoming one of the most popular go-to online brokers, and with commission-free trades and access to crypto trading it’s easy to see why. So, if you’d like to see how Robinhood does when pinned against the best online brokers out there, be sure to check out these comparison reviews as well:

- Stash vs Robinhood

- Coinbase vs Robinhood

- Acorns vs Robinhood

- Webull vs Robinhood

- Robinhood vs Ally Invest

- TD Ameritrade vs Robinhood

- M1 Finance vs Robinhood

- Fidelity vs Robinhood

Robinhood vs Charles Schwab Safety & Regulation

If you’re on the hunt for the best trading platform then safety and regulation is one topic that should be at the forefront of your mind. Our Robinhood vs Charles Schwab comparison found that both US-based brokers are regulated by top-level financial authorities such as FINRA, and the SEC and the UK’s Financial Conduct Authority (FCA).

Charles Schwab is also regulated by the Commodity Futures Trading Commission (CFTC), the Monetary Authority of Singapore (MAS), and the Hong Kong Securities and Futures Commission (SFC).

Client funds protection

Robinhood Financial LLC and Charles Schwab traders are protected by the US SIPC investor protection scheme which covers up to $500,000 and $250,000 for cash claims.

For those of you who are interested in cryptocurrency trading, Robinhood Crypto LLC is not regulated by the US Financial Industry Regulation Authority and therefore does not cover its clients with the SIPC investor protection scheme.

Robinhood vs Charles Schwab vs eToro

So far in our comparison of Robinhood and Charles Schwab, we have found that there are some key differences between the two brokers but they both offer good services for both beginner and advanced active traders.

How about taking a different perspective on things? So, let’s consider another trading platform – eToro. Getting straight to the point, eToro – which is now home to more than 20 million traders, stands out in almost all areas.

For instance, while our Robinhood vs Charles Schwab review found that both brokers allow you to buy US stocks and ETFs, this is still very limited compared to eToro. This is because eToro covers 17 international markets – including companies in Asia, Europe, the Middle East, and more.

Furthermore, eToro provides a range of top-rated trading vehicles that will appeal to those seeking a hands-off approach. This includes CopyPortolfios, which are managed investment portfolios. There is also the ability to copy experienced investors via the eToro Copy Trading feature.

| Share Dealing Fee | Share CFD Commission | Inactivity Fee | Deposit Fee | Withdrawal Fee | |

| eToro | FREE | 0% | $10 after 12 months | 0.5% FX fee | $5 |

Robinhood vs Charles Schwab – The Verdict

In summary, our Robinhood vs Charles Schwab review examined all key components that should be looked at when selecting a trading platform. This covers all metrics from tradable assets, trading and non-trading fees, customer service, payment options, and regulation.

We found that both brokers offer a user-friendly and low-cost way of accessing stock, ETF, and crypto trades – with the click of a button. But we didn’t like the fact that there are no demo accounts available.

Nevertheless, When we considered a third alternative in this review, we found that the social trading platform eToro is the best all-around option. Not only can you invest in and trade thousands of markets commission-free. There are great social trading features including CopyPortfolio and Copy Trading tools. eToro is mainly a CFD and forex trading platform. But, you can also trade with other financial instruments like stocks, ETFs, and a range of cryptocurrencies.

eToro – Best UK Stock Broker 2026

67% of retail investor accounts lose money when trading CFDs with this provider.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.