With blockchain evolution, cross-chain bridging has emerged as a critical solution to interoperability. The technology allows for the seamless transfer of assets between blockchain networks thus, unlocking new possibilities in the decentralized space.

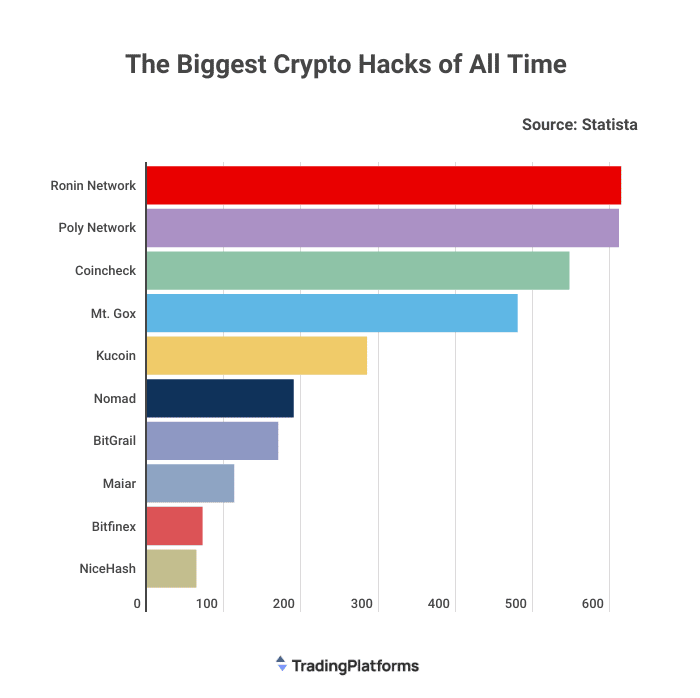

However, the innovation came with new risks. Cross-chain bridges became a popular target for hackers. According to TradingPlatforms.com, In 2022, malicious attacks on cross-chain bridges accounted for a staggering 64% of all digital currency losses.

Edith Reads, a senior analyst at TradingPlatforms, commented on the data. “The technology behind cross-chain bridges is still in its infancy and has yet to be fully tested. Unfortunately, hackers have breached them and made away with millions of dollars. It’s challenging, but these threats’ outcome will determine this promising technology’s future.”

Rising Popularity of Cross-Chain Bridges Fuels Hacking Activity

Lately, cross-chain bridges have become essential for facilitating transactions between different blockchain networks. It has enabled users to move assets between platforms efficiently. Consequently, it has helped increase the crypto markets’ overall liquidity.

Yet, the rise of cross-chain bridges has also created new security challenges. The bridges provide a convenient way for hackers to steal assets.

Hackers exploit vulnerabilities in the underlying protocols. Or, they use phishing attacks to trick users into sending purchases to fake addresses. In 2022, a series of high-profile hacks took place. Hackers preyed on these bridges’ vulnerabilities to steal lots of cryptos.

Lack of Security Measures Leaves Cross-Chain Bridges Vulnerable

One of the critical targets for hackers in 2022 was DeFi platforms. These platforms allow users to trade, borrow, and lend cryptos using smart contracts.

However, the popularity of DeFi platforms has also made them a prime target for hackers. In 2022, several high-profile hacks took place on DeFi. As a result, hackers stole millions of dollars worth of crypto. These hacks accounted for a significant portion of the total crypto losses for the year.

Many cross-chain bridges lack security measures to protect against hacking activity. Thus, leaving billions of dollars in assets at risk of theft.

There is a need to develop more robust security measures to protect these bridges from attacks. This could include using multi-signature addresses. Besides, it should have a more robust encryption protocol to protect against hacking attempts.

Users must also take responsibility for their security by using strong passwords. Also, they must keep their private keys secure and only store small amounts of crypto online.

Question & Answers (0)