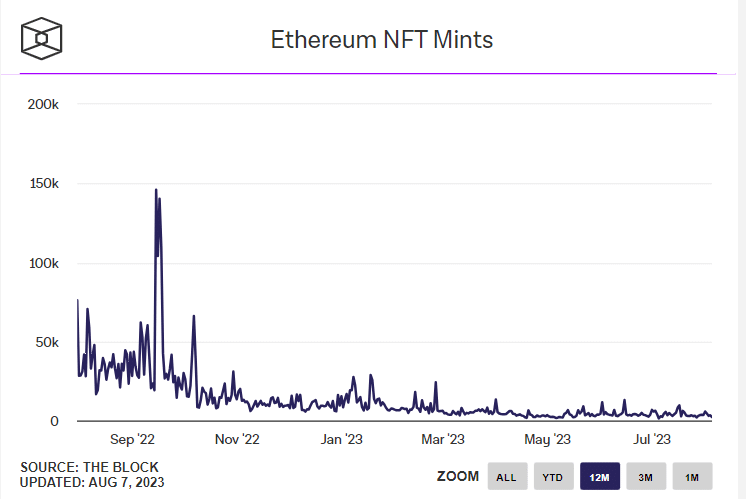

The NFT (Non-Fungible Token) revolution has caught the attention of the art, entertainment, and technology sectors. Ethereum, with its pioneering smart contract capabilities, has been the dominant player in the NFT market. Despite the initial enthusiasm for NFTs, an analysis from TradingPlatforms.com shows that NFTs minted on the Ethereum network have experienced a staggering 79% decline since the beginning of the year.

This unexpected downturn prompts exploring the factors driving this decline and the potential implications for the NFT ecosystem.

TradingPlatforms’ financial analyst Edith Reads commented on the analysis, “It’s difficult to determine the exact cause of this decline, but it’s likely due to a combination of factors. These include increasing competition from other blockchain networks entering the NFT space, market uncertainty caused by volatility in crypto prices, and saturation of supply relative to demand.”

Ethereum’s prominence in the NFT space can be attributed to its versatility and robust smart contract capabilities. These features allow developers to create various NFT-based projects and decentralized applications. Most NFTs were initially minted on Ethereum, leveraging the network’s wide adoption and established infrastructure.

Causes of the Decline

Congestion and Gas Fees: Ethereum’s success also led to its downfall, as the surge in demand for NFT minting led to network congestion and skyrocketing gas fees. High transaction costs deterred both creators and collectors, resulting in a slowdown in minting activities.

Market Maturity: The rapid proliferation of NFTs earlier in the year created a sense of urgency, with many artists and creators rushing to capitalize on the trend. As the market matured, the initial enthusiasm waned.

Platform Diversification: While Ethereum remains a dominant player, several other blockchain platforms have emerged, offering alternatives for minting NFTs with lower fees and improved scalability. Creators exploring these alternatives contributed to the decline in Ethereum minting.

Implications and Future Outlook

Quality over Quantity: The decline in NFT minting could signify a shift towards a more measured and thoughtful approach, emphasizing quality over quantity. This shift could lead to a stronger focus on valuable and unique digital assets rather than a flood of quickly created tokens.

Evolving NFT Platforms: The Ethereum network’s limitations have prompted a wave of innovation in the NFT space. Competing blockchain platforms are addressing scalability and fee concerns, potentially leading to a more diverse and sustainable NFT ecosystem.

Long-Term Viability: The decline in minting activities may be a temporary adjustment rather than a sign of NFTs’ demise. As the industry matures and blockchain technology evolves, NFTs could continue to play a significant role in reshaping ownership and value distribution for digital assets.

While the decline may raise questions about the sustainability of the NFT phenomenon, it also signals an industry in transition, with creators and collectors seeking an equilibrium between innovation and practicality. As the NFT ecosystem evolves, its long-term impact on art, culture, and ownership remains an ongoing narrative worth watching.

Question & Answers (0)