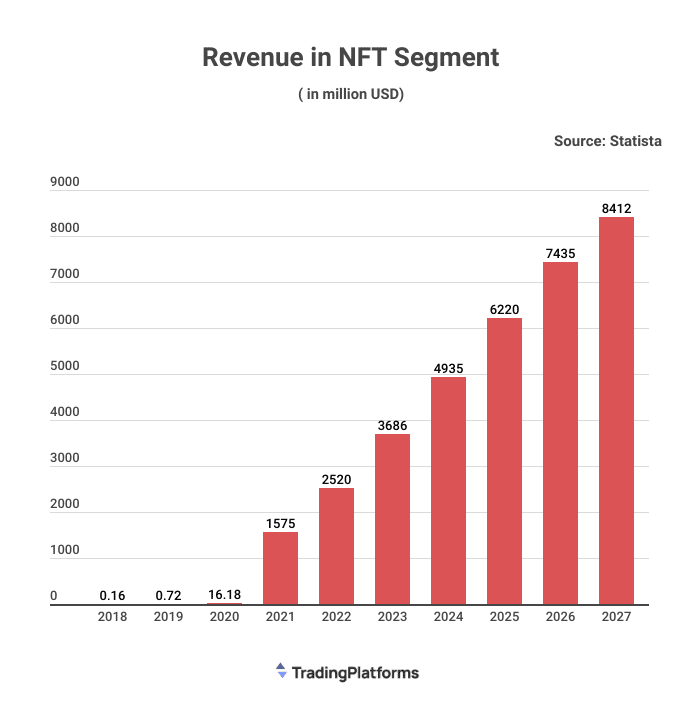

The world of NFTs is growing and becoming increasingly complex and lucrative. With the rise of NFTs, there is an increased need for financial instruments that can help facilitate liquidity in the market.

One of these instruments is cumulative NFT loans. These loans are an innovative type of loan structure that is gaining traction in the NFT market. The loan works by allowing an investor to borrow against their NFT, but they can only use a portion of it. For example, they could take out a loan on an NFT worth $100 and only use $10 of that value.

According to a new report from TradingPlatforms.com, this type of loan structure has been growing in popularity and usage in the NFT market. It is projected to grow 10X in 2022, standing over $500 million.

Edith Reads, the TradingPlatforms specialist, commented on the data, “This is a testament to the growing demand for alternative financial instruments in the NFT space. At the same time, it also highlights how these loans can provide a valuable solution to one of the biggest challenges faced by NFT holders – liquidity. By allowing them to borrow against their assets while retaining ownership, cumulative NFT loans are helping unlock even more value from their digital assets.

Increase in NFT Popularity Drives Loan Demand

With the increasing popularity of NFTs, it is no surprise that the demand and uptake for NFT loans are also rising. Besides, other factors are also driving the increase in demand. For instance, the price of NFTs has been growing in recent months, making them an attractive investment. Also, the number of platforms offering NFT loans is increasing, giving borrowers more choices.

The demand for NFT loans is set to continue to grow in the coming months and years. This is good news for lenders, but it also means that borrowers must be aware of the risks involved. NFTs are a relatively new asset class, and their prices can be volatile. As such, borrowers need to be sure they can afford the repayments before taking out a loan.

Why Is NFT Borrowing Lucrative?

NFTs have many benefits that make them attractive to investors and borrowers. They offer more liquidity than other assets, such as real estate or art. Thus, you can sell or trade them more easily. This provides borrowers with greater flexibility in how they use their assets.

NFTs are not subject to the same regulation as other assets, such as stocks or bonds. Therefore, they are a more attractive investment for those looking to avoid the hassle and expense of compliance with government regulations.

The tokens offer a higher degree of privacy than other assets. And this can be a significant advantage for borrowers who wish to keep their financial affairs private.

Question & Answers (0)