9 Best Stock Trading Apps of 2026

Stock trading apps make it possible for investors to manage their portfolios on the go. This is particularly helpful during volatile periods when you may need to quickly adjust your strategy to keep up with changing market trends.

Luckily, many of the best stock brokers offer proprietary trading apps that can be used seamlessly with your brokerage account. Most stock apps are free to use and available on both iOS and Android devices.

To help point you in the right direction, this guide reviews the best stock trading apps to consider in 2026.

-

-

9 Best Stock Trading Apps 2026

Looking to download the best stock trading app right now? If so, below you will find the top-rated trading platform apps we think you should consider. You can find out more about each provider by scrolling down!

- Plus500 – Plus500 is the best stock trading app for CFD trading. The platform offers over 2800 instruments and supports leverage trading for users who want to increase their position size.

- eToro – eToro is considered a top-rated platform and one of the best stock trading apps, which now boasts a customer base of over 17 million investors and allows you to trade in a 100% commission-free trading environment. Once you go through the 10-minute registration process, you will then have access to thousands of tradable markets.

- Axi: Axi stands out for its low trading fees, making it an attractive choice for less-experienced traders who are looking to start with minimal funds. Axi supports over 200 products and offers copy trading and spread betting accounts that are both tax-free.

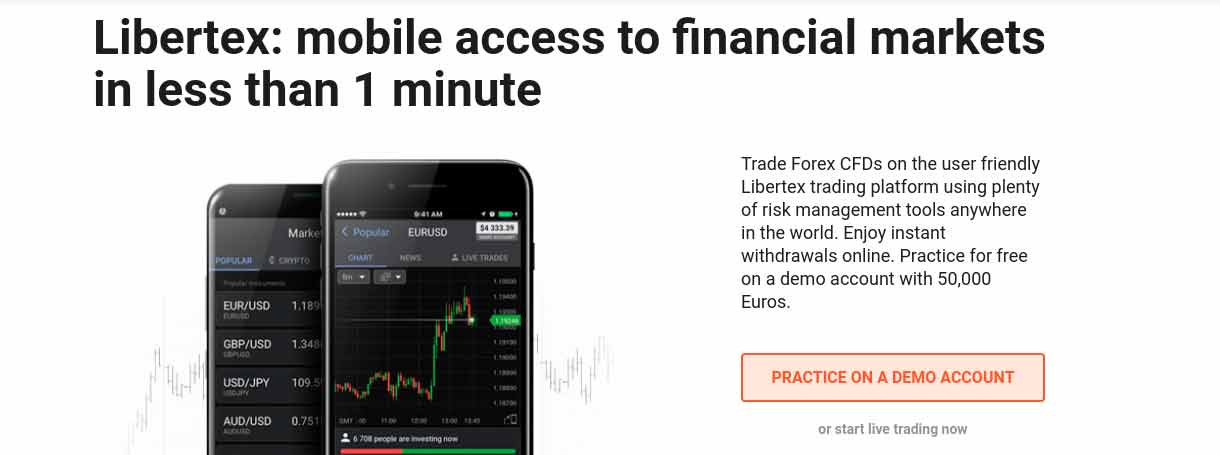

- Libertex – Libertex is a CFD platform that specializes in speculating asset prices without owning them. It offers low commissions, leverage, and supports various assets. It’s compatible with MT4 and has a good reputation for safety. Libertex is authorized and regulated by CySEC.

- Robinhood – Robinhood is a US-based trading app that has a community of over 10 million traders and is expected to go public this year. It offers a burden-free, commission-free platform for penny stocks, ETFs, and cryptocurrencies, with a simple user interface and no minimum account balance policy.

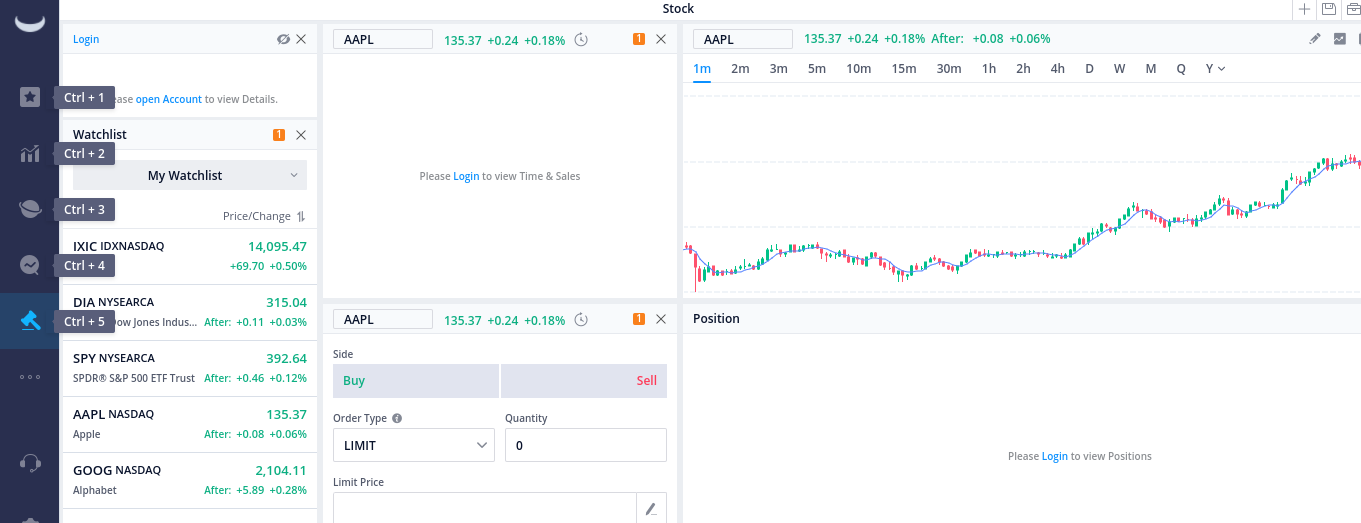

- Webull – Webull is a popular stock trading platform app, offering simple fractional ownership, ETFs, cryptocurrencies, and stock options trading. It charges no trading commissions but has a small monthly fee. It is possible to trade stocks on Webull with leverage of up to 4x.

- TD Ameritrade – TD Ameritrade offers a wide range of markets through its top-rated mobile app. It covers traditional investments, short-term trading instruments, and asset diversity, offering access to thousands of stocks, ETFs, mutual funds, bonds, and retirement accounts. The platform offers commission-free trading and no minimum account balance.

- Interactive Brokers – Interactive Brokers is a top-rated trading app for long-term investments, offering a variety of stocks and funds from 33 countries. It supports small amounts, mutual funds, ETFs, and bonds, and offers various account types and fees.

- IG – IG is a trading app for technical analysis, covering over 17,000 markets, including forex, indices, cryptocurrencies, shares, and commodities. With over 29 indicators and 19 charting drawing tools, it offers fast execution times and access to news and analysis.

- Fidelity – Fidelity is a US-based broker offering a popular trading app for long-term investors. It offers thousands of mutual funds, ETFs, bonds, and shares from 25 markets. The app supports retirement accounts and offers analysis tools. It’s low-cost, commission-free, and suitable for all budgets.

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

$10 por Año10 por AñoSort By2 Provider that match your filters Providers that match your filters

Payment methods

Features

Customer service

Classification

1or moreMobile App

1or moreFixed commissions per operation

$1or moreAccount Fee

$1or moreNo results found

Trying adjusting the filter to see some results.

Total Fees (for 12 months)$ 0What we like- Buy shares and ETFs with 0% commission

- Social and copy trading network

- Invest and trade crypto with low fees

Fixed commissions per operationAccount FeeMobile App10/10FeaturesPayment methodsAccount Info

Account From$10Deposit fees$0ETFS300+Inactivity fees$10/month after 12 monthsLeverageMaximum 1:30, minimum 1:2Operating marginYesMinimum operation$10Stocks3000+CFD PositionCommission relative to value of positionCFDS3000+Trading fees$0Withdrawal fees$5Fees per operation

BondsN/ACryptocurrencies1%CFDSSpread – Currency from 1 PIP, commodities from 2 PIPS, indices from 0,75 points, stocks and ETFs from 0,15 %DAX0.01%Copy Portfolio0%ETFSNo commissionCFD PositionYes, depending on the market that you tradeStocksno commissionSavings PlanN/ARobo AdvisorN/AFundsN/ATotal Fees (for 12 months)$ 0eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Account Info

Account From$10Deposit fees$0ETFS300+Inactivity fees$10/month after 12 monthsLeverageMaximum 1:30, minimum 1:2Operating marginYesMinimum operation$10Stocks3000+CFD PositionCommission relative to value of positionCFDS3000+Trading fees$0Withdrawal fees$5Fees per operation

BondsN/ACryptocurrencies1%CFDSSpread – Currency from 1 PIP, commodities from 2 PIPS, indices from 0,75 points, stocks and ETFs from 0,15 %DAX0.01%Copy Portfolio0%ETFSNo commissionCFD PositionYes, depending on the market that you tradeStocksno commissionSavings PlanN/ARobo AdvisorN/AFundsN/ATotal Fees (for 12 months)$ 0What we like- Buy stocks and ETFs with zero commission

- No minimum deposit

- Extended trading hours for US stocks

Fixed commissions per operationAccount FeeMobile App8/10FeaturesPayment methodsAccount Info

Account From$0Deposit fees$0ETFS+3,300Inactivity fees$0Leverage2:1Operating marginYesMinimum operation-Stocks+3,000CFD Position-CFDS-Trading feesNoneWithdrawal fees$0Fees per operation

Bonds-Cryptocurrencies-CFDS-DAX-Copy Portfolio-ETFS$0CFD Position-Stocks$0Savings Plan-Robo Advisor0.20% on all assets under management, billed monthly.Funds-Total Fees (for 12 months)$ 0All investments involve risk, and not all risks are suitable for every investor. The value of securities may fluctuate and as a result, clients may lose more than their original investment.

Account Info

Account From$0Deposit fees$0ETFS+3,300Inactivity fees$0Leverage2:1Operating marginYesMinimum operation-Stocks+3,000CFD Position-CFDS-Trading feesNoneWithdrawal fees$0Fees per operation

Bonds-Cryptocurrencies-CFDS-DAX-Copy Portfolio-ETFS$0CFD Position-Stocks$0Savings Plan-Robo Advisor0.20% on all assets under management, billed monthly.Funds-What Makes a Good Stock App?

We have reviewed the best trading mobile apps to consider in 2026 and beyond. As no two trading apps are the same, each provider will appeal to a certain type of investor.

For example, while some investment apps are great long-term investments, others are more suitable for short-term CFD trading.

With this in mind, below we discuss some of the most important metrics that need to be considered in your search for the best trading app.

- Regulation: Regulated investment apps follow anti-money laundering and KYC policies that protect investors. US stock traders should look for apps that are licensed by the SEC or FINRA.

- Fractional shares: The ability to invest in fractional shares is appealing to investors who want to build a diverse portfolio with a small amount of funds. Fractional shares are portions of stock that can be bought for as little as $1.

- Asset variety: Diversifying your portfolio is one way to minimize the risks of investing money. Therefore, it is a good idea to look for a stock trading app that offers a wide range of investment choices such as individual stocks, ETFs, mutual funds, futures trading, and indices.

- Low commissions: Investment apps that charge low (or zero) commissions are most suitable for stock traders who have a low budget. You should also check for spreads, overnight fees, and account management fees before choosing a platform.

- Research and analysis tools: It is important to conduct thorough research and analysis before making any investment decisions. Therefore, it is helpful to choose an investing app that provides in-house tools for fundamental and technical analysis. This could include expert insight, social trading features, market news, and charting software.

- User-friendly interface: By choosing an easy-to-use platform, it will be easier to conduct analysis and implement your desired trading strategy. The best stock trading apps should offer a seamless interface with clear navigation and fast trading speeds.

- Customer support: The best stock apps offer effective customer support services to help traders around the clock. Look for brokers that offer support in various formats such as live chat, email, and phone. This will increase your chances of getting help quickly.

Best Stock Trading Apps Reviewed

There are now hundreds of trading apps active in the mobile investment scene. This is great, as you are sure to find a provider that allows you to meet your financial goals.

You do, however, need to focus on a set of metrics in finding the best trading app, such as those surrounding tradable markets, commissions, usability, and regulation.

We have done the hard work for you by reviewing the best trading apps currently active in the market!

1. Plus500 – Top CFD stock app for active trading strategies

If you’re looking to trade stocks as CFDs, you might want to consider Plus500. This top-rated mobile app allows you to trade a wide variety stock CFDs, forex, indices and ETFs with low costs.

For example, stock CFDs can be traded with 0% commissions and spreads from just 0.7 pips. However, we did find that the platform charges high overnight and inactivity fees, which may not be suitable for long-term investors.

Plus500 is also worth considering if you are looking to trade with leverage. In accordance with the ESMA regulations, the maximum leverage that Plus500 offers is 1:30. This is suitable for experienced traders who want to increase their position size.

Plus500 is available on both mobile and desktop devices. The platform aso supports a range of payment methods This covers debit/credit cards issued by Visa and MasterCard, PayPal, and bank wires. The minimum deposit is just $100.

Finally, not only is Plus500 a publicly traded company, but it is heavily regulated. It holds licenses in various jurisdictions, including the UK, Australia, and Singapore.

Plus500 fees

Fee Amount Stock trading fee Spread. 23.51 pips for Amazon Forex trading fee Variable spreads Crypto trading fee Spread. 4.11% for Bitcoin Inactivity fee £10 per month after three months Withdrawal fee Free Pros:

- A commission-free trading policy for stock CFDs

- Thousands of CFD investment options

- Tight spreads for trading stocks

- In-house trading platform, available on web browsers and mobile phones

- There are plenty of features, including risk management tool, price alerts, and trader’s sentiment tool

Cons:

- No third-party trading tools

- CFDs are not available to US traders

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

2. eToro – Overall best free Stock trading app 2026

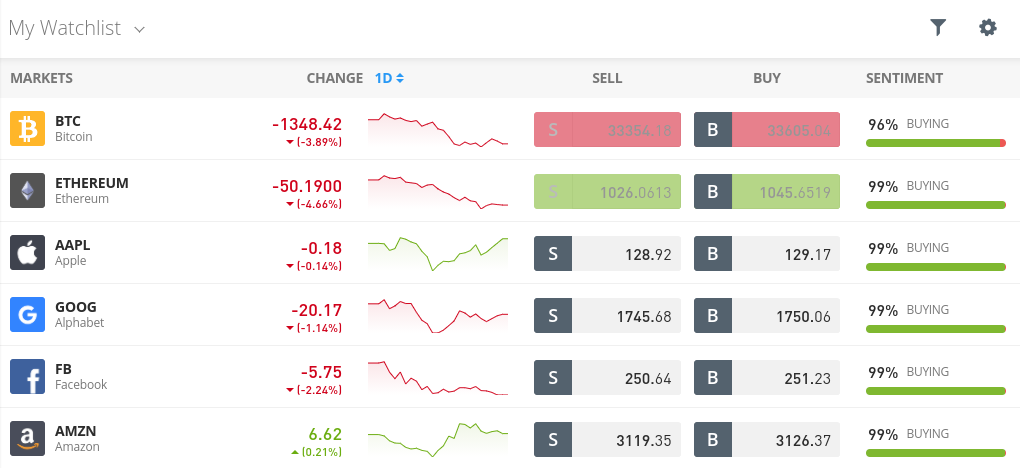

To put it simply, the eToro trading app is by far the best option in the mobile investment scene. This top-rated platform, which now boasts a customer base of over 17 million investors, allows you to trade with low commissions on US stocks.

You won’t need to pay anything to open a brokerage account, and you will not be charged any ongoing platform fees. Once you go through the 10-minute registration process, you will then have access to thousands of tradable markets.

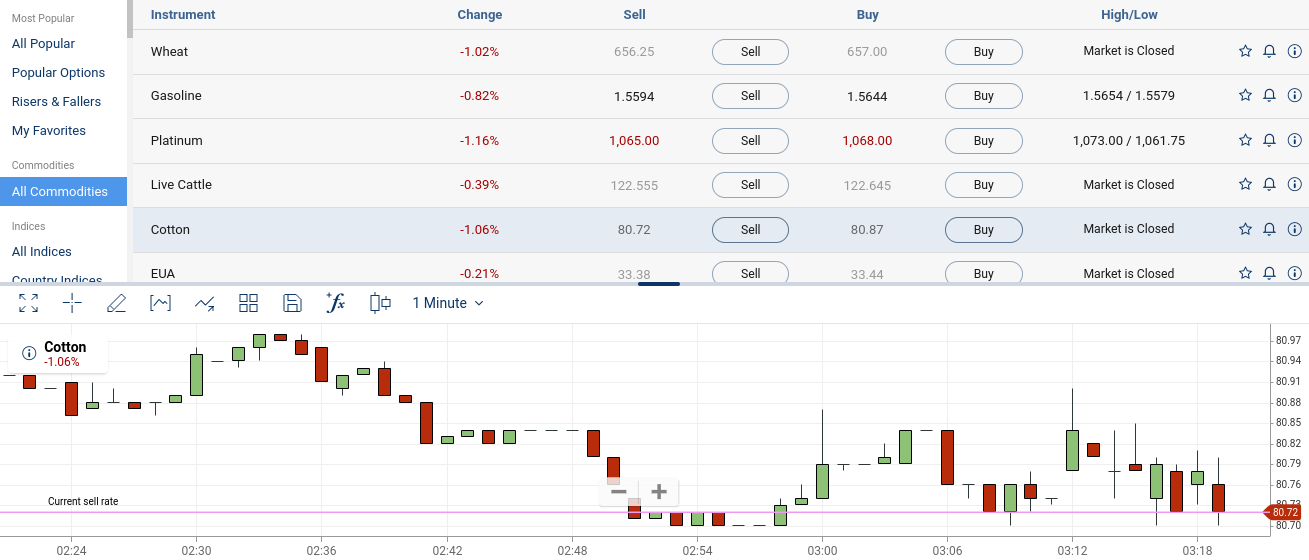

This includes more than 2,400 shares from 17 international markets, 250+ ETFs, 16 cryptocurrencies, and heaps of CFD instruments. The latter includes everything from gold, silver, and oil to natural gas, wheat, and copper. You can also trade forex on this top-rated investment app, with more than 55 pairs supported. eToro is also one of the fastest trading platforms on the market.

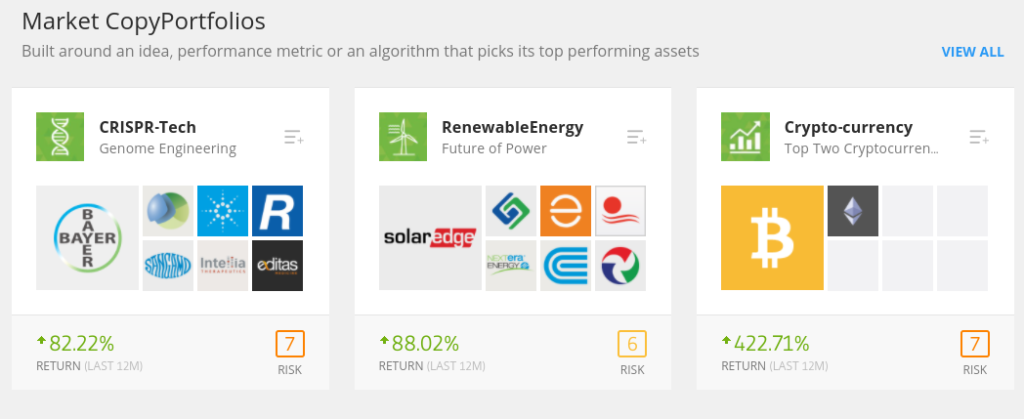

When it comes to core features, the eToro trading app allows you to invest passively. For example, the Copy Trading tool allows you to select from thousands of verified investors and then copy all of their ongoing positions. The trading app also allows you to invest in diversified portfolios that are managed by the team at eToro.

We also like this social trading platform app provider as it offers a fully-fledged demo account that comes pre-loaded with $100,000 in paper funds. Unlike a lot of trading apps that you’ll find on Google Play or Apple Stores, eToro is heavily regulated. This includes a license from the FCA, ASIC, and CySEC.

The app provider is also registered with FINRA in the US. Should you wish to choose eToro as your go-to trading app, you only need to meet a minimum deposit of $200. You can add funds to your account directly from the app, with supported payment methods including debit/credit cards and e-wallets like PayPal.

eToro fees

Fee Amount Stock trading fee Free Forex trading fee Spread, 2.1 pips for GBP/USD Crypto trading fees Spread, 0.75% for Bitcoin Inactivity fee $10 a month after one year Withdrawal fee $5 Pros:

- Super user-friendly trading platform

- Buy stocks without paying any commission or share dealing charges

- 2,400+ stocks and 250+ exchange traded funds listed on 17 international markets

- Trade cryptocurrencies, offshore, commodities, and forex

- Deposit funds with a debit/credit card, e-wallet, or bank account

- Ability to copy the trades of other users

- Regulated by the FCA, CySEC, and ASIC and registered with FINRA

Cons:

- Not suitable for advanced traders that like to perform technical analysis

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

3. Axi – Trade stock CFDs with spreads from 0 pips

Axi stands out as a reputable stock CFD broker known for its low fees and commitment to providing traders with a seamless trading experience. The platform offers spreads from 0 pips as well as low trading fees, which are among the most attractive in the industry.

With a commission of $3.50 per lot per trade and tight spreads, Axi offers traders a cost-effective solution for executing forex trades. Moreover, the platform does not charge withdrawal fees, further enhancing its appeal to traders looking to minimize costs.

While Axi primarily focuses on forex trading, it also offers a range of stock CFD products, albeit with a slightly less extensive lineup compared to some other brokers. Nevertheless, for traders prioritizing CFD trading, Axi’s competitive fees, user-friendly interface, and diverse base currencies make it a great choice.

Axi fees

Fee Amount Stock trading fee Commission: $3.50 per lot Forex trading fee Commission: $3.50 per lot per trade . Crypto trading fees N/A Inactivity fee $10 per month after 1 year Withdrawal fee Free Pros:

- Axi is regulated by ASIC as well as the Financial Conduct Authority

- Traders can access over 200 CFD products including stocks, indices and currencies

- The platform charges a fixed commission of $3.50 per lot for stock trading

- Users can trade with leverage up to 30:1

- Spreads start from 0 pips

Cons:

- Stocks are limited to CFDs

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76.3% of retail investor accounts lose money when trading with this provider.

4. Libertex – Low-cost CFD stock trading app with tight spreads

Libertex is different from the likes of eToro and Robinhood in that it specializes exclusively in CFD instruments. This means that you won’t be able to invest in assets in the traditional sense. Rather, you’ll be speculating on the future price of the asset without needing to take ownership.

This does, however, come with several benefits when using the Libertex trading app. For example, Libertex allows you to buy and sell financial instruments without paying any spreads. Commissions on each trader are super low, with major assets costing less than 0.1% per slide.

Libertex also offers leverage of up to 1:600 for professional clients and less if you’re a retail trader. In terms of what you can trade, this top-rated trading app supports everything from forex, cryptocurrencies, and commodities to stocks and indices.

If you’re looking to place more sophisticated trades, Libertex is also compatible with MT4. All you need to do is download the MT4 trading platform app and then log in with your Libertex credentials. Getting started at Libertex is really easy, as accounts take just minutes to open.

You can then use the Libertex demo facility or deposit a minimum of $100 if you wish to trade with real money. Supported payment types include debit and credit cards, bank transfers, and e-wallets. In terms of safety, Libertex has a great reputation. It first launched its proportion online trading platform in 1997 and is authorized and regulated by CySEC.

Libertex fees

Fee Amount Stock trading fee Commission: 0.034% for Amazon. Forex trading fee Commission: 0.008% for GBP/USD. Crypto trading fees Commission: 1.23% for Bitcoin. Inactivity fee $5 a month after 180 days Withdrawal fee Free Pros:

- Zero-spread CFD trading

- Very competitive commissions, starting from 0% upwards

- Good educational resources

- Long-established broker

- Compatible with MT4

- Great choice of markets

Cons:

- CFDs only

85% of retail investor accounts lose money when trading CFDs with this provider.

4. Robinhood – One of the best free stock trading apps for buying US stocks

Robinhood is now one of the largest trading app providers in the US. In fact, not only is the app home to over 10 million traders, but it is rumored that the company is planning to go public this year.

Perhaps the main attraction of the Robinhood app is that it allows everyday Americans to invest in the stock markets in a burden-free manner and is the best trading platform for penny stocks. According to the source, the two biggest stock markets in the world are NYSE and Nasdaq, with a market cap of $24.7 trillion and, respectively, $19.5 trillion. In terms of supported markets, this top-rated trading app gives you access to over 5,000 US-listed stocks and ETFs.

You can also invest in cryptocurrencies like Bitcoin and trade stock options. Irrespective of which asset interests you, Robinhood is a 100% commission-free broker. The app instead makes its money from the spread as well as margin trading fees. Americans also like this top-rated trading app, as it does not have a minimum account balance policy in place.

This is an ideal investing app if you want to invest in a few stocks but don’t want to trade large volumes. Additionally, it’s worth noting that the Robinhood investing app is really simple to use. It’s straightforward to find the stock, ETF, or cryptocurrency that interests you, as is the process of placing an order. When it comes to accounts, most traders opt for the free account, which comes with no ongoing fees.

This allows you to deposit up to $1,000 instantly, with the balance taking a few days. If you’re planning to invest larger amounts and want access to advanced pricing data, the Robinhood Gold Account will cost you $5 per month. This allows you to instantly deposit funds at an amount equal to your portfolio value, as well as trade with a margin.

Robinhood fees

Fee Amount Stock trading fee Free Forex trading fee N/A Crypto trading fees Free Inactivity fee No inactivity fee Withdrawal fee No withdrawal fee Pros:

- A hugely popular trading platform in the US

- Buy over 5,000 US-listed stocks

- ETFs, cryptocurrencies, and stock options also supported

- Does not charge any commissions

- No minimum deposit in place

- Very simple to use and ideal for newbies

- Heavily regulated in the US

Cons:

- Only 250-ish international stocks offered

- No debit/credit card or e-wallet deposits

There is no guarantee that you will make money with this provider. Proceed at your own risk..

5. Webull – Best free trading app with advanced trading tools

Webull is another top-rated stock trading platform that is popular with active traders. In a similar vein to Robinhood, the Webull app is really simple to use, and it allows you to invest with small amounts. In fact, one of the main attractions of the Webull app is that it supports fractional ownership.

This means that you can invest in companies like Amazon and Tesla with just a few dollars. This popular trading app also allows you to invest in a good range of ETFs and cryptocurrencies. You can also access stock options trading on the Webull app – all of which focus on US-listed stocks.

There are no trading commissions charged by Webull, but there is a small monthly fee. This starts at just $1 per month on the standard account and goes up to $9 per month if you seek additional features and tools. We also like Webull, as the app supports margin trading of up to 4x.

This means that a $3,000 account balance would allow you to buy $12,000 worth of stocks. When it comes to payments, the Webull trading app supports ACH and wire transfers. The former is processed free of charge, while the latter will cost you between $8 and $25 for deposits and withdrawals, respectively.

Webull fees

Fee Amount Stock trading fee U.S. SEC transaction fee (sells only): $0.0000051 * total trade amount (min. $0.01) Forex trading fee N/A Crypto trading fees Variable spread Inactivity fee Free Withdrawal fee $25 via wire transfer (U.S.) $45 via wire transfer (international) Pros:

- Commission-free trading

- Global stock, ETF, options, and crypto trading

- Includes highly advanced technical charts

- Fully customizable indicators

- Set up unlimited watchlists and complex alerts

- Includes basic social network and analyst recommendations

- Highly regulated in the US

Cons:

- Only available to US traders

- No forex or commodity CFD trading

- Payments are only by bank or wire transfer

- Limited educational resources

- Less than optimal customer support

There is no guarantee that you will make money with this provider. Proceed at your own risk..

6. TD Ameritrade – Reputable investing app with a diverse range of instruments

Launched in 1975, TD Ameritrade is arguably one of the most trusted US-based brokerage firms and stock trading apps in the online space. The platform, which allows you to trade online or via its top-rated mobile app, is a great option if you want access to an abundance of markets.

In fact, TD Ameritrade covers both traditional investments and short-term trading instruments. Regarding the former, the trading app allows you to invest in thousands of stocks. This not only covers stocks listed in the US but dozens of international exchanges, too.

You can also invest in thousands of ETFs and mutual funds—again, both domestically and internationally. Additionally, the TD Ameritrade app supports bonds and even dedicated retirement accounts.

If short-term trading is more your thing, TD Ameritrade is also worth considering if you are seeking an app that supports asset diversity. This is because the provider gives you access to dozens of forex trading pairs, futures, agricultural commodities, indices, metals, energies, and interest rates.

Ultimately, if there is a market that interests you, it’s all-but-certain that you’ll find it on the TD Ameritrade app. When it comes to trading fees, this will depend on which financial markets you decide to access. For example, TD Ameritrade allows you to buy US-listed stocks and ETFs on a commission-free basis.

Stock options are also competitive at just $0.065 per contract. Futures can be traded at $2.25 per contract and over-the-counter stocks at $6.95 per slide. There are no ongoing fees, and you won’t be charged to access data. Plus, there is no minimum account balance on the app, which is great for active traders risking small volumes.

TD Ameritrade fees

Fee Amount Stock trading fee Free Forex trading fee Spread: 1.2 pips average during peak hours. Crypto trading fees N/A Inactivity fee Free Withdrawal fee Free for ACH, $25 for wire transfer Pros:

- Trusted US brokerage firm

- The app is available on iOS and Android devices

- Buy stocks and ETFs commission-free

- Options can be traded at just $0.65 per contract

- Fully-fledged paper trading account

- There are more than 11,000 mutual funds to choose from

- No account minimums

Cons:

- Not as user-friendly as other investing apps in the market

- The sheer size of tradable markets on offer can appear overwhelming

There is no guarantee that you will make money with this provider. Proceed at your own risk..

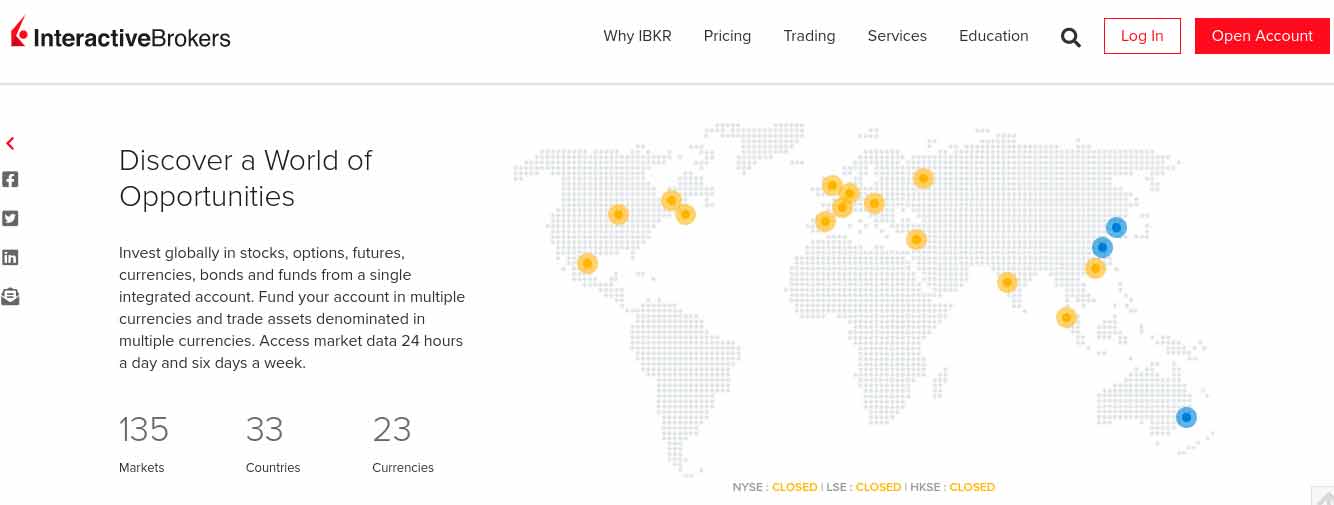

7. Interactive Brokers – Best trading app for building a long-term investment portfolio

If you are looking for the best trading app for making long-term investments, Interactive Brokers is a good choice. Launched in 1978, the age-old brokerage firm is now traded on the NASDAQ as a PLC.

You can access a variety of long-term investments on the app, which covers stocks and funds from over 33 countries. This is perfect if you’re planning to build a diversified portfolio of international assets.

The Interactive Brokers app is also useful if you want to invest small amounts in the stock markets. This is because you only need to buy 0.0001 of one share. On top of stocks, other popular long-term investments supported by Interactive Brokers include mutual funds, ETFs, and bonds.

There are plenty of account types to choose from, too. This includes individual accounts, retirement accounts, trust accounts, and institutional accounts. When it comes to fees, the trading app doesn’t charge any commission when you invest in US-listed stocks and ETFs.

Commissions on non-US stocks/ETFs and other asset classes will vary depending on the market and whether you opt for a fixed-rate or tiered-rate account plan. Finally, although Interactive Brokers is one of the best trading apps for long-term investments, you can also access more sophisticated financial products – like options, futures, and forex.

Interactive Brokers fees

Fee Amount Stock trading fee Free Forex trading fee Commission + spread. Commission is 0.08 to 0.20 basis points. 0.1 pip GBP/USD. Crypto trading fee Commission. $15.01 per Bitcoin futures contract. Inactivity fee $20 per month Withdrawal fee Free Pros:

- Huge library of traditional stocks, index funds, and ETFs

- Really advanced trading features and chart analysis tools

- More than 135 markets across 33 countries

- Trade CFDs, futures, options, forex, and more

- No minimum deposit

- Buy US-listed stocks and ETFs commission-free

Cons:

- Not suitable for newbie investors

- Fee structure is a bit confusing

There is no guarantee that you will make money with this provider. Proceed at your own risk..

8. IG – Free trading app for technical analysis

IG is one of the top-rated trading platforms for performing technical analysis. This UK-based broker – which was first launched in 1974, is now home to a huge global following. You can trade a wide variety of assets on the app – which covers over 17,000 markets.

This includes forex, indices, cryptocurrencies, shares, commodities, and more. Perhaps the biggest attraction of choosing IG as your go-to trading app is that it offers an abundance of tools that will suit technical traders.

This includes more than 29 technical indicators and 19 charting drawing tools. You can also compare four different timeframes on a single chart, and you’ll benefit from super-fast execution times. In fact, IG claims that the average execution speed on its platform is just 0.014 seconds.

The IG trading app is also great if you seek access to news and analysis. This includes a news feed that updates throughout the day – so you’ll never miss an important development. The app also allows you to set up alerts – which you can set up to cover price levels and changes, important economic events, and technical indicator findings.

When it comes to commissions, all CFD asset classes can be traded fee-free – apart from stocks. The specific fee that you’ll pay when trading stocks will depend on the location of the equity. For example, UK and European stocks typically come with a commission of 0.10% per slide, while US-listed stocks cost $0.02 per share.

If you want to start trading the stock market on the IG app, you will first need to open an account and meet a minimum deposit of $250. You can fund your account with a debit card or bank transfer. Finally, we should note that US-based traders will be limited to forex on the IG app. With that said, if currency trading is what interests you, you’ll have access to over 80 pairs.

IG fees

Fee Amount Stock trading fee Commission. 2 cents per share for US stocks, 0.10% for UK and EU stocks. Forex trading fee Spread. 1.4 pips for GBP/USD. Crypto trading fee Spread. 36 pips for Bitcoin. Inactivity fee £12 a month after 24 months. Withdrawal fee Free Pros:

- Best trading platform for seasoned pros

- More than 80 currency pairs offered

- Thousands of stock CFD investment options

- Trade on the IG website or via the app

- MT4 is supported

- More than four decades in the brokerage space

- Easily fund your account with a debit card or bank transfer

Cons:

- A minimum deposit of $250

- No traditional stocks or ETFs for US traders

There is no guarantee that you will make money with this provider. Proceed at your own risk..

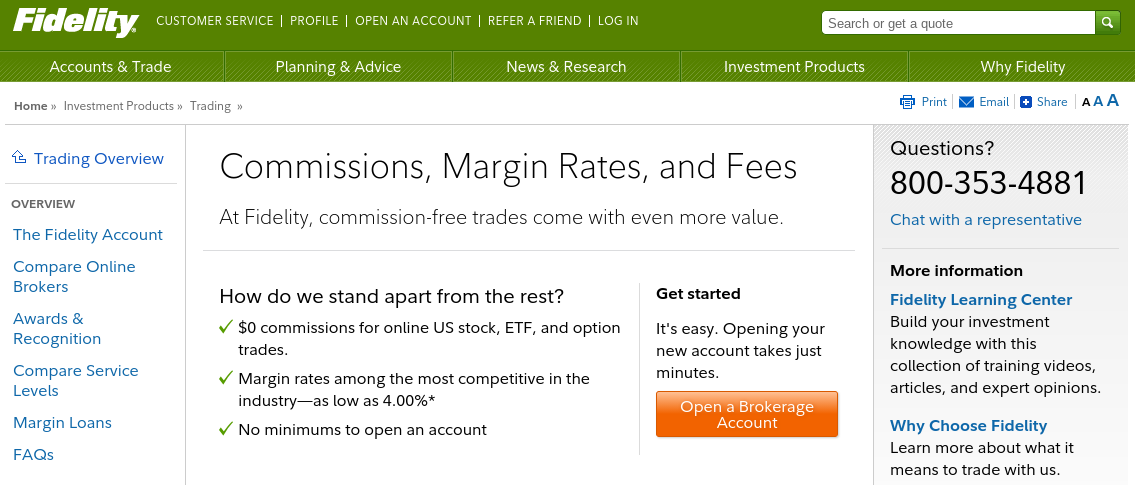

9. Fidelity – Top US stock investment app for long-term investors

Fidelity is another established US-based broker that offers a popular trading app. Available on both iOS and Android, the app is particularly appealing to those who are looking to build decade-long investment plans.

For example, the app is home to thousands of mutual funds, ETFs, and bonds. Or, if you want to pick and choose stocks on a DIY basis, Fidelity supports thousands of shares from 25 different markets. This allows you to invest in companies from several regions, which is perfect for diversification purposes.

Additionally, the Fidelity trading app also supports retirement accounts for those based in the US. If you like to perform in-depth research, the Fidelity trading app offers top-notch analysis tools. This includes heaps of market insights, news developments, and real-time data feeds.

The Fidelity app is also a great option if you’re seeking a low-cost provider. This is because Fidelity offers commission free trades for US stocks. This is also the case with mutual funds, but you must avoid selling your investment within 60 days of making the purchase.

If you do sell before the cut-off point, Fidelity will charge you a hefty fee of $49.95. Nevertheless, Fidelity is suitable for long-term investors of all budgets, as there is no minimum account balance. When it comes to payments, you’ll need to transfer funds from your bank account, as the provider does not support in-app debit card deposits.

Fidelity fees

Fee Amount Stock trading fee Free Forex trading fee N/A Crypto trading fee N/A Inactivity fee Free Withdrawal fee Free Pros:

- Great selection of long-term investment products

- Access US-listed stocks, exchange traded funds, and options commission-free

- Covers thousands of markets in 25 different countries

- Excellent reputation and heavily regulated

- No minimum account balance

- Top-rated research and educational materials

- Advanced analysis tools available for seasoned pros

Cons:

- Account opening process can be slow

- No debit card deposits/withdrawals

There is no guarantee that you will make money with this provider. Proceed at your own risk..

Getting Started with the Best Free Trading App

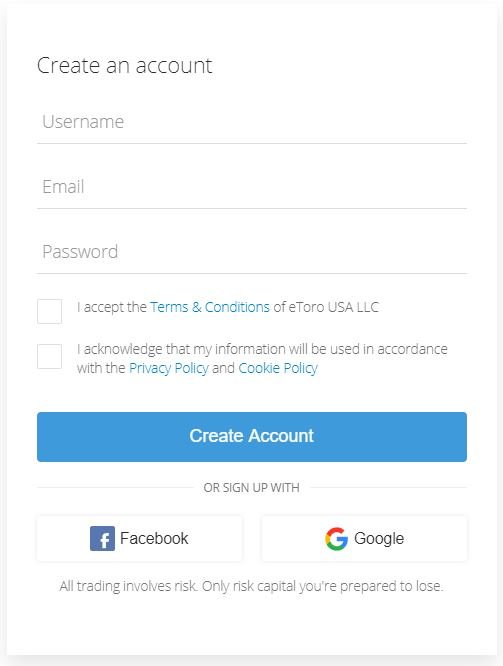

If you’re planning to use a trading app for the first time, we are now going to show you how to get started. Although you are free to use any provider of your choosing, the guidelines below will show you the ropes with the commission-free trading app eToro.

Step 1: Visit the eToro Website and Open an Account

Even if you want to start off with the eToro demo trading facility, you’ll still need to open an account. The process takes just a few minutes and simply requires some personal information from you.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

After heading over to the eToro website and clicking on the ‘Join Now’ button, you’ll need to provide the following:

- Name

- Home Address

- Date of Birth

- Email Address

- Mobile Number

- Tax Identification Number

- Username/Password

Step 2: Download the eToro Trading App

Once you have registered with eToro, the platform will then redirect you to the official download page as per your operating system. To clarify, the app is available on both iOS and Android.

Once you have downloaded and installed the eToro trading app, open it.

Step 3: Log In

You can now log in to your eToro account through the app. You’ll need to use the username and password that you created when you registered.

Step 4: Deposit Funds

Once you have logged into the app, you can trade for free via the eToro demo account. If you want to invest or trade with real money, you can deposit funds directly from within the app.

Instantly deposited payment methods include:

- Debit Cards

- Credit Cards

- PayPal

- Neteller

- Skrill

The minimum deposit is $50 for US citizens and $200 for all other nationalities.

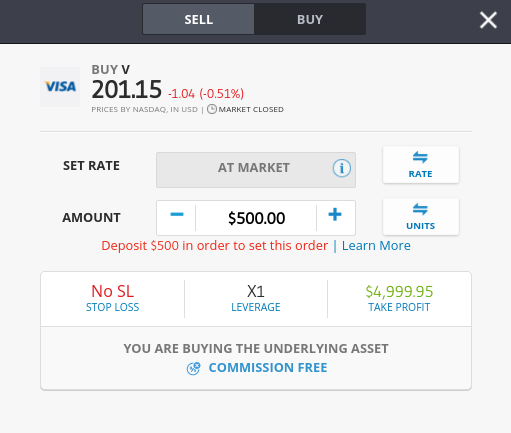

Step 5: Invest or Trade

As soon as you have made a deposit with one of the payment methods listed above, you can start trading straight away.

To find your desired asset, use the search facility at the top of the app screen. Or, you can browse the asset library by clicking on the respective financial instrument – such as crypto or ETFs.

Then, it’s just a case of placing an order. All you need to do is click on the ‘Trade’ button next to the asset and enter your stake in US dollars. To place your order, click on the ‘Open Trade’ button.

Conclusion

In summary, selecting a top-rated trading app can be challenging, as there are many factors that need to be considered. For example, not only does the app need to have a great reputation and offer competitive fees, but it must also support your chosen financial market.

And of course, you need to look at what features and tools are offered and whether or not the app offers a good user experience. In taking all of these important considerations into account, we found that the best trading app provider for 2026 is Plus500.

The regulated brokerage app allows you to trade stock CFDs on a commission-free basis. The app is simple to use, and getting started takes just 10 minutes. Furthermore, Plus500 is available on both mobile and desktop devices.

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

FAQs

What is the best trading app for beginners?

With more than 17 clients on its books, eToro has proven to be the best trading app for beginners. You don't need to have any experience of online trading to use the app, and minimum stakes start at just $25. .Are there any free trading apps?

Yes, there are plenty of free trading apps that allow you to buy and sell financial instruments without paying any commission. The best free trading apps do not charge any ongoing platform fees, either.What are the best mobile trading apps for stocks?

If you're looking to buy and sell shares, we found that the best trading apps for stocks are eToro and Robinhood. Both give you access to thousands of stocks on a commission-free basis. .Are the best trading platform apps safe?

Yes, the best trading platform apps discussed on this page are all authorized and regulated by at least one reputable financial body.How much do the best broker apps charge?

The best broker apps allow you to trade stocks, ETFs, and cryptocurrencies commission-free. This is the case with eToro, Robinhood, Plus500, and many other providers that made our list of the best broker apps of 2022.How do you find the best online trading app?

No-two providers are the same, so you need to do some homework to find the best online trading app for your needs. In particular, you need to look at factors like tradable markets, investor protections, commission, payments, and customer support.What is the best online trading app for leverage?

If you want access to leverage, your limits will be determined by the rules in your country of residence. For example, American forex traders can access leverage of up to 1:50 on the best online trading apps, while those in the UK are capped to 1:30.References:

Kane Pepi Finance Writer

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, InsideBitcoins, Blockonomi, Learnbonds, Buyshares n and the Malta Association of Compliance Officers.

Before starting his career as a writer, Kane studied at the University of Central Lancashire where he received a Masters Degree in Financial Investigation and then a Research Doctorate in Criminal Justice. Pepi is passionate about helping people to make informed decisions through high-quality, educational content.

eToro: Best Trading Platform - Trade Stocks & ETFs

61% of retail CFD accounts lose money. Your capital is at risk.

Visit eToroeToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.61% of retail CFD accounts lose money. Your capital is at risk.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up