Best Forex Brokers for February 2026

If you thinking about buying and selling currencies online, you’re going to need a top-rated forex trading platform.

Searching for the best forex trading platform for you can be time-consuming. After all, you need to explore things like supported currency pairs, commissions, minimum account balances, trading terms and regulations.

In this guide, we review the best forex brokers in 2026. We also walk you through the steps required to start buying and selling currencies today at a top-rated forex trading platform!

-

-

Top Online Forex Brokers in 2026

Here’s a breakdown of the top forex trading platforms that we found to offer a great all-around user experience. You can find a full review of each provider by scrolling down!

- eToro: eToro is known for its market-leading social trading features that allow users to copy the trades of experts. The platform supports 50+ currency pairs and crosses. It is possible to trade with leverage of up to 30x. eToro is regulated by the FCA, CYSEC and ASIC, making it one of the most reputable online forex brokers. Additionally, it is possible to trade CFDs on a commission-free basis.

- Forex.com: Forex.com offers over 80 forex pairs with competitive fees and a great selection of charting tools. The platform also supports various account types to cater to beginner and advanced traders and it is also possible to access third-party charting tools such as MT4.

- VantageFX: VantageFX offers CFD forex trading which means that traders do not own the underlying asset. The platform also offers leverage up to 500x as well as a variety of charting tools for technical analysis. VantageFX is regulated in several jurisdictions around the globe and is considered to be one of the best FX platforms.

- FXCM: FXCM is a popular forex broker for new traders because of its low minimum deposit requirement of $50. The platform also offers a good range of analysis tools as well as leverage trading options. It is possible to use the broker with MT4.

- TD Ameritrade: TD Ameritrade is an established trading platform that operates in the US. Users can access stocks, ETFs, and forex instruments as well as a good range of educational resources. TD Ameritrade is well-regulated in the US and has a strong reputation.

- IG: IG is a top forex broker that is ideal for day traders and advanced FX traders who are interested in trading with leverage. The platform supports over 80 currency pairs and offers competitive spreads on all FX assets.

- FXTM: FXTM is a forex broker that can be easily integrated with the MT4 and MT5 charting tools. This makes it suitable for conducting analysis or using automated trading APIs which are popular amongst forex traders.

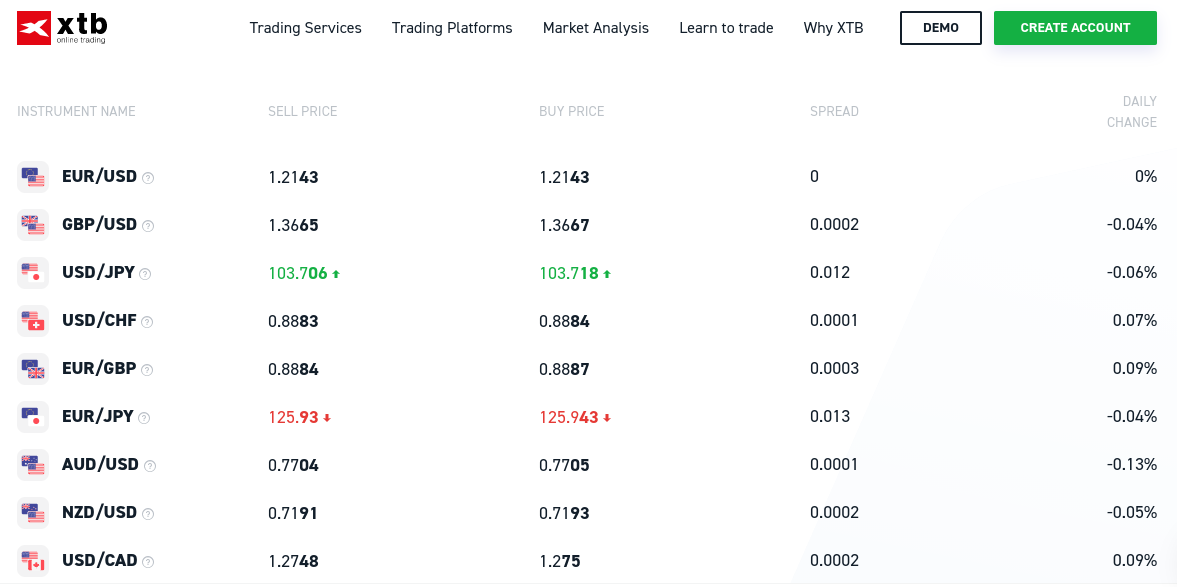

- XTB: XTB provides access to over 1,500 markets and charges zero commissions on some trades. Amongst the available instruments, XTB offers major forex pairs that can be traded around the clock.

- CMC Markets: CMC Markets stands out as one of the top forex platforms, offering over 300 forex pairs. This makes it a great platform for traders who are looking to trade exotic currencies as well as major pairs.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

What Is Forex Trading?

Forex trading, also known as FX trading, foreign exchange trading or currency trading, is the process of buying and selling currencies to profit from price movements. The forex market is the largest and most liquid financial market around the globe. The average forex daily trading volume is $5 trillion.

FX trading involves buying one currency while simultaneously selling another currency- the two currencies are called ‘pairs’. The exchange rate between the two currencies determines the value of the trade. Traders typically use a broker or a trading platform to execute their trades.

One of the unique features of the forex market is that it operates 24 hours a day, five days a week, allowing traders to access the market from anywhere in the world at any time. The market is open from Sunday evening through Friday evening, with trading sessions in Asia, Europe, and North America.

Forex trading is popular among traders because of its high liquidity, low transaction costs, and potential for profit. However, it’s also a highly volatile market, and traders should carefully consider the risks and benefits before investing.

Traders use a variety of techniques and strategies to try to profit from forex trading, including technical analysis, fundamental analysis, and algorithmic trading.

Is Forex Trading Easy?

The difficulty of FX trading will depend on an individual’s experience, knowledge, and skill level. While the basic concept of buying and selling currencies is relatively simple to understand, becoming a successful forex trader requires a significant amount of time and effort to learn the fundamentals, develop a trading strategy, and gain experience.

One of the main challenges in forex trading is the high level of risk involved. The market is highly volatile, and sudden changes in exchange rates can result in significant losses. Successful traders must have a thorough understanding of market trends, economic indicators, and geopolitical events that can affect currency values.

Moreover, successful forex traders must possess discipline, patience, and emotional control. They need to be able to make sound trading decisions based on analysis and strategy rather than emotions such as fear or greed.

While some traders may find forex trading easy, it is generally not recommended for inexperienced investors or those who are not willing to invest the time and effort to develop the necessary skills and knowledge. Forex trading requires discipline, patience, and a willingness to learn and adapt to market conditions, making it a challenging but potentially rewarding pursuit for those who are committed to it.

How to Choose the Best Forex Trading Platform for You

So now that we have reviewed the best forex brokers of 2026 and beyond – it’s now time to explain how you can find a provider yourself. After all, no two brokers are the same, so you need to ensure that the platform is conducive to your forex trading needs.

Below you will find a list of important factors that should be considered in your search for the best forex brokers.

Regulation

The global forex trading industry now sees trillions of dollars worth of currency change hands each and every day. As such, in most parts of the world, this online trading scene is heavily regulated. However, not all forex trading sites obtain the required license or authorization to operate in the countries it serves.

In other cases, although the platform might hold a license, this might be from a shady offshore financial body. As such, you should only open an account with a forex trading platform if it is regulated by a reputable license issuer.

This might include the:

- FCA (UK)

- ASIC (Australia)

- FINRA (US)

- SEC (US)

- CySEC (Cyprus)

- MAS (Singapore)

- IIROC (Canada)

By choose a forex trading platform that is regulated by one or more of the above bodies – you can rest assured that the provider is safe.

For example, our top-rated forex brokers – eToro, is regulated by the FCA, CySEC, and ASIC. It is also registered with FINRA in the US. All in all, these bodies have strict expectations on the best forex brokers that they regulate – all of which center on fairness, transparency, and investor protection.

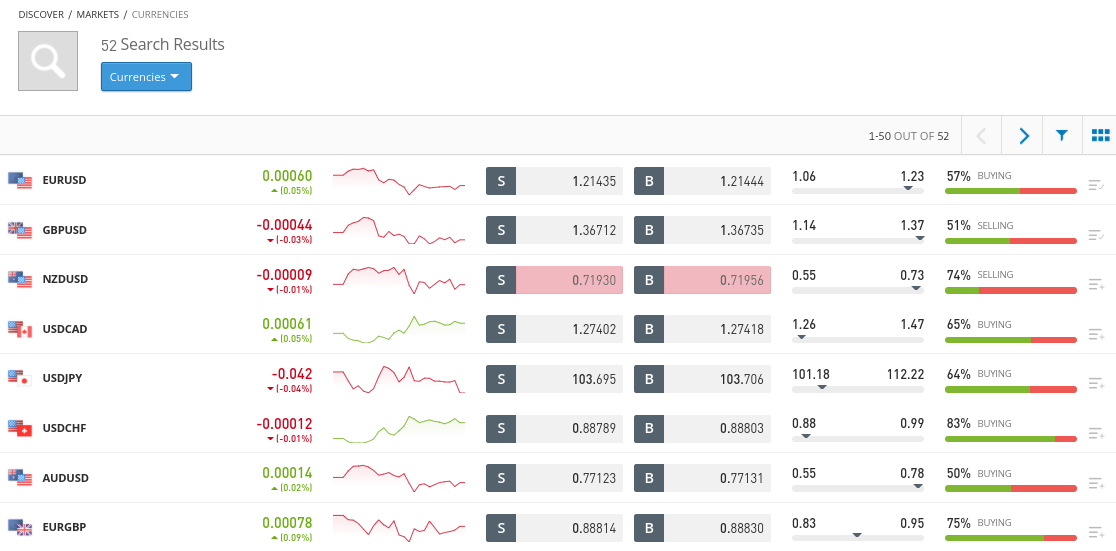

Forex Pairs

There are many forex pairs that you can trade from the comfort of your home. Most forex trading sites will cover most major and minor pairs. These are the most in-demand pairs as they carry the largest trading volume and liquidity. In turn, majors and minors benefit from the tightest spreads.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

With that said, the best forex brokers that we came across also offer lots in the way of exotic pairs. eToro, for example, allows you to trade many emerging currencies against the likes of the US dollar and Euro. Although more volatile, this is something that is often craved by seasoned forex traders anyway.

Fees

All forex trading platforms are in business to make money. How they achieve this can vary from platform to platform. Therefore, it is imperative that you check what fees will be applicable when trading forex at your chosen site.

The main fees charged by the best forex brokers are as follows:

Forex Trading Commission

Some forex trading platforms charge a commission on every buy and sell order that you place. In all but a few rare cases, this will come in the form of a variable percentage. Swap cannot be charged in Islamic forex brokers or swap free forex brokers.

For example:

- Let’s assume that you are trading EUR/GBP and your chosen broker charges a commission of 0.1%

- You place a buy order worth $500

- This means that to enter your trade, you will pay a commission of just $0.50 (0.1% of $500)

- When you get around to closing your trade, it is worth $600

- Closing the trade will again attract a 0.1% commission, so that’s $0.60 (0.1% of $600)

With that said, the best forex trading platforms of 2026 allow you to place buy and sell positions commission-free. This includes the likes eToro, Forex.com, CMC Markets, and more. In this scenario, you will only pay a fee in the form of the spread.

Forex Trading Spreads

All forex trading platforms make money from the spread. This is the difference between the buy and sell price of the forex pair.

Unlike traditional financial markets, the spread in forex is calculated in ‘pips’. In terms of what is deemed competitive, the best forex trading platforms offer spreads on major pairs at less than 1 pip.

If you are unfamiliar with the spread, it is an indirect cost that you need to cover to get back to the break-even point on your forex trade.

For example:

- Let’s say that you are trading GBP/USD

- The spread on offer at the time of trade is 0.8 pips

- This means that when you enter the trade, you will be 0.8 pips in the red

- As such, you need your position to increase in value by 0.8 pips to break even

- Any gains above and beyond 0.8 pips are clear profit

It is important to note that most forex trading platforms offer a variable spread. This means that the spread can change throughout the day depending on market conditions. Crucially, the more volatile the forex pair in question is, the wider the spread will be.

Leverage Fees

Unless you have a significant amount of capital in your forex trading platform account, you will likely need to use leverage. When you trade leveraged products, this attracts overnight financing fees.

In simple terms, this is a fee that you pay to your chosen platform for keeping the position open overnight. This fee will be deducted from your account balance and subsequently charged on a daily basis.

With this in mind, you need to check how much your chosen platform charges. This is usually expressed as a percentage and multiplied against your stake. The more you stake and the higher the leverage you apply, the more you will pay.

Other Fees

The best forex trading platforms are also known to charge fees in other areas.

This includes:

- Inactivity Fee: Even the best forex trading platforms charge a fee when your account remains inactive for a certain period. This usually kicks in after 12 months but can be much sooner.

- Transaction Fees: You might need to pay a fee to deposit and/or withdraw funds.

- Currency Conversion Fees: Some forex trading platforms charge you a fee when you trade an FX pair that isn’t priced in your base currency. For example, if your account is denominated in US dollars and you trade EUR/GBP, a conversion fee might apply.

Trading Tools and Features

Being able to trade forex online and make consistent profits is a difficult task. This is especially the case if you are a complete novice in the space. As such, you’ll want to see if your chosen forex platform offers a selection of tools and features that can take your currency trading efforts to the next level.

This includes:

Leverage

As we covered earlier, being able to make a living by trading forex without a sizable amount of capital can be challenging. This is because you will be targeting very small profit margins – especially if you’re looking to day trade.

As such, if leverage is something that you require, be sure to check whether your chosen forex trading platform offers this. Once again, your limits will be determined by your country of residence – with the UK, Europe, and several other regions capped to 1:30.

Order Types

The best forex trading platforms give you access to many order types. On top of buy/sell and market/limit orders, this should cover stop-loss and take-profit orders. This will allow you to trade forex online in a risk-averse manner.

Other order types that the best forex trading platforms offer include:

- Trailing Stop-Loss

- Guaranteed Stop-Loss

- Good for the Day (GFD)

- Good ‘Till Cancelled (GTC)

- One-Cancels-the-Other (OCO)

Automated Trading

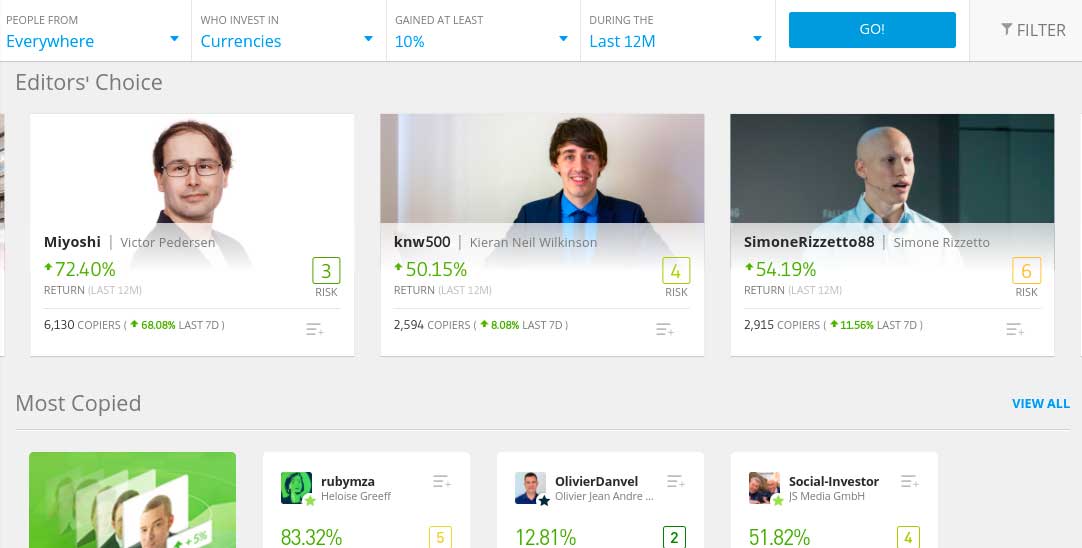

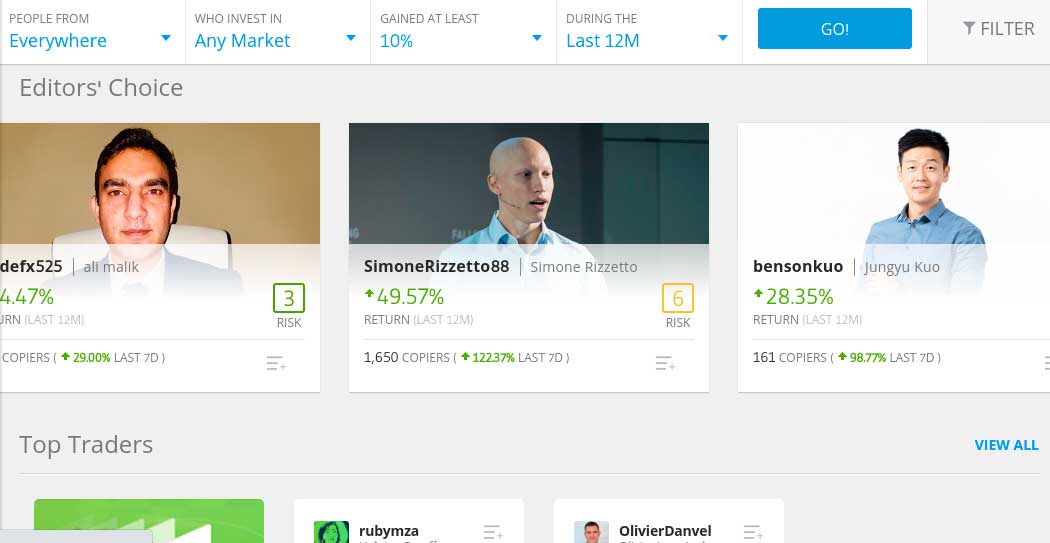

The best forex brokers offer automated tools. In the case of eToro, this comes in the form of a Copy Trading tool that allows you to mirror the buy and sell orders of an experienced currency investor.

In other words, every time your chosen investor places a forex trade, the exact position will be mirrored in your own account. The key point is that the size of your stake will be proportionate to how much you decide to invest into the eToro trader.

Past performance is not an indication of future results

Here’s an example of how this works:

- You invest $500 into a popular forex investor via the eToro Copy Trader tool

- The trader risks 5% of their portfolio into a GBP/USD buy order at leverage of 1:25

- You place the same order – but at a stake of $25 (5% of your $500 investment)

- The trader closes the position – making gains of 10%

- You made 10% of $25 – so that’s $2.50. However, you also applied leverage of 1:25 – so your total profit from this trade would have been $62.50

As per the above, the Copy Trading tool at eToro allows you to actively buy and sell currencies without you needing to lift a finger. This is great for newbies or those strapped for time.

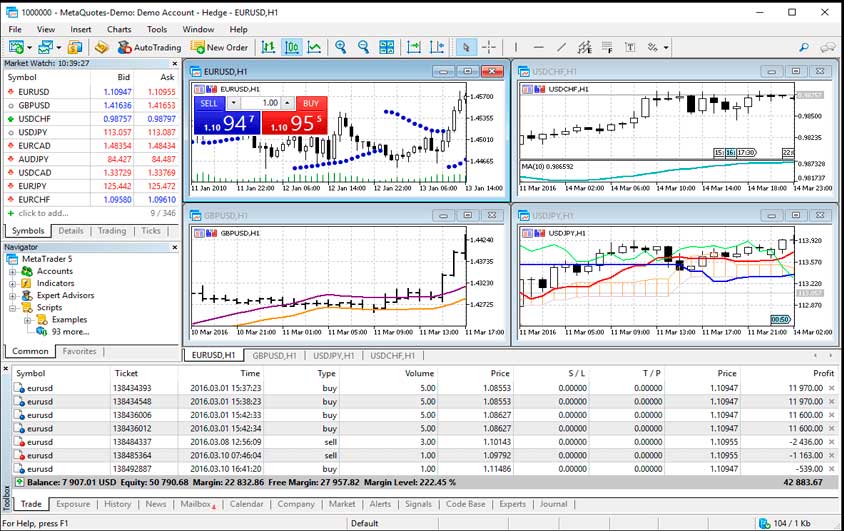

Forex EAs

An additional way to trade forex online in an automated manner is to opt for an EA (Expert Advisor). Otherwise referred to as a ‘forex robot’ the EA is a piece of software that has the ability to trade on your behalf.

Unlike the Copy Trading tool at eToro, forex EAs are based on pre-programmed algorithms. This means that it has the capacity to scan the forex markets 24 hours per day, 7 days per week.

In order to benefit from an EA, you need to sign up with a trading platform that supports MT4. Many of the best forex trading platforms discussed on this page offer this. Then, it’s just a case of installing your forex EA into MT4 and activating it.

Price Alerts

To ensure that you stay had of the game at all times, it’s best to choose a forex trading platform that offers alerts. Even better, these alerts should be delivered to your mobile phone in real-time.

For example, you might receive a notification if a major forex pair breaches a key residence line. Or, the platform might notify you when a news story breaks that could influence the future price of a currency pair.

Either way, the best forex trading platforms ensure that you never miss out on important fundamental and technical events.

Education, Research, and Analysis

If you are just started out as an online forex trader, it’s best to choose a platform that can help you improve your knowledge of the industry. For example, eToro offers everything from forex trading guides and videos to weekly webinars.

In the case of research, the best forex trading platforms offer financial news and market insights. This is great for keeping abreast of key market developments and can really help with your trading decision-making process.

In terms of technical data, the best forex trading platforms offer advanced chart reading tools. This should include customizable screens, technical indicators, and chart drawing capabilities.

User Experience

The forex trading industry moves at an alarming pace – with exchange rates changing on a second-by-second basis. As such, you’ll want to ensure that your chosen forex trading platform offers a great end-to-end user experience. For example, how easy is it to find your chosen forex market, and are there any difficulties in placing orders?

When we went through the research process ourselves, we found that there is often a huge difference in how user-friendly a forex trading platform is. For example, the likes of eToro and Forex.com are really simple to use – which is the case on the desktop version and mobile app.

However, some platforms – such as TD Ameritrade, are a lot more suited to seasoned forex pros. This is because it TD Ameritrade forex trading facility is packed with advanced functionality tools and features. While this might be great for experienced traders, it might be overwhelming for beginners.

Demo Account

We briefly mentioned forex demo accounts earlier on this page -and for good reason. Put simply, demo accounts allow you to practice your forex trading endeavors in a 100% risk-free environment. The best forex trading platforms offer demo accounts that mirror real trading conditions.

This is great for learning the ropes of a complex forex trading scene – as you can keep practices until you are ready to risk your own money. Take note, some forex trading platforms put a time limit on your long you can use the demo account facility – such as 30 days.

Payment Methods

The top forex trading platforms that we came across offer a huge selection of everyday payment methods. This makes the deposit and withdrawal process really simple. For example, eToro not supports instant deposits in the form of debit and credit cards, but e-wallets, too.

However, some of the forex trading platforms that we reviewed only accept bank transfers. If you are using a platform based in your country of residence, you might still benefit from an instant deposit. But, in a lot of cases, it can take several days for bank transfers to arrive.

Customer Service

We found that top forex trading platforms offer a live chat facility that is functional at least on a 24/5 basis. This means that you can speak with a support agent in real-time without needing to pick up the telephone.

At the other end of the spectrum, some of the forex trading platforms we came across only offer support via email. This means that you might need to wait several hours to get a reply.

Our Overview of The Best Forex Trading Brokers in February 2026

Here, we take a closer look at each of the top forex platforms to understand more about what each has to offer.

We will discuss platform fees, trading features, asset availability, regulation and user-friendliness as well as other important aspects to consider when choosing a trading site.

1. eToro – Over Best FX Trading Platform 2026

eToro is now one of the largest forex brokers in the online space – with more than 17 million clients on its books. The main attraction with eToro is that the platform is extremely easy to use.

And of course – the platform allows you to trade forex without paying a single cent in commission. Instead, this top-rated forex trading platform makes its money through the spread. In terms of what you can trade, eToro supports over 50+ forex pairs.

This covers a huge number of majors and minors, as well as a selection of exotic currencies like the South African rand and Hungarian forint. You can trade all supported currency pairs with leverage at eToro – with most users being able to access 1:30 on majors and 1:20 on minors and exotics.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

What we really like about eToro is that it is also suitable for those of you that have never previously traded forex and want to open a micro currency account. This is because you can elect to ‘copy’ a seasoned forex trader like-for-like.

There is no additional charge to do this and the minimum investment is just $200. In terms of the fundamentals, eToro is regulated by the FCA, CySEC, and ASIC. It keeps client funds in segregated bank accounts and verifies the identity of all trades. As such, you can trade forex at eToro in a safe and sound environment.

The platform supports debit/credit cards, e-wallets such as PayPal, and a bank transfer – so funding your account is easy. Finally, we should note that on top of forex, eToro also supports commission-free stocks, ETFs, indices, cryptocurrencies, and commodities.

Pros:

- Super user-friendly trading platform

- Buy stocks without paying any commission or share dealing charges

- 2,400+ stocks and 250+ ETFs listed on 17 international markets

- Trade cryptocurrencies, commodities, and forex

- Deposit funds with a debit/credit card, e-wallet, or bank account

- Ability to copy the trades of other users

- Regulated by the FCA, CySEC, ASIC and registered with FINRA

- Top-rated managed forex account

Cons:

- Not futures or mutual funds

- $5 withdrawal fee

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

2. Forex.com – Best Forex Trading Platform for US Residents

Although eToro makes our number one spot as the best forex trading platform of 2026 – it doesn’t allow US residents to buy and sell currencies. As such, if you’re an American and looking for the best forex site in the space right now – look no further than Forex.com.

As the name suggests, this provider is a specialist forex trading platform. By going through the motions of opening an account and making a deposit – you will then have unfettered access to over 80 currency pairs. This includes a huge variety of majors, minors, and exotics.

In particular, Forex.com is a great platform to consider if you want to access emerging currencies. In terms of fees, this popular forex trading platform offers several account types to choose from. For example, if you’re a casual forex trader you might consider opting for an account that offers commission-free positions.

At the other end of the scale, professional forex traders might opt for the STP Pro account. This allows you to trade from just 0.1 pips and a commission of $60 per $1 million traded. Crucially, we like the fact that Forex.com allows you to choose a pricing structure that meets your trading profile.

Forex.com gives you access to its own native trading platform – which can access online or via the provider’s mobile app, including advanced charting. Alternatively, you can also access your Forex.com account via the third-party platform MetaTrader 4 (MT4), where you can perform backtesting. The platform is also a proponent of forex EAs, as it offers 20 free forex trading strategies that you can easily install into your MT4 dashboard.

Pros:

- Specialist forex trading app

- Access to dozens of currency pairs

- An ECN forex broker.

- Particularly strong when it comes to exotic currencies

- No minimum deposit when opting for a bank wire

- Also offers CFDs for non-US traders

- Heavily regulated – including US licenses

- Access to the Small Exchange (small futures) and options

Cons:

- KYC process is a bit long-winded

There is no guarantee that you will make money with this provider. Proceed at your own risk..

3. VantageMarkets – Overall Best Forex Trading Platform 2026

VantageFX is our top recommended forex trading platform. This CFD trading platform first launched in Australia, but it’s since expanded around the globe. The brokerage has left its mark with a range of asset classes, very low fees, and excellent trading tools.

VantageFX is solely a CFD trading platform. They provide every investment opportunity from forex trading to cryptocurrencies, commodities, indices, and stocks. They are a brokerage geared towards every type of investor. Whether you’re new or experienced in trading, there is something to interest you here, with competitively low spreads and a zero commission account option.

A big part of why we recommend VantageFX is its high leverage forex trading. You can trade major forex pairs on margin of up to 500:1. Combined with the fact that you only need a $200 minimum deposit to open an account, this platform is excellent for traders who are starting out with small account sizes.

VantageFX offers a variety of trading platforms, including its own web trader and mobile app. The broker also integrates with the highly popular MetaTrader 4 and MetaTrader 5 trading platforms.

So, you can trade with forex signals or create custom technical indicators to suit your needs. Notably, VantageFX also enables social trading with Myfxbook, ZuluTrade, and Duplitrade.

VantageFX is regulated by the UK Financial Conduct Authority (FCA) and the Australian Securities and Investment Commission (ASIC). The broker offers 24/7 support in case you ever need help with your trading account.

VantageFX fees

Fee Amount Stock trading fee Variable spread Forex trading fee Spread, 1.4 pips for GBP/USD Crypto trading fee N/A Inactivity fee Free Withdrawal fee Free Pros:

- Zero commission on all assets and very low spreads

- Trade more than 40 forex pairs

- Up to 1:500 leverage

- Very fast trade execution

- Supports social trading with ZuluTrade and Myfxbook

- $200 minimum deposit

Cons:

- CFDs only

There is no guarantee that you will make money with this provider. Proceed at your own risk..

4. FXCM – Best Forex Trading Platform for Low Deposits ($50 Minimum)

If you a novice in the world of forex trading then you should choose a platform the supports low minimum deposits. In doing so, you can test the waters out slowly without risking too much capital.

In this sense, FXCM is a great option to consider - as the forex trading platform requires a minimum deposit of just $50.

Take note, that this is only the case for non-EU residents, as Europeans must meet a much higher deposit of $360. Nevertheless, FXCM is home to a great range of forex pairs - all of which can be traded commission-free.

Spreads are particularly competitive when trading major pairs. FXCM is also a great option if you want access to leverage. In fact, this top-rated forex trading platform offers leverage of up to 1:400. Your limits will, however, also be dictated by your location and prior trading knowledge.

For example, UK and European traders will be capped to 1:30. In terms of the forex trading platform itself, FXCM offers full support for MT4 and ZuluTrade.

Or, you might decide to use the provider's native FXCM Trading Station - with is very popular with newbies. Finally, FXCM has been active in the forex trading scene for over two decades and is regulated by the FCA.

Pros:

- FCA-regulated

- Lots of currency pairs to trade

- Choose from several trading platforms – including MT4

- Supports EAs and forex robots

- 0% commission on all assets

- Tight spreads

- You can also trade stock, crypto, oil, and gold via CFDs

Cons:

- Minimum deposit of $360 for EU clients

There is no guarantee that you will make money with this provider. Proceed at your own risk..

5. TD Ameritrade – Best Forex Broker for Reputation

TD Ameritrade is arguably one of the most reputable brokerage firms globally. Established more than four decades ago, the platform is typically known for offering a huge library of stocks, ETFs, and investment funds.

However, TD Ameritrade is also behind a fully-fledged forex trading facility. The platform supports a wide variety of tradable currencies, with pairs including the likes of USD, CAD, GBP, HKD, NZD, JPY, NOK, and more.

All supported pairs can be traded 23 hours per day - subsequently ensuring that the platform serves its global client base. We should note that the TD Ameritrade 'Thinkorswim' platform is best suited for experienced forex traders.

This is because it comes packed with professional-level tools and features that to the untrained eye - might come across as somewhat intimidating. When it comes to forex trading fees, TD Ameritrade builds all commissions into the spread. This means that you only need to look out for the gap between the bid and ask of your chosen FX pair.

Pros:

- Established US brokerage firm

- Huge asset library that includes thousands of stocks and funds

- Trade forex, futures, cryptocurrencies, and more

- Commission-free trades on US stocks and ETFs

- Fast bank transfer deposits

- Strong regulatory standing

- Great research materials

Cons:

- Best suited for experienced traders

- No deposits via debit/credit card or e-wallet

There is no guarantee that you will make money with this provider. Proceed at your own risk..

6. IG – Best Forex Trading Platform for Leverage

In some respect, leverage is a crucial tool to have at your disposal when trading forex online. After all, the day-to-day gains that you can make by buying and selling currency pairs are going to be somewhat modest.

As such, if you have access to a small amount of capital, it might be best to use a platform that offers high levels of leverage. Regulated broker IG is a good option here, as the platform offers leverage of up to 1:200 on pairs like EUR/USD, EUR/GBP, EUR/JPY, and USD/JPY.

US forex traders have smaller forex leverage, ranging between 20:1 to 30:1 for most currency pairs.

This means that with an account balance of just $200, you could potentially trade with $40,000. As always, you might be offered lower limits - especially if you are based in Europe and you're not deemed to be a professional trader. Nevertheless, we should note IG is much more than just a high leverage broker.

On the contrary, this hugely popular forex trading platform gives you access to over 80 currency pairs. Fees are really attractive too, as spreads on major pairs start from just 0.6 pips.

There are no commissions charged in the IG forex trading department, either. This platform allows you to trade directly from its website or via the iOS/Android mobile app.

Additionally, IG is also compatible with MT4. If you haven't previously heard of IG and are concerned about safety - you shouldn't be. This brokerage firm has been operational since the 1970s and it is now publicly listed on the London Stock Exchange. And most importantly - it is fully regulated in several jurisdictions.

Pros:

- Best trading platform for forex

- More than 80 currency pairs offered

- Spreads start at just 0.6 pips and no commissions charged

- Trade on the IG website or via the app

- MT4 is supported

- More than four decades in the brokerage space

- Easily fund your account with a debit card or bank transfer

Cons:

- A minimum deposit of $250

- No traditional stocks or ETFs for US traders

There is no guarantee that you will make money with this provider. Proceed at your own risk..

7. FXTM – Best Forex Broker for MT4

FXTM is a popular forex trading platform that offers full support for MT4. This means that once you open an account and make a deposit, you can place all buy and sell orders via the MT4 desktop software.

As a seasoned trader, you'll know that MT4 provides heaps of technical indicators and is compatible with automated forex EAs. FXTM itself offers a huge number of forex pairs and there are several account types on offer.

Albeit, if you're a low-level trader you will be pleased to know that the Cent Account requires a minimum deposit of just $10. Plus, this FXTM account allows you to trade forex with micro amounts. This is perfect if you are trading forex online for the first time. In terms of forex trading fees, this will depend on your chosen account type.

For example, some accounts offer zero commissions and wider spreads, while others allow you to trade currency pairs at 0 pips. If you're a newbie, FXTM offers a good selection of educational and research tools. This will allow you to become a better forex trader over the course of time. Furthermore, the broker offers its clients 24/7 customer support via chat and email.

Pros:

- Provides heaps of educational resources

- Great for market insights and market research

- Several account types supported

- Extensive forex department

- No commissions when trading currencies

- Great reputation and heavily regulated

Cons:

- Does not support US traders

There is no guarantee that you will make money with this provider. Proceed at your own risk..

8. XTB – Best Multi-Asset Forex Trading Broker

If you are looking to trade several different asset classes other than just forex, XTB might be a good option to consider. The online trading platform is particularly popular in Mainland Europe - as XTB's parent company is listed on the Warsaw Stock Exchange.

Nevertheless, the forex trading department at XTB is highly extensive, with dozens of pairs to choose from. Best of all, you won't need to pay any commissions when trading forex, as everything is built into the spread.

This is also the case with indices, commodities, and digital currencies like Bitcoin and Ethereum. If you're also keen on trading stock CFDs, XTB will charge you a very small commission of 0.08% per lot. There are no fees to get started with XTB and there is no minimum deposit to take into account.

You can easily add funds with your everyday debit/credit card - which is processed fee-free. Although several e-wallets are supported, this does come with a 2% transaction charge. XTB uses its own trading platform that was built from the ground up - xStation. This is available online or via the XTB mobile app, which you can use on mobile devices such as iPhone and the ones compatible with Android.

Pros:

- Great platform for trading multiple asset classes

- More than 1,500 markets

- Covers forex, stocks, indices, digital currencies, and more

- 0% commission on most markets

- Tight spreads

- Leverage available

Cons:

- 2% transaction fee on e-wallet deposits

75% of retail investor accounts lose money when trading CFDs with this provider.

9. CMC Markets – FX Trading Platform With More than 330+ Pairs

When it comes to the extensive of supported forex trading market, nobody gets close to CMC Markets. This is because the online trading platform offers more than 330+ forex pairs. Naturally, this includes each and every major and minor pair in the market.

But, CMC Markets is really strong when it comes to trading emerging currencies. This includes everything from the Indian rupee and Mexican peso to the South African rand and Singapore dollar. CMC Markets is home to an award-winning trading platform that is compatible with desktop browsers, Android, iOS, and tablets.

Additionally, you can also trade forex at CMC Markets via MT4. When it comes to trading fees, CMC Markets builds all costs into the spread. This starts at a very competitive 0.7 pips on EUR/USD and USD/JPY, and more on other pairs. Outside of the forex department, CMC Markets also supports CFDs in the form of stocks, indices, cryptocurrencies, commodities, and Treasuries.

If you like the sound of CMC Markets, it takes just minutes to open an account with this top-rated forex broker. There is no minimum deposit and the platform supports debit/credit cards and bank transfers. However, a major flaw here is that CMC Markets charges 2.3% on debit card deposits and 3% when using a credit card.

Pros:

- More than 330+ forex pairs supported

- Thousands of CFD markets on stocks, cryptocurrencies, commodities, and more

- 0% commission when trading forex

- No minimum deposit

- Great reputation and heavily regulated

- Tight spreads

Cons:

- 2.3% and 3% charge on debit card and credit card deposits, respectively

There is no guarantee that you will make money with this provider. Proceed at your own risk..

How to Start Trading Forex

If you've read through this guide up to this point, you should now know what it takes to find a forex trading platform for your needs. All that is left to do now is place your first forex trading order.

To ensure you know what this entails, we are going to walk you through the setup process is commission-free platform eToro.

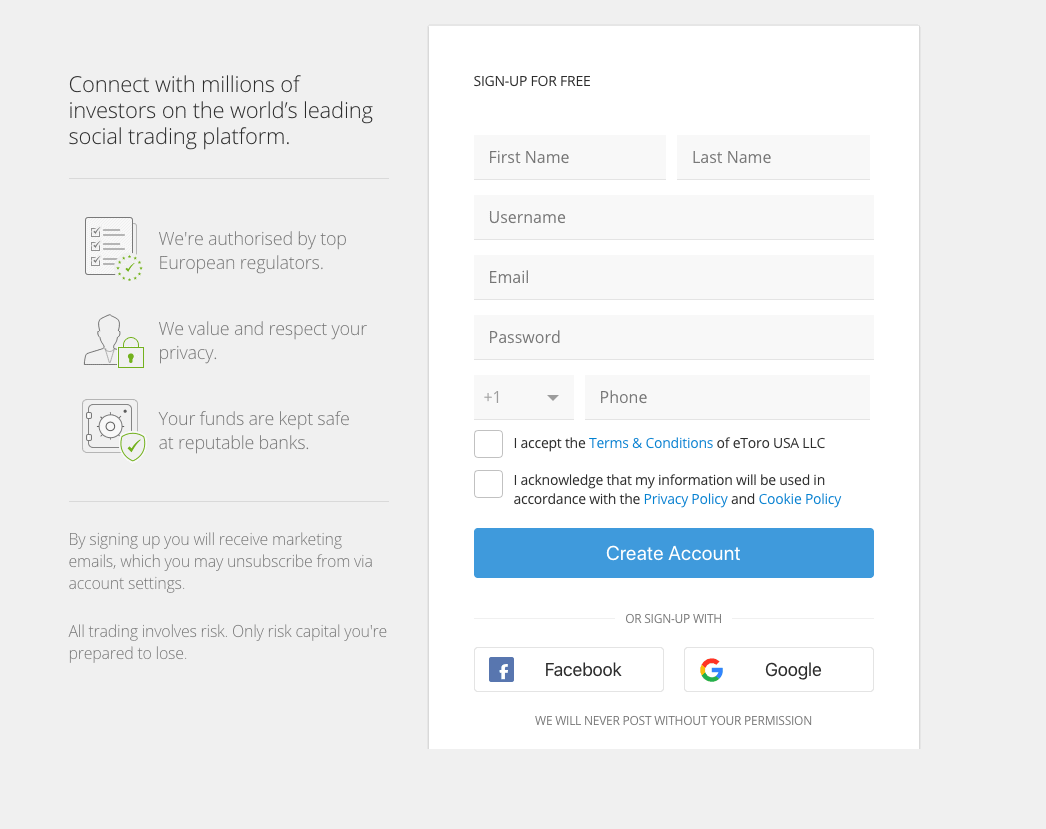

Step 1: Open an Account and Upload ID

Even if you want to use eToro to trade via the demo account, you will still need to open an account. This does, however, take just a few minutes.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

All you need to do is visit the eToro website, click on 'Join Now, and follow the on-screen instructions. You'll need to provide some personal information, contact details, and your national tax number.

Step 2: Confirm Identity

As a regulated forex trading platform, eToro is required to verify all new account holders. Once again, this takes just a couple of minutes at eToro and will require the following two documents:

- Valid passport or driver's license

- Utility bill or bank account statement (issued within the last 3 months)

Step 3: Deposit Funds

eToro will now ask you to make a deposit into your newly created forex trading account.

You can choose from the following deposit options:

- Debit cards

- Credit cards

- E-wallets (Paypal, Skrill, or Neteller)

- Bank transfer

Unless you opt for a bank transfer, all deposits on eToro are processed instantly.

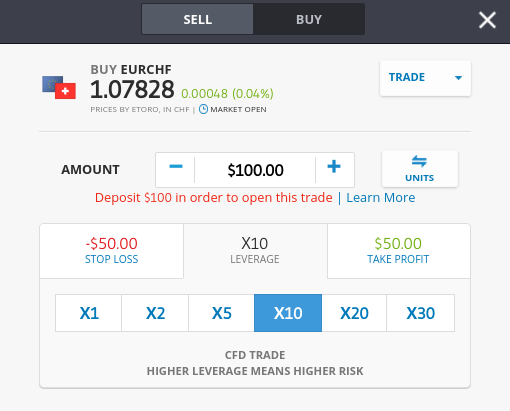

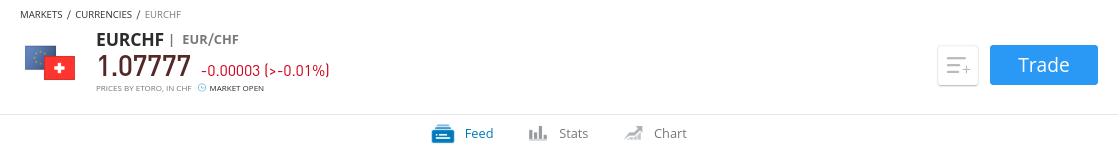

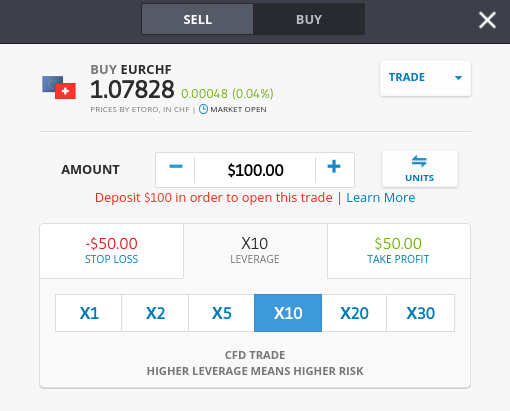

Step 4: Search for a Currency Pair

Once your deposit has been processed, your can search for the forex pair that you wish to trade. In our example, we are looking to trade the Euro (EUR) against the Swiss franc (CHF). As such, we enter 'EURCHF' into the search box and click on the result that pops up.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Then, you need to click on the 'Trade' button.

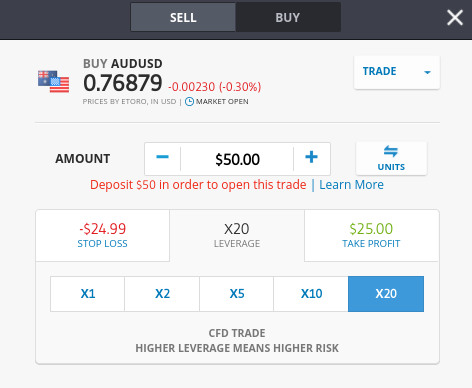

Step 5: Place a Trade

Now you will need to set up a forex trading order.

The main fields that you need to fill in are as follows:

- Buy/Sell Order: A buy needs to be placed if you think the pair will increase in value. A sell order is required if you think the pair will decrease in value.

- Amount: This is the amount that you want to stake on this forex trade. At eToro, this should always be entered in US dollars.

- Leverage: If you want to trade with leverage, select your desired multiple.

You can also select the exact price that you want your forex trade executed at. To do this, click on the 'Trade' button at the top right-hand side of the box and select 'Order'. Then, enter your desired entry price.

You can also enter stop-loss and take-profit orders by clicking on the respective button and entering your chosen exit price.

Finally, click on 'Open Trade' to place your commission-free forex trading order on eToro!

Conclusion

One of the most important decisions that you need to make when trading forex online is that of the platform you decide to sign up with.

After all, you will be risking your hard-earned money - so you need to ensure the provider is regulated by a reputable body. You also need to ensure the platform offers your chosen forex trading pairs and allows you to enter positions in a cost-effective manner.

After reviewing dozens of providers, we found that the best forex trading platform in the market right now is eToro. This heavily regulated platform offers over 50+ pairs - all of which can be traded commission-free and at low spreads.

Getting started at eToro takes minutes, the platform is simple to use, and you can instantly make a deposit with a debit/credit card or e-wallet!

eToro - Overall Best Regulated Forex Trading Platform

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

FAQs

Which forex trading platform charges the lowest fees?

When looking at forex trading fees - you need to consider commissions and spreads. We found that eToro is the best-priced forex trading platform, as the provider charges no commissions and offers tight spreads on most of its FX marketsWhich forex trading platform offers the most currency pairs?

If your main priority is having access to heaps of markets - our CMC Markets forex trading platform review found that the provider offers more than 330 pairs.What is the best forex trading platform for beginners?

If you are looking to access the multi-trillion-dollar forex trading market for the first time - you might want to consider using eToro. The popular online platform was built with newbies in mind, making it ideal for those of you with little to no experience.Are forex trading platforms safe?

All of the forex trading platforms discussed on this page are safe - as they all hold at least one license with a reputable financial body. Unfortunately, there are also forex trading platforms active in the online space that operate without the regulatory remit to do so. As such, always tread with caution.How do forex trading platforms make money?

Some forex trading platforms make money by charging a commission. Others make money from the spread - which is the gap you see between the buy and sell price of your chosen forex pair. Forex trading platforms can also make money by charging fees related to deposits, withdrawals, overnight funding, and inactivity.Which forex trading platforms accept Paypal?

eToro allows you to deposit and withdraw funds with Paypal. It also supports Skrill and Neteller.What is the best forex trading platform for US residents?

The best forex trading platform for US residents is arguably Forex.com. This heavily regulated platform offers over 80 FX pairs - all of which can be traded commission-free.Kane Pepi Finance Writer

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, InsideBitcoins, Blockonomi, Learnbonds, Buyshares n and the Malta Association of Compliance Officers.

Before starting his career as a writer, Kane studied at the University of Central Lancashire where he received a Masters Degree in Financial Investigation and then a Research Doctorate in Criminal Justice. Pepi is passionate about helping people to make informed decisions through high-quality, educational content.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

FXTM is a popular forex trading platform that offers full support for MT4. This means that once you open an account and make a deposit, you can place all buy and sell orders via the MT4 desktop software.

FXTM is a popular forex trading platform that offers full support for MT4. This means that once you open an account and make a deposit, you can place all buy and sell orders via the MT4 desktop software.

If you are looking to trade several different asset classes other than just forex,

If you are looking to trade several different asset classes other than just forex,