Best Swap Free Forex Brokers – Pros & Cons

Muslim traders keen on entering the forex market need to use Swap Free Forex Brokers in order to trade within Islamic law. Nowadays, however, many brokers make swap free account forex available to everyone.

In this swap free forex brokers article, we’ll take a look at all the best no-swap forex brokers, their key features, and what you need to know about free swap.

Best Swap Free Forex Brokers in 2025

So which forex broker has swap free accounts? Below is a list of our three forex swap free account brokerages. As you go through this article you will understand more the forex broker swap free features and free swap strategies.

What Does Swap in Forex Mean?

A swap in Forex is a transaction where two parties exchange a certain value of money but in different currencies. The parties essentially are loaning each other money until they need to repay the amounts back at a specified date and exchange rate. There are many reasons for this, like hedging their exposure to the exchange rate. They could also be doing this to reduce the cost of borrowing in a different currency.

The difference in interest rates between currencies means that there will be someone who will have to pay interest via swap and another who will be paid the interest via swap. Generally, the swap isn’t a significant amount when it comes to Forex, but it can definitely affect trades – especially for Muslim traders.

In Forex trading, a “swap” refers to the interest that is either earned or paid by a trader for holding a position overnight. This aspect of Forex trading is particularly relevant for Muslim traders due to the principles of Islamic finance.

Islamic finance, which is guided by Sharia law, strictly prohibits “Riba,” which can be translated as usury or unjust, exploitative gains made in trade or business. Riba is often interpreted to include any form of interest, making traditional swap fees in Forex trading non-compliant with Islamic financial principles.

For Muslim traders, this means engaging in traditional Forex trading, where swap fees are charged, could conflict with their religious beliefs. To address this, many Forex brokers offer “swap-free” accounts, also known as Islamic accounts. These accounts are structured to avoid any form of interest. Instead of swap fees, brokers might charge administrative fees or use other methods to compensate for the lack of swap revenue, but these charges are structured in a way that they do not constitute Riba.

Thus, for Muslim traders, a swap-free Forex account allows them to participate in the global currency markets while adhering to the ethical and religious principles outlined in Islamic finance. This accommodation is significant in ensuring inclusivity and respect for diverse financial practices and religious beliefs in the global financial market.

What is a Swap Free Forex Account?

So what does swap in Forex mean? In terms of the trader, it could be said that the swap is the interest that needs to be paid for the amount of money being held in a trade past 24 hours. So when we say free swap in a Forex account, that means that there is no interest for holding positions overnight. Which Forex broker has swap free accounts will vary, but in this article, we have already covered a few.

Additionally, it is possible to have a swap free account Forex for certain brokers. Swap free Forex brokers normally earn what they would normally earn from swaps via another agreed-upon fixed price. This does not go against the Shariah law that Muslim traders are under.

Best Low Swap Fee Forex Brokers Reviewed

Ready to get started on the reviews of the best free swap forex brokers? Let’s go through our top picks among all the top free account forex.

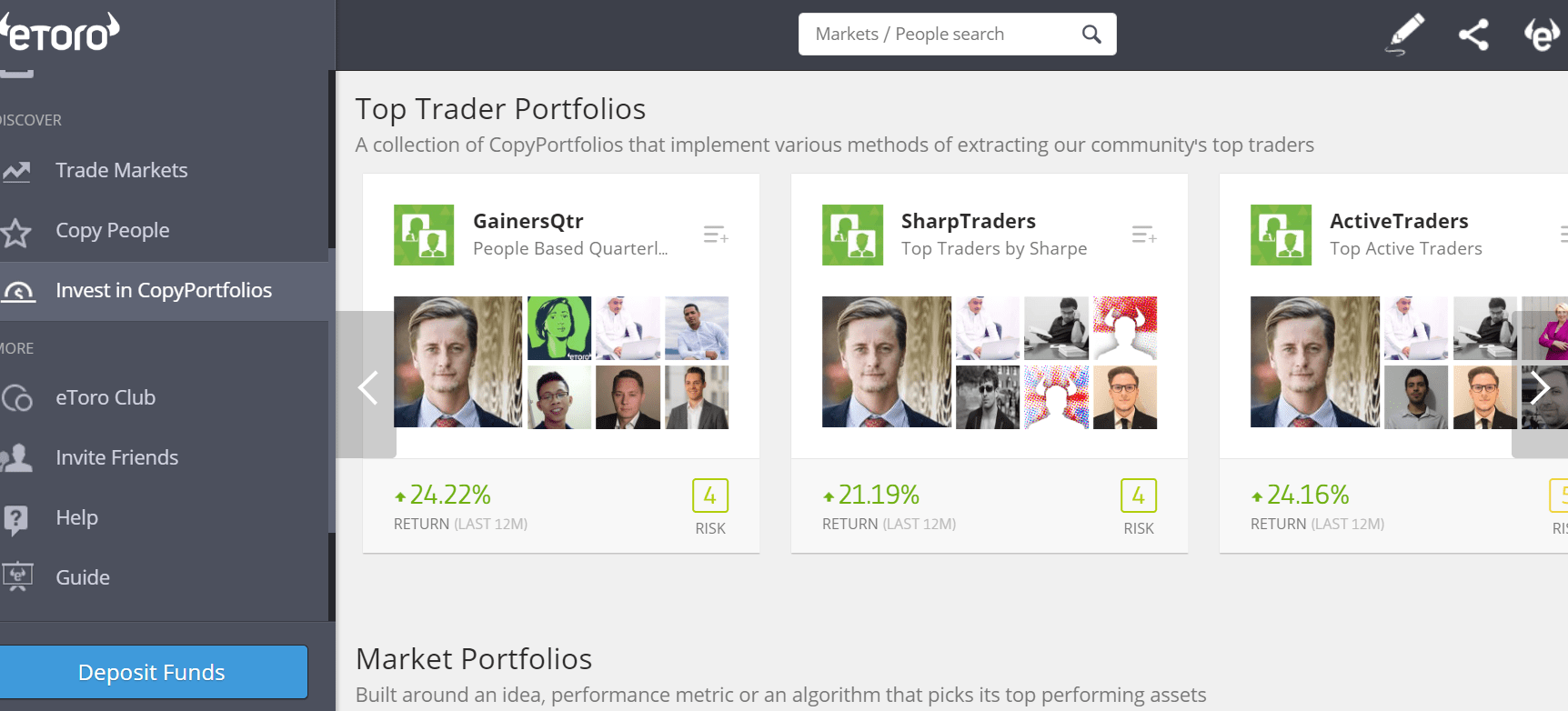

1. eToro – overall best swap free Forex trading app

Our first, and recommended swap free account forex is eToro as it is our highest-rated platform. Founded in 2007, eToro’s popularity is only preceded by its features. With over 20 million customers from different parts of the world, it’s not hard to keep the international broker at the forefront of forex platforms.

eToro has been recognized as the Overall Best Swap-Free Forex Trading App for Islamic accounts, a distinction highlighting its excellence in catering to the unique needs of Islamic finance.

This platform stands out for its compliance with Sharia law, which prohibits interest (or ‘Riba’). eToro offers an interest-free trading experience, ensuring that its Islamic accounts do not incur any swap fees or interest on positions held overnight.

This makes it an attractive choice for Muslim traders who seek to engage in Forex trading while adhering to their religious principles. Additionally, eToro’s user-friendly interface and comprehensive trading tools further contribute to its appeal as a top choice in this specialized market segment.

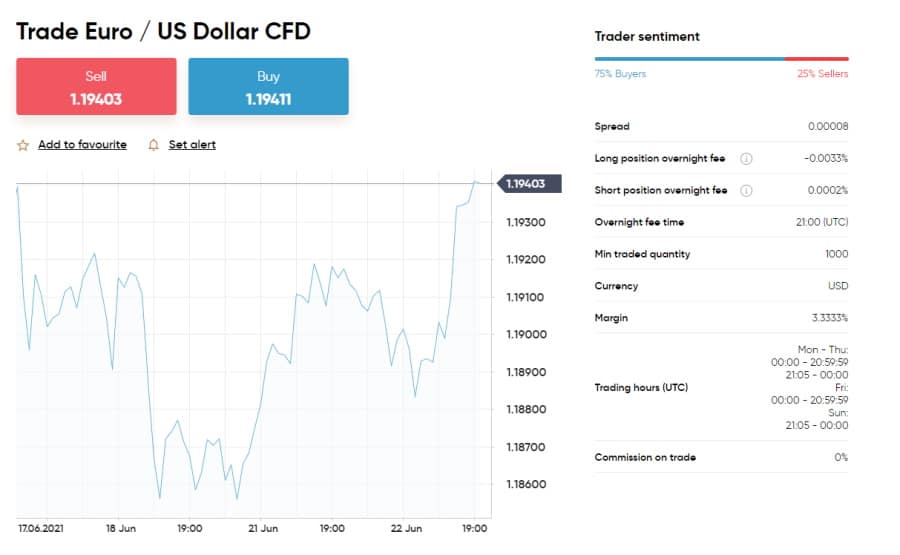

The social trading platform draws from the needs of customers with key features like an easy-to-use mobile app, copy trading, virtual equity, and superb customer support. eToro also has access to 40 major currency pairs like USD/EUR, as a couple of minor forex pairs and exotic pairs as well.

Additionally, eToro has a user-friendly proprietary platform that makes it easy especially for beginners to navigate through different equities and easily execute trades in any market. Because the trading platform also accepts payments via bank transfer, debit/credit cards, and e-wallets like Neteller and Paypal, it’s extremely easy for new users to start trading and using the platform.

In terms of fees, there are no deposit fees for eToro. However, there is an inactivity fee if you have not used the platform (no log in) for a year. This is easy to get around as you only need to log in once a year to be able to still be considered an active user.

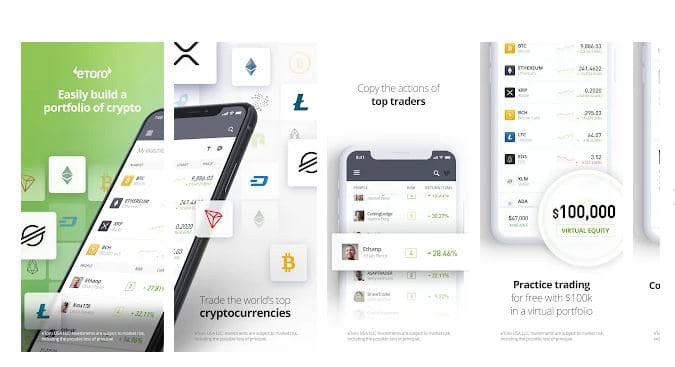

Perhaps the most attractive and popular feature of eToro is its social trading aspect. Users have the option of copying other traders in the platform – professionals, industry experts, and other investment specialists. Their earnings will reflect based on whoever they copy, so the more their copied trader earns, the more they earn as well.

For newbie traders, copy trading is a huge deal as it lets them more safely invest or have someone else handle their trading for them. They can then learn what trades and what executions their copy trader does and eventually branch out and learn how to do their own trading in the future.

As for the swap-free aspect, eToro also allows for Islamic accounts which are innately zero swap. Simply create an eToro account in the platform, verify the account, deposit $1,000, and then contact customer service in order to set up the Islamic account. This will allow you to trade in Etoro which has essentially become a free swap broker for you.

To add, eToro is also well regulated in various international standards. Being an international broker means the platform services users of various nationalities all over the world, so the right measures and laws have to be in place depending on the location of the users.

Finally, Etoro also hits the ball with its great customer service. They have live chat, 24/5 customer support, and an inquiries system that better helps them answer any of your questions and concerns. For the higher-tiered users who have larger amounts of equity in the platform, an account manager or an account agent is available for them if they want to email or schedule a call regarding their account.

eToro fees

[| Fee | Amount |

| Stock trading fee | Free |

| Forex trading fee | Spread, 2.1 pips for GBP/USD |

| Crypto trading fee | 1% for buying or selling crypto |

| Inactivity fee | $10 a month after one year |

| Withdrawal fee | $5 |

Pros

- All-in-one platform with stocks, indices, ETFs, cryptocurrencies, forex, and commodities trading

- Zero commission

- Wide range of payment methods with debit/credit card, e-wallet, bank transfer, and PayPal

- Social trading and copy trading features

- User-friendly mobile app

- Licensed and regulated by the FCA, ASIC, and CySEC

Cons

- Doesn’t display volume and more advanced technical indicators

- Lacks smaller cryptos, stocks, and forex pairs

- $5 withdrawal fee Only USD as base currency

- Customer support should be improved

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

2. AvaTrade – Multiple swap free Forex trading apps and competitive fees

AvaTrade is a popular forex broker founded in 2006 and is internationally regulated. Users can trade forex, CFDs, and cryptocurrencies with zero commission, making AvaTrade another all-in-one platform as well.

When it comes to zero swap trading, AvaTrade accepts Islamic accounts as well that follow the Shariah law. To do this in the platform, simply follow these steps:

- Create and verify an account with relevant documentation

- Deposit to fund your trading account

- Send a request in the platform for an Islamic account. This is usually processed in 1-2 business days.

Furthermore, AvaTrade integrated MetaTrader 4 (MT4) and MetaTrader 5 (MT5). There is also a proprietary mobile application available for download on Android and iOS.

To add, AvaTrade has great educational content and digital resources for those who are new at trading. They might not have copy trading like eToro, but they still do have virtual trading through their demo account. It comes with $100,000 of virtual equity that beginners and seasoned traders alike can use to test trading strategies.

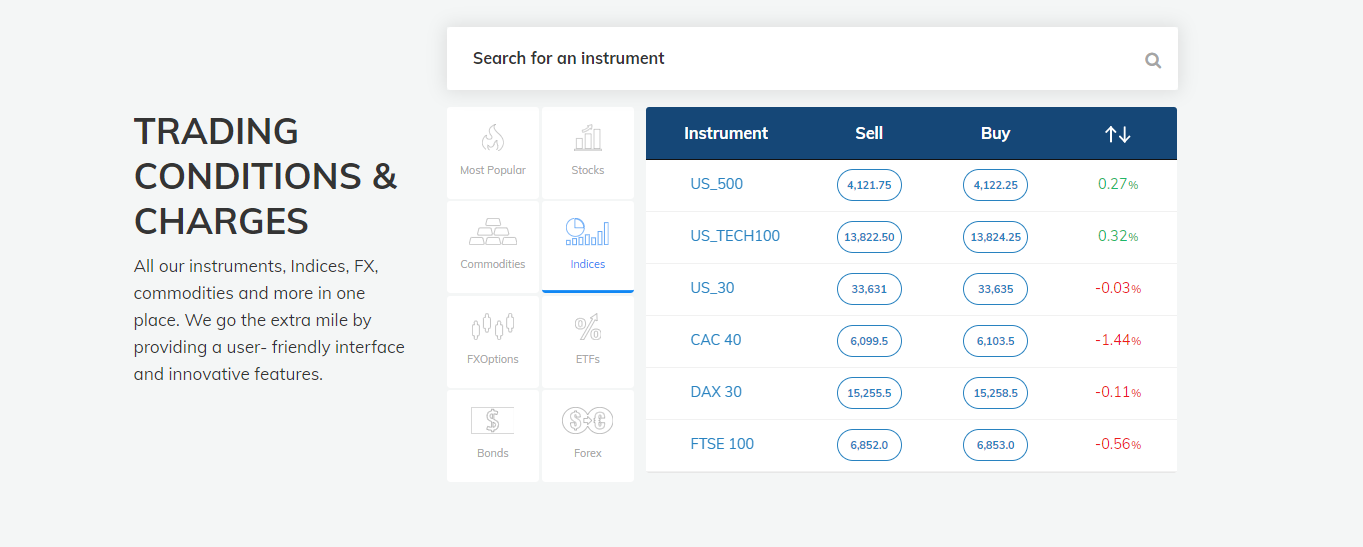

AvaTrade has highly advanced tools to help traders analyze and create trading strategies. With 250 financial instruments, 24/7 crypto trading, and other equities to invest in, AvaTrade makes it on our list for one of the best swap free account forex has.

Being an online broker of an international scale, AvaTrade is also a globally regulated platform. Among its licensors are the Australian Securities and Investments Commission (ASIC), the Financial Sector Conduct Authority in South Africa, and CySEC.

AvaTrade fees

| Fee | Amount |

| CFD trading fee | Variable spread |

| Forex trading fee | Spread. 0.9 pips for EUR/USD |

| Crypto trading fee | Commission. 0.25% (over-market) for Bitcoin/USD |

| Inactivity fee | $50 per quarter after three months of inactivity |

| Withdrawal fee | Free |

Pros

- Many payment methods – credit/debit cards, wire transfer, and e-payments

- The low minimum deposit at just $100

- Multiple integrations in MT4, MT5, AvaTradeGo, Automated Trading, and AvaSocial

- Many educational content and resources available

- Free demo account

- Internationally regulated

- Zero deposit and withdrawal fees

Cons

- Lack of traditional investments

- Hefty inactivity fees

- Limited to only CFDs, Forex, and cryptocurrencies

- Mediocre fees for CFD trading

There is no guarantee that you will make money with this provider. Proceed at your own risk..

Swap Free Forex Brokers Fees & Leverage Comparison

Below is a table comparison of some of the trading and other fees from our top Swap Free Forex Brokers.

| GBP/USD Spread | EUR/USD Spread | Deposit/Withdrawal Fees | Inactivity Fees | |

| eToro | 1.4 pips | 1.0 pips | $5 per withdrawal | $10 per month after 12 months |

| AvaTrade | 1.6 pips | 0.9 pips | None | $50 after 3 months of inactivity and a $100 administration fee after one year |

Below is a leverage comparison of the three Swap Free Forex Brokers for major and minor currency pairs.

| Major Currency Pair Leverage | Minor Currency Pair Leverage | |

| eToro | 30:1 | 30:1 |

| AvaTrade | 30:1 | 30:1 |

Tips for Trading With Swap Free Forex Accounts

Because every cost does count when it comes to Forex trading, it is important to know a few tips when it comes to trading with swap free forex accounts.

First, it is important to know which Forex broker has swap free accounts. Next, you’ll need to understand what does swap in Forex mean. Once you’ve got that figured out, you can create a swap free account Forex, use the free swap broker, and swap in Forex.

Leverage

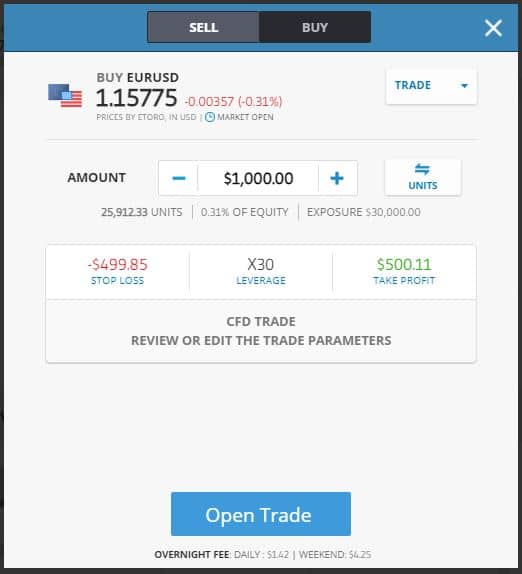

The reason why swaps exist for Forex accounts is that when you use CFD Forex trading, you’re actually borrowing money in order to execute a leveraged trade. With the maximum leverage at 30:1, it is important to keep in mind how much you’re okay with making money and how much you are with losing it.

You also need to understand or at least agree upon a certain time frame when executing your leveraged Forex trade. This is because long-term strategies work differently from short-term strategies. The same way as to how price movement is different in the short and long term.

Furthermore, it is especially important to figure out the volatility in the market when trading. The higher the leverage you use, the riskier things can get especially in a highly volatile market. What can end up happening is that price movement is too fast and can easily catch novice traders off the guard with their leveraged positions. Make sure that your strategy has volatility accounted for, especially when it comes to higher leveraged trade executions.

Fixed rate

There is a lot of merit in using a Forex broker that is swap free since so many brokers have varying swap fees depending on whether it is over a weekend or on a weekday. Understand how to use the free swap broker by figuring out instead how much the agreed-upon fixed rate you have with your broker is.

Once you know how much your fixed rate is for when you make Forex CFD trades, you can then easily account for it in your trading strategy. For example, make sure you know what your trading time frame is. Is it one week? One day? Five hours? This will affect how much you’ll need to pay your broker when it comes to the fixed-rate because this can add up.

End goal

Whether you are a Muslim trader or just a trader that wanted to simplify their experience with the use of swap free trading, you’ll need an end goal. The end goal anyway in any trade is to make sure you can continue to trade another day and that you also earn.

With this in mind, make sure that it is in your strategy not to risk your entire account with leverage even if your account is swap free. Make sure that the other costs are accounted for in your trading strategy and that it all works in your best interest.

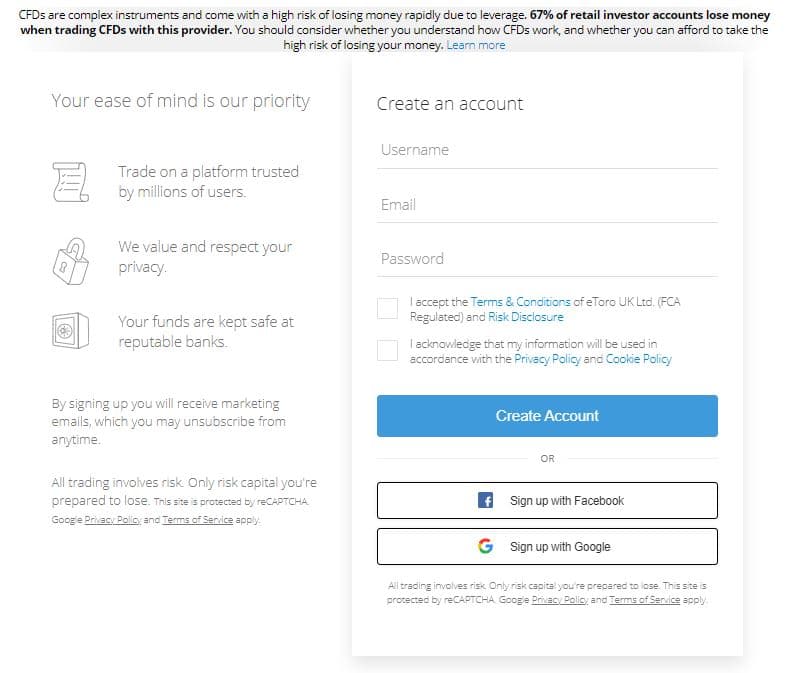

How To Get Started With A Swap Free Forex Broker – eToro

Among the best swap free Forex brokers is eToro, our recommended Forex swap free account. Below, we’ll go through a mini tutorial how to use the forex broker swap free.

Step 1: Create an account

Head over to the eToro website and create an account. You can use your Google or Facebook account to sign up or fill up the fields and sign up.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

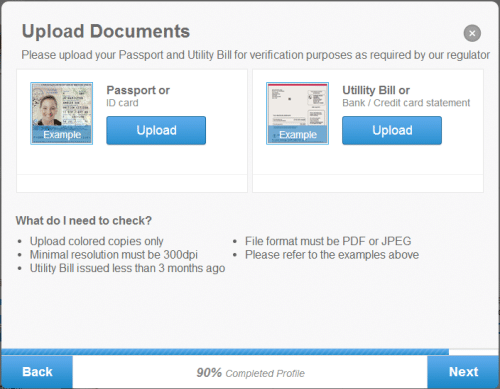

Step 2: Verify Your Identity

After creating an account, you’ll need to verify your identity in this next step. Upload a valid ID as well as a utility bill in the ‘upload documents’ part of the account verification. Make sure to upload a clear copy of your documents. Take note also that the utility bill submitted for the proof of address has to be issued less than 3 months ago. Alternatively for the proof of address, it is possible to release a bank or credit card statement of account.

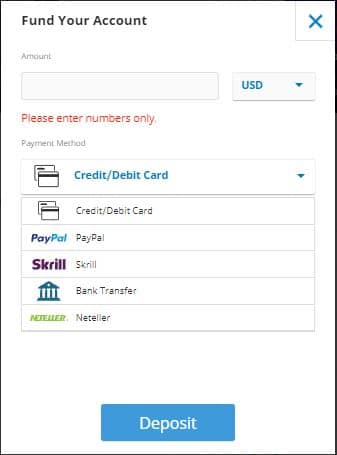

Step 3: Deposit funds

For the swap free account, make sure you have a minimum deposit of at least $1,000 to move on to the next step. Use one of the many listed payment options (credit/debit card, PayPal, Skrill, etc.) to make your deposit. Don’t worry, there are no deposit fees for eToro. It is also good practice to check your bank account or payment method to see if the funds were transferred correctly into the eToro platform.

Step 4: Start trading swap free

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

With a fully verified account and $1,000 equity, you can now send an inquiry to customer service about making your account an Islamic account. Wait for the response of the customer agent and they will communicate with you the necessary steps and agreements needed to have your account become swap free.

Once your account has been changed to an Islamic account that is swap free, you can then search for the forex pair of your choice available in eToro and start trading. Use up to 30:1 leverage on your trades and make sure to set the right stop loss and take profit measures depending on your trading strategy.

Conclusion

If you’re keen on following the Shariah law as a Muslim trader or just looking to trade with a forex broker swap free, keep in mind our top picks for swap free account forex. The easiest way is to create an account in eToro, a forex broker swap free.

Want to get started with a free swap account in Etoro? Click the link below to create an eToro forex swap free account today!

eToro – overall best low spread Forex broker

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.