A new study reveals that a significant quantity of the world’s wealth is illiquid. That includes real estate, pre-IPO stocks, private debt, business revenues, and private funds, among many more.

For many would-be investors, their pricey nature, deficiency in wealth management expertise, and regulatory hurdles exacerbate their scanty access. Tokenization provides a means of unlocking the liquidity of these assets.

Tokenization is the process of assigning a digital token to an underlying asset. The token can represent ownership of the asset, a right to use the asset, or a claim on the asset. One can then trade these tokens on decentralized exchanges.

Tokenized Assets are Growing in Popularity

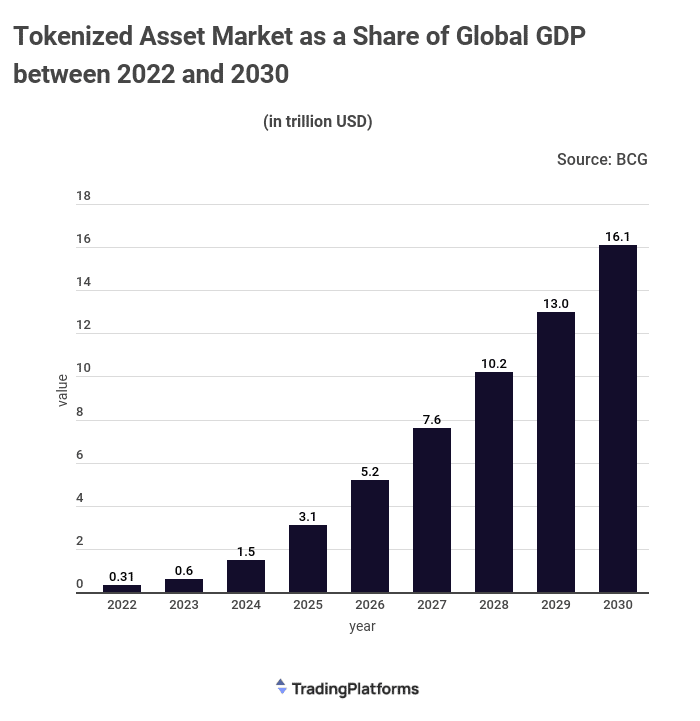

Tokenized assets have been gaining in popularity in recent years, and TradingPlatforms has predicted that this trend will only continue. The site has presented data projecting that the global market for these assets will grow from its current value of $310B to $16.1T by 2030. This growth would represent a 2400% surge and equate to 10% of the global GDP.

TradingPlatforms’ Financial lead Edith Reads has shared her thoughts on the data. She affirms, “Tokenization is a natural evolution of the current financial system, which is already moving towards digital asset ownership and trading.”

Edith adds. “ With tokenization, you can easily divide, manage, and trade assets globally. This would allow for a more efficient and liquid marketplace, with tokenized assets becoming a standard part of the global economy.”

Furthermore, she believes this shift could significantly impact the world’s GDP, with tokenized assets potentially accounting for a large share of the total.

As the tokenization of assets becomes more widespread, we may see a dramatic increase in the global trade of goods and services. This increase would not only boost GDP but also create new opportunities for economic growth and development.

What are the Benefits of Tokenization?

The benefits of tokenization are manifold. First, it allows investors to access a broader range of assets than they would otherwise have access to. By tokenizing assets such as real estate, art, or private equity, investors can gain exposure to new markets and asset classes that were previously unavailable to them.

Second, tokenization makes it easier for investors to manage their investments. With all their assets represented as digital tokens, investors can easily buy, sell, or trade them on decentralized exchanges. This liquidity makes it easy for investors to take advantage of market opportunities and rebalance their portfolios quickly and efficiently.

Third, tokenization provides investors with greater security and peace of mind. By taking assets out of the traditional financial system and into the blockchain-based world of tokens, investors can reduce their exposure to risk and fraud.

Tokenization and Future Investments

The transparent and immutable nature of the blockchain ensures that all transactions are recorded publicly and cannot be tampered with. This security is a major draw for investors looking for ways to protect their portfolios from potential mischief.

Looking ahead, it is clear that tokenization will play a significant role in the future of investing. By giving investors easier access to a broader range of assets and providing greater security and liquidity, tokenization is poised to revolutionize the global economy.

Question & Answers (0)