Best Crypto Loans in 2026 – Pros & Cons

Cryptocurrency is the most popular keyword in the financial and technological worlds. Crypto has introduced fresh perspectives on financial services based on the power of blockchain technology. Surprisingly, crypto has recently achieved widespread appeal, resulting in the rapid development of a slew of new methods for extracting value from crypto assets.

Crypto lending is clearly one of the most famous strategies for getting additional value from your crypto holdings in recent times. It is critical to comprehend the worth of crypto lending efficiently as the quest for the finest crypto loan platform becomes a top priority for crypto investors. You can also have a thorough understanding of the key criteria to consider when choosing a cryptocurrency loan platform.

Best Crypto Loans List 2026

- DeFi Swap – Best Loan Provided With High Interest Rates

- eToro – The Overall Best Crypto Loan Provider

- SALT -The Best Crypto Loan Provider for Stablecoins

- BlockFi – The Best Bitcoin Loan Provider for Low Interests

- Nexo – The Best Cryptocurrency Loan Platform for Instant Approvals

- Gemini – The Best Crypto Loan Provider for Flexible Rates and Plans

Best Crypto Loan Platforms Reviewed

1. DeFi Swap – Best DeFi Loan Provided With High Interest Rates

DeFi Swap offers the best crypto loans. DEX coins are among its most important features. As a DEX, it offers the services of exchange, yield farming, and staking and is a decentralized and community-run exchange. DeFi Coin, referred to as DEFC, is a token that must be used to access the platform.

The only requirement is that you use your preferred browser. Additionally, the platform is built on the Binance Smart network, which allows users to make purchases of Binance coins to exchange for the tokens supported by DeFi Swap, including DAI, USDC, and ANKR.

There are betting services available on DeFi Swap. In this service, users can also lock their tokens for some time to receive interest payments. However, the lock-in period is very similar to that for liquidity funds, and the units cannot be accessed until the lock-in period is over.

In DeFi, you receive much higher inside interest rates than can be received from a standard bank account, so if you are thinking of a long-term investment, performance farming could make sense.

The DeFi coin can also be purchased for just one dollar, and the official Telegram group has over 6000 members, making it one of the safest and most reputable coins.

DeFi Swap fees

| Fee | Amount |

| Crypto trading fee | 10% |

| Inactivity fee | N/A |

| Withdrawal fee | N/A |

Pros:

- Online portal designed with the user in mind

- Support for over 50 tokens

- Powered by Binance Smart Chain

- By investing in DEFC, you can earn passive income

- There are stake and yield farming mechanisms available

Cons:

- The mobile app is still being developed

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

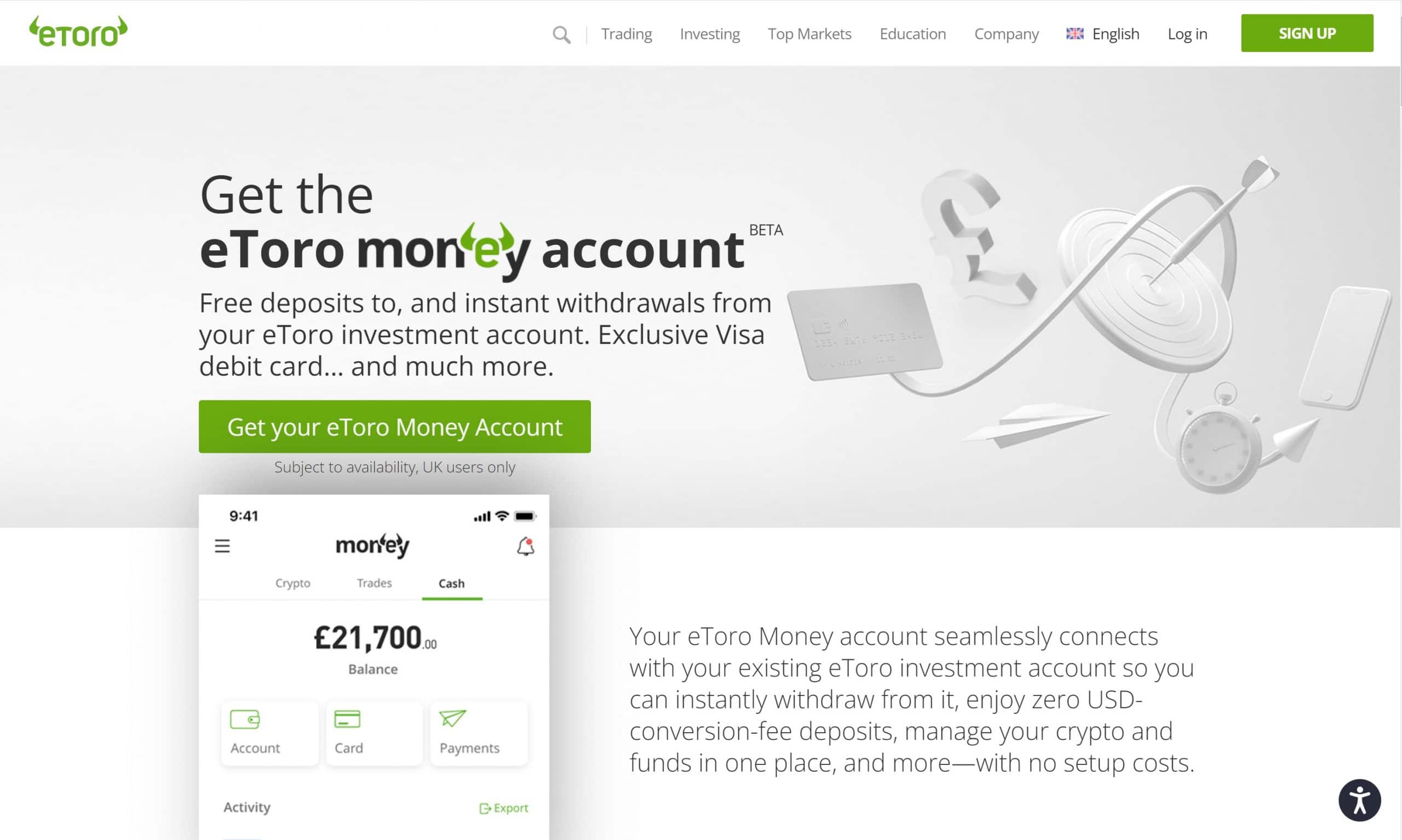

2. eToro – The Overall Best Crypto Loan Provider 2026

Crypto loans demand Bitcoin or Ether as security, and there is no better way to buy cryptocurrencies than with an eToro Money Account.

The eToro Money Account connects to your eToro account so you may trade cryptocurrencies, make quick withdrawals, and keep track of your crypto holdings. The Money account connects seamlessly with the eToro Investment platform, allowing investors to manage their cryptocurrency from a single location.

This program allows you to buy any cryptocurrency you want easily. Traders can also use the eToro Money Account to store and manage their assets. You can transmit any bitcoin you’ve acquired to any wallet using the program.

The eToro Money App includes a Visa Debit Card, allowing you to easily spend your crypto loans and withdraw them at ATMs. Customers who open a virtual bank account are also given a sort code and a personal bank account number. This account number can be used to send and receive money from other financial institutions. eToro’s Money Account also offers free currency conversions and a $5 savings bonus for every $1,000 you deposit. In conclusion, eToro Money Account is a fantastic way to keep track of your crypto-backed loans.

eToro fees

| Fee | Amount |

| Crypto trading fee | Spread, 0.75% for Bitcoin |

| Inactivity fee | $10 a month after one year |

| Withdrawal fee | $5 |

Pros:

- Support for 25+ cryptocurrencies including all major coins and some minors

- Different loan periods available according to requirements

- Comes with a VISA debit card

- Regulated by the FCA and a variety of other Tier-1 regulatory agencies

Cons:

- Subject to availability across different jurisdictions

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

3. SALT – The Best Crypto Loan Provider for Stablecoins

SALT is a cryptocurrency-based loan and borrowing platform. The platform was founded in 2016 and is situated in Denver, Colorado.

Twelve cryptocurrencies, including four stablecoins, are supported by the crypto lender. SALT has a $5,000 minimum loan deposit, which is quite hefty.

SALT’s main advantage is that it lets you take out a variety of loans, notably personal and business loans. Each offers a set of advantages to the perfect borrower. SALT offers loans with terms ranging from three to twelve months. There are no origination costs to pay, and transactions are also free. The platform, on the other hand, divides LTV ratios and interest rates.

Pros:

- No credit checks required, leading to a much quicker loan approval process

- Insurance cover loans, making it a safer lending option

- The option to use different coins as collateral, not necessarily the crypto that you’re taking a loan of

Cons:

- Repayment terms and times are quite stringent

- The minimum loan amount is quite high, and not conducive to smaller investors

Your capital is at risk.

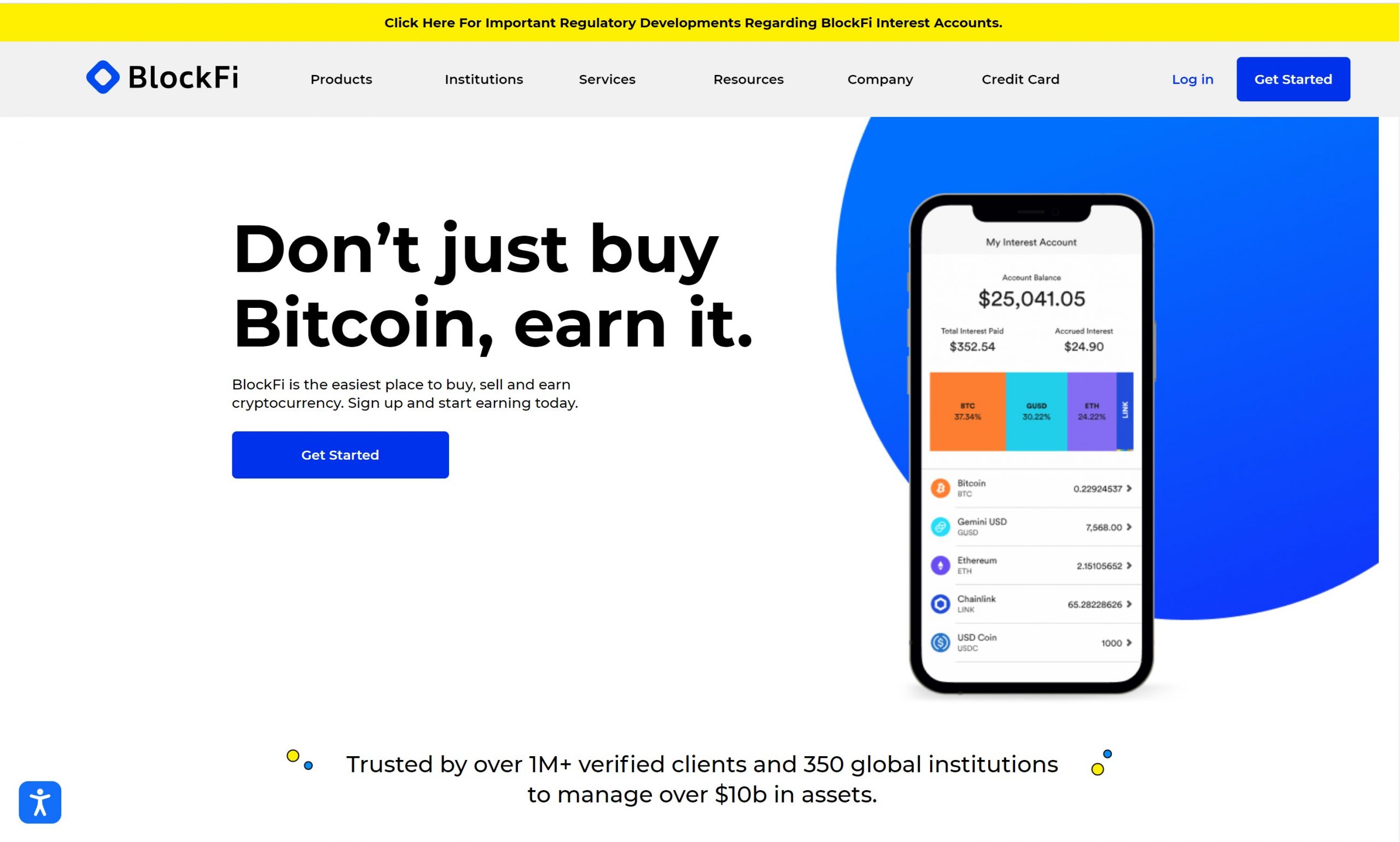

4. BlockFi – The Best Bitcoin Loan Provider for Low Interests

BlockFi was one of the first companies to offer crypto loans and yield farming. This U.S.-based organization, which was founded in 2017, uses a unique technology that allows you to take out loans in USD against your bitcoins. Bitcoin, Ether, PAX Gold, and Litecoin are the three cryptocurrencies that BlockFi permits you to borrow. The site is simple to use and pays out quickly.

You’ll need a minimum loan amount of $10,000 and a loan-to-value ratio of 50% with BlockFi. It’s worth noting that the service will alert you if your loan-to-value ratio exceeds 70%, indicating that you should raise your collateral. The loan term and interest rate were established at 12 months and 4.5%, respectively. However, you should be aware that in some cases, you may be charged additional fees.

Blockfi fees

| Fee | Amount |

| Crypto trading fee | Commission, starting from 0.7% |

| Inactivity fee | Free |

| Withdrawal fee | Rate-based withdrawal fee for some coins. |

Pros:

- Some of the most competitive rates in the industry among major crypto loan providers

- Highly competitive LTV ratio, making it attractive to investors

- Top-rated platform for crypto savings

- Regulated by a variety of other Tier-1 regulatory agencies

Cons:

- The minimum loan amount is quite high, and not conducive to smaller investors

- Asset variety is much lower than other comparable platforms only supports 3 coins

Your capital is at risk.

5. Nexo – The Best Cryptocurrency Loan Platform for Instant Approvals

Nexo is a fast-growing cryptocurrency banking app that makes lending and borrowing easier. Investors can earn up to 12% interest on their coins and fiat currencies in the platform’s interest-bearing accounts. Nexo also provides crypto-backed loans, allowing investors to keep ownership of their cryptocurrency holdings.

The platform’s processes are noted for their simplicity. Nexo does not charge origination costs or require monthly payments on credit lines it extends. This provider’s loan approval is automatic.

No extensive credit checks or credit reports are necessary. Nexo has a variety of loan percentages and a 6.9% interest rate as a starting point. You have a wide selection of currencies to pick from, with over 40 available for borrowing. Nexo has a $50 minimum loan amount and a $2 million maximum loan amount. Surprisingly, the program permits you to keep borrowing until your credit limit is reached. While this is risky, it is also quite useful for traders. Nexo’s LTV changes from currency to coin. The standard, however, is 50%.

Pros:

- Different loan periods to choose from, increasing the platform’s flexibility

- Supports a variety of coins to borrow, providing more choice

- Low minimum loan amount, more conducive to smaller investors

Cons:

- Higher interest rates than most competitors

- Variable LTV ratios depending on the coin you choose to borrow

Your capital is at risk.

6. Gemini – The Best Crypto Loans for Flexible Rates and Plans

Gemini is a crypto exchange that allows people and institutions to trade and store their coins.

Interest-bearing accounts (that will allow you to earn a high APY depending on the crypto assets that you own), online and offline storage options, and the ability to pay with crypto at select stores are all available with Gemini. The exchange also takes pride in being the first cryptocurrency exchange in the United States to provide traders interest-bearing account options.

By lending cryptocurrencies to specific financial institutions, Gemini allows you to earn up to 8.05% APY on your cryptocurrency balances. The Gemini Earn function provides daily interest beginning at 4 p.m. on the day immediately after the day you deposit the cash onto the Gemini Earn platform. However, interest rates for various cryptocurrencies vary.

These extraordinarily high APYs can be quite enticing in a time of historically low-interest rates, but keep in mind that the coins you loan out are not protected by the Federal Deposit Insurance Corp. (FDIC). Furthermore, while some of these rates apply to stablecoins, whose values are linked to fiat currencies and hence vary less than other cryptos, many coins may undergo big price swings, resulting in you losing money in the chase of a greater interest rate.

Furthermore, if you opt to withdraw coins from Gemini Earn, it could take up to five business days for your cryptocurrency to be transferred from the Earn platform to your regular Gemini account. When you register an account and buy cryptocurrencies on Gemini, you can opt into Gemini Earn right now, according to the company. On the web and mobile platforms, you can see both your combined trade balance and your Gemini earn balance.

Gemini fees

| Fee | Amount |

| Crypto trading fee | Commission, starting from 0.5% |

| Inactivity fee | Free |

| Withdrawal fee | Free |

Pros:

- Support for 25+ cryptocurrencies including all major coins and some minors

- Different loan periods available according to requirements

- The ability to earn a high APY depending on the currencies you invest in

- One of the most secure crypto exchanges in the world

Cons:

- Variable APYs depending on the currencies you opt to trade and borrow

- Slower withdrawal process than most competitors

Your capital is at risk.

Best Crypto Loans Comparison

| Platform | Loan Type | Coins Supported | Loan Period | Interest | Any Other Fees? |

| eToro Money | Centralized | 25 | Flexible | Varying | No |

| SALT | Centralized | 12 | 3-12 months | At least 3.5% | No |

| BlockFi | Centralized | 4 | 12 months | 4.5% | No |

| Nexo | Centralized | 40+ | 1- 12 months | Varying | No |

| Gemini | Centralized | 40 | 1-12 months | Varying | No |

What is a Crypto Loan?

A crypto loan is a type of financial product backed by cryptocurrencies. A crypto loan, like a standard securities-based loan, is a borrowing of money from a financial institution. The key difference here is that in this case, this money is borrowed using your crypto assets as collateral in exchange for providing liquidity. When the bull market was in full stride in 2020 and 2021, crypto loans were popular due to the dual potential of both profits and liquidity.

Many investors who were unconcerned about digital assets’ short-term volatility began to use their crypto portfolios as collateral, receiving cash from financial institutions to spend while maintaining their cryptocurrency. Long-term investors like crypto-backed loans since crypto prices tend to climb over time. So, if Bitcoin is worth $60,000 and you borrow $300k with 5 BTC over a year, the price of Bitcoin could rise by 50% before you pay off your loan, leaving you with more money even after you pay it off.

How do Crypto Loans Work?

A crypocurrency loan functions similarly to a securities-backed loan. A borrower gives the lender a certain amount of Bitcoin or any other accepted crypto as collateral, and the lender then lends them the fiat equivalent. The lender returns the collateral to the borrower once the loan is paid off. During the tenor, the borrower usually retains ownership of the collateral. While the borrower retains ownership, he or she loses certain rights, including the ability to trade or use loaned crypto for transactions.

Once the validity term has passed, you must repay the loan in full. Consider an example. Say the price of 1 BTC is currently $45,000, and you use this as collateral to take out a $45,000 loan for a year. At the end of this year, irrespective of the spot price of 1 BTC, you will have to repay the $45,000 that you borrowed. So, for example, if the value of your collateral goes up to $100,000, you will still only have to repay only $45,000. Of course, the converse is also true, and if the price of BTC drops to merely $30,000, you’ll still end up owing $45,000 to the exchange from which you borrowed the money.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Types of Cryptocurrency Loans

Just like regular loans, there are several different types of crypto loans that you could choose from. However, most crypto investors usually prefer to choose between 2 main types of loans, which have been discussed below in detail.

Custodial Loans

These are loans obtained through centralized finance systems (CeFi). A custodial entity, such as a loan company or a cryptocurrency exchange, essentially takes possession of your collateral. This means they have control over Bitcoins because they have private keys. Custodial crypto loans are offered by the great majority of crypto lenders on the market. Both crypto and fiat currencies are lent out on these services.

Non-Custodial Loans

Decentralized finance (DeFi) is an alternative to a centralized crypto loan. Instead of relying on a centralized company for approval, these crypto loans rely solely on smart contracts. You keep possession of your private keys if you take out a non-custodial crypto loan, except in one case. If you default on your loan and are unable to meet your loan obligations, then you will end up forfeiting your private keys.

While many consumers prefer non-custodial crypto loans to custodial crypto loans, they are still uncommon in the market. Because they are significantly less common, they tend to charge interest rates that are somewhat higher than custodial crypto loans, and their platforms have less liquidity than centralized alternatives.

Crypto Loan Fees & Rates

| Loan Platform | APR | Any Other Fees? |

| eToro | Varying | No |

| SALT | At least 3.5% | No |

| BlockFi | 4.5% | No |

| Nexo | Varying | No |

| Gemini | Varying | No |

Advantages of Crypto Loans

There are numerous advantages to leveraging your crypto assets to acquire a loan. Here are a few of the most important advantages:

- Low-interest rates: Crypto loans have lower interest rates than unsecured personal loans and credit cards since they are secured by an asset. As a result, they may be interesting to someone with digital assets they don’t intend to use or trade but who wants to save money.

- Ownership: If you require cash, a crypto loan allows you to obtain the funds you require without having to liquidate your crypto assets.

- No credit check: When you apply, the crypto loan site will likely not perform a credit check. If you have a poor credit history, this could be a very appealing option to a bad credit loan.

- Amount of loan dependent on value: Many crypto loans allow you to borrow up to half of your whole portfolio.

- Optional currency: You can acquire loans in a variety of cryptocurrencies, including fiat assets, depending on the platform you use. When compared to typical loans, which only support dollars, this is a win-win situation.

- Quick funding: Once your loan has been accepted, you will have access to your funds in minutes, if not hours.

Risks of Crypto Loans

While there are several major benefits that may appeal to some customers, there are also a number of drawbacks to consider:

- Borrowing minimums might be rather high. While platforms differ, you may simply not have enough assets to secure the lender’s minimum loan amount. For example, BlockFi’s minimum loan amount is $10,000, and with a maximum loan-to-value ratio of 50%, you’ll need $20,000 or more in assets to get authorized.

- The repayment period is short. Crypto loans often have terms of 12 months or fewer, which means you won’t have as much time to repay them as personal loans, which might have longer terms. If you default on the loan, the platform may liquidate your assets, perhaps resulting in a tax obligation if your portfolio has appreciated in value since you first purchased the digital assets.

- The threat of margin calls is real. When the value of the assets that you have deposited as collateral falls below the lender’s predetermined threshold, a margin call happens. You may need to deposit more into your account if the price of your crypto assets decreases significantly—which is more likely with crypto than traditional assets owing to the volatility of the crypto market—in order to keep your assets. If you don’t, the platform may decide to sell your assets, thereby affecting your tax liability.

- Assets are out of reach. You can’t utilize or trade your crypto assets as long as your loan is due. In other words, if the value of your assets plummets, you’re out of luck, and there’s no way to recover your losses.

- Security: Platform security is another growing concern, particularly with DeFi lending platforms.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

How to Choose the Best Crypto Loan for You

The last thing you need to do is make a list of important factors to consider when choosing one. Here are some of the most important aspects to consider when choosing a crypto lending platform.

Rates of Interest

The interest rate offered by a crypto loan platform is the most important thing to consider when choosing one. Choose a lending platform that will pay you a reasonable interest rate on your crypto assets.

Costs

The expenses associated with different crypto assets on different platforms are obviously a major aspect in determining the best crypto loan platform.

Platform Threats

Before deciding on a crypto loan platform, you should consider the platform’s dangers.

Term of the Loan

When looking for the safest crypto lending platform, it’s also important to consider the duration of the loan. Check to see if the loan term is fixed or variable, and then make your decision based on your needs.

Amount of Collateral

Another important consideration when selecting a crypto lending platform is the collateral required to borrow a specific amount.

Deposit Requirements

The deposit limit is the final consideration when selecting the best crypto loan platform for your needs. Check with the platform to see if there are any special restrictions for a minimum deposit amount.

How to Qualify for a Crypto Loan

Collateral

The first step is to gather and organize your materials. You must be careful with this because it will decide how much you can borrow on most platforms. As a general guideline, you should never use your entire cryptocurrency portfolio as collateral for a crypto loan. Set aside some money to serve as a safe haven in the event of a margin call.

Choose the Right Platform

After you’ve completed your portfolio, the following step is to discover the best lender for you. You can select between centralized and decentralized lenders, as previously stated. Lenders and borrowers can agree on some loan conditions using centralized platforms, but they still handle the key aspects of the loans, such as capital administration and transfer. Decentralized platforms, on the other hand, do away with the requirement for a third party to manage the loans.

Get the Loan

You’re all set once you’ve chosen a lending platform and agreed to the terms. You’re free to leave once you’ve collected your money.

Conclusion

Crypto loans are a remarkable financial invention that gives cryptocurrencies even more legitimacy. They borrow from the traditional sector in numerous ways, but crypto loans are far superior because they speed up the borrowing process and make it much more convenient. While there are a number of crypto loan platforms to choose from, we recommend starting with eToro.

The finest platform to buy, sell, and manage your crypto funds is the eToro Money Account. To spend your crypto cash, you’ll need a crypto debit card. Everything is set up and ready in the eToro Money Account. It’s easy to use and completely free.

eToro – Manage Crypto Loans via eToro Money Visa Debit Card

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.