Best Indices Trading Brokers & Platforms for February 2026

When you trade indices, you eliminate all of the outside noise and focus solely on the broad trend of the market. Trading indices also allow you to capitalize on opportunities that arise between different sectors, asset classes, and countries.

However, to fully realize the benefits of index trading, it’s important to carefully select the right broker. Whether it’s industry-leading commissions or access to the most reliable assets, our guide will help you find the Best Index Trading Platform in no time!

-

-

Best Brokers for Indices Trading in 2026

Offering the best combination of value, service, and platform features, below, you’ll find the best index trading platform as well as the top alternatives. For in-depth analysis of each, you can also scroll down for more information:

- eToro: eToro stands out as one of the best index trading platforms because it offers Smart Portfolios which can be used to invest in a selection of expert-approved assets, including index funds. eToro also supports copy trading, social trading and offers a free demo trading account. The broker is regulated by several reputable authorities including the FCA, ASIC and the CySEC. You can start trading from just $20.

- Plus500: Plus500 is a multi-asset broker that offers CFD trading, Share trading (on Plus500Invest), and Futures trading (on Plus500Futures, available only in the US). The most notable feature of this broker is its native mobile app which has received positive reviews on the app store. The Plus500 app allows users to manage their trades on the go which makes it ideal for day traders.

- Libertex: Libertex is a popular online trading platform for traders who want to use charting tools. The platform is compatible with MT4 and MT5 and provides a good range of educational resources to help traders to use the trading tools. Libertex is a well-known forex broker, however, it can also be used for index trading in the US.

- TD Ameritrade: TD Ameritrade is an established US broker that supports stock trading, ETF trading, commodity trading, index trading and more. This platform is suited to long-term investors who want to build a diverse portfolio of assets and profit from capital gains overtime.

- Charles Schwab: Charles Schwab is an investment broker with a $0 account minimum which makes it ideal for traders who have a low budget. The broker focusses on investing, rather than trading, and offers a variety of features to help customers build diverse, profitable portfolios.

- Interactive Brokers: Interactive Brokers is a great option for advanced traders who want to use technical indicators and tools to conduct analysis. The platform supports day trading strategies and offers low fees on all assets. The broker also supports algorithmic trading and margin trading which can be used by experienced traders to increase the profitability of their trades.

- Fidelity: Fidelity is a popular investment platform that is mainly used for long-term strategies and saving for retirement. The broker offers a good range of ready-made investment accounts and also offers users the tools that they need to build their own portfolio from scratch.

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Indices Trading Guide

To determine the best index trading platform for you, consider your time horizon, risk tolerance, and your preferred assets. If you’re an active trader, nearly all of the above options fit the bill. With access to real-time data and advanced charting tools, you can’t go wrong with any of the above names.

However, if you have a low-risk tolerance, avoid CFDs, futures, and options, and stick with trading index ETFs. Because the formers have leverage, you can gain/lose more on a single trade. Conversely, with index ETFs, the majority are equity-based, which means that gains/losses are similar to individual stocks.

Finally, always trade what you know. If you’re unfamiliar or uncomfortable determining margin requirements or analyzing option ‘Greeks,’ stick with index ETFs. Conversely, if you’re a sophisticated trader that’s looking to generate alpha, index CFDs, futures and options can greatly enhance your PnL.

What is Index Trading?

Rather than analyzing individual stocks, index trading allows you to speculate on an entire basket of equities, bonds, commodities, or even volatility. Index trading involves buying instruments that represent a selection of assets that are related to each other. This strategy enables investors to build a diverse portfolio without having to place multiple trades.

Ways of Trading Indices

Because not all products are created equal, it’s important to understand the difference between cash indices, index CFDs, index futures, and index ETFs.

For starters, cash indices allow you to invest in the cash value of an underlying index. Unlike options and futures, there is no expiry date and transactions are executed immediately. Second, index CFDs allow you to participate in the movement of an index without having to own it or having to take physical delivery. Because most CFDs are cash-settled, you either receive or pay the net difference on the settlement date.

Third, index futures allow you to buy or sell an index at a future date based on a price that’s agreed upon today. Finally, index ETFs have no expiry date and can be used for short-term and long-term trading. However, you have to pay the entire cash balance upfront and you also incur portfolio management expenses.

Why Trade Indices?

Allowing you to significantly reduce risk, indices are less volatile than individual stocks. Because the index return is the sum of the returns of the underlying constituents, a single stock doesn’t make or break its performance. Moreover, indices are much better option for trading macroeconomic divergences. For example, if you expect the European economy to outperform the U.S., you can buy the DAX 30 index and sell the S&P 500 index. Thus, trading indices allows you to focus on the macroeconomic environment without having to worry about idiosyncratic events.

Index Trading Strategies

Common among experienced traders, continuation, reversal and breakout index trading strategies are quite popular:

Continuation Trading Strategies:

Using the old adage, ‘the trend is your friend,’ traders will hold an index as long as it remains in an uptrend. For example, as long as an index holds its 20-day and/or 50-day moving averages, technicals signal that the ascension will likely continue. The logic is: if the index is trending, why bet against it?

Reversal Trading Strategies:

In stark contrast, reversal traders often analyze an index’s Relative Strength Index (RSI). When an index’s RSI rises above 70 (overbought), it’s likely to suffer a short-term decline. Conversely, when an index’s RSI falls below 30 (oversold), it’s likely to experience a short-term rally. Likewise, Bollinger Bands is another useful indicator. Plotted two standard deviations above and below an index’s moving average, when the price rises to the upper Bollinger band, it’s likely to fall, and when the price declines to the lower Bollinger band, it’s likely to rise.

Breakout Trading Strategies:

Drawing triangles and pennants on the chart, narrow price action can help traders capitalize on an index’s breakout. Taking the shape of a horizontal triangle (think of a sideways ice cream cone), when an index shifts from having large price swings to trading in a tight range, it will often ‘breakout’ one way or the other. When this occurs, index traders can confidently take advantage of the new trend.

Best Brokers for Indices Trading Ranked & Rated

Because the devil is in the details, it’s important to analyze all of the pros and cons before making your decision. However, to make the journey a little bit easier, we’ve reviewed the best index trading platforms and trading apps to help you find the right broker for you.

6. Plus500 – One of the Best Index Trading Platforms for Mobile Traders

Plus500 could be considered the best index trading platform for CFDs.The platform offers CFDs for some of the most popular indices around the world which can be traded with leverage up to 1:20.

Combining an easy-to-use platform with exceptional customer service, Plus500 shares a lot of similarities with our other best index trading platforms. Offering a $100 account minimum and no withdrawal fees, Plus500 accepts deposits in 16 different currencies as well as an e-wallet. And not offered by all brokers, Plus500’s demo trading account allows you to build your confidence before risking any of your hard-earned capital.

One downside of Plus500 is that it does not allow scalping. Defined as “A trading strategy based on the notion that client transactions are opened and closed within 2 minutes in order to accumulate quick profits from small price changes,” if you buy and sell index CFDs on a minute to minute basis, you could have your account blocked.

Despite that though, Plus500’s platform works seamlessly on all Apple iOS and Android devices, so mobile traders should be extremely satisfied with the broker’s service.

Plus500 fees

Fee Amount Stock trading fee Spread. 23.51 pips for Amazon. Forex trading fee Spread. 1.3 pips for GBP/USD. Crypto trading fee Spread. 4.11% for Bitcoin. Inactivity fee £10 per month after three months Withdrawal fee Free Pros:

- Plus500 provides access to 28 major indices

- Plus500’s demo trading account allows you to perfect your strategy with zero risk

- Plus500CY Ltd is authorized & regulated by CySEC (#250/14)

- For mobile traders, Plus500 offers a market-leading mobile app

Cons:

- Plus500 CFDs are not available in the US or Canada

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

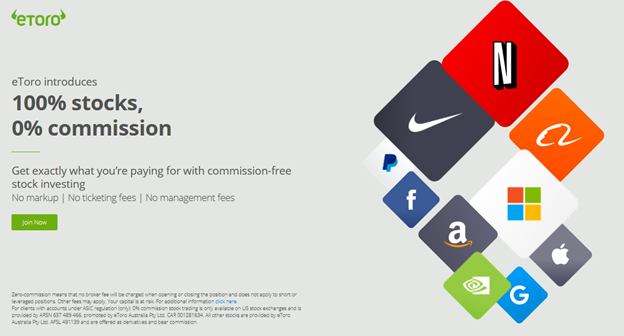

2. eToro – Overall Best Trading Platform for Index Funds

Topping our list, eToro is simply a cut above. With access to more than 3,000 different stocks spanning 140 countries, eToro’s 0% commission structure allows you to trade all of your favourite assets without incurring undue fees.

To determine which broker is the best index trading platform, it’s important to differentiate cost from efficiency. However, with eToro, you get the best of both worlds, as the U.K. broker is fully functional across all major exchanges – including stock markets from the NYSE, NASDAQ, FTSE 250, FTSE 100 and London Stock Exchange (LSE) – and you have access to both full and fractional shares.

Top-rated across nearly all categories, eToro is one of the best index trading brokers in the business. More importantly, though, eToro is a name that you know and trust: regulated by the U.K. Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC) in Australia, CySEC, and U.S. FINRA, eToro’s commitment to transparency is second to none.

What’s more, if you’re new to trading and need a helping hand, eToro’s CopyPortfolios uses an innovative algorithm to construct a portfolio that’s tailored to your risk tolerance. As a result, you can feel confident knowing that your investments have the highest probability of success when you use this free trading platform.

eToro fees

Fee Amount Stock trading fee Free Forex trading fee Spread, 2.1 pips for GBP/USD Crypto trading fee 1% fee each time you buy or sell a cryptoasset

Inactivity fee $10 a month after one year Withdrawal fee $5 Pros:

- Trade stocks, indices, ETFs, Bitcoin, commodities, and currencies all at the click of a button

- Trades are always commission-free and there are no hidden charges

- Suitable for trading CFDs

- Fractional shares provide access to stocks that would otherwise be too expensive

- eToro’s CopyPortfolios allows you to build a long-term investment account that supplements your trading account

- eToro is regulated by the U.K. Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), CySEC, and U.S. FINRA, according to its legal disclaimer

Cons:

- eToro’s platform is not suitable for conducting advanced technical analysis

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

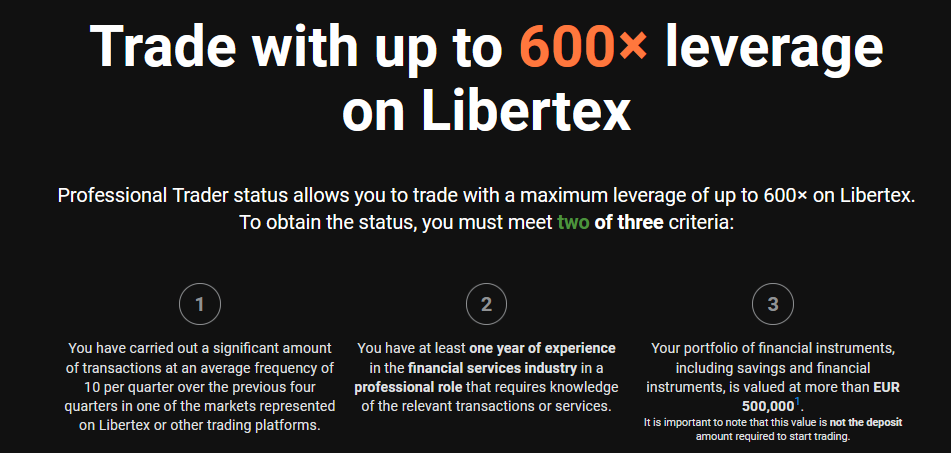

3. Libertex – Best Index Trading Platform for CFDs

Founded in 1997, Libertex has over 3 million clients worldwide. Specializing in CFDs, Libertex is one the best index trading brokers in the marketplace today.

In addition, Libertex accepts deposits via bank transfer, debit/credit card, and e-wallet and all deposits are free of charge. What’s more, withdrawals made through Skrill are always free, while withdrawals via other methods include a charge of €1 to 1%.

Unfortunately, though, Libertex does not offer 0% commissions. However, a 50% reduction is available for professional clients.

For a detailed breakdown of Libertex’s commission structure, please see below:

- Gold status: A €250 deposit earns you a commission discount of 3%.

- GoldPlus status: A €1,000 deposit earns you a commission discount of 4%.

- Platinum status: A €1,500 deposit earns you a 20% commission discount and access to priority withdrawals.

- VIP status: A €5,000 deposit or more earns you a 30% commission discount and access to priority withdrawals and premium customer support.

Cementing its position as one of the best indices trading platforms, Libertex’s demo trading account is extremely useful. Rather than having to risk your own capital right away, you can trade with €50,000 in virtual money and enjoy all of the platforms’ features free of charge with the demo account. Even better, all of Libertex’s services are fully functional on desktop, laptop, Apple iOS, and Android devices for mobile trading, as well as using its research tools.

You can also use Libertex’s demo paper trading platform to try the broker out before trading with real money.

Libertex fees

Fee Amount Stock trading fee Commission. 0.034% for Amazon. Forex trading fee Commission. 0.008% for GBP/USD. Crypto trading fee Commission. 1.23% for Bitcoin. Inactivity fee $5 a month after 180 days Withdrawal fee Free Pros:

- Libertex is a trusted CFD broker with more than 23 years of operational experience

- Supporting client growth, Libertex allows you to practice with virtual money before making a deposit by creating a retail investor account

- A wide selection of index futures and index ETFs makes Libertex one of the best brokers for index funds

- Free educational webinars are available to explain the difference between investing, trading, speculation, and hedging

- Libertex is regulated by the CySEC

Cons:

- Libertex does not offer commission-free trading

- Libertex is best suited for accounts of €5,000 or more

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

4. TD Ameritrade – Best Index Trading Platform to Build a Diversified Portfolio

Combining education with excellence, TD Ameritrade’s powerful platform, and its functionality helps you become a better trader and a smarter trader. As one of the best index trading platforms and online brokers, TD Ameritrade’s personalized educational service is tailored to your specific needs. Through interactive courses and webcasts, its commitment to knowledge makes TD Ameritrade one of the best indices trading platforms.

Offering 0% commissions and a bevy of advanced charting tools, finding the best index trading platform has never been easier. At the click of a button, you can trade through its brokerage accounts assets and financial products such as stocks, bonds, CDs, options ($0.65 commission per contract), non-proprietary mutual funds, futures, forex, and commission-free ETFs – all while enjoying a live stream of CNBC.

As the best trading platform for long-term investors, TD Ameritrade also grants access to Morningstar, CFRA, and TheStreet’s fundamental research reports, and the firm is fully regulated by U.S. FINRA.

Digital wallets are accepted.

TD Ameritrade fees

Fee Amount Stock trading fee Free Forex trading fee Spread. 1.2 pips average during peak hours. Crypto trading fee N/A Inactivity fee Free Withdrawal fee Free for ACH, $25 for wire transfer Pros:

- TD Ameritrade provides access to thousands of investment products, including stocks, bonds, options, ETFs, commodities, and currencies

- TD Ameritrade offers 0% commissions and there are no platform fees, data fees, or trade minimums.

- In-person customer support is available at more than 175 TD branches across the U.S.

- Best-in-class educational resources help increase your trading knowledge

- Regulated by U.S. FINRA

Cons:

- Debit, credit card and e-wallet deposits are not accepted

There is no guarantee that you will make money with this provider. Proceed at your own risk..

5. Charles Schwab – Best Index Trading Platform for Smartphone Investors

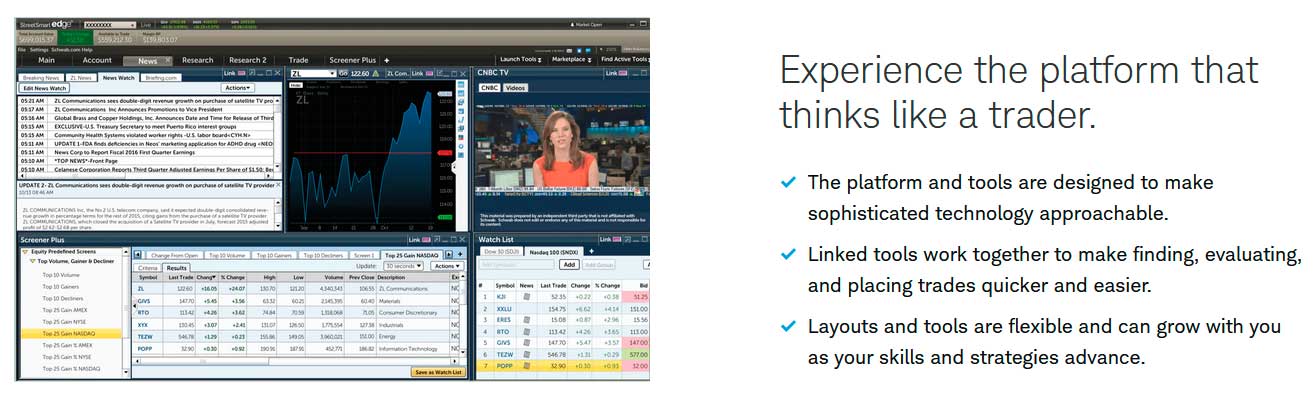

In the running for the best index trading platform, Charles Schwab’s StreetSmart Edge combines sophisticated technology with an easy-to-use layout. Finding, evaluating, and placing a trade has never been easier, and you can access the stock trading platform online or through Charles Schwab’s cloud platform.

Moreover, stocks, index ETFs, preferred shares, and REITs always trade commission-free, while index futures ($1.50 per contract) and index options ($0.65 to $1.50 per contract) also enjoy competitive pricing. However, despite being one of the best trading platforms for index funds, cryptocurrencies are not listed among Charles Schwab’s tradable assets, if you are more interested in crypto or forex, our TD Ameritrade vs Charles Schwab review goes over this in more detail.

Like other exceptional brokers, Charles Schwab’s technology works seamlessly on all desktop, laptop, Apple iOS, and Android devices, while the company’s Idea Hub can help you identify bullish, bearish, and neutral trade ideas all in real-time.

What’s more, its interactive Trade & Probability calculator allows you to effectively manage risk, while Micro E-mini futures allow you to trade all major indices at 1/10th the size and with lower margin requirements.

Charles Schwab fees

Fee Amount Stock trading fee Free Forex trading fee N/A Crypto trading fee N/A Inactivity fee Free Withdrawal fee Free Pros:

- Access thousands of assets, including index futures, ETFs options, and Micro E-mini futures

- Trade stocks, index ETFs, preferred shares, and REITs commission-free

- Charles Schwab’s proprietary Idea Hub scans for actionable trade ideas in real-time

- Enjoy free access to educational material and a live stream of CNBC

- Charles Schwab is a registered broker-dealer with the Securities and Exchange Commission (SEC) and is regulated by the Commodities Futures Trading Commission (CFTC)

- Charles Schwab’s platform is accessible to U.S., U.K., Hong Kong, and other international investors

Cons:

-

Schwab has several choices for gaining exposure to cryptocurrency markets, though spot trading of cryptocurrency is not currently available.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

6. Interactive Brokers – One of the Best Indices Trading Platforms for Advanced Traders

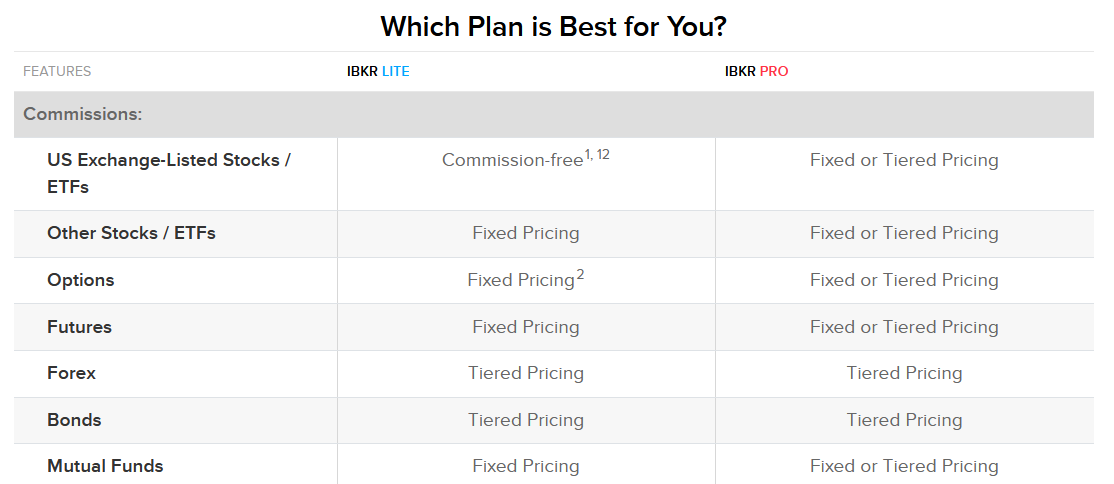

With access to stocks, options, futures, currencies, bonds, and investment funds from a single integrated account, Interactive Brokers could be the best index trading platform. Through its proprietary technology, you can optimize your trading strategy and perform sophisticated technical analysis. What’s more, commissions begin at $0 (for U.S. listed stocks and index ETFs), while commissions on index options ($0.15 to $0.65 per contract) and index futures ($0.25 to $0.85 per contract) are also extremely competitive. Even better, for both IBKR LITE and IBKR PRO accounts, there is no minimum balance required.

If choosing IBKR Pro, clients also have access to the IB SmartRouting system – which saves roughly $0.47 per 100 shares and ensures that your trades execute at the best possible price.

Providing access to equity and bond indices on 28 exchanges across 14 countries, including short ETFs and leveraged ETFs, Interactive Brokers allows you to trade both index futures and index options. Even better, the platform is accessible across a wide variety of countries, including the U.S., U.K., Germany, and France.

Interactive Brokers fees

Fee Amount Stock trading fee Free Forex trading fee Commission + spread. Commission is 0.08 to 0.20 basis points. 0.1 pip GBP/USD. Crypto trading fee Commission. $15.01 per Bitcoin futures contract. Inactivity fee $20 per month Withdrawal fee Free Pros:

- Trade indices via ETFs, futures, and options.

- Enjoy margin trading with financing costs up to 50% less than comparable brokers

- If holding for the long-term, earn extra income by lending your securities to short sellers

- Access market data 24 hours a day, six days a week, across 135 markets

- Interactive Brokers is regulated by the Securities and Exchange Commission (SEC) and the Commodities Futures Trading Commission (CFTC), while its U.K. operations are regulated by the Financial Conduct Authority (FCA) and regulated products are covered by the UK FSCS

Cons:

- Designed for advanced traders, less experienced investors may find Interactive Broker’s platform intimidating

There is no guarantee that you will make money with this provider. Proceed at your own risk..

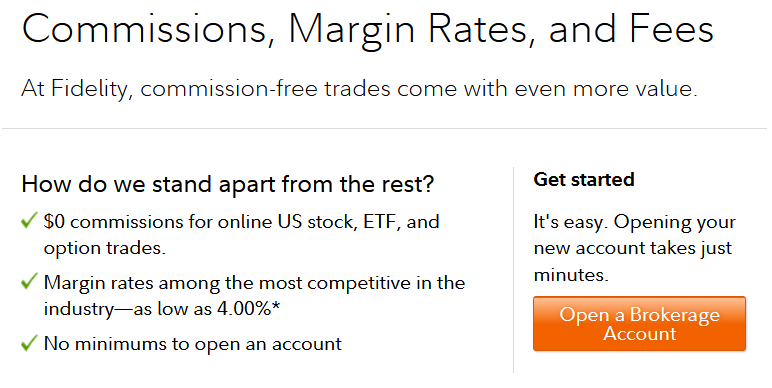

7. Fidelity – Best Index Trading Platform for Individual Retirement Accounts (IRAs)

Last but certainly not least, Fidelity offers commission-free trading on all U.S. stocks, ETFs (including indices) and charges $0.65 per option contract (including indices). Clients also have access to analyst reports that cover more than 4,500 stocks and span more than 20 independent, third-party research firms.

In addition, Fidelity’s advanced charting features, streaming quotes and option to manage up to 50 stocks as a single basket, cements its position as one of the best index trading platforms. For mobile aficionados, Fidelity’s app also includes all of these great features on one easy-to-use interface.

As well, because Fidelity is well-known for its industry-leading wealth management services, you can manage your Individual Retirement Account (IRA) both directly, and with the help of a Fidelity financial advisor. Keep in mind though: Fidelity does not offer index futures or index CFDs, and although its margin rates are extremely competitive, they’re still higher than Interactive Brokers. To see how Fidelity matches up with other brokers, check out our Fidelity vs TD Ameritrade comparison review.

Fidelity fees

Fee Amount Stock trading fee Free Forex trading fee N/A Crypto trading fee N/A Inactivity fee Free Withdrawal fee Free Pros:

- Perfect for long-term investors that enjoy direct trading but also value financial advice

- Fidelity Mobile includes all of the great futures that are embedded in the desktop version

- By far, Fidelity offers the widest selection of professional research

- Fidelity’s platform is functional in both the U.S. and the U.K.

- Fidelity is a registered broker-dealer with the U.S. Securities and Exchange Commission (SEC) and its U.K. operations are regulated by the K. Financial Conduct Authority (FCA)

Cons:

- Fidelity does not allow you to trade index futures or index CFDs

There is no guarantee that you will make money with this provider. Proceed at your own risk..

How to Get Started with the Best Index Broker

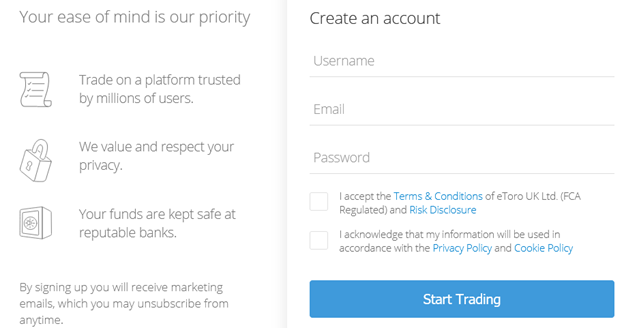

Setting the standard, eToro makes index trading a breeze. To get started, simply follow the steps below:

Step 1: Open an Account and Submit Your ID

By clicking the “Join Now” button at the top of eToro’s homepage, you’re only a few steps away from accessing the best index trading platform available.

Next, you’re prompted to enter a username, password, and email address. You also have to provide your first and last name, date of birth, home address, and mobile number. For security purposes, eToro also confirms your mobile number via text message.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Step 2: Confirm Your Identity

To verifiy your identity, you need to submit a copy of a valid driver’s license or passport, plus a utility bill or bank statement issued within the last three months. Most often, verification takes less than a few minutes and you can begin index trading immediately.

Step 3: Deposit Funds

Requiring a minimum despot of $200, you can choose from the following U.K. payment methods:

- Debit/Credit Card (Visa, MasterCard, Maestro)

- PayPal

- Skrill

- Neteller

- UK Bank Transfer

Even better, apart from a U.K. bank transfer, the above deposit methods are processed instantaneously.

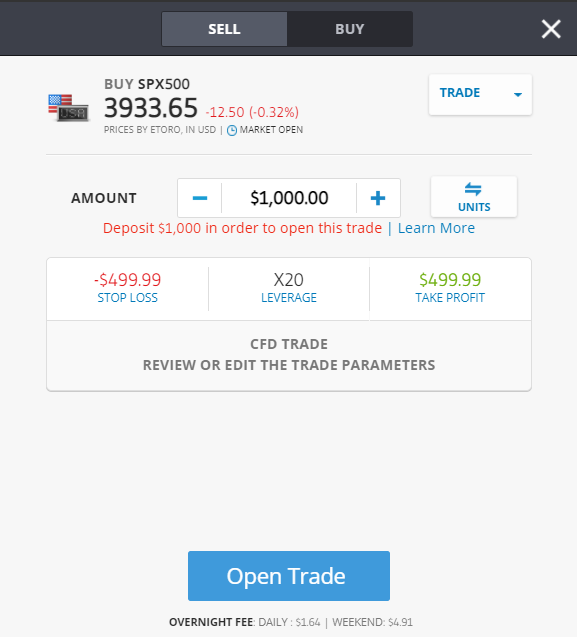

Step 4: Browse the Best Index Trading Platform

Using the search function at the top of the page, you can enter the name of the index or the ticker symbol. For example, you can enter “SPX500”.

Step 5: Making Your First Trade

Once you click on the index’s symbol and select the “Trade” button, you choose between a market order or a limit order. Next, you enter how much you want to invest and hit “Open Trade.” Once completed, eToro will send you a transaction confirmation and tthat’s it – you’ve made your first index trade!

Conclusion

If it isn’t clear by now, index trading is your gateway to efficient capital allocation. By eliminating stock-specific risk and following the broad trend, index trading allows you to actively manage your portfolio without incurring all of the unnecessary stress.

However, before you begin your journey, selecting the right broker is nearly as important as selecting the right investment. The more comfortable you are with the platform the easier it is to effectively implement your strategy. And checking off every box, Plus500 is by far the best in the business. Combining a transparent free structure with access to all major indices, partnering with Plus500 is a great way to get started!

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Frequently Asked Questions (FAQ)

How does index trading work?

Mechanically, index trading is analogous to trading stocks: you determine your strategy, determine your time horizon and enter/exit your positions in a manner that achieves your unique goals.Can you trade indexes with leverage?

Yes. Leveraged index ETFs and index options have embedded leverage, while index CFDs and index futures allow you to finance a portion of your position by borrowing money from your broker.Can you get index trading signals?

Yes. Algorithmic and quant traders often specialize in trading indices and their alert services are readily available.What are the tax laws for trading indices?

Index ETFs are subject to the same tax laws that govern stocks. However, governments often impose higher taxes on short-term capital gains than long-term capital gains. And though regulations vary depending on your country of origin, the tax treatment of option contracts is often less favorable than stocks, while the tax treatment of futures contracts is often more favorable than stocks.References:

Alan Lewis Senior Editor

Alan Lewis Senior Editor

View all posts by Alan LewisAlan is Head of Content at TradingPlatforms.com and also contributes as a writer specializing in stocks and cryptocurrency trading. Alan earned an MA in English Literature from the University of Sussex in 2017. Since then, he has used his exceptional writing skills to create and edit content in the finance space for several reputable platforms.

Before working at TradingPlatforms, Alan worked as a content writer for IvoryResearch.com and Seven Star Digital. He is a skilled writer who is able to cover complex topics in a way that is easy to understand.

As well as creating content, Alan actively invests in the financial markets. This helps him to create insightful and actionable content and provides him with first-hand experience with many of the platforms that are covered by TradingPlatforms.com.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

Top-rated across nearly all categories, eToro is one of the best index trading brokers in the business. More importantly, though, eToro is a name that you know and trust: regulated by the U.K. Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC) in Australia, CySEC, and U.S. FINRA, eToro’s commitment to transparency is second to none.

Top-rated across nearly all categories, eToro is one of the best index trading brokers in the business. More importantly, though, eToro is a name that you know and trust: regulated by the U.K. Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC) in Australia, CySEC, and U.S. FINRA, eToro’s commitment to transparency is second to none. What’s more, if you’re new to trading and need a helping hand, eToro’s CopyPortfolios uses an innovative algorithm to construct a portfolio that’s tailored to your risk tolerance. As a result, you can feel confident knowing that your investments have the highest probability of success when you use this

What’s more, if you’re new to trading and need a helping hand, eToro’s CopyPortfolios uses an innovative algorithm to construct a portfolio that’s tailored to your risk tolerance. As a result, you can feel confident knowing that your investments have the highest probability of success when you use this

Combining education with excellence, TD Ameritrade’s powerful platform, and its functionality helps you become a better trader and a smarter trader. As one of the best index trading platforms and online brokers, TD Ameritrade’s personalized educational service is tailored to your specific needs. Through interactive courses and webcasts, its commitment to knowledge makes TD Ameritrade one of the best indices trading platforms.

Combining education with excellence, TD Ameritrade’s powerful platform, and its functionality helps you become a better trader and a smarter trader. As one of the best index trading platforms and online brokers, TD Ameritrade’s personalized educational service is tailored to your specific needs. Through interactive courses and webcasts, its commitment to knowledge makes TD Ameritrade one of the best indices trading platforms. Offering 0% commissions and a bevy of advanced charting tools, finding the best index trading platform has never been easier. At the click of a button, you can trade through its brokerage accounts assets and financial products such as stocks, bonds, CDs, options ($0.65 commission per contract), non-proprietary mutual funds, futures, forex, and commission-free ETFs – all while enjoying a live stream of CNBC.

Offering 0% commissions and a bevy of advanced charting tools, finding the best index trading platform has never been easier. At the click of a button, you can trade through its brokerage accounts assets and financial products such as stocks, bonds, CDs, options ($0.65 commission per contract), non-proprietary mutual funds, futures, forex, and commission-free ETFs – all while enjoying a live stream of CNBC. As the

As the  In the running for the best index trading platform, Charles Schwab’s StreetSmart Edge combines sophisticated technology with an easy-to-use layout. Finding, evaluating, and placing a trade has never been easier, and you can access the

In the running for the best index trading platform, Charles Schwab’s StreetSmart Edge combines sophisticated technology with an easy-to-use layout. Finding, evaluating, and placing a trade has never been easier, and you can access the  Like other exceptional brokers, Charles Schwab’s technology works seamlessly on all desktop, laptop, Apple iOS, and Android devices, while the company’s Idea Hub can help you identify bullish, bearish, and neutral trade ideas all in real-time.

Like other exceptional brokers, Charles Schwab’s technology works seamlessly on all desktop, laptop, Apple iOS, and Android devices, while the company’s Idea Hub can help you identify bullish, bearish, and neutral trade ideas all in real-time.

If choosing IBKR Pro, clients also have access to the IB SmartRouting system – which saves roughly $0.47 per 100 shares and ensures that your trades execute at the best possible price.

If choosing IBKR Pro, clients also have access to the IB SmartRouting system – which saves roughly $0.47 per 100 shares and ensures that your trades execute at the best possible price.

As well, because Fidelity is well-known for its industry-leading wealth management services, you can manage your Individual Retirement Account (IRA) both directly, and with the help of a Fidelity financial advisor. Keep in mind though: Fidelity does not offer index futures or index CFDs, and although its margin rates are extremely competitive, they’re still higher than Interactive Brokers. To see how Fidelity matches up with other brokers, check out our

As well, because Fidelity is well-known for its industry-leading wealth management services, you can manage your Individual Retirement Account (IRA) both directly, and with the help of a Fidelity financial advisor. Keep in mind though: Fidelity does not offer index futures or index CFDs, and although its margin rates are extremely competitive, they’re still higher than Interactive Brokers. To see how Fidelity matches up with other brokers, check out our