Best Brokers for FTSE 250 UK – Cheapest Brokers Revealed

If you are on the search for FTSE 100 alternatives, which could result in substantial returns, then investing in and trading the FTSE 250 index might be a great option for you. In this guide, we not only reveal the best low-cost brokers for the FTSE 250 in 2025 but we show you how to get started straight away.

Best Brokers for FTSE 250 in 2025

Providing the best blend of low-cost trading, top-rated functionality, and innovative platform features, in this section you will find the best broker for the FTSE 250 in 2025 including alternative options that made our top 10 list of recommended online brokers. For more comprehensive reviews of each, simply scroll down to find out more.

- IG – Best CFD Broker With Great Educational Resources

- Interactive Brokers – Top-rated Index Trading Platform for Experienced Traders

- CMC Markets – Best CFD and Forex Broker with Low Fees

- Trading 212 – Top CFD Broker Offering Free ETF Trading

- Fidelity – Top UK-based Stock Broker with Low Fund Fees

- XTB – Global CFD and Forex Broker

- TD Ameritrade – Top US-based Broker Offering Industry Leading Trading Platform Thinkorswim

- FxPro – Best FCA-regulated Trading Platform With $0 Deposit Feesf

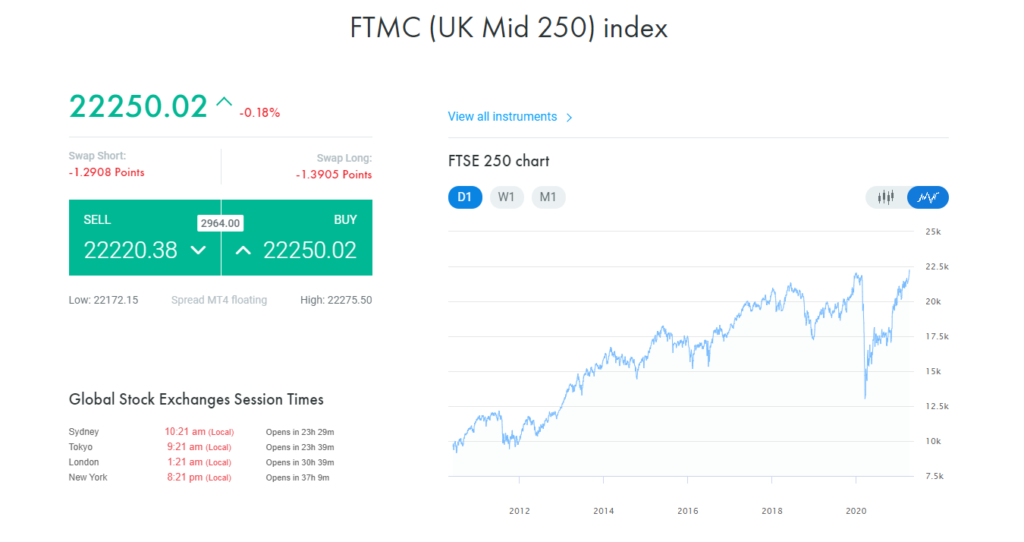

What is the FTSE 250?

The FTSE 250, commonly known as the UK 250 by traders who favour share dealing, spread betting, and CFD trades, is a stock market index that monitors the 250 LSE-listed constituents that come after the 100 blue-chip and the largest FTSE 250 companies.

The 250 mid-cap companies that make up the index are selected based on their market value. This index also includes a variety of investment trusts, which are investment vehicles that offer shares on the stock exchange. These investment trusts are managed in the same way that mutual funds are, however, traders invest in them by purchasing shares.

Ways to Trade and Invest in FTSE 250

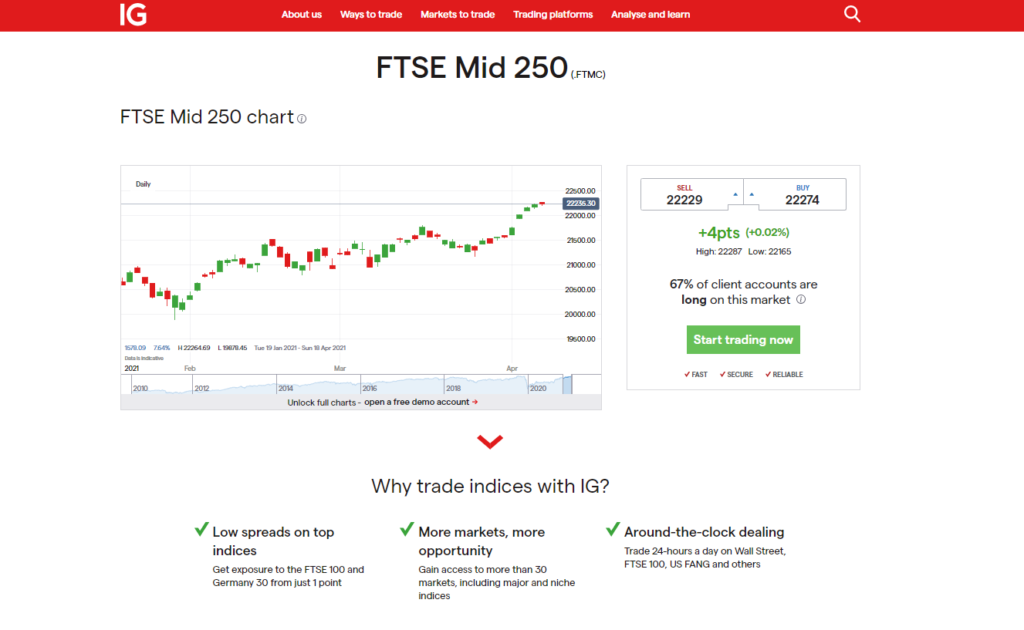

Trading and investing in the FTSE 250 index starts by picking a top-rated and trusted broker. For this we recommend IG as opening an account and trading at the click of a button is made easy and simple. But more on this in the next section.

Trading the FTSE 250 index

Index funds are one of the most effective and passive methods of gaining exposure to the FTSE 250. Index funds typically work by copying the FTSE 250’s performance through a portfolio of all 250 constituents that form the index itself.

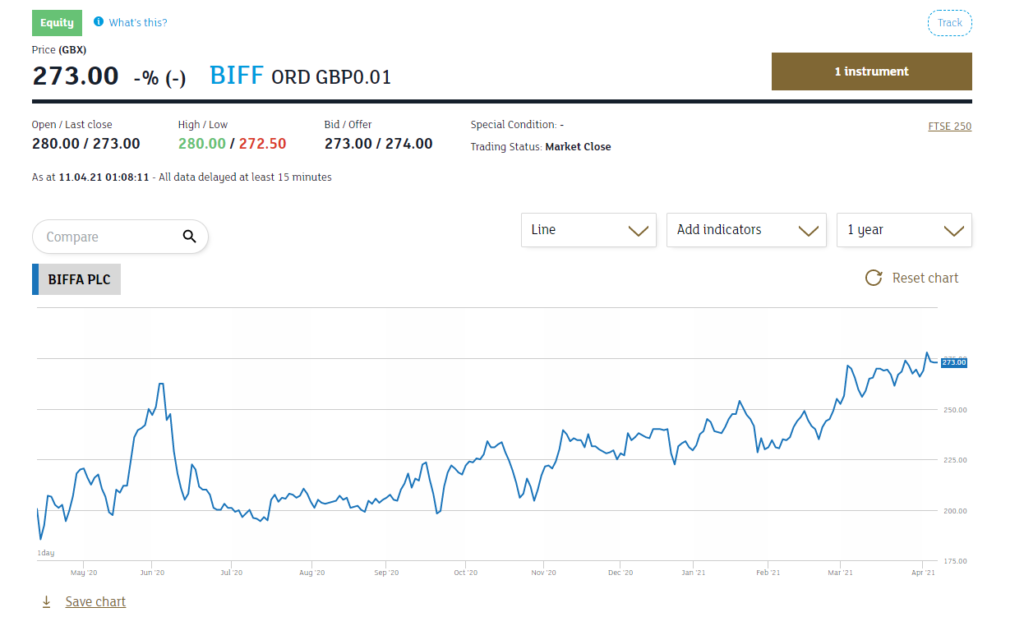

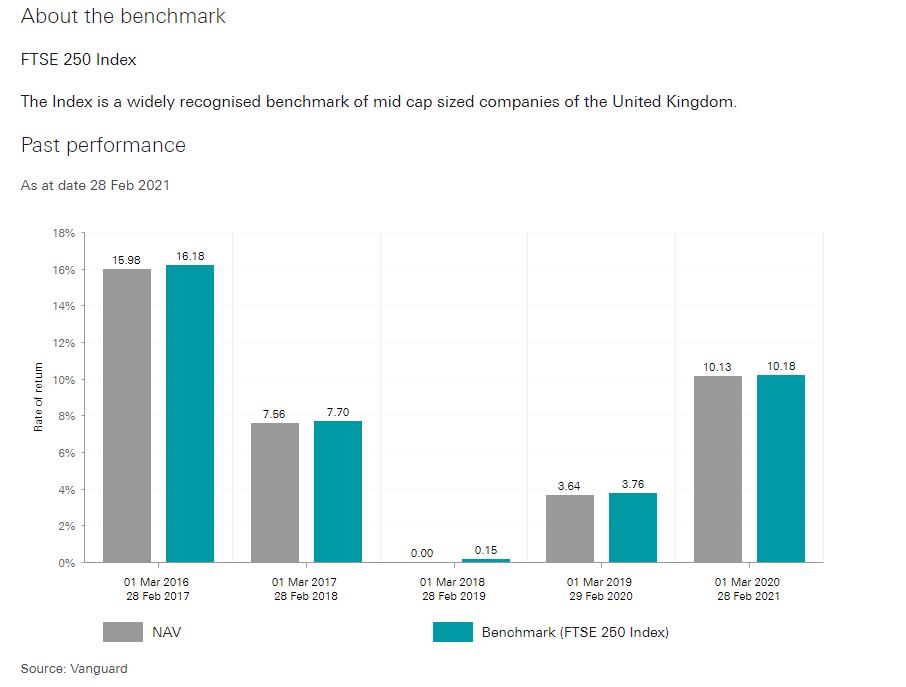

Arguably the most popular way to trade the UK 250 is via a traditional index fund. With some of the largest investment management companies, such as Vanguard, there are many available options. To get an idea of potential returns, we can cast our attention on the Biffa PLC FTSE 250 index, which happens to be highly sought after by the investing community in the UK. This index fund has returned 44.75% during the last year, reinforcing how much potential these funds have.

Alternatively, you can gain exposure to the UK 250 index via index futures. This asset class enables traders and investors to speculate on price movements in the future. Simply put this is a great investment for long-term investment strategies. Index futures give you the ability to buy and/or sell a position in the index now, which will be settled at a specified date in the future, and your returns will be based on the price set out by your futures contract and the actual price in the future.

Lastly, there is the option to day trade the FTSE 250 index. Despite not being as popular as futures contracts or index funds, this is a viable option for active day traders. FTSE 250 index funds usually display less risk than equities because of their diversification.

FTSE 250 Tracker Funds

Investing in FTSE 250 tracker funds is another way to gain exposure to the index. Much like index funds, tracker funds monitor the performance of underlying indices. Therefore, by investing in FTSE 250 tracker funds, your fund’s value depends on the price fluctuations of the actual FTSE 250 index. Simply put, when the FTSE 250 index price increases so do the value of FTSE 250 tracker funds.

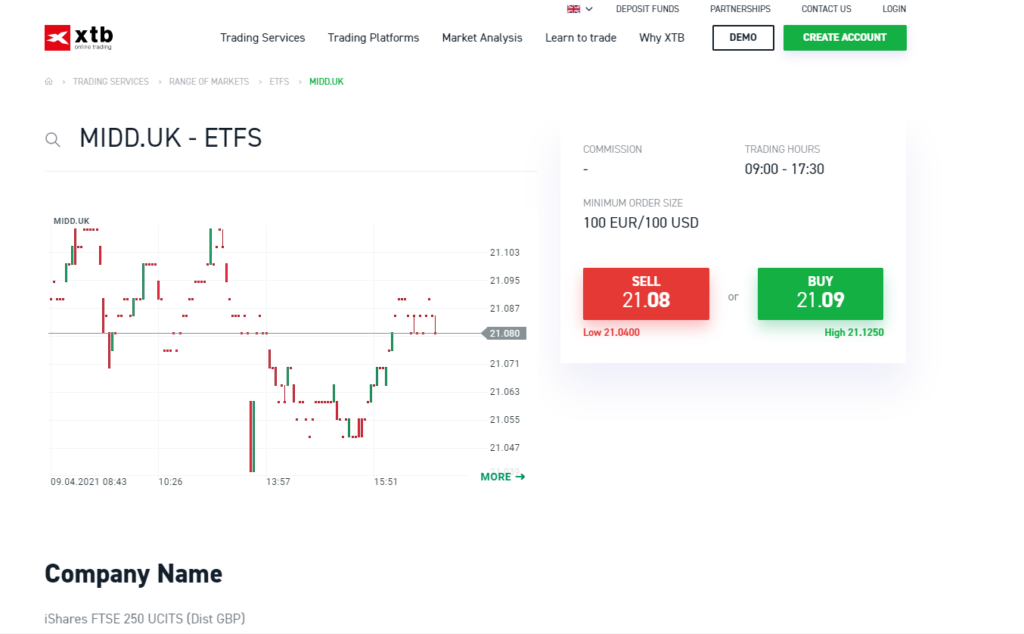

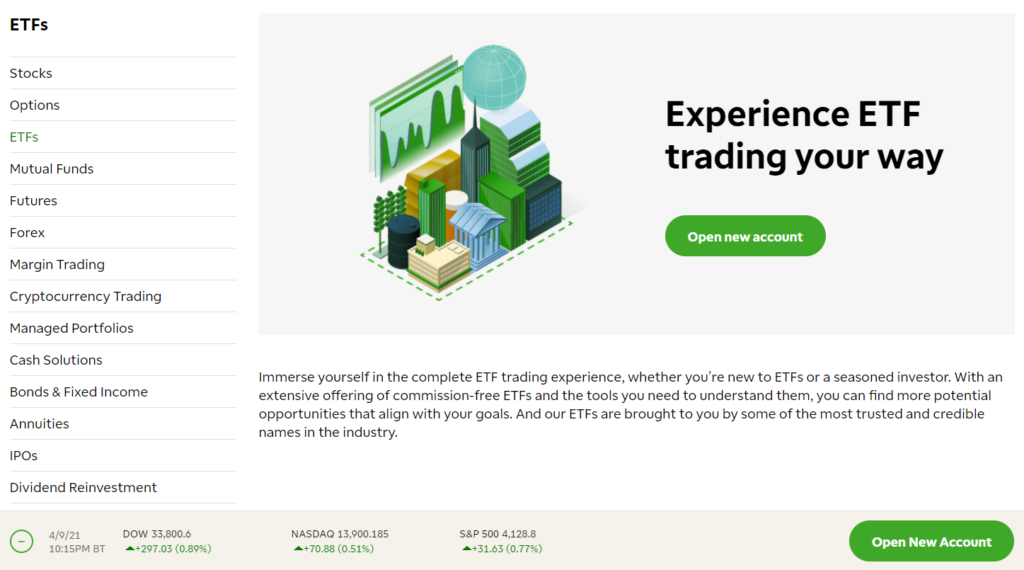

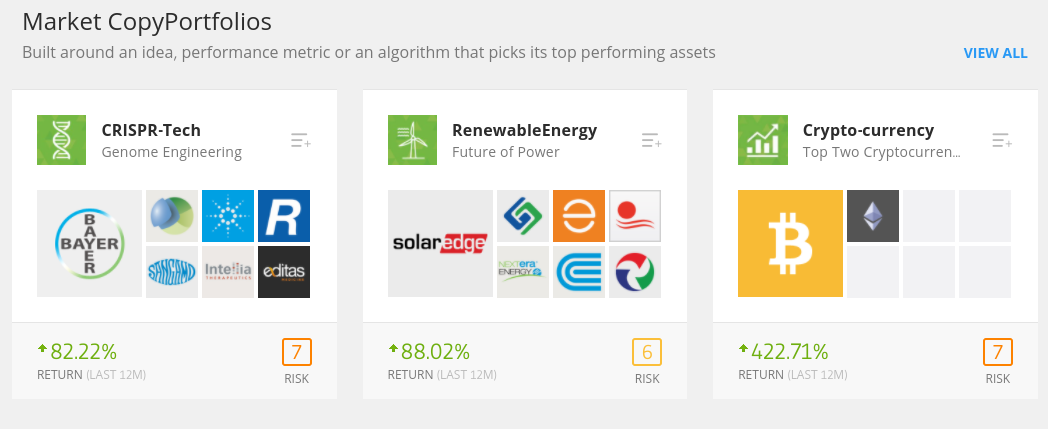

FTSE 250 ETFs & Stocks

Additionally, you can invest in the FTSE 250 index through stocks and ETFs. Investing in ETFs is a great way to gain exposure to the UK equity market and to diversify your portfolio.

On the other hand, if you don’t want to invest in exchange-traded funds then you can invest in FTSE 250 stocks to recreate the performance of the index. IG provides nearly all of the FTSE 250 stocks, giving you the chance to start stock trading and create a diversified portfolio with the added benefit of 100% zero-commission trading.

Best Brokers for FTSE 250 Reviewed

When searching on Google for FTSE 250 brokers you will be inundated with thousands of options. But, after extensive research, we have narrowed it down to a list of 10 top-rated and regulated brokers that have everything you need to make your investment goals a success.

With this in mind, below you will find our recommendations for the Best Brokers for the FTSE 250 UK to consider in 2025 and beyond.

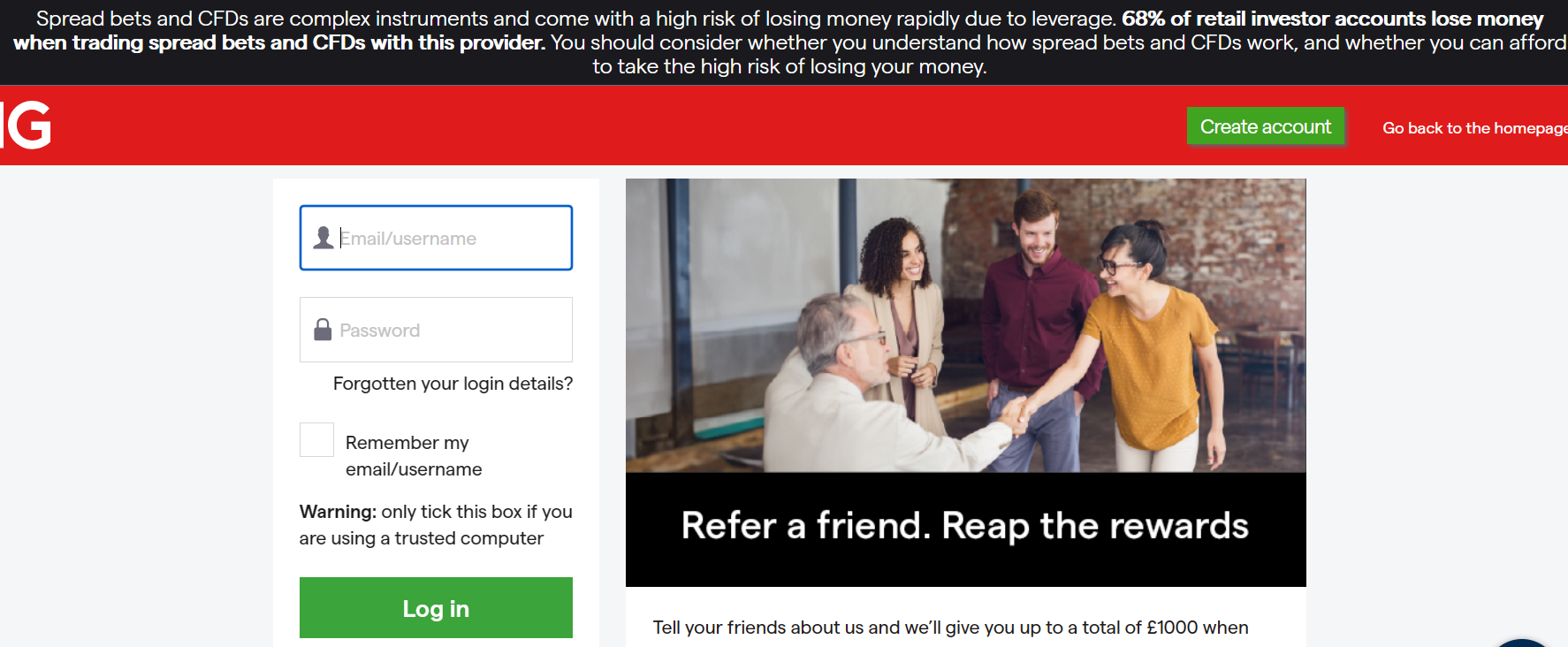

1. IG – Best CFD Broker With Great Educational Resources

Next on our list, IG is one of the largest global CFD brokers and is regulated by tons of financial authorities including FINMA, DFSA, ASIC, CFTC, and the UK’s FCA. IG Group is an internationally recognized broker and is listed on the LSE under the ticker symbol IGG. In terms of client fund protection, for UK-based traders funds up to £85,000 are covered by the FCA and the CFD broker offers negative balance protection.

IG has low non-trading fees such as £0 withdrawal and deposit charges. IG also offers Smart Portfolios which are iShares ETF portfolios that are actively managed by the investment management corporation BlackRock.

IG makes trading and investing in financial assets a breeze simply with the click of a buy or sell button. This CFD broker covers a range of international markets including most European exchanges.

When it comes to trading commissions, this typically depends on where you are located. For instance, certain nations have access to zero-commission trading on UK stock CFDs, whereas other countries incur low commission charges.

Pros:

- Offers user-friendly trading platforms and MetaTrader 4.

- Globally regulated CFD broker with 200,000+ traders

- Minimum spreads only 0.8 pips with zero-commission fee

- Fully-fledged mobile trading app

- Opening an account is easy and simple

- Funding methods include debit/credit cards, e-wallets, bank transfers

- Offers 6 different base currencies so you can avoid conversion fees

Cons:

- Does not offer a desktop trading platform

There is no guarantee that you will make money with this provider. Proceed at your own risk..

2. Interactive Brokers - Top-rated Index Trading Platform for Experienced Traders

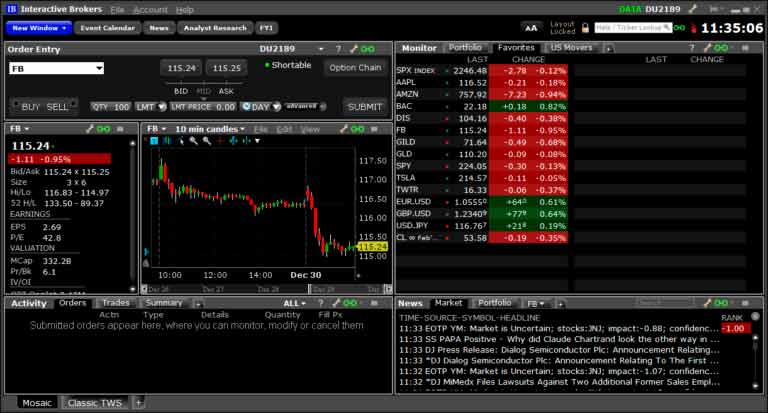

Interactive Brokers is perfectly suited for advanced traders and investors. This is due to the online platform’s array of trading tools and features. Interactive Brokers gives its clients exposure to over 130 markets all over the world. Launched in 1978, this discount broker is regulated by the likes of the FCA and the SEC. As far as client protection is concerned if you conduct forex, and CFD trades you will be covered by the FCA up to an £85,000 limit.

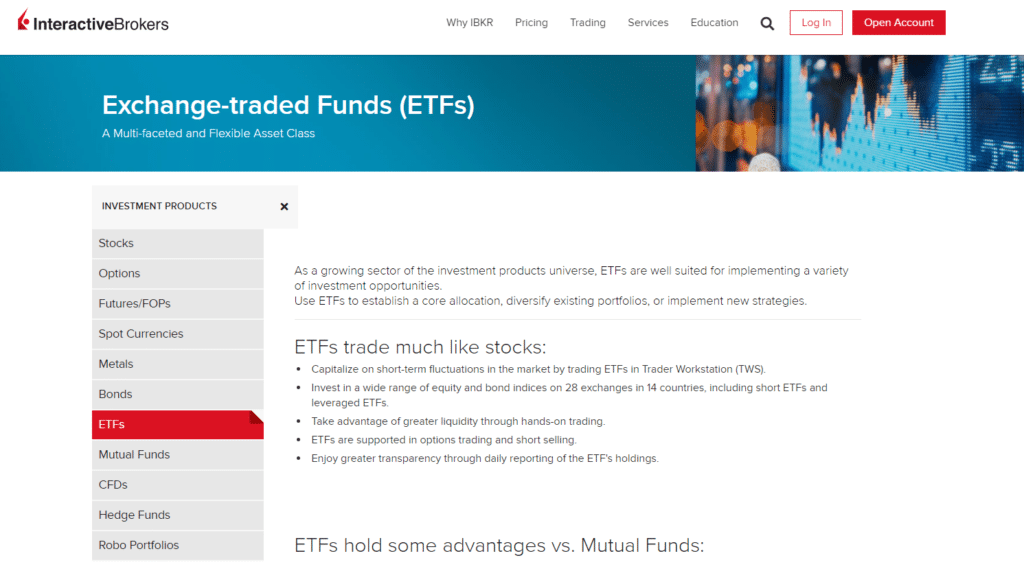

Interactive Brokers has a vast range of asset classes on offer especially when it comes to bonds and ETFs. Traders at Interactive Brokers have access to 78 stock markets and a whopping 13,000 ETFs. In terms of stock trading, last year this CFD stock broker started giving its clients the option of buying and selling fractional shares. This means that you can diversify your investment portfolio on a low budget.

As well as stock index CFDs Interactive Brokers offers Bitcoin and Ethereum trading in addition to Bitcoin futures. So, if you’re a trader with an eye for cryptocurrency trading or CFDs, Interactive Brokers has it all.

Pros:

- Offers user-friendly and well-designed Client Portal and Webtrader platforms

- Low trading fees

- Competitive margin rates

- Huge selection of tradable assets from cryptos to stocks

- Regulated by top-level financial bodies including the FCA and SEC

- Provides negative balance protection for CFD trades

- Demo account with paper trading accounts offering $1 million in virtual funds

- News feed supported by third-party providers including Morningstar and Reuters

- Provides heaps of fundamental data

- Over 100 technical indicators

Cons:

- Desktop trading platform not suitable for beginner traders

There is no guarantee that you will make money with this provider. Proceed at your own risk..

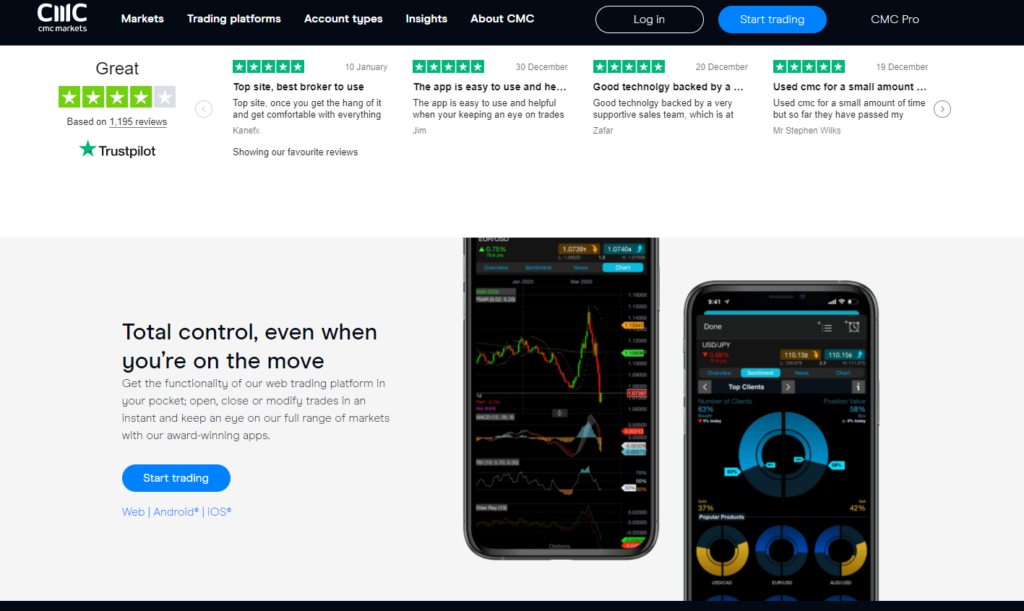

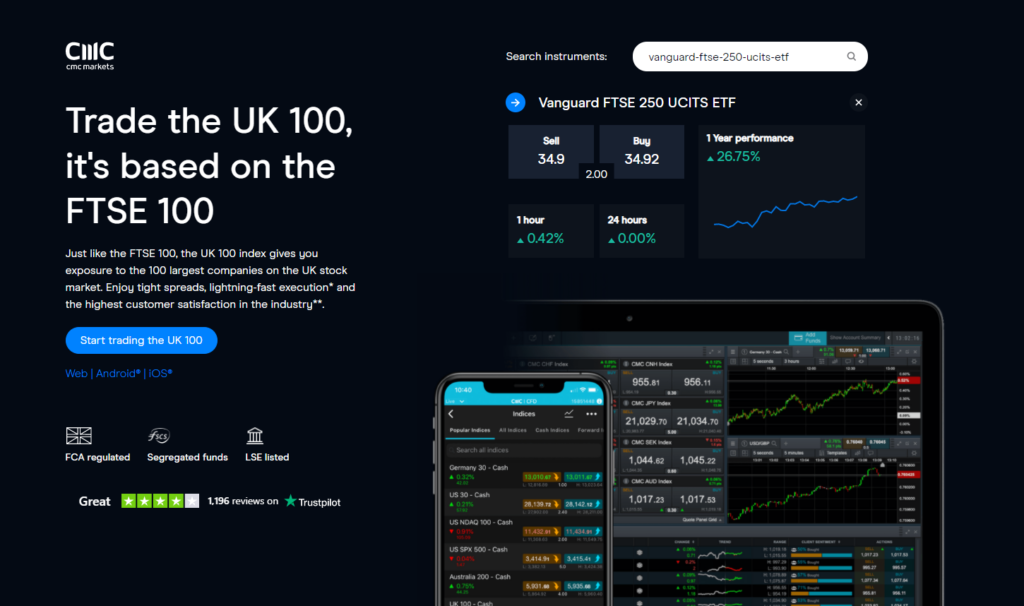

3. CMC Markets - Best CFD and Forex Broker with Low Fees

Established in 1989, CMC Markets is a global CFD and forex broker that is regulated by the Financial Conduct Authority and is listed on the London Stock Exchange under the ticker symbol CMCX. This CFD trading platform has competitive stock index CFD trading fees with low non-trading fees.

CMC Markets users have access to more than 8,000 stock CFDs, 1,000 ETF CFDs, over 135 commodity CFDs and 56 bond CFDs. Something to bear in mind is that leverage levels cannot be altered when trading with this broker.

CMC Markets offers a range of trading ideas which it calls Chart Forums and Insights. These are similar to social trading features as users have access to technical analysis and chart speculations, including the FTSE 250 chart, from financial experts and other traders.

If you are just starting out in the world of online trading then CMC Markets has you covered. Reflecting all features of a live trading account the demo account is a risk-free way of learning the ropes without having to worry about risk tolerance or losing capital.

Pros:

- Fully digital account opening process

- Low forex and stock index CFD trading fees

- No deposit or account fees

- Fully digital account opening process with no minimum deposit

- 10 account base currencies helping to avoid conversion fees

- User friendly demo account with paper funds

Cons:

- Customer support is not available 24/7

There is no guarantee that you will make money with this provider. Proceed at your own risk..

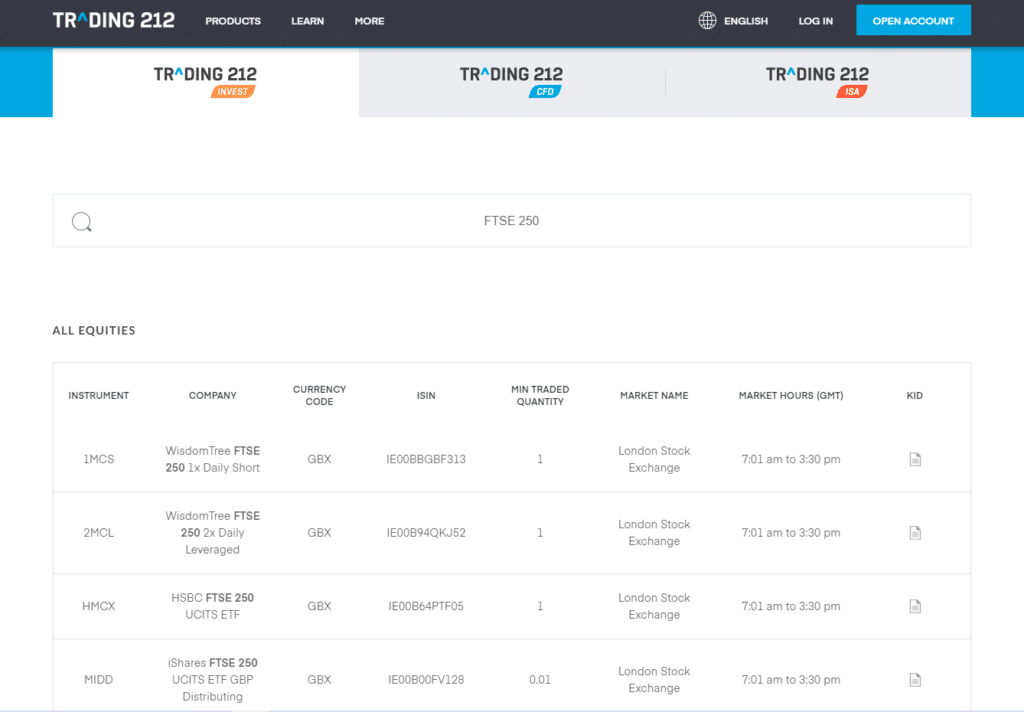

4. Trading 212 - Top CFD Broker Offering Free ETF Trading

If you’re on the search for a CFD broker with tons to offer then Trading 212 is a great option. This online broker has over 2,500 CFDs, and more than 10,000 funds and stocks for long-term traders and investors. Trading 212 provides zero-commission trades giving its clients access to low-cost trades. On the flip side, its spreads are slightly above average when compared to other brokers.

Established in 2004, Trading 212 is regulated by the UK’s Financial Conduct Authority and the FSC. Providing 100% commission-free ETF and stock trading it is home to thousands of traders. According to the broker itself, its mobile trading app has been downloaded by more than 14 million users which makes it one of the most popular trading apps out there.

Trading 212 CFD account holders have access to more than 1,500 share CFDs and just under 30 ETF CFDs. On the other hand, if you use a Trading 212 Invest account you can gain exposure to a range of UCITS ETFs that track the price movements of the FTSE 250 index.

Invest and ISA accounts with Trading 212 are charged zero-spreads when investing in shares. All in all, this CFD broker offers low-cost ETF and stock trading with 0% commission but can be slightly costly when it comes to active CFD trades.

Pros:

- Stock and ETF trades come with a 0% commission

- User-friendly web and mobile trading platforms

- Two-step authentication login process

- Great charting experience with over 60+ technical indicators

Cons:

- Customer support only available through email

- Zero account and inactivity fees

There is no guarantee that you will make money with this provider. Proceed at your own risk..

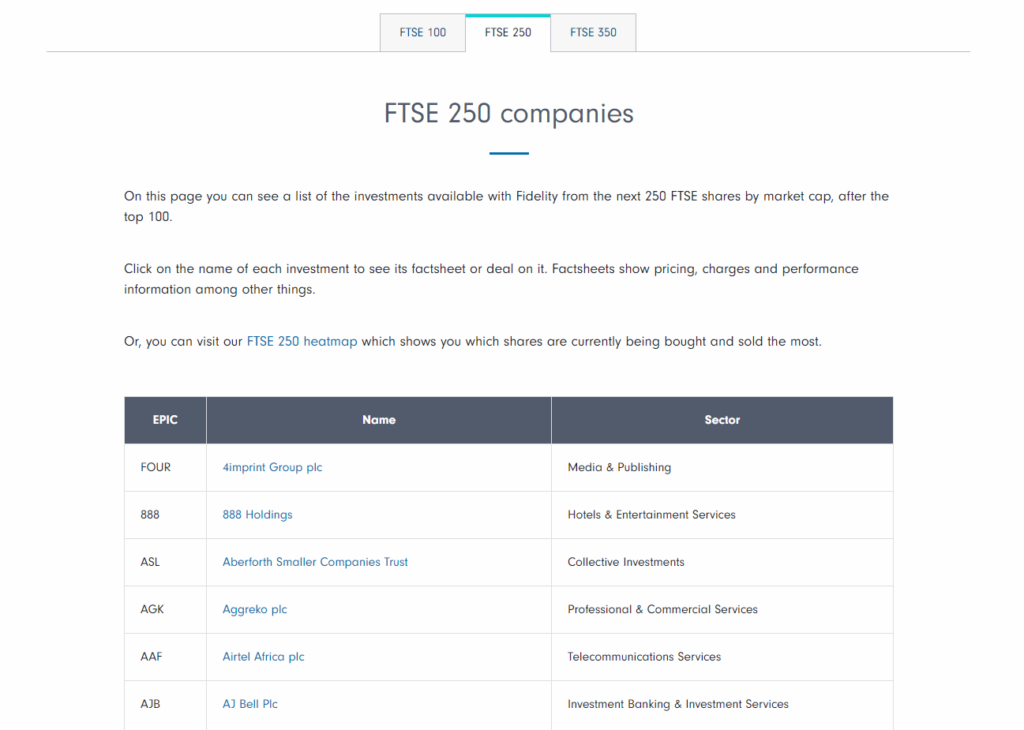

4. Fidelity - Top UK-based Stock Broker with Low Fund Fees

Offering low trading and non-trading fees, Fidelity International is a UK-based trading platform that is regulated by the FCA. This trading platform charges a £10 flat rate, which in a nutshell is a pricing structure that charges a fixed service fee.

On the plus side Fidelity International has low non-trading fees including £0 account and deposit fees. Opening an account with this broker is fully digital and can be completed in around 10 minutes. However, there is a £1,000 minimum deposit for ISA, SIPP, and Investment accounts.

In terms of tradable assets and markets that are on offer at Fidelity International, the range is quite limited when compared to the other brokers in this FTSE 250 index brokers guide. Put simply, ETFs and stocks traded on the LSE are offered with this broker, with the exception of 150 mutual funds.

You can also invest in investment trusts with Fidelity International, these are funds registered as public traded companies. There are more than 150 of these investment trusts available at Fidelity International, making it a great way to diversify your portfolio without owning the underlying asset.

Pros:

- User-friendly mobile trading platform

- No withdrawal or inactivity fees

- Well-designed research tools

- Relevant educational resources

Cons:

- Demo account not available

- No live chat or 24/7 customer support

- No cryptocurrency, CFD or forex trading available

There is no guarantee that you will make money with this provider. Proceed at your own risk..

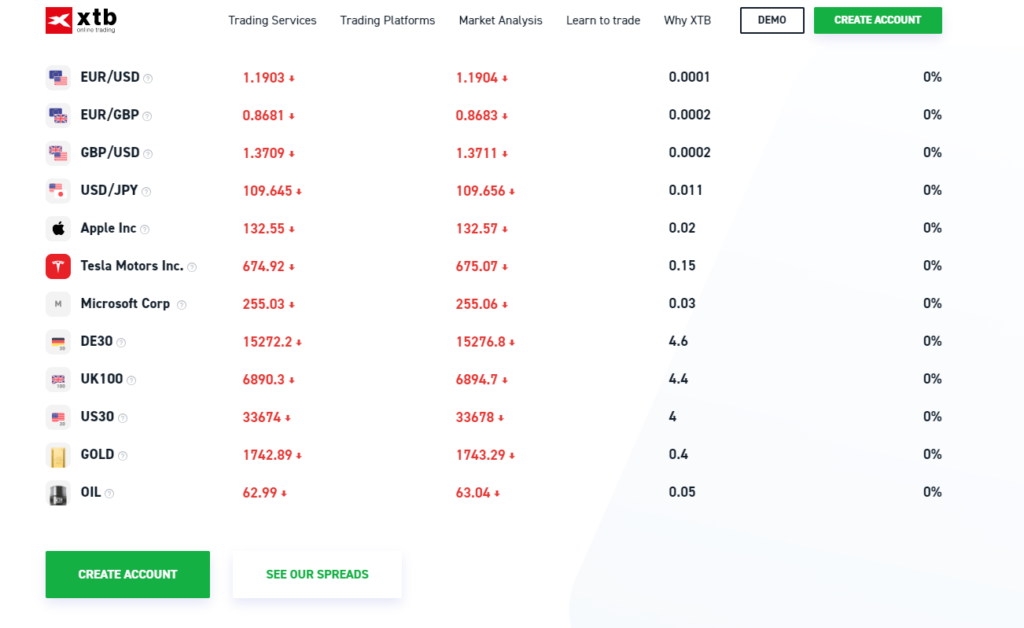

5. XTB - Global CFD and Forex Broker

If you’re looking for a CFD broker then XTB has a lot to offer. Despite only offering CFDs, forex, and crypto trading, there is a fair amount of each asset to satisfy most traders’ needs. XTB offers 1,800+ stock CFDs, more than 40 stock index CFDs and 114 ETF CFDs, as well as 25 cryptos. Basic and standard account users benefit from trading on a commission-free basis.

On the flip side, if trading stocks and ETFs in the traditional sense is more of your thing then you may be disappointed to find out that XTB does not offer real stock and ETF trading to clients in the UK.

In terms of fundamentals, XTB is regulated by a bunch of major financial authorities such as the FCA, CySEC, IFSC, KNF and the CNMV. XTB charges $0 deposit fees while popular e-wallets including PayPal charge a 2% fee. And when it comes to opening individual brokerage accounts there are no minimum deposits required. But, there is a £15,000 minimum required deposit if you open a corporate account.

Pros:

- Being a CFD broker it offers a wide range of stock index CFDs, ETF CFDs, and stock CFDs to help you trade the FTSE 250 index

- User-friendly xStation 5 trading platform offering high customization features

- Demo account and webinars available for beginner traders

- Regulated by major financial authorities including the FCA and IFSC

- Option to set price alerts and market news notifications in real-time on the XTB mobile trading app

Cons:

- $12 inactivity fee charged after 12 months

- As a disclaimer, the mobile trading app does not offer two-step authentication login

75% of retail investor accounts lose money when trading CFDs with this provider.

6. TD Ameritrade - Top US-based Broker Offering Industry Leading Trading Platform Thinkorswim

Mixing education with functionality, TD Ameritrade provides an all-round brilliant online trading platform that helps both new and advanced traders achieve their investment objectives. As one of the biggest US-based index brokers, TD Ameritrade’s offering of tradable assets and educational resources are designed to meet your trading needs.

Launched in 1975, TD Ameritrade is regulated by major financial authorities including the Securities and Exchange Commission, the Commodity Futures Trading Commission, and the Financial Regulatory Authority, or FINRA for short. As we have already mentioned this broker provides its own in-house developed a desktop trading platform called Thinkorswim which is industry-leading and has tons of research tools and fundamental data which makes charting a great experience.

TD Ameritrade has low trading and non-trading costs. For example, its clients benefit from 100% commission-free stock and ETF trading. Additionally, there are no deposit or account fees making this a great low-cost broker. In terms of its range of tradable instruments, TD Ameritrade offers everything from free stock and ETF trading to cryptos and futures. While this online broker does not offer CFD trading, it does offer other useful trading features such as robo-advisory services and social trading.

TD Ameritrade also offers a demo account called paperMoney via its user-friendly Thinkorswim desktop trading platform. In addition to a default virtual fund balance of $100,000, users also have access to heaps of state-of-the-art trading and charting features. As you may or may not know, demo accounts are perfect for beginner traders who want to get a hands-on experience of the online trading scene and even for advanced investors who want to use trial and error to test a new trading strategy or trading idea without risking their own capital.

Pros:

- Low non-trading and trading fees

- Free stock and ETF trading with 100% zero commission

- Fully-fledged web, mobile, and desktop trading platforms

- In-house developed Thinkorswim platform offers top-notch technical research and charting tools

- Trading ideas from top-tier third-party providers such as TD Group and Reuters.

- Wide range of account types to choose from including Individual accounts to Retirement accounts (Roth IRA)

Cons:

- Does not support the following deposit options: credit and debit cards, or e-wallets

- Trading is restricted to US markets only

There is no guarantee that you will make money with this provider. Proceed at your own risk..

7. FxPro - Best FCA-regulated Trading Platform With $0 Deposit Fees

Last but not least on our list is FxPro. This CFD and forex broker was established in 2006 and is regulated by the Securities Commission of the Bahamas, CySEC, FSCA, and the UK’s FCA. Furthermore, this broker also provides negative balance protection which means that you are covered should your account balance shift into the negatives.

FxPro has competitive trading fees and its price structure varies depending on the type of trading account you choose. In terms of trading and investing in the FTSE 250 index, this CFD and forex broker offers low stock index CFD fees while its stock CFD charges are quite high when compared to other brokers on the market.

When it comes to non-trading fees, FxPro does not charge an account fee, deposit fee, or withdrawal fee but does include an inactivity fee of $5 per calendar month after 6 months. There are also four separate trading platforms to pick from with FX Pro, including FxPro EDGE (its in-house developed trading platform), MetaTrader 4 and MetaTrader 5, and cTrader.

In terms of FxPro’s educational features, it offers platform tutorials, educational resources, and a demo account. You can even access educational content via its YouTube page, self-assessment trading tests, and a walkthrough guide to technical analysis via Trading Central. You can also attend online webinars which are tailored to either beginner or advanced traders.

Pros:

- Fully digital and user-friendly account opening process

- Top-rated and popular educational tools

- $0 withdrawal fees

- Trade over 140 stock CFDs and 36 stock index CFDs

Cons:

- Trading real stocks and ETFs are not offered with FxPro

There is no guarantee that you will make money with this provider. Proceed at your own risk..

FTSE 250 Brokers Fees Comparison

| Deposit fee | Withdrawal fee | Account fee | Inactivity fee | ETF fee | Stock fee | Index CFD Min Spread | |

| IG | No | No | No | $12 per month after 2 years | 0.75% | 0.75% | 1 |

| Interactive Brokers | No | No | No | Varies depending on account type | 0% | 0% | 1 |

| CMC Markets | No | No | No | £10 monthly after 1 year | n/a | n/a | 1 |

| Trading 212 | No | No | No | No | 0% | 0% | n/a for FTSE 250 |

| Fidelity | No | No | No | No | £10 per deal | £10 per deal | Fees built into spread |

| XTB | No | No | No | $12 per month after 1 year | 0.12% volume-based fee (10 euro min fee) | 0.12% volume-based fee (10 euro min fee) | 0.9 |

| TD Ameritrade | No | No | No | No | 0% | 0% | n/a |

| FxPro | No | No | No | $5 per month after 6 months | n/a | n/a | 0% commission as fees built into spread |

How to Get Started with a FTSE 250 Broker

Throughout this section of our FTSE 250 broker comparison review, we take you through the actual process of investing and trading the FTSE 250. We highly recommend picking IG as you can trade heaps of tradable assets with fixed commissions.

Step 1 - Open an Account with IG

There is no guarantee that you will make money with this provider. Proceed at your own risk..

Opening an IG account is user-friendly, fully digital, and simple. Furthermore, you can open an account via the website trading platform or mobile app. Just click the join now button and provide your personal credentials.

Step 2 - Upload ID and Proof of Address

Identity and address verification are requirements set out by the UK’s Financial Conduct Authority. Consequently, you must upload two forms of ID to be able to use the IG trading platform.

Acceptable forms of ID include birth certificates, passports, bank statements and recent utility bills.

Step 3: Deposit Funds

The next step involves depositing funds into your trading account to enable you to invest and trade the FTSE 250 index. When it comes to payment options IG gives you the option to use credit or debit cards, e-wallets including PayPal, or bank transfers. If you use a credit or debit card your funds are deposited into your account straight away.

There is no minimum deposit requirement to start using the IG platform.

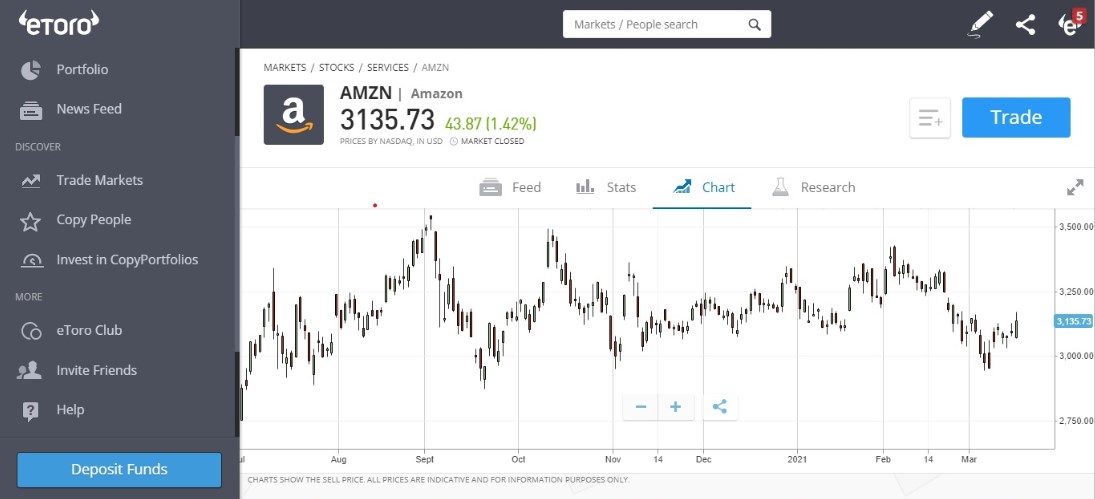

Step 4: Search for FTSE 250 Stocks

Now you’re ready to choose FTSE 250 stocks to add to your portfolio to track the performance of the index. For this step, we will focus on MEDICLINIC INTERNATIONAL PLC as an example of a FTSE 250 constituent that is available through the IG trading platform. Simply enter the company’s name in the search bar to access an overview of the stock as well as stats, charts (like FTSE 250 live chart), and social feeds.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

Step 5: Place Your Trade

The last step is confirming your trade with IG. After clicking on trade you will be presented with another page that asks you to specify the amount you want to invest. Purchasing the underlying asset with zero commission is made with the click of a button at IG, which is why we recommend it as the best broker for the FTSE 250 index.

Conclusion

To summarize, the FTSE 250 index is a popular investment amongst advanced and beginner investors who want to gain exposure to the equity market. The FTSE 250 is made up of 250 innovative companies that present promise for expansion and growth which offers investors the opportunity to yield huge returns.

If you’re on the hunt for a top-rated and regulated stock broker to trade and invest in the FTSE 250 then IG is the best choice. With IG you can buy shares of stocks that make up the UK 250 with fixed commissions. Moreover, there is no minimum deposit requirement making it a low-cost trading platform. Finally, IG offers a range of charting tools and features to facilitate different strategies and analysis.

There is no guarantee that you will make money with this provider. Proceed at your own risk..