eTrade vs Webull – Cheapest Broker Revealed

Amidst the thousands of brokers out there two, in particular, stand out. In this e*Trade vs Webull comparison, we cover all the key metrics from fees and commissions to tradable assets. So, to find out which broker suits you best, keep reading!

Buying and selling financial instruments online has never been easier. All you have to do is open a trading account and start investing. But how do you choose the right trading platform that suits your trading goals?

What are e*Trade and Webull?

In short, both Webull and e*Trade are online brokers that give you the ability to buy and sell tradable assets from the comfort of your own home. To get started you simply need to create a brokerage account, deposit funds, and you will then have unrestricted access to the markets and products that are on offer.

For instance, both e*Trade and Webull offer commission-free ETF, options, and stock trading. However, if you are interested in crypto trading or CFD derivatives then neither broker supports these types of assets. It should be noted here that e*Trade also offers mutual funds, bonds and CDs, and futures trades.

When it comes to traditional investment types and derivative instruments, the key difference is that derivatives are contracts between two parties whose worth and the price is determined by an underlying asset.

In terms of the fundamentals, Webull is a free trading platform that was launched in 2017 and is regulated by the Financial Industry Regulatory Authority and the US Securities and Exchange Commission. As well as zero commission US stock, ETF, and options trading, Webull also has low non-trading fees such as a $0 account and deposit fees.

On the other hand, e*Trade is a US-based broker that was established in 1982 and is also regulated by the US Securities and Exchange Commission and is a member of FINRA. e*Trade also provides a full-fledged and well-designed mobile trading app that allows you to buy and sell assets wherever you are on your Android or Apple device.

e*Trade vs Webull Tradable Assets

Starting with Webull, the range of markets and financial instruments is rather limited when compared to other brokers, nevertheless, you can invest in US stocks, ETFs, and options without paying a penny in commissions.

With a Webull brokerage account, you can access the three major US stock exchanges including the Nasdaq, New York Stock Exchange, and AMEX. Unfortunately, penny stock trading and fractional share trading are simply not available with this broker.

Furthermore, when you compare this to other free trading platforms such as Robinhood, you can see that Webull is rather limited in its offerings.

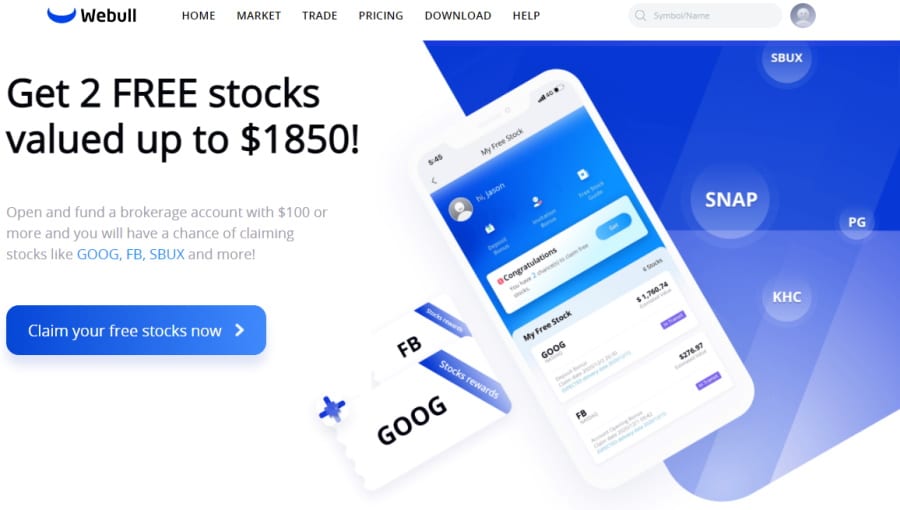

In terms of ETF trading, Webull provides access to more than 2,000 US ETFs as well as several US options markets. As for promotional offers and incentives to start trading, Webull gives you the chance to gain ownership of 2 free stocks worth up to $1,850.

But, how does this work exactly? Simply put, when you successfully open a Webull brokerage account you obtain one free stock with a value between $2.50 and $250. Similarly, after you deposit funds of at least $100 into your account, you receive another free stock, this time worth between $8 and $1,600.

The promotional stocks have a minimum market value of $2.5 billion and are listed on either the Nasdaq or the NYSE. The stock rewards are handed out at random using a lottery-based system.

Turning our attention to the second broker in this review, e*Trade provides access to stock trading, options, mutual funds, ETFs, futures, bonds and CDs, and prebuilt portfolios. e*Trade also only covers US exchanges which include the NYSE, AMEX, Nasdaq, OTC, and OTCBB. There are around 2,300 ETFs and a range of robo-advisory portfolios to choose from.

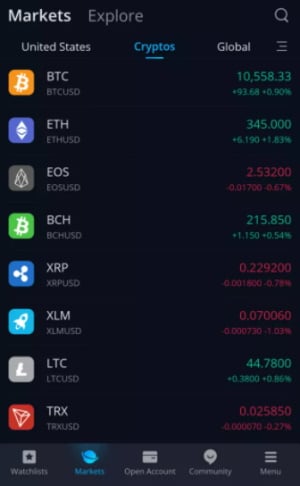

In terms of crypto trading, while you cannot invest or trade cryptos in the traditional sense, you can trade crypto derivatives via futures contracts. This means that when you invest in Bitcoin futures you gain exposure to Bitcoin without gaining ownership of the underlying asset. As is the case with futures contracts for commodities, crypto futures allow traders to speculate on the future price movements of the underlying digital currency.

With that in mind, e*Trade offers the following cryptocurrency futures:

- CME Micro Bitcoin Futures (USD) (/MBT) Tick size: 0.5, Tick value: $5.00, Trading hours (ET) 6:00 p.m. (Sunday) to 5:00 p.m.

- CME Bitcoin Futures (USD) (/BCT) Tick size: 5, Tick value: $25.00, Trading hours (ET) 6:00 p.m. (Sunday) to 5:00 p.m.

- CME Ether Futures (USD) (/ETH) Tick size: 0.25, Tick value: $12.50, Trading hours (ET) 6:00 p.m. (Sunday) to 5:00 p.m.

When it comes to futures trading with e*Trade, you can access a wide range of contracts which are broken down into relevant sectors such as:

- Equity index

- Energy

- Interest rates

- Metals

- Grains

- Softs

- Livestock

- Forex

All in all, e*Trade has a wider variety of markets and financial instruments for you to sink your investing teeth into. Moreover, e*Trade also allows you to short penny stocks on its platform, which means you can invest in shares of penny stocks for as little as $1.

But, this raises the question: just how do penny stocks work? In short, penny stocks function in the same way that stocks of companies with large market capitalizations do – when you invest in a penny stock, you are gaining ownership of a portion of a company. Your stock’s price movements are based on the company’s value. Penny stock investors make a profit by selling the shares for a greater price than that with which they bought it for, or from dividends.

e*Trade vs Webull Account Types

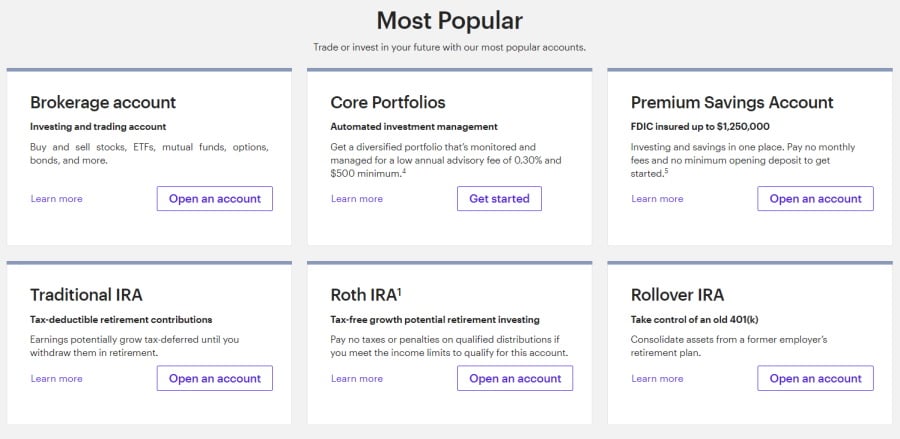

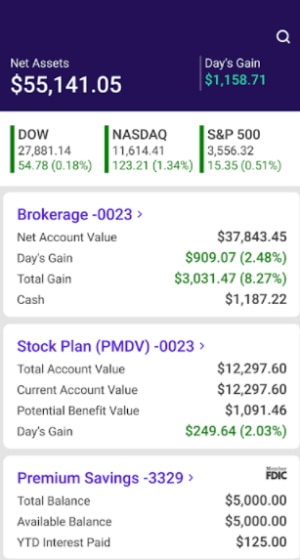

Firstly, Webull offers two kinds of individual brokerage accounts which are cash accounts and margin accounts. This means that each trader can have one of each account type. Additionally, this online trading platform also supports IRA accounts including Traditional IRA, Roth IRA, and Rollover IRAs. You are allowed to open one individual retirement account, but you need to have an individual account prior to opening an IRA account.

On the flip side, e*Trade has a much wider range of account types for you to choose from. These include:

- A brokerage account for investing and trading stocks, ETFs, mutual funds, and other assets.

- A Coverdell ESA account for saving for a minor’s education which offers tax-free withdrawals for eligible educational expenses (for example tuition fees).

- A custodial account – managed by a next of kin or custodian on behalf of a minor.

- Retirement accounts – Rollover IRA, Roth IRA, Traditional IRA, Beneficiary IRA, e*Trade Complete IRA, IRA for minors

- Small business retirement accounts including – Individual and Roth Individual 401(k) which is a retirement plan for those who are self-employed. Simple IRA account for companies with fewer than 100 employees, a SEP IRA account for the self-employed and small businesses. A Profit-Sharing Plan, and an Investment-only account.

- e*Trade bank accounts that offer FDIC insurance and free transfers to and from e*Trade accounts. These include a premium savings account, max-rate checking account, e*Trade checking account, and an e*Trade line of credit account.

e*Trade’s managed portfolios

When it comes to automated trading, e*Trade has a bunch of managed portfolios to help you manage your portfolio of investments with the click of a button. There are 4 different managed accounts to choose from with varying levels of management including robo-advisory services.

- Blend Portfolios – are mutual fund and ETF portfolios that are managed by expert financial consultants with a minimum investment of $25,000.

- Dedicated Portfolios – are custom-made professionally managed portfolios of ETFs, mutual funds, and stocks that are tailored to your trading goals. There is a minimum investment of $150,000.

- Fixed Income Portfolios – are bond portfolios managed by third-party professionals and come with a $250,000 minimum investment.

- Core Portfolios – automated investment management with ownership of a diversified portfolio. There is a low annual advisory fee of just 0.30% and a $500 minimum investment.

e*Trade vs Webull Fees & Commissions

In this section of our Webull vs e*Trade review, we will cover the trading and non-trading fees that you are likely to encounter.

| Inactivity fee | Deposit fee | Withdrawal fee | Account fee | US Stock fee | ETF fee | Account Transfer fee | Options fee | |

| eTrade | No | $0 | $0 | $0 | 0% | 0% | $25 for partial transfers and $75 for full transfers | $0.65 per contract |

| Webull | No | $0 | $0 | $0 | 0% | 0% | $75 | $0 |

Stocks, ETFs, and options

As we have already discussed, both free trading platforms offer US stock and ETF trading on a commission-free basis. Webull, on the one hand, does not charge a fee for options trades, but e*Trade charges $0.65 per options contract.

e*Trade futures contract commissions

e*Trade also charges a futures contract commission of $1.50 per contract, per side, and fees. However, if you are planning on trading Bitcoin futures products then there is a commission of $2.50 per contract, per side, and fees.

e*Trade’s fees for broker-assisted trades and OTC stock trades

There is an additional $25 charge for broker-assisted trades which excludes Extended Hours overnight session trades between the hours of 4 am and 7 am ET. In terms of over-the-counter stock trades, there is a $6.95 commission fee for online trades of OTC stocks.

Margin interest rates

Webull gives you up to 4x day-trade buying power and 2x overnight buying power with a margin trading account. To be eligible for a margin account at Webull you will need a minimum investment of $2,000.

e*Trade’s margin base rate as of March 2020 is 6.45%. It is worth noting here that margin trading involves considerable risk because while it can maximize potential returns it can also maximize potential losses.

Margin interest is calculated on a daily basis and is paid back in monthly installments. The margin rate is volume-tiered and varies depending on the margin loan amount.

Here’s a quick overview of the varying annual margin rate charged by Webull and e*Trade:

| Margin Balance | e*Trade margin rate | Webull margin rate |

| $0-$25,000.00 | 8.95% – 8.70% | 6.99% |

| $25,000.01-$100,000.00 | 8.45%-7.45% | 6.49% |

| $100,000.01-$250,000.00 | 7.45% | 5.99% |

| $250.000.01-$500,000.00 | 6.95% | 5.49% |

| $500,000.01-$1,000,000.00 | 6.45% | 4.99% |

Non-trading fees

When we compared e*Trade and Webull we found that both trading platforms have low non-trading fees in that there are no account fees, inactivity, withdrawal or deposit fees. However, when it comes to Webull’s deposit and withdrawal fees these are free when you use ACH deposits and withdrawals. If you were to deposit funds via wire transfer this would cost $8 per deposit, and similarly, if you were to withdraw via wire transfer this would cost you $25 per withdrawal.

e*Trade on the other hand charges $0 for incoming wire transfers and $25 for outgoing wire transfers.

e*Trade vs Webull User Experience

In terms of the overall user experience, our e*Trade vs Webull review found that the latter is a much better match for beginner traders with little to no experience with online trading. This is apparent from the moment that you land on the Webull website. For instance, there is no complex terminology or financial jargon.

Navigating your way around the site is simple and easy, and opening an account can be completed in a matter of minutes and is fully digital. The same applies when it comes to searching for a stock or other financial instrument. All you have to do is type the ticker symbol or the name of the stock into the search bar and Webull displays a list of relevant results for you to choose from.

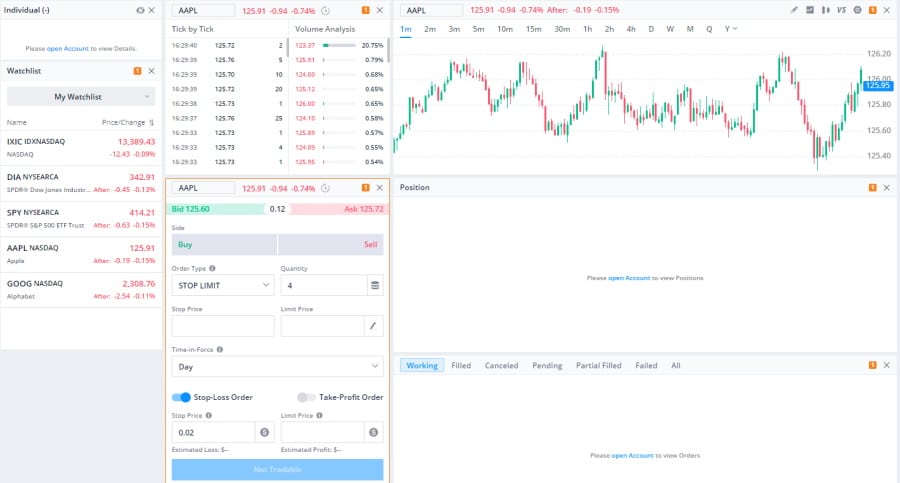

The interface and layout are neatly organized and user-friendly. The trading window has all the necessary information and features to help you make the best investment decisions. These include charts with fundamental data and more than 40 technical indicators. You can also change the line style of the charts from candle to Heikin Ashi.

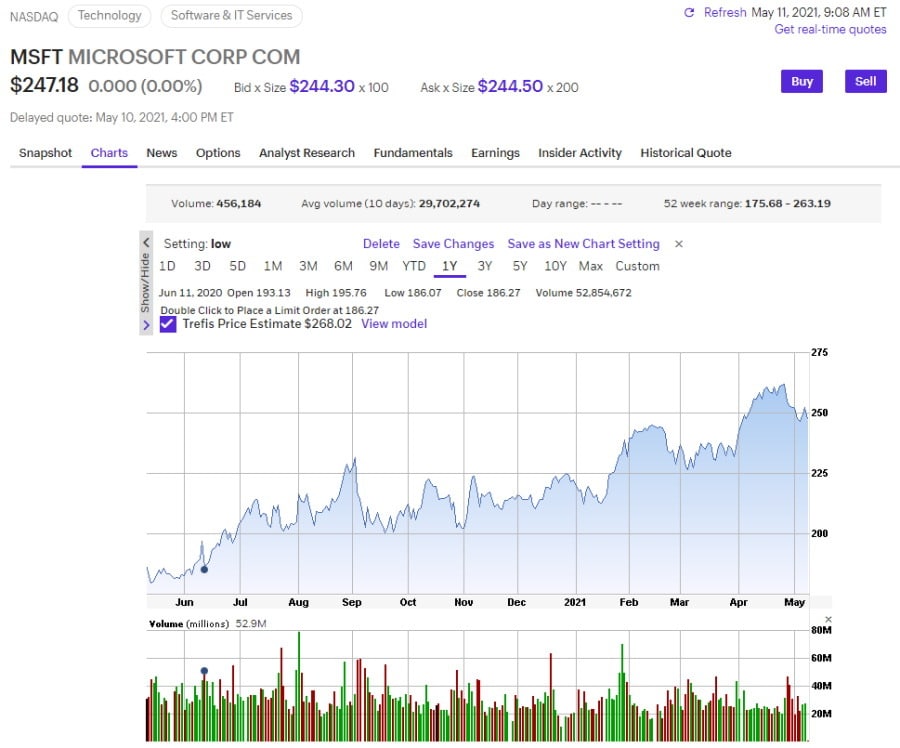

When it comes to e*Trade’s user experience, this is also user-friendly and best suited for both new and advanced investors. Opening an account is very simple and fully digital and takes a matter of minutes.

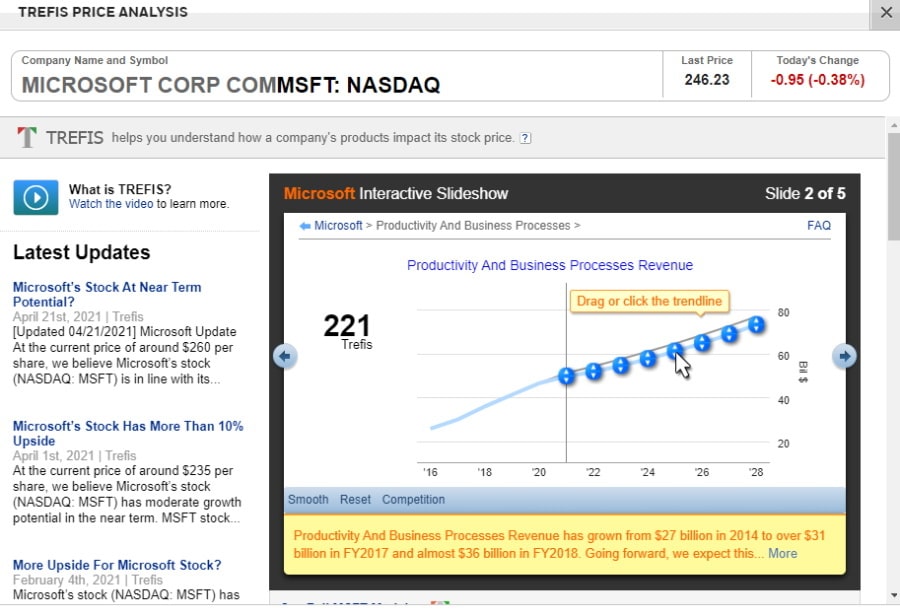

To trade your chosen stocks or assets, simply type the name of the company or ticker symbol into the search bar and you will be presented with a range of relevant results. The stock snapshot pages have tons of key information from analyst research to fundamental data and charts.

e*Trade vs Webull Mobile App

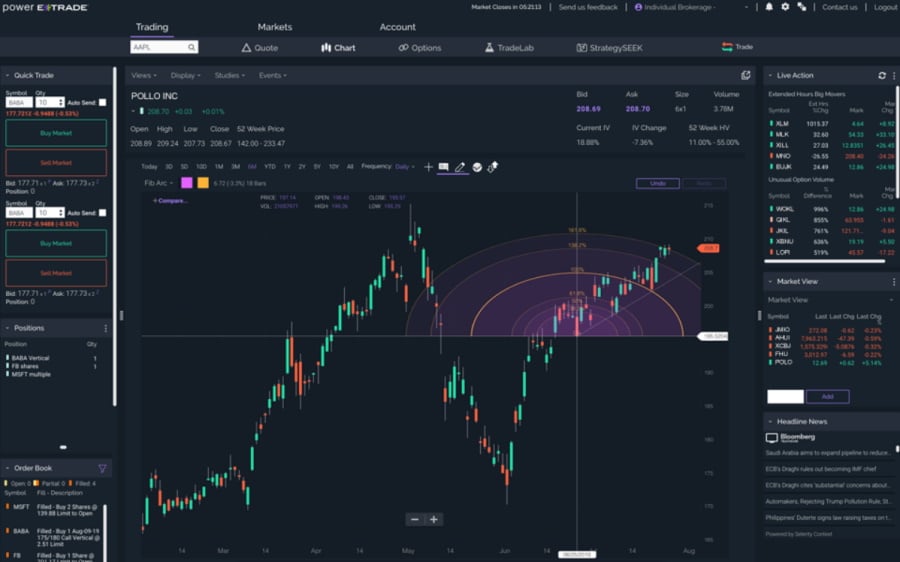

With the popularity of mobile trading apps growing exponentially both Webull and e*Trade offer user-friendly mobile trading apps that are compatible with iOS Apple and Android devices. e*Trade also offers two mobile trading apps: e*Trade Mobile and Power e*Trade.

All in all, web and mobile trading platforms provide similar features and user experiences, however, mobile trading apps are typically designed with simplicity and ease of use in mind. Both trading apps provide great search functionalities, allow you to set a variety of order types, set price alerts and push notifications to be received in real-time, and offer a two-step authentication process for added security and account protection.

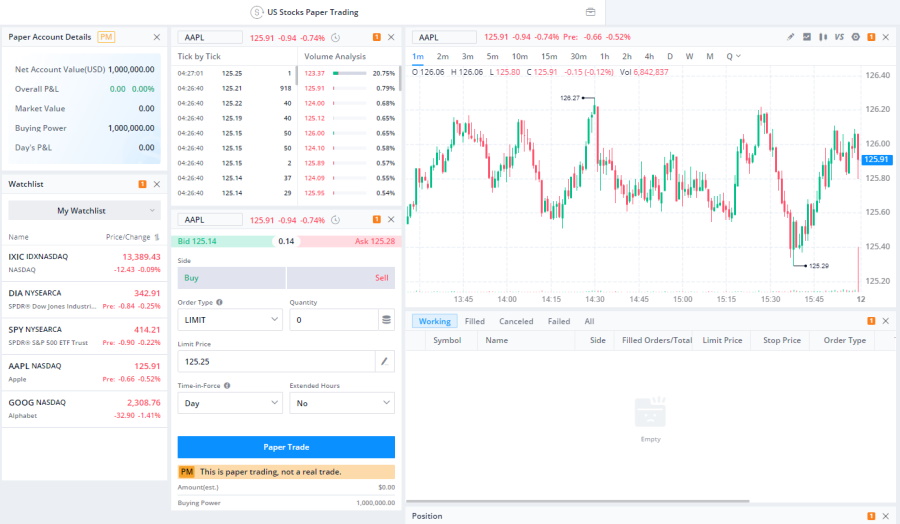

For example, to trade Apple stocks on the Webull mobile trading app, all you need to do is search for AAPL in the search bar. Then specify whether you want to buy or sell, the amount you want to invest, the order type, limit, and time-in-force. Then review your choices and click on the Place Order button at the bottom of the screen.

e*Trade vs Webull Trading Tools, Education, Research & Analysis

Thus far in our comparison of e*Trade and Webull, we have focused on multiple key metrics such as tradable assets and trading fees. In this section, we will cover the different educational materials and research tools that are available.

Trading ideas and fundamental data

Webull provides trading ideas for a selection of stocks, whereas e*Trade offers trading ideas for ETFs, stocks, and mutual funds which are sourced from credible third-party providers including TipRanks, Thomas Reuters, Morningstar, Argus, and MarketEdge.

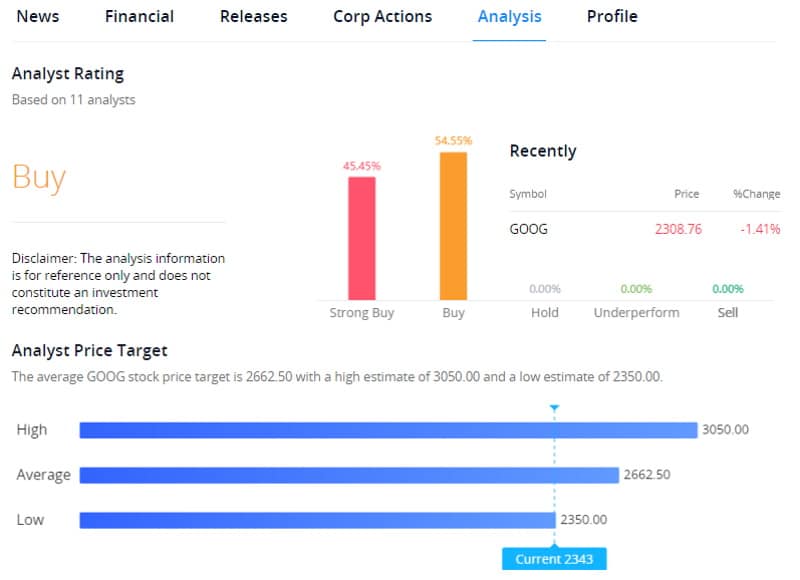

When you click on the Analysis tab in the Webull trading window you will have access to analyst ratings on selling, buying, and holding chosen securities.

When it comes to fundamental data, both brokers offer a range of key statistics from price/earnings and gross margin, to earnings, number of employees, and dividend yield.

Charting tools and Market data

e*Trade and Webull have useful charting tools including dozens of technical indicators. The charts can be customized depending on your trading preferences. You can also access a range of market data in real-time and news feeds from third-party sources such as CNBC.

e*Trade vs Webull Demo Account

What is a demo trading account? A demo account, otherwise referred to as a paper trading account, is a simulated trading environment that allows you to practice your investment strategies and familiarise yourself with the trading platform without the risk of losing your capital.

A demo account is a useful educational tool for beginners and advanced investors because it offers all the functionalities of a live brokerage account without having to worry about losing money.

Our e*Trade vs Webull review found that both brokers offer a paper trading account on both web and mobile trading platforms so that you can practice buying and selling assets with the click of a button from your very own mobile device.

e*Trade vs Webull Payments

The only available account base currency is USD for both brokers. Why is this important? This means that if you fund your account, or buy and sell financial instruments with any currency other than USD, you will incur a conversion fee.

As we have already mentioned, both trading platforms do not charge for ACH deposits or withdrawals. This charge varies when you choose to withdraw or deposit via wire transfers. However, credit/debit cards and e-wallets such as PayPal are not supported by either broker.

In terms of deposit processing times, it typically takes around 3 business days for ACH transfers with e*Trade if the request is submitted before 4 pm ET. If you make a deposit before 4 pm ET the total deposit amount will be credited to your Webull brokerage account at 9 am ET after four business days.

Pay Pal and Credit Cards, are not available for UK users under FCA as a payment method.

| Minimum Deposit | Deposit Fee | Processing Time | Withdrawal Fee | |

| Webull | $0 | FREE | 4 business days | FREE |

| eTrade | $0 | FREE | 3 business days | FREE |

e*Trade vs Webull Customer Service

When it comes to contacting customer services for either broker, you can do this via email, phone, or live chat. The responses are fairly prompt with relevant information and answers. There are also useful FAQ pages where you can find the answers to the most popular questions.

Both e*Trade and Webull provide 24/7 customer support to help you with your questions, needs, and inquiries.

e*Trade vs Webull Safety & Regulation

When it comes to choosing a broker, you need to ensure that they are fully regulated by industry-leading financial authorities. In the case of e*Trade and Webull, both trading platforms are members of the Financial Industry Regulatory Authority which means that clients are covered by the SIPC investor protection scheme which insures against the loss of funds and assets should the broker go out of business.

The US investor protection scheme, known as the Securities Investor Protection Corporation, covers losses up to $500,000 including up to $250,000 for cash claims.

e*Trade vs Webull vs eToro

In summary, we found that Webull is a great option for beginner traders to access traditional investment types such as stock, ETF, and options trading on a 100% commission-free basis. e*Trade is also a good alternative, but due to the fact that it offers a wider range of tradable assets and account types, this is a good broker for all experience levels.

However, if you are looking for an overall great broker that offers traditional investments as well as derivatives including CFD and forex trading, then eToro is our go-to broker for 2026.

Launched in 2007, this FCA, CySEC, and ASIC regulated social trading platform is home to 20 million active traders and counting. The most attractive feature is that you can buy and sell financial assets without paying commission. While this is something that most online brokers are implementing nowadays, this zero-commission trading structure is usually applied to stocks and ETFs listed on US exchanges.

67% of retail investor accounts lose money when trading CFDs with this provider.

On the contrary, eToro provides 100% commission-free trading on all 17 of its supported markets. From stocks and ETFs to crypto trading and commodity trading, you do not have to pay a penny in commission when trading with eToro. This is perfect if you want to keep your trading fees to a minimum.

As well as paying 0% stamp duty when you invest in shares listed on the LSE, eToro has some of the industry’s tightest spreads. For example, when it comes to Bitcoin trading the average spread is just 0.75%.

Furthermore, eToro has also taken it a step further by offering copy trading tools and features such as CopyTrader and CopyPortfolios. This is perhaps eToro’s most popular automated trading tool as it is a catalyst for hands-free trading and investing from the comfort of your own home.

With eToro’s CopyTrader you can copy the trades of other experienced and top-rated brokers with the click of a button. Alternatively, if you want to invest in a theme or portfolio of traders then eToro’s CopyPortfolios allows you to do this with ease.

eToro also allows you to access fractional share trading which means that you don’t have to worry about how many shares you can afford to buy, as you can invest as little as $50 to purchase a portion of a share whose price per unit is more than that.

With that said, let’s take a look at eToro’s main trading and non-trading fees:

| Asset type / non-trading fee | Commission fee / Charge |

| Stock trading | 0% |

| ETF trading | 0% |

| Crypto trading | 0% |

| Forex trading | 0% |

| Account opening fee | $0 |

| Inactivity fee | $10 per month after 1 year |

| Deposit fee | 0.5% conversion fee for non-USD deposits |

| Withdrawal fee | $5 |

e*Trade vs Webull – The Verdict

After weighing up the options, we recommend eToro as the best go-to broker in 2026. If you want to actively trade stocks, cryptos, forex, CFDs, fractional shares on a 100% commission-free basis, then you can do all that from the comfort of your home via the eToro web or mobile trading platform.

Alternatively, if you want to trade passively, eToro’s copy trading tools are perfect for copying the trades of your favourite eToro investors and portfolio themes. With access to 17 different international markets, you can diversify your portfolio with the click of a button.

If you are interested in practicing your trading strategies and skills then eToro provides a demo account with $100,000 worth of paper funds to buy and sell assets in a simulated investment environment.

So, to get the ball rolling, simply follow the link below and start trading with 0% commission on eToro today!

eToro – Best Trading Platform with 0% Commission to Trade ETFs

67% of retail investor accounts lose money when trading CFDs with this provider.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.