5 Best TradingView Brokers in June 2025

If you’re a trader looking to maximize your experience on TradingView, you’ll want to find the best broker that suits your needs. A good broker can provide access to a wide range of trading tools and features, seamless integration with the TradingView platform, and a solid reputation in the industry. To help you make the right choice, we’ve compiled a list of the best TradingView brokers in June 2025.

These brokers have been carefully selected based on their compatibility with TradingView, their reputation in the industry, and the range of features they offer to traders. Whether you’re a beginner or an experienced trader, finding the right broker can have a significant impact on your trading success.

-

-

Key Takeaways From Our Research Into The Best Brokers for TradingView

- Choosing the right broker for TradingView is crucial for traders looking to maximize their experience. TradingView is an advanced charting tool that comes with high risk. By choosing a reputable broker that offers a user-friendly interface, traders can increase their chances of finding profitable trading opportunities.

- The best brokers offer seamless integration with the TradingView platform and provide a wide range of trading tools and features. The 5 best brokers that we found were Pepperstone, Oanda, Forex.com, Interactive Brokers, and Ally Invest.

- Tradingview is suitable for experienced traders who have a high-risk appetite. The platform is used to support advanced trading strategies such as leverage trading and spread betting.

- To minimize the risks of using a TradingView broker, take advantage of demo accounts that are available and never invest more than you can afford to lose.

5 Best Brokers for TradingView List

Our team spent time reviewing numerous TradingView platforms to find the most suitable options for both forex traders and stock traders in 2025. Here is a list of the top 5 brokers that we found.

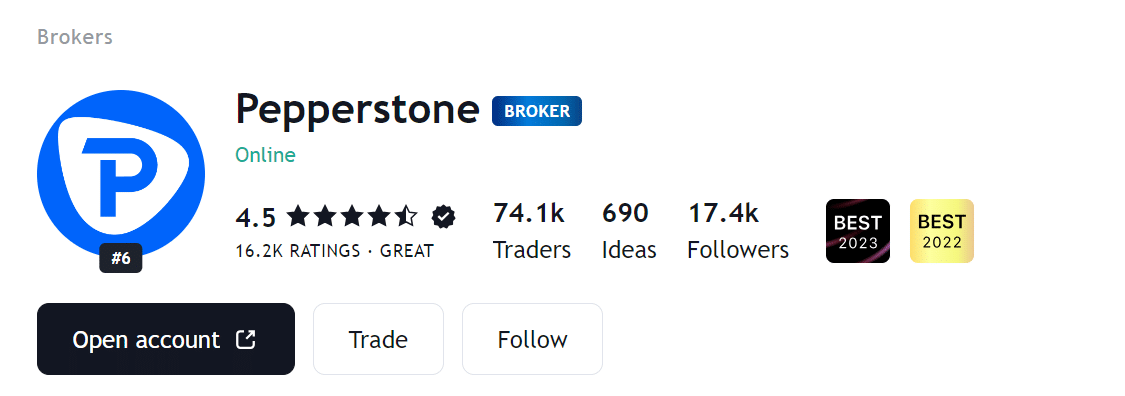

- Pepperstone: The best Tradingview broker for forex traders in 2024. Pepperstone offers spreads from 0 and is compatible with a variety of third-party charting tools.

- Oanda: Oanda is the most user-friendly forex broker with Tradingvew. The platform offers a great range of research tools as well as 71 Forex pairs.

- Forex.com: Best forex broker for Tradingview in 2024. Forex.com is licensed by the Commodity Futures Trading Commission and offers low forex-trading fees.

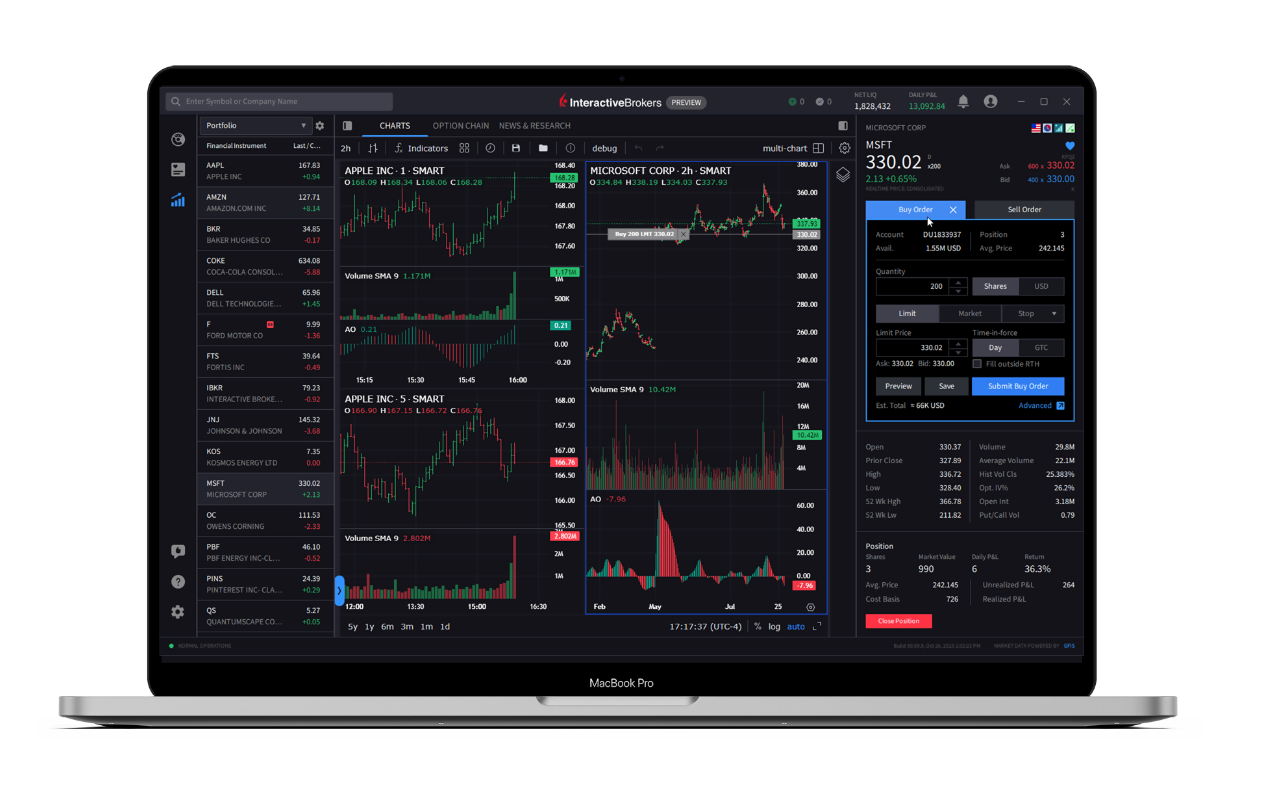

- Interactive Brokers: Best stock trading platform with Tradingview. Trade stocks CFDs with fixed commissions and zero account management fees.

- Ally Invest: Trade stocks with a reputable banking provider. Ally Invest offers great research tools and an easy-to-use platform.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

How We Found The Best TradingView Brokers in 2025

To provide helpful information about the best brokers for TradingView, our team spent time researching the different platforms that are compatible with the charting tool. Eventually, we narrowed the selection down to 5 brokers that stood out for various reasons.

We focussed on finding brokers that are suitable for both beginner and experienced traders, offer low trading fees, and are licensed by financial regulators. We also paid attention to the range of instruments available through each platform to ensure that each broker supports a diverse trading strategy.

What Is TradingView?

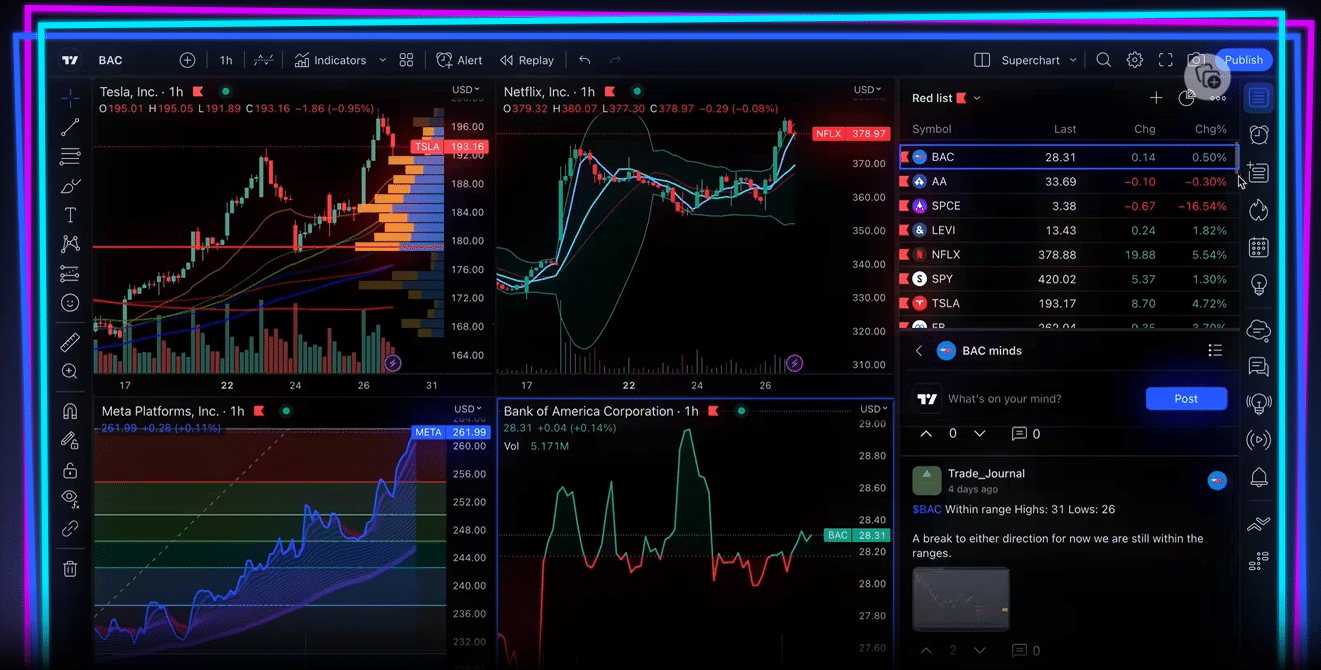

TradingView is a popular online platform that provides traders with advanced charting tools, real-time market data, and a vibrant community of traders. It is widely used by both beginners and experienced traders to analyze financial markets, identify trading opportunities, and make informed trading decisions.

TradingView offers a range of features that are suitable for building advanced trading strategies. This includes technical indicators, drawing tools, algorithmic trading, Tradingview support backtesting, and signals. These complex tools can be used to support unique trading strategies and identify potential trading opportunities.

What Are The Benefits of TradingView?

TradingView offers several key benefits to traders that make it stand out from other day trading platforms. However, it is also important to remember that using an advanced platform comes with a high level of risk. Nevertheless, here is an overview of some of the benefits that TradingView offers.

Advanced Charting

TradingView provides a wide range of sophisticated charting tools and indicators that allow traders to perform detailed technical analysis. This includes the ability to overlay multiple indicators, draw trendlines, and use various chart types.

Real-time Market Data

Traders can access real-time market data on TradingView, including stock prices, forex rates, and cryptocurrency prices. This enables traders to stay up-to-date with the latest market trends and make timely trading decisions.

Community and Social Features

The platform also stands out as one of the best social trading platforms to consider in 2025. TradingView has a vibrant community of traders who share trading ideas, strategies, and analysis.

Traders can interact with each other, follow influential traders, and even copy their trades. This social aspect of TradingView enhances collaboration and knowledge sharing among traders.

Integration with Brokers

Another benefit of the TradingView charting tool is that it offers integration with various online brokers, allowing traders to execute trades directly from the platform.

This seamless integration eliminates the need to switch between different applications, making the trading process more efficient and convenient.

Do I Need a Broker to Use TradingView?

No, you do not need a broker to use TradingView. TradingView provides a standalone platform that allows users to access advanced charting tools and market data for free. However, if you want to execute actual trades, you will need to have an account with a broker that is compatible with TradingView.

TradingView offers integration with a wide range of brokers, allowing traders to place trades directly from the TradingView platform. This integration provides a seamless trading experience, allowing traders to analyze the markets and execute trades seamlessly in one place.

It’s important to note that while TradingView provides the tools and analysis for trading, the actual execution of trades and financial transactions are facilitated through the broker. The broker serves as the intermediary between the trader and the financial markets.

Therefore, if you are looking to actively trade and execute trades based on your analysis on TradingView, it is recommended to choose a reputable broker that is compatible with the platform.

What Are The Best TradingView Forex Brokers?

TradingView can be used to trade forex, stocks, and cryptocurrencies. During our research, we spent time reviewing each compatible TradingView broker to find the best options for forex and stock trading.

In this section, we will discuss the best Tradingview forex brokers. We will provide detailed information about each broker, including their features, trading tools, and reputation in the industry.

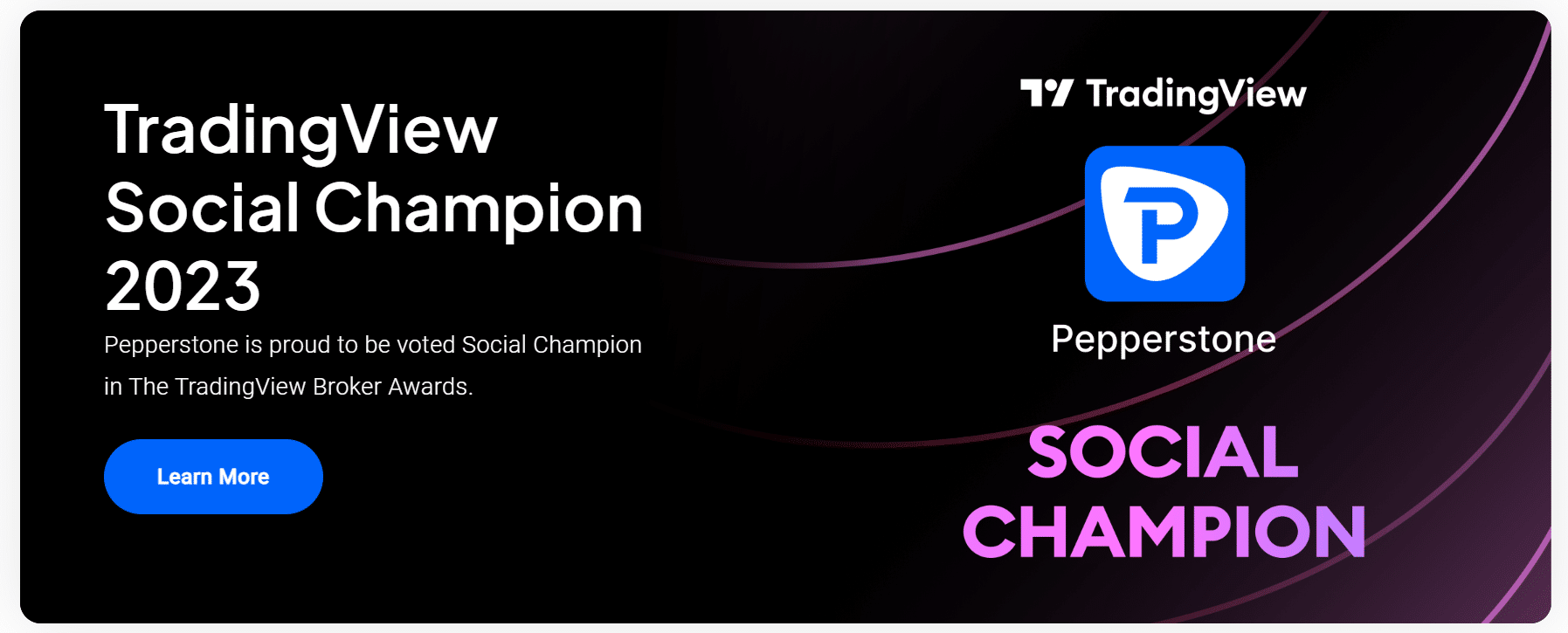

1. Pepperstone – The overall best Tradingview broker for trading forex

Pepperstone is widely regarded as the top TradingView broker for forex trading. They offer a comprehensive range of trading tools and features, including advanced charting capabilities, customizable indicators, and a user-friendly interface.

With low spreads and competitive pricing, Pepperstone ensures cost-effective trading for both beginner and experienced traders. They are also known for their excellent customer support and fast execution speeds. With its headquarters in Melbourne, Australia, the company offers its services to traders in over 150 countries worldwide.

In addition to its advanced technology, competitive pricing, and exceptional customer service, Pepperstone is licensed by the Australian Securities and Investment Commission (ASIC) and the Financial Conduct Authority (FCA) in the UK.

The platform offers several account types including a demo account, a standard trading account, and a professional account. Pepperstone is also one of the few TradingView brokers to offer spread betting, which is suitable for advanced traders who want to take advantage of complex strategies.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

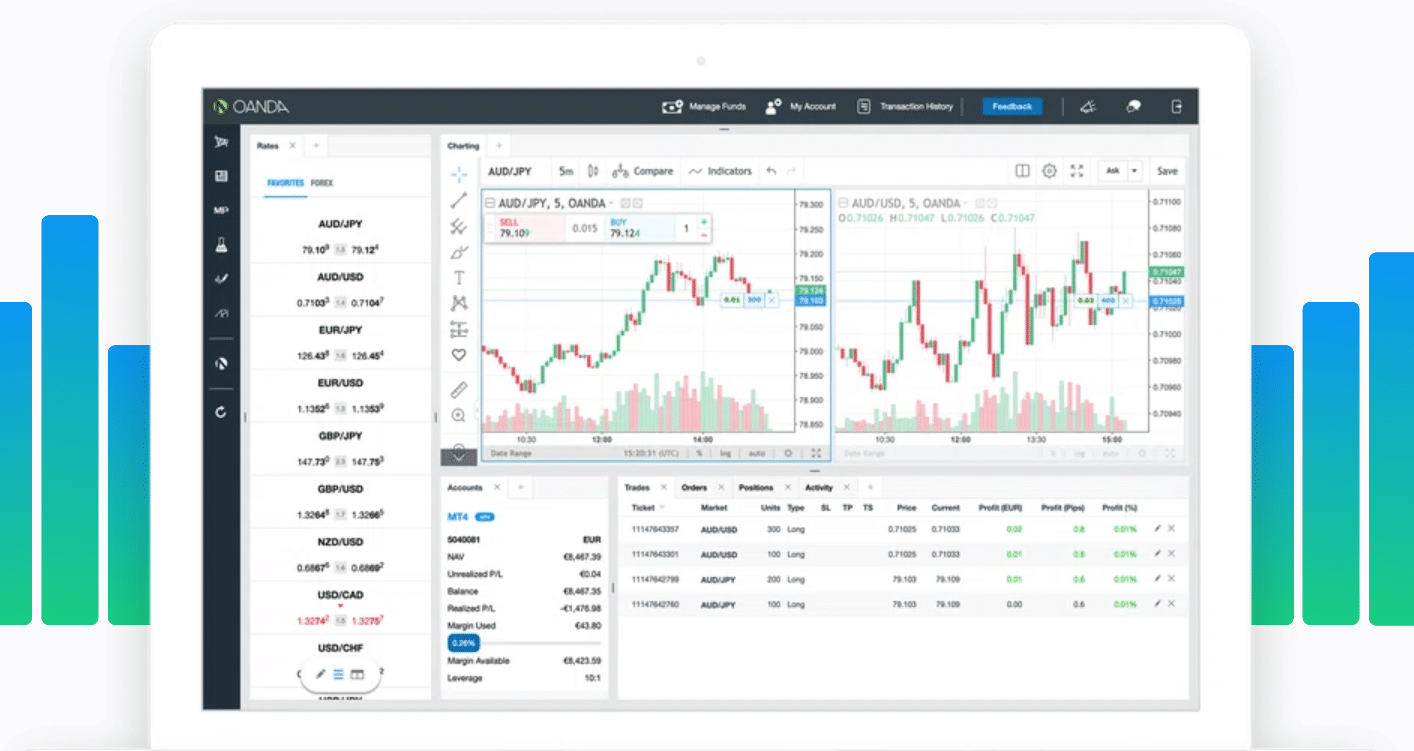

2. OANDA- User-friendly broker that supports Tradingview

OANDA is one of the most user-friendly TradingView brokers that is suitable for less-experienced traders.

They provide a wide range of forex trading instruments and offer powerful charting and analysis tools within the TradingView platform. Oanda is known for its transparent pricing, reliable execution, and strong regulatory oversight. They also provide educational resources and expert market analysis to help traders make informed trading decisions.

Traders access forex CFDs through the platform. There are a total of 71 different FX pairs available to trade through the platform and it is possible to practice trading using the free demo account before putting any money at risk.

It is also worth noting that Oanda is available on both mobile and desktop. This means that traders can manage their portfolios on the go which is ideal for day trading.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

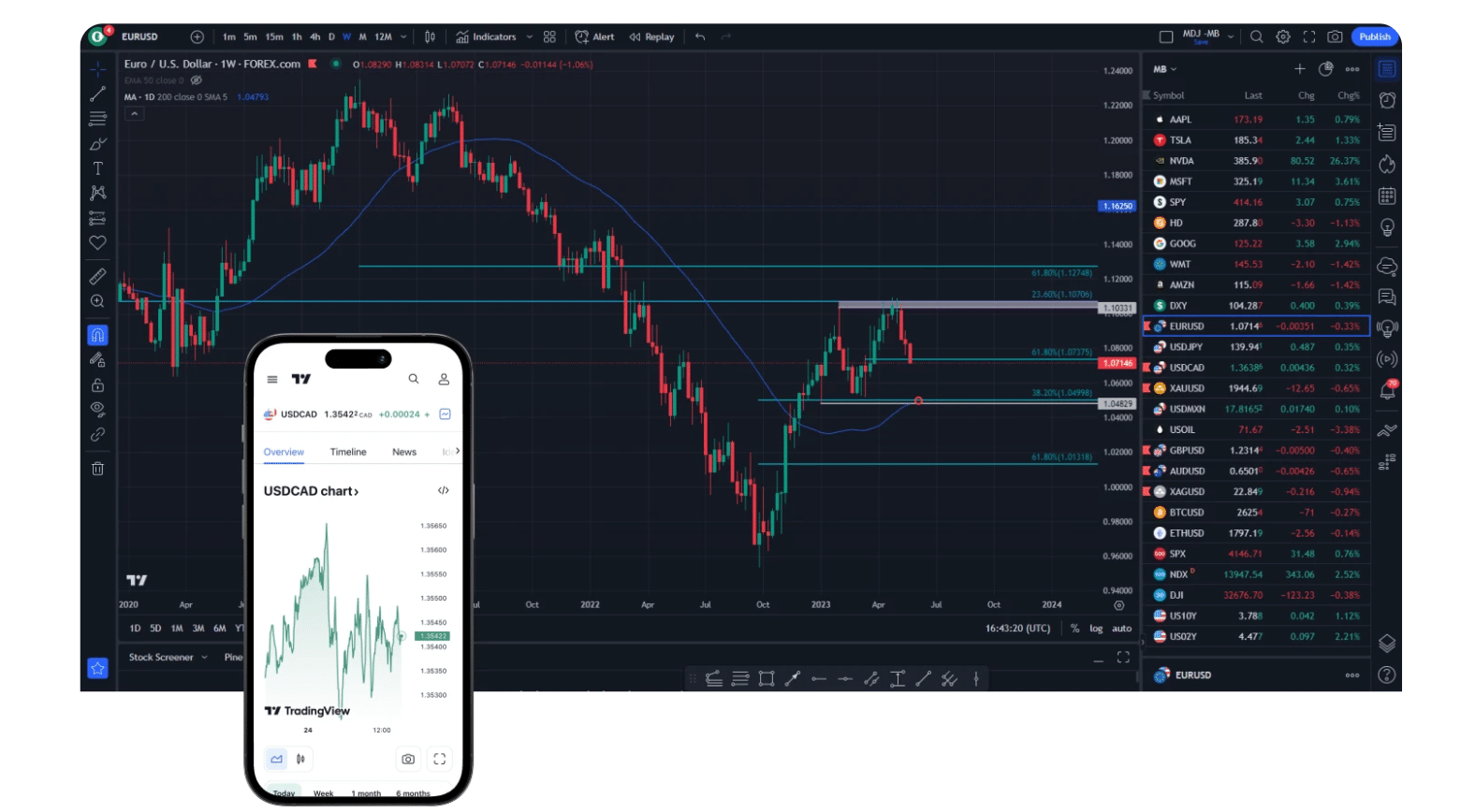

3. Forex.com – Reputable forex broker with over 80 currency pairs

Forex.com offers trading services to individuals and institutions worldwide in over 180 countries. Bedminster, New Jersey, is the headquarters of the company, founded in 2001.

Several top-tier financial authorities regulate Forex.com, including the National Futures Association (NFA) in the United States, the Australian Securities and Investments Commission (ASIC), and the Financial Conduct Authority (FCA) in the United Kingdom. Furthermore, the broker is equipped with advanced technology and offers competitive pricing.

Forex.com offers over 80 currency pairs for trading on the TradingView platform. They provide traders with access to advanced charting tools, technical analysis indicators, and customizable trading strategies. Forex.com is recognized for their competitive spreads, fast trade execution, and strong regulatory compliance.

As part of its trading service, Forex.com offers webinars, video tutorials, and trading guides to help traders improve their skills and knowledge. To help traders make informed trading decisions, the broker also provides market analysis, news updates, and economic calendars.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

What Are The Best TradingView Brokers For Stocks?

As well as finding the best forex brokers, we also spent time researching the best TradingView brokers for stock trading. After reviewing several platforms, we found two that stood out as the best options for 2025.

1. Interactive Brokers – The best TradingView broker for stock trading

Interactive Brokers (IBKR) leads as the most extensive investment platform available. Clients benefit from trading opportunities in stocks, options, futures, forex, cryptocurrencies, bonds, and funds across 150 markets, all from a single integrated account.

For sustainable investors, the Impact Dashboard and app provide a means to assess assets through a socially responsible investing (SRI) perspective. The Trader Workstation (TWS) downloadable platform caters to professional traders and active investors seeking sophisticated technical and fundamental trading tools alongside in-depth research capabilities.

IBKR sets itself apart through its vast array of assets, research reports, global market access, diverse tools, calculators, and educational materials, including tutorials available in multiple languages for international investors.

However, this abundance of offerings can sometimes be overwhelming to navigate. Nonetheless, the provision of free paper trading and a three-month trial period offers users an opportunity to explore the extensive capabilities of this comprehensive investment broker.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

2. Ally Invest – Best banking provider with TradingView

Ally Invest, a subsidiary of Ally Financial, is a popular choice for traders seeking a comprehensive banking and brokerage solution. Ally Invest offers a user-friendly interface, advanced trading tools, and competitive pricing.

Their integration with TradingView allows traders to combine the powerful charting and analysis capabilities of TradingView with Ally Invest’s extensive range of investment options. Whether you are a beginner or an experienced trader, Ally Invest provides the necessary tools and support to navigate the stock market efficiently.

As well as stock trading capabilities, Ally Invest offers savings accounts, credit cards, mortgages, and retirement accounts. This makes it a suitable option for people who are looking to manage all aspects of their finances in one platform.

The platform supports both manual trading and robo portfolios for investors who prefer a hands-off approach. Commissions start at $0 and the minimum deposit for a robo account is $100. Traders can also access professional advice from a dedicated advisor – these accounts require a minimum of $100,000.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

How to find a broker through TradingView

The above options are not the only brokers that are compatible with TradingView. It is a good idea to conduct your own research into the available options to find a platform that best suits your trading needs.

The following steps will assist you in finding a broker through the TradingView platform:

- Visit TradingView and log in: To start, you must create an account.

- Click on the “Broker” tab: TradingView’s homepage has this tab at the top.

- Browse the available brokers: In TradingView, you’ll find a list of brokers that are available to you. To find a broker that meets your preferences and needs, you can browse through them.

- Compare features and fees: Click on the name of the broker you’re interested in to learn more about its features, fees, and other details.

- Open an account with the broker: Depending on the broker you choose, you’ll need to open an account. It is usually possible to do this by clicking a link or button on the broker’s website.

- Set up TradingView with your broker account: Traders can trade directly from their brokers’ accounts through TradingView.

How to use Pepperstone to trade with Tradingview

In the next section, we will provide a step-by-step guide on how to use TradingView with Pepperstone. By following these instructions, you’ll be able to seamlessly integrate your TradingView account with the features and functionality of Pepperstone.

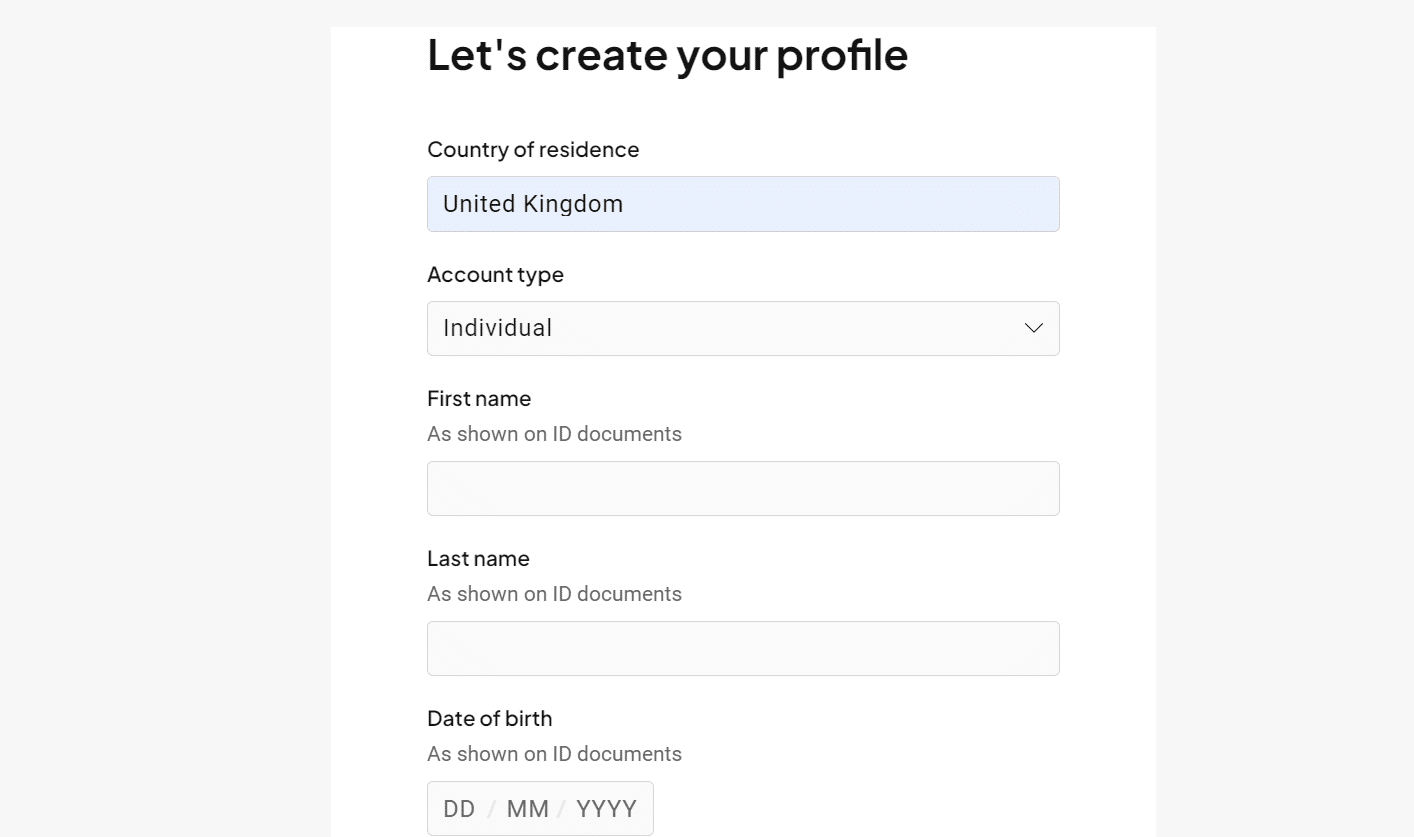

Step 1: Create a Pepperstone account

The first step is to create an account with Pepperstone. Simply visit the Pepperstone website and click on the “Sign Up” or “Create Account” button.

Fill in the required details, such as your name, email address, and preferred password. You will then be asked to verify your account by uploading two ID documents.

Step 2: Sign up to TradingView

If you don’t already have a TradingView account, you’ll need to create one in order to connect it with Pepperstone. To do this, go to the TradingView website and click on the “Sign Up” button. Fill in your personal information, including your name, email address, and password. Once you’ve successfully created your TradingView account, you’re ready to move on to the next step.

Step 3: Connect your TradingView account to Pepperstone

Login to your TradingView account and navigate to the “Brokerage” or “Connect Brokerage” section.

Look for Pepperstone in the list of available brokers and select it.

Follow the prompts to enter your Pepperstone account credentials, such as your account number and password.

Once you’ve successfully connected your TradingView account to Pepperstone, you’ll be able to access and trade using your Pepperstone account directly within the TradingView platform.

Step 4: Practice trading with the demo account

Before you start trading with real money, it’s always a good idea to practice using a demo account. Both Pepperstone and TradingView offer demo accounts that allow you to trade with virtual funds.

Take advantage of this feature to familiarize yourself with the platform, test out different trading strategies, and gain confidence in your trading abilities. The demo account is a risk-free way to hone your skills and make sure you’re comfortable with the trading process.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

Top Tips for Using TradingView Safely in 2025

TradingView is a platform that supports advanced trading strategies. Using these tools to trade comes with a high level of risk.

As you begin your trading journey on TradingView, it’s important to prioritize safety and minimize risk. Most accounts lose money and there is no guarantee that you will make any profit by using TradingView.

Here are some top tips to help you use the platform safely in 2025.

✔️ Practice trading with a demo account

Before diving into real trades, take advantage of TradingView’s demo trading account feature. This allows you to familiarize yourself with the platform, test different strategies, and gain confidence without risking real money. Practice trading with a demo account to refine your skills and develop a trading plan.

It is possible to access the TradingView demo account at any point during your trading journey. This means that traders can switch from live trading to demo trading during periods of high volatility or when they would like to implement a new strategy.

Demo trading accounts use historical price data to mimic live trading conditions. However, strategies that work in demo accounts may not generate the same results in the live markets. Make sure that you develop a strong risk management strategy before switching to live trading.

✔️ Never invest more than you can afford to lose

Investing in the financial markets always carries risks. It’s crucial to only invest money that you can afford to lose. TradingView provides access to a wide range of trading opportunities, but it’s important to approach investing with caution and avoid putting all your eggs in one basket.

The minimum deposit to trade with TradingView through Pepperstone is $0 which means that you can start trading with a small amount of capital before slowly increasing the size of your trades.

✔️ Limit the number of trades that you place each day

Overtrading can lead to poor decision-making and increased risk. Instead of jumping into multiple trades in a single day, consider limiting the number of trades you place. Focusing on quality over quantity can help you better manage your positions and avoid impulsive trades based on market noise.

✔️ Conduct thorough research before making any investment decisions

Before making any investment decisions, it’s crucial to conduct thorough research. Utilize TradingView’s extensive range of technical analysis tools to study price charts, indicators, and historical data.

Additionally, staying informed about market news, economic events, and company fundamentals can provide valuable insights to inform your trading decisions.

✔️ Set stop loss and take profit limits

Risk management is key to successful trading. Set stop loss and take profit limits for every trade to define your acceptable risk and potential reward. This helps protect your capital and ensures that losses are controlled.

By sticking to your predetermined exit points, you can minimize the impact of market fluctuations and emotional decision-making.

The Verdict

In this guide, we have explored 5 top brokers for TradingView that you could consider in 2025.

Pepperstone has proven to be the best platform for Trading View since it provides its clients with the best trading experience in the online forex broker community. In comparison to other popular forex brokers, Pepperstone offers lightning-fast execution systems, multiple account types, competitive pricing, and a full range of platforms, including MT4 and MT5, and cTrader functionality.

Traders of all types will benefit from Pepperstone’s exceptional trade experience, whether they’re looking for low spreads or advanced interface functionality.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

FAQs

Which broker is best for Tradingview?

Pepperstone stands out as the best broker for Tradingview. This is because the platform offers a wide range of financial instruments, is licensed in several jurisdictions and offer competitive spreads.

Which broker gives TradingView free?

TradingView can be integrated for free through Pepperstone, Oanda, Forex.com, Interactive Brokers and Ally Invest.

Can TradingView be used as a broker?

TradingView is a charting tool that provides traders with tools for technical analysis. The platform cannot be used as a stand alone broker. To place live trades, users must connect their TradingView account to a compatible brokerage.

Which brokers are integrated with Tradingview?

There are multiple brokers that are integrated with TradingView. These include Pepperstone, Oanda, Forex.com, Interactive Brokers and Ally Invest. You can view the full list of compatible brokers on the TradingView website.

Ruby Layram Finance Editor

View all posts by Ruby LayramRuby is a Finance Editor who has 5 years of experience in the finance and cryptocurrency space. Ruby attended the University of Winchester where she received a BSc in Psychology. During her studies, Ruby developed an interest in financial psychology and began writing content around the topic on a freelance basis. Whilst she was studying for her degree, Ruby spent time learning about personal finance, investing and trading. She has written content for The Motley Fool UK, Bankless Times and Cryptonary where she also worked as an editor. Her interest in cryptocurrency came about after writing a piece for The Motley Fool about the rise of CBDCs. Since then, Ruby has actively invested in the crypto market with a focus on long-term investing. Ruby is also an experienced trader with good analytical skills. She has used a used a variety of platforms and tools to trade and has first-hand experience with many of the platforms that are featured on the Trading Platforms website.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up