How To Invest In Index Funds- Beginner’s Guide 2026

Nowadays, many users are looking for ways to diversify their investment portfolios. This can be beneficial as there are great returns to be had. Investing in index funds can be an excellent way to do this as you can have a variety of assets at an economical price. In this guide, we show you how to invest in index funds and the best five places to do it.

4

Payment methods

Features

Customer service

Classification

Mobile App

Fixed commissions per operation

Account Fee

- Buy shares and ETFs with 0% commission

- Social and copy trading network

- Invest and trade crypto with low fees

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Account Info

Fees per operation

- Amazing research tools

- Almost no fees

- User-friendly platform

Schwab Stock Slices is not intended to be investment advice or a recommendation of any stock. Investing in stocks can be volatile and involves risk, including loss of principal. Consider your individual circumstances prior to investing.

Account Info

Fees per operation

- Great selection of long-term investment products

- Access US-listed stocks

- ETFs

Investing involves risk, including risk of loss.

Account Info

Fees per operation

- Offers low-commission CFD and Forex trading

- Exposure to 78 different stock markets

- No minimum deposit required

The risk of loss in online trading of stocks, options, futures, currencies, foreign equities, and fixed income can be substantial.

Account Info

Fees per operation

What Are Index Funds?

Some index funds provide exposure to different securities in a single fund, thus reducing risk through diversification. Moreover, a portfolio based on several index funds tracks different indexes and allows you to adjust to your asset allocation preferences. For example, your money can be split between bond index funds and equity index funds.

According to several experts, investing in index funds is one of the best options if you consider a long-term asset. This is because, with time, corporate profits may increase. In addition, with time, capitalization can be made use of.

Still, they are a good option because of their low cost and can be used for diversified portfolio construction. Before any investment is made, a range of possible expenses should be set so that it is possible to know the price that can be paid in terms of commissions.

Investing in stocks and bonds through index funds is considered easier for investors, as they do not have to monitor them as closely since index funds replicate a particular index rather than actively managing them, as opposed to actively managing their portfolios.

You should know that there are different types of index funds. We will explain them below:

Physical replication.

A replication fund buys stocks or bonds similar to the index it intends to replicate. These index funds are asset-backed. A low margin of error makes this method ideal for replicating liquid asset indexes.

Synthetic replication

These are a type of index fund that do not replicate physical assets. Instead, financial derivatives use contracts to back their index funds.

Sampling replication

By purchasing a representative sample of the index constituents, the manager can, for example, buy only the 450 largest companies that make up the S&P 500. This way, the financial advisor aims to maintain a lower tracking error than its competitors. Less than 0.5% is considered a good tracking error.

According to experts, physical and sample replication are the best types of index fund to invest in, as both allow investors to understand better where their money is going.

How To Invest In Index Funds At A Glance (2026)

Investing in index funds is easy if you follow the right process.

Ideally, you should open an account on a regulated exchange in your country with the necessary permissions. If you want to know where to invest in index funds, we recommend eToro.

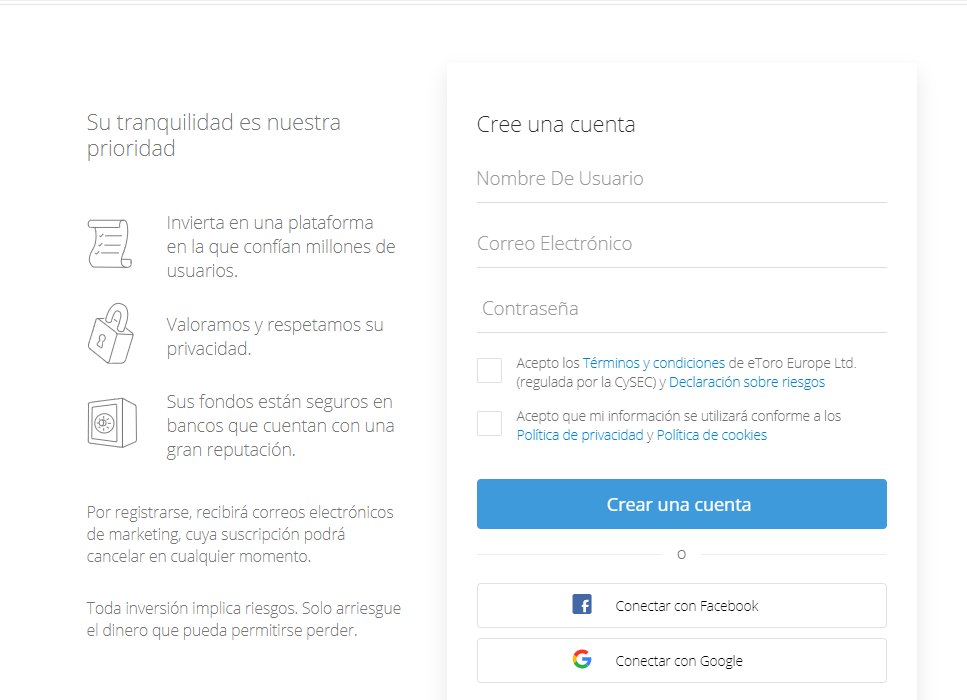

Step 1: Open a brokerage account

You will need to select a broker, click Register and then enter your details to create a new broker account.

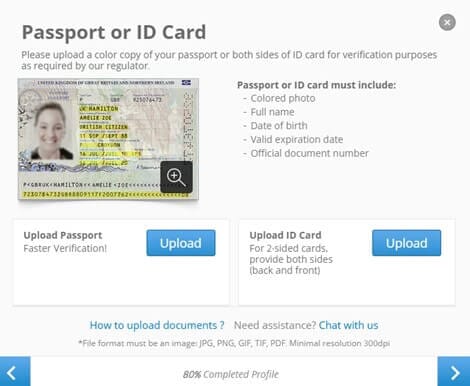

Step 2: Verify your account

KYC regulations require you to upload copies of your passport, bank statement, and utility bill to verify your identity and address.

Step 3: Fund your account

To put funds into your account, select the deposit funds button, enter the amount and currency, and select a deposit method.

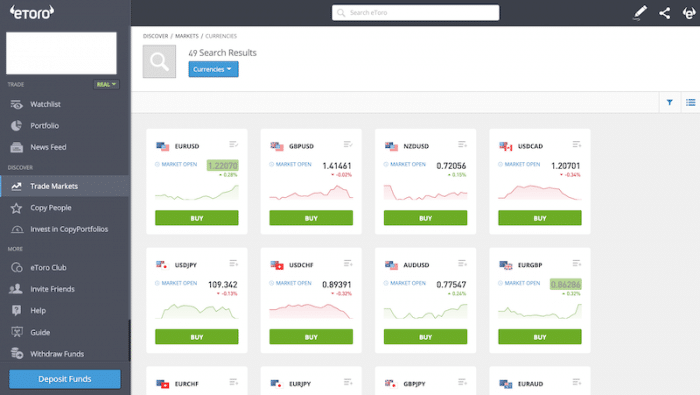

Step 4: Search for different funds.

Searching for different funds gives the possibility to diversify the portfolio. By doing a market analysis, you can track the best indices to buy and get great returns from the market.

Step 5: Place an order

Once you have identified the fund you want to invest in, you must place a purchase order to finalize the process.

5 Places To Invest In Index Funds- Reviewed

You will find the reviews of the five platforms in which you can invest in index funds. We present them to you so that you can analyze and choose the one you think is the best for what you are looking for in the market.

1. eToro – Overall The Best Platform To Buy Index Funds

Commissions at eToro are not something you need to worry about, as trading here is completely commission-free, so if you want to invest in index funds, you won’t pay anything extra. You have to pay a small commission of 0.5% when you deposit. The minimum deposit at eToro is only about $25.

There are around 15 cryptocurrencies available to trade on eToro including Bitcoin and Ethereum. Investing in other digital assets such as stocks and exchange-traded funds (ETFs) is also possible.

eToro is a great option for beginners compared to other platforms as it has a very user-friendly interface, so if you are not experienced in index fund investing, you don’t have to worry. eToro also has tools like Copy Trading, where it is possible to copy the trades of a more experienced trader. Furthermore, different payment methods can be used on this platform to place funds in the account.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

2. AvaTrade – The Best Platform To Invest In Index Funds For Experienced Traders

AvaTrade offers about 40 different currency pairs that can be used to invest in index funds. Moreover, with AvaTrade, it is possible to trade with smart contracts as well as CFDs.

AvaTrade also has a service known as AvaOptions, where you can analyze the profitability of the strategies and understand the extent of potential profits, losses, and balance.

For more experienced traders, AvaOptions has a number of professional tools that allow for risk management. AvaTrade is available for mobile devices and has a desktop application. This means that accessing this platform is extremely easy.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

3. Interactive Brokers – The Best Platorm To Learn About How To Invest In Index Funds

On Interactive Brokers, you can trade contracts on indices, stocks, commodities, and currencies. At Interactive Brokers, you can access different markets in many countries as well as the US. In addition, no minimum deposit is needed to sign up to the platform.

If you are new to the market, Interactive brokers offers an educational section that considered one of the best for new traders. A well-structured program is offered through the Interactive Brokers Campus, which consists of multiple investing categories. A great place to start your trading education is the Traders Academy, which offers three levels of educational material.

There is a wide selection of content to choose from, including interactive webinars with industry experts and a comprehensive video library that offers one of the best collections in the industry. In addition, students can access educational materials through the Student Trading Lab.

Your money is at risk.

4. TD Ameritrade – One Of The Mos Historical Platforms To Invest In index Founds

Like eToro, this platform does not charge any commission, something to take into account when you want to make any investment in index funds. However, if you want to make any operation in an assisted way, you must pay an additional $ 25. It is a platform that FINRA in the United States regulates.

TD Ameritrade offers a mobile application for both Android and iOS. In the application, it is possible to configure alerts on market movements. Depending on the type of account, a minimum deposit must be paid to be able to trade on the platform. On this platform, it is also possible to trade ETFs and stocks.

As for the strategies and tools available, this platform is more recommended for traders with vast market experience.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

5. Vanguard – Invest In Index Funds With Zero Commissions

This platform can be a great option for users looking to purchase index funds. At Vanguard, it is possible to find a variety of funds that do not charge any commissions or transfer fees, possibly generating more money to be invested and thus increasing profitability. As a result, Vanguard may be ideal if you are an infrequent trader looking to make long-term investments.

Vanguard Digital Advisor, Vanguard’s robot-advisor offering, may appeal to investors who want a hands-off approach to investing. In addition, investing this way may be perfect for new investors who aren’t ready to take on the responsibility of making trading decisions. As for the educational tools offered, users can set up a plan according to their financial goals and compare different funds.

Vanguard’s mobile app offers an easy-to-use interface. In addition to checking your account balance, trading fund shares, and controlling your portfolio, you can use it to monitor your performance. The mobile app is available for download on any mobile device.

Your money is at risk.

Tutorial- How To Invest In Index Funds With eToro

In the next part, we will guide you on investing in index funds using eToro, our recommended platform. Follow the steps explained to get started.

Download the mobile app or open the desktop website

The first step is to go to the broker’s website or download the mobile app. Apps are great for on the go trading but it may be easy to use your desktop when getting everything setup.

Visit the broker’s homepage to set up an account. You must also enter your mobile number, full name, and email address. It is now possible to proceed with creating your username and password.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Verify ID

Users may be asked to verify their accounts by brokers because brokers are usually regulated. Proof of identity must be provided as a driver’s license or passport and a utility bill as proof of address. Once uploaded, these documents should be verified within minutes by your broker.

Fund your account

After establishing an account, you need to deposit funds into it. You can choose from a variety of payment methods, such as:

- Credit card

- Debit card

- Bank transfer

- e-wallet

Using your preferred payment method, deposit funds into your account.

Search for Index Funds

Your platform’s search bar is the best place to find index funds once your account is funded. You will then be required to fill in the quantity you wish to credit to the trade and confirm the transaction.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Practice with a demo account

Once you have setup your trading account, you can practice using the eToro platform to trade index funds with a demo account. This way, you can learn how the platform works without putting any real money at risk.

Place an order

Once you have practiced trading, you can start trading with real money.

Why Invest In Index Funds?

An easy and effective way to build capital is to invest in index funds. With index funds, you can easily turn your investment into long-term savings by simply matching the performance of financial markets over time, and best of all, you don’t have to become an expert in the stock market.

It should also be said that by investing in index funds, you can choose to have better diversification, less risk, and the ownership of securities. Moreover, investing in index funds allows you to access different digital assets such as stocks and bonds.

One of the reasons to invest is their low cost. Thus, many interested investors, especially beginners, may conclude that index funds can be much more attractive than investing in stocks.

Individuals who do not have the time or inclination to manage their investments personally can also benefit from investing in index funds. Index funds also work well for people who do not want to worry about daily fluctuations in the value of individual stocks. A passive investment approach is best suited for index funds. In addition, index funds are gaining popularity as more financial institutions are offering them.

This type of investment is also very attractive for other reasons, so let’s explore them in more detail.

Long term gains

The stock market normally grows in value over time, regardless of whether individual companies outperform or underperform the market. Therefore, index funds offer investors high returns with low costs, making them excellent investments.

With the returns offered, the longer you stay in an index fund, the more gains you can achieve.

When investing in indices, investors need not be concerned about the short-term performance of an asset. Whether companies’ returns are higher or lower than the market, the stock market increases in value as time goes by. Moreover, index funds are great investments thanks to their relatively low prices. So, the extended you stay in the fund, the more returns you get.

This is why index funds have more options for good returns than an actively managed fund, making it an interesting investment for those investing for retirement. After all, picking the stocks most likely to perform best in the market can be tricky if you are new to the industry.

In order to estimate possible future returns, you must track the long-term performance of the index fund. Some funds may perform better than others over the long run, or some funds may track a different index. Observing long-term performance is a good indicator, but it does not guarantee future performance.

Low fees

Since they are passively controlled, they tend to have lower management fees than other funds. Index funds duplicate their designated indexes’ portfolios rather than having a manager making trades or a research team analyzing securities.

An advantage of investing in funds over other assets is that they are much more affordable in terms of costs which can be taxes and the same fees that can be charged when investing. So, a larger investment can be made by charging less or no fees, which can result in higher returns.

The management expense ratio of index funds is lower than that of actively managed funds. A fund’s expense ratio includes advisor fees, manager fees, transaction fees, taxes, and accounting fees.

Index fund managers do not have to hire research analysts because they simply replicate the performance of a benchmark index. To help them choose stocks for their portfolios, they work with them. Index fund managers enjoy lower transaction costs and fees because index funds have less trading activity. The cost of actively managed funds is higher due to more staff and increased transactions.

Investors pay the additional expenses associated with managing the fund through the expense ratio. Therefore, a mutual fund’s performance is directly influenced by its expense ratio. It is no secret that actively managed funds have difficulty matching their benchmarks in terms of performance due to their high expense and high expense ratios.Low risk

You are less likely to suffer big losses if something bad happens to one or two companies in most indexes because they contain dozens or even hundreds of stocks.

Although index funds involve less risk, it does not mean that you should not operate with caution. It is always important to operate with knowledge of the market and also, never invest more than you can lose, that is why the funds have one of their biggest advantages in the market because they buy shares in different companies and will never focus on a single one.

Low risk

You are less likely to suffer big losses if something bad happens to one or two companies in most indexes because they contain dozens or even hundreds of stocks.

An index fund’s low risk is also due to the overall stock market. A typical index fund represents at least one sector or segment of the market. Investing in the market long-term is extremely likely to produce tangible value. An index’s book value will rise over time due to all the underlying securities. Consequently, a well-diversified index fund with a long-time horizon will not lose significant value.

Buying index funds, however, will not destroy investors’ entire investment, on the other hand. Since they are investments backed by hundreds or thousands of underlying securities, they are extremely risky. Therefore, it is unlikely that they will reach zero value since they are highly diversified.

It is conceivable that all the companies that issued the shares would go bankrupt simultaneously. However, a liquidation may result in investors recovering some money based on book value.

How To Invest In Index Funds- Conclusion

Investing in an index fund can be beneficial if you would like to diversify your portfolio and make long-term investments.

In this guide, we have presented the possible advantages of investing in index funds. And we have shown you how to invest in an index fund step by step.

We have also reviewed the five best platforms available in the U.S. market. Our recommendation is eToro, where you can open a new account in a matter of seconds and is perfect for beginners in the market. So don’t hesitate and join eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.