8 Best Free Trading Platforms with No Fees in February 2026

If you’re looking for the best free trading platform for 2026 – there are now dozens of online brokers that allow you to buy and sell assets without paying any commissions.

This means that you trade your chosen financial instrument without getting hammered by brokerage fees. And of course, the best free trading platforms do not charge any fees to open an account, deposit funds, or keep your investments open.

In this guide, we discuss the best free trading platforms to consider right now.

-

-

8 Best Free Trading Platforms

In searching high and low for the best free trading platform for with no fees for 2026, we found that the providers listed below are the cheapest out there.

- Robinhood: Robinhood is a well-known US broker that is available on mobile apps. It charges no fees for stock trading on over 5000 US stocks. The standard account is also free of charge and there are no fees involved with deposits or withdrawals.

- Libertex: Libertex is another free-to-use trading platform that offers forex, CFD stocks, and crypto assets. Users can take advantage of tight spreads and zero commissions. The platform also offers a free demo account with mimics real-time market conditions.

- TD Ameritrade: TD Ameritrade is a commission-free platform that provides a good range of research and analysis tools to help traders make informed decisions. The platform doesn’t charge any fees for deposits or withdrawals and also has no minimum deposit.

- Charles Schwab: Charles Schwab is a good free trading platform to consider if you are interested in fractional shares. Users can invest in any shares from $5 and many US stocks are commission-free.

- Webull: Webull is a user-friendly trading app that offers many commission-free stocks, options, and ETFs. The app provides access to advanced charting tools and features. This includes customizable indicators that can be used to build custom trading strategies.

- Fidelity: Fidelity is a no-fee trading platform that supports ETFs and US stocks. The platform is well-known for offering a wealth of educational resources including expert analysis and research.

Best Brokers for Free Stock Trading Reviewed

The term ‘free trading platform’ is typically used to describe an online broker that allows you to trade without paying any commission or dealing fees.

You might also find that your chosen free brokerage platform doesn’t charge anything to open an account, deposit or withdraw funds, or use its demo trading facility. In turn, the free online trading platform will make its money elsewhere – perhaps through the spread or by lending your shares out to short-sellers.

Below you will find a selection of the best free trading platforms available to retail clients in 2026.

1. Robinhood – Best Free Trading Platform with No Fees for US Stocks and Options

If you’re an American that is looking for a free trading platform based in the US – Robinhood is worth considering. This is especially the case if you are new to the online trading space – as the broker is primarily aimed at retail investors.

Robinhood is primarily a stock trading platform and offers more than 5,000 stocks and ETFs. Other than a few hundred overseas instruments, stocks on Robinhood are listed on the NYSE and NASDAQ. As such, the platform is ideal if you want exposure to the US markets.

In addition to stocks, Robinhood also allows you to invest in digital currencies like Bitcoin. You can also trade stock options at this top-rated broker. In terms of its free trading service – every financial instrument hosted by Robinhood can be bought and sold commission-free.

Although the broker offers a Premium account for $5, the Standard Account is fee-free. Furthermore, Robinhood doesn’t charge anything on deposits and withdrawals. With that said, you’ll need to perform a US bank transfer as the broker doesn’t support debit or credit cards.

Robinhood fees

Fee Amount Stock trading fee Free Forex trading fee N/A Crypto trading fee Free Inactivity fee No inactivity fee Withdrawal fee No withdrawal fee Pros:

- Hugely popular trading platform in the US

- Buy over 5,000 US-listed stocks

- ETFs, cryptocurrencies, and stock options also supported

- Does not charge any commissions

- No minimum deposit in place

- Very simple to use and ideal for newbies

- Heavily regulated in the US

Cons:

- Only 250-ish international stocks offered

- No debit/credit card or e-wallet deposits

- Confusing margin rates

- Limited to US-based traders

There is no guarantee that you will make money with this provider. Proceed at your own risk..

2. Libertex – Best Free Stock Trading Platform for Tight Spreads

Libertex is a specialist CFD trading platform – so it won’t be suitable for those of you based in the US. However, if you are located in Europe where CFD trading is permitted, Libertex is well worth considering. This is because the platform allows you to trade without paying any spreads.

This is even more competitive than some ECN Accounts available in the market – which often come with a slight gap between the bid and ask price. In addition to this, many of the financial markets supported by Libertex can be traded commission-free.

If your chosen market does come with a commission, this is often less than 0.1%. Additionally, Libertex also offers a free demo trading facility. You will get access to this as soon as you register an account – which should take you no more than a couple of minutes.

The free demo account mirrors live trading conditions – meaning you can test the waters without risking any of your capital. In terms of support markets, Libertex covers CFD assets on stocks, ETFs, hard metals, energies, agricultural products, cryptocurrencies, ETFs, and indices.

Another free service offered by Libertex is that of its payment department. Whether you deposit with a debit/credit card, bank transfer, or e-wallet – you won’t be charged any transaction fees. In terms of safety, the Libertex platform has been active for over 20 years. It is also authorized and regulated by CySEC and the FSA (South Africa).

Libertex fees

Fee Amount Stock trading fee Commission. 0.034% for Amazon. Forex trading fee Commission. 0.008% for GBP/USD. Crypto trading fee Commission. 1.23% for Bitcoin. Inactivity fee $5 a month after 180 days Withdrawal fee Free Pros:

[/su_list]- Tight spread CFD trading

- Very competitive commissions

- Good educational resources

- Long established broker

- Trade stocks and indices like the Dow Jones

- Compatible with MT4

- Great choice of markets

Cons:

- Only offers CFDs

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

3. TD Ameritrade – Best Free Stock Trading Platform for Seasoned Investors

TD Ameritrade recently joined the commission-free parade – as you won’t be charged any dealing fees when you buy US-listed stocks, ETFs, and options. This mirrors the service offered by Robinhood in this respect.

However, while Robinhood is ideal for newbies, the platform isn’t quite suitable for those of you that wish to access more advanced trading tools. TD Ameritrade, on the other hand, is arguably the best free trading platform for seasoned pros. Also if you are looking to invest or trade in forex then this is a good option, unlike some other platforms which you can see from our TD Ameritrade vs Charles Schwab comparison.

This is because of its industry-leading thinkorswim trading platform. For those unaware, thinkorswim is the native trading platform built and managed by TD Ameritrade. Available online, through desktop software, or a mobile app – thinkorswim comes jam-packed with tools that allow you to analyze the market in real-time.

This covers technical studies and indicators, forecasting tools, and the ability to fully customize your trading screen. And of course – thinkorswim is completely free to use – so as long as you are trading US-listed assets, you don’t need to worry about commissions.

We should also note that TD Ameritrade allows you to set up thinkorswim in demo mode. This free paper trading facility, therefore, allows you to get to grips with how thinkorswim works before risking any capital. When it comes to payments, TD Ameritrade does not charge any deposit or withdrawal fees, and there is no account minimum.

TD Ameritrade fees

Fee Amount Stock trading fee Free Forex trading fee Spread. 1.2 pips average during peak hours. Crypto trading fee N/A Inactivity fee Free Withdrawal fee Free for ACH, $25 for wire transfer Pros:

- Trusted US brokerage firm

- App is available on iOS and Android devices

- Buy stocks and ETFs commission-free

- Options can be traded at just $0.65 per contract

- Fully-fledged paper trading account

- More than 11,000 mutuals to choose from

- No account minimums

Cons:

- Not as user-friendly as other investing apps in the market

- The sheer size of tradable markets on offer can appear overwhelming

There is no guarantee that you will make money with this provider. Proceed at your own risk..

4. Charles Schwab – Best Free Trading Platform for Fractional Shares

If you are looking to invest small amounts into the stock markets – you might be surprised that age-old broker Charles Schwab is one of the best free trading platforms for this purpose. This is because of the broker’s fractional share service.

In what it calls Schwab Stock Slices™, this allows you to invest in any share of your chosen from just $5. This means that you don’t need to form out hundreds of dollars on companies like Tesla, Apple, Amazon, or Facebook. Instead, as long as you meet the $5 minimum – you can invest any amount you like.

Most importantly, you will still benefit from free trades when using the Stock Slice feature – as long as the shares are listed on a US exchange. This commission-free offering is also applicable on US-listed ETFs and thousands of investment funds via Schwab Mutual Fund OneSource.

Much like What we also like about Charles Schwab is that it allows you to invest in IRAs (Traditional, Roth, or Rollover) with no opening or maintenance fees. Plus, there are no account minimums – so you can get started with an amount you feel comfortable with.

Perhaps the main drawback with Charles Schwab is that it is not a great platform for investing in international stocks. In fact, the broker will charge you a whopping $50 per non-US-listed trade – which is huge. On the flip side, this might actually work out somewhat favorable if you are investing a significant amount.

Charles Schwab fees

Fee Amount ETF trading fee Free Forex trading fee N/A Crypto trading fee N/A Inactivity fee Free Withdrawal fee Free Pros:

- Trusted US-based trading platform

- Top-rated investment app available on iOS and Android

- $0 commission on stocks and ETFs

- All US stocks covered, plus heaps of international shares

- Industry-leading research facilities

- 3 trading platforms to choose from

- No account fee or minimum deposit

Cons:

- Some mutual funds charges $50 for non-US stock trades

- High margin trading fees

There is no guarantee that you will make money with this provider. Proceed at your own risk..

5. Webull – Best Free Trading Platform App for Mobile Investments

If you are looking for a trading app that allows you to buy and sell assets on a commission-free basis – Webull is worth considering. This is especially the case if you have little to no experience of investing – as Webull is primary geared towards newbies.

In fact, the Webull trading app is so simple to use that you don’t need to have any prior investment knowledge. Instead, it’s just a case of searching for your chosen stock and entering the amount you wish to invest.

In terms of stand-out features, Webull allows you to trade commission-free. This is the case across its library of US-listed stocks, options, and ETFs. You can also buy foreign stocks in the shape of ADRs (American Depositary Receipt). If you are depositing and withdrawing funds via ACH, then you won’t be charged any fees.

However, wire transfer deposits/withdrawals cost $8 and $25 respectively. We should also note that the Webull trading app isn’t truly free – as you need to pay a small monthly fee of $1. If you decide to use the app to trade on margin, this will also attract a fee. This works out at 6.99% annual for balances of $25,000 or less.

Check out our Webull review to learn more about this broker.

Webull fees

Fee Amount Stock trading fee U.S. SEC transaction fee (sells only) – $0.0000051*Total $ Trade Amount (Min $0.01) Forex trading fee N/A Crypto trading fee Variable spread Inactivity fee Free Withdrawal fee $25 via wire transfer (U.S.) – $45 via wire transfer (international) Pros:

- Commission-free trading

- Global stock, ETF, options, and crypto trading

- Includes highly advanced technical charts

- Fully customizable indicators

- Set up unlimited watchlists and complex alerts

- Includes basic social network and analyst recommendations

- Highly regulated in the US

Cons:

- Only available to US traders

- No forex or commodity CFD trading

- Payments are only by bank or wire transfer

- Limited educational resources

- Less than optimal customer support

There is no guarantee that you will make money with this provider. Proceed at your own risk..

6. Fidelity – Best Free Trading Platform with No Fees for ETFs

If you’re looking for the best free trading platform with no fees for exchange-traded funds (ETFs) – Fidelity is well worth considering. The broker gives you access to a huge library of ETFs from a variety of markets and sectors – and if your chosen fund is US-listed, you won’t pay any commission.

Finding a suitable free ETF at Fidelity is easy – as the broker offers an intuitive screener. This allows you to find an ETF based on your financial goals and attitude to risk. The ETF screener is available online or via the Fidelity app.

We also note that Fidelity allows you to trade US-listed stocks for free, too. Additionally, the Fidelity Stocks by the SliceSM feature allows you to buy fractional shares and ETFs. This means that you can invest any amount from $1 up – making diversification a breeze. This is further supported by the fact that there is no minimum account balance or deposit amount at Fidelity.

An additional reason why we like this free trading platform is that it offers top-rated research and educational materials. This is ideal if you are a newbie and want to learn the ropes of investing step-by-step. Fidelity also gets the thumbs up because it gives you access to US-based tax forms that you’ll need to submit at the end of each year. To get an idea of how Fidelity compares to other brokers, then why not look at our Fidelity vs TD Ameritrade review.

Fidelity fees

Fee Amount Stock trading fee Free Forex trading fee N/A Crypto trading fee N/A Inactivity fee Free Withdrawal fee Free Pros:

- Great selection of long-term investment products

- Access US-listed stocks, ETFs, and options trading markets commission-free

- Covers thousands of markets in 25 different countries

- Excellent reputation and heavily regulated

- No minimum account balance

- ETF Trade Screener

- Top-rated research and educational materials

- Advanced analysis tools available for seasoned pros

Cons:

- Account opening process can be slow

- No debit card deposits/withdrawals

There is no guarantee that you will make money with this provider. Proceed at your own risk..

How Do Free Stock Trading Platforms Make Money?

One of the biggest questions surrounding free trading platforms is how they manage to make money? There are several ways that free trading platforms can make profits but the most common is to charge above the spot price for currency conversions. Platforms may also charge for withdrawals or inactivity- it is worth to check this before singing up!

Another way that some free trading platforms make money is by offering premium trading features that cost money to use. These features are created to help traders improve their trading for a price and often appeal to advanced traders who feel confident in their ability to make back any money that they may spend on the premium features.

Premium trading features can be helpful however, it is possible to make profitable trades without investing into any paid features. The key to making good trading decisions is to conduct thorough market research and analysis, develop a strong risk management strategy and to avoid emotional trading.

How to Choose the Best Free Trading Platform for You

So now that we have discussed the best free trading platforms available in the market right now – we are going to explain what considerations need to be made before you open an account.

This is because you often need to look beyond the free trading service offered by the broker. For example, what assets can you buy and sell for free, what is the minimum deposit requirement, and what payment methods are supported?

Below you will find a list of key metrics to consider in your search for the best trading platform for 2026.

Regulation

Sure – your chosen platform might offer a free trading service, but what if it isn’t regulated? Put simply, by using an unlicensed trading platform you are putting your money at risk. This is why all of the free trading platforms discussed on this page are heavily regulated.

- For example, our top-rated broker Libertex is regulated by three bodies – the FCA, ASIC, and CySEC. It’s also registered with FINRA in the US.

- Then you have the likes of Fidelity, Robinhood, Webull, and Charles Schwab – all of which are members of the Securities Investor Protection Corporation (SIPC).

- This means that you are covered up to the tune of $500,000 (including $250,000 on cash balances) should the broker run into financial problems.

- The UK equivalent of this is the Financial Services Compensation Scheme (FSCS), which covers you up to the first £85,000.

By choosing a regulated free online trading platform – the broker will also be required to keep your capital in segregated bank accounts. Plus, all users – including yourself, will be required to provide a copy of a government-issued ID. This prevents fraud and financial crimes.

Assets

Once you have established your chosen free online trading platform is regulated – it’s then time to check what assets you will be able to buy. Be extra careful here – as a lot of platforms only allow you to invest in specific assets to benefit from the commission-free offering.

For example, a lot of US-based brokers only offer fee-free investments on assets listed on the NASDAQ or NYSE. Fortunately, platforms like Libertex allow you to invest in over 17 international markets without charging any commission. As such, this broker is ideal if you wish to build a highly diversified portfolio of shares, ETFs, and even cryptocurrencies.

In addition to this, you also need to explore whether you are buying the asset outright or trading CFDs. Of course, if you’re an American you don’t need to worry about this as CFDs are prohibited.

Fees

As we mentioned earlier, the term ‘free trading platform’ is somewhat broad. Crucially, this is because online brokers are in the business of making money. As such, you need to have a firm grasp of what you will be charged – ensuring you cover deposits/withdrawals, commissions, platform fees, and more.

Here are the main fees that you need to explore in your search for the best free trading platform.

Commissions and Dealing Fees

First and foremost, all of the best free trading platforms discussed today allow you to invest commission-free. But, this isn’t the case with all supported financial instruments.

For example, if you were to use Charles Schwab, you can buy US-listed stocks fee-free. However, if you wanted to buy stocks listed in another country – you would be charged $50. In the case of Libertex – all trades are commission-free irrespective of the market.

Spreads

When using a free trading platform – it is likely that the provider makes its money from the spread. This is an indirect fee that many newbie investors are unaware of. In simple terms, the spread is the percentage difference between the bid and ask price of an asset.

- For example, if the bid price on Apple stocks is $124.72 and the ask price is $124.90 – the spread amounts to just under 0.15%.

- This means that as soon as you enter your trade, you’re 0.15% down.

- As such, financial gains are only realized once your position increases by 0.15%.

The key challenge here is that many free trading platforms do not actually advise what spread you are paying. This means that you might be under the impression that you are getting a good deal – because you are not paying any commission. But, if the spread is really uncompetitive, you are likely overpaying and completely unaware of this.

Deposits and Withdrawals

Most of the best free trading platforms discussed on this page allow you to deposit and withdraw funds for free. However, this isn’t always the case – especially if you are looking to use a specific payment method. For example, although Robinhood allows you to deposit funds for free via ACH, bank wires cost $8. The broker also charges $25 when you withdraw vis a bank wire.

Platform Fees

Once again, another trick employed by a number of ‘free’ trading sites is that you will need to pay an ongoing platform fee. In particular, Webull charges $1 per month to keep your account open. Sure, this is an inconsequential amount. But, if you are only trading a few dollars here and there – it can make the process unviable.

Trading Tools & Features

A lot of free trading platforms offer a simple, skin and bones service. This means that you can buy and sell assets fee-free, but you won’t have access to any notable tools. With that said, most of the free trading platforms that we reviewed on this page offer several features that you might be interested in.

This includes:

Fractional Ownership

The vast majority of free trading platforms on this page offer a fractional ownership tool. At Libertex, this allows you to invest in digital currencies from $25 and stocks/ETFs from $50. At Charles Schwab, the minimum stock and ETF investment is just $5 while at Fidelity it’s a mere $1.

Margin Trading and Short-Selling

Many of the free trading platforms discussed today allow you to trade on margin. This means that you can trade assets with more money than you have in your account.

- For example, Robinhood offers a margin limit of 50%. This means that you can buy $10,000 worth of stocks with an account balance of just $5,000.

- However – and as is the case with all margin accounts offered to US citizens, you need to have a balance of at least $2,000 to be eligible.

If you are based outside of the US, you will be able to get much higher margin limits by trading CFDs. This, for example, stands at up to 3.33% on major forex pairs if you’re based in the UK, Europe, or Australia. Other regions have no limits at all – meaning you can often trade with a margin of just 0.2%.

Additionally, we should also mention that some of the best free trading platforms that we reviewed offer short-selling services. This is much easier if you are eligible to trade CFDs – as you don’t need to borrow the stock from another investor. Instead, it’s just a case of placing a sell order on your chosen market.

Education, Research & Analysis

If you are a seasoned investor, then you likely won’t be too concerned about what educational materials the free trading platform offers. But, if you are entering the online brokerage scene for the first time – having access to guides, how-to videos, and trading tutorials can be invaluable.

Additionally – and irrespective of your skill-set, you’ll want to choose a free trading platform that allows you to perform research and analysis without leaving the site.

For example, when you use Libertex – you have access to webinars, investing guides and an economic calendar. If you want to take things to the next level – TD Ameritrade and its thinkorswim platform come jam-packed with advanced technical indicators, chart drawing tools, and fundamental news.

User Experience

Most free trading platforms are aimed at the everyday retail investor – so you should expect a smooth and seamless user experience. This isn’t always the case though – so be sure to explore how easy or difficult the platform is to use. The best way to do this is to see if a demo account facility is offered by the broker

If it is, you can test the free trading platform out before depositing any money. In addition to this, it’s also worth testing out the user experience on the broker’s mobile app – if one is offered. After all, there might come a come when you are away from your desktop device and you wish to place a trade, check the value of your outstanding investments, or even make a withdrawal.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

If your required task is hindered by a poor user experience – this can lead to costly errors. If your chosen broker doesn’t offer a demo facility on its mobile app – it’s worth exploring what reviews are like in the public domain. For example, you could head over to the Apple or Google Play Store and see what the free-trading app’s rating is like.

Payment Methods

Many of the free trading platforms discussed on this page – especially those that are headquartered in the US – only accept bank transfers. This will come in the form of ACH or a bank wire if you’re using a U.S. checking account.

With that said, the likes of Libertex allow you to instantly fund your trading account with a debit/credit card. The aforementioned free trading platforms even support e-wallets like Paypal and Neteller.

Customer Service

Perhaps the biggest drawback with free trading platforms is that you will often find the customer service department is lacking. This is because many of these platforms are working on wafer-thin margins – so they don’t have the resources to offer top-notch support around the clock.

In fact, many free trading platforms only offer support via a contact form – meaning you’ll need to wait for a reply.

How to Get Started With the Best Free Trading Platform For Stocks

This guide has covered everything there is to know about free trading platforms. Not only have we reviewed and critiqued the best free trading platforms in this space – but we have also explained how to choose a provider yourself.

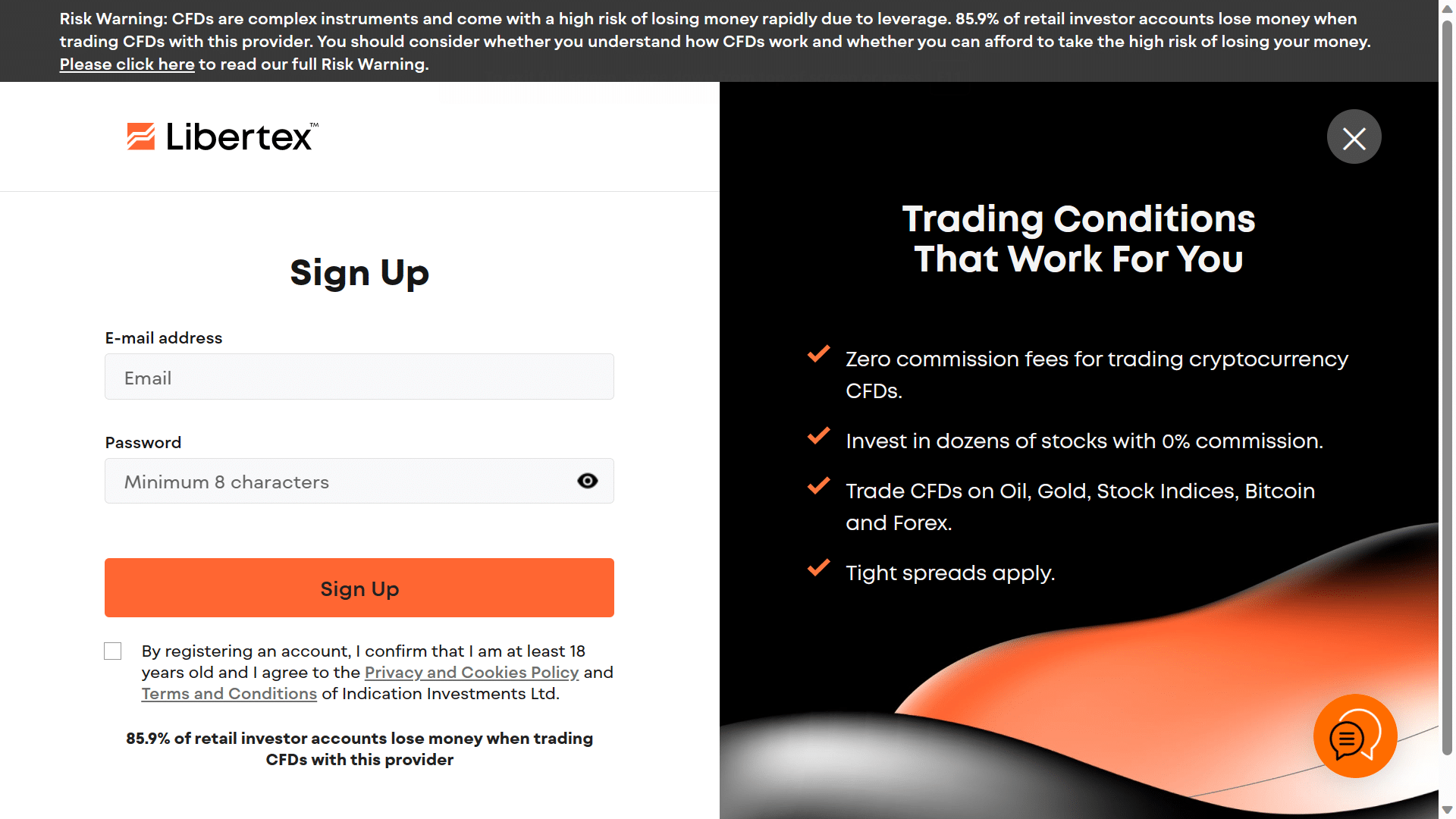

Now, all that is left to do is place your first trade at your selected free brokerage site. For this, we are going to walk you through the process with our top-rated trading platform – Libertex.

Step 1: Open an Account

As is the case with all free trading platforms – the first step is to open an account. This shouldn’t take you more than a few minutes at Libertex – as you simply need to provide some basic personal information and contact details.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Next, you will be asked to upload a copy of your government-issued ID (passport or driver’s license). This ensures that Libertex complies with its license issuers and that all clients are kept safe from financial crime.

Step 2: Deposit Funds

You can now deposit some funds into Libertex using one of the following payment methods:

- Debit/Credit Card (Visa, MasterCard, or Maestro)

- Paypal

- Bank Wire

Step 3: Search for an Asset

Libertex supports thousands of markets – both in the form of traditional assets and CFD instruments. You can click on the ‘Trade Markets’ button to browse what investments you have at your disposal. You can then filter your search down by the asset class – such as stocks or cryptocurrencies.

Alternatively, you can go straight to the respective trading page by searching for your chosen market. As you can see from the above, we are searching for Bitcoin on Libertex’s Bitcoin trading platform.

Step 4: Complete Your Free Trade

Once you have found your chosen market – click on the ‘Trade’ button. This will bring up an order box like the image below.

All you need to do is enter the amount that you wish to invest – ensuring you meet the minimum. This is $25 with crypto-assets and $50 on stocks and ETFs.

To complete your free investment – click on the ‘Open Trade’ button.

Conclusion

In summary, the internet is now packed with free trading platforms that allow you to invest commission-free. Just a few years ago – this would have been unthinkable.

With so much choice on the table – it is wise to do some research before opening an account with a free trading platform. As we discussed in this guide, you should concentrate on metrics like regulation, tradable markets, customer support, platform features, and payments.

If you’re looking to get started with the best free trading platform with no fees right now – Libertex stands out. You can buy, sell, and trade thousands of assets from 17 international markets – all on a commission-free basis. Getting started takes less than 10 minutes and the minimum investment starts from just $10 upwards!

FAQs

What are the best free paper trading platforms?

One of the best free paper trading platforms that we came across was Libertex. Once you open an account - which takes just a few minutes, you will have access to a free demo account facility that is pre-loaded with $100k in paper funds. Other free paper trading platforms that we like include Libertex and Webull.What is a free stock trading platform?

The term 'free stock trading platform' is used to describe an online that allows you to buy and sell shares without paying any commission.What is the best CFD trading platform?

After reviewing dozens of providers, we found that Libertex is the best CFD trading platform of 2023. Crucially, you can trade thousands of CFDs at this heavily regulated platform without paying any commission. Your chosen free stock trading platform may, however, charge fees in other departments. This might include deposits/withdrawals, spreads, or margin trading.What is the best free cryptocurrency trading platform?

If you're looking to invest in digital currencies like Bitcoin or XRP - the best free cryptocurrency trading platform is Libertex. Not only does this free cryptocurrency trading platform allow you to invest commission-free - but the minimum stake is just $25.How do free trading platforms make money?

In most cases, free trading platforms make money from the spread. They also make money from margin trading services and sometimes - from deposits and withdrawals.What is the best free trading app?

If you are looking to trade assets for free on your phone - Libertex offers a highly rated investment app for iOS and Android devices.What is the best free trading platform for CFDs?

As the underlying asset does not exist when you trade CFDs - the costs involved are very low. As such, most CFD providers allow you to trade commission-free.References:

Kane Pepi Finance Writer

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, InsideBitcoins, Blockonomi, Learnbonds, Buyshares n and the Malta Association of Compliance Officers.

Before starting his career as a writer, Kane studied at the University of Central Lancashire where he received a Masters Degree in Financial Investigation and then a Research Doctorate in Criminal Justice. Pepi is passionate about helping people to make informed decisions through high-quality, educational content.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

If you are looking to invest small amounts into the stock markets – you might be surprised that age-old broker Charles Schwab is one of the best free trading platforms for this purpose. This is because of the broker’s fractional share service.

If you are looking to invest small amounts into the stock markets – you might be surprised that age-old broker Charles Schwab is one of the best free trading platforms for this purpose. This is because of the broker’s fractional share service.

If you’re looking for the best free trading platform with no fees for exchange-traded funds (ETFs) – Fidelity is well worth considering. The broker gives you access to a huge library of ETFs from a variety of markets and sectors – and if your chosen fund is US-listed, you won’t pay any commission.

If you’re looking for the best free trading platform with no fees for exchange-traded funds (ETFs) – Fidelity is well worth considering. The broker gives you access to a huge library of ETFs from a variety of markets and sectors – and if your chosen fund is US-listed, you won’t pay any commission.