Best European Trading Platforms for July 2025

Trading platforms offer software applications that enable investors to directly buy and sell shares, funds, and various investments, bypassing the need for a financial adviser.

The surge in do-it-yourself (DIY) investing in the past decade has been fueled by the popularity of trading apps, especially for investors who prefer the convenience of managing their investments on the go. Notably, the four leading trading-app companies represent 40% of newly opened investment accounts.

While established DIY trading platforms continue to dominate the market, the last five years have witnessed the emergence of commission-free, app-centric trading platforms like eToro.

Unlike traditional commission-based models, these platforms generate revenue by leveraging the buy-sell spread, the pricing difference on shares, and more intricate financial products.

With the plethora of options available, investors may find it challenging to select the right trading platform. To assist in this decision-making process, we have conducted a comprehensive analysis of some of the top trading platforms in the market, considering factors such as fees, investment choices, and other crucial trading features.

Below is our list of the top European trading platforms for 2025.

-

-

Best Stock Trading Platforms in Europe 2025

- eToro: A well-known social trading platform with a user base of over 20 million. eToro is regulated by the FCA, ASIC and the CySEC and provides marketing-leading protection to it’s users. As well as European stocks, eToro supports US stocks, cryptocurrencies, forex, indices, commodities and ETFs. The platform also provides access to a market-leading copy trading platform that can be used to automate your trading strategy according to the trades of experts. eToro is free to use and offers zero commissions on stock CFDs.

- Libertex: Libertex is a suitable platform for traders who want to conduct technical analysis before placing trades. The platform is compatible with third-party charting tools including MT4 and MT5. Traders can access a range of indicators and use APIs and EAs to increase the accuracy of their strategy. Libertex also offers low fees and tight spreads of stock trading as well as a low minimum deposit requirement of just $10.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

$10 por Año10 por AñoSort By4 Provider that match your filters Providers that match your filters

Payment methods

Features

Customer service

Classification

1or moreMobile App

1or moreFixed commissions per operation

$1or moreAccount Fee

$1or moreNo results found

Trying adjusting the filter to see some results.

Total Fees (for 12 months)$ 0What we like- Buy shares and ETFs with 0% commission

- Social and copy trading network

- Invest and trade crypto with low fees

Fixed commissions per operationAccount FeeMobile App10/10FeaturesPayment methodsAccount Info

Account From$10Deposit fees$0ETFS300+Inactivity fees$10/month after 12 monthsLeverageMaximum 1:30, minimum 1:2Operating marginYesMinimum operation$10Stocks3000+CFD PositionCommission relative to value of positionCFDS3000+Trading fees$0Withdrawal fees$5Fees per operation

BondsN/ACryptocurrencies1%CFDSSpread – Currency from 1 PIP, commodities from 2 PIPS, indices from 0,75 points, stocks and ETFs from 0,15 %DAX0.01%Copy Portfolio0%ETFSNo commissionCFD PositionYes, depending on the market that you tradeStocksno commissionSavings PlanN/ARobo AdvisorN/AFundsN/ATotal Fees (for 12 months)$ 0eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Account Info

Account From$10Deposit fees$0ETFS300+Inactivity fees$10/month after 12 monthsLeverageMaximum 1:30, minimum 1:2Operating marginYesMinimum operation$10Stocks3000+CFD PositionCommission relative to value of positionCFDS3000+Trading fees$0Withdrawal fees$5Fees per operation

BondsN/ACryptocurrencies1%CFDSSpread – Currency from 1 PIP, commodities from 2 PIPS, indices from 0,75 points, stocks and ETFs from 0,15 %DAX0.01%Copy Portfolio0%ETFSNo commissionCFD PositionYes, depending on the market that you tradeStocksno commissionSavings PlanN/ARobo AdvisorN/AFundsN/ATotal Fees (for 12 months)$ 0What we like- Amazing research tools

- Almost no fees

- User-friendly platform

Fixed commissions per operationAccount FeeMobile App8/10FeaturesPayment methodsAccount Info

Account From$0Deposit fees$0ETFS+2,000Inactivity fees$0Leverage2:1Operating marginYesMinimum operation$0Stocks+3,000CFD Position-CFDS-Trading fees$0Withdrawal fees$0Fees per operation

Bonds$0Cryptocurrencies-CFDS-DAX-Copy Portfolio-ETFS$0CFD Position-Stocks$0Savings Plan0.48% APY on your savings account balance.Robo Advisor-Funds$0Total Fees (for 12 months)$ 0Schwab Stock Slices is not intended to be investment advice or a recommendation of any stock. Investing in stocks can be volatile and involves risk, including loss of principal. Consider your individual circumstances prior to investing.

Account Info

Account From$0Deposit fees$0ETFS+2,000Inactivity fees$0Leverage2:1Operating marginYesMinimum operation$0Stocks+3,000CFD Position-CFDS-Trading fees$0Withdrawal fees$0Fees per operation

Bonds$0Cryptocurrencies-CFDS-DAX-Copy Portfolio-ETFS$0CFD Position-Stocks$0Savings Plan0.48% APY on your savings account balance.Robo Advisor-Funds$0Total Fees (for 12 months)$ 0What we like- Great selection of long-term investment products

- Access US-listed stocks

- ETFs

Fixed commissions per operationAccount FeeMobile App9/10FeaturesPayment methodsAccount Info

Account From$0Deposit fees$0ETFS-Inactivity fees$0Leverage2:1Operating marginYesMinimum operation-Stocks+7,000CFD Position-CFDS-Trading fees$0Withdrawal fees$0Fees per operation

Bonds$1 mark-up per bondCryptocurrencies1% spreadCFDS-DAX-Copy Portfolio-ETFS$0CFD Position-Stocks$0Savings Plan$0Robo Advisor$0Funds$0Total Fees (for 12 months)$ 0Investing involves risk, including risk of loss.

Account Info

Account From$0Deposit fees$0ETFS-Inactivity fees$0Leverage2:1Operating marginYesMinimum operation-Stocks+7,000CFD Position-CFDS-Trading fees$0Withdrawal fees$0Fees per operation

Bonds$1 mark-up per bondCryptocurrencies1% spreadCFDS-DAX-Copy Portfolio-ETFS$0CFD Position-Stocks$0Savings Plan$0Robo Advisor$0Funds$0Total Fees (for 12 months)$ 0What we like- Offers low-commission CFD and Forex trading

- Exposure to 78 different stock markets

- No minimum deposit required

Fixed commissions per operationAccount FeeMobile App8/10FeaturesPayment methodsAccount Info

Account From$0Deposit fees$0ETFS-Inactivity fees-Leverage4:1Operating marginYesMinimum operation-Stocks-CFD Position-CFDS-Trading feesCommissionsWithdrawal fees$0Fees per operation

Bonds-Cryptocurrencies-CFDS$0.005/shareDAX0.005%Copy Portfolio-ETFS-CFD Position-Stocks$0.005/shareSavings Plan-Robo Advisor-Funds-Total Fees (for 12 months)$ 0The risk of loss in online trading of stocks, options, futures, currencies, foreign equities, and fixed income can be substantial.

Account Info

Account From$0Deposit fees$0ETFS-Inactivity fees-Leverage4:1Operating marginYesMinimum operation-Stocks-CFD Position-CFDS-Trading feesCommissionsWithdrawal fees$0Fees per operation

Bonds-Cryptocurrencies-CFDS$0.005/shareDAX0.005%Copy Portfolio-ETFS-CFD Position-Stocks$0.005/shareSavings Plan-Robo Advisor-Funds-What Is a European Trading Platform?

A European trading platform is an online brokerage that provides access to European stocks and shares. These platforms can often be used to trade instruments from global markets, including Europe.

European trading platforms work very similarly to traditional online brokerages. The platforms provide tools for research and analysis and support different trading strategies. Popular indices that are listed on European trading sites include the FTSE 100, STOXX Europe 600, the Swiss Market Index, and the AEX Index.

The best European brokers will offer low trading fees for European instruments, which makes them a suitable choice for building a portfolio of Europe stocks.

Best European Trading Platforms Reviewed

In the following section, we will take a closer look at some of the best European trading platforms to consider in 2025.

1. eToro – Overall Best European Trading Platform

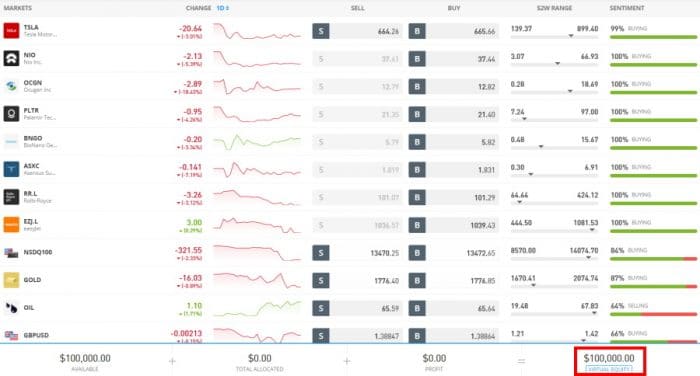

eToro has firmly positioned itself as the premier stock trading platform in Europe, providing investors with unparalleled access to a diverse portfolio of over 3,000 assets, spanning equities, ETFs, and commodities. Boasting a user base exceeding 30 million, eToro’s commitment to regulatory compliance is underscored by multiple tier-1 licenses, including those issued by the Cyprus Securities and Exchange Commission (CySEC) and the Dutch National Bank (DNB), among others. This ensures that users are not only engaging with a popular platform but also one that prioritizes trustworthiness and security.

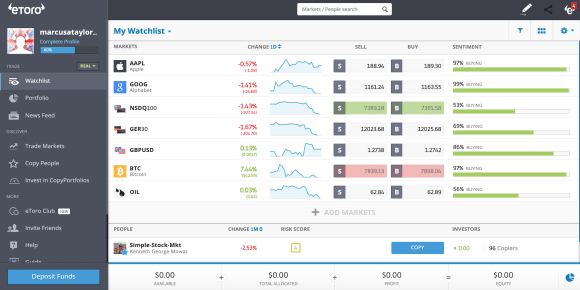

Setting eToro apart are its cutting-edge social trading features. Notable options like Copy Trading and a Virtual Account, featuring €100,000 in demo funds, provide unique opportunities for honing skills and assessing risks. The platform consistently earns acclaim for its modern user interface and user-friendly mobile apps available on both iOS and Android. Additionally, eToro excels in facilitating a variety of Euro deposit options, offering competitive spreads, and maintaining affordable fees.

Key Highlights:

- Fees: No trading fees; a 1% spread is applicable.

- Assets: A comprehensive selection of over 3,000 stocks, ETFs, commodities, currencies, and more.

- Regulation: Holds multiple tier-1 regulatory licenses, including ESMA, CySEC, and DNB.

- EUR Deposit Methods: Offers a wide range of options, including Instant Bank Transfer, SEPA, Giropay, Klarna, Trustly, Visa, Mastercard, and PayPal.

Newbies can easily use eToro because it is user-friendly. Since the platform is free of complicated financial terms, users can easily find an asset and place their buy and sell orders. Furthermore, eToro offers CopyFunds portfolios, a practical and accessible way to get into online trading easily. Additionally, there is a Copy Trading option so that you can invest passively.

In this type of trade, you will choose a verified trader and invest a minimum of $200, and all of the trades will be mirrored into your eToro portfolio. EToro’s minimum stake on cryptocurrencies is $25, $50 on stocks, and $200 on ETFs. Check out our review to see why eToro is considered one of the best-automated trading platforms in Europe!

eToro’s regulatory environment is state-of-the-art for European investors since it is licensed and regulated by the UK’s Financial Conduct Authority (FCA), a financial watchdog among the most stringent globally. In Australia and Cyprus, it is also licensed. As a result, the FSCS provides you with financial protection if you open an account with eToro. In addition, this cheap trading platform offers a variety of payment options, including bank transfers, debit cards, and electronic wallets.

eToro fees:

Fee Amount Stock trading fee Free Forex trading fee Spread, 2.1 pips for GBP/USD Crypto trading fee Spread, 0.75% for Bitcoin Inactivity fee $10 a month after one year Withdrawal fee $5 Pros:

- Online broker with a super-user-friendly platform

- Offers a wide range of assets at tight spreads

- 100% commission-free

- The platform also allows you to trade stocks, indices, and ETFs

- You can use a debit/credit card, an e-wallet, or an e-wallet for social trading

- ASIC, CySEC, and FCA regulate these firms

Cons:

- A withdrawal fee of $5 is applied.

- The platform exclusively operates with USD as the base currency.

- There is room for improvement in customer support services.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

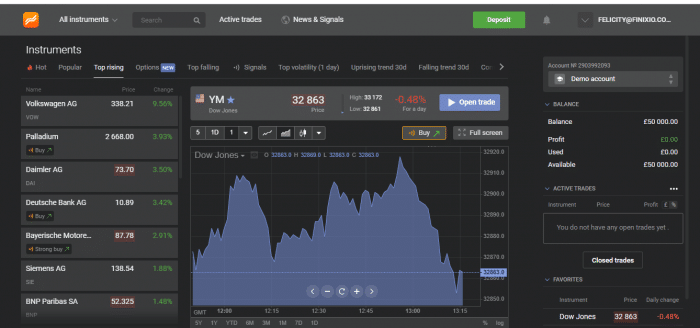

3. Libertex – Low-Cost Site with ZERO Spreads

Libertex, a member of the Libertex Group, stands as a pioneer in the online trading industry, commencing operations in 1997.

One of the group’s notable advantages lies in its expansive offering, allowing users to trade over 213 assets in various financial markets, including CFDs on Forex, commodities, indices, stocks, cryptocurrencies, and ETFs.

Functioning as a market maker broker, the Libertex Group caters to a substantial client base, serving over 2.2 million clients across 110 countries globally. With a presence in 27 countries and a workforce exceeding 700 individuals, the Group has notably witnessed over 10 clients achieving millionaire status through their trading services.

Originally founded in Russia, the Group’s headquarters is now situated in St. Vincent and the Grenadines. Indication Investments Ltd, operating under the Libertex brand, is a regulated entity headquartered in Limassol, Cyprus, with additional offices in Belarus, Russia, Asia, and Europe. Libertex gains favor among traders worldwide due to its unique pricing model based solely on commissions and the provision of reliable trading platforms.

The Libertex brand operates under the regulation of CySEC and FSCA. Their services leverage MetaTrader platforms from MetaQuotes Software Corporation, along with their proprietary trading platform named Libertex.

Its zero spread feature is at the forefront of this. As a result, you will not have a gap between the buy and sell price regardless of which asset you decide to trade.

As a result, you receive quotes that are industry-leading. Further, Libertex charges commissions on both sides of every trade, but these are typically very low. For example, the UK’s virtual trading platform charges commissions of as little as 0.1% per transaction.

Typical commission rates for popular forex pairs are as low as 0.12% in NZD/USD. CFDs are offered on stocks, commodities, and currencies by Libertex. Leveraging your CFD expertise allows you to take advantage of any trading opportunity.

You will be limited to 1:30 for major forex pairings and less on other instruments based on FCA restrictions. At Libertex, you can also go long or short on any CFD market. Therefore, you can profit if markets rise or fall. The company offers two trading platforms.

MetaTrader 4 and its platform, which was built in-house, are included. Both platforms can be accessed via an app or online. It is also possible to download MT4 to your desktop device, which is the suggested route to take if you wish to install an automated robot.

You can open an account with Libertex in minutes if you like the sound of it. You can deposit as little as £100 using a credit/debit card, bank account transfer, or an e-wallet. The first deposit into your account comes with a minimum deposit of just £10.

The FCA does not regulate Libertex’s safety. Nevertheless, it is regulated by CySEC, a leading issuer of EU licenses. Libertex has provided online trading and financial services since 1997 as well. Consequently, the provider has a track record of over 20 years.

Libertex fees:

Fee Amount Stock trading fee Commission. 0.034% for Amazon. Forex trading fee Commission. 0.008% for GBP/USD. Crypto trading fee Commission. 1.23% for Bitcoin. Inactivity fee $5 a month after 180 days Withdrawal fee Free Pros:

- CFD trading with no spread

- Their commissions are very competitive and start from

- A good selection of educational

- The broker has extensive experience

- Supports MT4

- Markets of great variety

Cons:

- CFDs only

- The selection of account types is restricted.

- There is a scarcity of educational materials tailored for beginners.

- The absence of the MetaTrader 5 platform.

- Lack of FIX API trading functionality.

- The platform does not offer managed accounts.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Best Stock Brokers Europe Fee Comparison

In our review of the best trading sites in Europe, we also compared the fees they charge to each other. As a result, you will find Europe’s cheapest trading platforms with no overnight fees and the lowest fees in the table below.

Trading Platform Stock trading fees Forex trading fees Overnight fees eToro Free. Fixed spread. 2 pips for GBP/USD. CFD fees overnight. For stocks, ETFs, and crypto, there are no overnight fees. Libertex 0%-0.46% commission. 0.034% for Amazon. Commission. 0.008% for GBP/USD. Interest was taken as of 9 pm GMT each day as positive or negative interest, depending on the day’s close. Overnight fees on CFDs are tripled when held between Friday and Monday. European Trading Platforms Assets & Software Comparison

Trading Platform Assets Software Features eToro Shares, ETFs, forex, commodities, indices, cryptocurrencies Proprietary Social trading, copy trading, CopyPortfolios Libertex Shares, ETFs, forex, commodities, indices, options Proprietary, MT4 Webinars, economic news Best European Stock Trading App

Saxo Bank, a Danish investment bank specializing in online trading and investment, originated as a brokerage firm named Midas Fondsmæglerselskab in 1992. Co-founded by Lars Seier Christensen, Kim Fournais, and Marc Hauschildt, the company underwent a name change to Saxo upon securing a banking license in 2001. Saxo facilitates trading across various financial instruments, including Forex, stocks, CFDs, futures, funds, bonds, and futures spreads through its online platforms. Although operating as an online broker with a banking license, Saxo does not provide traditional banking products. Approximately half of its activities involve collaborations with institutional trading partners, serving over 100 financial institutions globally through white-label arrangements.

Headquartered in Copenhagen, Saxo Bank has established offices in key financial hubs such as London, Paris, Zurich, Dubai, Singapore, India, and Tokyo. The bank claims a global client base across 180 countries and boasts a daily average turnover of around US$12 billion.

Recognized for its achievements in online trading and investment, Saxo Bank has garnered numerous awards. Domestically, the bank is notable for its founders, who actively express their views on Danish politics. In 2014, Saxo Bank reported a revenue of DKK 3,006 million, resulting in a net income of DKK 381.2 million. The bank employs a staff of 1600.

Saxo Bank has extended its reach through white-label partnerships with various banks, including Standard Bank, Old Mutual Wealth, Banco Carregosa, and Banco Best.

How to Choose the Best European Trading Platform for You

There are hundreds of online trading platforms now allowing Europeans to open accounts, so it’s a good idea to decide what’s most important to you.

Specifically, do you want access to a certain marketplace like a forex or stocks market in Europe, or are you more concerned with the lowest commissions and fees? Is there a feature you need – like automated trading?

Regulation and Safety

One or more reputable financial bodies must license the best trading platforms in Europe. Ideally, the FCA should be done, which is charged with keeping the investment and trading sectors transparent and safe. A host of safety nets are available to you if you stick with an FCA broker.

- Segregated Funds: Client funds must be held in separate accounts by the FCA-regulated best European trading platforms. The platform cannot use the money you provide to service its debt.

- Risk Warnings: Risks associated with trading must be made clear on all FCA-regulated platforms. The number of retail clients who lose money is usually displayed on the homepage.

- Regular Audits: All FCA-regulated brokers must have their books reviewed regularly. It provides a safe and secure trading environment for you and your fellow investors.

Also included are the best trading platforms in Europe that the FSCS covers. In case of platform failure, your funds are protected up to the first £85,000 in the bank account.

Our top-rated trading app has all of these credentials and is being regulated by CySEC and ASIC. That means you have regulatory oversight on several fronts. Additionally, it is registered with FINRA in the US.

Assets

The number of financial instruments available for online trading is enormous, spanning dozens of asset classes. However, not every European trading broker offers the specific market you want.

These are some of the best assets offered by the best European trading platforms:

- Stocks

- Bonds

- ETFs

- Indices

- Funds

- Commodities

- Cryptocurrencies

- Forex

The most important thing about CFDs is to figure out if you are trading them or buying them outright. You will not own the underlying asset if you trade a CFD instrument. In turn, you can engage in short-selling with ease and apply the leverage of up to 1:30 as a result.

CFDs are not suitable for investors who wish to invest in the traditional sense. CFDs attract overnight financing, which is especially important if you plan on building a long-term investment strategy. To make sure you can trade both traditional and CFD assets, you should select a broker.

You can, for example, buy over 2,400 stocks, 250 ETFs, and 16 cryptocurrencies on eToro. In addition, you have access to thousands of CFD markets, including forex, commodities, and indices.

Fees

Fees are often the deciding factor for investors in Europe when selecting a platform for online trading. After all, you should be aware that the amount you pay to trade online varies quite.

Share Dealing Fees

In addition to stock dealing fees, ETF, mutual fund, and investment trust dealing fees are also associated with buying traditional assets such as mutual funds. Almost all trading apps charge a flat fee, except in rare cases.

Therefore, regardless of your investment amount, the fee will remain unchanged. Of course, investors looking to trade larger amounts benefit from this; it goes without saying.

- Imagine you signed up with Hargreaves Lansdown, one of Europe’s leading stockbrokers.

- You would be charged a flat dealing fee of £11.95. So, for example, if you purchased £150 worth of BT shares, you would be charged a flat fee.

- That means that in percentage terms, you’re paying a commission of almost 8%.

- BT shareholders are then required to pay £11.95%.

As an alternative, we recommend using a world-class Europe trading platform, eToro, which would have come at no additional cost to you. Platforms on all of its markets are commission-free. So even the 0.5% stamp duty tax that you would normally have to pay on shares!

Trading Commission

You will be charged a variable fee if you choose to trade assets through a CFD instrument. However, small orders won’t be penalized, so this is more advantageous for entry-level traders.

You will always pay commissions based on which European trading platform you choose to join.

- Take the example of a CFD commission of 0.2% per slide charged by your chosen European trading platform

- A commission of €1 will be charged if you stake €500

- In the example above, if your commission for the trade is 0.2% worth €750, it will be €1.50.

It sounds like not much to pay, sure. However, it is important to keep in mind that these costs can quickly add up, making profitable trades almost unprofitable. In particular, this is true if you are using a trading platform with a minimum commission policy.

CFD trading is commission-free for the best brokers from Europe that we discussed on this page. Some of those include eToro and Plus500.

Spreads

If you’re wondering how the best brokers in Europe make money, it’s by charging a spread rather than a commission. It consists of the difference between the buy and sale prices of the financial instrument.

- Take the case of eToro, a platform that trades Apple stocks

- A ‘buy price’ of $135.10 is listed on the trading platform at this moment

- There is a ‘sell price’ of $134.85 quoted in this quote

- The spread between the two prices is 0.18 percent

What is the significance of this? Thus, when you open a trading position on eToro with Apple, your position is instantly 0.18% in the red. So to get back to the break-even point, you need your trade to increase in value by 0.18%. With a spread of 0.18%, the product is very competitive – especially when looking at the commission-free nature of eToro.

Other Trading Platform Fees

Share dealing fees, commissions, and spreads are the main costs to explore at length. The European trading platform you choose may, however, have additional charges. These may include:

- Overnight Financing: In the case of CFDs, if your position is open for more than a certain amount of time, you must pay an overnight financing fee. In the case of eToro, this begins after 10 pm time. Because All European trading platforms charge CFDs, they are only useful for short-term strategies.

- Transaction Fees: Deposits and withdrawals are fee-free with some online brokers, while others impose fees. Depending on the payment method you choose or the platform you use, you may be required to pay in a foreign currency.

- Inactivity Fees: If an account remains inactive for an extended period, certain brokers charge inactive account fees.

- FX Trading Fees: When you wish to trade non-listed assets, brokers typically charge a foreign exchange commission. Hargreaves Lansdown, for instance, charges a share dealing fee of €11.95, plus a 1% FX markup, when you purchase US stocks.

The fees and commissions you pay can and will significantly affect your ability to make gains, so you must know what you are paying before opening an account.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Trading Tools & Features

Some brokers offer nothing more than the possibility of buying and selling assets. However, you may also choose a service that offers a variety of tools and features that can enhance your investment endeavors.

Fractional Ownership and Low Minimums

It is not common for traders to invest thousands of pounds in a single transaction. Alternatively, some of you might just be getting started and would like to trade with small stakes. Therefore, the best brokers must be those that offer ‘fractional ownership.’

Those unfamiliar with fractional ownership can buy or trade a ‘fraction’ of an asset rather than having to buy the entire asset outright. Our best trader recommendation, eToro, offers traders the possibility of trading cryptocurrencies from just $25 upwards.

The minimum investment amount for stocks is just $50. Therefore, you shouldn’t need to spend more than $800 to acquire a single Tesla share or $100,000 to purchase a USD/AUD lot!

You could start trading with a small amount with the best trading apps if you had fractional ownership. In addition, traders of all budget levels can benefit from a low minimum deposit.

Automated Trading

Online trading is becoming increasingly popular. Trading without doing any research is the main idea. Some tools even go the extra mile by placing your orders on your behalf. It is also a good choice for traders who have little time to analyze the markets.

Automating your trades can be achieved in several ways. First, they then install the trading robot into MT4 once they’ve purchased it. To achieve this, your provider must be able to support this third-party platform.

In this regard, it is safest to use an FCA-regulated broker direct to use an automated trading platform. Copy Trading, for example, is available at no additional charge on eToro. You simply need to choose which verified eToro trader you need to copy, and the platform will automatically mirror all of their trades into your own.

Orders

Any trading platform or asset you choose to trade will require you to place orders.

By doing this, you are telling the trading platform what you hope to accomplish. To enter and exit your trade, all brokers offer to buy and sell orders.

In addition to risk-management orders, the best providers in this space will also offer them. It is recommended to have stop-loss and take-profit orders at a minimum, but trialing stop-loss and guaranteed stop-loss orders is also important.

Research and Analysis

It’s recommended not to execute a position unless some research supports it unless you plan to trade recklessly. That would be the equivalent of gambling. An assortment of analysis tools will be available on the best European trading platforms so that you can conduct your research faster.

eToro, for instance, offers pricing charts on all assets supported by the platform. Also offered are fundamentals about major stocks, as well as commentary on the current market environment. Direct access to financial news is very important for long-term investors, so some of the best brokers offer this service.

Demo Account

You cannot afford to overlook demo accounts, regardless of how experienced you are or whether you are a first-time trader. The best European trading platforms offer these and allow you to gain real-time market knowledge without risking a dime. The trades are executed with paper money.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

A demo account at eToro, for example, comes preloaded with $100,000. It is great to test the waters before making a real deposit since you can still access the same markets, prices, and trading volume. It is also good to use a demo account if you have some experience with online trading.

Mobile App

Android and iOS devices are usually compatible with mobile investment apps offered by the best trading platforms. However, I understand you may prefer to use your desktop or laptop computer to trade.

Nevertheless, there may be times when placing a trade is necessary when you are on the move. For example, Gamestop saw its share price drop by 60% a day before writing this guide.

You would have suffered significant losses if you had been unable to close a position in this stock until you got home.

You could have reduced your losses significantly by exiting the trade immediately if you had used a top-rated mobile trading app.

Other key account features are also available in the best mobile trading apps. In addition, you can also check the value of your portfolio in real-time, make deposits and withdrawals, and even speak to customer support through live chat in the eToro mobile app.

Payment Methods

You will be required to deposit some funds into a trading account when you open one with a platform. These apps allow you to use a credit or debit card to trade instantly. E-wallet support is also available on platforms like eToro and Libertex.

Customer Service

European trading platforms offer a variety of customer support channels that are worth checking out. Of course, live chat is the ideal feature. Additionally, real-time phone support is available so that you can speak with an agent immediately. However, you might have to wait several hours to respond if the trading platform only offers support via email.

How to Get Started with The European Trading Platform – eToro

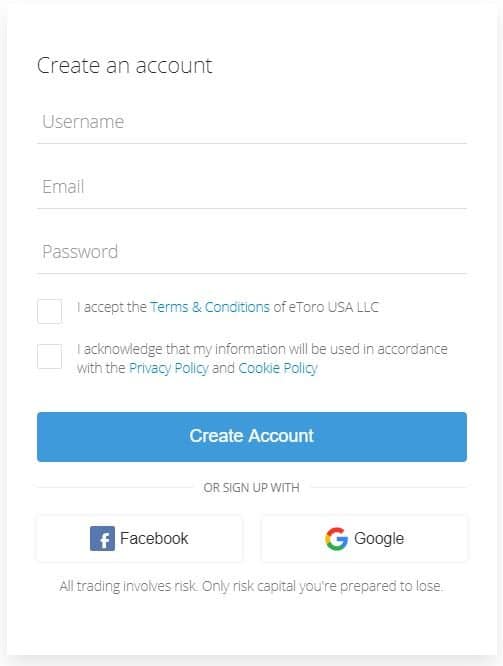

Step 1: Open a Trading Account

You can open an eToro account in only a few minutes, and you can start trading right away. eToro can be accessed via desktop or mobile web browsers. Next, click ‘Join Now’.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

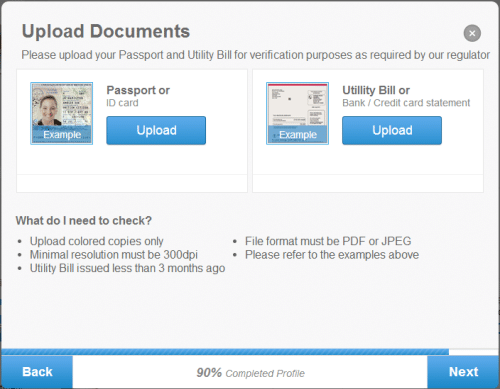

Step 2: Confirm Identity

The FCA regulations require eToro to verify your identity since it is an FCA-regulated platform.

You will need to upload a copy of:

- A valid passport or license is required

- Bills from utilities or bank statements (updated within the last three months)

- If you deposit less than $2,250, you can upload these documents later.

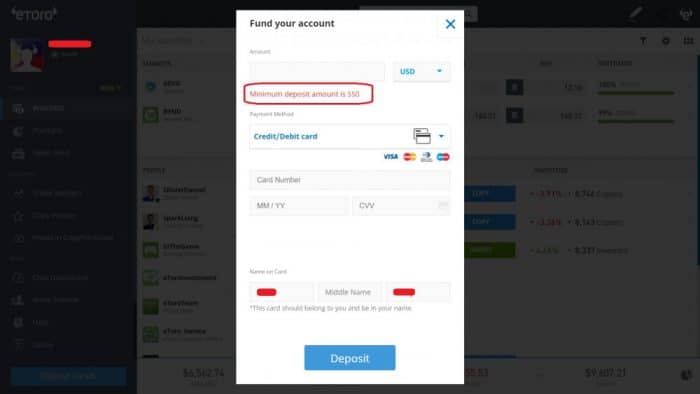

Step 3: Deposit Funds

The time has come to deposit some money. When you feel comfortable with how the trading platform works, you can use the eToro demo account.

Listed below are the payment methods you can choose from when you are ready to trade for real money:

- Visa

- MasterCard

- Maestro

- Paypal

- Skrill

- Neteller

- Bank Transfer

Step 4: Search For a Trading Market

You can begin trading with eToro, the best broker, once your deposit is processed. To see which assets are supported, click on the ‘Trade Markets’ button on the left side of the dashboard. You can also search for the asset you want to trade if you already know it.

Step 5: Place a CFD Trade

An order box will appear when you click on the ‘Trade’ button next to your chosen asset.

After that, you need to fill out the following fields:

- Buy/Sell: Placing a buy order on the asset is a good strategy if you expect its value to rise. In case the asset is likely to fall in value, place a sell order.

- Amount: Indicate the amount you want to stake. US dollars are always used on eToro.

- Leverage: Residents are permitted to use leverage on all of eToro’s supported markets (as per FCA regulations), except cryptocurrencies. You can select how much leverage you need.

You can also position take-profit, stop-loss, and trailing stop-loss orders when trading on eToro.

You must click the ‘Open Markets’ button to complete your trade.

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Conclusion

There have never been so many European trading platforms entering the online marketplace, making investing online easier than ever before. A good broker will often offer you access to many markets, regardless of your interest in stocks, forex, cryptocurrencies, or CFDs.

According to our analysis, eToro is the easiest and best trading platform available to Europeans. Several FCA-regulated markets can be traded with this broker, all of which can be accessed without paying a commission. Furthermore, you can immediately deposit funds with a debit/credit card or e-wallet after opening your account in a matter of minutes!

{etoroCFDrisk} % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

FAQs

What is the best European trading platform?

You should stick with a beginner-friendly provider like eToro if you're new to the European trading platform scene. The platform is easy to use, and you can enter trades for as little as $25. Furthermore, eToro provides a demo account feature that enables you to trade risk-free.Which European trading platform offers US shares?

You can trade US shares on many European trading platforms. However, fees should be kept in mind. Commission-free trading is possible with eToro, on the other hand.Are the European trading platforms safe?

Investing safely is possible if your choice of trading platform is FCA-regulated. Furthermore, FSCS-covered platforms are best to use.What is the best European trading platform to buy Bitcoin?

You can buy digital currencies in traditional ways despite the FCA's ban on crypto-CFDs in January 2022. For example, eToro lets you invest just $25 and offers 15 cryptocurrencies for commission-free trading.How do commission-free European trading platforms make money?

Commission-free trading platforms in Europe - such as eToro, make their money from the spreadHow much leverage do the best European trading platforms offer?

Jhonattan Jimenez Finance and Crypto Writer

View all posts by Jhonattan JimenezBefore starting his career as a freelance writer, Jhonattan studied at the Universidad La Gran Columbia from which he graduated in 2019. Jhonattan describes himself as a crypto enthusiast and regularly writes price prediction articles for new projects. During his time as a writer, Jhonattan has gained great knowledge about the crypto space and has mastered technical analysis skills that he uses when writing token price predictions. As well as writing for Trading Platforms, Jhonattan has written for Stocksapps.com and Buyshares.co.uk.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

By continuing to use this website you agree to our terms and conditions and privacy policy. Registered Company number: 103525© tradingplatforms.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up