Best Crypto Wallet in 2025 – Top Crypto Wallet Apps

Cryptocurrencies are the most talked-about investment class in the market these days, among beginner and experienced traders alike. Even people who do not fully understand the technical intricacies of how cryptocurrencies work are eager to invest in them and capitalise on the quick gains that they usually offer.

However, a key aspect of investing, or even trading cryptocurrencies, is understanding and deciding what is the best crypto wallet to store your crypto assets. In this guide, we reveal the best free crypto wallet you can use and discuss some general features of crypto wallets.

How to Sign Up for a Crypto Wallet – Quick Guide

Signing up for a crypto wallet is a three-step procedure that takes only a few minutes. These are the steps:

- Choose the best wallet for crypto you’d want to use: There are a variety of wallets to choose from, and you should decide what is the best crypto wallet for you, depending on your preferences. However, we believe that Best Wallet is the best wallet for crypto in general. The Best Wallet supports a very wide range of cryptocurrencies and provides access to presales, airdrops and an AI chatbot assistant that will help you to improve your trading decisions.

- Obtain the Wallet: You can sign up to join the Best Wallet waiting list by visiting the official Best Wallet website.

- Create a Wallet account: After the launch, those on the waiting list will be able to sign up and start using Best Wallet to manage their cryptocurrencies and access the web3 space.

eToro Crypto

Visit SiteDon’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong....

Coinbase – crypto

Visit SiteYour money is at risk. The exchange holds an e-money license from the FCA....

Best Crypto Wallets 2025

With the growing popularity and interest in cryptocurrencies, a number of wallet providers and trading platforms have popped up on the market, making it hard to understand what is the best crypto wallet out there. This is both a good thing and a bad thing. It is a good thing because of the fact that increased competition on the market will imply lower rates offered by brokers to attract customers, and will lead to a process of natural selection, placing the companies with the best wallet for crypto at the top of the market. The disadvantage here is that because there is such a high level of variety in the market, customers can get confused as to which one is the best wallet for crypto, leading to poor decision-making. In order to solve this problem, we have reviewed the top 3 best online crypto wallet providers in detail.

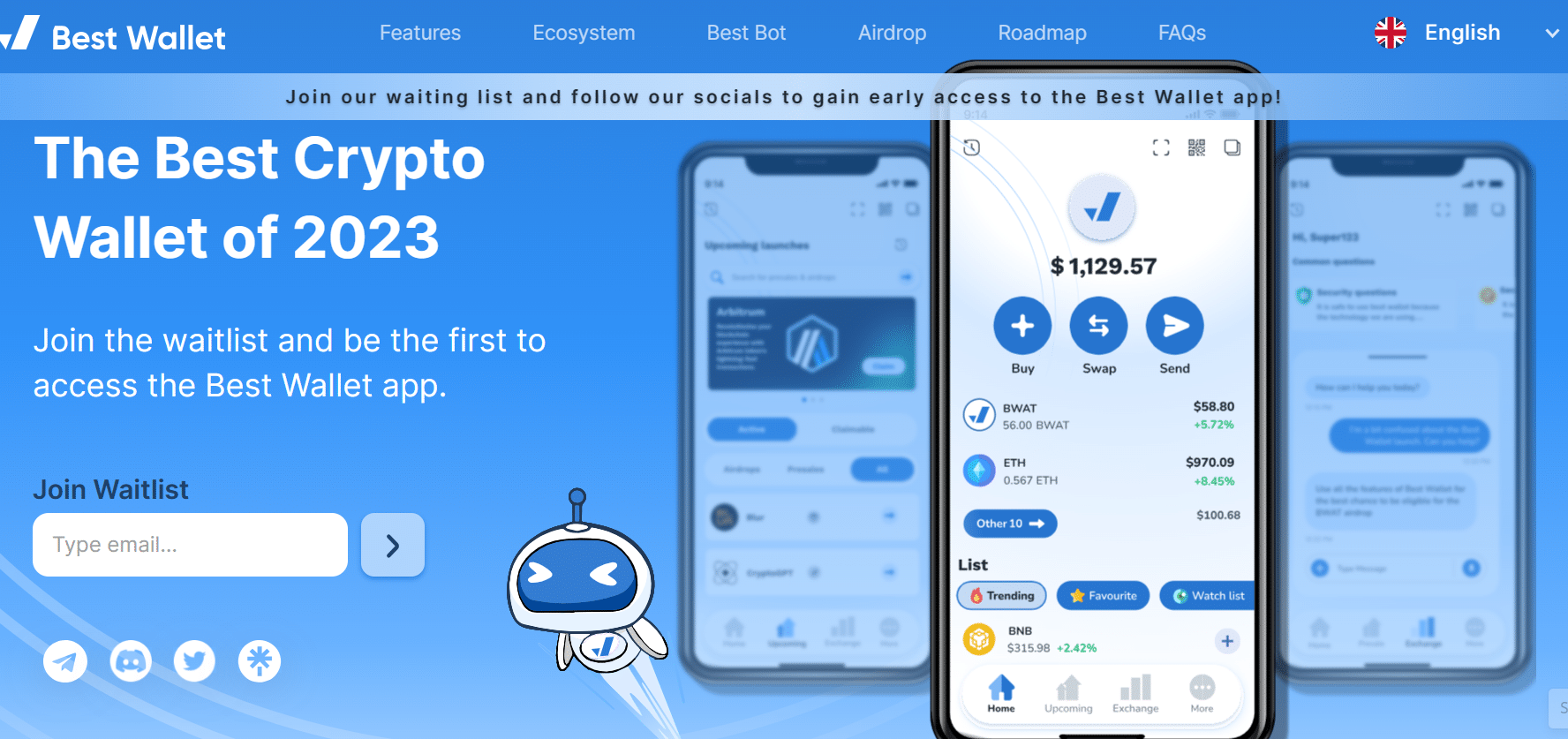

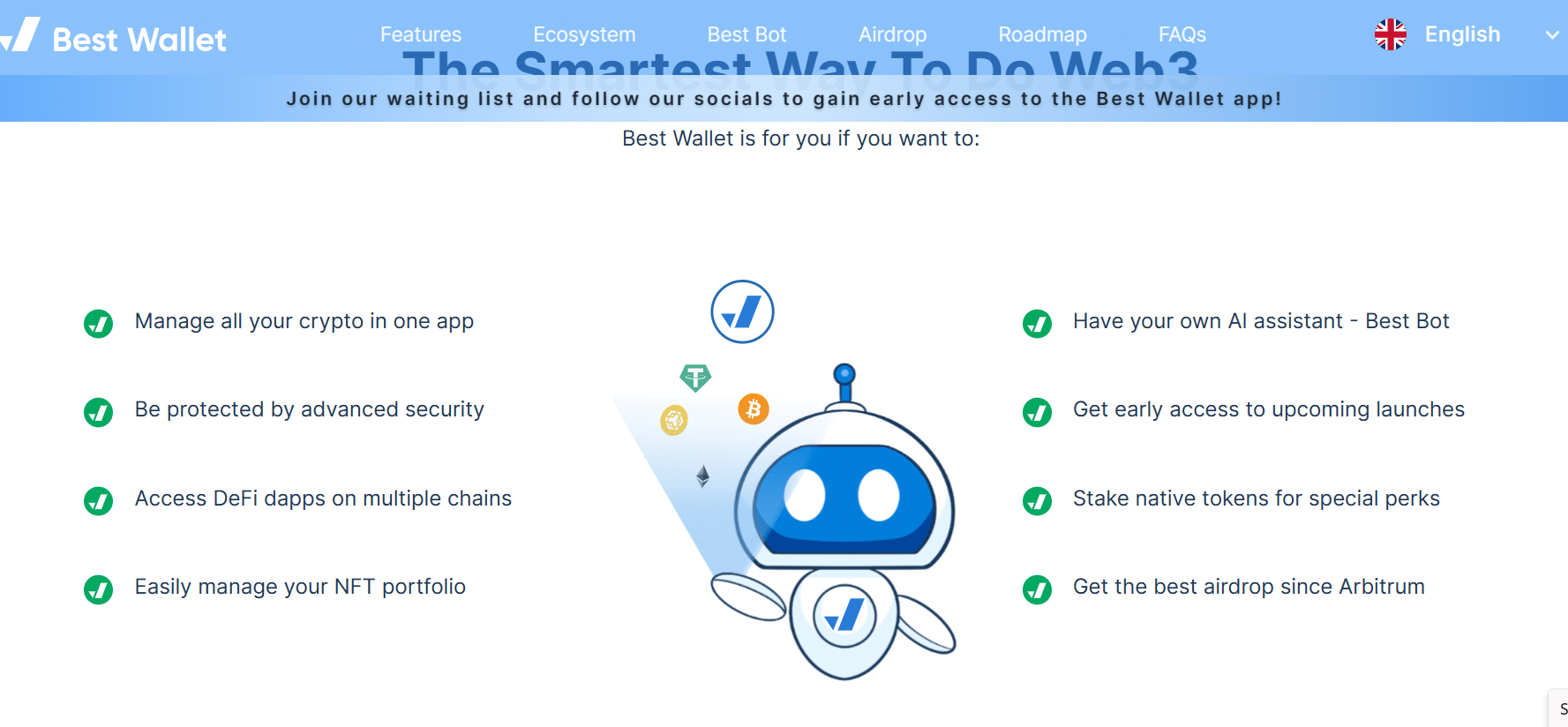

1. Best Wallet- Best AI-powered Web3 Crypto Wallet

Best Wallet is a brand new web3 wallet that recently opened its exclusive waiting list to new users. The innovative crypto wallet is an AI-powered web3 wallet that offers users everything that they need to manage their cryptos and access the web3 space.

One of the most appealing features offered by Best Wallet is the AI bot assistant that can provide users with instant access to accurate market information, can generate in-depth portfolio insights and can help users to effortlessly navigate the wallet. The AI chatbot can be used to make informed crypto trading decisions and is the first bot of it’s kind to be offered by a crypto wallet.

Other key features of Best Wallet include a wide-reaching web3 ecosystem, multi-chain functionality, exclusive presale access, a native marketplace, token airdrops an NFT portfolio and strong security. The wallet isn’t a basic crypto wallet. Best Wallet will allow users to access the web3 world from one easy-to-use place.

As well as offering traditional wallet functionality, Best Wallet has it’s own native crypto token, BWAT, which can be used by wallet users to access presales early, take part in staking and access exclusive platform features that could help to improve crypto trading. Token holders will be rewarded with special perks which will encourage users to invest in BWAT.

BWAT will be available to purchase via presale very soon. Investing early is the best way to increase your chance of returns. The token is likely to see high demand when the wallet is live.

You can join the Best Wallet waiting list by visiting the official website today. Early users will be rewarded with exclusive features and access.

Pros:

Pros:

- Supports cryptocurrencies across multiple blockchain networks

- Exclusive AI bot assistant to improve trading

- Access to presales and airdrops

- Native utility token that can be staked for passive rewards

- Advanced security features

Cons:

Cons:

- The wallet is not available to users yet

- Best Wallet isn’t regulated in the US

Your money is at risk.

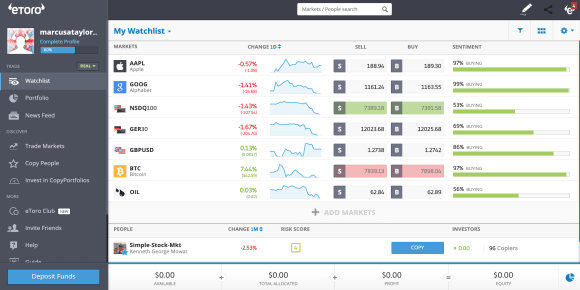

2. eToro – The Overall Best Crypto Wallet

For a variety of reasons, eToro is clearly the finest overall crypto trading platform and the best online crypto wallet for 2025. To begin with, the platform is extensively regulated by both the CySEC and the FCA. This is especially significant in the cryptocurrency markets because it ensures that any cryptocurrencies you trade with eToro are done safely and without risking your money. You may buy roughly 17 different cryptocurrencies on the platform, including BTC, ETH, BNB, ADA, XRP, and others.

eToro Wallet Features

You have two alternatives when it comes to storing the crypto you purchase. If you purchase cryptocurrencies directly through the eToro site, you may simply entrust eToro to manage them for you via your wallet. If you don’t want to buy cryptocurrencies through eToro, you can simply store your cryptocurrency in their eToro wallet. Its own digital wallet supports more than 120 different cryptocurrencies. This is the best mobile crypto wallet available as a mobile app that works on both iOS and Android devices. This is quite convenient because you don’t have to be seated at your desktop device to send and receive money. Exchanging coins with the eToro Crypto wallet is easy. In fact, it supports over 500 crypto-pairs, so you won’t have to rely on any third-party exchanges. eToro is also one of the best places to buy cryptocurrencies for crypto loans.

You can swap fiat currency for your crypto and trade crypto-fiat pairs. You can also trade crypto pairings, where you exchange one cryptocurrency for another. eToro is the best free crypto wallet, with the only fees being spreads. This implies that you can enter and exit a transaction whenever you want, without incurring any additional fees.

eToro also provides a number of passive trading tools for trading cryptocurrencies. This contains a number of traders who you can imitate or mirror using the platform’s copy trading tools. They also feature a curated CryptoPortfolio, which is a basket of bitcoin and many other notable cryptocurrencies with variable weights. Because the eToro investing team manages this portfolio, you won’t have to worry about rebalancing it on a regular basis. You may open an eToro trading account in minutes, and you can fund it with debit/credit cards, bank transfers, or e-wallets like Paypal.

eToro fees

| Fee | Amount |

| Stock trading fee | Free |

| Forex trading fee | Spread, 2.1 pips for GBP/USD |

| Crypto trading fee | Spread, 0.75% for Bitcoin |

| Inactivity fee | $10 a month after one year |

| Withdrawal fee | $5 |

Pros:

- Bitcoin wallet linked to the eToro trading platform

- Ability to buy and sell Bitcoins directly from the wallet

- The best mobile crypto wallet app available, being at the desktop is not required for transferring bitcoins

- Provides access to a variety of other assets besides bitcoins

- Supports over 500 crypto pairs to assist with easy exchange

- Regulated platform, ensuring the safety of any Bitcoins you deposit on it.

- Does not charge commissions which makes it a best free crypto wallet

Cons:

- Not suitable for advanced charting or technical analysis

- eToro trading supports trading of fewer cryptocurrencies than other platforms

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

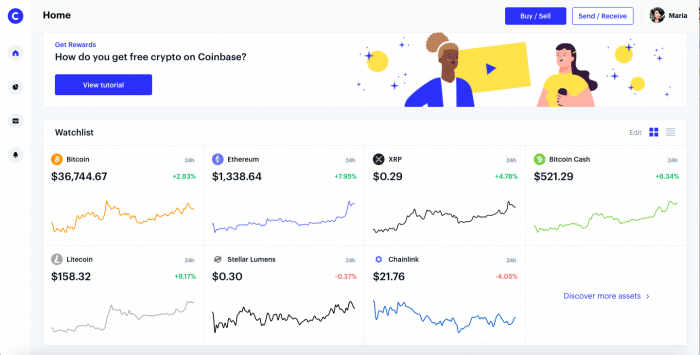

3. Coinbase – The Best Crypto Wallet for iOS and iPhone

Coinbase, a cryptocurrency trading, and investment website and the best crypto wallet for iOS and iPhone, offers over 100 tradable cryptocurrencies, including Bitcoin, Ethereum, and Cardano. It has more than 73 million users and manages more than $255 billion in assets.

Coinbase is well known for its digital wallet which is the best crypto wallet for iPhone and iOS devices. You can set one up on the Coinbase website or with a native mobile app. If you choose the former, all you have to do is send your cryptocurrency to the Coinbase-provided unique wallet address. If you like being able to access your bitcoins while on the go, the Coinbase wallet app is more likely to suit your needs. The wallet is available for free download for Android and iOS devices, but it is considered the best crypto wallet for iPhone. A slew of security safeguards, including two-factor authentication, are built into the wallet.

Before you can access your crypto wallet, you must first enter a code provided to your cell phone. Beginners on the original Coinbase platform are likely to prefer simple buy and sell orders. Coinbase Pro, on the other hand, is available to all Coinbase users and includes more complex tools and order types.

Digital currencies, in general, are a new asset class that is hazardous and unpredictable, making them inappropriate for all investors. Nonetheless, if you’re interested in cryptocurrencies and want to trade them, Coinbase is one of the best wallet for crypto for both beginners, seasoned traders as well as investors interesed in crypto savings accounts for passive income.

Coinbase fees

| Fee | Amount |

| Crypto trading fee | Commission, starting from 0.50% |

| Inactivity fee | Free |

| Withdrawal fee | 1.49% to a U.S. bank account |

Pros:

Pros:

- Wide variety of cryptocurrencies supported

- Highest selection of cryptocurrencies besides Bitcoins

- The best crypto wallet for iPhone with the option to use the wallet without using the trading platform

- Very low fees

Cons:

Cons:

- Unresponsive customer service

- Charges commissions on trades that you make

Your money is at risk.

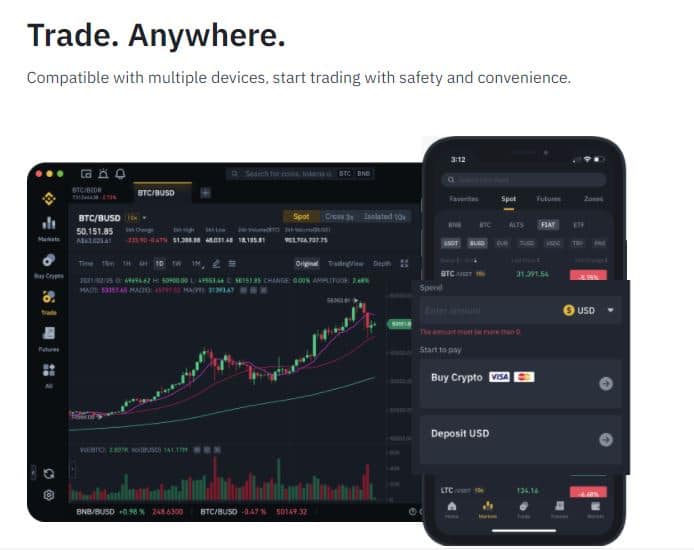

4. Binance – The Best Crypto Wallet for Android

Binance is among the most popular platforms with one of the best online crypto wallets in the world for android, with the largest selection of cryptocurrencies. If you want to invest in crypto or DeFi, whether it’s a small-cap or a large-cap, there’s a good chance Binance will have it. It allows you to trade cryptocurrencies for BNB, ETH, and a variety of other cryptocurrencies in addition to fiat currencies. Every day, the platform handles billions of dollars in trade volume. You can usually deposit funds into Binance using a credit/debit card or a bank transfer, making it a simple process. For long-term holder, Binance is also one of the best crypto savings accounts.

Binance is widely acknowledged as one of the most secure crypto wallets anywhere in the world. It has a number of safety features, such as two-factor authentication in addition to receiving email notifications anytime your wallet is accessed. To begin, if you are a Binance trader, any cryptocurrencies you purchase will be saved straight in your Binance wallet. This wallet is compatible with any cryptocurrency trading on the Binance platform, which includes all major cryptocurrencies. You will not be able to control your private keys if you use the wallet as a supplement to the trading platform in this situation.

You may also download the Binance Trust Wallet as a mobile app on both Android and iOS smartphones instead of using the trading platform. As a result, your wallet will become a separate entity from your Binance trading account. Binance will have no access to the funds in your crypto wallet. This is a more decentralized method of crypto storage, and unlike Coinbase, which is the best crypto wallet for iPhone, Binance is the best mobile crypto wallet for Android.

Binance fees

| Fee | Amount |

| Crypto trading fee | Commission, starting from 0.1% |

| Inactivity fee | Free |

| Withdrawal fee | 0.80 EUR (SEPA bank transfer) |

Pros:

Pros:

- One of the best mobile crypto wallets with highest selection of cryptocurrencies besides Bitcoins

- Option to use the wallet without using the trading platform

- Very low fees

- One of the securest and best online crypto wallets

- Supports a wide variety of cryptocurrencies and crypto pairs

Cons:

Cons:

- Unresponsive customer service

- Charges commissions on trades that you make

Your money is at risk.

What is a Crypto Wallet?

If you wish to start investing in cryptocurrencies, then you have two main considerations: where you’ll buy them from and what is the best crypto wallet for storing your funds. Optimally, your answer to both these questions will be the same, and you’ll end up choosing the best online crypto wallet that is the same as the platform that you use to buy cryptocurrencies in the first place.

As discussed above, there are several trading platforms that automatically store your crypto for you when you buy it through them, such as Best Wallet, eToro, Binance, and Coinbase, and they have the best online crypto wallets. However, sometimes, people wish to use separate wallets from their trading platforms, and this happens for a variety of reasons. The first and foremost reason is that they have safety preferences that their trading platform’s wallet does not meet, so they search for the best crypto hardware wallet for storing their funds. At the same time, there are other types of wallets such as paper and hardware wallets that are not compatible with your broker accounts, and therefore require a separate wallet.

How does a Crypto Wallet work?

No matter what kind of wallet you use and where it is located, there are two things that you will need to know about your wallet. The first is the public address of the wallet. For example, suppose you are setting up your new Best Wallet crypto wallet for the first time. In this case, you will have to transfer all your existing crypto holdings from your old wallet to Best Wallet.

This transfer is done through the public address, which you can enter on your trading platform as the location where all your crypto should be stored. This is also useful if you wish to receive or send cryptos to someone else, as the public address is what is used for this purpose. The second thing that you will need to know is the private key of the wallet. This is a kind of password that ensures the security and safety of your crypto wallet. It contains numbers, alphabets, as well as special symbols, and this is done to ensure that the odds of someone being able to crack your password are minuscule. Every time you wish to access your wallet or transfer your crypto holdings to someone else, you will need to enter your private key, as this will allow you to authorize the transaction.

However, the private key is quite long and complex, so in case you are using a mobile wallet, you can just simply enable fingerprint or biometric logins to bypass the process of having to enter your private key every time you make a transaction, which makes eToro an appealing wallet app.

Crypto Paper Wallet vs Crypto Hardware Wallet

As previously said, there are various sorts of crypto wallets available for storing your cryptocurrencies, and you might be in search of the best crypto hardware wallet apart from the best online crypto wallet. Each of them has its own set of benefits and drawbacks, so people choose the best wallet for crypto-based on their personal preferences. Paper wallets and hardware wallets, for example, are two of the most popular types of crypto wallets. Both of these groups have been thoroughly covered further down as we tried to discover what makes the best crypto hardware wallet and what paper wallets are all about.

Crypto Paper Wallets

Because your crypto wallet address is printed on a piece of paper in the form of a QR code, a crypto paper wallet is an old fashioned version of the best offline crypto wallet. To accomplish this, you will need to use an online portal that can generate a free crypto wallet address. Then all that’s left is to send the cryptocurrency to the appropriate address and print the credentials. It’s theoretically impossible for someone to hijack your computer. This is because the crypto funds that you own are stored securely off the internet, thus making digital unauthorised access impossible. The biggest disadvantage here is that transferring your cryptocurrencies to another wallet (for example, if you wanted to cash out your coins) can be a time-consuming operation, even with the best wallet for crypto.

Crypto Hardware Wallets

A hardware wallet, on the other hand, stores your coins on a physical device, so you might want to get the best crypto hardware wallet to store your funds. The best crypto hardware wallets provide the highest level of security for your funds. To begin using a hardware wallet, simply purchase one from your preferred provider with the best crypto hardware wallet, set up a PIN number using the device that comes with your wallet, and transfer your coins to your unique hardware wallet address. What makes the best crypto hardware wallet is the safe keeping of your cryptocurrency. For example, you can only send money if you have physical access to the device, which requires your PIN to authorize. Losing the PIN will trigger the contingency plan, which is basically using a passphrase to reset the PIN, thereby allowing you to access your funds.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

How to Choose the Right Crypto Wallet for You

Choosing the best online crypto wallet is no mean feat because while you might decide to change crypto trading platforms, changing the wallet that you use to trade crypto is a lot more cumbersome and expensive process. Therefore, there are several considerations that go into choosing the best wallet for crypto. The best online crypto wallets, the best mobile crypto wallets with best crypto wallet apps, and the best crypto wallets for iPhone, as well as the best crypto hardware wallets, have been discussed below in detail.

Wallet Type

When it comes to selecting the best wallet for crypto, it’s critical to be aware of the various options accessible. Consider the following points:

-

Web-Wallet:

This implies you’ll retain your cryptocurrency funds with the exchange or broker you used to make the purchase. Among all the other options available to you, this is probably the least secure option, even with the best online crypto wallet. The FCA has authorized and regulated eToro, which is the only exception to this rule and makes eToro the best regulated wallet for crypto out there.

-

Desktop-Wallet:

There are many crypto wallets with the best crypto wallet apps available on the market that you may download to your computer. You will require access to your desktop software wallet every time you want to send money. Although this is more secure than the best mobile crypto wallet this makes it inconvenient compared to the other options.

-

Mobile-Wallet:

This form of wallet strikes the ideal balance of convenience and security and there are some of the best mobile crypto wallets available. In terms of the former, merely opening the wallet app allows you to transfer, receive, and trade cryptocurrencies. The best mobile crypto wallets provide two-factor verification, biometric login, and email confirmation for withdrawals in terms of security, and you will find that some of them are the best crypto wallet for iPhone.

-

Hardware wallets

provide the highest level of security for your funds. Not only are the funds stored offline, but you must physically enter your PIN into the gadget to transfer funds which makes it the best crypto cold wallet popular among those who want to be in control of their funds personally. Even the best crypto hardware wallet, on the other hand, is the least handy for transfers. Some providers will offer a combination of these, such as the exodus wallet, which is available on mobile, desktop, and hardware.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Custodian or Non-Custodian

Custodian and non-custodian wallets are the two types of crypto wallets accessible, also known as hot and cold custodian wallets. They only differ in that custodian wallets are responsible for keeping your cryptocurrencies safe in the wallets, whilst non-custodial wallets are entirely responsible for keeping the crypto you store safely in the wallet, so with the best crypto cold wallet, you are the one in control. To put it another way, when you use a custodian wallet, you don’t have to worry about storage because the role of the entity behind the wallet is reversed, but if you choose the best crypto cold wallet, the safety is up to you. If you go with a custodian, make sure it’s an FCA-regulated broker like eToro which is the best free crypto wallet.

Features

When it comes to services, most crypto wallets, including the best crypto cold wallets, provide the basic minimum, allowing you to store your cryptocurrency safely and transfer it whenever you want. The best crypto wallet apps, such as the Best Wallet Crypto Wallet, on the other hand, allow you to purchase and sell cryptocurrencies without having to pay any commissions, and it holds the title of best free crypto wallet. The wallet also supports NFTs and provides access to its own native DeFi marketplace through which users can gain early access to token presales. Another advantage is that most of these platforms support cross-currency transactions, which means you can easily switch from one cryptocurrency to another.

Supported Coins

Because some online wallets only allow Bitcoin, this is a crucial factor when answering the question of what is the best crypto wallet app. As a result, if you wanted to buy Ethereum or Cardano later, you’d need to get a second wallet. This is why the best mobile crypto wallets in the US support a wide range of various cryptocurrencies. Best Wallet supports cryptos across multiple blockchain networks which makes it the best crypto wallet to use for diversification. This allows you to create a broad digital asset portfolio while keeping all of your coins in a single wallet.

How to Get a Crypto Wallet – Best Wallet

Step 1: Sign up to waiting list

Your money is at risk.

Best Wallet is by far the best cryptocurrency wallet to use in 2025. However, the launch hasn’t occured publicly just yet. This is because the team is still developing the wallet’s various features and functionalities. According to the roadmap, the wallet will be live by the end of this year.

To gain access to the wallet, you will need to sign up to the waiting list which is available on the Best Wallet website. This process is simple. Type your email address into the ‘join waitlist’ field and make sure to check your spam folder for any updates.

Subscribers will be notified a soon as the wallet is ready to use.

Step 2: Set up Best Wallet account

When the wallet is available to use, you will be able to create your own Best Wallet account through the app. Best Wallet is decentralized which means that there is no KYC process and you can sign up with just an email address and password. This makes the account set-up process very easy.

Step 3: Add Cryptos to your Best Wallet

If you already own crypto, you can transfer these into your Best Wallet account by using your address.

Before sending any crypto, double check the wallet address and make sure that you are using a reliable internet connection.

If you don’t already own crypto, you can buy crypto tokens directly through Best Wallet with BWAT.

Step 4: Explore Best Wallet Features

Best Wallet has several innovative features with the intention of improving your crypto trading. We recommended taking some time to explore the different features available on the platform, including the AI chatbot which can provide valuable market insights and advice.

Your money is at risk.

Conclusion

There are various solutions available if you want to trade cryptocurrencies and require a secure wallet. Few, however, compare to Best Wallet, which many consider to be the finest overall crypto wallet. Not only is it secure, but it also allows you to trade cryptocurrencies across multiple blockchain networks, access token presales and receive free tokens through airdrops. This, together with the user-friendly design, the AI assistant, and the NFT trading it offers, makes it the answer to the question of which crypto wallet is the best mobile wallet crypto world can offer.

Best Wallet – Overall Best Crypto Wallet

Your money is at risk.