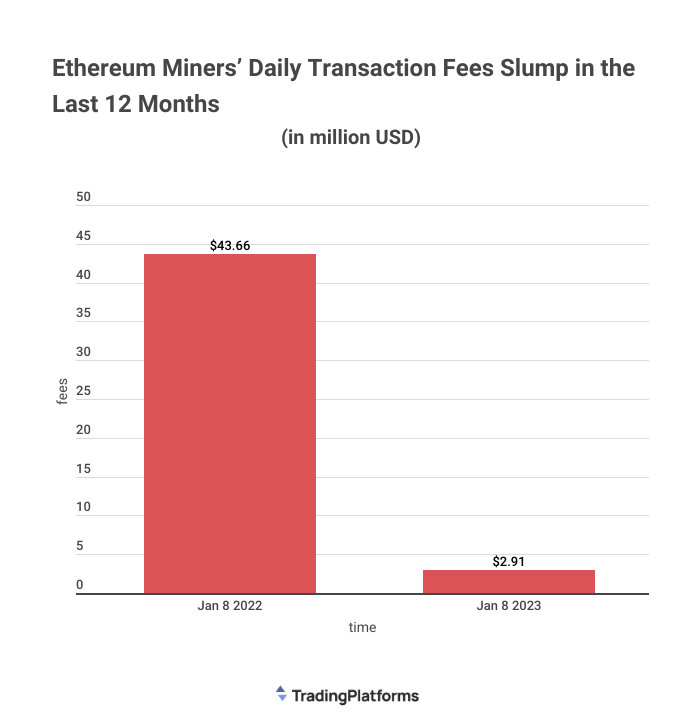

Ethereum (ETH) miners have had a roller coaster ride over the past year. According to a TradingPlatforms.com report, ETH miner’s daily transaction fees experienced an astounding tumble – dropping from $43.66M on January 8th, 2022, to just $2.91M one year later.

This drop represents a 93% reduction in transaction fees over 12 months. TradingPlatforms’ investment expert Edith Reads attributes that to the crypto market slump of 2022. She explained:

“2022’s crypto winter wiped billions of dollars from the cryptocurrency sector. The FUD it created led to reduced transactions not only in ETH but in other cryptos as well. ETH miners depend on transactions for their earnings, so it was inevitable that those would take a big hit on the back of dwindling ETH transactions.”

Ethereum 2.0’s Impact

But this isn’t the only factor contributing to the decline in daily transaction fees, according to Edith. She holds that changes to Ethereum’s underlying protocols and governance structures have affected miners’ rewards. These changes emanated from the platform’s shift to Ethereum 2.0.

Ethereum 2.0 marks a transition from Proof-of-Work algorithms toward Proof-of-Stake systems. One of its key effects is changing how ETH compensates users for processing transactions on the network. The shift will see a progressive decline in miners’ block rewards.

Instead of miners, PoS has transaction validators who earn staking rewards for confirming transactions on the ETH blockchain. This way, it incentivizes investments in the platform rather than having miners compete in solving complex mathematical functions.

That shift was occasioned by the challenges that Ethereum has grappled with since its inception. These are mainly its carbon footprint, scalability potential, and high transaction fees. Besides discarding the need for significant ASIC investments, the PoS consensus would see ETH cut its carbon footprint by 99%, boosting its sustainability credentials.

Building on the Merge

Ethereum will be looking to build on the Merge with its Shanghai upgrade this year. The crypto space is widely anticipating this revamp due to its game-changing potential. Shanghai is expected to revamp Ethereum’s infrastructure completely, tackling scalability, privacy, and efficiency issues.

Following the upgrade, transactions are expected to become cheaper and faster, reducing network congestion and improving overall user experience. And it won’t just benefit individuals; organizations that use Ethereum for their projects or applications can look forward to cost savings and faster data processing times.

Moreover, Shanghai provides validators with options for withdrawing their stakings, adding a new layer of options for users who want to participate in its success. Additionally, it will allow developers to build dapps faster, cheaper, and more securely than ever before.

With Shanghai, Ethereum is proposing solutions to many of the problems that have plagued the industry since its inception – setting the stage for further growth and success.

Question & Answers (0)