The US has the most gold reserves worldwide. According to a tradingplatforms.com data analysis, the country holds 8,133.54 metric tonnes of this precious metal. That stockpile is almost as much as the combined reserves of the next three leading gold-holding nations. The latest data shows that the US’s stash is worth $11.041 billion.

What’s interesting about this revelation is that the US isn’t the world’s largest gold producer. So how did it get here? Edith Reads is tradingplatforms.com’s financial expert and has been studying the trends in global gold ownership. She explains:

“The Bretton Woods Agreement designated gold as the standard against which the dollar would peg its value. The other nations would then peg the value of their currencies against the dollar. America offered to supply the rest of the countries with its dollars in exchange for it storing their gold. At the height of the Bretton Woods System, America held up to 95% of the world’s gold reserves. Half a century later, it still holds most of those reserves.”

Why do Nations Hold Gold Reserves?

Gold has been an essential medium of exchange for centuries on end. Many nations maintained that when they started issuing their fiat currencies. They denominated their banknotes and coins in terms of gold which served as a legal claim to actual gold.

Gold took international prominence with the Establishment of the Bretton Woods System. This system envisaged gold as a tool for promoting an efficient forex system hence global economic development. Thus countries felt it made political and economic sense to have their reserves of the commodity.

The Perfect Hedge Against Economic Downturns?

Today, the gold standard is no longer a consideration for nations issuing their currencies. That said, many governments still maintain a measure of gold deposits. In fact, many keep on increasing the quantities of their holdings.

The main reason behind that is that they view gold as a hedge against hyperinflation and other economic downturns. The commodity has proven to be resilient to political and economic shocks. Again, it is a vital asset for pulling countries out of cash crunches.

Who are the Leading Gold-holding Nations Globally?

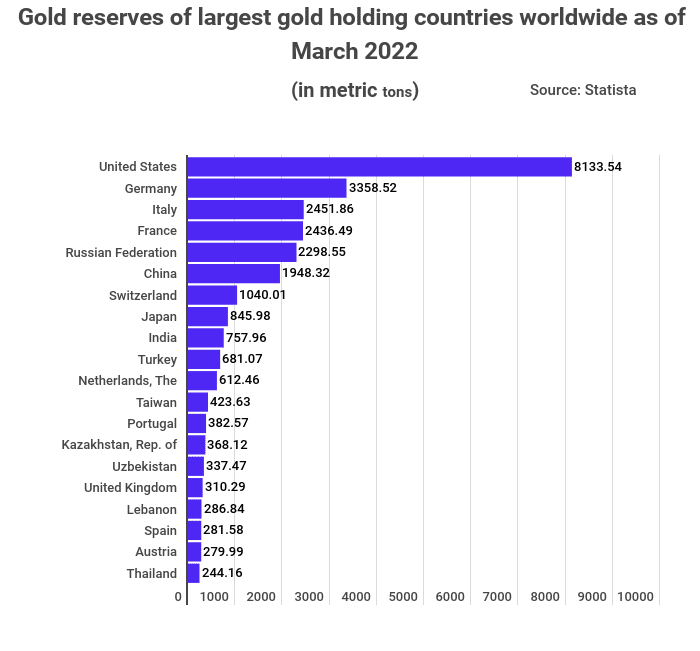

Germany holds the second largest gold reserve after the US. Its roughly 3,359 metric tonnes of the precious metal are just about half of America’s holding. Italy comes in at a distant third with deposits of some 2,451 tonnes. France and Russia complete the top five with reserves of 2,436 and 2,298 tonnes, respectively.

Despite being the world’s largest gold producer, China ranks sixth on the chart. Its 1,948.32 tonnes of gold are less than a quarter of America’s holdings. Switzerland, Japan, India, and Turkey complete the top 10. Despite having the largest gold mine reserves worldwide, Australia doesn’t feature in the top 20.

Question & Answers (0)