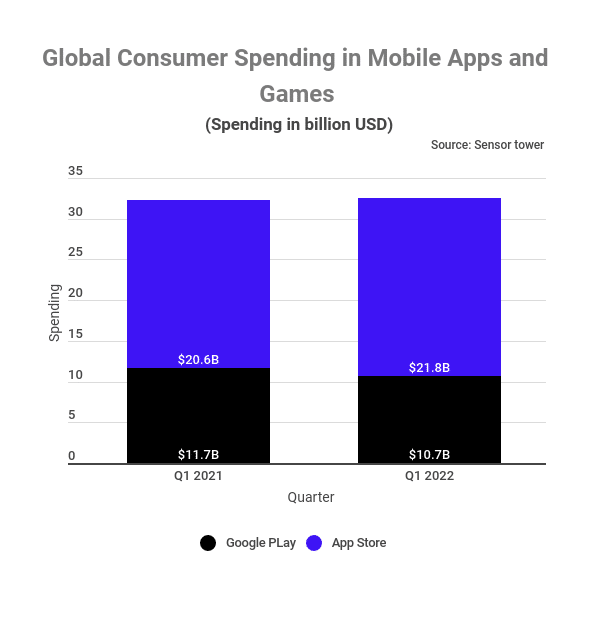

Q1 2022 witnessed the tanking of global consumer spending on in-app purchases. That’s per a TradingPlatforms.com analysis. The website has been following trends in that space and concludes that In-app purchases across all niches raised $32.5B in that period. This figure represents a 0.6% gain from the $32.3B that the sector raised in Q1 2021.

Apple’s dominance

Apple’s marketplace had the lion’s share of the revenues, more than doubling Google Play’s. The App Store grew its revenues to 21.8B, a 5.8% uptick based on year-on-year (YOY) terms. The store had recorded gains of up to $20.6B in Q1 2021. Meanwhile, Google Play recorded over $10.7 billion in consumer spending, which is a decline of about 8.5% from the $11.7B it raised in 2021.

TradingPlatforms.com’s Edith Reads links the tanking of revenue in Q1 2022 to due to market corrections. She says, “The onset of the pandemic saw an uptick in in-app spending leading to the hyper-growth in revenues that the sector recorded. Fast forward to now, normalcy is returning after many nations eased their containment measures. Therefore people are redirecting their funds to other priority areas.”

Which were the best performing apps?

TikTok was the top-grossing non-game application overall. It also topped the charts on the App Store and amassed $821 million in combined sales on both stores. However, it played second fiddle to Google One on Google Play. Here the latter emerged top with revenues of roughly $250 million.

Chinese publishers contributed three of the highest-earning games overall and on the App Store. Tencent’s Honor of Kings took the top spot after generating $735.4m. PUBG Mobile was second with an income of $643M, while Geshin Impact was third after earning $551M.

NCsoft’s Lineage W was the top-earning game on Google play. Second and third places went to Coin Master and Candy Crush Saga. That said, mobile games reported a 7.1% fall in consumer spending YOY to stand at $21B. Both stores’ Q1 2022 revenues dropped, with Apple shedding 2.3% or $12.9B of its Q1 2021 figures. Similarly, Google play lost 13.8% or $8.1B.

Marketers spent most on Gaming

America’s top five advertisers spent roughly $786.7M between the first Jan and the twenty-eighth of March 2022. That was an increase of 13.6 % YoY from the $692.3 they incurred in Q1 2021. The category that drew most of the digital advertisers was Gaming which attracted up to 41% of the digital marketing campaigns.

Question & Answers (0)