Fintech investments have risen steadily since the last global financial crisis. The sector’s growth was a technical solution to the traditional financial services industry. The world financial crisis exposed these weaknesses and so the need for a robust system.

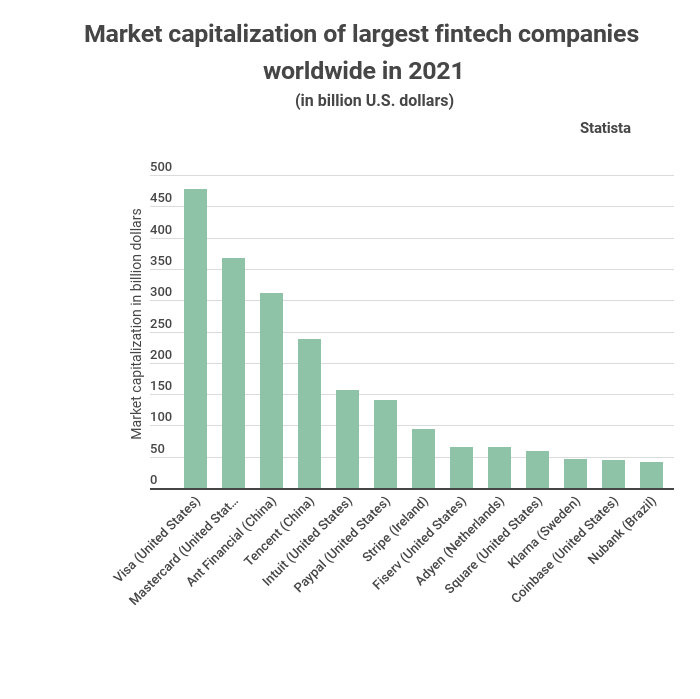

Data presented by Tradingplatform.com indicates that the global value of the top 100 Fintech is $2.8T and is steadily approaching the $3T mark.

Commenting on the data, Tradingplatform.com’s Edith Reads said. “The Fintech industry has grown from strength to strength. The sector is becoming popular daily. Despite the world’s economic breakdowns, the sector is surging. With little fine-tuning on regulations, Fintech will be exceptional.”

She further added, “The digital payments sector is the key segment of the Fintech industry. It accounts for more than 80% of global Fintech sales. People who adopted the practice of soft cash during COVID-19 are still relying on Fintech. Besides, many people are leveraging blockchain for financial transactions.”

Visa and Mastercard lead the pack

The leading fintech companies by market caps have headquarters in the United States. Visa and Mastercard’s payment firms are the most valuable, with a market cap of almost $478 billion and $368 billion, respectively. Chinese Ant Financial, or Ant Group, comes in third with a market valuation of 312 billion dollars.

Visa Inc. is a payment tech firm that links users, enterprises, banks, and authorities through the world’s most innovative, reliable, and secure payment network. VisaNet, Visa Inc.’s robust global processing network, delivers safe and reliable payments globally. It can handle over 65,000 transaction entries per second.

The firm’s devotion to innovation is a motivating factor behind the vision of a “cashless future for everyone, everywhere.” Visa uses the brand, goods, people, network, and scale to transform the future of commerce.

Technology is a significant booster in the Fintech sector

While Visa has shown a deviation in the first quarter of the year, many fintech platforms have had positive growth in their share value. The development is anchored on the adoption of Fintech by nearly all countries worldwide. Besides, there are reasonable regulations that govern how Fintechs operate.

The development of web 3.0 is significant for this sector. Blockchain technology helps the industry to have secure transactions. Smart contracts ensure there is enough trust among users.

Fintechs have altered consumer demands, raising the bar for user experience to new heights. Rapid loan adjudication is one example of an invention. Fintechs have demonstrated that the financial industry can meet the high standards set by huge technology companies like Apple and Google.

The Asia-Pacific and the Americas account for the most significant proportion of the worldwide Fintech market, with APAC expected to grow fastest.

Question & Answers (0)