Americans should brace themselves for a difficult year ahead. That’s per a TradingPlatforms.com projection showing that the U.S economy will recede in 2023. The website bases its prediction on a survey of the nation’s economic outlook. That survey featured 525 respondents drawn from the financial and investments sectors.

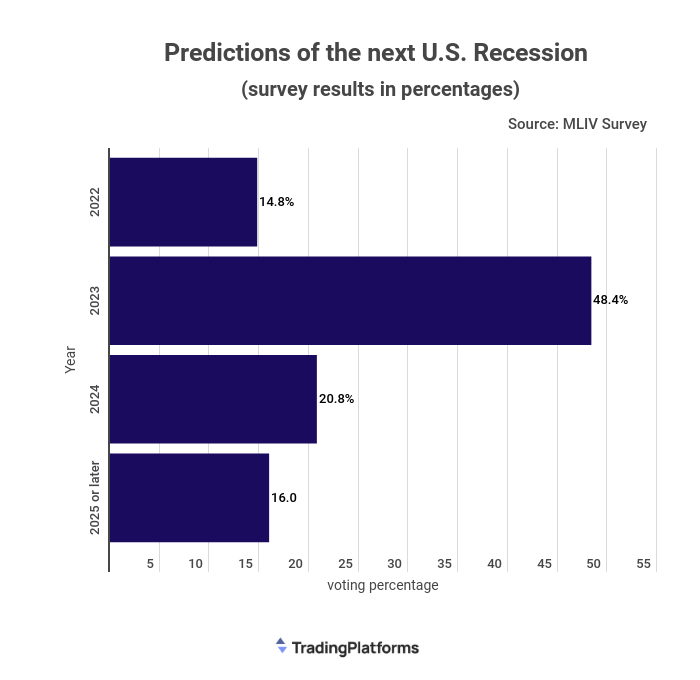

The survey sought to find out their predictions for the next U.S. recession. A majority of those polled (48.4%) picked next year. Another 21 percent reckoned that the economy would recede in 2024. Finally, 15% of them suggested that the economy will contract this year, while the remaining 16% suggested that the earliest that that would happen is in 2025.

Industry experts’ take

TradingPlatforms’ finance expert Edith Reads has weighed in on the matter. She holds, “We’re in the middle of the highest inflation since 1982. Again, The FED has suggested that it could raise its rates by up to 25 basis points to contain the situation. The Russian incursion into Ukraine has seen gas prices balloon and disrupted supply chains. All these factors suggest that we’re starting a recession soon.

She isn’t alone in her assessment of the situation either. Deutsche Bank, for instance, has warned of an economic downturn within the next couple of years. The bank cited the Russian-Ukraine conflict and the rising inflation rates in the U.S as key reasons for its conclusions.

Other analysts like Lawrence Summers, a former treasury secretary, have provided historical clues to the impending downturn. In a Washington Post Op-Ed, he affirms the current situation mirrors others in the last 75 years that have ended in recessions.

Although he holds there are firsts for everything, he says, two indicators embolden his stance. First, inflation is above 6%, and second, unemployment rates have fallen to below 4%. Summers says that the economy suffered when that has happened in the past.

Gary Pzegeo, Fixed Income lead at CIBC, insists that market signals point us in that direction. One such signal is the yield curve’s recent inversion. He argued that the Russia-Ukraine conflict precipitated the curve’s inversion. This bar, a single false signal, has correctly predicted recessions since 1955.

Study’s other key points

The study also inquired which yield curve inversion the investors would use to forecast the recession. Over 50% of them said they’d opt for the 2Y curve over the 10Y one. 27% said they’d back the latter measure, while 12% would look to the 3-18 month notes that the FED’s Jerome Powell backs.

Additionally, 79% of the l investors believe the fattening of the girl curve will persist. Further, there’s a general pessimism about the performance of bank shares. A significant proportion of the polled see them performing worse than the general market. 40% of professional investors compared to 35% of retail investors see the stocks underperforming.

The U.S. has avoided stagnation over the last decade. That’s partly because of the monetary stimulus it adopted after the financial collapse of 2008. Moreover, it has seen robust consumer spending and wage growth in that period. But now that interest rates are rising, wages are stagnating while consumer sentiment is falling.

Question & Answers (0)