The darknet is both a boon and a bane depending on its usage. On the one hand, it protects dissidents from reprisals and enables whistleblowers to go about their business unfettered. On the other hand, it’s an enabler of illegal activity, including trading illicit goods and services. It’s this latter feature that attracts illicit Bitcoin (BTC) holders.

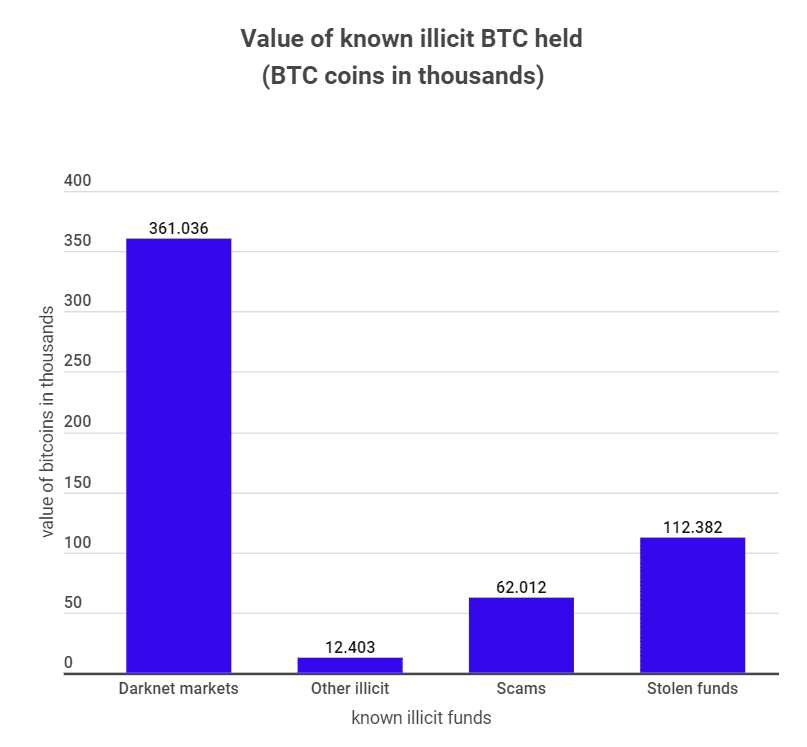

According to a recent study, the darknet holds the largest share of known illicit BTC. The tradingplatforms.com‘s data presentation shows that the darknet has over 360K BTC or 66% of known illicit BTC. That represents a 57% uptick in the darknet’s figures over the last 180 days.

“There’s a notion that crypto transactions are anonymous,” says tradingplatforms.com’s Edith Reads. “But nothing could be further from the truth. Cryptos are pseudonymous, meaning anyone can trace you through your wallet address(es). Bad actors know that and are looking for more sophisticated ways of covering their tracks. That explains their preference for the darknet markets.”

Distribution of known illicit BTC holdings

Though predominant, the darknet markets aren’t the only places holding known illicit BTC. Stolen funds account for the second-largest share of these funds’ holdings. At the time of writing, these had about 112K known illicit BTC.

Following closely were BTC scams. These held nearly 62K of known illegal Bitcoins. Finally, other illicit activities take up another 12K or so of these coins.

Besides holding the illicit Bitcoins, the bad actors also place them. Placing is the first stage of the money laundering process. It entails channelling the illegal funds to legitimate platforms to “clean” them.

“Cleaning” illegal Bitcoin

To that end, trading platforms.com’s analysis reveals that the crooks prefer BTC exchanges. These platforms had helped place over $5M worth of BTC at press time.

Other players favor the market mixers, also known as market tumblers. These tools had helped place nearly $960K in the last seven days at the time of writing. Finally, other illicit services had helped place coins worth around $1.3M.

Is Bitcoin a crime enabler?

Bitcoin and other cryptos have come under scrutiny for abetting money laundering and other financial ills. Skeptics say their decentralized nature makes them the perfect tool for pulling off nefarious deeds.

That said, market data shows BTC tied to criminal activity is a measly 3% of the entire BTC volume. Again fiat currencies support a comparatively higher volume of financial crimes.

According to the UN, the traditional finance system abets illicit activities to the tune of $4T annually. In contrast, crime-linked crypto transactions amounted to about $21B in 2021.

Question & Answers (0)