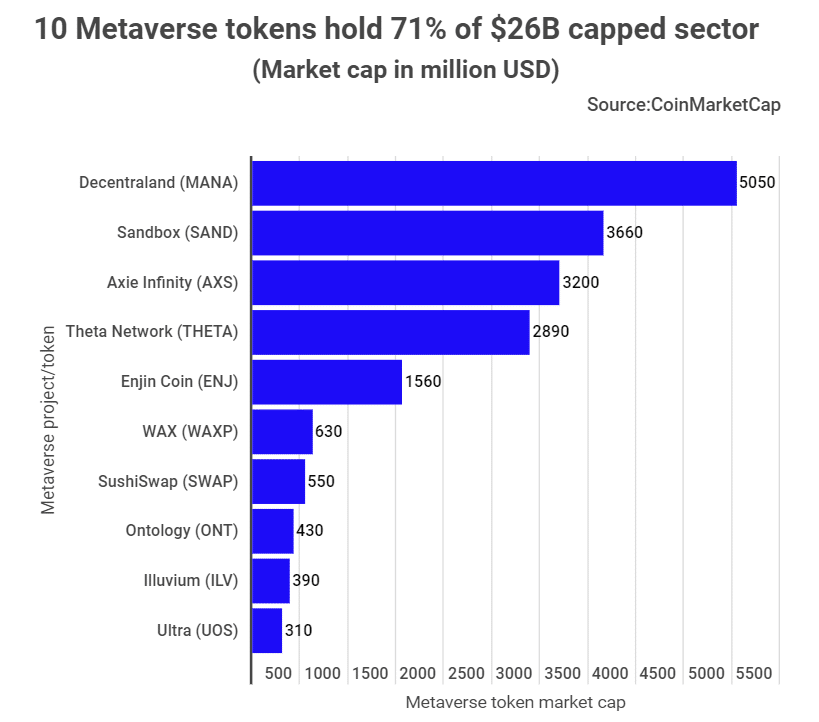

A recent tradingplatfroms.com analysis shows that 10 Metaverse tokens hold most of the sector’s trading volume. By press time, the ten had accounted for $18.67 billion of the $26.3B sector in the past week. That figure means that the tokens and their projects hold 71 percent of the Metaverse’s trading volume.

Tradingplatforms.com’s Edith Reads shared her thoughts on the study. She held, “What we’re seeing is a surging interest in the Metaverse buoyed by certain projects with a foothold in the sector. These hold sway because of their fast mover advantages and product differentiation. Again they’ve built a reputation for dependability and providing value to their users.”

Dominant Metaverse tokens

Decentraland (MANA) has the largest market cap of all the 185 projects the study considered. At the time of writing, its market valuation stood at $5.05 billion. That capitalization saw it command about 27 percent of the ten’s total volume.

Following in the second to fourth spot were Sandbox(SAND), Axie Infinity (AXS), and Theta Network (THETA). SAND commanded a market share of $3.66B. Meanwhile, AXS and THETA account for market caps of $3.20B and $2.89B, respectively.

Similarly, Enjin Coin (ENJ), WAX (WAXP), and SushiSwap (SUSHI) took the fifth to seventh spots. ENJ added $1.6B to the sector’s total. The other two, in turn, contributed nearly $0.6 billion each. And rounding up the top ten were Ontology (ONT), Illuvium (ILV), and Ultra (UOS). The three had a combined cap of about $1.1B.

Growing concerns about the Metaverse

Despite the Metaverse’s soaring popularity, it has drawn disquiet from certain quarters. Chief among these concerns are the privacy and security of the users.

Skeptics fear that merging our physical and virtual realities (VR) over the Metaverse will expose us to security breaches. Thus we risk exposing our sensitive and confidential information. That exposure could lead to other nefarious activities such as identity theft.

Additionally, there are fears that the Metaverse could cause addictions to the VR world. That’s because of the immersive experiences one can enjoy at a button’s touch.

Again, others have argued that the Metaverse could heighten social anxiety in users. They hold that the Metaverse would lead to blurred lines between our real and virtual selves. This exposure results in self-consciousness and unnecessary anxiety because we compare ourselves with others.

Question & Answers (0)