The Solana Ecosystem has been gaining popularity among developers and crypto enthusiasts over the last few months. Recent data presented by Tradingplatforms.com shows that the ecosystem’s market cap stands at $139,897,254,442 at the time of writing.

The Solana Ecosystem comprises several technologies and dApps that work together to enhance the network’s blockchain- Solana (SOL). SOL is an open-source blockchain protocol, and thus, developers from all around the world have been able to chip in on building the ecosystem. The synergy among the dApps and the ecosystem’s technologies makes SOL faster and more scalable.

Edith Reads from Trading Platforms had a few things to say about the data findings. “We know that 2021 was a huge year for DeFi, but it’s incredible how much the Solana ecosystem gained. And I think this is just the beginning. Defi keeps growing and Solana is just what developers and users need to hop onto this scene. I think we are yet to see the best of Solana.”

Tether comes first in ecosystem’s cryptocurrencies

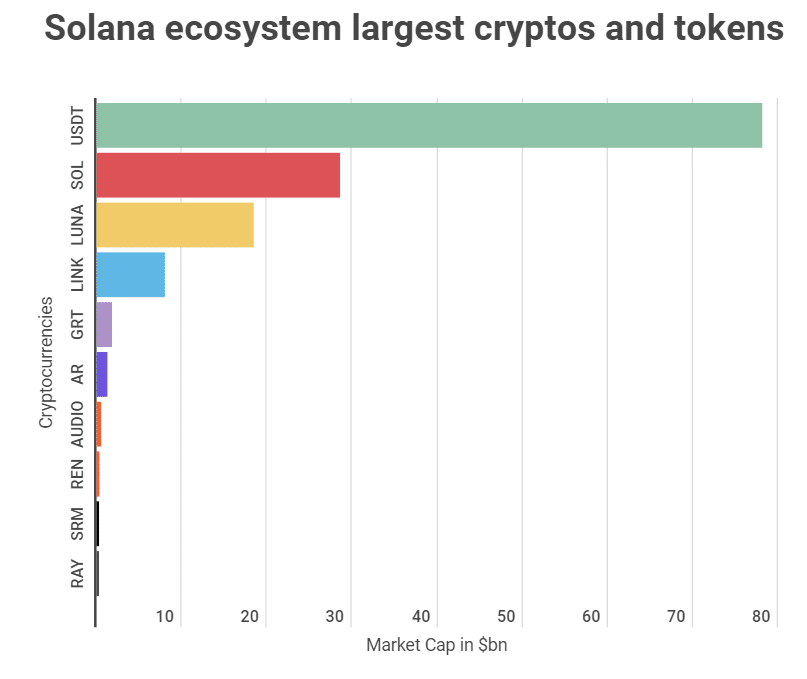

The presented data includes a breakdown of the ecosystem’s largest cryptos and tokens. The findings show that Tether (USDT) is the ecosystem’s largest crypto by market cap, at $78 bn. The stablecoin’s volume in 24 hours at the time of writing was $38.39B of its $78B available circulating supply.

The protocol’s native coin, SOL, comes in second with a market cap of $28.546B and a $1.12B trading volume in the last 24 hours. The cryptocurrency registered a price increase within the last seven trading days and is currently priced at $90.50.

Other impressive gainers within the top ten cryptos include Chainlink (LINK), Arweave (AR), and Ren (REN), which all gained 10.99%, 17.02%, and 19.88%, respectively. The three cryptos came in positions 4,6 and 8.

Terra (LUNA) is Solana’s third-largest cryptocurrency, with a market cap of $18.293bn. However, the cryptocurrency has seen a massive drop of 27.71%. When writing this piece, LUNA’s price was $45.35.

Other cryptos that make up the top ten list include The Graph, Audius, Serum, and Raydium.

Solana is on an upward trajectory

Solana was one of the biggest gainers of the 2021 crypto market bull run. The protocol’s coin, SOL, gained 400% in 2021, becoming one of the biggest cryptocurrencies by market cap.

Thanks to its fast transaction speeds and scalability, Solana is quickly becoming a favorite among developers and crypto enthusiasts. These factors and the low transaction fees make this protocol quite the competitor for Ethereum.

Solana registered a massive jump in the 2021 DeFi boom. The cryptocurrency seems to have maintained its upward trend ever since then. The ecosystem’s expansion fuels the crypto’s growth. We can only expect SOL to soar even higher as the Solana ecosystem continues growing by the day.

Critics remain skeptical of the protocol that is barely two years old. That said, it’s worth mentioning that Solana has achieved quite a lot in its short time of existence. It is fair to say that, given some time, the protocol could well overtake Ethereum as the preferred home for DeFi projects.

Question & Answers (0)