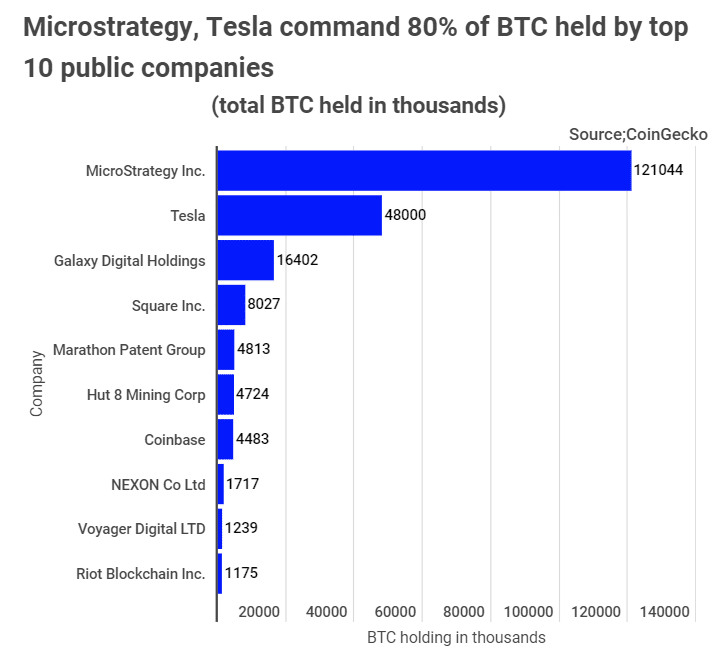

Two firms jointly own the lion’s share of Bitcoin (BTC) held by public companies. That’s according to data presented by tradingplatforms.com. The two MicroStrategy and Tesla own 169,044 of the 211,624 BTC held by the top 10 public companies. Their holding amounts to 80% of those institutions’ reserves.

Trafingplatforms.com’s Edith Reads has had her take on the data. She affirms, “There’s been a significant shift in corporate thinking about cryptos and BTC in particular. Many are beginning to see them as viable investment opportunities. Besides, BTC’s scarcity and value make it a better hedge against inflation compared to gold.”

Edith further affirms that corporate investors have increased their bitcoin exposure since March 2020. She avers that institutional players influence the crypto’s value as their valuation of it holds sway over the market.

BTC better than gold?

Edith’s analysis seems to resonate with MicroStrategy, the premier business analytics firm. According to the data, the company holds the most BTC for a public company. Its over 120 thousand BTC egg nest is worth more than $5 billion.

That’s not surprising as its CEO Michael Saylor is a leading BTC proponent. The former BTC skeptic has revealed that he owns about 18 thousand BTC worth more than $800 million. Again, Saylor has termed BTC digital gold; thus a better hedge compared to physical gold.

Despite its CEO’s reservations about BTC, Tesla has the second-largest reserve for a listed company. The EV manufacturer has a stash of 48,000 BTC. That figure works out to over $2 billion in cash.

The firm holds that diversification is the reason for its foray into crypto. In March 2021, its CEO Elon Musk announced that Tesla would accept purchases in BTC. But he suspended the payments two months later, citing the coin’s carbon footprint. That said, the company insists it won’t be disposing of its BTC holding.

Rounding up the top ten

Coming in third was Galaxy Digital Holdings. Its roughly 16000 BTC investment is worth about $700 million. And following in at fourth place is Square Inc. The outfit that has since rebranded to Block holds 8,027 BTC worth nearly $340 million.

The fifth to the seventh position was Marathon Patent Group, Hut 8 Mining Corp, and Coinbase. Marathon Patent has 4,813 BTC valued in the region of $200 million in reserves. On its part, Hut 8 owns 4727 BTC ($197.5 million), and Coinbase has 4483 coins ($187 million)

NEXON, Voyager Digital, and Riot Blockchain round up the ten largest institutional bitcoin holders. The trio possesses 1717, 1249, and 1175BTC, respectively. While NEXON’s holding amounts to over $71 million, Voyager Digital’s comes to about $52 million and Riot Blockchain’s to $49 million.

The acquisition waves

Market stats show that the BTC acquisition wave began in March 2020. The interest heightened in October before peaking in February 2021. At that time, BTC was exchanging for $33 thousand.

Pessimism about the coin going beyond $33,000 saw many sell their holdings. But the crypto held its bullish run, reaching an ATH of over $64,000. A bearish trend soon followed this, saw its value plummet to under $35,000.

The price drop triggered a second wave of institutional buying. Some who’d liquidated their positions at $33,000 saw an opportunity in re-entering the market at $30,000. Since stabilizing above that mark, the coin has emboldened more buyers.

Question & Answers (0)