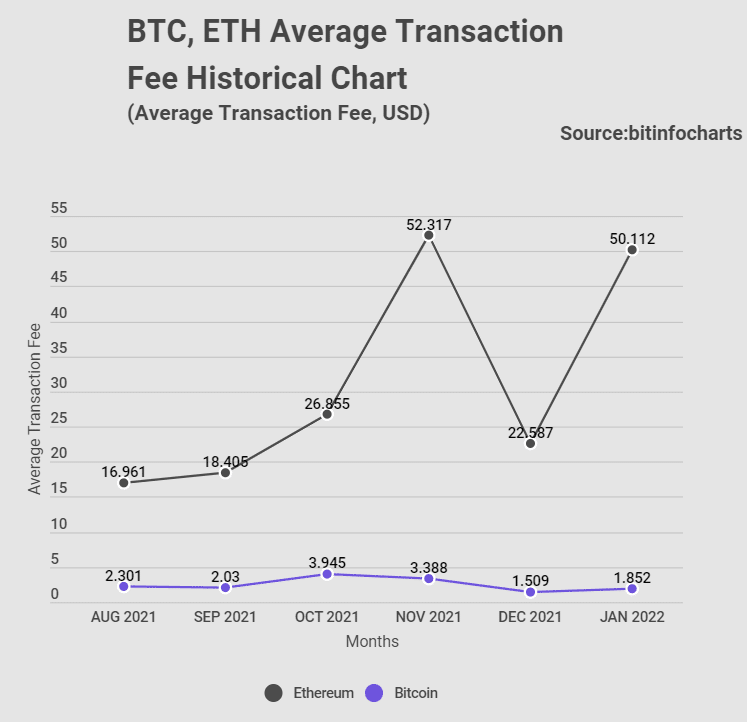

You’ll incur 33 times more for transacting on the Ethereum (ETH)Blockchain than if you did on the Bitcoin (BTC) network. That’s according to a new finding comparing average transaction fees across blockchains. The study covers the last six months as from August 2021.

Leading online education and comparison platform, tradingplatforms.com, presented the findings. According to the data, you’ll spend an average of 0.013 ETH per transaction on Ethereum. That comes to $41.69 at the time of writing, a charge significantly higher than the competition’s.

ETH gas vs. scalability

Tradingforms.com’s Edith Reads has been analyzing the data. Asked about what she made of it, here’s how she responded, “ The ballooning ETH gas fees is a perfect example of advancement at the expense of scalability. The burgeoning Defi and NFT sectors have clogged the platform. Add to ETH’s use of Proof of Work consensus, and you have a perfect recipe for surging gas fees.”

In contrast, transactions over the BTC network will set you back significantly less. For an average transaction, you’ll part with 0.00003 BTC. This amount works out to roughly $1.27.

Altcoins most affordable

Other altcoins would cost you much less too. For example, transacting on the Dogecoin (DOGE) network will cost you 1.28 DOGE. That comes to $0.218 per transaction, while you’ll spend $0.022 for every Litecoin exchange.

Bitcoin Cash (BCH), Monero (XMR), and Ethereum Classic (ETC) also charge negligible fees. While BCH charged an average of $0.00572, a trade, XMR, ETC levied $0.0057 and $0.0029, respectively. Similarly, you’ll pay an average of $0.03 for Zcash and $0.00002 for Ripple transactions.

Solving the ETH gas fees puzzle

The Ethereum Foundation is aware of the hue, and as such, it is working on several solutions to address the issue. The most prominent of these is the implementation of the Serenity upgrade (ETH 2.0)

ETH 2.0 will usher a raft of radical changes to the ETH network. First, it’ll see it move from a PoW consensus to a PoS mechanism. Many have blamed the current consensus for network clogging hence high gas charges. Adopting PoS will increase ETH’s throughput from 15 transactions per second (TPS) to 100, impacting transaction speeds and fees.

But importantly, ETH 2.0 will introduce data sharding. The network will be able to distribute its load across 64 Shard Chains. ETH will attain scalability through shading, theoretically enabling ETH to attain a 100,000 TPS throughput.

The expanded handling capacity will eliminate congestion and significantly lower gas fees. ETH estimates that it’ll complete the Serenity upgrade in 2023. At the moment, it has achieved the first stage of the advancement, the Beacon chain. The remaining two, “the merge” and “shad chains,” will ship in 2022 and 2023, respectively.

Question & Answers (0)