Best Options Trading Platform – Cheapest Platforms Revealed

Options trading is a highly complex, and yet highly profitable, way of getting involved with the financial markets. By trading on options, you can take on positions with very little capital, and speculate on the changes in their prices. The profits that you can make while trading through options are unmatched by any other asset class, and in several cases, you can limit your maximum downside too.

Even among traders who wish to trade options, there are very few platforms that actually let you do so in a proper manner. These platforms can be difficult to find, especially if you have any particular trading requirements or preferences. Therefore, this guide reviews and discusses the top options trading platforms alongside some tried and tested options trading strategies that you could use.

Best Options Trading Platforms List

Choosing the right platform that you can use to trade options is of the utmost importance, as it usually has a very direct and tangible effect on your profitability as a trader. While there are several platforms that will allow you to trade options, very few are as highly regarded as the ones discussed in this review. These platforms have been chosen because they possess a variety of desirable characteristics in addition to allowing options trading through them. A list of some of the top options trading platforms is:

- AvaTrade – The Best Forex Options Trading Platform

- Robinhood – The Best Options Trading Platform for Beginners

- Interactive Brokers – The Best Options Trading Platform for Professional Traders

- Charles Schwab – The Best Options Trading Platform for Unique Order Types

- Plus500 – The Overall Best Options Trading Platform

Best Options Trading Platforms Reviewed

A detailed review of the different options trading platforms listed above has been given below.

1. AvaTrade – The Best Forex Options Trading Platform

AvaTrade

AvaTrade also has a dedicated options trading platform called AvaOptions, which allows you to evaluate the potential profitability of various strategies and calculate the potential profits, losses, and the point at which you will break even on the trade. Since options are an inherently more risky asset class than trading stocks or currencies, AvaOptions also has professional risk management tools that help you ensure that you are only trading within your own risk appetite, such as stop losses that are tied to the prices of the underlying assets.

Just like Plus500, AvaTrade and AvaOptions are both available as a web platform, desktop app, and mobile app. This allows people of different preferences and schedules to monitor their positions on the go. One minor drawback of the platform is that if you choose to speculate on options premiums instead of actually exercising the contracts, the spreads on the sales can be a bit high, which will end up cutting into your profits.

AvaTrade fees

| Fee | Amount |

| CFD trading fee | Variable spread |

| Forex trading fee | Spread. 0.9 pips for EUR/USD |

| Crypto trading fee | Commission. 0.25% (over-market) for Bitcoin/USD |

| Inactivity fee | $50 per quarter after three months of inactivity |

| Withdrawal fee | Free |

Pros:

- Options trading available on 40+ pairs

- A specially dedicated platform for options traders with professional strategy analysis and risk management tools

- Commission-free trading

- Provides the ability to buy and sell actual options contracts as opposed to CFDs

- Stop loss options supported

Cons:

- Higher spreads than the industry average

- No other type of options except forex options are available

71% of retail CFD accounts lose money with this provider.

2. Robinhood – The Best Options Trading Platform for Beginners

Robinhood is the platform of choice for retail investors and the platform which first popularised the idea of commissions-free trading. There are several reasons why this is the platform of choice that beginners tend to use. Firstly, the platform has been designed in a way that makes it very simple to navigate. The design teams at Robinhood have said that their target audience was the unsophisticated investor, and therefore, they wanted to create a platform that anyone could understand and use irrespective of their technical expertise. This stands in stark contrast to other options trading platforms, which might require a learning curve of their own before you can trade on them.

In addition to this, Robinhood also allows you to trade options on stocks, indices, commodities, and forex pairs. These are actual options contracts and not CFDs, which means you can exercise them as well as simply speculate on the prices of the option premiums. In addition to options, the platform also allows you to trade stocks, commodities, cryptocurrencies, indices, and ETFs. Their wide product offering, all of which is provided to customers at very low commissions, is the reason that the platform stands out.

Robinhood fees

| Fee | Amount |

| Stock trading fee | Free |

| Forex trading fee | N/A |

| Crypto trading fee | Free |

| Inactivity fee | No inactivity fee |

| Withdrawal fee | No withdrawal fee |

Pros:

- Very wide variety of assets available to trade

- Options contracts are accessible instead of just CFDs

- User-friendly platform

- Commission-free trading

Cons:

- Not suitable for experienced traders who wish to perform advanced analysis

- No dedicated options trading platform available

Your capital is at risk.

3. Interactive Brokers – The Best Options Trading Platform for Professional Traders

They have a professional Trader Workstation that houses a variety of professional trading tools such as algorithmic options trading, a Strategy Lab, a Volatility Lab, a Strategy Builder, a Portfolio Builder, and support for backtesting strategies. However, you cannot trade on leverage through the Interactive Brokers platform without a very high margin deposit, and this is one of the only drawbacks of the platform.

Interactive Brokers fees

| Fee | Amount |

| Stock trading fee | Free |

| Forex trading fee | Commission + spread. Commission is 0.08 to 0.20 basis points. 0.1 pip GBP/USD. |

| Crypto trading fee | Commission. $15.01 per Bitcoin futures contract. |

| Inactivity fee | $20 per month |

| Withdrawal fee | Free |

Pros:

- Access to the global markets

- Unparalleled range of tools to assist with options trading

- A very wide variety of options are available to trade

- Robust mobile app

Cons:

- Does not allow leveraged trading without a margin deposit of at least $110,000

- Not suitable for beginners

Your capital is at risk.

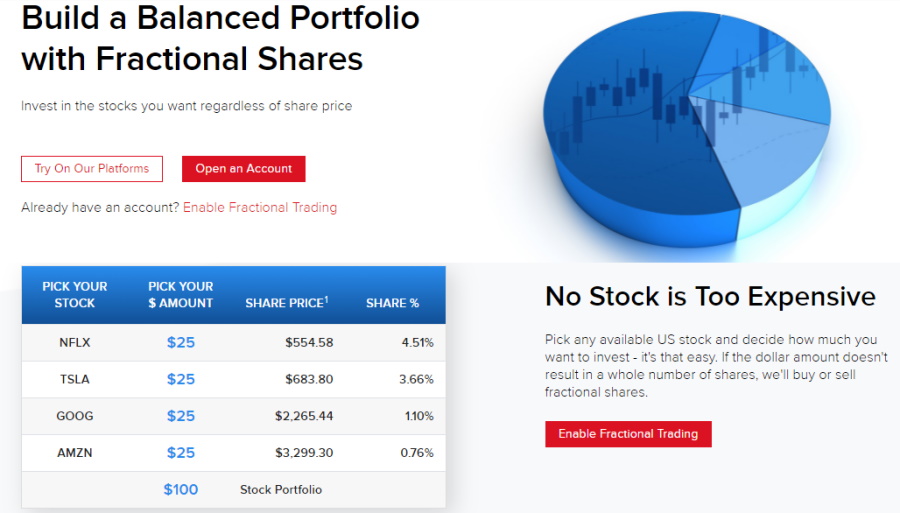

4. Charles Schwab – The Best Options Trading Platform for Unique Order Types

They also have a mobile app that you can use to trade, but it is not as good as the web platform, since it lacks the alerts features and does not support options chains either.

Charles Schwab fees

| Fee | Amount |

| Stock trading fee | Free |

| Forex trading fee | N/A |

| Crypto trading fee | N/A |

| Inactivity fee | Free |

| Withdrawal fee | Free |

Pros:

- Unparalleled research capabilities

- Fractional options ownership is available

- The web platform is suitable for highly technical traders too

Cons:

- The mobile app lacks several key functionalities

Your capital is at risk.

5. Plus500 – The Overall Best Options Trading Platform

Plus500

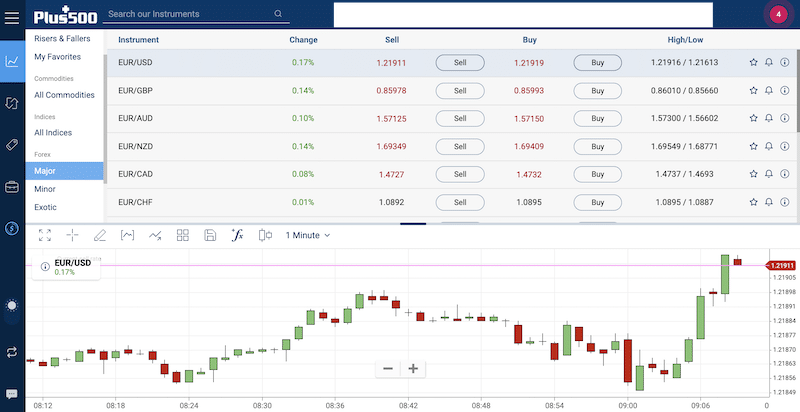

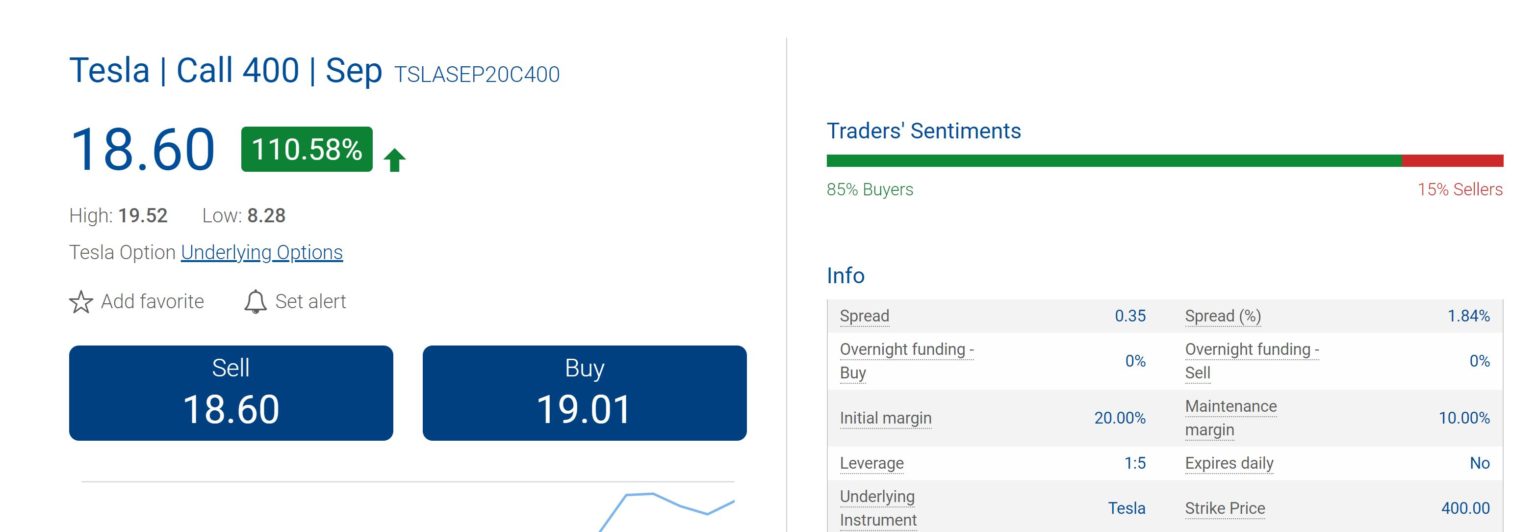

Another characteristic that sets Plus500 apart from the other platforms is that it operates completely on a commission-free model. This means that for every trade you make, you only pay fees in the form of spreads. Since these spreads are usually lower than the commissions charged by platforms, Plus500 has one of the most competitive fee structures among any other options platforms. This is further compounded by the fact that the platform only allows you to trade CFDs. Since most standard exchange-traded options are cash-settled anyway, this is not much of a difference-maker. All this means is that at no point in the trade do you own the options themselves, on the contrary, you own a CFD on the option and can speculate on the direction that the options premiums will take.

For any given security that you wish to trade options on, you get to choose from a very wide variety of strike prices and expiration dates, which gives traders a lot of variety. In addition to this, the platform also has several charting tools that you can use to analyze the prices and premiums before you decide on the option you wish to buy or write. The only major drawback of Plus500 is that it does not have a specific platform that is dedicated to options trading, which means that several options-specific tools and analysis methods are unavailable. However, this is made up for by the fact that the platform has been designed in a very user-friendly way, and it is very easy to navigate the platform and learn where everything is. In addition to this, they also offer the possibility of a demo account that is funded with $100,000 in virtual money so you can practice your strategies before beginning to trade.

Lastly, some of the general advantages of Plus500 as a platform are that besides options, it allows you to trade on a whole host of other asset classes such as stocks, indices, ETFs, commodities, and forex pairs. You can also download the Plus500 mobile app to easily and conveniently be able to trade through your phone on the move.

Plus500 fees

| Fee | Amount |

| CFD trading fee | Variable spread |

| Forex trading fee | Spread. 1.3 pips for GBP/USD |

| Crypto trading fee | Spread. 4.11% for Bitcoin |

| Inactivity fee | £10 per month after three months |

| Withdrawal fee | Free |

Pros:

- Stock, commodity, and index options available to be traded

- Commisison-free model, highly competitive spreads

- CFD trading only, the possibility of leverage is higher

- Very large variety in terms of the strike prices and expiration dates

- Platform designed in a user-friendly manner

- Mobile app available to trade on the move

Cons:

- No dedicated platform solely for trading options

- No ownership of the underlying option is available

72% of retail CFD accounts lose money.

Best Options Trading Platforms – Fees Comparison

A tabular comparison of the trading and non-trading fees that you will be paying while trading through some of the platforms discussed above has been provided.

| Broker | Commission | Deposit/Withdrawal Fees |

| Plus500 | 0 (variable spreads) | No deposit/withdrawal fees |

| AvaTrade | 0 (variable spreads) | No deposit/withdrawal fees |

| Robinhood | 0 (variable spreads) | No deposit/withdrawal fees |

| Interactive Brokers | $0.65 per contract | No deposit/withdrawal fees |

| Charles Schwab | $0.65 per contract | No deposit/withdrawal fees |

Options Trading Explained

In order to be able to fully understand options, there are several factors that you need to be aware of. Most of these peculiarities have been discussed below in detail.

What is Options Trading?

Options trading refers to the buying and selling of calls or puts on a stock. In order to best understand this, let us consider an example. Suppose A has a piece of land that is currently worth $500,000. If A is looking to sell the land now, he can get $500,000 for it. However, there are rumors that a major builder might be trying to build a shopping complex near the land, which would drastically improve the value of the land. However, since these are only rumors, it is very difficult to know for sure whether or not this would happen.

In this scenario, B approaches A with a deal. B says that 6 months from now, he would like to have the option to buy the land from A for $500,000. In addition to this, because A will have to hold the land and not sell it to anyone else for the next 6 months, B wishes to give him an additional $50,000 for his trouble. A agrees, and takes the $50,000.

In case the price of the land goes up to $750,000, then B can buy it for $500,000. Including the $50,000 he gave A initially, he still makes a profit of $200,000 on an initial investment of only $50,000, which is a 400% gain.

In case the price of the land remains the same, B refuses to buy it. Since he only has the right to buy the land and not the obligation, he can refuse to buy it for $500,000. This is because, including the $50,000 premium, he would end up paying $550,000 for a $500,000 property.

If the price of the property goes down, B still refuses to buy it.

This is an options contract. Here, the underlying asset is the land, $500,000 is the strike price at which B has the right to buy the land, 6 months is the time to expiry, and $50,000 is the options premium. Both parties are happy entering into an options contract because in case the deal goes in favor of B, the profit potential is practically unlimited, whereas the maximum downside is capped at $50,000. A is happy to do the deal because there are ⅔ scenarios where he comes out on top. This is what options work like.

Regulation

Options trading platforms are regulated in the same way as standard trading platforms. Usually, there is a separate platform that is solely dedicated to options trading, which is used by traders to perform complex analyses on options. This could include analyzing the profitability of options in a variety of situations to understand the profitability, or simply trying to ascertain the breakeven point of a particular trade.

Pros and Cons

The pros and cons of trading options have been discussed below in detail.

| Pros | Cons |

|

|

Options Assets

Options can be traded on any asset. Usually, the most popular options trading platforms tend to provide access to options on stocks, indices, commodities, and currencies. A few platforms even provide access to options on cryptocurrencies and ETFs, but those are rare. In addition to the standard exchange-traded options, you can also have more complex exotic options. For example, a compound option is an option on another option. You can also have options on futures contracts.

Trading Tools & Features

When you are trading options, it is best to use a trading platform that is dedicated to trading options. That is because options are derivatives and therefore are affected by a myriad of factors as opposed to standard securities. Therefore, specialist option trading platforms like Interactive Brokers usually boast of a variety of tools and features which include algorithmic options trading, a Strategy Lab, a Volatility Lab, a Strategy Builder, a Portfolio Builder, and support for backtesting strategies.

Mobile App and Device Compatibility

Since option prices are very sensitive to changes in any of the factors affecting them, it is important for options traders to have access to their trades at all times. If the tide begins turning against you, every second matters and it could enable you to cut your losses. Therefore, options traders usually prefer to use platforms that have mobile apps too, so that they can monitor their trades and open positions on the go.

Options Trading Strategy

There are several options trading strategies that people use in order to consistently make profits while trading them. While you might wish to use your own strategies or tweak them a little, it is important to be aware of these too. Some of the top strategies that are used have been discussed below.

Flat Market Options Trading

This is one of the most basic options trading strategies. This is usually employed when you believe that the price of a particular security will stay where it is. In this case, you buy an ITM option, as in, a call option where the strike price is lower than the current price, and wait for it to expire so that you can profit. This only works if the prices stay where they are or move in a favourable direction. Since the option is already ITM, the premium that you pay might be a bit high, but the strategy will still be profitable if you turn out to be right.

Momentum Based Options Trading

If you believe that you can spot the momentum of stocks and predict exactly where a currently ongoing bullish or bearish run will end, then you should buy an option with the strike price very close to that top point in the momentum. Since you will be trading on the momentum, you might end up paying higher premiums than usual, because the odds are in your favour. An important thing to remember here is that when you decide to trade through momentum strategies, you have to monitor your positions at all times. This is because if the market turns against you, the value of your options will fall very quickly.

How To Get Started With A Options Trading Platform

In order to get started with options trading, the process is quite simple and straightforward. The 4 steps that you need to follow in order to get started with Plus500 have been discussed below.

Step 1: Open a Trading Account and Verify Your Identity

The first step is to head over to the Plus500 website and click on Sign Up. You will have to fill up a form and set your login credentials, following which you will be asked to submit proof of your identity. You can submit any government-issued identity as proof of ID, and a bank statement or utility bill as proof of address. The verification process takes a few hours, after which you are free to begin trading.

72% of retail CFD accounts lose money.

Step 2: Deposit Funds

The next step is to deposit funds. On Plus500, you can do this through either a credit/debit card, in which case funds will show up immediately, or through a bank transfer, in which case the funds will take a few days to show up in your account.

Step 3: Practice Options Trading on a Demo Account

Before you begin risking your own capital and trading options, it is best for you to get some experience and try out your strategies under live market conditions through a demo account so you know what works and what doesn’t. This is also a good tool to get familiar with the platform and its navigation.

Step 4: Start Trading with Options

Once you are confident, you just need to go to the platform, go to the asset whose options you wish to trade, and click on options. Then, you will be able to see a table listing all the different strike prices and expiration dates, from which you can choose based on your strategy.

72% of retail CFD accounts lose money.

Conclusion

Options trading is a very attractive and highly profitable way of trading that does not require a lot of capital. An option is a contract that gives you the right to be able to buy or sell an asset at a predetermined price at a set date in the future. It is quite popular because of its cost-efficient nature and the large upside. There are several platforms that you can use in order to trade options, but the overall best platform that you can use for this purpose is definitely Plus500.

Plus 500 – Cheapest Trading Platform For Options Trading

72% of retail CFD accounts lose money.